Disappointed the Fed didn’t print antibodies?

By Wolf Richter for WOLF STREET.

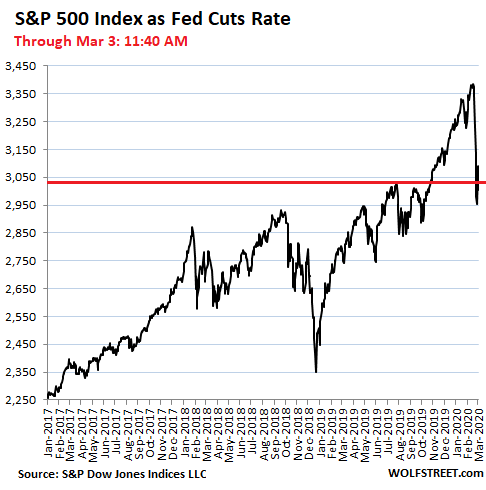

Because “the coronavirus poses evolving risks to economic activity,” despite the “strong” fundamentals of the US economy, and despite stocks being off just 7.8% from all-time highs, the Fed’s FOMC announced during trading hours this morning, following the G-7 conference call, that it had voted unanimously to cut the target for the federal funds rate by half a percentage point to a range between 1% and 1.25%:

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent. The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

But at the moment as I’m writing this, the impact of the biggest rate cut since the Financial Crisis is not propitious, with the Dow and the S&P 500 down between 1.5% and 2.0%. Note yesterday’s spike, about half of which has been undone at the moment:

This 50-basis-point shock-and-awe surprise rate cut occurred as the S&P 500 was just 7.8% off its all-time high, after the biggest one-day surge since 2009. And it occurred after the 10-year Treasury yield already hit an all-time low and is now just barely above 1%.

China has shown the way: Even as 70% of its economy was shut down to slow the spread of the virus, the government, the state-owned big four banks, the PBOC, which is part of the government, and the many state-owned companies, and state-controlled financial actors, working closely together, have managed, after a big one-day drop to push up stock prices and bond prices. The Shanghai Composite Index today was above where it had been at the end of the year, before the coronavirus cropped up as an issue.

And the government is seeing to it that companies that are teetering on the cliff don’t default on their bonds. For example, it has taken over HNA Group, the conglomerate with its 18 or so airlines in collapse-mode, and bondholders, which are going to be made whole in all likelihood, are breathing a huge sigh of relief. Markets are under control. No problem.

Cutting interest rates has turned into a cure for everything – with dubious results outside of asset price inflation. No one is going to get on a plane, after backing out of a trip due to the coronavirus, or stop panic-buying toilet paper because the three-month Treasury bill yield has dropped to 1%.

But even asset-price inflation may not be the result this time because too many underlying dynamics have changed, and even lower short-term rates – they were already super-low – are unlikely to change those underlying dynamics. But now the Fed can say that it has done its job. And we get to watch how the show unfolds.

“We are preparing for the possibility of further reductions to our schedules as the virus spreads.” Read... Just How Bad Is It Going to Get for US Airlines?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The roads in to Portland today were strangely quiet, more like a federal holiday than a regular work day. I think there are a whole host of economic side effects that are under the radar. Gig workers not called in, children staying home from school, yoga classes canceled, etc. The new economy is much different and many more people can find themselves economically idled without layoff notices in the news.

I haven’t noticed that slowdown yet here on my side of PDX but will keep an eye peeled.

Scary to think about isn’t it. The modern economy is certainly crazy – designed completely around short-term gain and/or monopolistic control, with the pretense of aiding consumers and shareholders, and no consideration whatsoever for the workers.

The Sherman Anti-Trust Act was passed in 1890 because of real cartels in those days e.g. Standard Oil Company of New Jersey, controlled by the Rockefeller family. These days, if you think Chevron’s gas prices are too high, you can buy your gas at Costco and save as much as 50 cents a gallon in my area.

In what you think of as the good old days, the New York Stock Exchange acted as a cartel and set commission rates to benefit its members. Now, my commission rate is zero. You can’t get any better than zero.

When my old employer closed its pension plan and replaced it with a 401k plan, there was a surplus in the old plan. All members of the plan who met minimum requirements saw their pension benefits fully vested even if they had been there less than the required 10 year vesting period and enhanced, in my case by over 7x.

About 45 years ago, an IBM 360/168 mainframe computer cost about $5 million when gas was about 60 cents a gallon. What did you pay for your PC or MAC and what can it do? I am not upset that Bill Gates is a multi-billionaire and I am not.

I am (not that I want any more money), but for what it’s worth, stocks are up as either Trump or Biden guarantees “business as usual” for our mentally ill rich.

Oh yeah, I ran thin film optic apps on a 360 in 1970 or so….punch cards…..and I’d give more credit to Scientists….(and maybe Intel and the like) than to Billy…..he sure screwed that DOS kid, eh?

Yep. CV19 has finally hit me. Daycare is cracking down on runny noses, and an office I went to today had a sign up asking people not to come in if they were symptomatic. All this hysteria for… a statistically typical flu season? I have a hard time believing any government, let alone China, will shut down it’s economy for anything less than Armageddon, which this is not. Anyone want to explore economic reasons governments might engage in such behavior?

Since it is very well documented from innumerable sources that China is largely shut down, the question is why anyone wouldn’t believe that.

Of course, one could argue that it shouldn’t be shut down, and ask why the Chinese have suddenly and uncharacteristically become nervous Nellies, and are shooting their economy in the foot for no good reason, but that is a different question.

Oh, I see another side of the post: China IS shut down but could there be an economic reason for shutting down the economy. No.

Nor for education- fixated Japan shutting down its schools.

Latest from WHO on new corona virus fatality rate on is just over 3 %.

In the 2017 -18 US flu season there were 45 million cases, 800,000 hospitalized and 60, 000 deaths. (Source CDC)

At a 2% fatality rate this virus is 16 times deadlier than seasonal flu. Like SARS, this one is dangerous to young doctors and nurses.

Add the longer asymptomatic infectious period and…bigger problem than flu.

Good question.

It is going to teach a lot of countries just how much they need cheap Chinese and Chinese sourced labor to maintain lifestyles.

Are you claiming there were 10,000 deaths PER MONTH during the 2017 flu season?

“a statistically typical flu season” – Assume 100 million Americans infected, a fatality rate of 2-3%. That implies 2-3 million American dead. Is that typical?

The persistence of this: ‘it’s just the usual flu’ is remarkable. I guess the idea is that the Chinese and CCP are a bunch of wimps.

What I worry about is more “fast tracking” of ever increasing needless toxic and expensive Pharma products. There have been viruses “chasing” me all my life, and sooner or later they or other microbes may win.

I’d rather it was them than Pharma.

My understanding is that he mortality rate outside of China is about 1.2%. Typical flu: about 1%. Mortality rates are among those who contract it, not the entire population. Face it, you all watch to many zombie movies.

According to the information from CDC quoted above regarding the flu, 45 millions infected and 60,000 died, the fatality rate is 0.0013 or 0.13%. Today (March 5) according to Johns Hopkins tracking site, there were 16309 confirmed cases outside of China, and 401 deaths outside of China, so the fatality rate is 2.46%. However, we need to know that the confirmed cases is not the total number of infected, so that should bring down the fatality rate a bit, but by how much? For the fatality rate of Covid-19 to be the same as the flu data quoted above, the total number of infected has to be at least 308,461 cases. Which is not unlikely. But we definitely need more data to make educated guesses.

Fed supporting asset inflation again.

The Fed bank cartel is figuring out ways to funnel more US legal tender to its bankster owners– as usual. I predict that whatever it secretly comes up with will later become public sooner or later when it is too late for taxpayers to complain– as usual.

Meanwhile, our government “leaders” foolishly think that with enough of a rate cut the coronavirus effects will just magically disappear and everything will be peachy. Exactly who do those fools think will use lower interest rates if we are all hunkered down in our homes (going out only for food or water) awaiting the passing of this plague? Credit card companies will assuredly keep the same or raise their interest rates charged to consumers.

Trump cut the post of senior director for global health security and biothreats on the national security council (NSC) last May, because he clearly does not believe in science or preparedness. See https://www.theguardian.com/world/2020/jan/31/us-coronavirus-budget-cuts-trump-underprepared

Persons tested are being charged for quarantine and also for the test. The lack of single-payer healthcare (as in most, advanced countries) means that no US entity plans for these disasters. Single-payer systems plan for these disasters because they will directly affect how they deliver services.

Thus, our country has the least testing per capital in the world among developed nations. Our coronavirus tests were even, initially defective. Our completely private health care system will soon become an anvil dragging each American to his/her death or bankruptcy.

Unfortunately, with coronavirus, governmental stupidity can be fatal to thousands of Americans. Thus, the supporters of intellectually-challenged candidates who were remedial, “trust-fund” students, when their way into college was purchased by parental contributions from tax-fraudster/bankster wealth, will indirectly soon cause thousands of deaths.

This reminds me of when I went to USC and was forced to help these “trust-fund” kids, who sought to cheat at every turn, were uncooperative in joint projects, and regularly evaded work. Now, we are led by one.

Yeah. I saw the same type in pre-med. They had tutors and daddy’s guarantee they were getting into Med School. But one bottleneck was Organic Chem lab. They pushed and shoved to get reactants first and almost ran around the lab. Not safe. Anyway one of the worst bumped me from behind and I knew people needed a 10ml flask of concentrated sulphuric (not 98%, luckily, but stronger than 18% battery acid, maybe 35%) and I yelled out “Damn You” when I felt liquid on my back. Instructor was hip to him and stopped everything, took my shirt, baking sodaed my back and gave us all a safety lecture holding up my shirt, setting everyone behind as it was a 4 hour lab, period. Anyway, he’s no doubt manager of a clinic somewhere or manager for the drug companies.

When i read “completely private health care system” i stopped reading.

I ask you, “why did I do that?”

Fundamentals aren’t strong at all. Exports were down in Q4 but imports more and that counts positively into GDP. Exclude the major expense of armament and GDP grew 0.2%. Japan had a -6.3% for Q4 GDP but Trumps’s is a zero sum world so the most recent fundamentals from the PRC don’t matter.

This probably hurt the economy more than helped it. The Fed should have withdrawn and said until inflation falls to 0%, we don’t see a pricing issue. All other problems are government related. Talk to your representative.

Now banks will be squeezed amid excessive consumer subprime leverage.

Fed is supporting Trump. As I have said time and again here, Trump’s main concern is the stock market — few things matter more to him. And he is making sure his soldiers, which include the Fed, share the same priorities. The stock market will make or break his re-election.

We’ll he IS a real estate man, so there’s that.

Wide and generic question: Wouldn’t asset-price inflation still perform well if inflation was going higher due to broken supply chain? After all in the current situation it seems supply may become more of an issue rather than demand itself?

Supply and demand will be wildly out of balance, impacting profitability in a lot of unpredictable ways.

Pricing power for supply-chain impacted items will be limited by the fact that discretionary purchases are going to be deferred; people know they’ll be able to get a better price later.

Demand destruction is going to dominate because most people in epidemic-ridden regions won’t be working much and aren’t going to be able to afford much more than food for a while. Looks like stop-work-to-restart time could be 2-3 months. Maybe more; China’s not fully back yet because people are trying to figure out how to balance the risk of a viral resurgence against risk of not having enough income to make ends meet.

Tks. Good points.

Nice headline. In a cash-based world the treasury could actually do it. Coat new dollar bills with a virus suppressor, encourage people to spend and handle money as much as possible.

Also nice plague-oriented typo: Rat cuts.

Or how about use silver coins

It’s not about whether an action is appropriate, it’s whether Mr Trump will be happy.

Yes: this scenario looks increasingly like Richard Nixon bossing Arthur Burns around in the runup to the 1972 elections, and I am not even a supporter of “history repeats itself”.

The big problem is Jerome Powell has almost run out of ammo: he has two 50bps rate cuts available and then it’s game over: as Europe and Japan proved negative rates are like quicksand. Easy to get in, impossible to get out and ultimately fatal. November cannot arrive quickly enough.

I have literally no idea how we’ll get out of this pit cowards like Powell and megalomaniacs like Draghi have dug for us: we’d need a big monetary shock but I honestly doubt mankind still has the stomach for it.

As Aristophanes wrote over two and a half millenia ago “Woe unto us! All we have left are tears”.

“The big problem is Jerome Powell has almost run out of ammo”- have you heard of negative interest rates? In a nutshell, when they run out of soap, they turn savers into soap.

But we already know that negative interests don’t work anyway…..

And if we go negative and every body else who hasn’t yet goes negative, you have to wonder where the hell does this end??

I seriously doubt negative interest rates will ever happen in the US. The Fed is fundamentally structured differently from the socialist ECB which is politically divorced from the private European banking system – the Fed was from the beginning tightly bound to the US private banking system, and really it’s #1 unwritten charter is to keep private banks in the USA healthy. Negative interest rates will hurt the big banks in the US.

Much more likely would be that the Fed extends its perpetual propping up of mortgages in this country, an asset bomb it created the last go round, to corporate bonds, the latest debt bomb, by buying up the collateralized securities of corporate debt.

Unless, of course, a huge economic collapse happens before November and Bernie and his merry band of socialists get elected – anything is possible after that

I’ve been living in a negative interest environment for years now.

I honestly doubt the US economic system would accept it without a fight, chiefly because it would squeeze yields to a level US financial institutions and savers would find unacceptable.

Janet Yellen, not exactly known for her personal courage or coherence, effectively closed the door to negative interest rates: the 100 largest US banks were speaking through her.

While Jerome Powell is too spineless and morally bankrupt to oppose any of the childish demands originating from the White House, he needs to keep those 100 large and potentially angry banks happy.

He tossed them a promise to do away with some regulation in return for this latest rate cut, but it’s just that: a promise. He needs to “sell” the regulatory changes to his colleagues tasked with regulatory oversight and perhaps even Congress, which can still scuttle the whole deal. While usually somnolent on these issues, this is an election year: somebody may jump on the occasion. “Banking deregulation you said? Let’s hear about it here in Congress.” And you lose a few months.

What happens if the tide turns in November and Powell is sent packing and replaced by somebody (hopefully) more suited to the task at hand?

I read an analysis which argued the current global System only works Because the USA has positive rates. I forget the crutch of the argument, but it seems hard to argue against/ imagine a complete Global financial system with out positive rates at its core.

Amen. This is just like when the Republican senators all got their backbones removed years ago.

When a monkey feels trapped it picks up its feces an throws them at its audience. That’s its ‘tool kit’. Jerome Powell may have to behave in a little more dignified manner but his ‘tool kit’ is just as mono dimensional and even less effective.

This had nada to do with covid-19 and everything to do with calming down spooked investors. Not surprisingly, they appear unimpressed.

It’s important to keep blaming it on the Wuhan Coronavirus, so that when a crash happens, hopefully “for them” after a bunch of Walmart’s and other stores get panic bought out and have empty shelves. It is much more believable. After that, they accept no blame for anything and say that everything would have just went on fine forever, if not for the Coronavirus.

Investors are spooked because of the covid-19 virus. Monetary or fiscal tricks won’t change that. Only a medical breakthrough in the form of anti-viral meds or a vaccine is likely to relieve that panic. How soon are you flying to Northern Italy or S Korea?

OMG, it didn’t work.

Jerome should have raised rates instead. Get the bleeding out now, let the blood letting happen so that at some point when this external effect is past, you have ammunition to drop rates. Otherwise, you’re just adding to the dam to keep the water back, when the inevitable breakage occurs, we get a bigger tidal wave.

But I guess Jerome is thin skinned, and couldn’t take being lambasted by Trump. It’s frigging ridiculous, JP might as well be sitting there asking Trump for directions.

‘strong fundamentals’

who writes this crap?

and who believes it?

Powell just fired the last shot. Now what?

More ‘strong fundamentals’ BS????

Well stated!

People seem to forget the other side of low rates is low to no growth .

And it is inevitable that disruption of supply chains will cause the prices of many goods to rise. So Powell may just exacerbating higher overall inflation in the further .

I would argue that the Fed is out of bullets when it comes to stimulating the economy.

I wanna be sedated

Get in line…

I am right behind you

Sorry, sedatives are produced in China.

not the alcohol

or Pot

maybe a good time to bring back good ole Timothy Leary.

Peace, Love and don’t bogart that joint

except now we have to bump elbows?

Thanks for making me laugh Saylor :)

Just get me in a wheelchair, take me to the show, hurry hurry hurry, before I comatose…

So funny. I am a full time musician and we perform this song often. Ramones rule !!

Good tune.

If a business cannot produce, sell its product or ship it, it has no revenue coming in, but still has costs – including servicing its debts.

What on earth does a rate cut do to help that business avoid collapse?

We know that the Fed can’t cure the virus. OK, they’re not doctors. But if this is their answer to businesses crippled by lock-downs, then they aren’t economists, either – or even logical.

The rate cut frees up debt-service capacity systemwide so that fewer companies will be forced through the bankruptcy wringer.

I expect there will be some federally-sponsored shotgun refinancings of TBTF enterprises as well.

Meanwhile Buffet, Apple, and any other entity sitting on a mountain of cash will be feasting on bargain-priced turnaround situations.

And I’m sure my credit card interest rate will promptly reduce in kind?

Funny about that, isn’t it- it’s still double digit rates on your bank cards. When Ben Bernanke opined that in an emergency money could be dropped from helicopters, he never mentioned (or was asked) about its only being dropped onto the banks that happen to own the Fed.

The best way to lower your credit-card interest rate is to quit playing the banks’ game. It’s rigged against the average person, who can’t resist the temptation to buy things they don’t actually have cash to pay for right now.

It’s not easy … and with a recession looming it will be much harder … but when the economy recovers it’s not impossible.

P.S. The best way I found to cure myself was to stop watching TV or anything with advertising in it, and to look for recreation and entertainment that was entirely free. After a little while of advertising-free life, I never went back.

Lower interest rates when they’re this low already does what? Lower long-term debt servicing costs? Yeah, that’s what I thought. Zombie corps will still be in the business of fooling “investors” until they can’t anymore. It’s not really a fix at all in the immediate moment to solve a crisis by lowering interest rates if the problem is shrinking revenues… If no one has solved how they’re going to earn money then what gives anyway. The real problem for these people is that markets might actually come to their senses and stop propping up massive chunks of the economy on credit. It’ll be game over for the few individuals getting filthy rich off this unbalanced system, better go beg the fed, fingers crossed it actually saves them if retirees have more reason to keep buying junk securities.

“The real problem for these people is that markets might actually come to their senses”

The trillion dollar question is why would markets come to their senses? It’s just a game that the majority agreed to play; the rules are man-made — it’s not physics, it’s not gravity.

The only way this game could come to an end is if enough people decide to stop playing. And for that to happen, there must be a major global “party pooper”. COVID-19 may be it.

If Savers are punished with NIRP, why are Buffet and Apple not also punished as cash hoarders? It is an honest question. I consider myself a Saver…why will NIRP kill me but not hurt them?

Beardawg,

Buffett and Apple hoard T-bills in their “cash-equivalent” accounts, and they’re punished by hoarding T-bills just like savers. Rates are similar, if you shop around.

because 1% of a billion is still enough for a normal person to live on. Sadly you don’t have a billion and neither do i, so we’ll take the 5 dollars each month we earn in interest.

Beardawg, they are both waiting for a better opportunity to invest.

But, Daddy, I want an Oompa Loompa! I want you to get me an Oompa Loompa right away!!!

Haha right on point…this market has become so spoiled and entitlement to FED blowing them at every turn. Much like a spoiled rotten brat, this market needs a much needed slap across the face and good STFU.

Thanks for this Wolf, and for your comments regarding wine futures a couple of days ago; however, based on this kind of ”stuff” I can only say, ”MORE WINE”, and let it go at that, for now…

Really and truly, it seems the FED will just do any damn thing at all to protect and support the banksters, while screwing us peons out of the interest on savings, etc., that for one example, my grandma lived on for about 30 years and lived fairly well. (And this was before SS kicked in.)

BTW, does that mug of your hold wine? Or only beer? LOL

A morphine shot for the addict.

There is a systemic problem in this market, as yet undefined. It is not credit, and it is not the REPO market, or liquidity. The market drop caused currency spreads to widen, which puts pressure on sovereigns who issue debt in dollars. The market money flow disappeared, and today’s Fed injection did not help. Money acts scarce, some went into bond funds which are now a powder keg. The rate cut sends more money into gold, not what the Fed wants. Confidence in the administration is at zero and the rate cut appears to be another self interested twitter pressure tactic. Money velocity, YC, extreme volatility. “I believe unprecedented global speculative leverage creates a high probability of a major accident – a “seizing up” of global markets. And from my experience analyzing market Bubbles throughout the nineties and up to 2008, things are surely even worse than I think.” Doug Noland

What’s the “boomer” comment all about?

‘The market drop caused currency spreads to widen, which puts pressure on sovereigns who issue debt in dollars. The market money flow disappeared, and today’s Fed injection did not help. Money acts scarce, some went into bond funds which are now a powder keg. The rate cut sends more money into gold, not what the Fed wants. Confidence in the administration is at zero and the rate cut appears to be another self interested twitter pressure tactic.’

Interesting points !

-Vulture Capitalism for the Win!

Fixed income and pensions get clobbered. Expect Trump to further punish the retired oldsters by demanding a payroll tax reduction that the Democrats can’t refuse when the rate cuts prove ineffective.

First he wants to gut SS and Medicare. He’s already cut CDC and NIH.

If they’re giving away free money, why can’t they give away free healthcare?

Una,

Post the specific cuts to the CDC, as well as the actual CDC budget in Trump’s 1st yr and now, because the data I have says there have been no such cuts to the CDC budget.

I’ve already told you to do your own research. You can’t afford my consulting fee. Try googling ‘CDC cuts’.

In a 2/27 press conference, Trump proudly admits to cutting the CDC budget,

“I’m a businessperson. I don’t like having thousands of people around when you don’t need them. When we need them, we can get them back very quickly.”

https://markets.businessinsider.com/news/stocks/trump-defends-cuts-cdc-budget-federal-government-hire-doctors-coronavirus-2020-2-1028946602

– ABC News

“President Donald Trump is taking heat from Democrats for proposing budget cuts to the Centers for Disease Control and Prevention amid growing fears about a new coronavirus outbreak in the United States, but administration officials say CDC funding has steadily increased since Trump took office.

An ABC News analysis of the president’s budget proposals compared to the congressionally approved spending plans ultimately enacted show both claims are true.

The president introduced his fiscal year 2021 budget proposal on Feb. 10, just 11 days after the World Health Organization declared the coronavirus outbreak a public health emergency of international concerns. The spending plan included a 16 percent reduction in CDC funding from the 2020 spending levels.

In fact, all of Trump’s budget proposals have called for cuts to CDC funding, but Congress has intervened each time by passing spending bills with year-over-year increases for the CDC that Trump then signed into law.”

TXRancher,

So no actual cuts and Una’s stmt was false.

Trump spent the past 2 years slashing the government agencies responsible for handling the coronavirus outbreak

https://www.businessinsider.com/trump-cuts-programs-responsible-for-fighting-coronavirus-2020-2?op=1

We’re talking cuts, my man, cuts.

@unamused

Where would u put border control in the virus control equation?

But, truly, We all appreciate ur doing ur part to assist the MSM in redirecting Us to these alleged budget cuts.

Maybe if the USA wasn’t spending untold billions on handling the effects off illegal immigrantion we’d have some money left over for directors of disease control and what not.

CDC and NIH budgets have not been cut, they’ve been increased under Trump. His budget proposals included cuts but he signed spending bills that include increases. He’s signed budgets as profligate as his predecessor, even more in some instances.

On that subject, Federal govt spending must eventually be cut somewhere, unless you favor complete debasement of the currency.

I think they sent an unintended message: “I suggest that you panic”.

1/4 point was expected. 1/2 point means they’re scared.

And guess what else? Per the CDC there’s already a shortage of one (unspecified) antiviral drug due to a “site impacted by the outbreak in China”.

Positive feedback loop?

Business continuity model fail!

I think the dealer (Janet Powell) needs to offer yet more heroin to the desperate junkie “markets”. Screw the little people. Save the rich.

Business as usual.

Who is Janet Powell?

A Freaky Friday blend of Janet Yellen and Jerome Powell, i.e. more of the same?

I say that we all pencil in a date with the FedHeads … surround them, and do an impromptu cough-in .. thus putting the fear of God into their corrupted black hearts !

That .50% rate cut is SSSSSOOOOOOOO 2 hours ago.

The Fed isn’t doing enough.

It needs to cut rates every 30 minutes until the stock go back up, and cure the flu.

In addition it need to place a bid for unlimited stock % 25 above current prices and do this every day.

It’s unbelievable that the Fed has become like a reflex, stock market down, automatic decrease in interest rates, what disastrous policy and clearly aimed at asset inflation for the banks.

A pay per view 11 years ago of the TBTF execs frog marched into Club Fed would have payed off the national debt. Too bad somebody high up placed themselves between these crooks and the peasants with the pitchforks. Those entities should have been broken up or dissolved. What we have now was inevitable from there.

Yeah, the Hugh Hendry line from years ago, “I recommend you panic”.

Meanwhile, we do not have a functioning government.

A friend in the healthcare field suspected symptoms of COVID-19 in King County, WA. After 40 minutes on the COVID-19 hotline and no response, calling primary care physicians (who have no idea how or where to get the tests for their patients), calling a hospital who connected her to the COVID-19 hotline through the medical provider route, she was told she is not eligible for testing unless she has bronchitis or pneumonia.

To be tested you need to have been out of the country for the last 14 days or have been in contact with someone who has tested positive for COVID-19. She was told to go to the ER if she develops bronchitis or pneumonia, after which she will be quarantined and have to wait until the test results show up.

Local health authorities claim that they are bound by CDC guidelines and the availability of testing kits and facilities.

People who work minimum wage and cannot afford days off will not even report symptoms under this system. The idea is to under-report the severity of the situation by making testing hard to access.

South Korea has drive-through testing. Taiwan has walk-in testing clinics and the costs of the tests and treatment are covered with a portion of pay covered when you are forced to take time off for this.

But yeah a rate cut will fix everything.

IdahoPotato,

Was this ordeal in the last day or two? Because I thought the CDC changed those ridiculous don’t-test-don’t-tell guidelines last week. And now testing should be more readily available.

Wolf I will email you with the Twitter thread of this person.

Thanks!

https://www.sciencemag.org/news/2020/02/united-states-badly-bungled-coronavirus-testing-things-may-soon-improve

The solution to the problem will come from the private sector, not the government. This week the US should catch up on testing which should mean more cases, and a rough week for markets. The death rate seems to be more randomized than ordinary flu. After a few healthy people die then we reach pandemic status.

You might mean “not THIS government.”

Your link mentions several, other governments…presumably with more success than our 3rd world government and underfunded CDC.

@Timbers

Anyone who goes to Australia gets a free test. According to the WHO, the test costs about $5. Walk into the ER here, you may be sent home without even getting tested. The $3000 ‘facility charge’ will follow in the mail. Now that they have reinstated the pre-existing condition rider in healthcare plans, you may need to prove a litany of things to your insurance company before they entertain your claim. Look up the case of the guy in Florida who tested negative or COVID-19 and got a huge bill that his private insurance company does not want to pay.

It may be cheaper to fly to Oz or Taiwan and get a test than to get one in our ‘free market’.

Regarding ‘free enterprise private health care to the rescue’….

No problem with testing in Canada…from the 1st mention of the virus. It is done by professionals in the public health care system.

Suspicious travel or contact history receives immediate testing.

Blurb on website: “Testing requires notification and consultation with the local Medical Health Officer and the BCCDC PHL Medical Microbiologist on-call (604-661-7033).

There is someone on call to facilitate testing.

Our Provincial Health Officer (BC) states it this way:

“Henry said the province had broadened its testing criteria to include people who are in hospital for respiratory issues but have tested negative for influenza.

She said the province’s lab network that tests for influenza outbreaks has also been tasked with screening samples for COVID-19.”

Good leadership requires people to stand back and let the experts do their job. Yesterday, Potus tried to talk over his slated experts and stated that a vaccine could be developed in a month or two. He was corrected publicly by a health officer (who is probably fired by now) saying it would take a minimum of 12-18 months to develop a vaccine. Potus sat with his arms crossed and seethed.

No wonder the Market is tanking. There is little to no trust in leadership or in the private health care system. Why? Private is accountable to shareholders and profits, despite costing 2X what public systems do.

As an aside, Scotus is now going to decide on removing the existing conditions provision of the ACA. Can’t make this up.

The death rate is not randomised, it is just starting. Apparently, Covid 19 is something like 10X more contagious than regular flu and 25X more lethal, at least according to data gleaned these past few weeks.

QANTAS has flights on sale from LAX to Sydney for only $699.

Potato,

Australia is slightly ahead of the curve, having tested about 10K people as of today, they are certainly not testing everyone who walks into a clinic with a cough, and they don’t have the capacity to do so, no one does yet. The testing totals in the US are no longer available as local and state labs are testing large numbers of people, but CDC had tested 3,600 as of March 1st. The US total is likely in the 10s of thousands now.

Here is an article title to Google for local critcism of Australia response and other details. They aren’t much happier with their government than you are with ours.

Should Australia be testing more broadly for the coronavirus?

CDC bungled earlier testing, they had trouble with the lab reagents and generally behaved like a a government entity, which they are, until the case count started to climb late last week and it became apparent that there was community spread.

FDA has opened up testing from all available private and local sources, director states a goal of 1,000,000 completed tests in US by the end of the week. This is probably not possible, but the US testing response after a bungled two weeks will probably be larger than the response in any other country within another two weeks.

Happy1,

They are still holding up the emergency funding package. ‘Cos former pharma executive and lobbyist Alex Azar knows that the inability to price gouge during an emergency would be such a travesty.

https://www.rollcall.com/2020/03/02/coronavirus-funding-talks-held-up-over-drug-pricing-language/

“Disagreement over provisions intended to ensure affordability of vaccines and other medications is holding up agreement on an emergency funding package to fight the novel coronavirus-caused illness that has killed over 3,000 worldwide, sources familiar with the talks said.

….

Democratic negotiators were also pushing to ensure “fair and reasonable price” standards in existing contracting regulations are adhered to for new purchases of vaccines and other medications to treat COVID-19, the illness caused by the new coronavirus. An aide said that would prevent drugmakers from charging above-market rates.

The disputes over affordability provisions threatened to delay passage of the emergency aid bill, expected to total between $7 billion and $8 billion, that House leaders were aiming to bring to the floor as soon as Wednesday or Thursday.”

Potato,

The 8 billion dollar funding here will be a mini stimulus package full of pork for all involved, and largely will not affect the clinical care of anyone in the short run. The initial ask was 2 billion, so there will be 6 billion of waste.

This isn’t what will stop the virus. And yes, there will be profiteering. Private testing is already being authorized regardless of this medical pork extravaganza.

I can’t speak to what “fair and reasonable price standards” are, but wish they were in place in the rest of government contracting and in education and medicine generally.

Paulo, surely you must recognize Canada has implemented ZERO proactive response to the coronavirus threat except to have arrivals fill out a form; flights were not stopped from any epicenter or peripheral location and in fact still continue after hundreds of thousands of arrivals since late December when alarm bells went off in China, and the policy from day one has been ‘containment’, (meaning that only if anyone exhibits symptoms and are found to be infected they are kept in isolation and treated), and more recently ‘self-isolation’ if you come from an infected zone.

Leadership? Also zero. And this when the SARS catastrophe is still within memory; the same response, nothing learned.

Regarding private sector, “free enterprise” healthcare, google for “Ebola vaccine almost didn’t happen”.

Better still, read The Fifth Risk by Michael Lewis. It talks about governement agencies and what they do behind the scenes that few citizens have the faintest idea about; and these agencies never “advertise” their success stories. Thousands of dedicated public servants perform jobs vital to the nation and its interests. Not only their contribution and that of their agency not recognized by the average citizen but they are often subject to stereotypical judgement.

In any case, you will learn soon enough (the hard way) what it is like to rely on the private sector, with a reduced/handicapped public sector, which Trump has been dismantling since day 1 of his presidency. But hey, learning the hard way is the best way, right?

My yearly scheduled physical was today, 3/3/2020, at the Everett (WA) clinic (aka ground zero) on Hoyt where all incoming patients were met by an army of nurses and doctors armed with clipboards, questions, and masks. Answering yes to 2 more questions got people sent home but not tested. I have a chest/head cold so I got a mask. I asked my doctor about being tested but was told because I only answered yes to one question they weren’t going to test anyone based on one positive answer. But they didn’t test those who answered yes to 2 more; just sent them home. There simply wasn’t enough test kits. Meanwhile I’m hacking up cats and riding the bus.

A Korean works for my daughter. He went to an Everett area clinic today and asked to be tested. Was told his temp. was 101 but it had to be 102 for testing, so they sent him home.

David, I’ll keep my fingers crossed that it’s just a cold. And stay home. All the best.

Wolf – How do you reckon Tesla Giga Shanghai is faring?

And why hasn’t the master illusionist announced a giga-billion new drone business to solve the world’s … nay, the universe’s … supply chain challenges?

Exactly! I was pretty sure that I had coronavirus after coming back from Hong Kong but no one wanted to hear about it. So I was just went on my merry way!

It will (maybe) fix things for owners of stocks, that’s the priority. People with the illness, not so much.

Been reading over at NC that the CDC did a Boeing or F-35, and required the test to look for “all” possible diseases…resulting in it not working at all.

What do you expect from 3rd World America that chronically under funds public agencies?

Oh….but wait….I’ve been told we have “the greatest healthcare system in the world” and are awesomely prepared for pandamics.

That’s why we have 40 million w/o access to healthcare…oh wait…I’ve been told they can go to the emergency rooms and pay maybe $20,000. Because that’s access to healthcare.

I know I am a broken record, but talk with people who actually work in critical care in the US. We have more ICU bed capacity than any other country on earth, and health insurance status for this kind of thing is largely irrelevant, people who are sick in the US visit ERs and receive care if they are ill. I don’t know a single person who works in critical care who is saying “if only I lived in the EU”.

If anything, our ERs are overflowing with people who aren’t very ill, that is a larger problem than people staying away.

If you have Coronavirus and aren’t very sick, that’s useful to know, but those people largely aren’t being tested countrywide anywhere, there is too much common cold for that to be practical. They are being tested largely in the context of contact with known cases, which is epidemiologically appropriate.

If you have serious viral pneumonia, you can’t breath. People in the US don’t die at home because they are worried about a hospital bill. Ask an ER physician or nurse.

Covid19 is going to spread, no government is having much success except China, whose numbers may not be believable anyway because they are undertesting and the government has the interest and ability to obscure the data. And they literally isolated 100 million people!

The key will be ICU care, and the US is in a better position than any other country in that regard.

For chronic illness you are absolutely correct, the current health system is a disaster. But that isn’t relevant here.

“People in the US don’t die at home because they are worried about a hospital bill. Ask an ER physician or nurse.”

Friend of mine did just that last week. Leg infection, bad insurance, can’t afford to go. Held out too long. Died at home.

BTW, my brother-in-law is an ER physician– known worldwide in his field. Says he hears about it all the time. Lots of others wait way too long to come in for help, and are beyond help when they arrive.

Then there’s The Lancet, which says 68,000 like die every year in the U.S.

A good friend of mine died in his 20’s from asthma, no health insurance.

There are stories about young adults with diabetes rationing insulin or even dying for lack of insulin in the news in the US, today. You’re in denial.

You are wrong, and obviously so.

A December 2019 poll conducted by Gallup found 25% of Americans say they or a family member have delayed medical treatment for a serious illness due to the costs of care, and you claim that there aren’t deaths as a result?

Please.

” Ask an ER physician or nurse”

And how exactly would they know how many people don’t attend their facility, and don’t use their service..?

Please try to think about what you’re writing from a rational, not ideological, standpoint before you write it. Saves us all from dying a little inside.

Thank you MD. Happy claimed he was an MD here a while ago. Haven’t heard that for a while. The only one here I am absolutely certain is one is Gandalf….Radiologist….he has so good insights to economics, as well.

CDC just updated the guidelines again today; now you can get tested by request of a doctor.

Test should still be made 100% free to anyone, but at least this is a step forward.

Tests will certainly be free soon because no one will want to do anything unless they know their status.

One guy had symptoms and was tested. He tested negative. His insurance paid for his hospital bill but not the test: $3400

What kind of insane system charges for a key tool in stopping the epidemic? What is the cost of people not being tested because they don’t have 3400?

That person should make sure to show up at the next annual shareholder meeting of the insurance company, coughing all over those rats.

The guy could write a letter expressing his gratitude for the services rendered to the CEO of the insurance company, cough all over it, and then mail it.

The Covid-19 tests are somewhat unreliable …

The members of the Fed are idiots, from Greenspan’s failure to communicate comprehensive ideas to investors to the current crop of rate-cutters, they don’t have a thought in their heads, it’s just cut cut cut, and, I imagine, where to have lunch.

Maybe this is the best we can do with the best we’ve got now. But I see them as gutless wonders.

OMG houses are going to be more expensive

Why do you say that?

I think he may mean because investments flow away from stocks into RE.

I see the exact opposite. Real estate will get cheap if the coronavirus keeps up. As people get sick they don’t want to go see a doc until the last minute to avoid missing work (or avoid driving for Uber) and to avoid co-pays, quarantines, or outright bankruptcy from the illness. With the virus the way it is people will be forced to stay home and go without pay. What happens to the rent and mortgage payment when someone living paycheck to paycheck is not getting a paycheck? Forced sellers will come out early, others will hang on for dear life hoping foreclosure will be staved off by someone else getting sick as well and not able to file the paperwork. It is all a house of cards waiting to fall.

When there’s a bubble everything and anything could be a pin the media and opposition politicians are licking their chops; we’re told the masses are responding accordingly and cleaning out grocery stores.

Any company that can’t survive the occasional interruption of business doesn’t deserve to exist anyway, there is a core value to businesses, and the market price of shares doesn’t directly have anything to do with conducting business. KO has gone down 40 to 70% on different occasions due to the crisis du jour, as have many other enterprises still with us, but people are still drinking their product. When the tide goes out, and the flush takes place the weak ones are supposed to go with it.

I do think the administration is a bit early to do the cranking, though. In an election year, it would have been better to crank it up from lows rather than the highs. Collective memory is short, and who remembers the market is up 60% from late 2016? Or that a correction of 10 or 15% should be expected and even normal?

No one expects the Spanish Inquisition!

Spiny Norman would like a word!

But almost everyone survived it!

My 3 grown children manage small business, one a co-owner. Many small businesses here end on the ropes because every penny of profit goes to celebrate and party. They hire old friends and won’t let the lazy go their way…small southern city.

Mine are getting by with ups and downs…their Mom is a fanatic about how we should all expect life to have downturns. I have no fat dividends to bail them out…but they are always welcome for meals or sleepover or living here.

The two-day rule would preclude moving in.

The cigarette is a form of social communication, the cell phone is an extension of that brought back into a direct one on one relationship. Cola is sugar water and fizz, they reverted back to just the water to take it back to basics. All things seem to be returning from their former state, which is just a state of mind, into their underlying commodity, especially money. How much added value has to be stripped out of the currency to achieve sound money? They are mass delusions turned inward.

Well, they’re using demand-side economics to solve a supply-side problem. But then maybe the virus isn’t really the issue.

“But then maybe the virus isn’t really the issue.”

I’ve been thinking that too lately, cover for economic problems.

EXACTLY!

By Jove … I think he’s got it !!!

China has shut down its economy to solve economic problems?

Please: Powell and the Fed all go down to Wall Street and all get on their knees and bow down to them and go “What else do you desire my master”? 50 basis points drop for a bloody 10% correction! I’m a saver and I and sick and tired of being of being asked to take in the teeth so these spoiled brats of the street won’t be inconvenienced with the risks that go with investing. God almighty, if there are more corrections will they start a “go fund me” page for them too!

My father lost a fortune to an insider trader that got him drunk and gave him the “deal of a lifetime”.

The second fortune he made after that was swindled away by a nursing home that kidnapped my mother and wouldn’t et her die a natural death until the money was all gone.

That is our world, ladies and gents. Be wise as serpents and gentle as doves….

China is setting up to provide financial aid and tax relief to SMALL businesses. Meanwhile the Fed takes emergency action to make money cheaper for immense banks, corps and hedge funds. (Am I wrong about the hedge funds?)

To paraphrase the old Jay Leno Doritos commercial – “Spend all you want, we’ll print more.”

Let me know when the average consumer’s credit card rate drops below 10%.

Its actually higher now then before the GFC. Credit card rates that is

What a mature, educated, well reasoned comment. Thanks for your contribution!

Yesterday the real yield on 10 year Treasuries was minus 31 basis points. Today ten year rates were down by almost 5 basis points

Who the heck would invest in security with such a negative real rate ?

This means that Congress gets paid to borrow money. Congress gets paid to forgive student loans and politicians get reelected. It’s a nice system they created.

I think the modern system is geared toward maximum economic activity whether or not the activity is productive.

When most stuff is made somewhere else you have to have a service economy and before you know it someone is saying they need $20 per hour to make you a cup of coffee. No thanks I will make my own.

It would appear Powell’s 50 basis point cut is ineffectual. Perhaps that is because we have now entered a credit contraction. Your short is looking more brilliant every day Wolf. Congrats.

I can’t say I’m surprised, but I am disappointed. What happens the next time, which may be next month if not sooner? You give a child an ice cream cone with two scoops of ice cream and he’ll want two scoops again next time or he’ll start whining again. “What? Only a quarter point with us confronting the CV crisis?” This may be the start of moving into negative territory. For Trump, there is no limit as to how low the rate can go. More fiscal stimulus: Isn’t a $4T federal budget enough of a fiscal stimulus? And now, to top it all off, talk of a cut in payroll taxes. I thought Social Security was in financial jeopardy.

1) The DOW never go down in a straight line.

2) The DOW might spend few weeks in a trading range,

building a cause.

3) Market makers will use the Fed, Burnie, the coronavius, Tehran… to

send prices up and down.

4) The media will get busy in the service of market makers.

Oh I get it. They probably told their friends (about the Tuesday rate decrease) this weekend to buy and sell by Monday so we got a whiplash.

Iamafan,

Yes, occurred to me too. And algos talking to algos. Algos are so much more efficient at this than humans.

Ask Chris Collins about it when he gets out of jail. :-)

Or Friday. The blast higher in the last 15 mins of regular trading was awesome. That was no accident and not John Q moving the market like that.

The government, if it wants to do good, can make a proclamation that it will pay for any covid-19 hospitalization bill for any American CITIZEN. They can always make a special insurance fund.

10 year note hit 0.999% according to Santelli. First time ever?

Iamafan,

“10 year note hit 0.999% according to Santelli. First time ever?”

Yes, briefly dipped below 1%, but closed at 1.02%. Both first time ever.

You will find that the 30-year yield futures are MUCH MORE interesting.

https://www.cmegroup.com/trading/interest-rates/us-treasury/30-year-us-treasury-bond.html

Ha, Ha, Powell should not have listened to the crybabies on Wall Street and the White House. They got the rattle they wanted, but now they are going to wail, ball and spit back in his face, because it doesn’t give them the thrill they imagined, or the market didn’t go up. Babies and the markets are the same, unpredictable.

Given all the economic disconnects I have no idea how they are going to stop an epic deleveraging bomb from detonating very soon.

I see a severe recession straight ahead.

For the worlds sake I hope I am just naive.

Hold on, I thought we could drown the virus with liquidity in dollars

I tried to log in to Marcus account (online CD’s ) they are overwhelmed and down I am wondering what they are going to do as they have billions tied up in various short and long term CD accounts . Doubt they want to cash out their client base.

Consider this: ever smell cigarette smoke from inside your car with your windows closed, and the car in front of you, the guy or gal is smoking inside their car ? Well how about your car sucking up someone else’s coronavirus molecules while you are out driving around when the US decides its not bad enough to warrant a quarantine, and wreck the economy.

It will be pure luck if the temperatures get warm enough here, and the spread is limited until then.

Dude. Just activate your ride’s heater !! Problem unsolved.

JP is a traitor to our country.

I’m so ready to spend my principal if it is still there.

The internets are saying the yield curves are still inverted so the Fed has to cut rates more to cure the flu and make stocks go up.

Interests also saying Fed’s big mistake was not doing QE5.

The internets are smart. At least smarter than the Fed. The internets are manipulating the fed like a mentally challenged school kid.

By the looks of it, I’d say: another 50-basis point surprise cut and stocks are going to collapse :-]

It’s time for reverse psychology, raise the rates by 1%. We think the world is fine and can stand this.

Then watch, because it can’t possibly hurt, what’s the worst that can happen, the market drops another 20%. That would barely cause an eyeblink now.

Get it right man ! .. It’s ‘Market Droplets’ .. Free for the offing.

‘Now, how much will you pay .. the Ferryman ?’

The Fed has lost control. Now they’ll be exposed as the Keynesian fraudsters that they are as their financial house of cards implodes under the weight of its own debt, fraud, and fake valuations.

1) The DOW moved to a new box, a higher box.

2) Today the DOW closed the Feb 27/28 gap, reversed

and descended on top Feb 27/28 gap.

3) In the first 2 hours the cloud Chikou, the lagging price, hit

the daily cloud from below and turned around and retreated.

4) Today rd trip was 1,300 pt.

5) Yesterday rd trip was 1,314, but today

volume is so far smaller than the last two previous days, so far.

Michael Engel, I enjoy your posts, but I have to wonder: does all of your financial mumbo jumbo translate into anything actionable? If so, do you act on it? If so, do you get good results?

The only time candlesticks and seasonals don’t work is if you actually do what the signal tells you to do. I’ve tried doing the opposite, but that doesn’t work either.

I enjoy your posts as well. Good, thought provoking.

Covid19 is a bubble full of uncertainties trying to merge with the other bubble.

Meanwhile China is recovering from their handling of the virus while the west is still trying to figure out how to save ‘markets’ from WuFlu.

Public Health will not be served until we find out how to make money out of the pandemic.

All of your statements are only assumptions, especially about China.

Lol, said it yesterday, “I hear nothing, absolute silence.”

King Dollar is back!

Liquidate first to survive.

Wolf,

Your short is looking good and I’m holding getting 7-8%. Stay safe people.

You could say Jerome Powell “shot his wad.” I mean the old musketeer definition not the modern vulgar one. Look it up and you will see the analogy. Same result.

Endeavor,

“Fixed income and pensions get clobbered”

Like ZIRP hasn’t been going on for 20 years.

But……Trump!!!!

CAS127,

True but I was setting up the payroll tax tax cut as another transfer of wealth away from seniors.

MC01:

I have literally no idea how we’ll get out of this pit

Neither does the Fed. They’ve been in emergency mode since the last meltdown with no end in sight.

As Aristophanes wrote over two and a half millenia ago “Woe unto us! All we have left are tears”.

Van Gogh’s last words were “La tristesse durera toujours.” “The sadness will last forever.”

Jonathan Swift’s headstone says “Where fierce indignation can no longer

Rend his heart. Go, traveller, and imitate if you can This earnest and dedicated Champion of Liberty”. Got your work cut out for you.

Michael Gorback

I think they sent an unintended message: “I suggest that you panic”.

Now is not the time to panic. You should have done that a long time ago. Like, ahead of the crowd.

IdahoPotato

Meanwhile, we do not have a functioning government.

You don’t need one with a Stable Genius running the show.

Diogenes

Well, they’re using demand-side economics to solve a supply-side problem.

Exactly.

But then maybe the virus isn’t really the issue.

Never let a crisis go to waste. If none are available, create one. If one is available, make it worse and blame the usual scapegoats. The rubes love it.

Iamafan

The government, if it wants to do good, can make a proclamation that it will pay for any covid-19 hospitalization bill for any American CITIZEN.

Refugees are on their own.

As the coronavirus continues to spread in the United States, people exhibiting symptoms and people who were exposed to the virus are being placed under mandatory isolation and quarantine. This requirement is meant to protect public health, but it’s having a major detrimental effect. The U.S. government isn’t picking up the tab, leaving uninsured and underinsured patients with massive medical bills.

VeryAmused

Given all the economic disconnects I have no idea how they are going to stop an epic deleveraging bomb from detonating very soon.

They don’t either. But what part of the promise that it’s “totally under control” didn’t you understand?

I see a severe recession straight ahead.

It won’t be a recession until it hits the TBTF banks. Ex asset inflation, the real economy never recovered from the dot-com meltdown.

For the worlds sake I hope I am just naive.

Hope is such a cruel, cruel thing.

Are we related? Evil twin maybe?

DawnsEarlyLight

JP is a traitor to our country.

Loyalty is no longer a survival characteristic, at least not to the country. Powell either does what he’s told or gets purged. He’s trying to stay off Johnny McEntee’s radar.

George Eastman’s last words were: “To my friends: My work is done. Why wait.”

Here’s a piece of confused logic from a Fed member:

“Cleveland Fed President Loretta Mester said Tuesday that the central bank’s impromptu 50 basis point cut amid coronavirus concerns still leaves the U.S. economy in the dark about what happens next.

“At this point, both the magnitude and duration of the economic effects of the virus are highly uncertain,” Mester said in a pre-scheduled speech in London.

But Mester said the rate cut enacted just hours earlier was needed to ensure the availability of credit to households and businesses.

“The action taken by the FOMC can help support confidence and ease financial conditions of indebted households and firms, thereby helping to mitigate potential demand-side impacts of the virus,” Mester said.

In other words, things are still “dark” and “uncertain” after a rate cut to bring “light” and “certainty.”

But’s ok, because the rate cut is for bringing “confidence” that more loans will come to people and companies that have too many loans already.

In a broken system that makes no rational sense (perpetual growth required whilst continuously seeking to pay people less to boost short-term stock price to appease speculators) and is just operating “because there’s no alternative”…

…do you expect rational thought and speech to be to the fore?

“perpetual growth required whilst continuously seeking to pay people less to boost short-term stock price to appease speculators”

The DOW:

2017 – 19819.78

2018 – 23,062.40

2019 – 28,583.44

2020 – 25,748.50

– Gain of 29.9%

Median Household Income:

2017 – $62,626

2018 – $63,179

2019 – $63,688

– Gain of 1.6%

Minimum Wage:

2017: $7.25

2018: $7.25

2019: $7.25

– Gain of 0.0%

So factor in inflation (of the real kind, not the politically expedient kind), and people are earning less.

Quod Erat Demonstrandum.

Stock markets don’t mean that much. After an IPO, the stock price only indicates and determines earnings per share. It is understandable but wrong to suggest that the Fed is buying stocks. The Fed regulates liquidity and if consumers stop spending then that is a liquidity issue.

Well not ecactly eps but you know what I mean, the usual complaint is the Fed inflates asset prices. This time it doesn’t so I guess they’re quite happy about it.

This thing is getting worse by the day regardless of virus. Think mid to late 2020 it will cause a real shock which is when the market will likely have a cardiac arrest and then aggressive move by the fed towards ZIRP and then potentially NIRP. If you can time the bottom of the next cardiac arrest I think that’s when you buy and then you ride the thing up until NIRP and then you get the hell out completely and board up your house, wait for zombies.

1) Dr Ben Mandelbrot day.

2) Dr Mandelbrot is the chaos king.

3) A French math genius that debunk old economics theories.

4) He discovered the fractal math.

5) Most wild days, closing more than 3% Up or DOWN, occur

during a correction, or a bear market.

6) A day of 3% quickly will be followed by more wild days.

7) Moves over 3% – either up or down – usually cluster together.

8) They do not predict direction.

9) They predict that chaos will rule the day.

10) A long period of tranquility usually follow chaos.

Hmmm tranquility, like that calm float downstream towards that roaring waterfall.

Paulo said float being in a toxic swill … mercifully, you never make it to the whirlpool (not waterfall)

Kinda like just before, during, and then after a major cardiac ‘event’ ————————

I sense a change in sentiment. As we saw today, the Fed has lost its power to “shock and awe”. Given that the Fed was the only thing keeping the market together till now, I think we’ll see a couple 5-10% down days in the near future.

Powell cut for one reason. Trump probably threatened his life!

It was an Emergency Non- Emergency cut. Talking heads say Fed has lots of ammo for equities. The economy,not so much. All of us cupcakes can buckel up for a Nantucket Sleigh Ride. It’s time for the comfort of the HECK MUG , loaded with a rich Porter for me of course. I got mine , pony up. We will all be happy together. Wolf can keep us informed.

I pity the small business owners and their employees. The little people are going to suffer, as always.

But when they get it in their heads just who was responsible for their plight, watch out !

The game is that a) Fed has no control over real economic backdrop that’s a fact b) but their actions receive a lot of emotional response especially in equities c) as global economy keeps sliding lower you can count on the central banks to act regardless of how ineffective their actions may be in reality because they simply have to do something. And every time they do something it sends equities into a frenzy higher. Their actions are costly every time they do QE the actual economic background gets worse even though asset prices continue upwards. At some point this has to end. How it ends is anybody’s guess.

Everything I read points to this year causing a heart attack that will force the Fed to do more QE and we will likely first see ZIRP and then probably NIRP. Which means higher asset values and equities on an even higher tear, but before they get forced into NIRP you have to see a serious scary cardiac arrest to force their hand. So I would wait for a scare and if you want buy but carefully because you don’t know how deep the next scare will be.

And then once we get to ZIRP and then NIRP then we are truly in uncharted territory because USD is a reserve currency and NIRP in reserve currency context means something really fu…. scary.

Some people don’t think that they will dare do NIRP but the Fed cannot simply give up so they will do whatever even if it makes little difference OT even if it’s harmful.

So these fu…. I think will drive this thing off a cliff real hard. I just don’t see any other way.

At that point people think that politicians will likely try MMT

And that will usher the final breakdown of USD as the reserve currency and massive hyperinflation … but this last stage is way off and we’ll get plenty of warning before we even get anywhere close. They would have to change the federal reserve act first to be able to do MMT and that would be massively politically controversial.

The real scare that will force the feds hand is the underlying economic malaise and the problems of the global monetary system. That has been getting progressively worse since early 2018 and finally caught everyone’s attention mid 2019 and especially in 4th quarter.

We broke 1% … ZIRP next… this virus may become the prick that pops this bubble … impossible to know… but the way market is reacting to the rate cut is telling that people are scared

The Fed’s not looking at the equity markets they are looking at rates and Eurodollar futures are telling them that they have to move and move quickly. So I think they are testing market reaction with a rate cut to see how much real bullets that have to load next to have an effect.

Eurodollar front contract was already pricing a rate cut by its expiry which is only two days after the next Fed meeting.

So people in credit markets were expecting something out of these jokers and they even got it right that this dude would panic and do it ahead of the stupid scheduled meeting.

Nobody cares, they were already pricing this in. Powell is just catching up – same thing he’s been doing his entire tenure at the Fed so far.

More Upside Down Fed Logic:

“Cutting rates was the right policy choice, certainly the right thing to do, but doing it the way they did was a mistake,” Zandi told Yahoo Finance’s “The Ticker” on Tuesday, several hours after the Fed made its first decision on rates outside of a scheduled meeting since October 2008.

“Certainly we know that in hindsight,” Zandi added, “because it didn’t do what it was supposed to do and that was instill confidence. It in fact undermined confidence.”

So, if the Fed seeks to instill confidence the Everything Is Awesome, why doesn’t RAISE rates?

. … Instill confidence in the con-men – long after the gig is up? Indeed!

Well, refi activity will be off the charts. I look for relaxed lending standards and many other aggressive measures. Below is a quote from an article on Zero Hedge. “Support Corona Response” sounds open-ended (turn on the fiat fire hose). The debt is piled high. In hind-sight the 50 bp rate cut will be inconsequential to what could follow. China effectively suspended defaults until Q3 – initially. But maybe the virus will go away –

FEMA officials are preparing for an “infectious disease emergency declaration” by the president that would allow the agency to provide disaster relief funding to state and local governments, as well as federal assistance to support the coronavirus response, according to agency planning documents reviewed by NBC News.

QQQball:. Just change the rules!

Yield curve inversion again.

Hunger sets in as Wuhan remains on lockdown. It shut down so quickly vegetables in stores spoiled. China reported fewer active cases, or did they stop counting?

No signs of epidemic in Brazil.

Pretty sure that China has just decided to stop counting. With everything locked down, and foreigners fleeing/avoiding the country, nobody would know any better.

As the Diamond Princess cruise ship experience showed, confining everybody, uninfected people with asymptomatic infected people, is highly effective at spreading the virus to more previously uninfected people.

Brazil just reported its first confirmed case of corona virus. It’s barely made a blip in the news.

Like India and Africa, I don’t think Brazil’s healthcare system, combined with the widespread poverty and high rates of pre-existing diseases that cause fever and respiratory symptoms, make it possible for those countries to notice early spread of COVID-19. Only the wealthy will get tested, and the wealthy also are most likely to be able to protect themselves against getting the disease in the first place

Question: Is the Fed actually useful for anything?

I’m scratching my head.

Iamafan: The fed is not completely worthless . It can always be used as a bad example.

of glorius portraits of Fed Head diktats …

The FED has proven itself, over the years, to be extremely valuable in dramatically enriching a certain European family of some repute (dis?) just saying …..

The two largest food supermarkets in the Washington DC Metro area are getting ready to close Thursday because of a strike by its labor unions. What timing.

Starve a cold blooded government, Feed a feverously enraged public ??

Here’s a few new things I learned today about the SARS-CoV-2 virus:

1. It doesn’t just bind to the relatively scarce ACE 2 receptors on cell membranes like SARS did, it also likely binds to the far more ubiquitous furin protein on cell membranes. This would account for the fact that SARS-CoV-2 is about 100-1000x more infectious than SARS was, and is similar to the way HIV and Ebola viruses infect cells. This was discovered at the Nankai University in Tianjin and published (early release, non-peer reviewed) on 2/14/20. Articles about this can be found on Salon and the South Morning Post, or, if you want to try to translate it, you can read the original article at chinaxiv.org/abs/202002.00004

2. The virus has been acquiring about 2 new mutations per month, based on analyses of the family tree from the collections of viruses taken at different locations and dates around the world as the disease has spread.

A few comments:

The discovery that SARS-CoV-2 attacks the furin receptor has only added fuel to conspiracy theories that this was a man made weaponized virus that accidentally escaped. These conspiracy theories always assume that other countries with this technological capability are too pure and ethical to have created the virus and deliberately released it in China, which is why it has to have been an accidental release upon themselves by the evil/stupid Chinese. And these theories conveniently (or out of the sheer ignorance from which they arise) ignore the fact that, besides HIV and Ebola, furin is also the point of attack of a large number of other diseases including influenza, dengue fever, and papillomaviruses (the cause of cervical and throat cancers, warts, etc.). In other, words, it’s incredibly common for viruses to develop the ability to attack furin because furin is so ubiquitous and is involved in a huge number of key normal physiologic functions (this also makes it a near impossible task to use this knowledge to block infections through the furin protein, because you would block these key biologic functions of furin also, most likely)

The mutations will likely change the course of the disease, but it remains unclear how. Natural selection would favor those viruses with mutations enabling continued and improved spread. This may also make the SARS-CoV-2 virus increasingly less lethal, evolving into something with the fatality rates of the common cold or flu. But, it may also become so contagious that it may NEVER completely disappear, and, even with lesser lethality, will continue to inflict large numbers of deaths similar to influenza.

Assumptions that China has successfully quarantined its way out of further spread of the SARS-CoV-2 virus are, ahem, highly premature. The best quote that I’ve read about this is that stopping this virus will be like trying to stop the wind.

It’s more likely that what’s going on currently in China is that the leadership has decided that the economic damage caused by the quarantine cannot be allowed to continue, and so has opened up all the most crucial cities involved in manufacturing and trade – a “damn the torpedoes, full speed ahead” sort of approach. Just get everybody back to work and take the 2% fatalities, kind of like the way working in the mines was like 100 years ago around the world. After all, they do have over 1 billion people. As they say, in China, if you’re a one in a million, there’s a thousand just like you.

So, I predict (again) a second wave of COVID-19 to appear in China, probably bigger and more severe. And, since China’s billions of cheap goodies cannot get designed, made, and shipped out from the country without major interaction with human beings from the destination countries, I predict that this will spread the infection further worldwide.

Apple, for instance, to start up production of its new line of iPhones, which were supposed to arrive this April, would have normally sent teams of its people to oversee the changes in production process at Foxconn’s factories in Shenzhen.

Volunteers, anyone? Draw straws? Black beans?

The Fed doesn’t know what the hell they are doing. They proved it today with the 1/2% rate cut. Its the wrong medicine for an economy that has had interest rates pegged way below the inflation rate for a long time. It didn’t work before and it won’t work now. That’s why the market crashed today. Savers are getting crushed and will have to cut back their spending, offsetting any benefit of the interest rate cut.

1) The Fed cut rate. The yield curve is flat.

2) US 10Y – 2Y is steeper than last week @ 0.295.

3) US 10Y – 3M is higher than last week @ (-) 0.092, underwater.

4) The German 10Y hardly moved and US 10Y plunged.

5) US 10Y – German 10Y cont its downtrend, approaching 2016 trading range.

6) Since Oct 2018 its down from 2.84% to 1.66%.

7) Fred : SOFR today, on 3/2/20 is @ 1.59.

8) US 10Y, the lowest ever, might hit a springboard before popping up…

The next step for the fed is to go out and buy the 10 yr to provide liquidity to the market.. They bought enough of the Treasuries… The repo market wants cash as collateral, no one trusts treasuries..

Well… nobody saw that coming… lol

BB cdx spreads declined 0.5 bps yesterday and jumped 11bps today… go ahead leveraged junkies… go max margin and continue to collect those pennies!

\\\

It doesn’t matter how you push a rope, it wont work. They know this, the FED are bad people, but not idiots. This was a desperate bid to increase market confidence and it will not work.

\\\

Random thought: What do the anti-vaxxers do if/when the pandemic becomes an epidemic and an effective vaccine is readily available?

This is going to be the first DNA based vaccine. You want to be first to try it? Don’t worry there are not enough test kits to discover who has been exposed, and they said they would have it ready NEXT YEAR. Since this virus can reinfect that timeline may prove pivotal. Even if they had the vaccine right now, do they have the means to produce several hundred million doses?