Inflation runs hot in housing, medical services, health insurance, other items that are not imported.

The consumer price inflation data released today by the Bureau of Labor Statistics, which corroborates prior inflation data, says that, yes, prices are rising, but they’re rising sharply in services that are not impacted by imports and tariffs, such as rents and other housing costs, healthcare, education, and other services, and also in restaurants (where customers pay mostly for labor and rent). But inflation in durable goods, such as electronics, cars, and the like – where the tariffs would show up – was very low.

Inflation as measure by the Consumer Price Index (CPI) rose 0.3% in July from June and 1.8% over the 12-month period. This was largely held down by a decline in energy costs (-2.0% due to the ongoing oil bust) and by a very slow rise in the costs of durable goods.

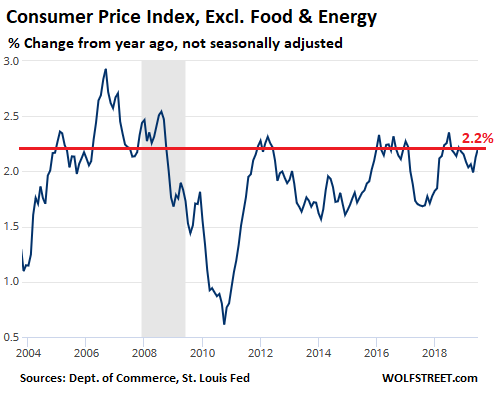

Food and energy prices are very volatile, dancing to the tune of oil busts, droughts, floods, diseases in animals, and other factors. Together, they weigh about 21% in the overall CPI. A less volatile measure is the CPI without food and energy, or “core CPI,” which rose 2.2% over the 12-month period, at the high end of the 10-year range:

Where does this inflation come from?

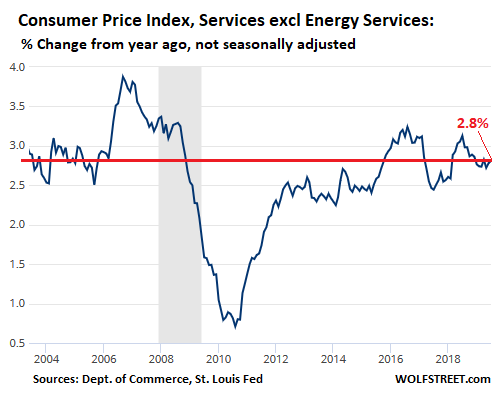

Primarily Services: Services include the biggies that consumers spend most of their money on: housing costs, healthcare, financial services, telecommunications services, education, etc. Services without energy services (such as utilities) weigh about 60% in the overall CPI. These services have nothing to do with imports or tariffs, and over the 12-month period, their prices jumped 2.8%:

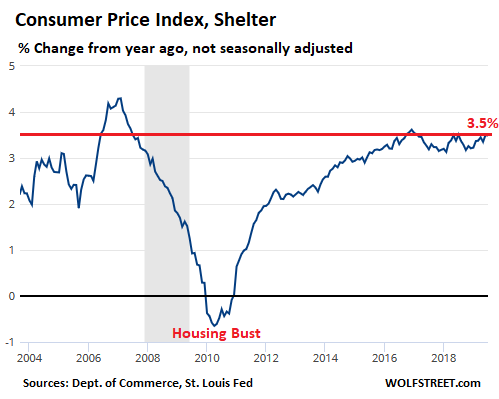

“Shelter,” the biggie, accounts for 33% of the overall CPI. “Shelter” is a group of services that includes housing costs, such as rents and “owner’s equivalent of rent” (what it would cost a homeowner to rent the home), plus hotels, and the like. Shelter has nothing to do with imports or tariffs, and it jumped 3.5% over the 12-month period, at the very top of the 10-year range:

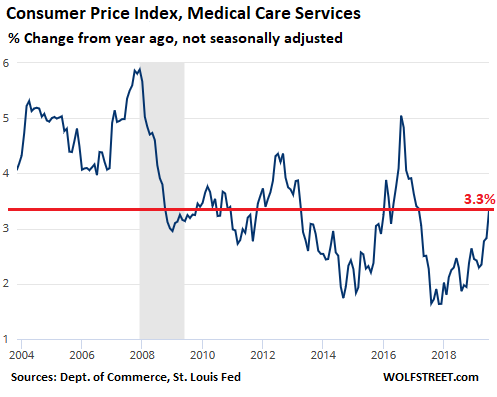

Medical care services, the second largest group in services, account for about 7% of total CPI. This does not include pharmaceutical products, but includes hospital services, dental services, and the like. And it includes health insurance, which – as we guessed with our grin-and-bear-it grimace – soared 15.9% over the 12-month period, driving prices of total medical services up by 3.3%:

Where does this inflation not come from?

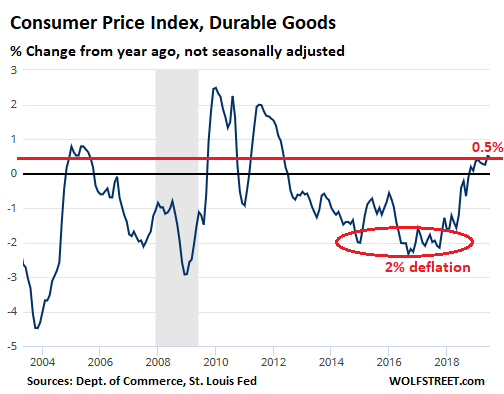

Durable Goods – products like cars, furniture, appliances, TVs, smartphones, computers, tools, lawnmowers, etc. A lot of products in this category are imported, or even if the products are “made” in the US, their components are imported. This is where tariffs would hit the hardest.

A reminder what inflation is and is not. Inflation is a price increase of the same item with the same qualities and features, and the same quantity or size. If new cars get better – improved safety features, performance, electronics, etc. – this cost of the improvements shows up in a higher price of the car, but is removed from the inflation data. Same with smartphones, and other products. A $800 laptop today is a thousand times more powerful and feature-laden than a laptop in 1995 that cost $2,400.

Many durable goods are far better than they were, but cost less, such as laptops. Other products cost more, but you’re getting a better product. Your cost of living goes up because you buy those improved products, and because you buy products that didn’t exist before, such as smartphones. In return, you’re presumably safer and more comfortable and better connected and get better quality of life of whatever. That’s the theory. Inflation is when the same thing with the same qualities gets more expensive.

By this measure, deflation in durable goods has long been common. As manufacturing (automation) and transportation get more efficient, the same products should cost less. Globalization of manufacturing has contributed to that, as US companies offshored production to cheap countries.

The Consumer Price Index for durable goods inched up 0.5% in July, compared to a year ago (and a slightly slower rate than the year-over-year increase in June). In the Fed’s eyes, while an improvement over the -2% range (deflation) in 2016 and 2017, it was still insufferably low inflation. Some upward pressure in prices of durable goods – tariffs or no tariffs – would bring the Fed to its goal, and it can get off its “low inflation” bandwagon. But we’re not there yet:

Corporate America, focused on offshoring production, hates tariffs. Foreign companies, focused on sending their goods to the US, also hate tariffs. They’re first in line to pay for the tariffs. Their hope is that they can pass them on to consumers. But they’re having trouble doing so.

Consumer prices in the US are not set by companies but by the market (unless there is a monopoly or a screwed-up situation as in healthcare where there is no market). Walmart might want to raise the prices of its Chinese stuff, but consumers can buy this stuff elsewhere, and they can dig up the lowest price on the internet. This causes Walmart to lose a sale. Price increases in goods that can be comparison-shopped over the internet have had a very hard time sticking.

Corporate America just received a large income-tax cut. And companies didn’t pass those tax cuts on to consumers. Tariffs are the opposite, but on a smaller scale: They’re a tax increase on corporations, both US importers and foreign companies exporting to the US. But they impact profit margins on sales, rather than taxable income.

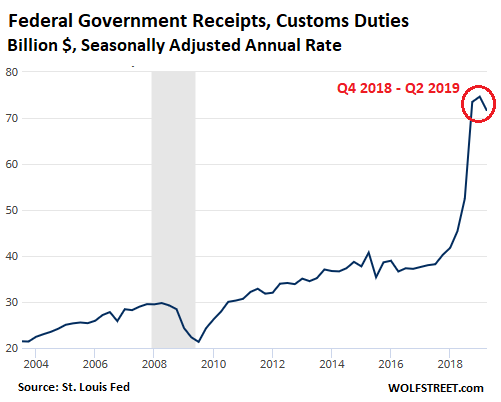

If in the future foreign and US companies are finally able to raise prices on durable goods – tariffs or no tariffs – and make them stick, it might finally cause the Fed to get off its “low inflation” bandwagon and declare that long-sought-after “victory” of having met or exceeded its target. Meanwhile, these tariffs bring in big revenues to the US government, having doubled from prior years to a seasonally adjusted annual rate of over $70 billion, and the government sure needs that moolah:

In the US alone, “Financial Repression” impacts nearly $40 trillion — with consequences for the real economy. Read… The Giant Sucking Sound of Financial Repression

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The tariffs are an additional “sales tax” on goods paid by consumers and Corporate America to the Government. It is paid either by Corporation or the Consumers. For now, Corporations are bearing the brunt. Soon they will pass it onto Consumers in the form of increased prices leading to more inflation. The Federal Government is the winner which has found a new source of revenue and a new way to increase tax without calling it a tax. The losers will be middle class and poor Americans.

Or corporations will import stuff from another nation without tariffs.

Or, maybe, decide to move some production back to the states.

or corporations will decide its better to accept a lower profit margin on a per item basis than to reduce overall profitability by increasing prices and lowering sales

I think that’s wolf’s point. I wish the WSJ would give him the front cover on this one.

I raise rents each year based on min wage in our state

now $11 and goes up .50 cents each jan 1

at which point all restaurants raise prices

I see how much(usually 3%) and that is what I raise rents by

joe saba

What do you do if your tenants make a little above min wage and thereby saw no increase in income? I guess they just start digging deeper for housing and spend less on things like Health Care. Maybe they stop paying bills and apply for government aid? I guess taxpayers are subsidizing landlord rent increases then.

Nobody’s going to move production back to the US because of tariffs – unless they’re sure the tariffs will remain in effect for many years. Think about the costs and efforts involved: finding a new factory site, installing (or moving) equipment, training staff… Companies won’t incur those costs for what Trump himself characterizes as a negotiating tactic.

Plus, China’s markets are growing – what if China decided to blackball anyone moving production out of China?

The bottom line here is that we live in a consumer economy where the average consumer’s salary hasn’t gone up much in many years. So far, ever-cheaper prices on consumer goods has staved off collapse. However, it’s looking increasingly fragile – which is why nobody’s investing in expanding manufacturing. Why increase capacity if it’ll just sit idle?

Three economists, Aaron Flaanen (Federal Reserve Board), Ali Hortaçsu (University of Chicago), and Felix Tintelnot (University of Chicago) just published a working paper on the effects of these tariffs: (April 2019)

We find that in response to the 2018 tariffs … , the price of washers rose by nearly 12 percent; the price of dryers—a complementary good not subject to tariffs—increased by an equivalent amount.’

As of April 2019 the increased cost to consumers was about 1.4 billion.

Note that the tariffs gave ‘cover’ to the increase in dryers, even though they weren’t subject to them

nick kelly,

I just hate this manipulative cherry-picked anti-tariff propaganda that is floating around all over the place. So here is a dose of reality, paid for with my own dollars:

In April 2017, I purchased a washer online, after shopping and working browsing-history magic for the best deal. We paid $479.99 (Best Buy email confirmation below).

So just now, I shopped for the VERY SAME MODEL online, and it took me a while (using the magic of browsing history), and after the 6th try, I found the very same model for $425.00 (Sears Outlet, screenshot below). “Variable pricing” on the internet is such that everything is in flux, and prices are all over the place. The longer you look, the cheaper it gets. The first price was the most expensive.

So, over these two years, the price of this very same washer DROPPED by 11.4%. OK, I might not buy from Sears, but it’s still a price. Also, I don’t extrapolate from this that washer prices in general fell over those two years. This is just once instance. But it shows how powerful competition on the internet is, and that it’s tough to raise prices on the internet unless companies engage in price fixing.

This is an excerpt from the email confirmation from Best Buy (click on it to enlarge) from April 2017:

And this is the screenshot of the deal I found today August 13, 2019, for $425 (click on it to enlarge):

I suspect that by dint of being an online specialist you get better deals than Mom and Pop who just wander into a Home Depot and buy a set and that there are more of them.

Thousands of US companies have applied for exemptions from the tariffs. Are they all able to absorb the extra costs? I thought a lot of corporate US was on thin ice.

Both sides of the tariff debate have points to make. I think one of the best for the pro-tariff side is that this is short term pain for long term gain.

You would have done better by paying a bit more for a Wisconsin made Speed Queen. The first pair went twenty-two years with a single belt replacement on the dryer. I bought my wife a new pair to do something that I don’t recall. Then the originals went to my work shop to launder shop rags. Thirty years and still run well.

They are commercial machines with lighter sheet metal as they are unlikely to be abused by the chimps at the laundromat. They have no powder metal gears and are built like a brick sh-thouse.

There it is Wolf, I knew someone was going to ding you for going with a Whirlpool!

RIPP,

The least I should have done is charge Whirlpool, Best Buy, and Sears $1,000 each for the promo, but it was late last night, and my eyes had ceased functioning and my brain had locked up, and so it slipped through my fingers :-]

That comparison is dishonest. You’re comparing the price you paid for it with a price on a site (Sears Outlet) that sells slightly-damaged goods. The cheapest price I could find was from Home Depot at $527.40. That’s nearly a 10% increase in retail price.

Also, as for this statement:

“Foreign companies, focused on sending their goods to the US, also hate tariffs. They’re first in line to pay for the tariffs.”

I’m not sure I understand the logic. Exporters don’t pay tariffs. Importers pay tariffs. Sure, tariffs may provide pressure on exporters to lower their prices but that’s a far cry from them being “first in line to pay for the tariffs”.

That said, yes, the central premise is correct – most things driving the CPI upward were not tariff related. However, the real question is if the lack of CPI impact by the tariffs simply the result of all the inventory build up we saw earlier this year? Furthermore, there’s been a significant uptick in the US-China goods trade deficit since the trade war began. That could be interpreted as inventory build-up as a hedge against even larger tariffs down the line.

In other words, time will tell. Once inventory is depleted we may see a sudden rise in CPI driven by an increase in retail prices.

This is basically correct. It’s all about time. Given long enough, the prices filter/drift into the whole economy. “Every” entity in the market pays them, depending on where they can be pushed to by other entities.

The “consumers” pay every day all the time conclusion, is BS foisted yet again by the corrupt academic economists and related toadies.

The tariffs on US Consumers was the 10 % to be enacted in Sep, but Mr T folded like a cheap suit and pretty much cancelled them if you look at list of things removed, by November the 10 percent will be cancelled entirely cause trade talks are ” going good ”

Democracies will increasingly have to choose between raising wages and redistributing income or maintaining free trade and capital flows. Because they are likely to choose the former, the world may face a long-term reversal of globalization… The next US president going down that road, Europe also.

Excellent Article btw… What a roller coaster two weeks in markets, thrilla in Manila!

In England wages surged in the past year, while there was negative GDP growth in Q2.

There have been times of low economic growth and inflation called “stagflation.” The run away inflation of the US 1970’s and early 80’s resulted in higher interest rates. Venezuela is an extreme example of a nation unable to balance its budget.

… copying and pasting Michael Pettis? https://carnegieendowment.org/chinafinancialmarkets/75972?lang=en

Well, if you buy shoes made in China that cost 100 and the “manufacturer” paid twenty, for then your import tax is two bux at 10%.

NO next year is 2020 an election year, remember.

Simply political rule, going into an election year, give the populace, a good holiday season.

Thats why the p45 team is pulling every and any dirty stunt it can, to drive down interest rates untill dec 2020.

As I commented a few days ago, there is no US apparel industry to protect and China’s competitors like Vietnam, India. Sri Lanka etc, can’t fill the gap in time for the winter season. This is especially true of footwear (ex. flip flops) which are more demanding than dresses, T- shirts etc.

So someone got through to the decider- in -chief and the tariffs on apparel and phones (also no US manufacturing) are not happening as planned. So Lo! the market is up 400 at this point.

The absurdity of this is obvious but here is a question. All insider trading

prosecuted so far involved individual stocks. But now we have someone who can move the entire market on a whim and a word, in a way that is unpredictable. So how many people knew about this latest mood swing before it went public?

So how many people knew about this latest mood swing before it went public?

Only favored insiders, if anybody. Of course, the laws prohibiting insider trading, market manipulation, and so forth specifically exclude federal officials. Which means he could tweet the markets up and down according to what’s most profitable.

Would you like to know how ‘greenmailing’ is done? Not that it could really be happening, of course, because that would be wrong.

http://www.salon.com/2019/08/13/donald-trump-is-driving-america-off-an-economic-cliff-but-is-it-deliberate/

Even if companies figure out a way to pass on tariffs to consumers, it will only affect those who buy new durable goods.

Most car sales are used. The now-mature cell phone market could migrate to mostly refurbished soon. Laptops & tablets too.

If this ends up being true, tariffs will mostly affect vanity purchases. And what’s wrong with that?

Legerdemain: companies eat their profits. PBOC floats the yuan, dollar rises, consumers lose spending power. Rinse and repeat.

Cause the US Dollar is so strong along with much higher wages then other exporting nations, US can’t compete in exports… A strong US Dollar is very bullish for the Consumer due to US importing a lot more then locally manufacturing, if the Dollar were to weaken substantially, then Americans will feel high Inflation.

PBOC doesn’t float CNH, it just stopped defending it, having trouble rolling over swaps in that corner of the world, they are pretty much broke, net debt well into the trillions on Foreign Reserves

In my view, the cost of living (inflation isn’t the same thing) has been soaring for years. Rent and health insurance are the biggest culprits.

When rent is crazy high there is a lot less room to purchase durable goods – both physically and financially.

Sounds about where we’re headed.

I don’t follow how a rising dollar causes consumers to lose spending power (assuming they keep their jobs).

Strong dollar will impact US exports and tourist arrivals. —equals job losses.

Who bothers to be a USA tourist? …To get a feelup and X-ray from some fat uniformed subhumanoid creatures?

Aha! The truth come out and the big boys don’t like it one bit. Seems they might be getting their comeuppance after not helping the American worker keep their jobs and going after cheap profits. Thanks Wolf, for keeping a truthful eye and keeping us informed.

An article in another blog contends from their data a basket of goods at Walmart has increased by 5.2% between this June and last June, and Target almost as much. Home insurance and deductibles went up almost 10% this year, and that was true for 3 other people I talked to, with similarly valued homes. It has climbed over 30 in the last five years. Supplemental medical and drug insurance went up only about 3% since about 60% of the cost is paid by my former employer. Auto insurance was up 8% this years, depending on whose data you read. So, to the Bureau of Labor Statistics: phooey.

The CPI is best described by the phrase; “lies, damned lies, and statistics”. It is designed for the sole purpose of minimizing the governments cost increases for entitlement programs and does not reflect the actual inflation seen by even the Average consumer, let alone any individual consumer. And while it may move up and down in sync with actual consumer price data, it has been manipulated to represent a fraction of the real number.

Amen!

b

Since 1960, real per capita (average, not median) PCE expenditures for shelter are up 200%. For healthcare services, up 900%. For higher education, up 750%. Meanwhile, in that same period, real wages for the 70% of employed Americans classified as production and nonsupervisory, wages are up 15%. (These are all US government figures.)

I think that CPI doesn’t measure what we want it to measure. We want it to measure how much the price of a product / service increases, and instead it tries to measure the price of that product / service as it evolves over time, i.e., with changing criteria. So for example we are told there is no inflation in new vehicles, but we can easily prove that there is plenty of price inflation but (we are told) that price inflation is fully offset by the various improvements in quality, safety, reliability.

Dale,

Inflation is the loss of the purchasing power of the dollar. That is all CPI measures.

But if you’re buying an improved product, such as a new car with improved performance and safety features, there are two elements:

1. the purchasing power of the dollar;

2. the cost of improvements.

CPI only tracks #1.

Cost of living (and your bank account) tracks #1 plus #2.

Thanks Wolf, and appreciation for the good work you do.

Dale,

I agree with what you’re saying in the your first paragraph, but you’re comparing the wrong sets of numbers. You have to compare “real” to “real” and “nominal” to “nominal.”

“Real” wages are already adjusted for inflation. But the prices you compare them to you quote as “nominal” (not adjusted for inflation). So you get distorted results. You need to compare real wages to real home prices and real healthcare costs. Or you need to compare nominal wages to nominal home price costs and nominal healthcare costs.

“Healthcare”….sigh….

Has anyone ever really thought about all this constant advertising of “drugs”? Don’t you trust your Doc, or do you just walk in and say I like the looks of this one, I want it prescribed? Exactly what is your Bio-Medical background, anyway? Maybe “nobody” here does that, but ads cost mucho money and Pharma wouldn’t spend it if it didn’t work on many many “someones”, and also a jaded, or bought off Doc who now has to work for “managers”, instead of being able to run his own practice.

I agree with you. Anyone who or tell me insurance – health, auto etc, and housing are going up at the rates mentioned in this article needs to get mite. I don’t believe it.

Old Engineer,

Please read the article.

Also 1: Most of what consumers buy is NOT sold at Walmart (services, cars, etc.).

Also 2: I, like many other people, hardly ever buy anything at Walmart, and if I buy, it’s only online if it’s the cheapest. Some guy’s basket of goods he bought at Walmart is not an indicator of the US inflation rate, which doesn’t just cover goods that Walmart sells. That kind of stuff is cute and makes good click-bait headlines, but you cannot extrapolate anything from it.

Here is some anecdotal stuff from our household: Our health insurance rose 1.8%. Our housing costs didn’t go up. The prices of the laptop we bought fell, though it’s a lot more powerful than any prior laptop we bought. The price of our clothes we bought fell. Our shoes got cheaper. Years ago, I canceled cable TV because I don’t need it anymore with broadband, so I don’t care what cable TV prices do. Our broadband bandwidth more than quadrupled a month ago for the same price (I called and asked, and they increased it even while I was on the phone). Our cellphone service costs fell though we got a bigger data plan. Our car insurance went up, but I reduced coverage, so I pay about the same. Gasoline is cheaper than it was 11 years ago.

Also you need to understand — as explained in the article — the difference between inflation (dollar loses purchasing power) and higher prices due to higher-quality products, and the phenomenon that a lot of goods prices are LOWER despite higher quality (consumer electronics, for example).

Wolf,

The running theme you hear over and over again from the talking heads in the media is that the tariff eventually hits the consumers. Now, I do agree with that sentiment, because no company in the world is going to ever want to lose margins. But your article brings up an interesting point. Service is where the inflation is.

I would assume that part of the reason that the tariff hasn’t impacted the consumer yet is how they are targeted so far. But the implication of your article is that scale will matter. Amazon and Walmart certainly has scale, and they have the ability to withstand the pains of the tariffs longer, and up to a certain point, there are going to be winners if the tariff are implemented in full force.

Namely the larger guys survive by having enough margin shrinkage, but kill the smaller guys because the consumers now have a distinct choice when it comes the pricing for their stuff. So, when this eventually blows over, the larger guys are in a more powerful position.

I think there is an interesting point you make about the purchasing power of the dollar as well, but that is temporarily hidden at this point, isn’t it? Due to the cleanest of dirty shirt theory, and hence the strength of the dollar.

At some point, this whole charade will come crashing down. I am wondering at what point the US will truly start to fall. Europe and Japan is already in trouble, China is hanging on, but is getting hurt in the process, one has to wonder where all of this will eventually end.

“… I don’t need (cable), so I don’t care what cable TV prices do.

Very important point, IMO: Anything one doesn’t need OR CAN PROVIDE FOR ONE”S SELF “off market” so to speak, makes one care not what its price might be on the market.

Home and property insurance is entirely a different animal. The climate has not been pleasant for their bottom lines. Wild fires, floods, tornadoes off season and every other black swan events have hit them in recent years. Their main underlying investments of commercial property and interest haven’t been real good hedges either. If the climate continues to be as wild and unpredictable as it has in recent years, I can imagine that rates will go much higher faster. At least this year the wild fires have not been as big or active as in recent years. Knock on wood!

I’m guessing the massive amount of fiscal spending for defense and medicare makes us the cleanest dirty shirt.

Defense budget: $700B.

Healthcare spending (government and non-government): $3500B.

There is plenty of waste in the defense budget. But imho far more in healthcare.

Every $1 spent in Medicare saves $2 in alternative healthcare. Expanding Medicare to all who don’t have would cost half what they/we are spending under their current plans and would save state, local and Federal Govt mucho $trillions$ over 10 yrs time. It’s a bargain. That’s why it’s so strongly opposed by corporations and the politicians who take their money.

Preach

https://khn.org

AND READ!!!!!!!! This is a great site for people who don’t speak the lingo well enough to use NIH-PubMed. I have posted it before, but I’ll go through it again.

This is a foundation supported by the Kaiser Family itself, probably out of some guilt over what they started, “Managed Health Care” for their steel mill workers, which has turned into a MONSTER, and your health care costs right along with it.

The Kaiser Family was only about steel and making stuff with it, anyway.

Exactly. The health care I’ve gotten recently has all been things that could be taken care of in a village clinic in India with a working X-ray machine. But because it’s the US and I’m not in the top 10%, it’s been the most expensive and inefficient way possible. It’s even been expensive for me, out of pocket costs approaching $750 now and counting, and this is with my grossing $300/week.

And the top 10% are going to scratch their heads and come up with all kinds of weird theories when the pitch forks come out…

Technological advancements made goods cheaper, next step is to make services cheaper by replacing humans with robots.

Already happening in many areas, including lawyering, where much of the grunt-work that newly hired lawyers used to do in all-nighters, such as searching through thousands of pages of documents, is now done by machines in seconds.

That doesn’t mean that the retail costs of hiring a lawyer went down. It just means that a law firm’s costs went down :-]

Interesting coincidence: The documents produced for highly repeatable circumstances are called “boilerplate”.

Yeah, funny how that game works. I remember when running IR tests on chemical “foot prints” involved hours of work going through the Sadtler Spectra books…two full library rows of 3-4 inch thick books from Germany of “known” pure compound’s IR scans. Now a computer pulls it up in milliseconds, after a chromatograph of some sort separates all the stuff for ya. Lab tests didn’t get any cheaper, either. The lab management and investors pick up the diff.

1) Energy :

Canadian oil is suppressed to to a lack of pipelines.

Many refineries all over the world love Iranian oil, but due to US embargo Iran cannot get paid.

Iran is forced to sell its oil to Turkey, at a discount and from there, with other sources of oil, all over the world. Refineries have difficulties with high sulfur Saudi oil, even with a discount.

2) Medical care at 3.3% is trending down, since 2008, from 6%.

3) Shelter :

After jumping sharply from 2010 to 2012, momentum have stalled to trading range, to a lower high, since 2016 at 3.5%.

The next move is probably down.

Services : a similar chart like shelter, but to a lower high, at 2.8%.

4) the CPI in a trading range, of about 2%, since 2000, with a bubble

up to 2007 // and an inverse bubble in 2010, well above the front

end of US yield curve.

US collect few dimes from tariff on China, which devalued USDRMB > 7.0, but collected : $20T x 10Y x 0.015(1.5%) = $3T from UST investors.

China is the largest UST holder benefited from a huge capital gains, in the last 25Y.

Then robotics should be the equalizer in world manufacturing for the US. It’s not like corporations can’t be spending their cash on modern manufacturing in the US instead of stock buy-backs to get a jump. If the government had vision instead of greed for themselves and supporters, Tax Cuts should have had incentives to modernize and bring home manufacturing if we’re heading for a robotic/AI future.

Ok so why did Mr. Trump delay the tarrifs? He didn’t like to spoil Christmas.

Corporate America and Wall Street HATE the tariffs. That’s your answer.

taken from bloomberg:

Tariffs on more than $110 billion in new imports from China — including kids’ clothes and sports gear ranging from lacrosse sticks to golf carts — will take effect Sept 1.

Duties on the remaining $160 billion in other imports from China, including toys and smartphones, will go into effect Dec. 15, making for an escalation in two chapters. That may have saved Christmas for many retailers and parents. But in the middle of the holiday season, virtually all U.S. imports from China will face new border taxes.

So Yes, some in corporate America speak louder and have more influence.

Excellent breakdown.

“Corporate America just received a large income-tax cut. And companies didn’t pass those tax cuts on to consumers.”. Are you deducing that based on the durable goods CPI or are there any other metrics?

A corporation is just a set of contracts. Human factors of a corporation are investor/owners, consumers, employees (and perhaps suppliers).

Any time there are windfalls (tax cuts, low energy prices) or headwinds (tariffs, new regulations) they get divvied up (unevenly) by those groups. Are there reliable ways to measure who shared what share of burden (or profit)?

GP,

All corporations got the tax cut, from my media mogul empire to Microsoft. Those are companies providing services. So if the tax cuts had been passed on, there should have been a broad-based decline in prices from healthcare to rents. That hasn’t happened.

I guess they went to buybacks first rather than to price cuts.

I am not even sure what a price cut can and will do.

We certainly have a different economy today.

The powers that be are always shaping the narrative. They like the focus on GDP growth be a use it serves the interest of the 1%. A much more appropriate yardstick of economic success would be real wage growth of the 99%. By that measure we’ve been in recession for a long time.

Why does the general population and media fall for this deception?

Ideally ,this should be the case.But we are not living in Utopia.

Last time I saw any real stats, and that was some time ago, about 80% of the tariffs were being eaten by the Chinese. It may have changed since then, but people have to look at the whole picture. It is not just who “pays”, in the cut the cheque or legal sense. China is competing for business, if you don’t cut your price, you don’t loose just a 10% tariff, you might loose 100% of the business to say Mexico, India or the US. Loose too much business it’s lay people off or close the doors, then how can China pay its USD debt with no USD’s coming in -well it can’t. It’s pretty obvious business is falling around the world, and tariffs add to a deflationary impulse already built into the new mercantilism of the developing world. In any event this ridiculous fake argument in the media about “who” pays the tariff will go on and on..”he said, she said” journalism is incapable of understanding anything more about business than such rubbish.

It makes sense that inflation is focused on services. Maybe the Phillips Curve is not dead but has been on an extended lunch break.

1) Tariff flip flop, on/ off is an incentive for Sept trade talks and PLA

out of HK.

If the Chinese the military takeover HK ==> tariff will double down,

Xmas 2019 will not be saved and the global economy will be hit by a hurricane.

Under a threat of a new midnight tweet, a sudden new flip, AAPl & friends cannot risk large orders, with a potential for higher punitive tariff and smashing AAPL store from Yenan to Peking, as it happened before to Japanese auto makers, few years ago.

2) CPI @ 2.2% :

WTI in 2008 had a vertical rise, collapsed and recovered to a lower high, before the 2014 waterfall sent oil to $26.

The CPI had a vertical rise til 2007, technically an Adam.

After the 2009 decline, CPI is tried again for the 2nd time, in a flatbed

like Eve, since 2012.

Adam & Eve expulsion from paradise is next

– SPX, according to a top guru, will correct to 2,000, bounce back to SPX = 4,000 and from there, on a log chart, only an inch

away, to the moon. SPX in a new plateau, on the moon, before flying to Mars.

– The next correction is an opportunity to double your money,

on a log chart, because log make movements at the top small, almost invisible, but magnify, for free, the bottoms.

– On a linear chart, the horizontal distance from 1998 to 2011, is

about equal to the vertical rise from 2011 to 2019.

– If correct, SPX used all the fuel in the tank.

– A bounce up to a lower high is likely, to LPSY. The most oppressed

energy sector will be leading the charge.

XLE with few oppressed friends don’t have enough energy, for a liftoff to the moon.

When fuel cost will be rocking, the economy will hit a bottom.

There you have it. The global money printing machine is working 7/24 and the US is top capital flight destination.

QUESTION: Marty (Armstrong) : If I have this correctly, you’ve said the Great Depression of the 1930s was a Global Capital Flow problem set in motion largely by sovereign debt issues that led to a massive capital flight into the dollar which created a tidal wave of deflation. Are we seeing this scenario today?

Cheers, TM

ANSWER: Yes. It is the economic crisis outside the USA that is compelling the dollar to move higher. This is what caused deflation and ultimately forced Roosevelt to devalue the dollar. You can see the dramatic spike and rally in the dollar as Europe defaulted on its debts but the US held.

Wolf,

I heard Peter Schiff define inflation differently: Inflation not in colloquial diction meant, and still means to the initiates, an increase in the money supply; price increases followed. But then, the term got linked to increase in prices and not increase in money supply or credit. Perhaps with the advent of credit and not paper money the inflation and prices are more fungible?

I consulted a few legal dictionaries and did not find the definition I was seeking, but I think several older versions of Mariam Webster’s Colligiate dictionaries carry that exact definition- an increase in the money supply.

“Inflation” means many things. There are all kinds of “inflation,” including “monetary inflation,” which is what you’re referring to. There is also consumer price inflation, asset price inflation, wholesale price inflation, house price inflation, grade inflation….

And yes, “grade inflation” is in the dictionary. Random House Unabridged: “The awarding of higher grades than students deserve either to maintain a school’s academic reputation or as a result of diminished teacher expectations.”

People who say that the word “inflation” means only one thing don’t understand how the English language works.

Choose the Quantity of Coins and Spins you want in game.