My fancy-schmancy FANGMAN index dropped 4.3% today, the most since December 24.

It’s a rare moment in recent years that US government regulators are suddenly going after four tech and social media giants simultaneously – Facebook, Amazon, Google, and Apple. These four companies are part of my FANGMAN index that also includes Microsoft, Nvidia, and Netflix.

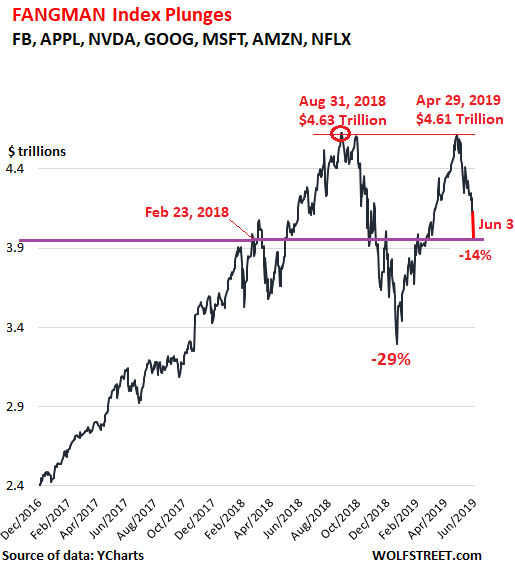

The index dove 4.3% today, the biggest percentage decline since the infamous 4.6% drop on December 24, 2018. In terms of dollars, $137 billion in market capitalization was wiped out. Over the past four trading days the FANGMAN index has dropped by 6.6%. I highlighted today’s move in red (market cap data via YCharts):

The index has gone through some brain-twisting surges and plunges over the past two years. It peaked on August 31, 2018 (at $4.63 trillion), then plunged 29% by December 24 (to $3.29 trillion), then exploded 40% higher by April 29. But that day, at $4.61 trillion, it failed to take out the August high. And then the selling started.

Since April 29, the FANGMAN index has dropped 14.0%, or by $645 billion in market cap, giving up 49% of the post-Christmas rally in just five weeks.

I track these stocks because of their outsized weight in the overall stock market, and because they range from very overvalued to immensely overvalued, depending on the stock – and symptomatic for much of the stock market.

But given the sell-off over the past few weeks, what happened since Friday in terms of regulatory pressure was quite a handful.

On Friday, the Wall Street Journal reported that, according to its sources, the Justice Department “has been laying the groundwork” for an anti-trust investigation into Google, the largest advertising platform in the world. Reuters reported on Monday that Google still “declined comment.”

The WSJ summarized the problem:

The rise of big tech has seen three corporate titans that didn’t exist 30 years ago – Amazon, Google, and Facebook – suddenly amassing the power to sway large parts of the U.S. economy and society, from the stock market to political discourse, from personal shopping habits to how small businesses sell their wares.

With their enormous size and dominance have come network advantages, data caches and economies of scale that can make it challenging for new rivals to succeed. Many firms that compete with those giants in one sector also depend on their platforms to reach customers, and they complain of being unfairly squeezed.

Google has already been hit with three mega-fines by the European Union’s antitrust regulators, totaling €8.2 billion in three years:

- In June 2017, Google was fined €2.42 billion for abusing its position as the top search engine by giving preferential treatment to its own comparison-shopping service.

- In July 2018, Google was fined €4.34 billion for pushing smartphone makers into using its Android operating system.

- And in March 2019, Google was fined €1.5 billion concerning its search advertising.

Over the weekend, it was reported that the FTC would have jurisdiction over a potential antitrust probe into Amazon’s practices. And on Monday, Reuters reported that “Amazon declined comment on Monday.”

It was reported that, according to sources, the FTC would also have jurisdiction over a potential antitrust probe into Facebook, which also owns Instagram and WhatsApp.

The FTC has long been investigating Facebook for privacy violations. In 2012, it approved a final settlement with Facebook, “resolving charges that Facebook deceived consumers by telling them they could keep their information on Facebook private, and then repeatedly allowing it to be shared and made public.” This settlement included a consent decree that Facebook subsequently was alleged to have violated by sharing user data with Cambridge Analytica.

In April, Facebook said that it expected to be fined between $3 billion and $5 billion for these violations. Sen. Richard Blumenthal (D-Conn.) and Sen. Josh Hawley (R-Mo.), members of the Senate Judiciary Committee, lambasted it as a “bargain for Facebook” that doesn’t go nearly far enough in holding the company accountable to its users and forcing changes.

“Even a fine in the billions is imply a write-down for the company, and large penalties have done little to deter large tech firms,” they wrote in the letter. “Fines alone are insufficient. Far-reaching reforms must finally hold Facebook accountable to consumers. We’re deeply concerned that one-time penalties of any size every few years are woefully in adequate to effectively restrain Facebook.”

They proposed a slew of reforms, including that “personal responsibility must be recognized from the top of the corporate board down to the product development teams.” And they added, “It is also time for the FTC to learn from a history of broken and under-enforced consent orders.”

And it was reported over the weekend, again according to sources, that the Justice Department would have jurisdiction of a potential antitrust probe into Apple, which is already entangled in an investigation by EU regulators, following a complaint by Spotify that it abuses its power over app downloads.

That puts the four companies simultaneously under the US regulatory microscope. And clearly, officials have been fanning out to let the media know. On Monday, Reuters reported that “people briefed on the matter say neither the Justice Department nor the FTC have contacted Google or Amazon about any probes, and that company executives are unaware of what issues regulators are reviewing.” So they got their info from the media.

Divvying up jurisdiction was the first essential step. The rest might take years.

Sources told Reuters on Monday that the government “is gearing up to investigate whether Amazon, Apple, Facebook and Google misuse their massive market power … setting up what could be an unprecedented, wide-ranging probe of some of the world’s largest companies.”

Congress appears to be on board, according to Reuters:

Senate Judiciary Committee Chairman Lindsey Graham, a Republican, told Reuters that the business model of companies like Google and Facebook needs to be scrutinized. “It’s got so much power, and so unregulated,” he said.

Another Republican, Senator Marsha Blackburn, said the panel would do what she called a “deeper dive” into big tech companies.

Democratic Senator Richard Blumenthal, who said on Monday that U.S. enforcers have to do more than wring their hands about the companies’ clout, also weighed in. “Their predatory power grabs demand strict & stiff investigation & antitrust action,” the Connecticut senator wrote on Twitter.

So let’s see how that will turn out — if the outcome will effectively change business practices, or if any fines will just raise the cost of doing business, costs that can be written off as “one-time charges” that analysts and the financial media eagerly exclude from earnings reports and hastily send into oblivion where they don’t matter. But for now, the FANGMAN index shows that there is a price to pay.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Nothing will come of any of this political posturing and Washington theater. The reason that Facebook, Google, Amazon, and Apple were allowed to become the size that they are and not broken up years ago is that they provide valuable data to the intelligence agencies…..it’s as simple as that.

Indeed…this is what happens when governments stop listening to the people and stop working for the greater good. In fact, the people are considered to be the problem. “They” pushed the BIG LIE that happiness comes from stuff and consumption. The Gov’t and Wall St. working hand in glove succeeded in convincing so many folks to take on mountains of debt…from credit cards, autos, personal, student loans and mortgages many cannot afford. I can’t believe how quickly folks have forgotten 2008/09. Was swept under the rug pretty quickly. Now, the only thing left is a major correction of some kind. Just plain disgraceful!!!

re: ” “They” pushed the BIG LIE that happiness comes from stuff and consumption.”

No one HAS to buy that lie.

Is this an ideological sortie against the “Liberal” media, allowing for the occasional reference to hate groups on FB, and even allowing for Russian meddling, these places represent left leaning entities. Amazon, Bezos and WP? No love lost there. Barr-ing justice?

Yep. Maybe the Just-Us Department can instigate itself and the CIA with it’s illegal 600 million contract with Amazon to illegally spy on us. And pay Bezos to be a conduit of Fake News and the CIA’s propaganda too no doubt.

The NSA reported it stopped collecting data because there too much to actually filter. Maybe that data on the whole isn’t that valuable

Storage is cheap, so they still probably scoop it all up and store it, until they need it.

:) there is a building in Utah where they keep a record of all your conversations, and god sees every sparrow fall. I sort of wonder if the beef with Huawei isn’t about allowing them into the data collection business.

Yep. Everyone now walks around unwittingly with a camera and microphone connected to the world and broadcasting to anyone with eyes to see and ears to hear – a malevolent dictator’s future paradise.

Case in point… I put an Amazon firestick in a rental house a year or so ago so they could stream. Just discovered the link to Amazon’s archives which has audio recording of what was said in the house…omg. Now I know why vulgar things are on my Amazon “wish list”. This stuff is so out of control.

This is nothing compared to what the market is now saying: that (as many long maintained) no amount of rate cutting -500%! whatever you please!) will rescue the economy from collapse. Next up? Pricing in the failure of Fed purchases of stocks and bonds to prevent an economic crash).

Funds are already blocking redemptions. How long til the Govt simply and permanently shuts the stock market? That will be the ultimate confession that the Government has run out of power. Which it already has. It is that recognition which will sink the dollar, not some silliness like stagflation. Don’t be afraid of the facts.

PPP, you need to stop taking ZeroHedge so seriously.

Just because a fund in Britain is blowing up, and a bank in China, and maybe even Tesla, does not imply “shuts down the stock market”.

Treasuries aren’t going to default either.

And you had some other comment about gold… gold has barely twitched this week and is still in a long term downtrend. Not sure what you think is going on there. But take a look at your own charts and don’t swallow anyone’s propaganda…

The case for Google and Facebook’s abuse and invasion of privacy is straightforward. Even the crud that lives in the tip of my shoes understands it.

There are quite a few quasi-monopolies that abuse their dominance. Yet no Congressman seems to have a problem with them. Comcast for example.

And then there are just shenanigans abusing willy-nilly their government-granted monopoly status. Like the three credit agencies. Equifax, for example, acknowledged that 143 million people in the US were hit by a breach in Sep 2017. The financial histories of 143 million Americans were stolen. Equifax responded by showering its executives and CEO with multi-million dollar bonuses. No penalties were imposed for their negligence.

God forbid the Justice Department got wind that you grow pot in your backyard. They will fall on you like a ton of bricks. Some Justice.

Totalitarian oligarchy, my friend. With all the super-rich above the law.

From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

– Alexander Fraser Tytler

@TXRancher Profound and true… we never know what we have til its gone. Time to examine things.

Old Dog….

Surely many Americans realize we have a “multi-level”….”Justice” system?

As little as I expect from regulatory authorities on this, I suppose they might actually have an easier time dislodging some of these companies from their perches by disaggregating recent acquisitions- these are more modular monopolists than most.

Plus, it’s being done bi-partisan.

However, I would feel better if they also took on agri-business, pharma, and insurance.

With Amazon people have a choice to buy elsewhere. Insurance, not so much.

Everything…the tariffs, anti-trust, politics, gridlock, etc reminds me of some kid tossing rocks off an overpass. Sooner or later the economic momentum is going to start piling up and cracking up.

You know, I’m actually of two mind on this one. On the one hand, the government does need to reign in Facebook, and Google, and probably Amazon. And those companies need to get a kick in the teeth to remind them that they aren’t the masters of the universe.

But on the other, these particular tech giants are already facing real degree of competition from a well entrenched and protected Chinese trio, the BAT. And let’s face it, the BAT isn’t going away anytime soon. Then there is also the fact that they aren’t exactly innovating like before, heck, Google and Facebook are almost like dinosaurs now. All the talk in the valley about those companies are revolving around “the values of their employees,” and “social justice,” and such. I’m struggling to think of the last real innovation that came out of Google and Facebook instead of how employees feel their values are being trampled on in those companies, and how they don’t want to enable evil… whatever the hell that means. So, I’m not sure it’s necessarily a good idea to kick them while they’re down.

Anyway, it ought to make for good TV at least.

I see that the stock of these companies is going down but is it possible that they are actually more valuable if broken apart? Is this a case where the sum of the parts would be worth more than the whole? For example, perhaps if Facebook spun out Instagram both remaining companies would be worth more than they are together now. Same with Amazon.com and AWS, etc.

Yes, that happens soon after Microsoft spins out Internet Explorer and MS Office.

Funny thing is that for a while there, people talked about breaking out Windows as its own operating system and separating it from the rest of MSFT. But turns out, that wasn’t necessary. Events obviated the need for market action. In terms of regulating Amazon and Google, I truly think they are way too late anyhow, somewhere out there, a competitor is coming to kill Google. It won’t be obvious for at least another decade, but it will happen, but I’m comfortable with my prognostication for two reasons.

a) In 2000, if anybody said Microsoft is going to be beaten up and left for dead would have been laughed out of town, and at that point, Google was already in existence, Apple was still an also ran but clawing its way back to relevance, Amazon’s primary business was selling books, and Netflix was busy trying to mail you DVDs.

b) nobody in a decade will remember this post. So, there ain’t no way I can be proven wrong.

Actually the American political system eliminated the need. Before being sued for their obvious anti-trust violations, Microsoft rarely made political donations. Microsoft corrected that oversight, then suddenly all the anti-trust charges disappeared. The magic of American politics.

So, what are the odds that this is just a way of searching for donations to CREEP? (Committee to Re-elect the President for those who are doomed to repeat history)

Regulation is like that snowflake which triggers the avalanche. But the energy was built up all along. Two years ago these same stocks would rally on these same news.

Wolf, nice site icon. ?

Thanks. A commenter here has been hounding me via email to install a “favicon” because it makes it easier for him to sort through his open tabs (I agree) — and the other night he hounded me again, and I finally buckled :-]

Here’s a weird bug about US antitrust law. A monopoly isn’t illegal. but attempting to monopolize is. So the issue isn’t really whether there’s competition, but rather are the players using their dominant positions to stamp out competition?

Because the Big Four not only operate the platform (e.g. Markeplace, App Store, PlayStore), but are also participants, the antitrust case is pretty strong.

1) The FANG are the most important stocks in the world.

If FDN, – the FANG ETF, – cannot regain its glory & strength, rotation will not help to lift the DOW and to a new all time high, even if the US economy will be doing well.

2) The USD is the most important currency in the future market.

USDXYZ pairs are the most important in the FX trade.

3) The XYZ/RMB pairs are important in the barter trade. XYX/RMB dominate the global silk road and Russian pipelines.

Real Goods, commodities & services are traded in Yuan.

Infrastructure for oil, Brazil grains for Chinese goods….

Russian energy, SKA and Iranian oil in Yuan..

The Yuan is the most dominant currency for barter trading in Real Goods.

4) When the FANG have a bad day, the Pareto top might get a heart attack.

When the USDRMB is rising, China is slowing.

Since the Yuan is the most important currency in the barter trade, a devalued RMB will push oil & commodities up, even if Chinese demand will be falling falling, because Putin don’t like worthless Yuan, while the USD in a trading range can give him better value.

5) The US is weakening the grip of the Yuan in the barter trade, forcing them to devalue.

These regulatory actions miss the main point of antitrust.

Google’s search dominates because it works better than other searches. That’s just proper competition. Facebook’s privacy violation is the whole business model. If you join FB, you know in advance that your data is the product. That’s not a monopoly.

Amazon is the only predatory monopolizer. It specifically uses its dominance to WIPE OUT entire industries. Eliminating competition is the ENTIRE PURPOSE of Amazon.

I don’t see any real antitrust action against Amazon.

I’m not sure which Adam Smith you read but competition doesn’t just imply competitors, it demands competitors. No competition, no free market. Now, if you are fine with that, I’m fine with you. But too many people who drone on about “free markets” really don’t get the point of why they are purported to be a good thing: if you have a vast number of buyers and a vast number of sellers, no one can set the price and the consumer wins with better products at lower costs. There is some plausibility to that assumption, but only if you have too many producers to form a monopoly or cartel. The problem for modern businessmen is that Smith’s model is designed around the needs of consumers, not businesses, as a real free market is a very low profit margin market. That’s why whatever ideological persiflage the business community might spout, they really like monopolies and oligopolies and really don’t like wide open competitive markets.

Totally wrong re Amazon. The point of antitrust law is to protect the consumer from price gouging through the anti-competitive destruction of competition. Amazon has always been a driving force to LOWER consumer prices. Consumers pay less overall because of Amazon’s influence on the market. So where is the justification for enforcement? The antitrust laws are not there to protect businesses from being wiped out through competition, they are there to protect consumers.

Further, there are TONS of online and independent portals where you can go shopping. Go to Wallmart, go to Overstock, go to BestBuy online. Anyone can invent a product and start on online business. They can even go sell it on Amazon. Maybe you can identify certain practices that Amazon could clean up (although you have not identified any at this point), but overall the business has benefited consumers.

Re “Google’s search dominates because it works better than other searches.”

Not anymore.

Re “If you join FB, you know in advance”. – no, people didn’t. They were told their data would be kept private. FB had to settle on that. FB is hovering up data without you even knowing about it or, for that matter, even “joining FB”. That’s abusive.

Re Amazon – the online retail business has been run at a loss (subsidized by profits from AWS and other lines of business) to deliberately undercut the competition. That’s dumping and it’s illegal in many other industries.

One other comment – both consumers And Workers benefit from competitive markets. When businesses compete, prices and profits are both lower. Reduced profits implies a higher share of GDP going to workers’ wages. In a competitive market, businesses have to compete for their workers as well as their customers, so wages are healthy.

@Wisdom Seeker. Nonsense. Amazon is not Uber or Lyft. Online retailers have relatively low profit margins on their inventory. Amazon for years would dump any profits into expanding their operations, which is how we got AWS and one of the best product distribution networks on the planet. The LAST thing online retailers are doing is subsidizing consumers at the expense of margins on any kind of consistent basis. Many manufacturers will simply not allow advertising of such prices online, and practically will refuse to sell to online retailers who do this.

It amazes me the stories that people tell to justify their version of the world.

Besides, even if retailers did this as a regular practice, so what? It benefits consumers so how is that an antitrust problem? Lower prices = good for consumers.

All the news and market is doing is posing for a RATE CUT. They have already succeeded in the Long Term Rates, now they want the Fed to cut short term rates with lower FFRs.

The real problem is what really would a rate cut do? For one thing, it will create more debt.

Growth is generated in only a limited number of ways. You’ve got profits, wages, and debt. Profits work if you plow them back into production, but that rarely happens any more. Wages, give me a break: the people who run modern capitalist economies will try any damned trick (see QE, NIRP, “trickle down”) rather than raise worker’s raises significantly and across the board. That leaves debt. Debt is preferable in a modern capitalist economy because it is cheap, because it has tax advantages for the corporations, and because it is turned into a commodity itself so that rich people can borrow money with one hand and buy debt with the other. So, we get more debt. There is no incentive in employing either alternative.

Maybe we ought to tax debt.

Didn’t the new tax code limit the deductibility of debt for unprofitable companies and for related companies?

That’s a very astute question: a lot of commenters here have been clamoring for huge rate cuts as well but nobody so far said “it will do this and that”.

Here in Europe we have literally nothing left to cut but quite a few heads (ah!) and Japan is in the same boat as we are. We both come from a mini-boom which lasted about two years and now we are back where we started but with a lot more risky debt. Quantitative Easing to infinity and beyond? We are still doing that as well. Again, we are back where we started. Direct cash injections? China is doing just that. Again, they have nothing to show but their usual suspicious data.

I genuinely and honestly don’t understand what all these rate cut enthusiasts want. If they cannot stomach a very slight dip in stock valuations which is completely undone by panic buyers in 12 hours… perhaps it’s time they pause and reflect.

Google and Facebook are evil. I won’t shed any tears if they get broken up.

Restricting big tech is the best way to light a fire under the US economy in relatively short order. Acquisitions and consolidation have taken away many good paying US jobs.

Restrict these companies from making acquisitions and suddenly you have 100-200 small tech companies per year that won’t get bought out. They each will require separate managements and all the support functions that go along with it. Further, more innovative products will come out of it. If China or another country won’t respect size restrictions as well, then you address that through tariffs or regulation.

Further, it’s about time executives get paid less money for doing real work. Any monkey can grow revenues and restrict competition through acquisitions, then keep the stock price high via stock buybacks. It’s the organic growth that requires management ingenuity and talent.

Ridiculous comment. Say goodbye to any funding for those companies and watch them all get undercut by big tech regardless when their ideas are co-opted and they can’t compete at scale. Not to mention say goodbye to motivated founders or workforce. People already take less money to work at startups in the hopes that the Company will be acquired, a much more likely exit than an IPO. Most small businesses that exist in tech today would never get off the ground and all those people would got end up working a the big tech firms.

Absolutely not. Think it through.

The startups with no real business model, like the ones you refer to, will go belly up, but the good ones would survive.

Are you suggesting Instagram would have gone belly up if Facebook wouldn’t bought them? Are you suggesting LinkedIn would have gone belly up without Microsoft?

The ridiculous business plan of starting a company then hoping to get bought in a year or two would die. Good riddance. A viable business plan needs to project profits within a reasonable time frame.

FANGMAN crushed yesterday and on a tear today. C’est la vie.

Right on queue. Powell joins the Wall Street and Bullard clamor :

I just read that Powell is open to a rate cut to “sustain the expansion” ( i.e. S&P 500). Good for FANGMAN.

I thought those of you FED supporters may want to know the latest.

akiddy111,

“we will act as appropriate to sustain the expansion,” he said in the second paragraph, and then the entire rest of the speech was about long-term strategy stuff the Fed was mulling over … nothing to do with what the Fed will do over the next few meetings.

And this line is a standard line that the Fed always says. It’s their mandate, full employment and “price stability” defined at the moment as 2% core PCE inflation. The Fed cuts rates when the economy slows down enough. There is zero new in this line. They also used this line to justify HIKING rates … even Yellen did. To “sustain the expansion” is the Fed’s job. They raise rates to sustain the expansion (to keep it from overheating and blowing up later), and they lower rates to sustain it.

The kinds of nonsense people read into standard cookie-cutter Fed phrases is amazing. People cherry-pick whatever they want to hear to confirm their theory… and markets run on it. This (your reaction) once again confirms my theory about the market being powered by “consensual hallucination.” Which works until it doesn’t.

shakedown street….

maybe this is a defensive move, periscope depth and rig for depth charges while they decide who/how to defend the current system (yes, there’s an ugly word for it). candidates and voters alike are skipping ‘reform/regulations’ and moving straight to system change’. doj, ftc, faa, intel/security svc for hire, et f’n cetera have been cashing their checks enjoying health ins/pensions and no fire jobs all along…but now are ‘gearing up’ for something…? if it comes to (hull) integrity, expect them to be covered in whale shit by 2024.

It was only 6 months ago when we had a Fed narrative that was not going to miss a beat when it came to slowly hiking rates.

Why ? Because we had a Fed that was worried about inflation and determined to tamp down on speculative (Corporate) lending. Our fed was not going to let a 10% or even 20% drop in the S&P 500 derail it from hiking rates to a normal level.

Is the notion of pricing in rate cuts a fallacy. Or conversely, pricing in rate hikes ? Current talk of resuming QE is nonsense ?

Okay. Maybe i need to think deeper about what is going on. But i do know that there is over $10 trillion of debt out there yielding zero or less.

The Federal Reserve appears to me to be the major Central Bank that is out of kilter with a very “relatively ” high short duration rate.

I bet some of the legacy media is behind this as well – their power to influence is eroding along with their viewer base at the hands of google and facebook.

I would say the same about retail like walmart backing this move against amazon, but walmart isnt helping itself with its junky website.

One thought re Google: my feelings re Google have recently been I’mpacted (hey thx word-pricessor !) by the increasing impact of their advertising: the great stuff on YouTube is increasingly larded with advertising. They offer me ad-free viewing and listening if I pay a monthly subscription fee, so I choose to listen less to YouTube, and more to my CDs.

Here’s my question: how do the Google advertisers feel about having their ads used for annoyance rather than appeal ? Stick rather than carrot ? (Subscribe, and we Google will stop annoying you with these stupid ads.) Am I the only one who sees it this way ?