But what will happen to banks and automakers when the cycle turns?

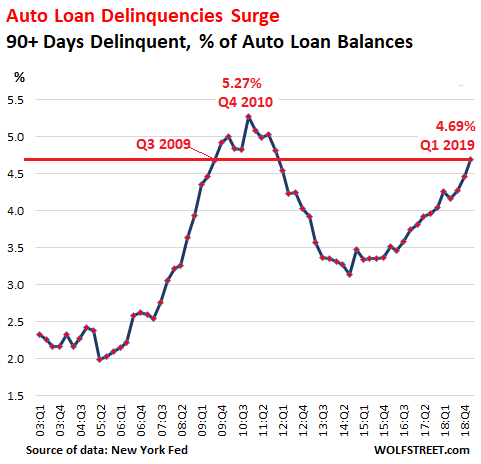

Serious auto-loan delinquencies – 90 days or more past due – jumped to 4.69% of outstanding auto loans and leases in the first quarter of 2019, according to New York Fed data. This put the auto-loan delinquency rate at the highest level since Q4 2011 and merely 58 basis points below the peak during the Great Recession in Q4 2010 (5.27%):

These souring auto loans are going to impact banks and specialized lenders along with the real economy – the automakers and auto dealers and the industries that support them.

This is what the banks are looking at.

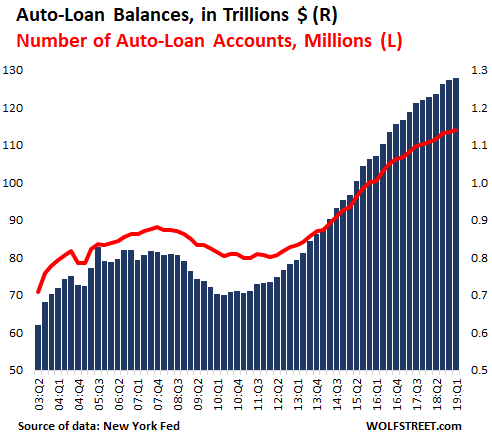

The dollars are big. In Q1, total outstanding balances of auto loans and leases rose by 4% from a year ago to $1.28 trillion (this amount by the New York Fed is slightly higher than the amount reported by the Federal Reserve Board of Governors as part of its consumer credit data). Over the past decade, since in Q1 2009, total auto loans and leases outstanding have risen by 65%.

But the number of auto-loan accounts has risen only 34% over the decade, to 113.9 million accounts in Q1 2019. In other words, what caused much of the increase in the auto-loan balances is the ballooning amount financed with each new loan and longer loan terms that causes those loans to stay on the books longer.

The chart below shows the dollar amounts of auto loan balances (blue columns, right scale) in trillion dollars and the number of auto-loan accounts (red line, left scale) in millions:

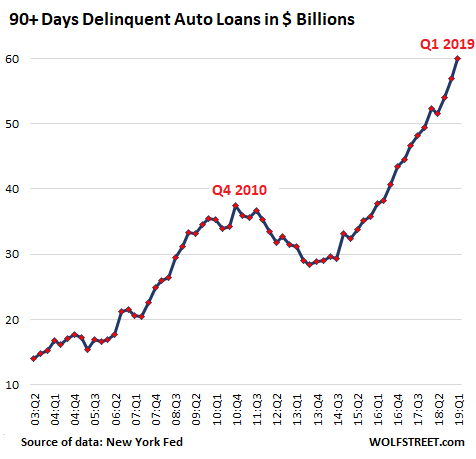

Of this ballooning amount of auto loans, 4.67% is seriously delinquent (90+ days). This amounts to $60 billion. This chart shows the trajectory of what the banks and specialized lenders are facing, in billion dollars:

For lenders, these delinquent loans don’t represent total losses. This debt is collateralized by vehicles, which can be repossessed without much of a delay – unlike foreclosing on a house. But generally, the loan amount is far higher than what a repossessed vehicle will bring at the auction. Perhaps the banks can recover 50% on average of the loan amount. So, if all of the current vintage of 90+ day delinquencies turn into repossessions, and the banks lose 50% on them, it would amount to $30 billion in loan losses.

But there are more loans going delinquent even as we speak, and they will become seriously delinquent in Q2, and the next batch in Q3, and so on, and this is working itself forward wave after wave. So the cumulative losses over the next two years will be higher.

These losses are spread over thousands of banks, credit unions, and specialized non-bank lenders, and over asset-backed securities holders, such as pensions funds, other institutional investors, and bonds funds, and most will get through this by just licking their wounds. But some smaller subprime-focused non-bank lenders will collapse, and a few have already collapsed. So these defaulted auto loans are going to hurt, and they’re going to take down some smaller lenders, but they’re not going to take down the US banking system. They’re just not big enough.

This is what automakers are facing.

Lenders have already figured out that subprime auto loans have soured. They’ve been seeing this since 2015 or 2016. And ever so gradually, lenders have tightened their subprime underwriting standards. And subprime customers that don’t get approved for a new-vehicle loans may get approved for a much smaller loan for a cheaper used vehicle. This process has already been shifting potential new-vehicle customers to used vehicles.

For automakers, this has already shown up in their sales. New-vehicle sales, in terms of vehicles delivered to end-users, peaked in 2016 and have been declining ever since. Through Q1 this year, new-vehicles sales, fleet and retail, were down 3.2% from Q1 2018, and so 2019 looks to be another down-year for the industry – the third in a row.

But this isn’t happening in a recession with millions of people losing their jobs and defaulting on their auto loans because they lost their jobs. This is happening during one of the strongest labor markets in many years. It’s happening when the economy is growing at around 3% a year. It’s happening in good times. And people with jobs are defaulting.

This is not a sign of a worsening economy, but a result of years of aggressive and reckless auto lending, aided and abetted by yield-chasing investors piling into subprime auto-loan backed securities because they offer a little more yield in an era of central-bank engineered financial repression. It’s a sign like so many others in this economy, that the whole credit spectrum has gone haywire over the years. Thank you Fed, for having engineered this whole thing with your ingenious policies. So now there’s a price to pay – even during good times.

And we already know what a scenario looks like when the cycle turns, when unemployment surges and millions of people lose their jobs and cannot make their car payments, even people with a prime credit rating – that will then turn into subprime. We know what happens to the auto industry when the economy dives into a recession. We know what this will look like because we’ve seen it before. The auto industry is very cyclical.

What we haven’t seen before is this kind of credit stress among car buyers during good times – with the bad times still ahead. So when credit stress gets this bad during good times, we don’t even want to imagine what it might look like during bad times. Whatever that scenario will be, it won’t be fun for automakers.

The surprise was in the SEC 10-Q filing when no one was supposed to pay attention. Read... Tesla Discloses Record Pollution Credits for Q1: Without Them, it Would Have Lost $918 Million and Bled $1.14 Billion in Cash

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sure the loans are spread over a variety of players, but whats the leverage ratio of the securities they hold to those loans? 1:1? :P

At least the repo-man is busier nowadays. A service industry employment plus count.

Today’s Repo man:

1. Locate vehicle on GPS.

2. Disable vehicle ignition remotely.

3. Pick up vehicle.

GPS has been a game-changer for subprime, and why they can afford to have a riskier portfolio of loans. With GPS, there isn’t even a need for a tow-truck. After the car is located, they simply drive it through the carwash, and put it back on the used car lot for the next “buyer”.

Most of the Repo Men are no more. The Lenders have been using middlemen debt collection companies to outsource their collections’ departments for years. This includes Repo assignments. Their high profits at the expense of the repo companies has caused over 60% of all licensed, insured, bonded, equipped, trained, repo companies out of business in the last decade. To fill the void they have used cheap sub-standard, unlicensed, untrained, towing companies in place of the higher cost professionals. With CFPB requirements and new consumer laws, many of these wannaby repo men, who don’t know what they’re doing, have been sued. Violence during repos has increased exponentially and has become a public safety hazard. If you don’t believe me just check the stats. This has caused insurance rates to climb and now there are less than a handful of insurers left to provide for the “repo” industry and their rates have quadrupled in the past 5 years. Although there are dozens of laws being “allegedly” violated and dozens of complaints filed to stop this, nothing has been done. And why should they. After all, it was this “Beef Industry Meat Packer Model” that has allowed repossession and liquidation to become the first tool to collect on a delinquent note instead of a last resort like it used to be. It has also allowed for the lenders to finance overpriced cars to unemployed fools who will never have the means to pay off the loan. And by the way, the cost passed onto the consumers’ deficiency balance for getting his car repoed is about 4 to 5 times what the repo man gets paid, and 3 to 4 times what it was when the lenders hired the Repo man directly. Today , the remaining 40% of the repo men left are paid contingency only, and at a rate they got over 20 years ago. Now you know why there are people that are 90 to 180 days overdue and still driving their cars. There are no more professional repo men left. Oh yes, as to those license plate cameras you mentioned, if you don’t have a “Chuck” in the truck, who I would add is authorized to read a possess consumer information, to come and haul it away: its worthless. One last thought, most of these middlemen debt collectors own the auctions where these repoed cars are sold. Once they convert the collateral (car) into cash they scrape off a healthy profit and their fees, which untimely is added as mentioned, to the Consumers deficiency with compounding interest. The higher the cost, the more the unpaid balance and the greater the interest. The consumer has no control. So I don’t think the Banks are going to lose 50% on the unpaid balance, if anything they’ll probably make money.

This is good news for people who can’t afford to buy a new car, and for young savers.

Alex,

A vehicle without a warranty is not affordable transportation for the masses…the poor can only afford new cars.

I keep hearing that we won’t get another sub prime mortgage crisis but then you start looking at auto loans,the fact they’ve been repackaged and sliced and diced to investors and you start looking at ‘sub prime’ corporate debt that’s been blown up exponentially on QE and been sliced and diced to investors.

Then you figure that maybe for the second time in twenty years we’ll experience another crisis that the central banks created and still didn’t see coming.

‘What we haven’t seen before is this kind of credit stress among car buyers during the best of times – with the bad times still ahead. So when credit stress gets this bad during good times, we don’t even want to imagine what it might look like during bad times.’

The first time around wasn’t all that much of a crisis anyway. That was a media made up word to scare you. Had the govt stayed out of it, the “crisis” would have self corrected quickly. Instead the govt showed up to help and the “crisis” lasted for years. Made for great campaign speeches though.

Besides cars and houses are night and day. Someone gets their BMW repoed isn’t anywhere near the same impact as someone foreclosing on a home.

>The first time around wasn’t all that much of a crisis anyway. That was a media made up word to scare you

I guess you weren’t around in 2008 when the money market funds were breaking the buck and the entire banking system was on the cusp of freezing up.

Any figure on banks repossessing homeless people living in their RVs?

I took the train to/from Palo Alto yesterday and if you keep your eyes open, there are a loooooooooot of RVs parked on streets there alongside the train right-of-way.

Realize that many in high-tech live in RVs during the week and spend the weekend at home where the mortgage is reasonable.

In the same report credit card debt is starting to show stress as well, being led by 18-29 and 60-69 year old brackets. On the other hand it certainly looks like a lot of people learned their lessons on mortgage debt.

I think the issue with mortgage debt is that its slower to show issues. Many of the homes sold in the past 3 years have been on 5% or less down, and super high interest rates, along with overbidding on fear of “being priced out forever”. I predict we’ll see a spike in mortgage delinquencies in 12-24 months as the stress from auto and credit cards oozes over to homeowners who are over-leveraged.

Remember, the mortgage delinquency rates looked really good through 2004-2005, right before things started to spike last time.

“Many of the homes sold in the past 3 years have been on 5% or less down, and super high interest rate”

Super high interest rates in the past 3 years? Whaaaaaa?

In the late 70s and ealy 80s, mortgage rates were double digit. That was super high. In the past 3 years rates have hovered around 4%. If you consider that not just high, but super high, you need to re-examine your knowledge of a) history and b) financial products.

I agree. There are too many home loans made based on priced-to-perfection, meaning if the homeowner experiences any emergency, they will fall behind in all kinds of loans.

I sold my house to someone who paid 5% down (family of five, one paycheck) and was told by the realtor that it was “quite normal”.

When I bought my first house 17 years ago I was told that 20% down was “normal”.

It used to be that if you didn’t put at least 20% down then you had to pay insurance on your mortgage. In other words, even more money drained from the hapless wannabe-but-can’t-afford-it homeowner. I wonder if that is still the case.

@Dale

Mortgage insurance below 20% down is still the norm, I believe.

More people chasing housing (population increase) on top of speculative mania in housing.

My banker was recently trying to get me interested in a mortgage. I said something about the 20% down payment and he responded that “almost everyone” was putting down 3% these days.

I sold a $290k condo in 2016 to a young family using what I believe was a VA loan. His total out of pocket was $26. Yes that’s twenty-six dollars. I don’t know how much mortgage insurance he may have needed, if any. But even the Escrow company was amazed.

Yes a number of costs were front loaded into the price.

“What we haven’t seen before is this kind of credit stress among car buyers during the best of times – with the bad times still ahead. So when credit stress gets this bad during good times, we don’t even want to imagine what it might look like during bad times. Whatever that scenario will be, it won’t be fun for automakers.”

Employment is supposedly strong.

How many of those “Employed” peopel still qualify for food stamps or other state/Federal assistance program’s.?

When a “Strong” employment economy, has issue like this auto and the growing credit card Delinquency.

Their are obviously issues for many in this “great (As described by p 45) American Economy” that is only actually great for those asset holders at the top of the pile.

It always helps my perspective, when I remind myself that despite the “strong economy” etc. etc.., the labor participation rate has been about 63% in recent years (that’s right, the “recovery” years).

On the same tack, yesterday morning on CNBC, some remarks from Mohamed El-Erian (now at Allianz) were broadcast: he said something about how, despite the way the “wealth effect” from the ZIRPs and VLIRPs has played out in the stock markets, this effect is not evidenced in the economy ; clearly, he referred here to main street, the underlying economy, the working classes. The shrinking middle class………….

El-Erian understands what is going on, though he is too smart to open his mouth too much.

The wealth effect has played out all that it can in my opinion. It just marginally helps- by enriching the already (somewhat) rich, thereby dodging a deep depression bullet.

Does it totally correct the economy and/or provide for a way to transmit (trickle down) the positive impacts down the income and wealth scale?

Nope, that can is kicked.

The problem is that there’s too much concentrated wealth, so the super wealthy don’t spend to consume. They spend to make more money, chasing yield. They buy companies, shopping centers, apartment complexes, patents, etc etc. Sure this activity spins off a few jobs here and there, but if the ventures are profitable, they are by definition, extractive from Main Street.

The majority of the “wealth effect” on spurring the economy is to encourage asset bubbles which lead to more construction jobs. Part of it also allows companies to stay in business that would otherwise close if they had to be profitable in order to borrow.

The costs of this are an ever-increasing asset bubble, the concentration of wealth, and social unrest as worker incomes are stretched over ever higher costs of living (such as housing).

It seems to me the solution is simple but not currently legal. If you think of money creation as a transfer of wealth, and you want to right-size the system, then use QE only as direct payments in equal amounts to every citizen. Much of it would be used to pay down debt which would help right the system. The rest would increase consumption so that consumer industries don’t have to collapse and re-build.

I saw a report a few weeks back that said that 83% of those employed lived pay check to pay check… Doesn’t take much under that kind of *employment* to cause missed payments.

Recent survey showed that 50% of “working” Americans are ONE paycheck away from going broke (cannot cover the expenses).

In the nerd world people are hiring. Friends are switching jobs as recruiters and employers are hungry for the skilled. I’m not on the market but still get a lot of lower quality spam job offers, and an occasional headhunter.

In the DC suburbs I see no weakness in the job market. No friends talking of layoffs. I hear there is talent shortage. I hear nothing bad in 2nd tier Virginia Cities as well, Norfolk/Virginia Beach and Richmond.

Re: “It’s a sign like so many others in this economy, that the whole credit spectrum has gone haywire over the years.”

This credit nonsense has not only changed the economy, it has changed a great deal about what it means to be a person and citizen. People now have extremely unrealistic expectations, and coupled with the power of social media pandering to ‘like seeking like’ online, + manipulation and advertising, this trend has become a virulent disease. Our societies are becoming sick the world over. “More more more, right now because I’m me.”

No wonder there’s an opioid crisis; deaden the pain as we wander lost and without purpose beyond consumption. Good day to putter in the shop and make something.

Great comment, Paolo. Succinct and hit the nail on the head. All this over-consumption is indicative of a much deeper problem.

Leadership is as bad as young people, or are you going to pretend that exploding debt in every country is rational? People are just doing what has been construed to be normal.

It’s not a strong labor market. The economy isn’t strong. All the Government stats are BS. There’s ample technical evidence for this, e.g. Shadowstats, but simplest argument is what you are seeing.

If the labor market was weak and the economy weak, would one expect loan defaults? Yes.

The labor market is weak because job security has gone and real-world disposable income is ever-decreasing. GDP is BS because Government spending is counted, and much of it is now going of inefficient and even counterproductive bureaucracy.

A huge swath of society has no money, and now (even though credit has been made a lot easier) they are running out of credit too. Approximately 26 years of spending has been brought forward in the last 10 years*.

In short, in 10 years there has been no recovery for most people, and unless things (and maybe even if they do) soon there will be new Great Depression for everyone.

*based on the increase in private debt being paid back at minimum cc rates. If anyone has a better way to estimate it, I’d be grateful, but I’ve seen several articles using this measure.

Pretty much agree. On average/macro level the economy is good to very good.

On “median” it’s fair to poor.

It goes with the frequently quoted ” 80% of wage workers live from pay check to pay check’! How can there be ‘wealth effect’ for these folks when, they don’t have enough for the ‘living’?

According to the NYT those people are doing better than ever (especially if they are low-pay + high skill) so I’m not sure why they stopped making their car payments. Maybe they just forgot.

https://www.nytimes.com/2019/05/02/business/economy/wage-growth-economy.html?mc_cid=29d0d89331&mc_eid=b71d3df985

“Maybe they just forgot.” You don’t go three months behind in your car (or house) payment without being constantly reminded!

There’s gonna be some awesome deals on lightly used luxury cars soon.

More like $60k luxury trucks.

So, are we saying that the Fed is responsible for creating this auto loan bubble through QE and near-zero interest rates?

NO you are.

Auto loan companies, frequently part owned and underwritten by auto manufacturers went from 36 to 72 plus month terms @ 1 or 2 % interest with 0 down for almost anybody, and YOU Blame the FED.

Chutzpah.

I think the economy isn’t as strong as many seem to think. Thus these numbers are not surprising.

If the economy is strong, why do people squeal at the hint of a 0.25% rate hike?

My thinking as well. If the economy is so great why are we not raising interest and why is Trump asking for rate cuts? Unemployment is at “record lows”.

There is a labor “shortage.” Someone is lying.

Q. What should I drive a $5000 beater car when I can drive a $50,000 F150 or $40,000 SUV? I can afford the monthly payments, barely, at my $45,000 per year job…

A:

The answer I am often told is “Warranty”. The average consumer is strapped for cash so the surprise repair bills of a cheaper car is more frightening than a scheduled payment plan with warranty they hope to get coverage from.

This is a very good point. An employer will fire you in a heartbeat if you miss a day of work due to your hooptie breaking down.

So maybe you’ve been worldly-wise enough to stay away from high tech and you’ve got a good solid job in a machine shop or a warehouse, and it pays above minimum wage which makes it a real plum job these days, but they depend on you to show up. So if you can have a known payment and reliability, that makes life a bit less terrifying.

A lot of small things combined can mean a big thing. The auto industry continues to try to right size itself. GM closed what, 5 factories recently. They want to be ahead of the curve as they know things will slow. The final couple of % of new car volume automakers pump out of their factories is where their profit is. Take away the last few percent in volume and the financial performance is greatly impacted.

The corporate debt market, I believe is where the villain is for the next downturn lies. There is a lot of junk out there and a lot of paper with a BBB rating that should be junk today and will undoubtedly be junk once things slow down. An the covenants, or lack thereof add a big of gas to the fire.

Hi Wolf (or anyone with knowledge)

Long time lurker, first time poster. Do you know if leases are included in auto loan data? I went to the NY CMD’s dataset, but can’t seem to find a definition beyond the source as the NY Fed’s Credit Panel/Equifax.

The reason I ask is because recently leases have begun to account for almost 1/3 of all new car sales.

Yes, loans and leases are included in the same data set. It also says so in the title of the data sets.

These auto loan delinquencies are the first cracks in the debt-fueled crackup boom we are currently enjoying.

Auto lending was exempted from Dodd-Frank. Do we have to securitize everyeffingthing?

Wolf, in dollar terms, how do the auto and other consumer credit debt and defaults compare to the subprime mortgage crisis?

It would be good to compare the scale of this coming debt bomb explosion with the previous one that set off the GFC

There’s also the multi trillion dollar corporate debt bomb to consider

Subprime auto loans are about 23% of total auto loans. So about $300 billion. Subprime mortgages were in the trillions (of $10 trillion in total mortgages outstanding). So subprime auto loans are, give or take, about 1/10th of subprime mortgages in 2006.

Yes, I agree, in terms of risk to the financial system, corporate debt is now the biggie.

Thanks, Wolf.

Just the other day, Credit Acceptance Corp. reported earnings. Have suspected the company has been cooking the books. This latest report shows they LOWERED loan loss provisions once again to just $14.5 million. Loans receivable at $6.1 billion.

Not sure when it blows up, but blow up it will, spectacularly.

Interesting. Unless I am mistaking, they are assuming a 0.25% default rate?

I’m sure the regulators are all over that clearly fraudulent behavior.

*crickets*

I think people have to work toward something to be happy, but getting a new Tesla or fancy house won’t cut it as a goal. Showboating is an empty existence that leads to isolation. Helping others and spending time with loved ones is a better way to be happy. We all know that. The key is to live it.

Exactly….

The “things” used to come with intangible things, though. in the 1960s we had a house with 4 bedrooms because there were 5 kids. It was room to roughhouse in and play with the pets and play Twister and watch TV all together in the living room, after eating a meal together in the dining room. Every kid had a bike and we’d ride ’em together. I even remember at least once, the whole family, Mom, Dad, and us kids, all on wheels riding down the street. Scouting uniforms cost money but there was Scouting with jamborees and meetings and such, it was all very social.

I think what may be happening is, we may be buying the things still, associating them with family and community they used to be tied to. But just about everyone’s an atomized individual now. Everyone’s either studying, and after-school activities, or they’re working a job and a side-job, and there’s no time now for big family dinners around the oak dining table, or afternoons spent, just coloring with that big set of Crayolas, or spending an hour or two working on the finer points of tetherball.

So Bobber you are entirely correct.

What are the odds “the industry” isn’t prepared for a wave of defaults and a high percentage of defaulted borrowers just end up in possession of their cars?

The growth in loans and the growth in delinquencies is roughly the same. More people borrowing money to buy cars? That should be good news economically.

This is another reason why the Fed will start cutting rates soon. Better to do a 50bp cut. The Fed is begining to realise that it over-tightened.

The 10 year is pricing in at least one 25bp rate cut this year.

The Fed is not infallible. It makes mistakes too.

No, it didn’t over-tighten. It needs to raise rates and allow the market to clear up this mess.

If they ‘really’ meant that, they would have allowed urgently needed global financial reform in 2009, following the example of S&L scandal (Keating 5) in 90s and reform-Resolution Trust ( Prof Bill Black) where 100s of Bank executives sent to jail, wearing orange uniform.

Now 0.01% won’t allow until the last moment and the pundits including will plead – No one saw this coming’ again!

It’s much easier to destroy collateral than destroy credit. Once you destroy a consumers equity its gone forever. If twenty years ago you could pay cash for a car,and now you have to borrow, you are never going to get that equity back. The bank provides the equity. When the consumer defaults the lender gets stuck with the vehicle, and the loss. Bankers stock and trade is in charging fees for credit not paying dividends on equity. Banks went so far recently as to discourage large deposits. Raising rates is antithetical to their business so they use complex financial products and government backing to guarantee consumer credit, but raising rates will never make savers whole again. Asset inflation is a zero sum game. you have to play to keep from losing more equity. The only way to regain equity is to speculate successfully, and in order to do that you need low interest rates as the backdrop.

NOT the 1%.

CONGRESS.

Dodd Frank a bill named after.

FRANK.

Who promoted and blew the housing bubble with his party boys, until it BLEW UP.

Them threw a regulatory bone to the populace, who were footing the bill. Before retiring.

Congress does this sort of thing repeatedly, as the 1% own them.

The 1% own them, as THE ELECTORATE LETS THEM.

The last thing America need’s is Socialism, it just needs to outlaw all the legal corruption. Starting with congress, and other electoral campaign financing.

Instead of blaming the 1%, go look in a mirror you will see where the problem starts.

√

***

Problem being all CB’S need to get on the same page even if in different paragraphs.

The EU and ccp china will not do what has to be done, particularly with their NPL mountain ranges, and the banks that are effectively underwater, due to them. Hence, it is even harder for the FED to at least try to stabilise the US system.

You have freedom of movement and domicile in finance and stock ownership. But NOT International or regional CB policy.

Just as globilised trade is failing, due mainly to ccp china gaming the system.

So to must globalised Stock and financial markets. unless all the major CB’S get on the same Paragraph on the same page.

This is currently the feds problem.

As the FED bleeds money from the US system, the forigen CB’s simply pour many more times that amount in.

There is nowhere for the amount of money the ECB and ccp china are still covertly injecting to go in their Economies apart from into institutions overloaded with NPL’S which half sane investors, no longer wish to do.

So the money flows to the US and JAPAN.

The Yen is strengthening against the $ when Japan is still in a 0 to NIRP environment. yet other developed countries are falling against the $. Most Yen govt bonds are being possessed by the BOJ to keep control of the currency and Japanese govt interest payments.

The Physical as opposed to FX trade buy pressure on the Yen (Not Japanese Stock’s) is huge.

Just as there is a Shortage of CHF 1000.00 CHF notes (You practically need to order them in advance) and most Swiss Banks/Facilities have waiting lists averaging 14 Months + for safe deposit boxes in the larger sizes.

The FED is trying to hiss this bunch of over-inflated asset balloons, at least in the US. So that there is some degree of stability in the US Economy. Yet Most are throwing rock’s at the FED from the White house down.

ccp china in particular thinks it’s 10 feet tall and bullet proof.

Maybe the FED should just stand back and let the whole lot POP.

Then the message might sink in for a generation or 2 just as it did after 1929.

The only thing iran respects and understands, is an angry mailed fist.

The only time those who speculate, and live easily based in credit, will listen, is when there is. NO CREDIT.

d-

here’s hoping YOU are willing to enlist as part of ‘the angry mailed fist’ (leading by example, so to speak…). May we all find a better day.

This level of auto debt stress will not be pretty when the oncoming recession spools out to its apex. Last time we almost lost GM and Chrysler. I expect with the additional collapse in sales that will come with a serious economic downturn, the wave of repos hitting the market and associated pull back in risky lending will probably take down those two for good along with Tesla and perhaps Nissan.

Semi conductor sales are down Q1 over last year. So too are class 8’s.

RV sales are down 27.1% in Q1 over last year. Total construction spending is down 0.8% in Q1 over last year. Retail sales are softening since last November. Ditto the Industrial Production report yesterday. Also, World trade is down. China, Germany and Japan are fragile.

Fed probably over tightened by 50bp to 100bp.. Debt holders need a cut. It will be much needed oxygen. No other option. Too much debt.

Yes seeing acres of RV’s piling up at dealers. Believe this is a major middle class economic barometer.

You can finance a Class C for only 5.99%. Figure $80k with $10k down, finance $70k for 20 years (20…Not a typo) is only $500 a month. Final cost $130k…granted 2039 bucks probably won’t be worth much, but the RV will probably be dead on blocks for five years by then.

You are talking about a Fed that is owned by the too-big-to-fail banks who have not reduced the double-digit rates they charge cardholders one iota. Does that sound like sensitivity to the overburdened debtor?

Having gouged trillions, virtually interest-free from the taxpayers via TARP and QE, they have simultaneously enabled themselves to justify paying virtually nothing to savers. The next step, of course is to actually charge savers for the privilege of lending their money to the banks! (Negative interest rates,) which apparently you can get away with only in countries so feeble their citizens can’t even own guns)

I know a guy who owns one of those shady “buy her, pay here” used car lots. First, these guys WANT bad credit borrowers. Because of technology, these guys can zap away all of the down payment equipment with a push of a button, all without having to go to court for a repossession. Late fees, disconnect charges, reconnect fees, etc. They’ve got a million ways to nickel and dime the consumer.

At about $60 billion, it appears that the amount of delinquent loans now is on par with the entire balance of all loans in 2003. How far we’ve come!

My bad… I read that chart incorrectly. It was 600 billion in total loans in 2003.

Delinquency amongst self-entitled millenials, perhaps? My guess is gen-xers prove light-years more responsible, it wouldn’t be hard.

FFR is at 2.39%;

3mo. Treasury @2.39%

2yr @2.20

5yr @2.17

10yr @2.39

20yr @2.63

30yr @2.82

S&P definitely on a downer???

number of S&P corporate entities traded on the Exchange have decreased by what 50%???

Just where would everything VS anything- go, if the FFR goes lower???