This is a very cyclical business.

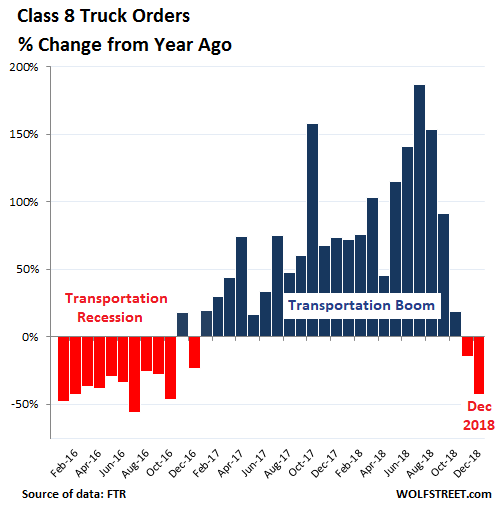

In December, orders for new Class-8 trucks — the heavy trucks that haul the products of the goods-based economy across the US — plunged by 43% from a year ago, to just 21,000 orders, the lowest since August 2017, and down by 60% from August 2018. The chart shows the percent change of Class-8 truck orders for each month compared to the same month a year earlier, which eliminates the effects of seasonality (data via transportation data provider FTR):

In the chart above, there are some standouts that show just how cyclical this business is:

- The impact of the “transportation recession” in 2015 and 2016 when Class-8 truck orders plunged to the lowest level since 2009. This entailed layoffs at truck and engine makers.

- The subsequent boom in orders in 2017 and 2018, when demand for transportation services soared, and trucking companies found themselves short on equipment. This boom in orders led to a record backlog for truck makers and their suppliers.

- And since fall 2018, the next phase in the cycle.

The trucking business is very dependent on the goods-based economy. Late 2017 and through much of 2018, demand for transportation services, such as shipping by truck, was very strong for a number of reasons, including a strong goods-based economy with booming e-commerce, a buildup of inventories, companies trying to front-run potential tariffs, etc. Freight rates spiked. As shippers struggled with higher costs and delays, truckers ordered new trucks to meet the demand. Truck makers were swamped with orders, and their backlog balloon to 11 months at the peak.

Demand for transportation services continues to be strong, but just not as strong as it was. And trucking companies are adjusting. Their fear is overcapacity, which entails plunging freight rates, which is precisely what occurred during the transportation recession of 2015 and 2016.

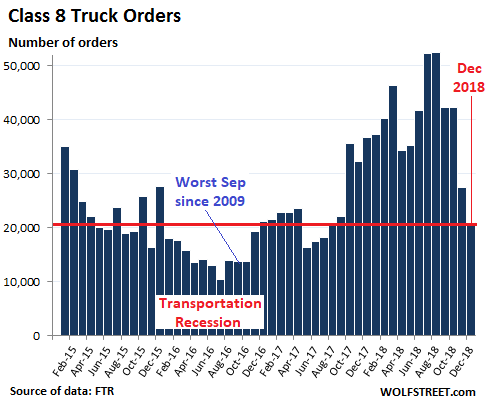

The chart below shows that orders in December are now in the range of orders prevailing at the beginning and at the end of the transportation recession:

Over the past 12 months as of December, truckers ordered 482,000 Class-8 trucks, according to FTR data. And truck makers are still working through the large backlog.

The annual capacity of truck makers in the US is about 320,000 Class-8 trucks per year. This averages out to about 26,500 per month. So the orders in December were 21% below that level. In addition, there have been some cancellations. But the current backlog still extends deep into this year.

FTR VP of commercial vehicles Don Ake explains: “All the orders are in, the question now is how many of these orders will actually be built? We will have to watch the build rates and retail sales closely for clues about the future strength of the Class 8 market.”

The Class-8 Truck makers in the US are:

- Freightliner and Western Star owned by Daimler.

- Peterbilt and Kenworth owned by Paccar [PCAR]; shares are down 25% from a year ago.

- Navistar International [NAV], shares are down 40% from a year ago.

- Mack Trucks and Volvo Trucks owned by Volvo Group, the Swedish manufacturer of trucks, buses, construction equipment, and marine drive systems, not affiliated with the automaker Volvo).

The cyclicality of the trucking business is legendary, bouncing between over-capacity, dropping freight rates, and plunging orders for trucks to equipment shortages, soaring freight rates, soaring orders for trucks, supply-chain bottlenecks, and shipping delays. And everyone in it ends up having to ride it up and down. So this doesn’t come as a surprise, after the blistering boom through the summer last year. It’s just the beginning of another phase in the cycle.

2018 was the third relentless down-year in a row for three of the four biggest automakers, GM, Ford, and Toyota. For them peak sales occurred in 2015. But average transaction prices rose to record highs. Read... Carmageddon for GM, Ford & Toyota: 3rd Down-Year in a Row. Industry Sales Below 2015. Hyundai-Kia Drop 11% in 2 Years. BMW & Mercedes-Benz Fizzle

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Are you sure this doesn’t have anything to with the fact that you have to have an electronic logging device (ELD) in new trucks? Pre 1999 trucks you don’t have to have them. That law just went into full effect December of 17. You are seeing more older trucks going up and down the interstate now than ever before.

The driver shortage and shipping delays may have been aggravated by ELDs for a few months early last year. Class-8 orders not so much. But there was a huge boom in demand by shippers to get their stuff delivered, and this hit right after trucking companies had cut back during the last transportation recession (2015-2016). Check my earlier articles on this. In terms of Class-8 orders, this just fits into the cycle.

Just what I thought that would happen. These idiots governing us don’t see the picture. Just like military training. We had instructors who were only book smart and couldn’t actually how to do hands on. Wake up people. I’ve been driving for 24 plus years

This has to do with the FUEL REBATE that caused an artificially inflated surcharge rate on a cost for fuel that didn’t exist creating a profit for trucking company’s on every gallon purchased that wasn’t reported as revenue on their SECURITY EXCHANGE REPORTS that allowed them to hide the money from the investors while minipulating their financial statements.I have calculated one company’s fuel cost per gallon at a 1.27 while the marquee price was 3.02,yet they charged a surcharge on the 3.02 instead of the 1.27 creating a 72% increase instead of 32% which is what is should have been,then not reporting the 38 million additional revenue but deducting the 72% surcharge.

I think it has to do with a myriad of issues making a perfect storm.

1 ELD.

2. states with strict rules turning the rules into revenue makers

3. the possible rebirth of gliders including pre 99 rebuilds

4. trade issues with China and its new internal truck factories

5 Europe slowdown

6 crazy burst of trucks getting purchased last couple of years driving prices up

7 Truck driving schools with sketchy services, you pass but did you really get trained?

8 Fed raised rates

9 US becoming a net oil exporter (yep you heard that right not since 1973)

10 The biggest of them all. When you get 11 months behind because the leaders of this industry were sleeping at the wheel (LOL) Everyone pauses for a moment. It doesn’t matter what industry your in. This kind of price shock and demand scarcity can hurt the very market that demands it.

So when you add that up in my book we are doing great. As soon as this stuff gets baked in we will see growth again. I give it 6 months. The bright spots like the DAT report that still shows 8 to 1 loads to truck national average which is just under last years rates and still above 2016 is still great. Also many companies started keeping their trucks longer by a year. When pricing used trucks before i retired from corporate America seems to show that average miles on trucks went up from 350 to 450k ($60k) to 450 to 550 k at ($60K or more). That a 10k+ jump. I have been collecting data about this industry for 2 years while planning an entrance when i retired form Telecom. Its not all doom and gloom. Just to say it before someone asks I have been in the business zero days, LOL but watching for 2 years the way corporate giants would. I am buying my first truck in a couple of months or so. When I read this article I was happy that truck prices might come down a bit before I buy or might give me some leverage. If trade talks get resolved oil will spike, GDP will spike and drivers will go back to oil fields and international commerce will unleash a tsunami of pent up demand so be ready!

You got it right! Shale oil is what has been driving this market. When activity on the shale fields drops, a lot of trucking capacity gets released suddenly and you have a lot of that capacity for other needs.

2015-2016 trucking recession was just that. The question is whether WTI is going to the level when activity will pick up again. Q4 was when most shale drillers stopped activity and released crews because they had exhausted their drilling budget (good thing, they are no longer drilling just to keep drilling).

DV,

“When activity on the shale fields drops, a lot of trucking capacity gets released suddenly and you have a lot of that capacity for other needs. 2015-2016 trucking recession was just that. ”

No.

Transportation services for oil field activity are handled mostly by flatbed trailers. But the transportation recession in 2015-2016 hit van trailers and intermodal (containers and van trailers via truck and rail) very hard. This segment has nothing to do with the oil field, and everything to do with the other and much larger segments of the goods-based economy.

The oil bust simply added to it by also cutting demand for flatbed trailers.

That is quite a cliff….

To many nonsense regulations is making owner-operators buy older trucks. That makes new truck sales drop

These “too many nonsense regulations” have been there for years. They didn’t just pop up all of a sudden in September. But in September that’s when new truck orders began dropping.

Normal Pavlovian, conditioned response – “it must be all the fault of government regulation”! The solution is lower taxes for the wealthy!

Roulette wheel. Spins really, really fast and the ball bounces around then stops dead. All those options and only one winner, the bank.

Who want to buy a overpriced truck with 500.000 mile for $60.000 greedy peoples want to make money off driver because they see a big turnover

Wolf,

I read from a number of other sources that active oil/gas as well as new digging is a very big driver of freight. I wonder how much of this reduction in class 8 orders r due to the recent oil plunge

I was thinking the same thing. There was clasic overextension in the AB oil patch. It was a bubble. BOC was called upon to reduce rates. It was a joke.

Hope you have your debt in order. Rates will drop even more, all those people bought new trucks for $170k they will take any rate just to secure the load and not default on their payments.

The used market is way ahead of the curve. Dealers and wholesalers aren’t rookies. They are cutting prices to the bone NOW, preparing for the onslaught of fleet truck trades hitting the market. Bought a 2010 International day cab (reliable Cummins engine) with only 35,000 miles this week for 26K with all new rubber. Not a typo…only 35,000 miles, plus no delivery cost on 600 mile one way delivery. Most of these trucks are designed to run 1,000,000 miles plus before major maintenance to the most expensive component, the engine. The impending used truck hangover is going to be huge and lengthy!

Where do you find a nice deal like that ?

That’s what I think as well. Has very little to do with, ELDs and emissions. Just look at large carriers parking lots and you see tractors parked with no drivers to fill them.

Or possibly more tractors than demand?

That’s a better price than buying a 2010 Ram 3500 with a Cummins these days. What a steal.

“a build up of inventories”… ding ding ding!

The Trump tariffs and threats of further trade action by the administration, has motivated importers and corporations that depend on Asian suppliers, to pull forward inventory supply. Before said tariffs and trade actions are enacted, thus avoiding prohibitive costs.

eg: Warehouse space has become a premium. Corporations are running out of space to store their stuff. Reports are rife with some companies leasing complete fleets of trailers, then utilizing them as dry, secure, temporary inventory storage.

If the present economic malaise continues to drift lower, morphing into a full blown recession, then this supply line glut will take much time to clear. During which period of slow to no activity, will prove to be terminal for some.

Why order trucks is they dont have a driver to put in the seat. Low pay more rules has always been the reason for this alleged “driver shortage” they have been claiming for 20 yrs. A $15 minimum wage will have more potential drivers choosing to work at McDonald’s. 85% percent or truckers pay is laughable , who would choose this industry life for 40k per year. Pay for trucking is a joke.

How much of this is due to trucking in California? There are very few old trucks to even buy here in Calif due to the recent air quality regulations. People have been scrambling to replace their old trucks with compliant trucks. Could some of this dip be due to the fact that everyone replaced their trucks at the end of the deadline??

California’s emission laws also affect out of state shippers who operate in CA. Must have created huge demand for newer trucks.

Wolf,

I am curious if the purchases that did take place were by larger “buyers” such as Amazon? The consolidation in trucking companies would see fewer trucks purchased as well as they seek to reduce costs by larger loads and less shipments.

The same can be said for the Rail industry:

https://www.businessinsider.com/the-trucking-and-rail-industry-may-have-reached-its-peak-this-year-2018-7

Amazon doesn’t own tractors, just a fleet of trailers. For now.

I hope people more knowledgeable than me will fill in, but I seem to recall they have their own in-house brokerage service for the tractors themselves.

This fits well with their model, as Amazon Air operates a model similar to DHL Aviation (which incidentally is Amazon’s carrier of choice in Europe): they own and lease the aircraft themselves, but have them operated by external contractors, including some they partially or completely own.

More 2016 redux. Powell even referred to it specifically in his remarks Friday. The solution (he seems to abide by) is to put any programmed rate hikes on hold, and WAIT for the markets and the economy to get their footing (took six months into 2016) while pols and yellow vests want it NOW. Fed thinks there will be another strong GDP quarter, and weakness thereafter, but maybe they overestimate the pullback. In 16 the planet was printing money, which found its way to the NYSE (and main street) and we avoided a far worse problem. In six months the global backdrop will be far different. What happens when GDP doesn’t slow down, what about pent up demand from the tepid recovery, and what about the impact of falling stock prices on the economic recovery as money does not leave the system, and they just rearrange the deck chairs on the USS Bubble.