But no letup in freight rates yet.

In November, according to transportation data provider FTR, orders for new Class-8 trucks — the heavy trucks that haul the products of the goods-based economy across the US — plunged nearly 50% from July and August, 35% from October, and 15% from November 2017, to 27,500 orders, the lowest all year.

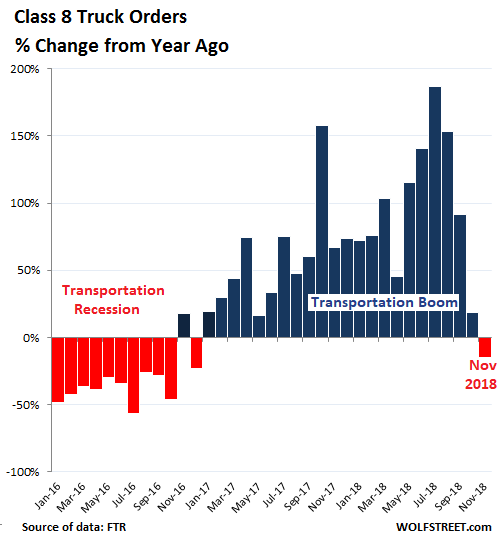

This chart shows the percent change of Class-8 truck orders for each month compared to the same month a year earlier, which eliminates the effects of seasonality:

Red-hot demand for transportation services this year and late last year, especially by truck, caused shortages, spiking freight rates, shipping delays, and more gray hair among shippers, while truckers were scrambling to order new trucks to meet the demand, and truck makers, swamped with orders saw their backlog balloon to 11 months, and records were broken on a monthly basis. But suddenly the hot air is hissing out of the market.

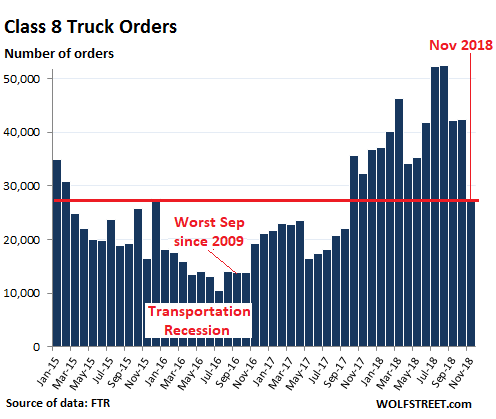

The chart above shows just how cyclical this business is:

- The effects of the “transportation recession” on Class-8 truck orders in 2015 and 2016 when orders collapsed to the lowest level since 2009, triggering layoffs at truck and engine makers;

- The blistering boom in orders leading to record backlog for truck makers, amid component shortages and supply-chain bottlenecks;

- And now the beginning of the next phase in the cycle.

Truck makers aren’t going to hurt just yet. Over the past 12 months, Class-8 truck orders have reached nearly 500,000 according to FTR data. Truck makers are running at capacity, building trucks at an annual rate of about 320,000 units. Some cancellations have started to come in, but the backlog extends way into next year. The chart below shows that orders in November plunged from the super high levels that had peaked in July and August at 52,000, but were still above the levels of the transportation recession:

“27,500 is not that bad of a number,” said Don Ake, FTR vice president of commercial vehicles.

Truckers were motivated to put in these record orders earlier this year because freight demand had been enormous, and there wasn’t enough equipment to move it, and they were able to raise rates and make more money. Now they see demand backing off, and overcapacity, created during boom times is precisely why this industry is so cyclical.

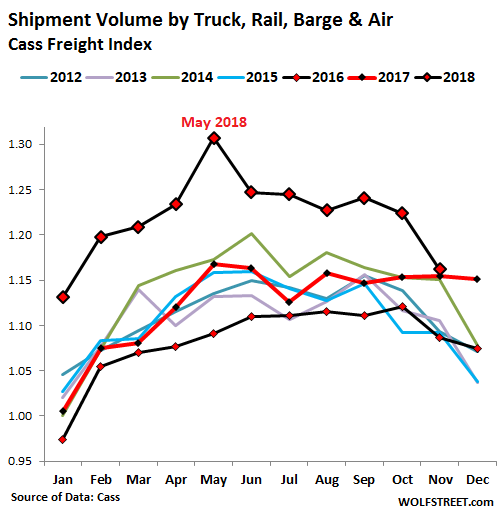

And growth of demand for transportation is now stalling. Freight shipment volume across all modes of transportation – truck, rail, air, and barge – was essentially flat in November compared to November 2017, and about flat with November 2014 (the other recent banner year), according to the Cass Freight Index. This year-over-year no-growth is down from growth in the double-digits earlier this year. The index covers merchandise for the consumer and industrial economy but does not include bulk commodities, such as grains or chemicals:

The chart above shows just how powerful the boom in late 2017 and in the first three quarters of 2018 had been. Note the seasonal drops starting in October every year – except in 2017 (red line). This was the beginning of the boom that has now run its course, with shipments still strong, but flat with November 2017 and November 2014.

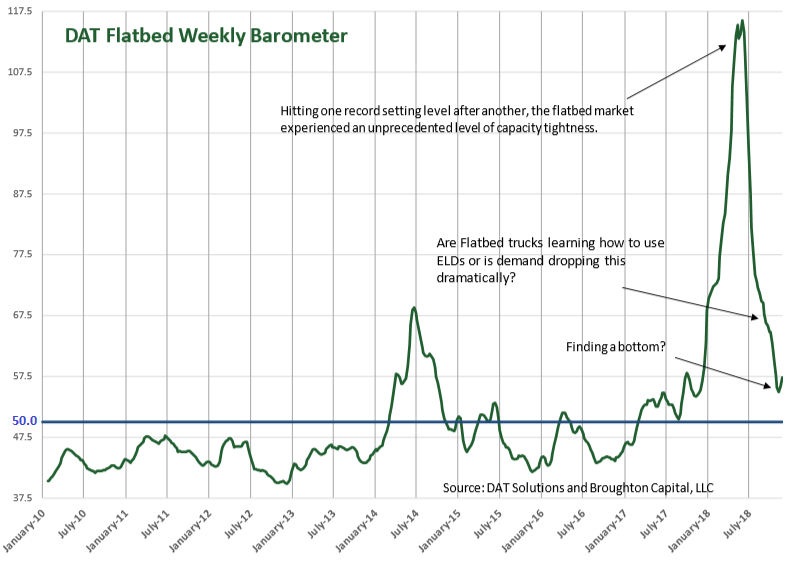

Demand for transportation from the industrial sector is reflected in demand for flatbed trailers that haul equipment and supplies for manufacturing, oil-and-gas drilling, construction, etc. Demand for flatbed trailers too surged late last year, but capacity suddenly tightened in January 2018 in part due to the newly required use of Electronic Logging Devices (ELDs).

As a result, the DAT Flatbed Monthly Barometer, which tracks demand-capacity imbalances, spiked to historic highs. But the indicator, cited by Cass in its report, has now plunged back closer to earth. The horizontal blue line (=50) indicates that supply and demand for flatbed trailers are in balance. So for now there is still slightly more demand for flatbed trailers than supply, with the indicator being above 50, but a far cry from the historic spike earlier this year (click to enlarge):

But freight rates and fuel surcharges have shown no signs of backing off just yet, as price pressures continue.

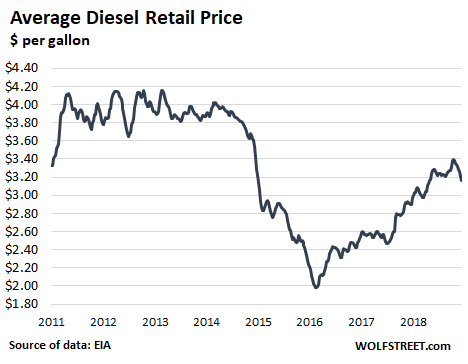

The average price of diesel at the pump, according to EIA data, has been edging back down ever so reluctantly from the cycle peak in October ($3.40 a gallon), despite the 30% plunge in the price of crude oil since then. At $3.16 a gallon, the average retail price of diesel is still up 8.6% from a year ago:

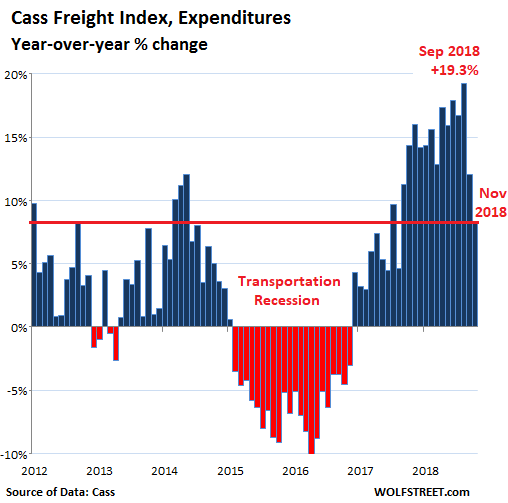

And freight rates are still hot. The total amount companies spent on shipping their merchandise via all modes of transportation – by truck, rail, air, and barge – rose 8.4% in November compared to a year ago. This is a result of flat shipment volumes but at higher prices that continue to squeeze the margins of shippers. But that 8.4% increase was a far cry from the year-over-year growth of freight expenditures between 12% and 19% in the prior 12 months:

The chart above also shows just how massive the boom has been and how sharp the wind-down now is. At the moment – if the wind-down doesn’t go much further – it means a return to something perhaps considered “normal,” a reversion to the mean, if you will. But the industry is known for its wild cyclicality.

It now faces a mind-boggling build-up of businesses inventories around the country that in part has powered the transportation boom over the past year-and-a-half. But business, as they invariably do, will sooner or later deal with these inventories to trim them back down, which will entail less demand for transportation services. And a classic overshoot on the way down for demand in the transportation sector, as we have seen during the last transportation recession, would then be on the schedule for sometime next year.

The price of rising interest rates. Read… US Banks Disclose Biggest Unrealized Losses on Security Investments since Q1 2009: FDIC

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Tracking the Baltic Dry Index (BDI) it bottomed in early Summer 2016, which matches with the reading of the Cass Freight Index.

However, if you look at the weekly chart of the BDI over the past five years, you will plainly see it chopping sideways.

This nascent global economic recovery that began in 2016, has been cut off at the knees by recent central banks policy decisions.

Not just the Fed (however they were the first) but the other big central banks, raising rates and taking away the punch bowl.

Which proves that the economic uptick enjoyed these past few years, was nothing more than central bank debt fueled.

The bottom to come is a long way down.

Agreed. Also note how steep the truck order decline in Nov 18. Far faster decline than in the trans recession. Looks more like a trans crash. Extrapolate that baby three months on.

Along with stocks, commercial real estate…

Implosive deflation?

In about the year 2000, there were tremendous backlogs of orders for tech equipment. The backlog evaporated suddenly. People were doubling and tripling up on orders in the hope of getting delivery from at least one source. When they got delivery they cancelled the other orders. This happens occasionally in other product groups as well.

I can imagine the same thing happened with trucks, and some statistics involving cryptocurrency mining equipment would be interesting too.

I work for Food service distributor. I don’t blame people for double ordering. It has been a year and we are waiting for our tractors to be put in service. Just finally arrived 1 month ago.

As I previously wrote, the Baltic Dry Index is not the reliable indicator of worldwide industrial activity it once was due to the iron ore trade: iron ore accounts for an amazing 29% of the dry bulk trade worldwide and there isn’t any lack of iron ore transport capacity as the Valemax class carriers alone account for 15% of that capacity, with more becoming operative over the next couple of years in both China and Japan.

This means the Baltic Dry Index is much more responsive to “background noise”, meaning rates for dry bulk goods which account for a small fraction of the worlwide maritime trade, such as granulated sugar and plastic pellets.

As US steel production is mostly fed by scrap metal, the iron ore trade is usually largely ignored by the US press, which kept on concentrating on the big bumps containerized freight rates to the US have experienced all year. To give an example the Shanghai Containerized Freight Index hit a massive 952 points in week 45 (November 5-11): it has since declined to 849, still very high by recent December standards, but down a big 100+ points in about a month.

Hundreds of articles, studies and opinion pieces have been published over the past few months about this discrepancy between “slowing growth” worldwide and very high containerized freight rates.

While I haven’t got the answers, two things stand out.

The first is the US foreign trade balance: in October 2018, the last figure available from the US Census Bureau, it recorded a record deficit of $89.3 billion (not seasonally adjusted), and this in spite of record exports of $147 billion.

The second is the sputtering performance of China, regardless of the fanciful numbers they expect us to believe, like we are expected to believe China building roads in Montenegro is part of some ingenious long-term strategic design.

MC01

Agreed.

However one must use the BDI as just one small piece of the larger puzzle, as your counter post points out.

Farther down the comment section I posted a few stats from the container Port of Long Beach, as another small piece of that larger puzzle.

When you dig deeper into the global trade transportation numbers, it does not portend a healthy economic future. The stats from some of the bigger shippers eg: Haphag-Llloyd, Maersk, VLCC’s, and other indexes such as Diana’s Ships, all seem to be trending down.

I’am currently looking at global air freight and its active carriers. Just the amount of leased aircraft returns, and cancellations of previously announced deals, indicates another down trend in the bigger picture. Enjoy your input.

I wonder how much of this is due to stuffing imports especially from China before the tarriffs take effect?

Bingo and good catch on a variable much larger than the hours of service ELD both needed….driver here.

Good question. I suspect that the answer is “more than 10%, less than 40%”.

In other words, any “increase” is likely to be masked by channel stuffing, and the true trade value of imports may actually have dropped.

Like many Chinese numbers, it is very hard to be sure.

Wolf,

A sort of car related question. The luxury fashion house Chanel filed a lawsuit last month against a website, The Real Real, which is a luxury goods reseller. My interest in particular is about Chanel claiming some sort of infringement of their trademark because their goods and logo are displayed on the site. Fashionistas are up in arms over the implications of this lawsuit and see it as a move to curtail the resale market. Since cars, which are trademarked and display logos, comprise one of the biggest resale markets in the world, can you comment.

Hi Petunia. The crux of the Chanel lawsuit is that The Real Real is not affiliated with Chanel but TRR says they have “authentication experts” to verify all products are 100 percent authentic. If they are not affiliated with Chanel, how can they verify? It has already been proven some of the products are not authentic so Chanel is going after them for selling fakes as well. Also the use of “vintage” when the products are not vintage as to the term (50 plus) years. Legally, TRR looks like they screwed up by using the term “authentication experts” which implies affiliation with Chanel.

Dona,

Thanks for replying. I think Chanel is on shaky ground on the authentication issue as expertise in the arts doesn’t imply affiliation with the creator. Auction houses are full of recognized experts and luxury goods are becoming a huge part of reselling.

I would challenge sales associates in any designer store to authenticate items which may be older than they are as authentic. I own a Dior saddle bag which is probably ~20 years old and looks brand new. They would probable say it’s a fake.

Also, vintage is a relative term depending on the item. While living in Palm Beach County, I learned that a historic home is defined as a house over 50 years old. Food for thought.

Doesn’t this whole authentication issue draw a bead on the core problem with the modern luxury goods market….there is little to no value left in many of these products (e.g. most of them mass produced in China and stamped with “luxury” house’s stamp). Anyone who has ever has ever owned a well made custom garment or sewn one themselves could easily tell the difference between a real haute couture Chanel and a knockoff. Chanel’s problem is that the money is made in the ready-to-wear market where construction and materials are significantly different from cheap markets and the main difference is the label.

The Fed is tightening the money supply and raising rates because if we don’t go through this pain we will wake up and one day we will be Italy, then Greece, then Brazil and finally Zimbabwe if things go completely unchecked. Tightening shakes out the weak hands which is another way to say it forces all parties (business and consumers) to reevaluate how we deploy resources. Fast fashion and fake luxury goods (regardless of the authenticity of the label) aren’t really the most effective way to spend a dollar.

Wrote that previous comment incorrectly…

I meant to say that Chanel makes all their money in ready to wear and branded accessories but these products aren’t made to true luxury standards…they are part of the flood of commodity grade, factory produced cheap goods we see everyday, usually for selling for less.

Petunia,

To answer your question, sort of: The first time an authorized dealer sells a new car, it becomes a used car. This is documented legally via the title registered with the state. It’s a crime to do otherwise. So you cannot “resell” new cars.

Dealers of the same franchise (such as Ford or Chevrolet) can transfer new vehicles among each other without triggering a sale. This transfer is also legally documented.

But you can resell used cars, and that is being done massively.

Has a car manufacturer ever sued a dealer or any reseller for showing the car brand in an ad offering the car for sale. This was really what I was getting at, cars are a branded commodity, just like a designer handbag. Owners sell and consign cars all the time, it’s a standard practice. I don’t understand why the handbag would be any different than the car, especially since the logo is sold as part of the property in both cases.

I see. New-vehicle dealers are franchised. To get the franchise and be able to sell those new Fords, dealers agree to stick to the rules. Certain brand items HAVE to be shown, as a requirement, such as the “Ford” sign outside, on ads, etc. So this is a very constrained relationship and a very different one than the one you mentioned between manufacturer/brand and some unauthorized reseller.

However, if a Ford dealer (or anyone else) puts up an official-looking “Chevrolet” sign to look like a franchised Chevy dealer to sell new-looking Chevy vehicles, all heck will break lose, and the offending dealer might end up in jail for fraud.

This is a interesting conversation.

I see what your getting at with the fashion goods.

I believe the fashion industry is all about image – trying to sell you a lifestyle –

Branding (label) being an important part of (concept) of fashion.

In some cases this happens with high end car brands like Mercedes, BMW, rolls Royce, etc.

However, when someone resells a used/new car it is NOT a knock off; it’s the real deal, genuine example.

If someone tried to resell a Mercedes knock off (made in China for example)

Then the same issue applies as with Chanel case.

GM and possible other US automobile manufacturers have used daily loaner vehicles, which are new vehicles used in the service department. These vehicles are usually internally incentivized by GM and usually have to be retained for a specific amount of time and/or mileage i.e. up to six months or minimum of 3000 – 9000 miles in order to qualify for the internal manufacturer incentive to the dealer. The dealer is then able to sell that vehicle at a discounted price. Why does GM do this? When the dealer puts the vehicle into service GM is able to report this as a sale for their records even though it has not been titled yet. The state of Florida (and possibly other states) have stated that if this occurs it constitutes a sale and the dealer is required to pay sales tax. This has been used to move slow selling vehicles by coding them as a rental/loaner internal sale to the dealer with the price discounted and later sold as a loaner/demo etc. sale. When looking at total manufacturers sales it is important to distinguish between RETAIL sales and other types of “sales”.

Sadie,

There is a huge distinction between “demos” and service loaner/rental cars that dealers own. And so I take this opportunity to point this out.

We (big Ford dealership) were one of the first dealers to get massively into service loaners (ca. 1990). By the time I left, we had fleet of 400 cars that served as service loaners as well as rental cars (intermingled). Because of the loaner program, we had a huge service department with over 100 techs working in shifts. Service department was open 24 hours per day, 6 days a week.

1. Here is the ownership chain and titling for service loaners and rental cars:

— Dealers BUYS from the manufacturer the service loaner or rental vehicle and titles it in dealer’s name. Manufacturer may subsidize this.

— The finance branch of manufacturer (such as Ford Credit) or a bank finances these vehicles under a floorplan arrangement.

— Vehicle gets a regular license tag.

— Dealer insures this vehicle as rental/service loaner. This may be part of the overall insurance package.

— Manufacturer records this as a “dollar sale” for quarterly financial reports when the vehicle is “invoiced” to the dealer, which is before the dealer actually takes delivery of it. Same for ALL new vehicles a manufacturer sells to the dealer.

— Manufacturer records this as “unit sale” for monthly unit sales report when the dealer puts this unit into the service loaner/rental fleet.

— At some point at dealer’s discretion, the dealer takes this service loaner/rental out of the fleet and puts it on the USED-car-side of the lot and sells it as a USED car.

2. Demos

— Dealer buys all new vehicles from the manufacturer, demos included.

— Dealer decides what units become “demos” that dealer, managers, and sales consultants drive and put a special “demo” tag on it. In our state, demo tags started out with a “D.” In our state, each dealer had a fixed number of “D-tags” and could swap them from vehicle to vehicle.

— Under IRS rules driving a demo generates taxable income for the individual and must be reported (but often isn’t).

— Some dealers also lend demos to customers.

— Demos remain in new vehicle inventory and remain new vehicles.

— Manufacturer records this vehicle as a “dollar sale” for quarterly financial reports when the vehicle is “invoiced” to the dealer, which is before the dealer actually takes delivery of it. Same for ALL new vehicles a manufacturer sells to the dealer, and demos are no exception.

— Manufacturer records this as “unit sale” for monthly unit sales report when the dealer sells this demo to a customer, at which point the dealer removes the demo tag. The vehicle gets a regular tag.

— When the dealer sells this demo to a customer, it has to be with full disclosure of the demo status and mileage, and at a discount.

— Regular new-vehicle sales taxes and license fees applied at the time of sale in our state. This may differ from state to state.

So I think you might be talking about a “demo” rather than a pure service loaner or rental.

In terms of taxes, it gets complicated very quickly, as you point out. And it differs from state to state. A dealer that buys a vehicle as a rental car or loaner may not be considered a “retail customer” in some states. So there may be differences in how sales taxes are applied.

Don’t worry these RICH guys got it all u der control they r definitely gonna look out for US

Well–that didn’t last long.

I have owned and driven trucks since 5/68 negotiating my own freight rates through some rough times. The mega carriers have been crying driver shortage for all of that time. My question is if there’s a driver shortage why doesn’t the pay increase or the freight rates increase? If adjusted for inflation the drivers would be earning $111,000. An average wage at that time for a decent drivers job was $15000, a factory job was about $8000.00 you could buy a new car for $3500. A nice home was $35000.00 I spent $10.00 per day on meals and ate very well. Freight rates were averaging $.40 per mile fuel was $.28 a gal. I bought a new Peterbilt 359 decked put for $36000.or about the same price a a nice home. My payments were $685.00 per month. Now a driver may make $45000. A factory worker $35000 . A new car is $35000. A nice home is $350000 if I eat 3 decent meals a day I might get away with $45.00 a day if I have a steak which I used to do at least 3 times a week that’s an additional $50.00 or more. Fuel is at present is $3.25 a new Peterbilt 389 decked out is about $180000. Freight rates at this time on a round trip basis is about $1.70 per mile and truck payments close to $3000 per month everything else is 10 times higher as well insurance is up 10 fold as well the only thing that hasn’t went up is our pay. Do you see a pattern here. How can there not be a shortage of drivers when we work our brains out and just keep going backwards. I’m 70 now still in good health I had intended to work until I couldn’t I still love doing my job but when the rates went up I thought at last I might do well my last few years. Then when I saw the rates go down fuel going up in October I saw the same thing in late 2007 and early 2008 where I lost eveything. I decided I was done. The thrill is gone as the late BB King said. I quit. I hope these kids coming in if the mega carriers can hoodwink them into it have the courage to hold out for the pay they deserve.

You are absolutely right. I am making the same money as 15years ago .Everyone is telling that prices goes up because of transportation rates but the money doesn’t go to drivers.

Very very interesting info on trucking. Thank you.

I knew a logging truck contractor who once said during a downturn, “The only thing keeping me going is the bank’s parking lot is too small for my truck”.

All working folks standard of living has been going down since the late’70s, unless you land in a specialized trade/occupation, and that never lasts once ‘they’ figure out a way to offshore or contract out….. Thanks to computers, even engineering specialists have had their work contracted out to Indian firms. The only way out of the decline is controlling personal debt, as far as I’m concerned. And the secret to controlling debt is to not believe advertising…ever, and follow a personal economic compass while executing a life plan.

“The only way out of the decline is controlling personal debt, as far as I’m concerned. And the secret to controlling debt is to not believe advertising…ever, and follow a personal economic compass while executing a life plan.”

Truer words never written or spoken.

Ditto.

And the life plan should be to take advantage of whatever contemporary opportunities are available to live independently of the need to work for “the other man”.

Most of my opportunities as a young man 60 years or so ago are gone, but there remain a few which many young people simply can’t get their heads around: build your own house, for example.

https://lenpenzo.com/blog/id43684-grandfather-says-the-benefits-of-diy-housing.html

Paulo and CB: I’m in the advertising business, and you’re right.

Also: please don’t spread this around :)

And, political promises (both parties) is just more advertising.

I am running a day cab until I see where trucking is heading. My company pays decent but the insurance is EXPENSIVE. I’m curious to see how autonomous vehicles may impact our industry. Thank you for letting people know how hard we work for such little pay.

Why is it that if I have a comment it always goes in moderation. I use no foul language or am not angry just blunt. Free speech seems to be tilted towards pc. If they publish my comments. They seem to wait until the subject is to old and no on sees or reads it.

Lester,

From what I can tell, you made your first comment a little while ago. This automatically goes into moderation. The comment has now been released. I see no other comment from you on this site.

However, if you changed your screen name and email to log in, you automatically start over again as a new commenter.

I, for one, very much appreciate the “earned freedom” we have here, Wolf.

I have wondered since the article Wolf did some weeks ago about the trucking boom how much of the increase in truck orders, shipments, and rates was due to the recent implementation of the government requirement to track trucker drive/rest hours electronically. This, I am sure, caused a reduction in the hours drivers could drive in a week. And if e-tailers wanted to get their goods through to their customers in the same amount of time it was going to require more shipments, more drivers, and more trucks. Plus with drivers getting fewer actual work miles per week the cost was going to go up. (Many truck drivers are contractors who have to make their own truck and insurance payments.)

So, while I do believe the total shipment of goods is up, I think the the little boom this year in truck/driver demand and some of the increase in “shipments” was due to the reduction in driver hours.

As the owner of a Trucking company that specializes in over dimensional loads such as heavy equipment, army tanks and airplanes, this November December have been the busiest I have ever been. One interesting thing I have been working on is hauling new Caterpillar tractors off of our docks here in Calif, everyone assumes Cat made in America, these machines came from Brazil and Japan where Cat recently closed plants. I am sure this has to do with Trump policy in some way.

Yes wages need to improve and Electronic log books have caused many to quit or retire early with no younger drivers to take their place.

Freight rates are up but brokers in this business play a bigger role than in years past, they typically take a minimum of 15 percent and up.

There are too many people selling what other people make.

In this case, selling somebody else’s truck assignment.

Freight brokers serve a distinct purpose, especially for smaller carriers, who have no sales representation outside of their domicile area. If you consider what it would cost these carriers to build a relationship with with shippers in other areas, the brokered load makes sense – they’re paying for a service that is provided at a cost below what it would cost them to do internally.

Disclaimer: Owned a small freight brokerage for several years in the 80s just after deregulation.

Been in the truck transportation field since 1975,going from a single truck O/O, small fleet owner with USPS contracts, terminal mgr and then OM for a nationwide TL carrier. Currently working in Hazwaste transport.

And in several years we’re going to be seeing those Self Driving trucks,,, that will sure change things…

Yeah a lot more dead four wheelers and highway workers.

Until the first accident and the lawsuits begin. And there will be liability issues. Guaranteed.

I always take article I find under Google stories with scepticism. 90 % of their stories are Trump bashing and negative stories . It’s anyones guess what’s going to happen . Goods . materials and machines still need to move. People love negativity. That is what puzzles me.

I covered the last transportation recession, and I covered the transportation boom after it, and now I’m covering the turning point. It’s just the data that’s doing the talking.

So let me see if I got this right. Deflation in assets, inflation in essentials, and stagnation

at best in wages. The Fed has hit the trifecta.

Looking at the Port of Long Beach container shipments.

Containers are (TEU) twenty-foot equivalent unit.

For the past month of November:

Empties outbound up 11.4%

Inbound loaded up 0.2%

Loaded outbound down -8.4%

Loaded outbound since 2013 down -13.7%

The above does not denote a healthy economy. I don’t think you may pin the sudden end of trucking expansion plans on any one catalyst.

Transports are facing a litany of economic and financial head winds, as the sector scrambles to deal with these ill winds of change.

The one constant is change. Good or bad.

What is coming however, won’t be good.

I’m not so certain a slow down isn’t being help along to kill any momentum

in applying tariffs and curtailing immigration . The Free Trade is good myth

must be perpetuated.

The two most important categories of containerized goods passing through the three main California ports (Oakland, Los Angeles and Long Beach) are furniture and automotive parts.

Furniture heads straight for the distribution centers of retailers such as Walmart but only a small fraction of automotive components are spare parts: the rest are OE components meant for assembly plants.

As car and truck assembly has shifted from the US to Mexico, so have shipments of components from The Philippines, Japan, China, Thailand etc: Manzanillo shifts more containers than Oakland and Lázaro Cárdenas has been growing at double digit pace for years now.

So far it seems this trend has been little affected by the so called Trade War, but any slowdown in car and truck demand form the US for whatever reason (educated guess: a combination of higher sticker prices and market saturation) will be first felt in Guanajuato and Jalisco.

Loin des yeux, loin du cœur.

Just to finally be on topic. Amazon Prime small vans can be seen delivering all over my neighborhood. I noticed them for the first time around Black Friday.

Yes, one reason Fedex and UPS have been hammered is that it’s only a matter of time before Amazon weaponizes its hub-to-hub logistics and Flex last-mile. I’m guessing that the Instacart/Whole Foods partnership was severed last week was because of Flex.

Driver shortage? Don’t believe that hype! Call OOIDA or a funding company, ask how many owner ops have started since 2012,ask them for numbers on how many company drivers have became independent! It will show you drivers are not joining big companies that constantly strangle the company driver and now the big guys are crying wolf to get government and public help because Karm finally coming after them! As far as freight rates! Sure it costs more to ship due to the hype out there! A load I do regularly pays over 3.00 a loaded mile,once I asked to nogitate the rate it went up $50 more, then I played between 4 brokers that constantly broker the same loads out of this place,I get near $4. A mile and loads and unloads by appt. I got even more determined to get a better rate and asked the shippers logistics manager exactly what it took to become dedicated 2 loads a week from them,this exact same run I’ve been doing for over a year and totally happy with but always feel I’m leaving money on the table pays $1100.00 each load going to remote distribution center,no less and never no more! So my 234 mile run I did 3 times a week for $850 suddenly became a very profitable load. I am now set up directly with shipper! Goes to show who is pocketing the high freight rates! The brokers are getting rich from drivers,independent and shippers! Brokers should be required by law of full disclosure and display exactly what shippers pay to have load shipped! Brokers,carriers and drivers need to have more honesty and open lines of communication!

This is really interesting. Thank you for the insight.

Disagree with brokers having to be shouldered with full dislosure, that’s like you having to supply your customer w a detailed P&L on every load hauled – I don’t think you’d agree to that.

More independents need the chutzpah to approach the shipper as you have done, IMO. Shorthaul runs like yours are perfect for that scenario.

However, if the independent guy ventures out with longhaul loads, he’s likely going to be looking for a broker at the other end to get back to base.

=Brokers should be required by law of full disclosure and display exactly what shippers pay to have load shipped !=

My good man Black Pete;

This law is in effect since Carter deregulation ( aka Motor Carrier Act of 1980 )

49 CFR 371.3 – Records to be kept by brokers.

§ 371.3 Records to be kept by brokers.

(a) A broker shall keep a record of each transaction. For purposes of this section, brokers may keep master lists of consignors and the address and registration number of the carrier, rather than repeating this information for each transaction. The record shall show:

(1) The name and address of the consignor;

(2) The name, address, and registration number of the originating motor carrier;

(3) The bill of lading or freight bill number;

(4) The amount of compensation received by the broker for the brokerage service performed and the name of the payer;

(5) A description of any non-brokerage service performed in connection with each shipment or other activity, the amount of compensation received for the service, and the name of the payer; and

(6) The amount of any freight charges collected by the broker and the date of payment to the carrier.

(b) Brokers shall keep the records required by this section for a period of three years.

(c) Each party to a brokered transaction has the right to review the record of the transaction required to be kept by these rules.

[ 45 FR 68942, Oct. 17, 1980. Redesignated at 61 FR 54707, Oct. 21, 1996, as amended at 62 FR 15421, Apr. 1, 1997]

Hi Wolf

According to Aztec chronicles, Horses introduced into North America April 21, 1519.

(And 500 years after Columbus showed up, the WWW was created. )

So the situation looks pretty clear to me. Somethings coming very soon we havent ever seen, or know in any which way how to handle.

GLTA

” …and there is no new thing under the sun” – Ecclesiastes 1:9

Re Columbus and his “discovery”: An Accoma Indian guide told me he Columbus didn’t. “We knew where it was all the time.”

Insurance is a big path of this. The spike in rates is driven by the thousands of plaintiff attorneys and folks looking for the big, bad trucking/insurance company to get a check! Sweeping tort reform is necessary to help insurance costs. Also truckers need to be educated thoroughly on risk and keeping themselves out of the eye of the ambulance chasers. We’ve seen rates as high as 25k per year per truck for smaller, start up haulers.

Low prevailing interest rates have a substantial effect on truck insurance rates.

Back in the days of ultra high interest rates, truck insurance was being sold which wouldn’t cover their loss ratios.

Looking at the graphs above, it is easy to see why there is a “correction”.

I hope it’s still part of our vocabulary.

I offer the following photographic evidence: https://photos.smugmug.com/Mixed-Gallery/i-4FpH3hj/0/81d49a68/XL/IMG_0665-XL.jpg

This is a MAN service center I sometimes drive by. They don’t sell lorries and vans there: it’s a maintenance and repair center. About five months ago they started parking these brand new lorries in front of it (those waiting to be serviced or picked up are at the back) and the number has been steadily growing: they go all the way around the dealership but it’s a nasty place to stop and take and picture.

While they may not look as glamorous as US trucks, that’s a lot of capital sitting idle there, to the tune of several millions.

I also offer another piece of evidence: CNH Industrial, the sister company of car manufacturer FCA, announced they are idling a number of plants in Europe for three weeks in January.

This business is cyclical: it has been this way since I was a child.

But the big problem is instead of building a flexible business model that will allow them to deal with fat cows and lean cows alike, manufacturers have definetely shifted to building up as much capacity as they can while business is good, hoping all the while somebody (the Chinese government, the European Central Bank etc) would find the magic formula to give them an eternal boom. This means that when trucking busts (and it always does, like all cyclical business), manufacturers start running around with their hair on fire while all the inventory resulting from the overcapacity they built up accumulates in parking lots like the one above.

You can thank the President’s Trade War for the decline… It affected the steel industry and the freight industry…among others…. Don’t believe me prove me wrong… I’ll wait

The latest available data from the US Census Bureau (October 2018) put US exports at $147 billion and imports at $236 billion. Both are all time records (non-inflation adjusted).

The same figures for October 2017 were $136 billion and $210 billion respectively and for October 2016 $128 billion and $192 billion. See for yourself here: https://www.census.gov/foreign-trade/balance/c0015.html

These data are not coherent with an all-out “trade war”: even if it’s really being waged in any more substantial way than diplomatic channels, it’s not being felt in dollar terms.

Trucking is the most cyclical transport industry, even more so than air and sea transport, and what you see in those graphics above is what has happened time and time again since the 50’s, the only difference being this time manufacturers and shipping companies have increased capacity to a level that will make the inevitable and customary landing considerably harder than usual. A lot of people are going to get hurt.

Unless you are in the industry or are very observant (and lucky) you probably won’t spot this landing because it’s always the same. For example you may notice lorries are not loaded to maximum capacity anymore, or that shipping has become a little cheaper and/or faster than six months before or that the local transmission plant has stopped hiring and has reduced the number of shifts…

Again: it has happened before and will happen again, and I am always shaking my head at how manufacturers think that every time around it is different.

Trucking is always going to be up and down. I’ve been owning my own truck for 6 yrs now. I am on the DAT load board and it Sucks right now. The squeeze from brokers has loads paying from 1.50 to 3.50 but the average is 2.05 now 2.05 isn’t quite enough to Truely survive comfortably. I am so sick and tired of these Brokers something needs to be done about the total rate showing and clarity. I am doing all the work and this Detention it’s a real Joke. Detention is so hard to get out of these Brokers. I have a 35 percent rate of getting detention and a good detention hourly rate. Some regulations need to be put in place on These Freight Brokers. They are the ones Destroying and Slowing down the Freight with Being Overly Greedy. The middle man is the Biggest Problem. BROKERS

Have you ever seriously approached shippers about hauling direct?

My interest here is in attempting to fathom how the information Wolf presents will affect me indirectly, as I do not participate (stock market, for example) in most of the macroeconomic activity covered.

As a highway user, I wonder if the burgeoning supply of new trucks will affect the accident rate? Older trucks retired, newer trucks safer?

IMO: Newer trucks safer, newer drivers maybe not so much.

You’ve said a mouthful there, Clete

the 5 was damn busy with Caravans this week, I will be on it again this week….this is nothing like 2010-2013…trucking is humming per my freeway view…

trucking …especially in the Us is so goddamned fickle…i mean oil is at 50 so whaaat the problem?? …anyway..for a macro picture i like the bdx…and she’s looking…goodish but almost like a dead cat bounce…

https://tradingeconomics.com/commodity/baltic

and then you add that to the ted spread….

https://fred.stlouisfed.org/series/TEDRATE

lol nyse just vomitted like a 90s kid on bad ecstasy