Amazon, Google, Netflix, Nvidia get crushed. Et tu Apple?

The Dow Jones Industrial Average confusingly dropped from a 352-point gain 32 minutes after the open to a 245-point loss, amounting to an intraday swing of nearly 600 points, ending the day down 1%. At 24,443, it has now dipped 1.1% into the red for the year. This was not supposed to happen. Today was supposed to have soothed the aches and pains from last week. But no. Not today.

The S&P 500, after a rally that too had lasted 32 minutes and took the index to 2,707, gave it all up and swung to a loss, ending the day down 0.7%. At 2,641, the index dipped 1.2% into the red for the year. Well, tomorrow is another day.

But as the above chart shows, the sell-off, after this huge run-up, is still not much to write home about, down just 10% from its ludicrous peak.

The Russell 2000, which tracks stocks with smaller capitalization, had been up 2% early today but then too gave it all up and ended the day down 0.4%. It has dropped 15% since August 31 and is back where it had been in September 2017.

But the Nasdaq was the mover-and-shaker, so to speak. After getting whacked down in October through last week, it jumped 1.9% in the first 35 minutes of the day for a well-deserved breather, but then began to wheeze badly and dropped 117 points, or 1.6%. That amounted to a 3.3% intraday swing. It’s down 13.3% from its peak. Still a far cry from the 78% plunge after the dotcom bubble, but it’s starting to add up.

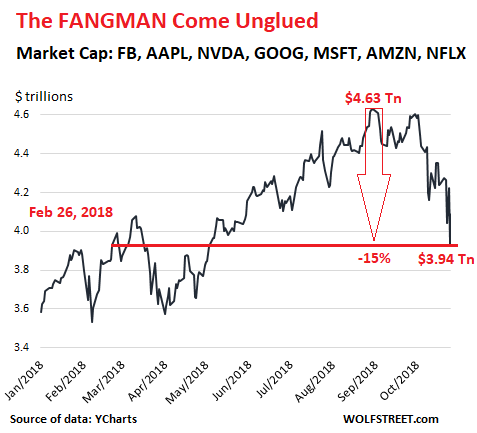

Blame the sell-off on the FANGMAN stocks – Facebook, Amazon, Netflix, Google’s parent Alphabet, Microsoft, Apple, and NVIDIA.

Amazon [AMZN] dropped 6.3% to $1,538.88 a share. Once upon a time on September 5, it had a market capitalization of a hair under $1 trillion. By Monday at the close, $250 billion of it have evaporated. Thursday evening, Amazon had reported record profits but missed on revenues and lowered guidance, setting off fears of slowing revenue growth. On Friday, its shares got crushed, and today, its shares got crushed further and with exemplary force, losing another $103.93 a share, or 6.3%.

Alphabet [GOOG] dropped 4.8%. It had also reported earnings Thursday evening, got beaten down on Friday, and got beaten down another $51.39 a share today. At $1,020.08, shares are now down nearly 20% from the peak in August.

NVIDIA [NVDA] dropped 6.4% today, Netflix [NFLX] 5.0%, and Microsoft [MSFT] 2.9%. Facebook [FB] fell 2.3% today and is down 35% from the peak. Even Apple [AAPL] dropped 1.9%. The FANGMAN stocks, all of them, ended the day in the red.

Combined, in terms of dollars, the FANGMAN stocks dropped 3.8% today to $3.94 trillion and are down 15% from their peak on August 31: $692 billion dissolved into ambient air:

But it’s still no big deal in the grander scheme of things: That 15% dive since August 31 took the combined market capitalization back to where it had been on February 26. Easy-come, easy-go, sure, but it is still up year-to-date and is up 13% from a year ago. After a ludicrous stock price boom, even a 15% drop doesn’t make a dent big enough for anyone at the Fed to worry about. And besides, tomorrow is another day to give that inevitable relief rally another shot in the arm.

Will the Fed buckle? Listen to… THE WOLF STREET REPORT

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

> Craps Out

I do not understand this technical jargon. Does this mean the rally is going strong?

I have always understood the term to come from the dice game craps.

https://www.dictionary.com/browse/crap–out

It’s generally *bad*…

> It’s generally *bad*…

I’m fuzzy on the whole good/bad thing. What do you mean, “bad”? Like all life as you know it stopping instantaneously, and every molecule in your body exploding at the speed of light?

Its when the person running the dice game takes your money and says “new shooter” and gives the dice to the next person who wants to try to beat the house’s edge in the odds.

The actual time the dice pass is after the shooter “sevens out” and all bets are taken off the table. Craps is only bad when you are on the pass or come line and only takes that one bet.

That’s a big twinkie.

Something “craps out” when it stops operating properly. The battery on my e-bike crapped out and I had to pedal home.

Thomas Crapper was a plumber in 19th Britain who did not invent, but was renowned for his Crapper-branded flushing toilets.

“Visiting the crapper” was a colloquialism that soon extended into “taking a crap”.

For those of us with unrefined minds, “craps out” is similar in meaning to “the shit has hit the fan”.

Yes, it does lend itself to that interpretation.

Welp, after about 5 years of service, and the little light on the printer blinking away to warn me, the toner in my laser printer’s finally crapping out, so I ordered a new cartridge.

Means, run out, failed, went bad, etc.

Wolf shame on you. Bikes with motors have never worked well unless they are motorbikes and you felt for the adding an e- (like e-mail) scam that’s literally from the past century?

I mean yes in theory adding a motor to a bike sounds great. In practice is crap unless is a motorbike and even then riding a motorbike has risks.

Make it diesel, make it electric, at least it did not catch your pants on fire… this time.

And yes I do know a guy who got burned due to using a motor on a pedal bike.

Back on FANGMAN while is quite evident for most of them, I am not clear why Amazon and Microsoft went down.

Amazon might be due to having yo pay more for credit since it has been investing a lot of money in lots of things and Microsoft might be a mix of Windows 10 growth being lower than expected and the “Opps my updated deleted your stuff” thing.

Just for the record: the e-bike was an example. I don’t own an e-bike. I own shoes and walk practically everywhere I go, which you can do in SF.

I know that in American slang people refer to internal combustion engines as “motors”, but having gone to school for four years to become an industrial mechanic, we were taught that motors are electrical devices and internal combustion engines burn petroleum products.

Who stepped in at 3:45?

Dip buyers. They always do.

Don’t u mean the plunge protection team. Trying to unclog the crap out of the crappy.

Actually it was the Feds purchasing S&P Futures….

You people had better believe Wolf: there’s no vast labyrinthine conspiracy here. Only dip and panic buyers who think the Dow Jones at 24,500+ is “underpriced” and hence they had better stock up on AAPL at $212+ a pop for fear of being “priced out”.

On the other side of the Pacific it’s another matter as the Bank of Japan has been steadily trying to reanimate the Nikkei 225 for almost a week now after the inexplicable late Septermber spike ended like these binges always do, with a massive hangover. If you want to see what government-sponsored manipulation looks like, look no further.

Isn’t the PPT like Bigfoot?

If the Fed is purchasing futures they paid dearly. The overnight futures buyers apparently backed off last night, and put their money to work at the open today. As soon as the bulls catch a bid they close their position in gold. It’s all pretty orderly. To get some perspective you have to widen the time frame and you appreciate how far this market correction has to go. You trade around your positions minimize damage.

Yes, Virginia, there really is a Plunge Protection Team.

Mostly, they buy S&P 500 futures.

They are probably going to be a factor in this market until, um, next Tuesday. After that, stand back!

It was an odd vertical ramp.

I do not feel confident in these markets. Fed doesn’t plan to slow down, tariffs hitting bottom lines, blue wave fears, buybacks getting more expensive, and risky bets on trade talks with Xi coming up all have me feeling nervous. But of course, I will reallocate my money into bonds and it’ll all rally and I’ll miss out. Not sure when or if reality will ever set in or if we will ping pong lower/higher or stay the same, with hair-loss inducing volatility along the way.

Funny comments. As a saver it is strange to feel/see the angst so many are exhibiting as the Market roller coasters along. (another technical term. :-) But seriously, piggy backing on notbuying’s “missing out”, that feeling goes away over time. Yes, savers have not made the big gains these past few years, but we still have our money and tonight I will sleep like a baby, or at least won’t be worrying about losses. My neighbour and friend down the street lost a couple hundred K in 2007/8. It forced him to sell a small rental he owned to make up the loss for retirement income. It was like watching someone you know eat their arm to keep from starving.

Confession time: I look at the Futures and imagine a tomorrow of Dow down 600. Anything could happen and people buy a 3:45 pm dip should have their heads examined.

regards

I am a fairy new investor, mostly putting money away into my tax-deferred vehicle, and a little into a small individual account. I have lost quite a chunk in my individual account, but only makes up 5% of my overall investment savings. I am just barely break-even on my retirement account for the year. I am not sure if I’m making an educated decision, but all of these macro factors have made me move my retirement money out of stocks and into bonds. I just am not sure I can stomach the risk, even as a late 20s investor with only a couple years of savings socked away. I alternately have a savings account that is about 75% of what my retirement account is worth, drawing 2% APY. So I guess I am hedging a bit on the safe side, but it’s only really supposed to be for emergency savings, not as a hedge against market uncertainty. Any input is welcome.

Thanks

notBuying,

I hope you mean that you bought the bonds outright.

If you bought an open-ended bond mutual fund, you don’t know what you’re getting. They can experience a “run on the fund.” Quite a few experienced that during the financial crisis and collapsed, taking 60% or 70% of their investors’ money with them, those investors who were foolish enough to not get out in time, with the “first-mover advantage.” Conservative-sounding open-end bond mutual funds can be super-high risk because in a crisis, they HAVE to sell bonds to meet redemptions just when there is no liquidity. They’re the biggest forced sellers, and they might get 10 cents on the dollar for what they have to sell. The counter-parties could be insiders or hedge funds, making a killing off those bonds later on.

Hi wolf, the fund in question is VBTIX. It doesn’t look like it was affected much by the 2008 downturn, from looking at the charts.

Wolf, I heard you talk about bond funds this way before…

Can you clarify that something like Vanguard’s CA intermediate muni bond fund might be subject to the same issues?

I cannot discuss individual bond funds. The thing is, you don’t know what is in it. You just know the top ten or so positions. Those are usually the best most liquid bonds they have in it. When there is run on the fund, those are sold without problems, and early movers are able to get out. Once those are gone, and now they’re forced to sell sparsely traded junk bonds and the like, all heck breaks loose.

To see some examples of how that worked out, google: schwab bond fund class action

I don’t I remember a Vanguard bond fund collapsing. So if my memory is correct, they got through the crisis. But this is no guarantee they will get through the next.

If it has to be a bond mutual fund, I’d prefer a closed-end fund. They’re not as vulnerable to a run on the fund. But they may be harder to buy into, and the fees may be higher.

There is a good chance (about 50%) that the Stawks will rip up to new highs and get another 50% upside like they did in 1999 to 2000. Simply because there is so much worry about trade war, China, Italy, Fed. Then you will feel “hey, market is up, that means those things do NOT matter! Is there anything else that is worse than those? Probably NOT. If market can go up 30% against those, it will go up for ever!”, the you will worry about nothing, and all of your money will be put into the market, then, you get killed.

I am seriously thinking the S&P will rip to new highs simply because there is soooooo much worries and uncomfortable.

Feels a bit like 1997-1998 again right now to me. Just like 1999, I still see one more rip to ATHs in 2019 before this economic cycle finally ends.

Nothing is for sure. But hey, if you read on this website, you hear people saying all bonds, worried, things are crapping out. I am 95% sure if I keep laddering treasury bills, I will beat S&P 10 years from now. That’s from valuation point of view which only works long term, meaning more than 10 years. From technical point of view, there is still lots of “worry money” in the retail hands, the bull market is over. If retail does not get slaughtered, the bull will run rage and leav the retail behind in the dust. The moment retail jumps in, they get slaughtered. As long as there is enough people on this website saying “worry”, I am bullish.

I think I can see a little twitch in the fingers of Mr Bezos.

Let’s see if he is tempted to extend his invisible hand to the editorial columns of the Washington Post for a smidgen of stock support

As a multi-billionaire the losses so far for “baldy” is pure pocket change…..

And then tax loss selling for strategic investors

“Craps out” is the perfect jargon, it refers to losing on the first throw of the dice in the gambling game of the same name. Bear markets have a notorious tendency to open with optimism and then crap out during the day, falling down the slope of hope. (This is much the opposite of bull markets opening weak and then climbing a wall of worry.)

Perhaps the trading at 3:45 was algorithms programmed to defend round-number prices. The markets bounced off the 2600 line on the S&P 500 and 24,000 on the Dow Industrials, and rebounded from below the 7000 line on the NASDAQ composite to close above.

Historically that sort of sharp rebound is a bullish signal with a high probability of setting a near-term bottom, but that signal failed last week so now I am skeptical. Apparently algorithmic buying doesn’t stimulate the animal spirits the way the older organic buying did!

Like Sherlock Holmes, I think there is a clue in “the dog that is not barking”: the equity selloff is not being matched by the usual flight-to-safety bid in Treasuries.

Investors expressing genuine doubt about US growth prospects would normally buy Treasuries when dumping stocks, but that’s not happening. So perhaps the selloff is exogenous – rebalancing by global investors, or forced selling by overseas stockholders facing domestic liquidity issues and/or margin calls?

One would normally expect a month-end rally, particularly in a week with a significant holiday, but another scenario has players choosing to put all the pain into one month in order to set the stage for stronger monthly numbers in the standard year-end rally.

Or perhaps something big blows up and the whole market craps out for the year?

Maybe investors are buying Treasuries, but the Treasury is selling so many that the buyers’ bid isn’t having so much effect on prices.

Wow! What a scary chart. Many traders, long and short alike, are looking at the same chart of course.

The way I’m reading it, if this falls below 2600 with any conviction they will confirm the double top and sell like hell and go short,

and the algos will pile on and scare the hell out of whoever’s left. We’re only about 50 points away and we’ve already had worse days this past month.

Index fund holders look out.

That’s the $64K question. Just what will the “algos” do? Does anyone actually know? The market left the realm of human time scales a long time ago. Just one ultra small error in the software, which is *really* easy to do, and the “algos” can go nuts. It’s the same types as the “quants” (who said that house prices can *never* go down and who caused the GFC) that are designing these things. They are completely out of touch with real reality (as most of “silicon valley” is).

” Just what will the “algos” do? Does anyone actually know?”

If the algos are written in a Turing complete language (highly likely) then no. It was proved impossible way back before there were any computers. DuckDuckGo, “The Halting Problem”.

Like the models, algos change all the time. Every algo is implementing a strategy du jour which complements or conflicts with other trading strategies. Their only known boundary is that trading stops at a specific time of the day.

I only know enough to be appropriately afraid of the possibilities.

The banksters made out like bandits today. Buy golly, a trillion here or a trillion there; it ain’t what it use to be.

I don’t think we will see a substantial rally until we see a painful 5-10% daily loss for the major indices. You need high volume panic selling to create a nice V-bottom that will last for more than a few days.

So, some big money came in early. Just an impression, but some big players who wanted to change the story of last week and the drops, and thus reassure the market with headlines by mid-day that said “wall street bounces back.” But the psychology of the market is such at this time that a lot of people saw the little bounce at the start of the day and said “here’s my chance to get out.”

Wonder who the big early money was?

If you sold AMZN at 2k you made a killing. My parents bought at 1k and are holding for the long term.

The person you sold it to at $2k isn’t making a killing at the moment :-]

Wolf, has borrowing against stocks increased significantly this last run-up ? If so, at what general level could these loans cause a domino effect where other investment need to be sold to cover loans. I’ve read where in China this is a common practice ? If the China market continues to drop, causing Chinese investors to sell US investments, this added pressure on the US markets should speed up Market declines.

Margin debt is very high. Margin debt seems to correlate almost perfectly with the stock market itself.

https://www.yardeni.com/pub/stmkteqmardebt.pdf

It’s hard for me to draw any conclusions specific to October, 2018. It seems that margin debt is dangerous exactly to the extent one might think a sharp drop in the market is in the offing.

@Lion, obviously I didn’t answer your question!

Figured I should admit that. Just thought the chart was interesting, but it doesn’t give any clue to a margin tipping point. I don’t know how fully invested people are now. I do know a lot of people were still sitting out last year.

Thanks Ed, I’m looking for info and you’ve helped.

In terms of margin debt at brokers reported to the NYSE, margin debt has been flat all year, after spiking last year. This is in billions:

The NYSE reported margin debt is not the only form or margin debt. But it’s the only reliably reported form of margin debt. Margin debt causes forced selling once share prices drop far enough. This is not an issue generally in the US yet. Share prices would have to drop more. But investors that are exposed too deeply to certain stocks that have plunged a lot might have to deal with it.

Thanks Wolf. Always appreciate the education. Also enjoy your commenters, many have a great sense of humor !

Yes they’re down 15% this month but up 300% in the past 5 years. This is not news

Nothing wrong with a difference of opinion Jon, but many of your comments are simply dismissive of the subject matter.

Many people, deprived of any safe investment return alternatives for years, are concerned that stocks have become wildly disconnected from mathematical ROI fundamentals due to stock price momentum fueling stock price growth in a continuous loop (among myriad other issues). When this self-reinforcing loop stops, who knows how far things can drop.

WS is great resource to cut through all the crap you get elsewhere.

Maybe you should start your own website. Believe ‘NothingToSeeHere-dot-com is available ;-]

That’s actually a pretty legit website name. But being hardheaded and fighting the Fed for the last 8 years have been a pretty dumb move. And again if you want to stay hard headed and not dollar cost average in index funds over the last few decades then you’re simply not that smart. No matter what fundamentals tell you. Average returns prove more.

Average returns can be misleading. I can guarantee you a 25% return PER MINUTE for two minutes on any amount you like.

Let’s say $100K. Two minutes later your $100K is worth $24K. How? In minute 1 you lost 90% so have $10K. In minute 2 you made 140% so add $10K + $14K = $24K.

But (90%) + 140% = 50% divided by 2 minutes is 25% per minute. Averages don’t account for loss of capital.

Extreme example? Hope so…

Jon,

You said: “But being hardheaded and fighting the Fed for the last 8 years have been a pretty dumb move. ”

Yes, yes, yes. But in case you haven’t noticed, the Fed has made U-turn. It’s now going the other way. If you keep going straight as before, you’re fighting the Fed. So have fun doing it.

At today’s low of $176.03, Nvidia was down over 39% from the all time high it hit about a month ago. That is some drop. I can see the other hot stocks on this list haven’t fallen as far. Another silicon chip company, AMD, was down over 50% from this year’s high when it hit $16.27 today.

AMD hardly ever makes any money and isn’t making much right now, so that I expected.

What goes up hard and fast comes down

Harder and faster

Like the NASDAQ ? I dunno last time I looked it’s still up like 600% from 8 years ago. Don’t fight equities ever. Be like water.

Jon,

Pay attention to the Fed. It has made a U-turn, and you haven’t.

Apparently we don’t have any craps players here. On your first roll of the dice a crap occurs if you roll a 2, 3 or 12. If you have your money on the pass line you lose but keep the dice and get to roll again. However, if you bet the don’t pass line and roll a 2 or 3 then you win your bet. If you roll a 12 then it is considered a push and you neither win or lose. In any case you keep the dice and roll again.

You only lose the dice when you 7 out, not when you roll craps.

To make the game more complex, you can bet that the next roll of the dice will be a craps at any point. If you bet any craps and a craps comes up you win 7 to one. If you bet on snake eyes 2 or boxcars 12 and you hit it you win 30 to one. If any other number comes up, you lose.

But the chances of a 2 or 12 rolling on a single throw are only 1 in 36 so a 30 for 1 payout is pretty crappy. The house always wins?

My favorite story about craps occurred when I was playing craps at the Flamingo in Vegas. It was just before noon on a weekday and the table wasn’t crowded. A woman held the dice when a guy walked up. It was clear he was slightly drunk. He laid a single black chip ($100.00) on the table and told the dealer “boxcars”. The dealer put the black chip on the 12 and the women rolled the dice. It came up 12. Back then the casino paid 30 for one meaning he had just won 3000. He told the dealer to let it ride which meant he was betting 3000 on the next roll of the dice. Another 12 came up. He had just won 90,000. He gave the lady a yellow chip–$1,000 and walked away with $89,000 after wishing the rest of us a pleasant day.

One of the best gambling stories I have heard. Funny thing is he could have said let it ride twice more and still the odds would have been better than the large lotteries.

According to the Guardian website the big four aka “Big Tech” are Amazon, Facebook, Google company Alphabet and Apple. Those are supposelly the ones that really matter.

FAGA? Because when you say Alphabet people things Google. and FAAA sounds funny.

Plus ya know, Elite Four jokes.

In terms of market cap, Microsoft is #2, behind Apple and ahead of Amazon and everyone else. To leave MSFT off the list of biggest tech stocks is just silly.

So the point being made is that no matter who is playing, it’s always a game and the House always wins.

CT

Every game in Vegas has set odds that favor the house. You can pick up any book on gambling and learn the odds. That implies that the house will come out ahead over the long run. But on any given day the odds get skewed and the house will actually show a loss.

It is the nature of gambling.

BTW did you know that investing is just another name for gambling. Probably never thought about it that way did you. Just like gambling in Vegas, the market is rigged to favor the house or in this case the Wall Street banks.

The saving grace, I think, is that investing is not zero sum. :)

In the long run, it is zero hedge.

Not too long ago, I told you when the markets dropped they would be led by tech. Tech is a volatile sector, companies can disappear in the blink of an eye. The list of big tech companies that no longer exist is too long to remember.

According to a CNBC article (okay, headline) I just read, nearly half of 18-29 year-olds have deleted Facebook’s app from their phones. I just killed my account altogether. If their core demographic and others like me are bailing, and all that’s left are marketing teams, propaganda, lies, censorship and the uneducated blathering of distant cousins…

\

/

\

death spiral.

I feel like there’s a honeymoon ending for them and a lot of other tech companies. Or I’m wrong.

If folks are still using Instagram or WhatsApp, they’re still feeding Facebook, which owns both (among others). The hydra of social networking has many heads, so just because one is fading doesn’t mean the beast is dying…

My 11 year old came home in late August / early September all excited about learning that Apple was worth a trillion dollars and wanted to know how to own some of it. It gave an opportunity to teach about longterm value and the stock market / casino.

It also made me think the top may be close if kids that young are getting into stock ‘excitement’.

Yup! I made good money on Vestas Wind System stock because the guy fixing my oil furnace was talking the whole time about investing in VWS shares, so I figured it would absolutely be running out of buyers :).

After my boiler was fixed, that stock went down all the way from 400 DKK to 25 or so, then back up because VWS was hyped as a flagship for the very powerful Minister for the Environment’s “Green Revolution”. In Denmark we have “means and ways” for people with influence to affect outcomes. Power is often exercised by “just” talking to someone who knows the right people to get together over some herring, beer and akvavit at one of the traditional Danish lunch restaurants in Copenhagen.

The Danish pension funds and perhaps Maersk invested in it, and, since “everyone knew by osmosis” that exactly this would happen, “everyone” piled into the stock, causing a fantastic run.

It is good to be aware of “Politically Connected” stocks.

If you buy stocks and they went up, where did that profit come from? Once you understand that, you will realize that those profits can return to whence they came. And they eventually will.

The only thing that has real value is the value added to anything by human labor. Everything else is a chimera in the long run.

Thus the boomer prayer, “Oh lord, please let this sh*t house stay together until I die.