What will the Bank of Canada do?

The Bank of Canada has nudged up its target rate four times, starting July a year ago, from 0.5% to 1.5%. It last hiked on July 11. But now it is facing inflation that suddenly and unexpectedly jumped at twice the Bank of Canada’s current target rate.

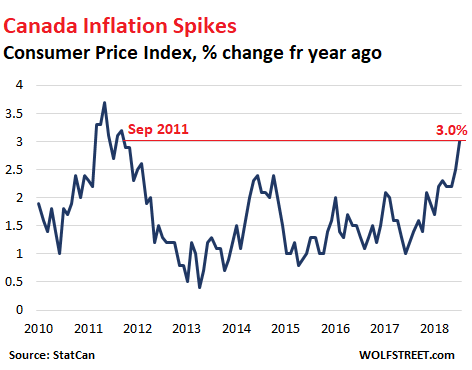

Canada’s Consumer Price Index (CPI) rose 3.0% in July from a year earlier, the hottest since September 2011, Statistics Canada reported on Friday. Consensus expectation was a rise of 2.5%, same as in June.

Prices rose in all major components. Prices for services – the largest part of consumer spending – jumped 3.2% year over year, up from a 2.2% increase in June.

In most provinces, CPI ran even hotter:

- Alberta : 3.5%

- Prince Edward Island: 3.4%

- Manitoba: 3.3%

- British Columbia: 3.3%

- Ontario: 3.1%

- Saskatchewan: 3.1%

- Newfoundland and Labrador: 2.7%

- Nova Scotia: 2.7%

- New Brunswick: 2.7%

- Quebec: 2.4:

But no problem.

Like the Fed and other central banks, the Bank of Canada has its “preferred” measures of inflation. And they’re a lot lower, of course. Which is the point. But unlike the Fed, it does not use a core index “without food and energy.” Instead, it has three measures (definitions) that have been statistically “trimmed:” CPI-trim, CPI-median and CPI-common.

Its stated goal is to keep inflation as measured by these three indices at the 2% midpoint of “an inflation-control range of 1% to 3%.” And this is how these three indices stacked up in July:

- CPI-trim: 2.1%

- CPI-median: 2.0%

- CPI-common: 1.9%

Statistically trimming the hot items out of an index works miracles, though it makes this trimmed index even more meaningless to consumers because consumers, who live in the the real world, cannot trim those items out of their budgets quite so easily. So now, after a proper trimming of the index, the BOC is right on target.

Among economists, the clamoring has already started for the BOC not to raise its target rate at its next meeting in September since its preferred measures of inflation are “under control,” even while the overall CPI is threatening to run amok.

The BOC faces a self-inflicted quandary. After keeping rates too low for way too many years that inflated all kinds of asset bubbles, it is now confronted with those asset bubbles, including one of the world’s biggest and riskiest housing bubbles that has begun to deflate in some corners.

The BOC has been on record for well over a year, trying to tamp down on the housing bubble and housing speculation by warning potential homebuyers and speculators to be prudent, to be aware of the risks, and to be ready for declining home prices. It’s doing so because it knows how risky a housing bubble, when it deflates, is for the banks and mortgage insurers.

In theory, it should have raised rates sooner, faster, and further, at least keeping up with the excruciatingly slow snail’s pace that the Fed has set – seven hikes in 2.5 years. In practice, the BOC faces Canada’s mortgages.

The 30-year fixed rate mortgages that are standard in the US are rare in Canada. These are the three basic most common mortgage types in Canada – and they all entail rising mortgage payments for current homeowners when rates rise:

So-called “Fixed-rate mortgages”: By US lingo, this a misnomer. The interest rate only stays fixed for a set period, such as five years (“five-year fixed-rate mortgage”), and when that period is up, the rate adjusts to a current rate. In a rising-rate environment, you could wake up to a potentially much higher payment in the sixth year of your mortgage.

“Adjustable rate mortgages”: The interest rate adjusts with the moves of a bank’s current prime rate. An increase in rate causes the monthly payment to increase. These adjustments can happen as often as eight times a year – and without a lot of notice. So homeowners need to have the extra income to make mortgage payments in a rising-rate environment.

“Variable rate mortgages”: The interest rate adjusts with the prime rate. But the monthly payment stays the same for the term of the mortgage, such as five years. During that time, the extra interest that is added to the payment replaces the principal portion of the payment. After the term (five years), the mortgage is renewed. The remaining principal is now higher than it would have been. And current rates apply. After going through a rising-rate environment, your payment would be far larger.

With all three mortgage types in a rising-interest-rate environment, current homeowners will sooner or later face higher mortgage payments. In other words, it’s not just potential and future homebuyers that are impacted by higher mortgage rates, it’s also current homeowners.

If a current homeowner is stretching to make payments at the current rate, after six mini-hikes by the BOC to bring its rate to 3.0%, the future payment could be out of reach.

In this case, homeowners, threatened with default, would try to sell the home. But if home prices have been skidding due to the rising interest-rate environment, homeowners might owe more on the mortgage than their home will bring in the sale after fees, and these homeowners cannot afford to sell. And they cannot afford to make the payment either. The inevitable happens: a default.

If a small number of homeowners get wrapped up in this mechanism, it’s no big deal; the banks and mortgage insurers can take the losses. If it is 8% or 10%, it’s a major mortgage crisis.

This is what the Bank of Canada is facing: Trying to tamp down on inflation by raising rates more than a tiny wee-bit could conjure up all kinds of problems. And not doing anything about inflation could too.

If you’re tempted to think that what happened in the US cannot happen in Canada because Canadians cannot just walk away from their mortgages, read this… Why a US-Style Housing Bust & Mortgage Crisis Can Happen in Canada, Australia, and Other Bubble Markets

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

To summarize.

Nearly all Canadian mortgage loans adjust. Usually every five years.

Nearly all Canadian mortgages are recourse loans.

Canadian homeowners have been on a record tear of getting home equity loans.

So when interest rates rise and the housing market tanks…

Pretty much all loans are recourse loans, maybe Alberta is the exception. When you default in Canada the bank will sell your home for ehat the market will bear. If that does not cover the debt they will sue the owner for the difference.

Already stories are starting to appear about couples not being able to close sales because they no longer qualify for mortgages because of higher rates and a lower home value since they signed.

Unmentioned in the story is that home buyers have to pass a stress test of an additional 2% on top of the going mortgage rate in order to qualify for a mortgage at a bank.

A tanking housing market is only one possible outcome. There is safety in numbers so if a majority of homeowners have large mortgage debt the Bank of Canada can be expected to bail them out by lowering short term rates back near zero percent – this is, without doubt, the most likely outcome. Homeowners were bailed out in the U.S. in 2009 why should 2018 be any different – by now we should all know how the world works.

Given the choice, the typical homeowner would rather pay higher prices, through inflation, then suffer rising mortgage payments and the Bank of Canada will be all too happy to oblige. Expect short rates to be back near zero (or negative) within the next year or two and expect rates to stay low into perpetuity.

The time has come for Central Bankers to begin to forgive all outstanding debts by wiping out the value of their currencies. Sure, this will entail a few rough years of adjustment but when the dust settles all debts will have been wiped clean (paid back with worthless electronic currency units) and everyone will own their possessions free and clear. The tab will be paid by those greedy savers and who cares about them (they are a small minority). Simple enough to start up again with a new currency – Brasil is a perfect test case for this (Cruzeros to Reis) it works and will allow everyone to move on (except those greedy savers).

But US homeowners were NOT bailed out in 2009. It’s more accurate to say that securitized mortgage holders were bailed out, and some homeowners got some scraps thrown their way.

Canada is run differently than the US and IIRC, securitized mortgages were never a thing there, so it’s entirely possible that Canadian homeowners will be treated better in the face of a crisis. The problem of course is that, given the way that Canadian home loans are structured, the crisis will hit Canadian homeowners much, much harder than US homeowners, and the magnitude of the problem may dwarf the government’s power to fix it.

U.S. homeowners were bailed out. They were given ultra low mortgage refinance rates that not only saved them hundreds of dollars per month but also quickly inflated the value of their houses. The low cost money they were given was not determined by the free markets but instead set, by fiat, by Ben Bernanke.

U.S. homeowners were bailed out at the expense of people who saved money but did not own a home. Winners and losers are chosen by Central Bankers.

Canadians who paid inflated prices for homes can also expect a Central Bank bailout as sure as the sun rises in the East.

@Van

“U.S. homeowners were bailed out.”

Tell that to the millions who lost their homes.

“They were given ultra low mortgage refinance rates that not only saved them hundreds of dollars per month but also quickly inflated the value of their houses.”

See above. Also, most homes in the US are still below 2007 prices.

“The low cost money they were given was not determined by the free markets but instead set, by fiat, by Ben Bernanke.”

No. Maybe if you were in ARMs, but 30-years are basically set at the 10-year treasury yield + a premium. The 10-year yield is not set by fiat by Ben Bernanke.

You have no clue what you’re talking about, per usual.

Regards

The Bank of Canada should not be bailing out Punjabs and Paki’s who bought homes in Mississauga and Brampton on combined welfare cheques back when you could get a 0 down and 40 year mortgage in Canada.

Canada is a commodity based economy, and rising inflation should provide some lift. The equation says that higher wages offset higher inflation. Two caveats to that, a lot of retired people hold mortgages, and commodity prices are not enjoying the ride. In a predominately service based economy rising interest rates stoke inflation. The US/CA apples to apples comparison has some flaws, if CA’s boomtown/China hot money economy collapses, commodity prices will also collapse and combined with tariffs doubly so. That said CA gold ought to shine

‘But unlike the Fed, it does not use a core index “without food and energy.” Instead, it has three measures (definitions) …’

I’m not sure which of the three the Canadian financial press uses, but when the CPI is mentioned by any media here, it always says: does not include volatile food and gas prices.

One of the jokes re: our CPI is that since it doesn’t include rents or house prices either, it doesn’t include basic needs.

nick kelly,

The shift to the three new measures took place in October 2016.

https://ca.reuters.com/article/domesticNews/idCAKCN12O1L7

While “core” can be used to describe those new inflation measures, “without food and energy” cannot. So you would still see “core” pop up a lot. But when an article adds “without food and energy,” the author is still on the old track.

However, StatCan still tracks CPI “excluding food and energy,” and you can find it if you dig through the pages. It increased 2.0% year-over-year….

https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=1810000601

‘The CPI hit 3 % in July, a broad measure…was fueled by a 25.4 % increase in gas prices….’

But:

‘while the overall number is quite high, the Bank of Canada’s core measure of inflation- which strips out more volatile items such as energy- remains steady at 2 percent.’

From front page Business, Globe and Mail: Aug 18

So I guess it’s the old story, there are lots of stats to choose from. But I’ll have to stop saying CPI strips out fuel.

I think there was popular pressure on the old CPI because of what it didn’t include.

I am not usually a conspiracy theorist, but might believe that there are three measures (definitions) to convince the semi-inquisitive, the bank knows how to measure inflation, despite what they experiences in their daily life.

There is only one type of inflation, monetary.

Asset bubbles are arguably a different kind of inflation. Monetary inflation theoretically drives all prices higher, while asset bubbles are misallocation of capital raising costs in a certain area.

There is also commodity-driven inflation or tax-driven inflation, which can raise prices even with a fixed monetary base.

Milton Friedman had some interesting ideas, but he grossly oversimplified economic theory and his models just don’t work. His monetary theory famously used a set of data in which the velocity of money was relatively stable, so he thought it could be ignored. Since his time their have been great advances in fields such as behavioral economics, but those ideas are only used in private sector applications like finance and advertising, while government economists and central bankers stick with the old simplified theories with their elegant equations and models that are grossly inaccurate at forecasting the economy.

In case you’re wondering though, I do think the massive QE was a terrible idea and that the Fed should be raising rates. The danger of deflating bubbles does not justify the creation of new ones. Even worse is the way that QE in its current form creates a number of distortions like reducing the value of labor vs capital and handing big firms a huge financial advantage over small ones, crushing competition and fostering monopolization.

“There is only one type of inflation, monetary.”

correct

Henry Hazlitt:

“It is not merely that inflation breeds dishonesty in a nation. Inflation is itself a dishonest act on the part of government, and sets the example for private citizens. When modern governments inflate by increasing the paper-money supply, directly or indirectly, they do in principle what kings once did when they clipped coins. Diluting the money supply with paper is the moral equivalent of diluting the milk supply with water. Notwithstanding all the pious pretenses of governments that inflation is some evil visitation from without, inflation is practically always the result of deliberate governmental policy.”

“asset bubbles are misallocation of capital”

“Interest rates are to asset prices sort of like gravity to the apple,”

Central banks manipulation of interest rates create artificial boom, mirage of wealth

I didn’t think for a moment that there was a grand theory behind QE, just a pants-on-the-fire fumbling to the crumbling system. Of course, you want find that in the Courage to Print.

Channeling Milton Friedman Mr. B.? Try Martin Armstrong and Three forms of inflation….Demand—Asset—-Currency.

No worries, these loans are safe as houses!

Trust me, Suzanne researched it.

– “Five year fixed” is actually quite close to what was called “Sub-Prime” in the US.

– Some countries have 10 year fixed rates with duration of the mortgage loan of 30 years.

– Even the BoC follows the rates that are set by a force called “Mr. Market”.

– I once more want to bring to the attention of the readers of this blog that inflation doesn’t drive interest rate. Just look at what happened in the US from early 2007 up to mid 2008. In that time frame the oilprice kept rising (=rising inflation) but both the 3 month T-bill and the 10 year yield kept falling.

Willy2. Oil was driven up by Wall Street speculators to about $150 per barrel. Cannot pick one year in time. How about some other times where that association was the same?

In the Wall Street world today with trading commodities and currencies, and we know about manipulation of Libor, anything can happen. Senator Levin discovered Wall Street hoarded aluminium in warehouses to drive up prices. Then we have the Fed and their monetary policy. It this world relationships or associations vary too much in my opinion with all these crazy players.

– Every man and his dog are looking at the 1970s. And then think that this is universally true.

– Then look at the timeframe from 2001 to mid 2008. In that timeframe the CRB index tripled, oil prices in USD went up sevenfold but both the US 10 year and 30 year kept falling. The 10 year fell from about 6.25%/6.50% down to about 4.5% in mid 2008.

– If Deflation/Inflation drives interest rates then we should have seen that yield came crashing down in the 2nd half of 2008. Yes, interest rates fell in the second half of 2008. But rates weren’t “Crashing down” (like the stockmarket), they were down “Drifting lower” in the second half of 2008.

– Take e.g. the 3-month T-bill rate between 2000 and 2008: first they fell (2001-2003) while the CRB index kept rising. Then they rose (2004-2007) while the CRB index kept rising and then they fell again (2007- mid 2008) while the CRB index kept rising.

– And rising interest rates are actually VERY DEFLATIONARY !!!

Is any weight being given to the Canadian dollar regarding raising interest rates? When the Canadian dollar rose $0.09 (cents) over the USD in 2007, exports were decimated and Canadian is highly dependent on exports to the U.S. Also millions of Canadians began venturing south of the border spending the money on much cheaper consumption goodies. I think the BOC is cornered and the most logical path is keeping goods flowing south and people employed. I don’t expect much interest rate increases, only that those that follow the FED’s increases. Exports are jobs.

The Canadian dollar already moved lower due to FED raising rates above BOC rate. This is just basic economic sense. I would like to believe that the market finally realized how much BOC is boxed in. Raising rates too far crashes the housing bubble, and the whole sand castle built on it.

The other item is inflation indexed pension payouts. As well as worker compensation payouts tethered to inflation metrics. And tinckering with what will be considered as part of the basket for payouts. O is paying out and why it is in that parties interests to arrange a basket of costs and prices that reflect subdued inflation

Further consider that a growing group of retirees don’t own homes but have rented and thus have nothing to unbundle to offset inflation. Such magic math as practiced by academics provided a lethal punch to consumers

How do tariffs affect CPI/ Inflation? It would seems like a huge bump.

If anything, tariffs lower corporate profit margins. That’s why companies hate them. Consumer prices are always and already at the maximum possible level that the market will bear.

Re: “consumer prices are always at the maximum possible level that the market will bear” … that’s not true unless the market is not competitive. Even in that case, it’s still not quite true, since prices are set at the level that maximizes profits, no? Profit is combination of price, volume and cost. In non-competitive market, rising costs might shift the optimal price higher, because for somewhat lower volume the profit per item might be significantly higher.

Yes, that’s exactly what my sentence said :-]

Yes, but some folks still have savings so if the market price of goods rise because of tariffs some will still be able to afford them at the higher price, right? Sure net profits mights sink for companies but I thought CPI was a price thing.

Mortgage rates have been going up in Canada without the BOC anyways. So, not sure how relevant BOC is. This is why I think they will raise rates. The BOC is, at its heart, a bureaucracy worried about its turf. The more influence the Fed and Libor have over the BOC’s sinecure, the less the BOC likes it. A good Canadian analogy is, they will try and keep up with the puck even if they can’t get control or take it off the other guy. We Canadians always like to look like we are in the game even if we aren’t.

The Bank of Canada can (and probably will) set mortgage rates to record low levels. This is Bernanke Central Banking 101, simply create currency and buy up mortgages at artificial levels to rescue mortgage rates from the whims of the free market – mortgage rates are whatever Central Banks decide they should be (low).

30 year fixed rate mortgages weren’t yielding 3.5% because of market forces, the rates fell to that level because Bernanke decided it. I believe Powell will decide to lower mortgage rates again and certainly never allow market forces to set rates – obviously the same holds true for Canada and their central bank.

You keep saying this, but I don’t think you understand the bank’s long-term game plan: to create booms and busts that cause enough pain to get ever increasing bailouts and other concessions from the taxpayers to themselves. Expect a lot of pain to come before interest rates get lowered again. This is not the time for further asset appreciation optimism.

When you buy in Canada there are a few different ways to approach your mortgage.

#1 You research options and lock in right away for usually a 5 year term, just so you can budget for it. This is when you decide if you want your house paid for in 5-10-15 or 20 years. That determines payment size for that 5 year term. Your budget and crystal ball is the deciding factor. Regardless, you will have to renew at term…either at 3 or 5 years and your new rate might be higher or lower upon renewal. Your guess is as good as anyone’s.

#2 Or, you can do pretty much the same with a variable, then quickly lock in if you think rates will rise, or are rising…if you have this option. Rates usually fall very slowly but are quick to rise so this is not much of a savings as far as I am concerned. It seems more of a marketing tool for the lender. I didn’t bother going variable preferring the certainty of a known budget.

Nick K will know more about these things than I do, for sure, but I am speaking from my experience. If a buyer barely qualifies and really needs low interest rates to ‘make it’, then perhaps that housing market isn’t feasible.

My story: so you can skip :-)

In my case, in 1978? I had saved up $7,000 and bought a house for $40,000 in Powell River BC. I took on a 15 year mortgage with a 3 year term. At three years the new rate had shot up to somewhere around 17-18% to help curb the wild inflation of that time. This was uncharted territory just like it is today with cheap money. Was I happy? No, but we could afford it on one salary because the original house price was modest. (The house was 60 years old) By ’87 the house was mostly paid for but stagnant in value due to the local economy and I moved to a higher priced market for a better job. The new house we purchased privately was for $63,000 because I had set a mental limit for no more that $65,000….which was around 1.8X my salary. This was still done on one wage with a stay-at-home spouse. That house was paid for by my age 40 because we worked within a budget throughout. At age 44 I took out a HELOC and bought another place for cash in a cheaper rural area, then sold the original place at a huge appreciation…almost 500%….this was towards the end of the first housing bubble…2005? Today, 13 years later after selling, that same house is now worth $450,000, an appreciation of 50% for the new owners.

This is the tale of two bubbles: In 13 years the new purchasers of my 2nd house appreciated 50% of their investment. In 18 years it appreciated 460%+ for us due to the lower purchase price.

first purchase appreciation approx 24% per year

new buyers appreciation approx 4% per year

Much of our appreciation recoup was due to sweat equity as I renovated big time…a little bit every year, so it wasn’t just buying and sitting on the investment. But, the market influence was huge.

Point:

Buying a house today is not a good investment, imho. Buying a house in the ’70s and ’80s was a good investment, in fact it was an excellent investment, but that is just a result of luck. People who squeek into today’s market and make insane payments are playing russian roulette with their future. It makes sense ONLY if your resulting house payments are lower, or likely to be lower, than current rents. And, there is a strong probability that prices can increase/will increase.

Buying a house for me was never an investment. It was our home. It was always about having a home for the kids and a home can really take any form. It wasn’t about investing.

If I was starting out today I would make do where I worked, and would try to buy some property where I wanted to live. Then, figure out a way to make it happen. :-)

I have some friends who take your advice – make do where you work and buy where you can afford. They live in the desert and commute 1.5 hours each way to and from work. No dinner with the family or little league coaching or anything like that. One guy I work with has a house and family a bit further out that he can only see on weekends – he stays in a motel during the week. And these are all 2-income households.

Some guys I work with who are in their late 50’s own modest homes that they share with their kids and grandkids. Many like me have been putting off marriage altogether and renting rooms from homeowners rather than apartment units. I turn 40 next year so I don’t have much longer I can wait if I do want kids.

I live in Los Angeles, but I’m sure Canadians face similar pressures with the high housing prices and rents.

You’re certainly right that housing today is a lousy investment though, but young families will often stretch because it allows you more space and privacy than an apartment and it’s really much nicer to be able to raise kids in a house. Renting also has drawbacks in that the annual rent hikes come in like clockwork so it’s hard to get stabile for more than a few years, and moving with kids is a lot harder than it is as a bachelor.

The larger “growing group of retirees” still partially own the home that they live in. Through what is known as mortgage buy back deals.

The biggest of these in Canada is the CHIP program – Canadian Home Improvement Plan.

Retirees get to live in their homes and receive a monthly payment, based on the amount of equity they have built up in their home over the years. Many stipulations apply.

Still other home owners are going the HELOC route using their home equity to spend, spend, spend!

The financial sector loves these financial products! They are quickly packaged up with other loans into OTC (over the counter) derivatives such as CDO (collateralized debt obligations) or CDS (credit default swaps) and other similar financial products. Then sold onto the financial market, bought mainly by pension funds and other investors, frantically seeking higher yield with safety! What could go wrong? lol

The present (very opaque) world of derivatives has an estimated notional value north of one quadrillion dollars!

I live in a housing co-op in one of the nice neighbourhoods of Edmonton, where housing prices are absurdly expensive — 5-700,000 for small bungalows or aging wooden frame houses. The co-op has its own frustrations, because many of the people who live in it are absurdly stretched just to do so — but if you’re financially competent, it’s a great deal. The rent is under $1300, and as long as you’re able to put away a decent chunk of money, the penalty for not owning is not so great. My wife and I figure that we’ll get into the market if it ever declines decently; if it doesn’t, we’ll stay put and save money instead.

If you’re referring to Edmonton, Alberta Canada home prices today are slightly less than they were 11 years ago in the 2007 peak. Resale townhouses and resale apartments today are selling for less than 50 percent of what they sold for way back in the summer of 2007.

We expect rates to rise next month in Canada, and again in December. The banks are all on board with this plan because new mortgage originations have dropped by 50%.

Some economists (especially the ones that work for the banks) are pretending to care about the homebuyer/owner by making statements on TV and in newspaper articles, stating the Bank of Canada should pause on the rate hikes. But that’s all just for show, so homeowners can blame the Bank of Canada instead of themselves or their banks for taking on too much debt in a rising interest rate environment.

I wouldn’t be surprised if the Bank of Canada tries to raise rates as much as possible (e.g. 4 hikes over the next 12 – 18 months) and then take a pause before they get blamed for the fallout of the housing bubble in Canada. There are thousands of domestic speculators who will be taking ownership of condos and new houses that were purchased when interest rates were lower, banks didn’t care about your income in relation to the price of the home you wanted to buy and when there was a strong belief foreigners were going to buy a 500 sqft concrete investment condo selling for half a million dollars.

commods are heading south; steve in reno

If the cost of a mortgage is part of the calculation of inflation, an increase in interest rates will increase inflation on top of what is already baked in the cake by all the money loaned into existence already. Any credit-financed business would feel the rising rates as rising cost commonly called inflation as well.

This can get interesting.

Gunther

For those who think Canadian gov’t pensions are part and parcel of inflation, just a reminder that over the last three years, CPP has increase 1.8%, 1.7% and 1.1%. Other elements like Old Age Security do not increase annually, and when it does, it is miniscule. Real inflation is certainly much higher than pension increases, thus seniors who rely on CPP and OAS are losing ground rather quickly.

My understanding is that OAS is inflation adjusted, 4 times per year. https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/oas-price.html

We need a new definition of home ownership, if you have a mortgage you DO NOT own the house ,you are only renting it from the bank a slave to the system. To own it you are as free, well as free as be can be in todays world.Houses should be for shelter nothing more nothing less.

Even when you have paid off your mortgage, you are still renting from the true owner, the State. Try not paying your property tax and see what happens. Men with guns will come to your house, kick you out, and sell it to somebody else.

In today’s world of outrageously high government pensions, every town or city has a tsunami of unfunded pensions and other expenses to cover. Most of them have only one source of income–property taxes. Expect to see that skyrocket in the future.

Keep an eye on first home buyers in Australia.

This demographic are also saddled with huge student debt and struggle to pay both their rent and mortgages. Both Mortgage stress and defaults are on the rise.

With little media coverage, the Government passed legislation last week that student debt repayments, collected by the Tax Office, will now kick in when your salary exceeds $45k per year.

Two years ago, this threshold was $55k per year.

That’s a massive increase in a tax bill for a demographic saddled with both mortgages and rents they can’t afford.

I admit I’m not going to shed any tears for them. For so long they arrogantly assumed a real estate bubble and personal debt problems are only American problems, that it can’t happen where they are at for various reason. For so long they looked down on us lowly Americans. It will be glorious to see their chickens come home to roost.

Not so sure I agree with the throwaway line in the original post “excruciatingly slow snail’s pace that the Fed has set – seven hikes in 2.5 years.”

That slow pace may have been a Good Thing. It has given everyone time to adjust. It might actually be textbook case of how to raise rates without triggering a recession.

Though some will not have taken the time to adjust, and we might still be facing recession (and certainly the EMs, Australia and Canada among others are feeling the stress)…

If Trump can squash China with stiff tariffs and other punitive measures then the Canadian housing bubble will implode since the Chinese with their laundered money were the main cause in the Toronto and Vancouver areas. It’s as simple as this but you have to remember Canadians aren’t too bright and it will take them some time to figure this out.

Housing in Canada is the most crowded trade in the history of this country. What was once a roof over a head became an obsession and now a liability. If rates revert back to the mean I expect to see prices drop to levels that will be shocking. New homeowners are going to be the real losers, screwing up their financial futures for decades buying at these prices.

Maybe I’m just hearing them more now that I’m terrified of this market but I feel like I hear “crazy mortgage deal!” ads on British Columbia radio at an unprecedented clip.

All the signs point to funny money from China no longer coming to Canada. Mark Carney is lucky that he won’t be around to deal with the upcoming disaster in Canada. Even luckier, people will still think he was the wiz kid that never was.