The national slowdown was particularly unkind to the province of BC.

By Steve Saretsky, Vancouver, Canada, Vancity Condo Guide:

Canadian housing data continued to disappoint in the month of June. Albeit the year-over-year decline in home sales was not nearly as disappointing as the month of May. National home sales fell 11% year-over-year in June, a slight upgrade from the 16% decline suffered in May.

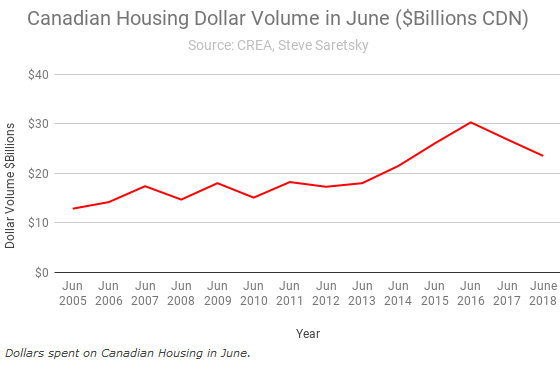

As sales dipped, so too did the total amount spent on real estate. The total dollar volume dipped 12% year-over-year in June, totaling C$23.5 billion. A tough blow to government tax coffers which have reaped record sums of property tax dollars in recent years.

The national slowdown was particularly unkind to the province of BC where home sales slid 33% year over year, the largest draw-down since June of 2008. Weak buying activity hit Greater Vancouver & Victoria the hardest, sales fell 38% and 30% respectively.

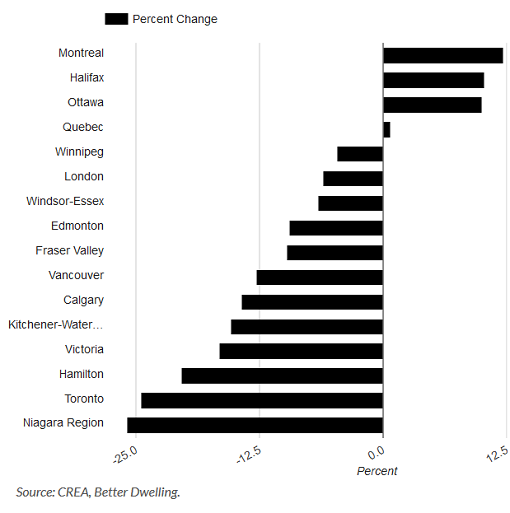

However, the pullback was not exclusive to the province of BC. Other than small year over year gains in Quebec City, Toronto, and Montreal, most major cities were hit with a drop in home sales.

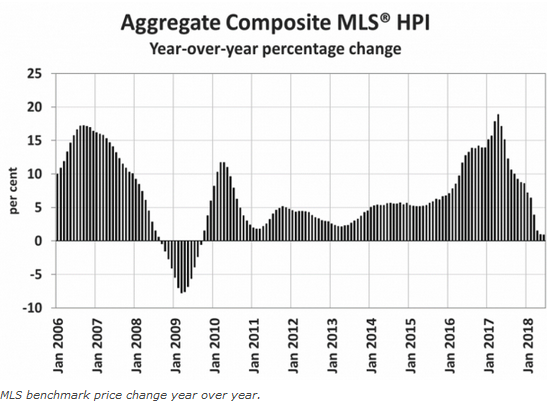

The average sales price across the nation dipped in June for the first time since June of 2012, shedding 1% year over year. While this marked the fifth month in a row in which the national average price was down on a year-over-year basis, it was the smallest decline among them. The Aggregate Composite MLS® HPI was up 0.9% y-o-y in June 2018, marking the 14th consecutive month of decelerating gains. It was also the smallest increase since September 2009.

Despite the rather grim data, the Canadian Real Estate Association remained upbeat, CREA President Barb Sukkau noted, “This year’s new stress-test on mortgage applicants has been weighing on homes sales activity; however, the increase in June suggests its impact may be starting to lift.”

CREA’s chief economist Gregory Clump added, “The national increase in June home sales (seasonally adjusted) suggests activity may indeed be starting to turn the corner.”

With another rate increase from the Bank of Canada in July, and housing inventory still building, up 3%, CREA’s enthusiasm may be a little premature. By Steve Saretsky, Vancity Condo Guide

It’s not subtle: Home sales plunge, inventory jumps, prices begin to react. Read… Mind the “Directional Shift” in the Housing Bubble in BC, Canada

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Still waiting for some serious price reductions. It will come no later than when stock prices correct.

Exactly bobber It’s Coming Perhaps by winter you should be in better shape as a buyer IMO of course

Canada’s govt mortgage insurance outfit CMHC just (26 th) issued its highest level of warning re: Toronto and Vancouver.

In addition to the usual ‘overvalued’ etc. it added the market is at risk of becoming ‘unstable’.

This is not a ‘soft landing’ or ‘cooling’ warning. This means we may enter a era the reverse of the ‘multiple offer’ panic buying.

If many people have overextended themselves they will have to sell. We will then enter a new era of panic selling.

You forget all the other major cities..which showed gains too.

The chart shows the 16 largest cities in Canada.

It could have shown Regina, but that would miss the narrative because the drop in Regina hit over the last 2 years. Now they have flatlined, likely found bottom. They would be between Quebec and Winnipeg on the chart, but they had double digit declines in 2016 and 2017 to get there.

There was somebody from CREA on the radio (I was stuck in traffic) a few days ago, sounding so upbeat, it was as if they were breathing helium.

Nothing new there They’re getting nervous and need to spew the “ Now is a great time to buy” hopium around Got to keep up the payments ya know

Provinces relying on land transfer tax revenue will b disappointed.

In our area not much in the way of listings, and what there is tends to be at the higher level, which is moving much more slowly than before. Was out east looking for a bit and noticed that properties stay listed for quite a while and sizeable price reductions do occur these days.

“Average price dropped 1%” seems like meaningless noise to me.

All of these stories regarding a “drop” in home sales are always about a drop in volume and not a drop in price. So what, volumes are down because new buyers can’t afford the cost but wealthy investors still seem to be quite willing to scoop up whatever hits the market. The only thing that has changed is the type of person who ends up owning the home – not the cost of the housing itself.

Spending on housing is overrated anyways. Once you stop wasting hard earned money on housing you will never go back to being a consumer of shelter again. Enjoy the money you earn and stop giving it all to a greedy landlord.

As more and more people are forced out of shelter municipalities are becoming more tolerant of those of us living in vehicles, Seattle police never hassle me and as long as I move on after the evening the neighbors don’t seem too concerned either. The best solution would be to set aside land for slums with sewer, water and electricity available – this has worked out well in other nations, like ours, where working people are no longer able to afford shelter.

I agree. Full-time van and RV living is definitely taking off as a movement. For example, the rubber tramp rendezvous (RTR) held in the desert has exploded in popularity, and youtube is full of van dwellers telling their stories. It’s drawing all kinds of people — retirees, full-time workers, educated, economically struggling, dreamers, minimalists, and downshifters. May are just people pissed off at unaffordable housing. It is amazing how much more is left over each month when housing expenses are cut drastically by saying no to rent or mortgages. Some municipalities are harassing van-dwellers. I hope a more stable acceptance of this way of living evolves, but there may also be greater push back as it gets bigger.

Drop in sales volume is usually precursor to drop in sales price..

Housing prices are notoriously sticky going down and it takes some time to see it happening

Have patience

Edmonton, Alberta resale apartment and resale townhouse prices fell forty percent from July 2007 to February 2008. Calgary wasn’t far behind but fell about one year later.

The drop in volume proceeds the drop in prices And yes a 1 percent drop may not seem like much it sure is when compared to a 20 percent increase This nonsense has gone on far longer than I dreamt it would

I look at it as a short term (long view) sacrifice for long term gain.

Buy in an affordable area.

Live within your means.

Do without while paying off the house.

Then, when you are in your forties you have no payments of any kind.

But, you live in a home of your choice.

All the while save 10% net for later.

Worked for me and is now working for my children in their 30s.

You know the urge to get in on the ground floor of ‘the next best thing’? Start and buy in an area that is a candidate as the next best place. If I was in the US it would be Appalachia. The wage will be lower but the possibilities for getting ahead are there…over time. Canada, northern Vancouver Island, Yukon, or Maritimes.

regarding BC Stats: Yes, Van and Vic are certainly down. However, other centres are very busy. In Campbell River (poulation approx 40,000), apt construction is booming with two 13 storey (twin) towers in the works in addition to the usual 4 story wood frame buildings just being completed. Single family const is unending with several sub divisions developing, and a small shopping centre approved. (You can’t get a contractor) I live 45 minute drive west in a rural area and we are getting an unending stream of lookie loos hoping for ‘deals’ and cheap property. One fellow is developing 40 acres into 5 acre lots, which is unheard of here with almost all land tied up in the ALR or designated public and/or private forestry. Last week I checked out the RE adds and an undeveloped 1/2 acre building lot on upper Campbell Lake is listed at $299,000 (no hydro or services) 50 minutes southwest of CR (shitty drive). 10 years ago it wouldn’t sell at $30,000.

Courtenay and Comox is so busy I refuse to return until after Labour Day. Getting across the river with the traffic is a freaking nightmare. Vancouver Island is basically booming and is bursting with tourists.

When the local nitwits finally figure out the Chinese aren’t buying anymore in British Columbia property prices in all of B.C will tank. The devaluing of the yuan can only accelerate this as the Chinese become poorer outside their native China.

All outside buyers such as Chinese is a false narrative.

Consider the “Baby Boomer’s”.

The baby boom comprises the years from 1946 to 1964.

This segment of the population is still a very large percentage of the whole, with attendant accumulated wealth attached.

This means the oldest boomer is now 72 and the youngest at 54.

As these empty nesters reach retirement, they are liquidating their big empty houses and relocating to the Okanagan or the south-west coast of Canada.

First thing they do upon arrival is buy a new car, second is to buy a place to live, and third, sign a petition against any further development! lol Demographics prove this out.

The average yearly wage in Vancouver is just under the $40,000 mark. Home prices didn’t magically reach the 1.5 million mark based on the local wages. The entire world knows the Chinese did it.

I read it only takes about one hundred and twenty years for the average couple to save up for a 20 percent down payment on a house in Vancouver. Looks like Steve will have to put in his resume at McDonalds or Walmart. Alberta, Canada which has been falling in price since 2007 capsized pulling down the national average.

Is the CREA the Canadian equivalent of our NAR ?

The National Association of Rodents ?

Sure appears they are one in the same bunch of propagandists to me Mark Bunch Of parasites

I was just in Squamish BC, north of vancouver, its pure heaven-was interested in leaving so cal for it-but the home prices are more than my house here in Orange County Ca! it’s insane. There is no slow down.

I think you are mixing up pace and price when you say “no slow down”. Sales volume is down across Canada, prices in BC are just not dropping because too many speculators bought high.

Expand your location from such a small tourist filled area and you will find prices dropping. If you want to be with fellow Americans I hear Canmore is a popular spot to dump US Dollars on housing and it is just down the road a couple hours.

If you want a water front property for less, look East. The maritimes is dirt cheap in comparison. Weather isn’t as nice though.

Ehh? This totally won’t go like in America guys, this crash will have over 90% of exclusive Canadian content! More so now that the Chinese have left us, so we will show America how crashes are done!

Toronto & Vancouver are asset bubbles formed via China’s Hot Money Launderers since 08 and the restructuring that China’s Central Bank engaged in to survive the post-08 apocalypse. The Hot Money Laundering had to be stopped in CANADA and the knock-on effects have to be endured in order to mute the formation of a Bimodal Distribution of housing in CANADA. Allowing Vancouver & Toronto to speculate with Chinese Hot Money Launderers via the unscrupulous shenanigans of the unethical Real Estate Sector was just a recipe for Financial Disaster for the working class of service sector workers in these regions of CANADA. The name of the game for Central Planners is to achieve some semblance of equilibrium for average Canadians with respect to Mobility in CANADA. Service Sector workers must be able to afford living within the regions they work in or the entirety of these regions will suffer from the very inefficiency Liberal Intensification has wrought over time in these regions.

CANADA cannot afford to pay the working class service sector workers a living wage based upon housing costs exemplified via the bimodal distribution of costs across the board. Regulatory intervention was very necessary with respect to Vancouver & Toronto given where they were going after the Chinese Hot Money Launderers started scrambling out of mainland China. Regulating their collective movements is necessary for the entire world going forward. The USA has the same conundrum and I would advise the USA to deal with the Hot Money Launderers in the same manner as CANADA has dealt with them.

RW

I’m in Calgary, and they keep putting up cheap condo’s (you got to see how this stuff is built) even though its so obvious we are overbuilt. A lot of condos here are rented out now(or rather for rent-some are empty, waiting tenants). There are a lot of property investor/speculators in the condo market (including some friends), but with rising interest rates I wonder if they will have to dump them. Potential homeowners are starting to avoid buying and renting instead- to wait and see. You go into the downtown of Calgary and the office buildings are half empty from the oil industry debacle. So you wonder, since oil jobs make this town, who is renting let alone buying. Anyways, townhouse condo’s and small-medium size houses seem to be doing okay, expensive homes and condo apartments sit and wait.