With QE, the Fed created money to buy securities and pump up asset prices; now it sheds securities to destroy this money.

Here’s what the Fed’s QE unwind – or the balance sheet normalization, as it calls it – is all about: it reverses over an unknown span of years a large part of what QE had done over the span of five-and-a-half years. During QE, whose stated purpose was the “wealth effect,” the Fed amassed $3.4 trillion in Treasury securities and mortgage-backed securities (MBS). Just as the Fed spent a year tapering QE to zero, it is now spending a year ramping up the QE unwind.

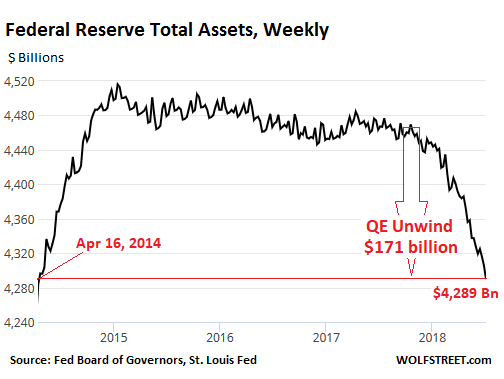

Total assets on the Fed’s balance sheet for the week ending July 4 dropped by $29.4 billion over the past four weeks. This brought the total drop since October, when the QE unwind began, to $171 billion. At $4,289 billion, total assets are now at the lowest level since April 16, 2014, during the middle of the “taper.”

The Fed’s announced plan calls for shedding up to $420 billion in securities this year and up to $600 billion a year in each of the following years until the Fed considers its balance sheet to be “normalized” — or until something major goes awry. For June, the plan calls for the Fed to shed up to $18 billion in Treasuries and up to $12 billion in MBS. So how did it go?

Treasury securities

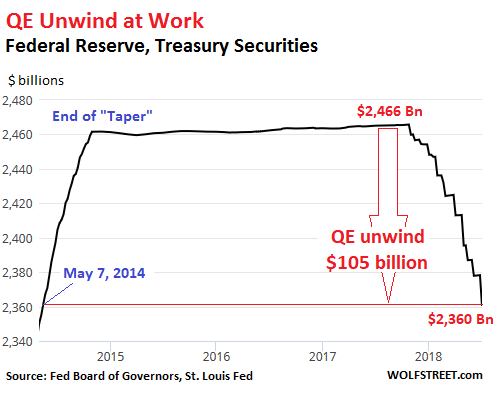

The balance of Treasury securities fell by $17.5 billion in June to $2,360 billion, the lowest since May 7, 2014. Since the beginning of the QE-Unwind, $105 billion in Treasuries “rolled off.”

The step-pattern in the chart below is a result of how the Fed sheds securities. It doesn’t sell them outright but allows them to “roll off” when they mature. Treasuries only mature mid-month or at the end of the month. Hence the stair-steps.

In mid-June, no Treasuries matured, but on June 30, $30.4 billion matured. The Fed replaced about $12 billion of them with new Treasury securities directly via its arrangement with the Treasury Department that cuts out the primary dealers with which the Fed normally does business. Those $12 billion in securities, to use the jargon, were “rolled over.” But it did not replace about $18 billion of maturing Treasuries. They “rolled off.”

Mortgage-backed securities

The MBS on the Fed’s balance sheet were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The credit risk lies with these entities, not with the Fed.

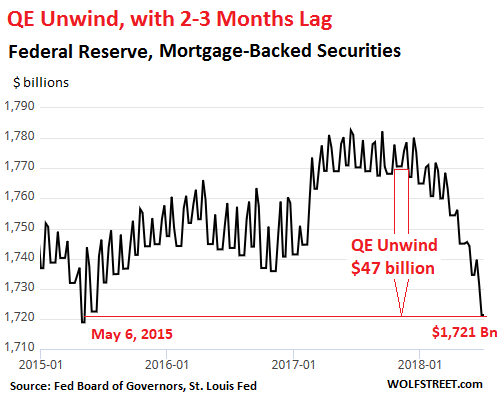

Residential MBS are a different breed, compared to normal bonds. Holders receive principal payments on a regular basis as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. Over the years, to keep the MBS balance from declining, the New York Fed’s Open Market Operations (OMO) kept buying MBS.

Settlement of those trades occurs two to three months later. Since the Fed books the trades at settlement, the time lag between trade and settlement causes large weekly fluctuations on the Fed’s balance sheet — the jagged line in the chart below – and caused a delay of two to three month before the declines began to show up on the balance sheet [here’s my detailed explanation].

Over the past four weeks, the MBS balance fell by $13.3 billion, to $1,721 billion, the lowest since May 6, 2015. In total, $47 billion in MBS have been shed since the beginning of the QE unwind:

What this QE unwind does is the opposite of QE: Under QE, the Fed created money out of nothing with a few clicks of its almighty mouse and bought securities with it to pump up asset prices. Now, under the QE unwind, the Fed takes the money it receives from the maturing securities and destroys it. This money just disappears to where it had come from. Just like QE added liquidity to the markets, the QE unwind is draining liquidity.

And there’s another “opposite”: QE was conducted with enormous media hoopla and Wall Street hype – they even, and ludicrously, called it “QE infinity” – to achieve the maximum “wealth effect,” namely asset price inflation; but the QE unwind occurs quietly and on autopilot, and nary a word in the media.

This Fed is getting seriously hawkish: It revealed that instead of thinking about backing off rate hikes because the yield curve is threatening to invert, it’ll just replace the yield curve. Read… As the Yield Curve Flattens, Threatens to Invert, the Fed Discards it as Recession Indicator

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Funny how the Fed did not call it “Balance Sheet Abnormalization” when they were creating trillions of dollars to give to their banker pals.

That’s hilarious! You made my day.

now, it’s just a matter of time.

It seems to me that everybody is discounting the effect of creating abnormal valuations for such things as antiques, paintings, certain autos with perceived value, broad market stocks and overvalued junk bonds and certain housing. This it seems to be which is hidden in the resultant effects. When you create abnormal pricing as a result of fake liquidity you see bubbles that appear and nobody cares or is looking as long as they are not hurt except they forgot 1929. It is like runaway governments that promise utopia out of thin air but never tell you it has to be repaid. Like Mr Trump’s trillion and a half giveaway! When this realization of no return arrives you’ll wish you had some real value like gold or silver or ownership via share certificates.

This is criminel act.

No, is the cover up.

The criminal act was creating the imaginary money, this is getting rid of said imaginary money.

And if zero interest rates was a criminal act, Europe and Asia negative rates was and is outright murder.

When kids being born today grow up, some will attend Universities to study business and economics. Incredulously, they will ask the professor, “Did people really deposit money in their bank only to be charged a fee by the bank to hold their money?”

The professor will answer, “Yes they actually did. But as crazy as that was, there was something even more strange.” Now the professor will add, “For a while people bought bonds from central banks and received less money back at maturity than they paid for the bond initially!”

Students will remark back, “Damn, that was stupid. Why did people do that?”

They did because in a deflationary economy taking a small hit is preferable to taking a big hit

You assume people in the future will be smarter than now and that lies your own stupidity.

The proof?

The crisis we’ll have in the future will make 1929 look like nothing. We have a Perfect Storm brewing.

Students will remark back, “Damn, that was stupid. Why did people do that?”

Clearly you haven’t met today’s students, graduates of the NEA’s “Everyone’s a winner!” indoctrination mills. They are utterly devoid of any capacity for critical or independent thought, but they’ll make great dependency voters.

Has anyone told the trucking companies covered in your previous article entitled,

“Heavy-Truck Orders Explode, Trucking Companies Struggle with “Capacity Crisis,” Truck Makers & Supply Chains are Inundated, Backlog is Ballooning, But it’s a Cyclical Business”

about the Fed’s QE unwind? If not, somebody should give them a holler about all that Federal Reserve money going to fiat currency heaven. It’s probably going to cause a cyclical downturn sooner rather than later.

They’ll figure it out eventually :-]

Yes, it will be another one of those, “Well, who could have seen that coming?” moments.

And yet asset markets continue the inexorable march higher. The world is awash with cash and wealthy people everywhere are desperate to find any physical asset to buy and unload their cash trash.

Americans hold $100 trillion in assets. $90 trillion of those assets are held by 15 percent of the population. If you’re not in that 15 percent your tiny slice will never move the needle or matter in any way. All that matters is what wealthy people do and they are still buying assets hand over fist, no price is too high compared to getting stuck in cash.

I keep my wealth safely in the stock market and I consider cash to be a very dangerous asset. Does anyone doubt the S&P 500 will be well north of 3000 by year end? Seems all but guaranteed.

“… continue to inexorably march higher”? The S&P 500 peaked on Jan 26, if remember right. That was nearly six months ago. That’s not very “inexorably.”

Maybe he’s talking about the nasdaq and rut2000 type markets. Since companies like Apple have huge piles of cash for buybacks, there is some immunity from tightening, for some shares. Both had peaks in June, and are close to those peak levels again. The RUT is in a different position than the nasdaq, I don’t know what’s going on with the small caps that is making them so wonderfully bubbly, but I have some guesses.

A couple things to note:

1) inexorable does not imply straight line, and the market is, in fact, drifting higher with the S&P 500 higher for the year, despite the February hiccup.

2) The market has continued to drift higher even as the Fed let $30 billion roll off the balance sheet on June 30.

3) The market has continue to drift higher during this earnings blackout period, even though companies are unable to make share buy-backs during this 4 or 5 week period (no buy-backs but market still up sharply this week).

I know you aren’t saying the market will correct (in fact a few weeks back you said the chances of a 2018 correction are unlikely) and you appear smart enough to avoid crystal balls but where I would disagree with you is I don’t think Fed tightening will cause any correction.

The Fed has barely dipped a toe in the tub and they will reverse if there is any sign of risk to the markets, also rich people are still holding too many dollars that need to go into the market. The rich are the true sideline money and they still hold too much cash.

The strongest argument for a correction, in my opinion, would be the stock market valuation hockey stick pattern that started in the 90’s and continues even now – but I write off this parabolic move because I see a corresponding drop in the value of currencies stocks are valued in.

@van_down_by_river – i pretty much agree with you. there just is nowhere else to go but stocks. however, when everything blows up in the bond markets, it will take stocks down with them. the liquidity crisis is going to be very painful. after the dust settles, stocks will bounce back fast.

Actually smart money is leaving like hell; the only thing that has kept NASDAQ at almost the same level as a few month ago is the money companies repatriated and are using to buy their own shares. Without those buybacks NASDAQ would have probably been down by at least 10%. But as soon as companies run out of the money they repatriated expect the fall to start.

I’m with you too Van. As the currencies drop, equity markets will rise. So the QE unwind needn’t be equity negative imo. My dollars these days are going into the resource/export currencies(Aussie dollar, Canadian dollar, Japanese Yen, and the Deutsche Mark/Euro) and equities. I’ll be wrong as to timing, as usual, but as a belt and suspender guy, I can’t seem to do much about it.

“And yet asset markets continue the inexorable march higher.”

Pal, I have some bad news for you…

What’s the bad news, is my cat going to die? Sure doesn’t appear to be any bad news from the markets – brokerage account balance just keeps sending me good news and I fully expect that to continue.

I gotta say there seems to be a strong bearish tone in the comments following all of these articles – more good news for the markets!

‘I keep my wealth safely in the stock market and I consider cash to be a very dangerous asset.’

With a CAPE ratio of 33, the S&P500 cannot be considered “safe”.

What central banks have done is very simple. They caused asset (especially financial instruments) prices to rise significantly in the present, but at the cost of guaranteeing lower returns in the future. Eventually, the most powerful force in the universe — mean reversion — will balance these things out.

Van Man

Everything is unstable and imperilled. Everything.

Not a comforting thought, but, alas, that’s where we are.

Do not neglect cash.

‘All eggs in one basket’ ,etc……..

Safely in the artificially manipulated stock markets, with corporations loading up on cheap debt to pump up their stock price..?

Good luck with that one.

Make sure you panic first would be my advice.

S&P might be north of 3000 but could just as easily be south of 1000 so alittle insurance may not be such a bad idea Van

I peg the value at 400.

Luxury real estate prices are already getting pinched in many markets. Appears the tide is already rolling out as the unwind increases. You just have to know where to look to see it.

As liquidity rolls off the table–by the Fed, blue chips putting it back into their stock price, and the average Joe putting what money they have left into this inflated housing and stock market), I think we’ll see the liquidity crunch that will add fuel to the next fire. It’s not the cause, but it will make the next downturn worse for sure.

I suspect your post is a bit of tongue-in-cheek but if not, Van, we’ve been in a running bear market for months now.. The Dow is about 2,000 pts off it’s peak from back in Jan..

I agree van. Trump’s Federal reserve is returning the economy AND the Fed to something that resembles a world before communists got control of the Fed. The world just experienced years of Marxist central banking. How’d you like it people ? If Maduro got control of the Fed it would have exactly the same… Promising wealth to the masses but giving it to the hedge funds that bankrolled their rise to power, destroying and stealing everything from the working class savers with zero percent returns, burying the youth with mortgages on their head before they have even got their first job…we could go on and on but i am hopeful now.

All tin pot dictators and Marxists do the same thing when they get power…attempt to confiscate gold and guns, print money like there is no tomorrow and proclaim victory !!

“I keep my wealth safely in the stock market and I consider cash to be a very dangerous asset. Does anyone doubt the S&P 500 will be well north of 3000 by year end? Seems all but guaranteed.”

You’re probably right that the S&P will be up for the year as fund managers want their end of year bonuses. This will happen ‘IF’ the trade war does not become hostile and if emerging markets don’t blow up and if rates don’t keep rising, and if we don’t nuke Iran, to name a few ‘ifs’ .

And I expect stocks to promptly fall off a cliff at the start of 2019. With a rising dollar, cash is always a pretty good bet.

Only stocks that have pricing power do well in inflationary environments.

Has anyone at the Fed ever admitted that the purpose of QE was to inflate asset prices? The Fed has a mandate from Congress, but I don’t believe blowing stock and real estate price bubbles is one of them.

I think the purpose of QE was multi-pronged. First, it made good on a trillion + of MBS junk (bad then probably not so bad now). This was necessary to restore faith in US obligations to various parties here and abroad.

Second, treasury purchase was done to drive down interest rates to help out all the strapped debt holders and to allow corps to boost their stock price through stock buybacks financed with cheap debt. This wasn’t an accident; this was planned.

Third, QE was designed to loose inflation when and if the economy picked up steam. It is now doing that in spades. The Fed wants inflation; lots of it, in spite of their BS protestations to the opposite.

And yes, QE pumped asset prices but only indirectly. Housing went back up due to the economy healing and cheap interest and stocks went up primarily through buybacks designed to fool the average Joe with lower PEs.

Mike Ra says:

“…QE was designed to loose inflation when and if the economy picked up steam. It is now doing that in spades.”

Mike Ra, when were you born? 10 years ago? 20 years ago? Yesterday? i’m old enough to have lived through a few economic recoveries from recessions, and barely (if ever) hitting 3% growth in most definitely not normal and certainly not hitting recovery “in spades.”

For example, I recall quarterly growth rates of something like 8% during the recovery after the deep recession in the 1980’s.

Newsflash, the U.S. economy is not healing. All we’ve seen is 9 years of total lies and fabricated data. They couldn’t rig every last detail as they forgot the resource and commodity sector.

Ben Bernanke himself spelled it out in an editorial in the WaPo in 2010. Explained the “wealth effect” in plain language to everyone. Via this “wealth effect,” where the asset holders get wealthier and spend more, he tied asset price inflation to employment, one of the Fed’s two “mandates.” It was pretty slick.

What do you believe would have been the result if the Fed had not done QE? At the time QE began in mid-2009, Congress had already passed TARP and suspended mark-to-market accounting, so it wasn’t exactly an emergency program.

Raising interest rates would have done the same thing, which is dampen speculation (on the downside) and there job was to set rates commensurate with risk in the market, ergo stability. They doubled down on risk, and what they created was instability, financed by global central bankers. I’m not telling you anything you don’t know, but if they had raised interest rates in 2008 the real economy would be in recovery and when the economy got more stable they could lower rates which is usually about the time the business cycle peaks. Having done it backwards they now raise rates in order to lower them. Alice in WOOWOO land.

The Fed had a whole slew of bailout programs that came with an alphabet soup of acronyms. These were short-term emergency loans to banks and large corporate entities with finance branches, such as GE. The Fed offered those in its legit role of lender-as-last-resort. Some of those programs applicable to certain investors were questionable because their purpose was to provide liquidity in the markets (lending money to hedge funds and other entities to buy assets with), and those that received those ultra-cheap loans benefited hugely from them. But OK.

All of these loans were paid back and the programs expired after the crisis.

QE was totally different. It was designed to inflate asset prices. That was the sole purpose. It had nothing to do with emergency lending.

Without QE, markets would have priced assets more or less as they saw fit, which is how this is supposed to work. A lot more money-losing companies would have restructured in bankruptcy court and shed much of their debts at investors’ expense. Home prices would be more reasonable to where maybe a household with a median income could afford a median home without stretching too much, and they might have had a lot more money left to spend on other things. Same for renters. In this scenario, the economy might have actually boomed after the Great Recession because it would have gone through a proper cleansing. The “Wealth Effect” prevented that from happening.

Wolf,

And without QE, many in the top 1% (or 0.5%, 0.1%, etc.) would have moved down the totem pole and many in the lower tier would have moved up, reducing wealth inequality considerably. QE was a total giveaway to the oligarchy, financed indirectly by the population at large.

But Ben Bernanke (and the other shoeshine boys for the 1%) have to think of cute explanations like the “wealth effect” to justify their actions. Nassim Taleb’s term IYI (intellectual yet idiot) applies to Bernanke.

QE1 in late 2008/early 2009 was justified by the collapse of the financial system. QE2 and QE3, by contrast, were all about reflating asset prices and literally giving money to banks to rebuild their capital.

Yeah, they were issued the dual-mandate back in the 70s, but I think that had more to do with stagflation. Now “price stability” seems to be propping up asset values by hook or crook.

“… I don’t believe blowing stock and real estate price bubbles is one of them (i.e. Fed mandates)”

The Fed’s mandate is fundamentally to support the monetary and financial interests of the Overclass -defined here as the top .05% and their managerial, professional and technical viziers – and it will do what it must, even when those same interests inevitably blow themselves and everybody else up.

If cash is too risky, what does one strike with when the real estate prices marked to market?

For your less informed readers, couldn’t you explain that the “wealth effect” goal is a coverup lie that has been discredited and that the likely real reason for QE was to provide a bailout of the “financial terrorist banks” who threatened to blow up themselves and the financial system, and for the 0.1% elitists who were the banks bondholders who didn’t want to experience “creative destruction? “

I have said this sort of thing many times since 2011 when I started the website that preceded WOLF STREET. In fact, it was part of the reason I started it. I’m afraid that I sound like a broken record after repeating it all these years :-]

Your comment above that references Bernanke’s editorial in the WaPo really nicely sums up monetary history of the last decade.

Why I have issue with the Bernanke dollar debasement policy is he made dollars so cheap that debt levels exploded (mostly government but also corporate and personal).

The Fed can pretend they will normalize monetary policy but it’s too late, they caused debt levels to reach these elevated levels and they got society so hooked on cheap debt that we have passed the point of no return.

Why do I believe this “Fed tightening cycle” is going nowhere? Because debt levels (and addiction to cheap money) have reached a level where serious debasement is the only answer. The debts cannot be repaid. The Fed will allow all parties to default via continued debasement. One of their explicitly stated policy mandates is to debase the currency – what more do you need as an alarm to exit dollar holdings?

Problem is: the more the central banks debase the more debts continue to run higher in an awful feedback. Debasement of the fiat dollar was inevitable but Bernanke gave the dollar a solid shove into it’s grave and sped its death by perhaps decades.

Don’t forget 43 wanted to put the SSN trust fund into the stock market. Wall Street embeds itself in the economics of main street America through 401K and various pension funds. Wall Street used to be a side bar to the economy, they have brought it to the front, when they defend stocks they protect you and the 1%. Many Americans say, well I don’t care I am not in the stock market, but of course they are wrong. The market is now a matter of national security as well, so expect some real dazzling do overs in the next crisis.

There is no social security trust fund.

If you have $100,000 dollars in your 401K but you pull all of the money out (to pay for your grandma’s foot amputation due to diabetes) and replace it with an IOU to your own account are there any actual funds in your account?

Your account has a note “worth” $100,000 but you went into debt by $100,000 to provide the debt note – sounds like zero dollars to me.

Social security is a welfare program that pays elderly who are (presumably) too old to work. Why this welfare system is only disbursed based on age and not means is beyond crazy.

And enough with the “I paid into it and the government owes me” crap. You paid taxes toward elderly welfare that kept old folks fed and housed. There was a surplus but you voted for governments that spent that money on other stuff – too late to bitch and moan now.

It’s up to the millennial generation to decide whether to keep on paying this old age welfare tax – I suggest we start treating them with respect (the royal “we”).

If the rightfully elected president in 2000 had been allowed to take office there would a SSN trust fund in a lock box. :)

“If….” -hypothesis contrary to fact. We can’t tell what would have happened in that alternate universe.

“or until something major goes awry.”

I was thinking that, have been since 1981. Its on its way.

None of us know what the central banks will do the next time ” this sucker is going down” to paraphrase George Bush. Panic might cause them to do something crazy. We live in interesting times.

Van’s comments about the wealthy reminds me of the insidious nature of the banking cabal. When you think hard about it, the Earth First crowd and global warming proponents should be ardently opposed to the central banking model and fractional reserve lending for the supporting role it plays in the boom bust cycles of mal-investment.

I have a wealthy client who makes so much money that he complains that he has nothing to invest it in. He has been renovating a 10,000sf structure for over 2 years. He has renovated it twice, only to then have the foreman tear out the improvements because trophy wife was unhappy with the result. It’s like a make-work project, only privately funded. He is likely responsible for a local shipping boom in our neck of the woods. And what happens to these materials that he tears out? Straight to the landfill.

The wealthy client employs over 2000 people, all but 15 of whom are paid minimum wage or near minimum and rely on the annual windfall of the EITC taxpayer subsidy (you want to get a glimpse of the “golden horde”? Check out W-2 distribution in January). And people wonder what has gone wrong in America….

The Fed is a cartel similar to OPEC. Does that give you a warm feeling? Maybe when you read that you had a urinary accident. The Fed was comprised of J P Morgan and National City Bank (Citi) and others. It was approved by Congress in darkness when many members had left for Christmas. It’s the banker’s bank. It’s not there for your benefit.

There is an old adage in technical analysis that “all gaps must close” and this has proven right many times over since the inception of technical analysis…see July 2009…and when this gap closes…there will be a lot of pain…A good friend of mine always said to sell out when too many people start using the “H” word…Hope…not enough people using the H word so we should still see continued advances in the market…no matter how artificial it may appear or is…

So the Fed is removing money from the monetary system? Then asset values should at some point decline. Won’t people and businesses just walk away from their debt obligations? That was the lesson from the 2008 housing bust. Just mail the keys back to the bank, wait a couple years rinse and repeat. Back in 2008 there might have been a moral obligation to payback a loan. However, since there is an entity constantly resetting asset prices based on their perception of market dynamics making it harder or easier to repay a debt…I say there isn’t a moral obligation to repay debts when the game changes without your consent. I think your average debtor is going to reach the same conclusion.

You got that right. The only way to buy a home in Bernanke’s wold is to put 3% down under a government program then walk when SHTF. Bernanke took all choices and responsibility away from the market. It’s a command economy now and they are commanding you to buy assets with debt. They are also commanding you to default and receive a bailout.

When QT began last October the Federal Reserve also began winding down its overnight domestic reverse repo operation, an operation which had effectively drained liquidity (i.e. money) from the financial system in the timeframe between tapering and QT. As a result, in the first quarter of QT (Q4’17) the Fed actually added $35B in net liquidity, as the $24B reduction in treasury/MBS portfolio was more than offset by a $59B reduction in domestic reverse repos. In the second quarter of QT (Q1’18), once again the Fed added net liquidity of $26B as the $46B reduction in the treasury/MBS portfolio was more than offset by a $72B reduction in domestic reverse repos. In the past quarter of QT (Q2’18) we saw the first real drain of liquidity by the Fed, as the $89B drop in treasury/MBS balances was accompanied by a $4B increase in domestic reverse repos, for a total drain of $93B.

Reverse purchase agreements are included on the balance sheet.

Yes, they are, but they are a liability on the Federal Reserve balance sheet, not an asset like treasuries/MBS. When the Fed allows reverse repos to roll off they increase Fed reserves in the system, while allowing treasuries/MBS to expire decreases Fed reserves.

Yes, the reason I said this is because otherwise people might think this is another SECRET thing that the Fed does to manipulate the markets. This comes up all the time here.

Could you please break down the quarterly data (since 3Q17) for me.

Much appreciated.

Thanks

All the data is provided in the H.4.1 and the System Open Market Account Fed releases, both which come out each Thursday. All the prior releases can be found here:

https://www.federalreserve.gov/releases/h41/

https://www.newyorkfed.org/markets/soma/sysopen_accholdings.html

Thanks

Not only will the Fed get rid of the Yield Curve but they will continually finesse Gross Domestic Product as debt increases off balance sheet. Bottom line is that nixing the Yield Curve is merely yet one more step in the direction of completely destroying the basic fundamentals of contemporary Finance in the Western world.

Fake news & fake metrics = Totalitarianism

MOU

“Get rid of the yield curve” is a meaningless expression.

The Fed could come out of this okay if Federal spending tanks and I think it will. A lot of us have forgotten who is in charge. Their real mission is downsizing government. The fiscal spending plan is dead. Do you think the economy is going anywhere without government spending? And blame will be on the Dems after they win the midterms. The economy contracts credit contracts their balance sheet contracts.

Don’t know what you are talking about. Government spending is accelerating.

You Republican vs Democrat guys crack me up. You remind me of sports fans cheering for their team (Go Wildcats!) – none of your cheerleading has any substance or relevance to reality. Both parties are eagerly spending and borrowing the country into oblivion.

Don’t blame me I voted for Kodos.

Simple demographics, the House GOP ramps up spending when its THEIR spending, and plays the part of obstructionists when the Democrats control spending. If the Dems take enough seats to spoil THEIR party, they will have a hissy fit, pay attention to Grover Norquist. These guys will discover their true (conservative?) colors when the Democrats rise up and remind them just who they are. When that day happens the debt ceiling will come crashing down. It’s a perfect storm the Fed offloading bonds, rates rising in the EU, credit contraction, dollar based debt imploding in the EM. Usually we count on government to INCREASE spending during a recession but that ship already sailed and an outsider running the Fed (like Volker) means USG will not be riding to the rescue of the markets which are part of the global zombie ponzi scheme anyway. That means fiscal spending is off the table, or it gets lost in parochial issues, and there is no pork barrel big enough to make everyone satisfied. The blue states are getting their finances in order, so let DC sink. You like America, there may be more of them.

So….Let me get this straight…While the Fed was buying everything they could get their hands on during QE, the hard money crowd goes crazy saying the ‘sky is falling’…. And….now that the Fed is unwinding all of this QE, the same crowd is hand wringing and yelling the ‘sky is falling’

I don’t think the hard money crowd is hand wringing and yelling. We are watching with anticipation. some of us are cheering it on.

IMO, any discussion that has to do with the magical, mysterious Fed must include mentioning two great days.

First, The Fourth of July, AKA Matrix-Reinforcement Day:

https://www.paulcraigroberts.org/2018/07/03/tomorrow-is-matrix-reinforcement-day/

and, second, our very own days of birth in the pods of the present-day Matrix:

https://caitlinjohnstone.com/2018/07/04/babies/

If all we are capable of doing is begging the Elite to behave better and typing comments on Wolf Street, we will suffer increasingly severe austerity until we, like cornered mice, desperately, mindlessly lash out not only at the Elite, but, eventually, even at our equally-desperate neighbors across the street and all over the world.

During their first meeting, Morpheus asks Neo the most important question about their world of “The Matrix” — “Do you want to know what ‘it’ is?”

Each one of us must ask essentially the same question. What is “it” that keeps failing for the vast majority of people and preventing things from improving?

I am here to tell you that “it” is NOT any president. “It” is NOT the Fed. “It” is NOT the constitution. And “it” is most definitely NOT an incorrectly adjusted interest rate, balance sheet or chart.

“It” resides between human ears.

“It” is an inevitably-fatal, deeply-inculcated, religious-like belief in the infallibility of human greed (NOT of greed’s existence or power, but, again, capitalism’s belief in greed’s INFALLIBILITY) — that all every single human being of 7.4 billion individuals has to do is attempt to satisfy his\her insatiable greed and everything will turn out just fine for the collective whole of humanity.

It won’t.

Greed, my fellow humans, is NOT good, because “it” will, by “whatever it takes”, OVERCOME any well-intended measure (from constitutions to Glass Stegalls to TARPs to QEs to NIRPs to fiat money to banning cash to QTs) that that same human mind can invent in an attempt to control ‘it’. History has PROVEN with absolute certainty that this is true. The proof is in the pudding of today. The TBTF banks, invented in 2008, have only grown bigger, not smaller, and measures to prevent another crisis have already been pared back.

What we all, as individuals, must somehow, some way come to recognize and accept as truth is something that we have been brainwashed by a capitalist system from Day 1 to believe is not true — that the one and only thing that will save humanity from itself (us from each other) is the EXACT OPPOSITE of greed, and that is to “Do unto others as you would have them do unto you.”

To boil down why this must be the case to something easy to understand, when several nuclear-armed nations can not understand that they must treat each other as they would want to be treated by others, and they instead struggle to do “whatever it takes” to dominate the others, as they are doing now, nuclear war is inevitable. Something built into the greed-system’s DNA will “see an opening” or “detect a weakness” in an adversary’s defenses and instead of automatically buying or selling something, or slapping on a sanction, or imposing another tariff, a nuclear button will be “accidentally” pushed.

What you write contains some truth, but is incomplete … and the rest of the story alters the conclusions one might reasonably reach.

For example, you cite greed as a problem. How do YOU detect greed? The answer lies between YOUR ears because if you didn’t also possess it, you would have no basis in detecting it. When you have perfected yourself further, you will realize that the “it” problem must be solved from the bottom up. Solving it from the top down requires tyranny and oppression.

Now when people who possess greed try to rid the world of greed, there is an infinite amount of it. How can you rid the world of something that you cannot even rid from the 1 person have control over (yourself)?

If the US lets rates approach market rates, then getting over the pain first will allow the US to lead the global economic recovery.

Wolf, you have, in the past, scolded Commenters for remarks describing the Fed as creating money out of thin air, but more recently, and above, you are describing the Fed’s actions in the same terms.

……………………………

I think the Fed started out trying to rescue the nation from a financial crisis, and then they began to believe in their own financial genius and power, that they WERE in control. Fast forward to now, when the Fed is hoping and praying that their asset elevator will not go into free fall. (We’ve all seen the movies.) Gravity: not just a good idea, it’s the law.

I’d like to think that somewhere in a back room at the Fed, there’s ONE person imagining how, next time, – when the tide flows out again- we focus on keeping the American middle class from getting stranded on the sand bars. Hey, Fed, you have proven repeatedly that you can keep the bankers off the sand bars.

My thought experiment goes like this: instead of paying banks interest on excess reserves, you had instead channeled that money to interest paid to savers, on their savings accounts. A simple idea; fine, come up with something more sophisticated; in the meanwhile, good luck with the elevator.

As usual, thx, Wolf.

“…you have, in the past, scolded Commenters for remarks describing the Fed as creating money out of thin air,..”

I think in those discussions we were talking about individual banks creating money out of thin air (no they don’t), rather than the Fed. That’s a huge difference. But the banking system overall creates money in a complex mechanism that involves deposits, but not individual banks … that’s what that whole long and confusing discussion was about, if I recall correctly :-]

My mistake, Wolf, and I was careless, regarding an important distinction that you had made.

To restate your summary, it goes something like this: The Fed has license to create money. Individual banks do not have that license, but as deposit-takers, the nation’s banks, as a collective entity, are involved in the money-creation process, under the aegis of the Fed. ………………………

So maybe the Fed created “too much money” during Balance Sheet Abnormalization, thx Suarez,- or, we could suppose that it wasn’t too much, but it was badly distributed, and has created new bubbles. Not enough to create grandly; must then look after one’s creation……

This has literally nothing to do with him.

It is possible to fully unwind QE, but only by implementing a negative interest rate on currency (including cash).

How do we know that the FED is truly unwinding their balance sheet? Maybe they’re lying. Maybe the ESF is injecting trillions in dark money to prop up markets. Why should any of this be believed?

You’re welcome to not believe it. No problem. Just don’t be surprised by the outcome :-]

Actually, this question raises another. Does anybody audit the fed’s books? As far as I know, the answer is no.

How do we, the outsiders, have any way of checking out these details? For example, when China was publishing numbers back in the day of an economy going gangbusters, there were some who looked at electricity consumption as a way to check the claim.

Do we know how exactly Fed got the ‘printed’ money into the economy and how much through each channel? Is there a place to see if the numbers in the pipeline add up?

For what it’s worth, audit firm KPMG audits the financial statements of the 12 regional Federal Reserve Banks and the consolidated Federal Reserve annual report

https://www.federalreserve.gov/aboutthefed/audited-annual-financial-statements.htm

None of the Big 4 auditors has any credibility left at this point.

foreign central banks are still buying assets. That’s what keeping the market propped up. Wolf’s right, the fed will keep raising short term rates until something breaks. When that happens is anybody guess but they want to get short term rates to 3.5%

During the financial crisis the fed created various loan programs such as TARP, TALF and Maiden Lane 1, 2 and 3 ( Bear Stearns etc.) creating a shell corporation to hold questionable assets and loaning money so these assets would not be liquidated along with the bankruptcy of the businesses who the loans were given to. This delayed the liquidation of these assets at fire sale prices which would have been a normal consequence for excessive risk taking and speculation. Someone said that Bernanke and the Fed engineered a “slow train wreck”. When Bernanke and the Fed had trouble trying to handle all the insured MBS and CDS especially from AIG they just took over AIG, since Greenberg had sold every investment bank insurance on mortgages. The fed just waited for the mortgage paper to default at Greenbergs and bought it to contain the crisis. They kept this off the market to keep asset prices from tanking. Even the banks were afraid to loan money to each other on supposedly good paper. Imagine that, banks not trusting each other. Wolf I agree with you, they should have let them eat their speculative paper. Let the market run its course and clean out the banksters. I could go on and on like the Fed keeping the discount window the same as overnight lending so as not to embarrass the bad banks that normally would have to go to the discount window to try and stay liquid. I remember Ron Paul wanting the Fed to release the names of the entities and individuals who received all the preferential treatment. The Fed replied we are audited… only the numbers are audited which does not include names etc.

Tomorrow, nearly 4 billion people wake up and go to work for a rigged system that rewards cronyism and fraud and ill-gotten gains. Amazing.

“How worried should the government be if a punishment causes a company to go out of business? Should regulators worry about the cashiering of innocent employees? What about customers, suppliers, or competitors? Should they fret about financial crises? From this rather innocuous mention, the little notion of collateral consequences would blossom into the great strangling vine that came to be known after the financial crisis of 2008 by its shorthand: “too big to jail.” Prosecutors and regulators were crippled by the idea that the government could not criminally sanction some companies—particularly giant banks—for fear that they would collapse, causing serious problems for financial markets or the economy.

Today’s Department of Justice has lost the will and indeed the ability to go after the highest-ranking corporate wrongdoers.”

Jesse Eisinger, The Chickenshit Club

In the 9 months since QE unwind started Fed has cut ~5% off the balance sheet. Since then:

US Tsy real yields are at top of the QE range, 80bps at 10yr

Tsy curve has flattened

USD rallied

BBB IG bond spreads to 1.6% vs 1.3%

US high yield spreads seems to have bottomed

EM tanked

Liquidity has dried up at times in some areas of bonds markets as they reset to higher yield levels with not much market making to intermediate the move

Global Prime Residential is in a bear market in many locations

S&P equity breadth narrowed

We had one volatility explosion in equities, and one in govvies (Italian 2yr) and several in EM FX/ equities.

Nevertheless with credit growth in Q1 at 18% of GDP annualised, main street USA is doing fine.

In Q4 balance sheet reductions will go to $50bn a month and next year they are targetting 15%/ $600bn in reductions and potentially 100bps more from here in Fed funds rate hikes which would take Libor to about 3.5%.

If the USD Treasury yield curve steepens on a reflationary policy outlook it could see the 10year at 3.5-4%.

“The MBS on the Fed’s balance sheet were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The credit risk lies with these entities, not with the Fed.”

If the Fed steps in when these entities fail, (as it did last time around), and as it would next time as well, who is actually bearing the credit risk? Isn’t it every holder of dollars on earth???

lending money at 2.85% for ten years is not as good as lending money at two years at 2.56, unless there’s going to be monster rally in the 10.

fed seems to think the same.