“Recent home buyers could be facing negative equity”: CoreLogic.

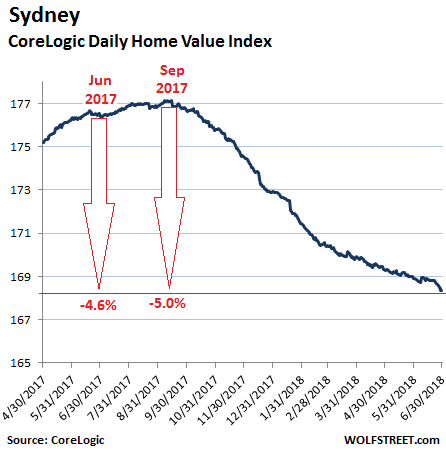

In Sydney, Australia’s largest property market and Petri dish for one of the world’s biggest housing bubbles, home prices fell 4.6% in June compared to a year ago, with house prices down 6.2%, and prices of condos (“units” as they’re called) down 0.7%, according to CoreLogic. The most expensive sector got hit the hardest: in the top quartile of home sales, prices fell 7.3%. In the nine months since the peak in September, the overall Daily Home Value Index has fallen 5.0%:

But it had been one heck of a boom in Sydney, where home prices had jumped over 80% from the end of 2009 through the peak in September last year. Even during the big-bad Global Financial Crisis, they’d only dipped 4.6%.

So the market is changing, and the denying has stopped. Australian banks are getting put through the wringer by the Royal Commission with ongoing revelations of an ever longer list of misdeeds, particularly in the mortgage sector.

The Australian Prudential Regulation Authority (ARPA), which is supposed to regulate the financial services industry, put in place some macroprodential measures to tamp down on the housing bubble, and they’re finally having an impact. Banks are suddenly focusing on borrowers’ debt-to-income ratios and other specifics, rather than just the assurance that home prices will always rise. They’re under investigation, and they’re tightening credit. And investors – a huge force in the market – have suddenly lost their appetite for property speculation, and banks have lost their appetite for funding them.

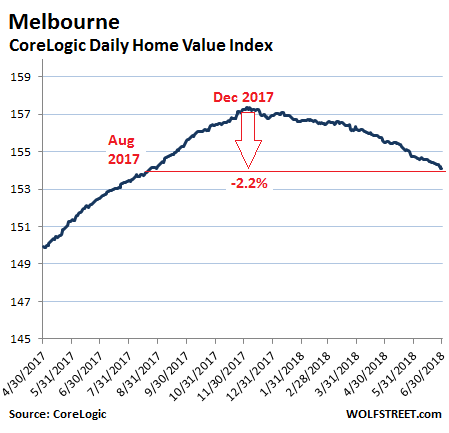

Melbourne lags a few months behind Sydney. Home prices in Melbourne peaked in December 2017 and have since declined 2.1%, but are still up 1.0% compared to a year ago. In the upper quartile of sales, property prices already dropped 2.5% from a year ago. The overall index is now back where it had last been in August 2017.

For the other three capital cities, the situation is mixed. In Brisbane, home prices ticked up 1.2% from a year ago and in Adelaide 1.1%. But in Perth, home prices have been declining since late 2014, when Western Australia got hit by the mining bust. In June, the CoreLogic index fell 2.1% from a year earlier, with houses down 1.7% and condos down 3.7%.

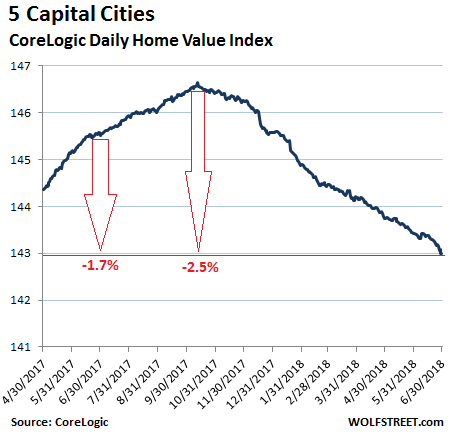

For the five capital cities in aggregate, the index was down 1.7% in June from a year ago. May (when the index was down 1.1%) had been the first month with an annual decline since October 2012, according to CoreLogic. The index has now declined month-to-month for nine months in a row and is down 2.5% from the peak in October last year:

But these are just the initial signs that the market is turning. Home prices remain 32% higher than five years ago, according to Corelogic research director Tim Lawless. Seen from a different perspective: there’s still a lot of air underneath these prices.

And suddenly there’s the prospect that “recent home buyers could be facing negative equity,” he said:

“Tighter finance conditions and less investment activity have been the primary drivers of weaker housing market conditions, and we don’t see either of these factors relaxing over the second half of 2018, despite APRA’s 10% investment speed limit being lifted this month.”

A large part of the home sales are via auctions that take place, mediatized and televised, in front of the home. This is supposed to whip current and future home buyers into frenzy. Every Monday, the auction results are reported with great fanfare. The key number everyone watches as sort of a real-time measure of the housing market is the “clearance rate.” It’s an indication of the percentage of homes that sold over the weekend either at auction or before the auction, compared to the homes that had been scheduled for auction.

During the boom times until late last year, clearance rates had been high. From 2013 through 2016 in Sydney, they’d mostly been in the 70% to 80% range. Last year, they began to drift lower and late last year fell below 60%, something that happened only a couple of times since 2012. And clearance rates have plunged further. This weekend:

- Sydney: 56%, down from 68% a year ago

- Melbourne: 60%, down from 71% a year ago

- Brisbane: 38%, down from 52% a year ago

- Adelaide: 55%, down from 61% a year ago

- Perth: 25%, down from 40% a year ago

CoreLogic summarizes in its auction report:

The 2018 auction market so far has demonstrated the weakening property market, with the success rate of auctions continuing to fall through the first half of the year; returning the lowest weekly clearance rates seen since 2012 as property values decline in turn.

In Canada, the housing bubbles in Toronto and Vancouver have been on a similar track. Locking back on the wild party times, the public mortgage insurer’s massive survey of recent homebuyers reveals all. Read… Foreign Buyers Made Me Do It: Canada Reflects Back on its Housing Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– Australian banks also have been confronted with rising funding costs.

Australian banks have also been exposed to be lending excessive loans to people that can’t repay them. This is one of the main reasons why prices went up so much. There was too much speculation.

Second reason behind the bubble was (and still is) that you can buy a house in Oz with cash and no questions will be asked. Lot of Chinese dirty money pored into Oz over the past few years.

It appears China found a way to stop this and also, lot of Chinese cash is going elsewhere.

I guess it is all coming to Southern California, prices are still skyrocketing, and every open house still lots of Chinese.

We’re in our mid-30s, have just had a baby, and at this point not sure how much longer we can hold out until we buy a bigger place. Our options seem to be buy a place we know is insanely outrageously overpriced (and requiring lots of work) in CA, or move out of state completely uprooting our family. Rock vs. hard place. We’ve ruled out renting, the asking rents are insane and the rental applications are like signing your life away.

Get out of CA. You can find PLENTY of other places where you can afford to buy a place, where the air is cleaner, freeways and streets are not jam-packed with people 24/7, there is natural beauty, and the politics are liberal.

Hang on mate do not buy a conventional abode try an RV

This asset bubble is going to burst big time

I’ve noticed that all articles telling us about deflating bubbles always make sure to spend at least 2 paragraphs bragging about how high prices went and how great a boom it was.

The fear among the establishment at this time is tangible. This is the hour they dread more than any because they have to stay in power, keep the masses from figuring out that they are the ones responsible for these messes, and somehow come out of it as our heroes.

Best of luck to them. I for one will expend every ounce of energy and breath I have doing all I can to educate people and expose the lies of the establishment to everyone I know when this thing goes bust.

I would suggest those Corelogic figures are following the establishment line.

Anecdotal and personnel experience is showing me that the percentage drop may in fact be quite a bit larger.

I sold my house in August last year. The price I got for it then was probably at the peak. There is no way I would get anywhere near that price – My agent telling me now it would be at least 10% less.

I’m looking at buying a replacement property (retirement). properties I looked at 6 months ago are still on the market with prices now 5 – 8 % less.

I know of and extremely large Melbourne CBD apartment complex currently under construction – owned by overseas interests. It’s has stopped work for a month. Friend of mine is the electrical contractor – he told me the developer is waiting for a tranche of funds to come from overseas before starting up again. They were supposed to be off for a week – it’s been over a month now with no sign of restart.

The establishment will not want that development to fail.

Note that the first paragraphs points out that HOUSE prices are down 6.2% in Sydney year-over-year, and that house prices in the top quartile are down 7.3% year-over-year. The peak was in about September, and so there’s an even steeper decline since then, but I don’t have data on it. So depending on where your house was and where it ranged on the price scale, the drop from peak would be in the range you’re pointing at, down 5-8%.

I am just doing THAT for years now and cannot keep up with followers on Facebook. THEY cannot stop that …..

and meanwhile, the sheeple start to wake up.

The sheeple NEVER wakes up. They do what they are supposed to do. When there is grass, they will bump each each other’s head chewing as much as they could to compete each other out. When they feel danger, they will stampede away from it and they do NOT give a damn if a bunch of their own kind gets stomped on and killed. And yet, they feel extremely uncomfortable leaving the crowd and doing something different. Pure selfish without any regard to their crowd.

Yes, the grass may turn into danger now and the stampede may begin, but to say they “wake up”? I don’t think so.

Preach it brother I’m with you

And, mick, here’s an example from Tucson:

https://www.kgun9.com/news/local-news/new-home-prices-rise-to-more-than-300k-for-the-first-time-in-tucson

The final two grafs are killer:

The price for resale homes is still between $200,000 – $250,000.

Huffman says, “I still think that the over 300 price tag is going to be a tough one to sell.”

Another factor is that the chinese government is trying to stop their currency being smuggled or laundered out of the country. There is some evidence that this type of “investor” has been dwindling due to the chinese goverment’s policy. The various local aust governments have been increasing taxes and charges on overseas investors and introducing “empty dwelling” taxes. They have also been making noises about enforcing existing laws on non-citizen buyers. So there are a lot of factors quite apart from the local banks fraudulent practices. Australia is a nothing far away from everything (in the middle of nowhere) so the current dwelling prices are completely ludicrous and the banks are probably starting to realize this fact. There have also been some flaccid arguments about auction attendance, and consequently buyer interest being down because of the current “cold winter weather.” But there is always a buyer if there is a buck to be made, regardless if the auction is held during a hurricane. During the past frenzy (rain or shine), you could hang an auction sign on a dead cat and have some idiot bidding on it: with unlimited finance from some local bank who had helpfully “massaged” the client documentation.

anyone from China can buy Real Estate with cash in Oz and no one will ask any questions. Yes, some taxes have been imposed but that is the price Chinese have to pay for our Gov to launder their money.

Anti Money Laundering Org from Paris has listed Oz as top country where you can launder your dirty cash. Top of the list among developed countries.

The so-called “recovery” is about to be exposed as a fraud and chimera, enabled only by trillions in fake money conjured up by the central banks and gifted to its bankster accomplices.

The financial reckoning day, when it shows up, is going to devastate the reckless and greedy speculators who drove home prices up to such extreme and unsustainable valuations. And this time around, the popular rage at the banks and their captured regulators, enforcers, and politicians will likely preclude another bailout using taxpayer money.

Brace for impact.

That was “last time” in 2008. At that time, those those who drove up prices by leveraging were the ones holding debt when it failed, therefore,

a bailout.

This time, those who drove up prices using debt will hold cash and the debt would be transferred to TAX payer.

Yes, there will be NO tax payer to bailout to bailout themselves.

They messed up during the wealth transfer of last time. They will NOT this time. So unless tax payer still have cash and NOT holding debt, they inflation continues until the transfer is complete.

The Wall Street-Federal Reserve Looting Syndicate arranges these engineered boom-bust cycles about every 8-10 years. First came the tech bubble implosion in 2000, then the housing bubble and stock market crash of 2007-2008. In each case, the muppets got fleeced for trillions in wealth and assets, which the Fed’s bankster accomplices ended up picking up at distressed pricing using “stimulus” gifted to them by Bernanke and Yellen. So we are about due for the Great Muppet Slaughter of 2018 to commence. Wash, rinse, repeat. Only this time around the Fed and its bankster accomplices probably can’t count on the same docility from the sheeple that was the case in 2000 and 2008. This time around people might finally decide enough is enough.

So give it a year or so until you buy a house in Australia, to live there, not to have people rent or get a loan using it as collateral?

People who wants to buy a house to actually live there must be happy about this, save for the fact they might complain if they buy now and in six months they could have got the same house cheaper.

Asset inflation is all over the world.

Not a good time to buy anywhere

I remember my friends in Sydney telling me last year… this time is different and prices would never go down in sydney

Everyone think this no matter where are they located

Your friends are right as real estate has decoupled from ‘reality’. Central banks must start cutting again soon, or the bubble will bust, sending the world into chaos.

In the US salaries have been flat for decades and the ‘wealth effect’ from using homes as ATMs is the only way people are getting by. It’s what the ‘raise rates crowd’ doesn’t get. We have tapped out consumers who are using homes and in some cases stocks to compensate for rising prices.

So if rates go up, we undermine 70% of our GDP, then must promptly cut rates to heal it?

Not a chance this will happen as it’s much easier to keep the status quo steady, then if we have another economic calamity the politicians will simply say that ‘nobody could have seen it coming’.

Trump is already talking about tax cut 2! I assume at some point they’ll just hand out wads of cash.

“A man’s view of the future depends very much on the amount of debt he is in”..

There must be lots of people in Japan who remember the events of 30 years ago looking at the speculative bubbles all over the place and thinking “they’re about to find out what we found out back then”!

I have no debt and I see no future. My measly $100K a year job can’t keep up with the costs associated with survival…….it’s all about just managing the decline

It depends how hard it is to immigrate to Japan, or to launder money. Anecdotal evidence says it’s quite hard.

In US there is all that hype that mortgage lending in US is much more regulated and much more difficult in comparison to 2007-2008; watch this to understand that getting mortgage is as easy as it was in 2007-2008: https://www.youtube.com/watch?v=pS9NqRDf6dQ.

This can never happen in USA. USA is different. USA has reached a new normal of high real estate prices forever :-)

The negative equity issue really pivots on the ability of the lender to withstand the losses? That brings to mind the character of the housing boom, is a lot of this mortgage paper held by less than solid banks or loan originating companies?

No Wolf. “What happened in the USA can’t happen in Australia”.

They have kangaroos there, I’ve been told. Supposedly kangaroo loans are imbued with some special mortgage insurance or something ….

Purchased a home in July of 2007 in the SLC area for $190,000. Two years later it was worth $140,000. We sold for a profit FINALLY in 2016.

We are now renting because each and every sign we missed before is PRECISELY the same as in 2007. I suppose my question is this: Can tens of millions of people simply forget what happened a decade ago?! The stupidity is bewildering and frightening. That same house we sold is now approaching $300,000.

Recessions come and go; inflation is constant.

Like the housing crash last time? Ok.

A decade? Maybe two. WWI and WWII.

The last down turn is long forgotten except for those who were burned by it or those lucky to avoid it. While I like Gershon’s sentiment I am not convinced the sheep will place the appropriate blame where it belongs on government, banks, and wallstreet

I think that people today have weighed up the pro’s & con’s of home ownership & have decided, that life is to short to be strapped into a straightjacket till the end.

Remember that we are on the verge of WWIII End Time.

Also, the whole world has been bombarded with the lie, that the population of the world will blow out to 9 billion & there will be no food & water.

More & more, couples are deciding not have children, there was a scathing article on Psychology Today admonishing young couples as selfish, for abstaining from parenthood.

I wrote to remind the author that we have beaten our young into this mind set of responsible global citizenry.

Be Responsible Choose Not To Have Children.

in Oz both partners (I am talking average people) must have full time jobs in order to repay the astronomical mortgages. No one have time for kids.

I assure you Wolf, the Australian Royal Commission is just an extravagantly expensive whitewash – the act of Pontius Pilate buy Our Malcolm Turnbull & his political ilk, past & present.

Curse of society: “Mental hernias”…….(No historical memories)

Great new video on some China real estate where they claim the bubble is popping. But just at how bad some of the construction is. So bad that it may not last even if the bubble popping happens soon. https://youtu.be/XopSDJq6w8E

That’s why they are racing to build and sell these junky units while they can, and the units are still standing.

St Vinnies is Nicholson St – Napier ST – Gertrude St – Victoria Parade & maybe even further.

I have no idea who owns the Medical Professional Consulting Suits that are on the other side of Victoria Parade ??