This is the brick & mortar part of e-commerce.

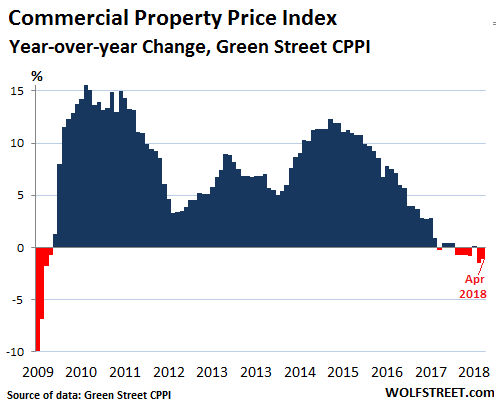

Commercial real estate prices peaked in August 2017 at 27% above the crazy peak of the prior bubble, according to the Green Street Commercial Property Price Index (CPPI). By April this year, the index was down 1.4% from the peak and by about 1% from April a year ago.

The chart of the year-over-year changes of the CPPI shows the gentle down-trend since September last year. But it hides the turmoil beneath the surface, with the subsector for malls plunging 16% from its peak at the end of 2016 as brick-and-mortar retail is melting down, and with industrial — which includes warehouses, the brick-and-mortar component of e-commerce – soaring 11%:

The industrial segment has been hot around the country, particularly in large urban areas, such as the San Francisco Bay Area, New York-New Jersey, or Seattle, where warehouse capacity is tight amid high demand. And rents for industrial space have been soaring.

So here are some of the dynamics of industrial properties in greater Silicon Valley, based on data provided by the research team at Transwestern, a national commercial real estate firm.

The total inventory of industrial space in greater Silicon Valley inched up to 192 million square feet in the first quarter of 2018. But vacant inventory, offered by landlords directly and by companies that no longer need it and thus try to sublet it, fell to 11.4 million square feet, or to 5.9% of the total, a historic low.

The data includes warehouse, manufacturing, and flex buildings of 20,000 sq. ft. or larger, but excludes data center and showroom buildings. Vacancies among warehouse buildings were only 1.8%, and among manufacturing buildings 1.9%; which means essentially no vacancies. However, flex buildings had vacancies of 10%.

This chart shows greater Silicon Valley’s vacant industrial space in million square feet (red line, left scale), and vacant space as a percent of the total industrial space (blue line, right scale):

![]()

According to Transwestern:

Investment and leasing activity among Silicon Valley tech giants was very robust in the first quarter, as Google continued to buy industrial space in San Jose, and Facebook made its big move into Fremont after signing a notable lease in the previous quarter. In all, tech giants’ activity is keeping momentum in the Silicon Valley industrial market.

Under these conditions of tight supply, robust demand, and few vacancies, landlords can raise rents, and so rents are jumping from historic high to historic high.

In greater Silicon Valley, industrial rents rose 6.7% year-over-year to $1.76 per square foot per month, the 22nd quarterly increase in a row. Rents have doubled since Q2 2011 ($0.87) and are up 50% from the crazy peak in Q2 2008 ($1.17). Note that rents dropped 27% in three years, from Q2 2008 to the low point of the Great Recession Q1 2011 ($0.85):

![]()

In the first quarter, new supply of industrial space was scarce: only 22,000 square feet was added. But more will come on the market, with 1.1 million square feet under construction. Transwestern provides some details:

The much-anticipated McCarthy Ranch in Milpitas will have over 450,000 square feet of warehouse space come online in its first phase early in the second quarter. Other notable developments to hit the market include Intuitive Surgical’s redevelopment of buildings on Kifer Road in Sunnyvale into two, 600,000 square foot buildings, of which 326,000 square feet is slated to complete in the second quarter of 2019.

The chart below shows the total industrial space under construction. Note the collapse of new construction activity to zero as a result of the Great Recession four about three years. The lag between the Great Recession and the shutdown of industrial construction is because projects are planned years ahead of time; those that have been started are generally completed unless the developer collapses, but during the Great Recession, no new projects moved forward from the planning stages:

![]()

Transwestern sees this new construction as adding “some relief to a market that is showing no signs of cooling off.”

These trends in industrial real estate are playing out across the country. So even as many retail properties are getting into serious trouble due to the attack from e-commerce, and some are becoming essentially useless for retail and have to be repurposed or redeveloped into something else, it’s the brick-and-mortar side of e-commerce – lowly warehouses and fulfillment centers – that has become the hottest trend in commercial real estate.

But the Fed’s QE Unwind is already ramping up toward cruising speed to bleed oxygen out of the markets. These are getting to be serious amounts. Read… Fed’s QE Unwind Accelerates Sharply

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Huh. And this data excludes data centers, which would cover server farms and clusters. Those will probably have a perpetual and growing demand.

Until they don’t.

Depends how important proximity of the data center is to the business model, otherwise you could be better off in a more remote location with lower energy costs or just unloaded to cloud hosting which is generally remote as well.

And the data centers where the cloud is running have to be situated somewhere

A major area for cloud servers is eastern Oregon and Washington — cheap power from Columbia River hydro, a dry moderate climate for cooling costs, no sales tax on the hardware in Oregon.

Maybe there’s so little industrial & warehouse space because residential has consumed it all. And what’s left is in short supply because what little demand is left is chasing a tiny amount of supply?

As a Bay Area resident I’ve witnessed a high-density residential building boom in SF and South Bay like none other. That property downtown has to come from somewhere and it’s no longer from filled in marsh (aka Foster City). So I’d be more likely to believe that Bay Area warehouse & industrial space is being cannibalized more so than experiencing a boom.

Many SouthBay one-story office buildings and warehouses have been torn down to build stacks of townhouses and condos between 2009-2018, no doubt. Especially in locations that are some distance from major streets and freeways. The freeway locations have also been torn down, but instead replaced by 4–6 story steel/glass office boxes. See more below.

good assumption, it would seem in the national short run, warehouse space growth would be a zero sum game(i.e the brick and mortar warehouse gets transferred/sublet-ed to e-commerce). Where was stuff stored during the 3 year building sabbatical? Or has our editor identified another bubble ? Maybe the new e-commerce model requires fulfillment centers to be close to the end requester to lower shipping costs .

here’s a good read explaining strong demand for Industrial property , it seems that newer, robotized warehouses located proximate to the end user is the new paradigm .

https://www.nfiindustries.com/blog/industrial-real-estate-outlook-2018/

Seattle has AMZN IN REVOLT over new taxes it wants for the poor etc. The outcome depends on politics which is very widely spread in state government. My California winter house Has even worse problems, a Fed rate increase spree will just cause Brown to drive harder to get more labor into state to do any thing regardless of citizenship. The popular trading maxim of sell-in-May-and-go-away may prove misguided in 2018. This month could instead see America’s aging bull market flare up again before failing in the second half of 2018.

With the key word being “ could “

Jack – did you write this ZeroHedge article?

https://www.zerohedge.com/news/2018-05-07/trader-why-sell-may-may-be-delayed-year

“The popular trading maxim of sell-in-May-and-go-away may prove misguided in 2018. This month could instead see America’s aging bull market flare up again before failing in the second half of 2018.”

Yes

Speaking of Malls in meltdown, I just found out that one of the local Sears here in the San Diego area is having a fire sale and is closing their doors this summer.

If any Sears store could make a go of it then this would be the one. Situated in the San Diego East County city of El Cajon, a working class suburb of SD, this store has been the anchor of the Parkway Plaza Mall since 1969. There is a Walmart right next door that is always crowded but the last couple of years, this Sears has neglected to present their goods in a organized fashion, and the help is pretty much non existent. In short, the place has been grossly mismanaged and now the death rattle is here. A 250,000 Sq Ft vacancy that isn’t about to be occupied any time soon.

The demographics are the story, Sears is a big lawn and garden store, Walmart is a consumer store. People in SD rip out there lawns, spend their weekends in recreation outdoors, and become more deeply embedded in the service economy; housekeeping, yard maintenance, plumbing and handyman services are all hired out. Aerospace used to be the main employer, now its tech and biotech, and the old blue collar model is broken completely. People who work their hands replaced by people who type and who browse with their fingers.

It’s too bad that replacing one’s lawn with a veggie garden is illegal.

“Illegal?” You mean against local ordinances in your locality?

Yep. Stories abound of people growing veggies instead of a lawn, and being threatened with jail, seizure of property, etc.

And in WWII “Victory Gardens” were encouraged.

I don’t mean messy eyesore gardens with ducks running around pooping on everything, I mean rather nice looking gardens.

Hate Walmart’s I find it difficult to imagine why anyone would shop there to be honest Lousy to non existent service and just too many of those obese mammas riding around on those mobility carts No thanks

Well, it may come as a surprise but millions of American jobs pay crappy wages and make people poor, so they shop were they can afford to get what they need to survive. Add in the fact that Capitalists do tend to like keeping around a reserve army of the unemployed, and the lust for profits from outsourcing, downsizing, and shipping jobs overseas, and perhaps that may be why Walmart is the largest store chain (and largest employer) in the United States.

Amazon is surrounding me with giant distribution centers in NE NJ. One used to be a huge carrier air conditioning factory with high paying union jobs. Now, it is a traffic jam area as they have set up a system where people get paid to deliver packages from the center locally, kind of like doing uber. Whether these delivery people make money or are just not aware that driving your car costs more then gas I don’t know. The only other new buildings I notice are government and education. My town has decided to construct a giant recreation center with three swimming pools and tells me it doesn’t actually cost anything because they made some new construction projects pay for it. Obviously, this extorted money could have been used to just reduce taxes but the rec center will provide dozens of highly paid easy government jobs. It is supposed to be complete in two years. It is located on a highway they have been constructing for the last 30 years with still no end in sight. I expect the rec center to take at least ten years and go over budget by at least 500%. If ever completed, it will become a handy headquarters for some kind of local youth gang that will terrorize the people that pay for it if they try to use it.

Now THIS is the story of modern America. The federal government is Locke’s Leviathan and state and local governments are “economic development” engines of growth. In reality, these local governments are more like the People’s Republic of Parks and Recreation. I don’t see that there is any way to turn this tide.

I have a brother who thinks he is “conservative.” We got into a heated discussion years ago when the state decided to pay the local NFL team to stay in town. He said, without any hint of irony, that this NFL team was a big driver of tourism and economic development. Eight home games per year, huh? And he didn’t think that if the money was so good a private enterprise would pursue it…we are dead as a culture.

This is the opportune time to get creative….

“Under the provisions of this bill we would snatch 200,000 acres of Indian territory, which we have deemed unsafe for their use at this time. Also, the state mental hospital will be converted to a casino. Gentlemen, this bill will be a giant step forward in the treatment of the insane gambler. “

Will they have a big silent guy named “ Chief”

Anecdotally, all the warehouse/industrial space in Colorado is being used to raise and process marijuana. Could be an under-the-radar issue other places as well.

>> The data includes warehouse, manufacturing, and flex buildings of 20,000 sq. f.

Aha, “industrial” space includes “flex” buildings. The key to really understanding what the data says depends on knowing what a “flex” building is. But I am not sure I have a working definition of “flex”.

Does “flex” include all those 4-5-6 story steel/glass office buildings that have been built in Silicon Valley during the period 2009-2018? A typical example is the southeast quadrant of the I-101 and Montague Expy interchange, There are at least 4-5 of these boxes that are offices occupied by the likes of AMD and other tech companies. There are many similar 4-5-6-story glass boxes that have been built along the I-101 and CA-237 corridors in 2009-2018. Are these included in the “industrial” category as “flex” buildings?

By the way, that particular development mentioned is called Santa Clara Square, and was built by the Irvine Company, according to web search.

Correction: I-101 and Bowers Ave interchange.

According to Bobeck Commercial Group, “Flex space is a term commonly used to describe industrial space. You start with warehouse space, that is not air conditioned and add office or showroom space that is air conditioned. You can “flex” into larger of smaller air conditioned spaces as you need.”

There’s new commercial space being built like crazy where I am, as well as residential, but there’s also got to be something like a 20% vacancy rate in non-residential RE.

Your Silicon Valley dystopian fiction — “20% vacancy rate in non-residential RE” — gets boring after a while.

No. A flex building is typically a warehouse-type building or a service center with a showroom fronting a major road.

From web search:

“Flex space is a term commonly used to describe industrial space. You start with warehouse space, that is not air conditioned and add office or showroom space that is air conditioned. You can “flex” into larger of smaller air conditioned spaces as you need.”

By that definition, all those shiny mid-rise office buildings do not seem to fit the definition, in my estimation.

Assuming the above interpretation is correct, is there a surplus of midrise office buildings in Silicon Valley?

Judging by the for lease signs…yes

Yeah lease signs everywhere. I’m sure that’s because there is a tight supply of office space; ask any commercial realtor if you don’t believe me :).

I wouldn’t be surprised if some falling company got buy out just because it has a lot of warehouses.

Is not a gig economy guys, is a sell showels to gold diggers economy!

Even better, get people to rent the showels (warehouses) instead! That way you don’t need to replace showels!

During the 1849 Gold Rush, the people who really made out were those who supplied the miners with their needs, including shovels.

In fact when gold was found in Sutter’s Creek, Sutter’s reaction was pretty much, “Oh, shit, not this”. He wasn’t able to keep miners off of his land and his profitable mill could no longer function.

No one seems to address why malls are floundering. The reason I haven’t been to a mall in years is the lack of security. Malls have turned into a meeting place for teens that don’t go to purchase products, just to hang out after school. Flash mobs, fights, etc. are not uncommon and families stay away. Outdoor outlet centers are going the same way in my town. Add to that the fact that stores limit choices to avoid large inventory costs. Online retailers have more choice and liberal return policies.