Some flat spots disappear, new ones form.

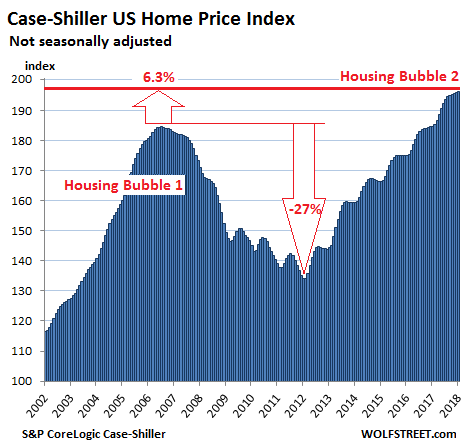

Prices of houses and condos across the US rose on average 6.2% from a year earlier (not seasonally-adjusted), according to the S&P CoreLogic Case-Shiller National Home Price Index for January, released this morning. The index exceeds by 6.3% the crazy peak of “Housing Bubble 1” in July 2006 just before it collapsed. Prices have now been inflated by 46% since the bottom of “Housing Bust 1”:

Local real estate prices are impacted by national and global factors — monetary policies, offshore investors looking at US housing as an asset class and escape hatch, etc. — as well as by local factors. Together they form local housing bubbles. When enough of them coincide, they turn into a national housing bubble, as depicted in the chart above.

The Case-Shiller Index is based on a rolling three-month average; today’s release is based on data from November, December, and January. The index uses “home price sales pairs,” i.e. comparing the January transaction to the prior transaction of the same house years earlier. Other factors and algorithms are used to obtain a price movement. The index was set at 100 for January 2000. An index value of 200 means prices as figured by the index have doubled.

The most splendid housing bubbles in major metro areas:

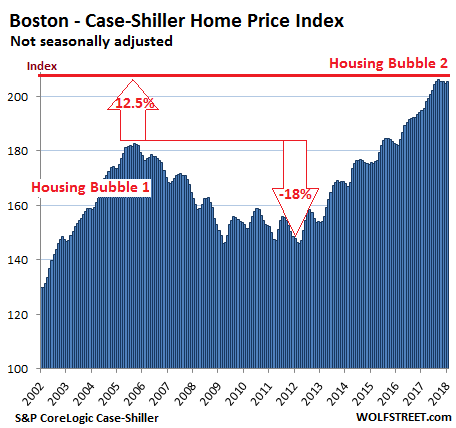

Boston:

The Case-Shiller home price index for the Boston metro rose on a monthly basis, after three declines in a row, that had followed 22 months in a row of increases, during which the index defied even the normal seasonal variations. It is now flat with August 2017, but after the price surge in early 2017, the index is still up 5.3% year-over-year. During Housing Bubble 1, from January 2000 to October 2005, the index soared 82% before dropping. It now topped that peak by 12.5%:

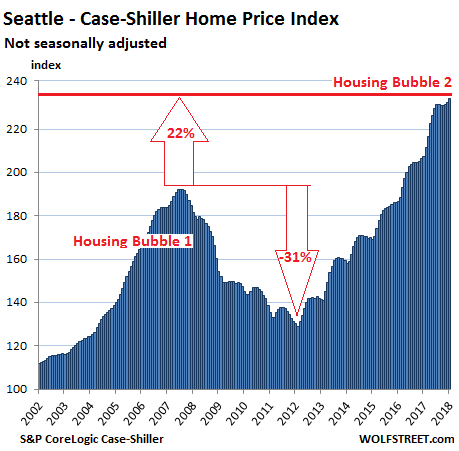

Seattle:

The index for the Seattle metro jumped 1% on a month-to-month basis to a new record. Late last year, it had experienced the first since the end of 2014! But that phase appears to be over at the moment. The index soared 12.9% year-over-year, 22% from the peak of Housing Bubble 1 (July 2007), and 81% from the bottom of Housing Bust 1 in February 2011:

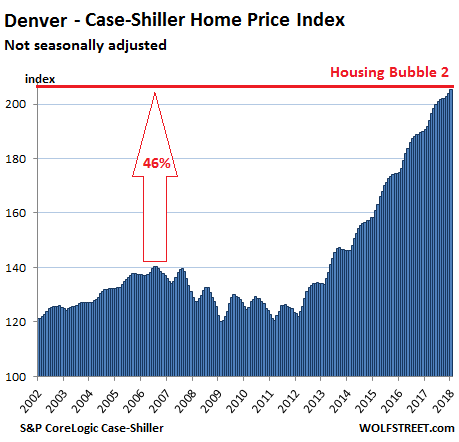

Denver:

The Denver metro index rose 0.7% on a monthly basis, the 27th increase in a row. The index is up 7.6% year-over-year and 46% from the peak in July 2006:

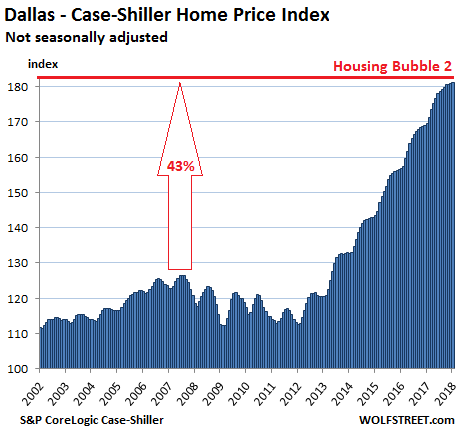

Dallas-Fort Worth:

The index for the Dallas-Fort Worth metro ticked up on a monthly basis for the 48th month in a row and rose 6.9% year-over-year. Since its peak during Housing Bubble 1 in June 2007, it has skyrocketed spectacularly 43%:

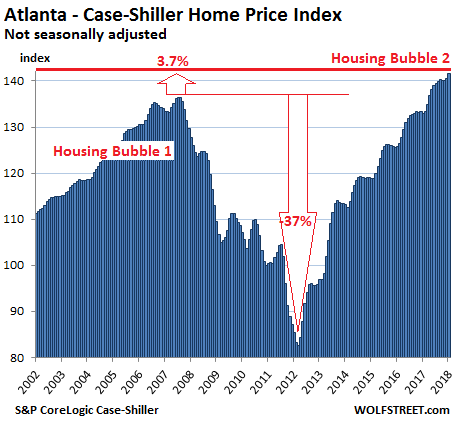

Atlanta:

The index for the Atlanta metro, which had been flat-ish for four months in a row, in line with prior seasonal patterns, ticked up 0.7% on a monthly basis and is up 6.5% year-over-year. It now exceeds the peak of Housing Bubble 1 in July 2007 by 3.7%, after having surged 70% since February 2012:

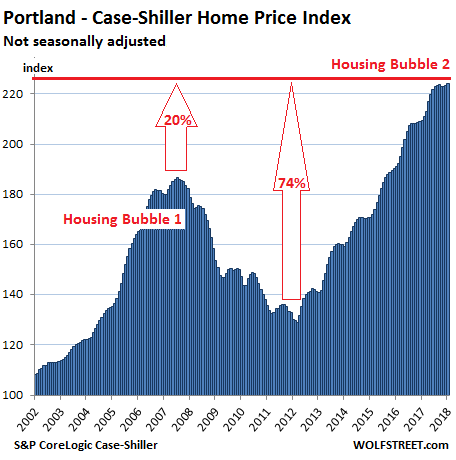

Portland:

The index for the Portland metro, after remaining about flat for five months, ticked up 0.43% on a monthly basis and hit a new record. The index is up 7.1% year-over-year, has soared 74% since 2012, is 20% above the peak of Housing Bubble 1 in July 2007, and has ballooned 124% since 2000:

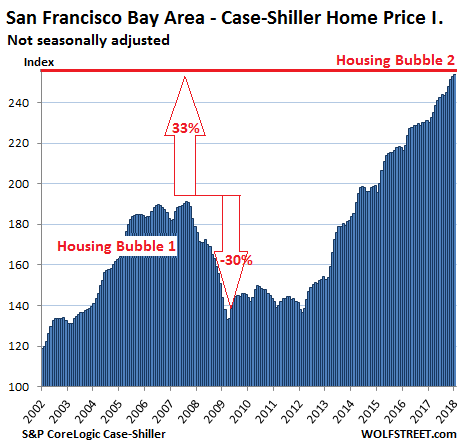

San Francisco Bay Area:

The Case-Shiller home price index for “San Francisco” actually covers the counties of San Francisco, Alameda, Contra Costa, Marin, and San Mateo. This is a large and very diverse area that includes the city of San Francisco, the northern part of Silicon Valley (San Mateo county), part of the East Bay (the counties of Alameda and Contra Costa) and part of the North Bay (Marin county). The index rose 0.4% on a monthly basis and shot up 10.2% year-over-year. It’s up 33% from the insane peak of Housing Bubble 1, 87% from the end of Housing Bust 1, and 154% since 2000:

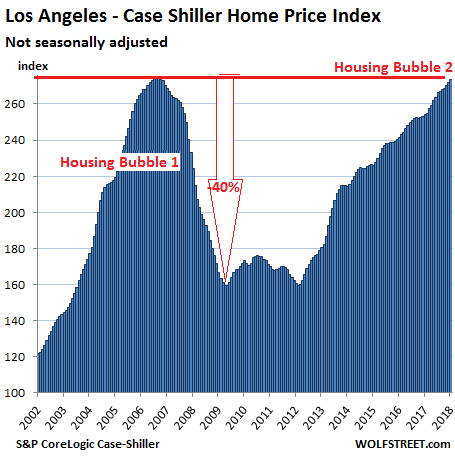

Los Angeles:

The index for the Los Angeles metro rose 0.6% for the month and 7.6% year-over-year. During Housing Bubble 1 in Los Angeles, home prices surged 174% from January 2000 to July 2006. The the crash that followed was nearly as steep. The index is now about a quarter point from where it had been during the peak of the housing insanity in 2006 and is likely to set a new record next month. The index for the neighboring San Diego metro looks nearly identical, with similar percentage changes, though the absolute numbers are just a tad lower.

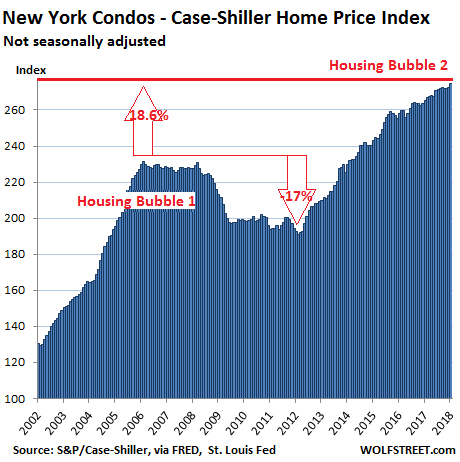

New York City Condos:

Case-Shiller’s special index for the condo market in New York City inched rose 0.8% on a monthly basis and is up 3.5% year-over-year. From 2000 to February 2006, the index soared 131%, and then declined. But QE unleashed money for Wall Street and global investors, and this stabilized the condo market until it began rising again in 2012. The index is 18.6% above the prior peak and has surged 175% in 17 years:

These charts show the handiwork of asset-price inflation, a monetary phenomenon where the dollar loses its purchasing power with regards to assets, such as homes. The Fed has set out to accomplish this starting in late 2008. Over the same period there has been little wage inflation. As a result, income from labor has been devalued with regards to assets, and this process continues as long as home prices rise faster than wages. The result of this type of asset price inflation that exceeds wage inflation can bee seen in the current “affordability crisis” or “housing crisis,” as it’s called in many cities.

At a certain level of wealth, these things aren’t the end of the world. But they do add up, as the co-founder of YouTube is finding out. Read… How Much Does it Really Cost to Buy a Luxury Condo in San Francisco, Not Live in it for 10 Years, Then Sell at a Loss?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We have friends that are going to sell their home in Santa Clara, Calif near the new Apple Headquarters. A 57 Ranch 1500 sq ft with foundation issues and their expectations are for a biding war pushing the price well above 2K.

I have my doubts but Redfin has the house at 1.85 so anything is possible. We sold a 2200 sq ft house (Los Altos) only 5 miles from this location for 2.3M late last year and only had one bidder that met our price the other two bids were all cash flippers. Our friends can only fathom a big bidding war as RE agents and neighbors push the meme that buyers will pay anything to live in the area further separating them from any other reality.

These homes are middle class at best its not wealthy neighborhoods so to speak and anyone buying into this market probably has to sell stock plus make very large monthly payments. My friend has not put his house up yet waiting for nice weather and will bypass listing for 10 days with an exclusive RE agent at an inflated price if it doesn’t sell at the inflated price they will list on the open RE listing at a slightly lower price and hope for a bidding war. Its not hard to imagine that this meme is normal among local Santa Clara homeowners.

It seems the residential housing market in Silicon Valley has been pushed up by all the flippers and tech workers. My brother and SIL wanted to move back to SV from NYC and after searching a bit last year realized they would get a very mediocre home for $2 million. As a result, they changed directions are plan to buy in New Jersey, where they can a very high quality refurbished 4k sf house with a big yard for $2 million.

I am in the RE market in SW FL. All real estate is local. There areas in our market that are at 50% of the bubble prices reached in 2007. Other areas reached 120% of bubble prices in 2015 and have since corrected by about 10 to 15%. That said, if a house is priced right and it does not have Mediterranean architecture, it sells quickly.

Ron,

I think your friend will get 2 million easy. Check out what just sold, and it is 5 miles from the Apple campus. Also read the “related” articles at the bottom of this attached article. Lots of tear downs going on, does not matter condition. My neighbor bought his house for $1.6 million, in November 2016, perfectly good ranch house, tore it down completely (without leaving even one wall up for tax purposes). In this one block, three tear downs. Has built a new 2800 sq.ft. house costing $800,000.

He works at Google, she at LinkedIn. Nice young couple in there late 30’s. (funny enough, he hales from Toronto)

https://sf.curbed.com/2018/3/2/17073100/silicon-valley-house-home-sunnyvale-record-price-crisis

“He works at Google, she at LinkedIn”

damn. both in basically the same industry so when the tech meltdown arrives they might end up on the not so nice side of life……enjoy it while you can. My late 30’s was as good as it ever got and it ain’t been that good since.

AND who uses LinkedIn…….these sites just seem annoying to me.

“AND who uses LinkedIn…….these sites just seem annoying to me.”

Literally almost every single professional I know has an account. Whether they actively use it or not, I don’t know, but off the top of my head I can’t actually think of a single person from my real life network who doesn’t have an account on it.

re: “AND who uses LinkedIn”

Recruiters.

Smingles,

do you use yours? And if so, for what?

Anecdotal ‘data point:’

I just sold my small, 1950s-era tract home in West San Jose. We listed on a Wednesday, had a buyer on Thursday and a signed contract on Friday (we cancelled the weekend open house). After a few days the buyer wanted to back out; I let him stew over the loss of his $39K deposit for a few days, then the RE got hold of another buyer who’d seen the original listing (I couldn’t wait for mediation/arbitration/litigation on the deposit to run its course). This is a house of 1,140sq ft in a decent area, hurt somewhat by nearby low-rent/Section 8 apt. housing and a poorly-rated elementary school, but it ‘shows well.’ It’s about 3 miles as the crow files from the new AAPL HQ, about 5 miles from the NFLX HQ and a couple miles from Santana Row (and the new SPLK HQ).

We listed at $1.099M and got $1.305M ($5K over the original sale price).

Why would the buyer have lost their deposit after a few days unless they signed the contract with no contingencies (which would be stupid).

Apparently, in this competitive market, a lot of buyers have to offer “no contingencies” if they want to get the house. Crazy, isn’t it?

The buyer had released all contingencies before he reneged (we had already done all inspections; the house is in remarkably good shape for being 60 years old). The only contingency he had was getting an appraisal at or above the sale price and the appraisal–surprise, surprise–came in right at the agreed sale price (as did the second buyer’s appraisal). The RE agent–who was representing both him and me (3% commission)–strongly advised him against it, but he was hell-bent on buying the house (until he wasn’t).

If the homes sell for $2,000,000 they are not middle class (available to people who earn a wage), as you’ve said. I live (in a van) near Seattle, middle class wage earners are no longer able to buy homes here – that is just the reality. The homes are a commodity asset that can be purchased to escape the crashing dollar.

The U.S. has sent trillions of dollars overseas in exchange for cheap plastic baubles and other imported and mostly disposable junk. Now, foreigners can see the dollars they hold losing value and they need to own a tangible asset. They could buy a flat in Paris or London but that would still leave the dollars in the hands of a foreigner who needs to also unload the dollars on someone else, like a hot potato. Eventually the dollars come home to buy U.S. assets.

There are many more dollars overseas then in the states. More and more foreigners will not need these dollars for trade and those dollars will continue to return home and bid up tangible assets (in dollar terms). The stock market is also supported by the long slow death of the dollar – no one denies it loses value everyday (our overlords tell us a worth less – soon worthless – dollar is excellent).

There is no housing bubble. What you perceive as a bubble is merely the loss of purchasing power of your currency.

True enough, but the home prices–notice I didn’t say ‘values’–in SV are also due to enormous demand and very limited supply. Econ101.

i just had a thought.

it’s the reverse of peter minuit.

the funny part is that the tribe that sold manhattan weren’t the tribe that controlled it.

wait, er……

What I see is a conflation of a need for habitation and concurrent gaming\venture for profit.

When these gaming primers wain (employment, gapping cap gain profits, interest costs, market appreciation, days on market, increases in les pendis actions, etc.) things can change quickly.

Illiquidity of all Real Estate, has no choice but to relies on small amount of recent comps (THE EDGE) to set the value the balance not for sales Real Estate. This is the proverbial small tail wagging a big dog.

Once the dual reason, the conflation is removed, cost of habitation reverts back to historical 35% AGI capacity to service notes.. +\-.

Love the updates, the bubble is quite spectacular although us millennials are royally f***ed. I never thought I’d be hoping for a recession but we need one to weed out the negligent speculation

A recession will not do it. Only a true depression can.

The Greatest Depression(tm)

Keep in mind, in the 1930s while the 90% were really hurting, there were still luxury goods being made, advances in aviation, cinematography, electronics, etc. The top 10% were really makin’ whoopee.

I naturally don’t think we pulled out of the last recession, and from my perspective, we didn’t. I’m making 1/5th what I made in 2005, I no longer entertain any dreams of ever owning a motor vehicle again, and I guess I’m moving to a larger loft than the office I’ve been living in but that’s about it.

So, to have a real, cleansing, Depression with a capital D, things are going to have to get really bad. Bad enough that types like me will be catching pigeons to eat, for the top 10% to even feel it.

1/5th? You gotta find some new work. There are a lot of people out there making lots of money right now. There are a lot of jobs.

Frenzied buying of long term Treasuries (TLT) suggests the epic run has room to go yet.

Only if you can wait ten years for them to mature. Buying them to sell them a year or two from now is risky. I am pretty sure the FED rates will rise until they reach the 3% to 4% range. But we also have all these bubbles that cannot decide when to crash.

Personally I think higher Fed rates will make the regular houses and apartments bubble crash because once the Fed rates reach 2% since they will be greatly preferred over “bricks.” by then. More so with more hikes in the horizon.

Condos is basically a different market but is likely to be affected too.

I mean sure hoping for a short term gain with long term treasures seems like a safe bet but who knows?

Lots of “safe bets” don’t end being so safe.

Then again US treasuries are realitively low risk compared to everything else.

Definitely way a better choice than buying Netfix bonds or Telsa or any of those compnies that hewvily depend on debt to keep going.

And yes I am aware how ironic is saying that with US debt is so huge and getting bigger.

In the end nothing is risk free, in fact you have way more chances of death or injury inside your home than outside it.

“Buying them to sell them a year or two from now is risky.”

I don’t think it is, not at current rates. I don’t think there’s much room to go higher, not unless the economy all of a sudden out of nowhere accelerates meaningfully… which is, well, unlikely.

“I am pretty sure the FED rates will rise until they reach the 3% to 4% range.”

Not a chance in hell– exaggerating obviously as I don’t have a crystal ball and anything is possible. But given what the bond market has been saying since 2008– which is we are stuck in a low growth environment– the curve will invert long before they get to 3%.

30 yr UST rate may likely fail to move mich higher

Prices in Toronto might be coming down but I thought you guys would get a kick out of this.

https://www.remax.ca/on/toronto-real-estate/na-305-shaw-st-treb_c4060764-lst/

This is a hipster neighborhood in TO. Great area and lots of peoeple would love to live there, but it ain’t the “Beverly Hills” of the city by any means. (or even close)

It is insane, kelly. In fact, the above comments are talking about absolute lemming insanity regard home purchases. There is a point where people have to step back off the hamster wheel as far as buying RE and expecting unending price increases. It just isn’t worth the time people are going to spend paying this stuff off when compared to lifestyle. As for realizing future profits on selling out, how much longer can this continue?

Plus, there are reno and upgrade costs, insurance, maintenance, taxes…..

Congrats to Ron and his friend for being able to cash out at an opportune time. Wel done. And, where are you folks going to move to?

I still don’t know what to make of home prices in Cali right now. It doesn’t seem likely a mass sell off of homes is likely, at least not due to risky loans.

But at the same time there is so much investment property ownership in California that any mass sell off by land lords could cause home prices to sink.

It will be crazy if prices keep climbing at a similar pace if mortgage interest rates edge into the 5%+ range.

Or to see if buyers dry up to the point where prices have to come down to move property.

California is a unique market, compared with the rest of the country. Yes, it is a wealthier region, but the prices are even high by that metric. It took me awhile to figure it out, but California zoning and regulatory requirements impede the building of new housing stock. Hence the expensive houses. The market in Texas, on the other hand, is much more flexible in this respect. I think they are better off for it.

“… The market in Texas, on the other hand, is much more flexible in this respect. I think they are better off for it.”

In Texas they build houses in flood plains. Ask the people who bought outside Houston if they are ‘better off.’

https://www.chron.com/news/politics/houston/article/See-where-homes-have-been-built-in-Houston-s-12785993.php

For investors, if they smell yield in treasury is more than rent/price, they will sell. For W2 buyers, yes, there is NOT much subprime, but they will become subprime when layoff starts. But there will never be a lay off, they will print the money to keep suckers from going under, right?

>For investors, if they smell yield in treasury is more

>than rent/price, they will sell.

Indeed. It’s not complicated.

Wolf called it earlier when he broke down the Tax cut and its effects, that in combination with rate hikes = https://www.wsj.com/articles/homeowners-ditch-refinancings-as-mortgage-rates-rise-1522062001

“that any mass sell off by land lords could cause home prices to sink”

that’s been my premise. If you own a couple houses and rents start falling and prices start falling and you’re not getting any younger take the money and run.

“regulatory requirements impede the building of new housing stock”

not really in my neck of the woods, there are condo’s, houses and apartments going up everywhere. There’s a 5 acre park that has just been bulldozed over and a new neighborhood is being built…..last time I saw this happen I figure they could fit 50 houses…….boy was I wrong……not one “house” had a yard and they built what looked like 4 plexes with shared driveways …..they must have crammed 200 homes in that area.

Don’t forget – a good bit of the CA single family housing stock is being used as an offshore bank account by wealthy Chinese nationals. 1 in every 5 RE transactions in the Bay Area is to an offshore buyer and the realtors sun shuttles from SFO for Chinese investors to fly in and find a good home for hot money.

Putting restrictions on this, like Canada has recently done, will have a bigger effect than the media here wants to admit. Perhaps a trade war or souring relations with China could spark that. But the US is the only market that lets this happen without penalty.

Also, thanks to Prop 13, the younger generation is completely screwed while our parents get to pay 1977-era property taxes on a multimillion dollar house and then have the balls to wonder why the schools suck here…it’s really Bizarro World.

With such little inventory and lots of organic demand; if landlords liquidate I think those buyers step in to soak up the new units.

I hate to say it but the government is to blame. With the dumb downed credit scores, up to 55% of gross income to housing payments and lower down payments. Lets all remember the banks are originating the loans not holding them. Getting paid and shipping them off to us the taxpayer. How dumb are we? Real dumb.

Home price increase partly due to inflation. A lot of money floating around looking for a home. Makes housing unaffordable for average working person who spends most of income for a place to live. Wages or savings buy less every day. Government inflation numbers unrealistic…more like 10-12%. Banks paying savers next to nothing in interest. A rigged system skewed towards big financial interest against Joe Public.

I just got ANOTHER credit card offer…….1 year zero interest and then it resets to…..and get this……18.5% after that year…….when I read that I actually said aloud……suck my ……well you get the picture.

A few months ago BoA gave me an offer for 0% for 18 months, with 0% fee on transfers in the first 90 days and a 19K limit card. Ca-ching! The 19K are going into a savings account currently yielding 1.8%. BoA is practically bending over and asking for it ;-)

The interest rate afterwards is 20.24% APR but who cares.

I wouldn’t call this a bubble and don’t expect prices to come down.

First, inventory it’s so low (at least in so cal) that if anything prices will continue to go up. I see multiple offers and houses selling quickly. Wake me up when inventories start to build up.

The charts don’t reflect the rental increase since last bubble. Rents have increased dramatically so a price to rent chart will be more relevant. Cap rates are low but still in the 5% range.

So if you have 1m where are you going to invest today?

I would buy a 5% cap rate building without hesitation, not only are you getting a decent cash flow but capital appreciation too.

Which other asset out there provides a better alternative? None.

In the long run, think housing will come down, it just probably won’t come down as much as financial instruments will. If you figure it’s at a 5% cap rate now and a reasonable long term average might yield say 6.5% then housing has about 20% to fall.

To reach a conservative S&P 500 fair value at about say CAPE 23, the S&P would need to drop by about 30%, although there are reasonable arguments to be made that a fair long term CAPE might be closer to 18. To reach that, the S&P would need to shed almost 45% of its current value.

My personal gut feel says at some point in the next 1.5 to 3 years RE drops 15%-20%. Equities probably 30-37% (after having already dropped about 10% from their top).

Price drops are not gonna happen in urban coastal areas. Foreign buyers need to find assets that will hold value and they have a lot of dollars to unload.

Americans will need to move to flyover country where houses and land will never appreciate (try looking in Cincinnati). Citizenship no longer matters, only money matters.

The urban coasts will be owned by wealthy elites and everyone else needs to get out. These areas are the new country clubs, eventually even travel to these areas will be restricted if you are not wealthy or someone performing a service for the wealthy.

In south bay, not only rents haven’t increased, but decreased. I’m moving out of my apartment soon cause now I can easily find a one bed room for the same price that I’m paying for an studio. Now, the funny part is that, the dumb building owner thinks that she can compensate for her large number of vacancies by increasing the rent and she has sent me a notice in this regard. I was laughing in her face. How dumb can you be to try to increase the rent when a huge number of apartments far better than yours are on the market. Take a look at the number of apartments available for rent in south bay on Craigslist (go to map mode and zoom out to get the total number of available apartments): https://sfbay.craigslist.org/search/sby/apa. The number is 5615 which is a huge number for such a small area; on top of that for each apartment posted, each building has probably at least 5 more vacancies (my building has at least 7 apartments that I know of). Do the math, and you have about 25000 vacant apartments in such a small area.

Another point; the buildings on the other side of the street that I live at are the higher end and more expensive apartments. All the old tenants from the section of the apartment that is in my view have left; what they had to replace the old tenants with? 5-6 Indian men living in one apartment, and this is supposed to be a high end apartment. What a joke. And they keep the myth that the rents has increased in south bay bay 10% year over year. I’m sure those those 6 Indian men living in one apartment pay probably $200 more than the rent that the couple or the single guy who used to live there; but the you have 6 people living in one apartment.

“Now, the funny part is that, the dumb building owner thinks that she can compensate for her large number of vacancies by increasing the rent and she has sent me a notice in this regard. I was laughing in her face. How dumb can you be to try to increase the rent when a huge number of apartments far better than yours are on the market. ”

R2D2, you’re assuming that the landlord’s goal is to fill the space. However, if the landlord doesn’t fill the space, they can use that loss to offset other gains which can lower their taxes (plus they don’t have to deal with as much hassles related to having the tenant). If they do fill the space at the higher rate, it will justify the higher asking rents. So it’s win-win for them. This is also one of the reasons why retail units sit vacant for long periods of time instead of lower their asking rent.

This article talks about it: https://therealdeal.com/2018/04/02/de-blasio-to-retail-landlords-fill-the-space-or-prepare-to-pay-the-tax/

Memento mori: I forgot; so, I guess it’s time for you to wake up ??.

I work in the industry and manage apartment buidings in the so cal area. Let me tell you what I know as a fact, we used to rent 1bd 1ba for $1300 per month in 2013, now the same unit is going for $1800 per month. I also can say that in the last 3 years we had as close as it gets to zero vacancy and are operating at full capacity right now.

We have less than 100 units and they are in good locations and probably does not represent all so cal, but those are the facts.

I follow real estate in the area and I have been outbid the last 6 months for units that went above listing prices at what I thought was insane. But reality does not care about insanity, it is what it is and right now real estate is as hot as ever in the areas that I follow. The way it looks is that RE will go up another 30% and then maybe crash 20% but I dont think we are ever going to go back to 2012 prices.

Never say never

I have seen real estate in so cal crashed many times

The reasons are all different each time but the effect is same

It is all going up until it is not .

We are not comparing 2013 rent to what is now; I’m comparing rents to 18 month ago. I don’t know much about So Cal real estate either. But Bay area is one of the hottest markets specially with regards to rent. And there are these huge number of vacancies. The building that I live in is a good building and in an area with a lot of tech worker; and in the last 18 month, not even one day their craigslist posting, or the leasing now sign has gone away. So, explain the large number of rentals on Craigslist, and also the fact that now you can easily find a one bedroom apartment for $1500-$1600 in south bay while 18 month ago you couldn’t find a good studio for this price.

Memento,

I’m one of the techies who supports your RE industry. You’re right about prices having climbed well about 40% in most areas i see (West LA) since 2013. That goes for sales and to some extent rents too.

I hear nightmare stories from my coworkers, $500/month increase in rent very common and forcing unwanted moves. And though the market looked like it dropped in the zone on the top end by 6%, hardly call it a crash, when we’re still up y-to-y.

But again, i’m the techie who supports these prices by having to live close to work. Many companies build on shaky grounds, looks like money is drying up on a few projects we’re involved in. Clients pulling projects or forcing a faster paced finish to shave off overages which not half year ago didn’t matter to them.

Money is starting to get tighter. You’re predictions of RE are based on demand, but when that dries up then what? and that’s beyond your prediction i’m guessing.

Wasn’t the headline today with the fang drop “TOOTHLESS” ?

I observed exactly similar sentiment in 2006-2007 as well. IN 2004-/2005, the inventory was low and there was bidding wars all over.

Everyone was euphoric about real estate that time.

Real estate is all a game of affordability and psyche.

Once the psyche turns around and people realize it does not make sense to buy at these ludicrous levels and if things simply become unaffordable then it’d fall like a domino.

The definition of “bubble” is price level that can NOT be sustained through up and down of reasonable economic conditions.

Modern days, economic conditions don’t matter as much as monetary rate policies until they do. Even rate can NOT stay low and Wolf has been howlering about rate rise for a while and everybody still thinks rate will stay this low which makes the current house price sustainable, therefore, NOT a bubble. Even the rate stay low, you have to think about rent which reflects the economic conditions. Can the rent stay this high across reasonable up and down economic conditions? Rent is high now, but that does NOT mean now is a good measure of normal economic conditions.

In other words, to say whether this is a bubble, you have to say, can rate keep staying this low? Can rent keep staying this high to sustain this price level? My answer to this is current situation is a fake situation, both rate and economic, and therefore it will NOT sustain, therefore a bubble.

Yawn. This time it’s different…. from the last, what, 5 California housing bubbles?

The myopia is astounding. All it will take is one recession, one market crash where techies lose 40% of their net worth in a few months as FANG crashes, one black swan that can’t be predicted but will be all too obvious in hindsight, for this to come to a grinding halt.

I can’t predict what it will be or when it will come, but the idea that everything will just keep going up is quite frankly, absurd. No market anywhere has worked like that, ever.

Low inventory

Strong Demand

Economy looking strong

Building way down

Doubt there is a substantial pull back in pricing.

The charts represent what is probably not applicable to most of other areas of the US. Silicon V. is right now notoriously out of whack compared to most other areas as is San Fran. Have family in both and left SV about 20 years ago, retired (modestly) to the Sierras. To get a better picture we have to include other areas of the country.

Wolf, I can’t believe you left out Silicon Valley, I’m very curious about how San Jose and all the surrounding municipalities are doing in this situation. I was in Cupertino over the weekend, and there seem to be way too many people even at the Whole Foods there.

I am forced to wonder when this bubble will burst. Considering condos are now going for $1M, it’s just a bit crazy.

I included the northern half of Silicon Valley (San Mateo county) which is part of the Five-County “San Francisco” chart.

If interest rate do continue to rise, the party will come to an end. Underwriting is getting looser. Affordability in the teens is usually what signals the end is near. Of course, a recession would bring it all down pretty fast. Selling my last house in a few weeks. If it’s like the last two , 5 months ago, it will go pending in a week or so.

Promises, promises! In 2008, et. al., I was able to pick up a half dozen SFR’s in SoCal as rentals and flip about a dozen houses as well. I am anxiously sitting on the sideline waiting for the next RE bubble to burst, so bring it on!

There’s a beautiful area about 30 miles south of here, Morgan Hill, unincorporated Gilroy, Uvas Creek, etc., where in 2012 you could buy a house with a barn and a few acres of land for a quarter-million. Oh, to have that kind of money to gamble with, because you know those places are all valued at a million now.

I just don’t know how someone like me gets involved in RE. Become an agent, maybe?

Some Stats on zip code 95051 in SV:

Owned Households With A Mortgage 7,777 37%

Owned Households Free & Clear 2,688 13%

Renter Occupied Households 9,765 46%

Households Vacant 889 4%

Rentals seems to be the driver in this market which is a bit of a surprise as to why the turnover rate in housing is well below the average of 5%.

link to stats:https://www.unitedstateszipcodes.org/95051/#real-estate

Maybe housing prices crashes in northern California like the last time tech stocks plunged. Tech is going to get hammered. When the stocks fall people don’t feel so spendy I sold in Seattle about 18 months ago. Got 1.6 million and its up another 400 k according to the comps. No sellers regret here. The lack of inventory is a big factor in rising prices. Moved out to the Olympic peninsula. After a buying frenzy post election no inventory out here either now

Houses can go in a day or two.

My sf bro thinking about buying a place up here as well. He better hurry up

The Dallas/Fort Worth metrolex is adding about 400 people a day.

I’m not sure where these people are coming from, but I suspect areas with more expensive housing.

Its those dastardly Russian’s!

There’s one behind every tree!

If you draw a straight line on the US home price index graph from 2002 to 2018, you see that at one point (2007) houses were high (over the straight line) and then by 2012 they were lower, but if inflation over this 16 year span is taken into account, are we really in a bubble, or just experiencing the effects of inflation over a 16 year period?

If you extend the straight line to 2027, we we declare housing bubble 3.0,or just wake up to the fact the dollar is declining, and that is most evident in housing “prices”.

Another factor, as Sam Zell once said, there will always be a demand for housing, since people seem to be able to reproduce in such impressive numbers.

Good point on inflation. We also need to probably overlay a graph of salary increase too to see if it has kept up with the rate of inflation. I am guessing not. What has allowed housing to go up faster than wages is the interest rates dropping from around 6% in 23007

Here is what a $1000 payment on a 30 year loan would buy base on the interest rate in parenthesis.

A $1000 a month payment in 1980 would buy a $66k home (18%)

A $1000 a month payment in 1995 would buy a $131k home (8.5%)

A $1000 a month payment in 2015 would buy a $220k home (3.5%)

If interest rates go up to just 5%, a $1000 payment will buy a $186k home or almost a 10% drop in the amount of house a person can buy.

Lets juice this up to a $1500 a month payment.

At 3.5% this will buy a $335k home.

At 5% this will buy a $285k home. That is a 50k drop in just 1.5% rate increase.

At 6.5%, which was the rate in 2007, will buy a home at $240k. That is a $85k difference based on rates in 2007.

So interest rates have surely helped?

I think the answer lies somewhere in the middle. There will probably be a drop at some point, but it won’t resemble the sort of drop we saw back in the original housing bubble.

If we use more current figures like the current median home price ($200,000) and a reasonable current 30 year rate (4.35%), a rise to 6.5% embeds a value reduction of about 20%. In reality I don’t think it will be quite that bad since unlike the 2003-2007 time period where the various home affordability metrics were absolutely off the charts, currently they are well within their historical averages, meaning there can still be some give in prices. Therefore, I guesstimate a possible price reduction of 15-20%. That BTW tracks closely with a different calculation I made using rental cap rates in another post in this thread.

Of course we’re talking averages here since housing prices vary greatly from region to region. In areas where affordability metrics currently show more stress the drop could be more and where they show less stress it could be less.

Houses are expensive and will always be where there is plenty of

opportunity. The gov’t purposeful lowering the value of the dollar

leaves one trying to figure out how to invest.Buying houses seems

like a winner for most.They always seem to go up.

I just remember buying a place for 550 and selling it 9 years

later for 450 . I can happen

I don’t see a bubble in my area, Orange County, CA. Folks are buying to live in. Moving here for jobs. My house is presently valued slightly more than at the 2007 bubble peak, If you adjust for inflation (reduced purchasing power of the dollar), my house still hasn’t gotten back to that 2007 price. I agree with Wendy regarding prices and inflation. Over the past 25 years my house has gone up an average of 5%/yr. I bet this is close to the real life inflation rate, not the manipulated CPI.

I live in flyover country. They say housing tends to rise about 1% over inflation. Unfortunately I calculated the appreciation of my house an it is 1.7% YOY over the past 20 years.

Not as good as your 5%. But I am guessing for many people the homes in my area are still somewhat affordable on an average salary couples avg income. You can get a 3000 sq ft house with 4 bedrooms for a little under $300k or about 100 per sq ft. A new home would probably be a little more at $350k.

A friend of mine looked at getting a mortgage to buy a house in Berkeley, CA for about 1.2 million, and he was told that he needed an income of 150K to get a loan for 800K. (He was putting 400K down.)

The monthly costs would be as follows (approx):

Mortgage: $4,000

Property tax: $1,4000

Insurance: $200

Total monthly housing: $5,600

(The broker left out maintenance expenses which can add up.)

Assuming an effective tax rate of 25% (???), my friend’s monthly take- home pay is $9,375.

That means after paying for housing, he only has $3,775 per month to cover everything else. His housing costs are 60% of his take-home pay (or 45% of his gross pay). If you have a family to raise, I don’t know how you can stay under $3,775 per month when you consider things like childcare and piano lessons.

I don’t understand how lenders think that this person can manage those kinds of monthly payments. And I wonder if we’ll eventually see people defaulting on these kinds of outrageous mortgages on relatively modest salaries.

Everyone knows that housing prices always rise especially when bank holding companies are allowed to leverage to infinity on the taxpayer’s dime. The Gorilla of Wall Street leveraged 44:1 before he got a haircut, time off, and severance.

Bears eat, & bulls eat, but gorillas get slaughtered.

MOU

Is it me, or this article has caught the attention of a lot of people working in real estate??

WOLF STREET has long had a lot of readers who work in real estate. Only a few comment normally. I know some of them personally.

I have a question about the graphs, if you will indulge me.

On most graphs Housing Bubble 1 looks like a pretty much perfect curve, the very definition of a true asset mania.

But… Housing Bubble 2 seems to be mostly composed of steep peaks followed flat spots. This is most unusual behavior.

I know all real estate markets are different but explains those flat spots followed by frenzied price growth? A large supply coming on the market at the same time? Stock market growth allowing people to borrow against their equity? Periodic aggressive expansion by lenders? Something else?

Thanks!

Here’s one factor, but there are likely other factors involved: Housing is seasonal, with a downturn in the winter. I have noticed that the seasonal flat-spots disappear when the fever gets very high and they reappear when the fever, though persisting, comes down a little.

In short the 20+ years mortgaged equivalent of shopping frenzies filling mall parking lots to the brim for no reason in particular? Makes an awful lot of sense. And it’s pretty scary.

Thanks.

>I know all real estate markets are different but explains

>those flat spots followed by frenzied price growth?

The flat spots have been when prices reach the FHA lending limits, the government eventually raises the lending limits and the party resumes.

if you adjust for interest rates, ah, never mind. but prices are a tad high for an investor.

The common denominator for many of these cities is the tech industry and its well rewarded employees who can afford to rent/buy million dollar properties. If tech turns down like the dot com bust then I would expect that to have a flow on impact the these local RE markets.

Out here in Western Mass/Northern CT prices have been stagnant for a decade….it doesn’t help when you live in a state like CT with a declining population! The flipside is low housing prices make the cost of living here relatively low, but don’t count on your home to add anything to your net worth here.

http://www.courant.com/business/hc-biz-connecticut-population-20171221-story.html

Valuation: the “intrinsic value” of a house is approximately it’s replacement cost less some wear-n-tear or obsolescence (“real” depreciation of the asset). So, the r e bubble that everyone is hyper-ventilating over is all about land value. The actual construction cost for a SFR has probably not increased in the last 20 years (can’t verify this but I think I”m making an educated guess). Fees and such have gone up, though. So, the metro areas have inflated while the rural areas of the country have seen stagnant or worse house pricing, regardless of inflation. Throughout the U S, where employment has evaporated, there have been dramatic, silent price devaluations. And the decline is continuing.

Remember the ratio of manufacturing vs. service sectors, how that has shifted over the last century? The service sector jobs require populated areas; as manufacturing disappears, so do the associated service jobs. The Case-Shiller index doesn’t measure rural housing. And few people care. But you can get older mansions at prices in the $35/sq ft range in what was once a very desirable area in cities which are now ghost towns – in W. Virginia, for example.

If the the hot job markets begin to cool, or if the effects of global warming get beyond the hypno-denial level, look out below.

I came across this article. The head of a New York mostly housing developer, Douglaston, places the blame for the decline on the Trump tax cuts. How much of this is the truth versus a convenient excuse, I don’t know.

“Levine believes the next downturn is “upon us” and that the tax reform has put the condo market “in the toilet” because homeowners have lost the ability to deduct the interest on high-priced properties.”

https://www.bisnow.com/new-york/news/commercial-real-estate/sl-green-brookfield-worry-aging-infrastructure-poses-threats-to-new-yorks-cre-86338

condos a tad overbuilt in high dollar areas, yes. arithmetic not working, yes.

and, screwing the higher earning parts of the country isn’t the brightest idea, but it might work for a little while, because resentment is a unifier, solidarity forever.

so, my take away from the comments section is “this time is different”

I just walked the High Line park along NYC’s west side with an out of town visitor. Even for a New Yorker like me the scope and size of the residential construction activity over the 20 street distance is at a “shock & awe” level. My friend and I speculated that given the price these flats will likely command the demand is driven by hot capital flows from Russia, Middle East and China. This may bode well for the outer boroughs and suburbs as prices drive the worker bees out of Manhattan.

If it’s hot money flowing into those projects, especially those near the north end of the High Line and Hudson Yards, it’s being deployed with a lot of local political and financial juice.

Mayor Michael Bloomberg jump-started the area’s development, with his ex-Lehman Brothers banker, deputy mayor and head of Bloomberg, LP, Danial Doctoroff as his point man.

It’s a lesson in how quickly things can get done, when elites are all in agreement: Bloomberg was able to get the #7 train extended to Hudson yards almost overnight, anchoring property values for the developers, while other projects were mired in delays and cost overruns, or not funded at all, for years.

Funny, that.

Michael – very good insight on the project scope/speed of when the juice flows and elites agree. The construction goes the entire length of the High Line and includes smaller projects but almost every street has something being renovated/expanded. The open question is whose going to buy these things and whose going to take the hit in a recession?

Eventually this will drive companies out of setting up in high cost areas. Real estate in mid-sized mid-western and southern cities are 10x less expensive than the major coastal areas, and many don’t have other big city issues.

I would like to see similar analysis of non-metro areas. For instance, I live in Bozeman, MT and while the median house costs a little under $400,000, the wages in the region do not support it. This town has had sustained high-growth rates for five years or so, but because it has a total population of under 50,000 it falls into a category that is not generally looked at. In my opinion, when these micropolitan areas start gathering bubble trends, it is an indicator that a bubble is gathering nationwide.

Contrast the residential market to the traded commercial real estate market. The NAREIT pure property index series indicates that commercial property prices have dropped by approximately 10% since 4Q17. What is different about the commercial market is that there is cash flow underlying the properties and the growth rate of free cash flow is still quite healthy by historical standards.

Wolf, you should look at case-shiller housing prices in the Nashville, TN area,. They are up huge since the last bubble, maybe more than anywhere else. I looked them up because my father-in-law took a business trip down there and told me about how ridiculously expensive everything was.