But Cryptocurrency hedge funds fell off a cliff.

Artificial intelligence and machine learning are everywhere, in your smartphone, when you’re on Amazon or Netflix where they decide what you might be interested in next, in online advertising to determine what ads you’ll see…. They’re in ordinary devices that adjust to your preferences, and billions of dollars get poured into it every year because this is the next Holy Grail that’s going to revolutionize the way we live.

And hedge funds use it too. And when the first major sell-off in two years came along in February – an unexpected event in a market that can only go up and where all models where optimized to reflect that simple fact – these hedge funds got crushed.

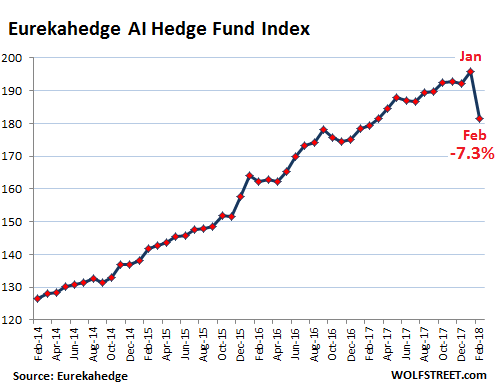

This morning, Eurekahedge released its monthly hedge fund indices for February, including its AI Hedge Fund Index that tracks 15 hedge funds that use artificial intelligence and machine learning for their trading decisions.

But AI is having a hard time. Machine learning apparently figured out, given how stocks have behaved over the past two years, that in this market there will not be a sell-off ever again. And then the sell-off happened.

The AI Hedge Fund Index plunged 7.3% in February from January, its worst month ever. It’s down 5.5% for the first two months this year, when the S&P 500 index was up 1.5%. But in 2017, when the S&P 500 index rose nearly 20%, the AI and machine learning luminaries were able to cobble together a return of 9.9%.

Eurekahedge has tracked the AI hedge-fund segment since 2011. This chart shows the index for the past four years. The plunge in February took the index back to March 2017:

“The first equity correction in two years upended their strategies as once-reliable cross-asset correlations shifted,” Bloomberg noted:

The slump even surpassed a more traditional category of quants, commodity trading advisers or CTAs, which posted near-record losses as the equity reversal hammered the automated trend-following strategies.

There is some suspicion that machine-driven funds – whether classic quant funds or AI funds – can speed up and deepen sell-offs. JPMorgan Chase strategists wrote in a note on Friday, cited by Bloomberg, that adoption rates of AI and quant trading have increased, which is making AI strategies more crowded. “In all, we find that AI funds, similar to CTAs, likely played a big role in February’s correction by being forced to de-risk given an unprecedented 7.3 percent loss over the past month,” they said.

So it seems AI-driven algos have a little more machine-learning to do to get beyond their understanding that markets can only go up.

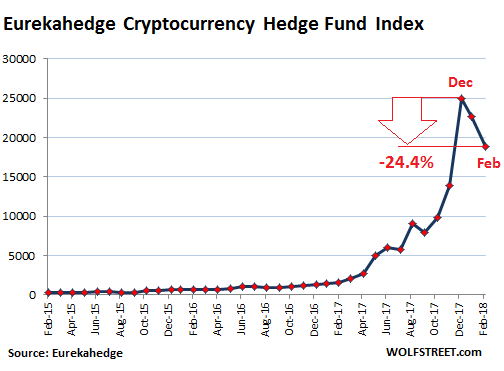

But the AI Hedge Fund Index wasn’t the worst performing index in the bunch. Far from it. The honor went to Eurekahedge’s Crypto-Currency Hedge Fund Index, which tracks nine hedge funds engaged in the cryptocurrency space.

It plunged 16.8% in February, after having already plunged 9.1% in January. It’s down 24.4% for the first two months this year. This chart shows the downfall after the exponential rise in 2016 and 2017:

But note the December spike: it was so mind-bogglingly ludicrous – the index shot up nearly 80% in just one month – that the January and February plunge, as steep as it was, only wiped out half of the December spike.

Speculation running rampant? The QE Unwind’s “very slow pace may still be contributing to a buildup of various financial imbalances.” Read… QE Unwind Is Too Slow, Says Fed Governor, Thus Launching First Trial Balloon

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

For me, the problem with all quant trading of any sort in any market is that the assorted dynamics of various types of moves are all a bit different. Additionally (and this is obvious but seems as if some very smart people don’t get it) almost every type of trade has dynamics of its own.

As a coder, you try to allow for an optimal handling of move type 1. But then after a sufficient amount of backtesting (assuming a solid enough data set and after tossing out aberrant circumstances – ie the 07-09 period in almost every market) that keeps you from being able to get type 2, 3, 4, etc as fully as you want. You then either have to hyper-optimize or make things broader and neither is a particularly great alternative. Not that I’ve ever had this job or anything ;)

So these quants do fine with certain environments for which they are optimized but if something goes a bit cockeyed then all hell breaks loose and you then get Transformers-style fights between one machine and another.

Just one techno-geek’s opinion here, but I think the resultant chaos makes for all sorts of inefficiencies that can be exploited. But only if you are a person and can pick up on that! (oh the irony).

You nailed it. Trying to figure out an edge in Tiers 2,3,4, with each higher layer acting as a context, is really damn difficult! You find one in a backtest but then perturb it, or walkforward, and the out of sample goes to hell (statistically speaking). That being said, I’m a bit surprised these quants, with all these resources, apparently overreact this strongly!

Well Said!

AI can only learn what you feed it. If all it has seen is constant upward momentum, it would not know how to react to downward momentum. Garbage in, Garbage out.

but but but … SELF-DRIVING CARS!!

I’m assuming that hedge funds can afford to buy old data from different kinds of markets. That they didn’t is indicative of a problem that isn’t technical in nature.

A lot of historical market data is available online. I’m guessing they never bothered going back to the 30s with the data.

1) if you don’t know who the sucker at the table is …..

2) Makes me think all drops are man made in origin, prompting the bigger question of why any drop occurred at all.

Once AI learns deceit, caprice, and avarice, then, and only then, will it keep up with humans.

Poor things were programmed by pompous programmers, what chance do they have.

Humans have hours and days to survive a crisis. Pull the plug and these pathetic creatures are done.

Aaaah, those clever hedge funds. They figured out a way to program their machines to Buy, Buy, Buy as long as the VIX hovered around 10. To ensure it did hover around 10, even as the market continued to reach for the stars through 2017 and Jan 18, they shorted the VIX with derivatives like XIV and SVXY. They had fun at the party until early February, when some of them wanted to go home. So they started to cover their shorts on the VIX. Only problem is, the machines didn’t like that, and started to Sell, Sell, Sell. So what started out as orderly short-covering very quickly morphed into a massive short-squeeze with a negative feedback loop, and the rest is history, as they say. This is just my suspicion as to what happened, but I wouldn’t be surprised if a thorough investigation proves me right.

I read an article about bots being used to drive up crypto currency values. Computers scamming other computers. Playing them for suckers… downright human.

Oh, yeah – I read it on this blog, the article about crypto currency manipulators going to jail

Never trust what paid journalists write. They have been feeding us that AI will be smarter than humans. Further, we are told innovation is dead. Innovation is doing what is not expected— that’s what the patent office calls non-obvious.

I interviewed with one such hedge fund a decade ago. They were proud of the fact that they, like others, would train a neural net based on data set bought from a third party. Where is the business advantage, I asked? There was silence in the room, in response, as if I had asked a stupid question.

Since AI learns from data, it’ll not be trained on edge cases. This is what Taleb was pointing out a decade ago when he said we did not understand behavior of Normal curves in tail regions. The quants spent time in safe zones near the middle of the curves until they saw an event they couldn’t model well. These AI driven entities are still making the same mistakes believing that throwing more lingo and verbiage will Make up for ignorance. What one doesn’t know, one doesn’t know. This is where one’s experience and gut feelings come into play.

Ever notice how ESPN’s success tracker shamelessly flips probabilities once ground realities change? Consider the game where Patriots were losing to jaguars in AFC finals in 2018, until a single touchdown sealed the fate. ESPN tracker gave jaguars 68% probability of win before the fateful touchdown. A few seconds after the Patriots got their touch down, it claimed Patriots had a 68% chance of win. Just like that, the numbers flipped. If espn had claimed that Patriots had a 68% chance of win when the going was tough, that would have been good use of AI. What espn was doing was counting frequencies. Fancy name, stale ideas. So what these entities are doing, imo, is simple statistics. I was told by my school counselor that the chances of students finding a job that year were very high. Some people got multiple offers. I got none. Statistically, the numbers were right even though the prediction was wrong where it mattered most to me.

Very interesting take and very enjoyable read, Guido. Thanks.

As the prospectuses all say: past performance is not necessarily an indication of future performance. However, perhaps the AI systems can start spotting market manipulation.

AI has been ‘just around the corner’ since the ’60s (a little longer than I’ve been in tech). I haven’t kept up with the ‘theories’ lately, but as far as I can tell it’s still rules-based or neural nets, just with better numbers crunchers (Anybody remember ‘fuzzy logic?’ The Japanese were going to eat our lunch with it). Even the vaunted IBM Watson appears to be mostly a very powerful search engine, with massive DBs and an a good inference engine.

I’ll believe ‘AI’ is real intelligence when a machine spontaneously paints a Mona Lisa-grade work of art. Until then, it’s (arguably) more sophisticated algorithms, nothing else.

Yes, and algorithms are little more than opinions, assumptions and interests embedded in code.

“Just around the corner”? Well, while you weren’t looking that bus turned the corner and ran you over. Ever used voice to text? Or spoken to a robot to make flight reservations, etal? That is some smart as AI tech, IMO.

I’ve written those types of simulators for sports before and the numbers you used sound correct to me. The flip flop is a feature, not a bug. As you said, it uses cumulative frequencies, and a change in score late in the game is supposed to flip the probability. I highly doubt ESPN’s simulator is using ML algorithms!

Also, although each model is different of course, my experience is that various ML approaches to financial data are over-influenced by edge cases, not under. Lots of effort has to be expended to make sure a model hasn’t run to the comfort of a powerful edge case. I suppose everyone’s mileage may vary, however.

Bad robot! You just can’t predict rational human behavior in the current stock market. Just look at all the ripples tiny little Greece set off every time it made the news. The sky never fell but stocks sure did at the time.

AI & Quantitative Mathematicians are linear thinkers programmed to spot macroeconomic ‘metrics’ that are quantitatively significant when markets have attained relative equilibrium. When markets, and ‘metrics’ are naturally strained with respect to credulity of market participants we evidence flash crashes on expectations of both the live trader & Algo expectations. Expectation and observations are mutually exclusive. Macroeconomics relies heavily on spot measures in time whereby time is viewed as static for the purposes of betting against it. In actuality, the markets are in a state of flux at all times so any measure that assumes differently is naturally going to fail at least some of the time.

All markets, and so-called ‘metrics’ are now in a state of decoherence of the wave function if we are to take a different perspective that is intuitively counterintuitive and the obverse of macroeconomic measure in time. That counterintuitive perspective is Quantum Mechanics & Quantum Behavioural Economics. Quantitative Mathematicians must now become Particle Physicists and view the decoherence of the wave function as a sign of disequilibrium in markets, and AI betting outcomes.

In Particle Physics & Quantum Theory when one ‘observes’ a ‘spot measure’ in time one is automatically taking a mathematical measure of a particle in a continuum of time that is analogous to that which is static and NOT in a state of flux. The wave properties of ‘spot measures’ are NOT factored into the mix at the Quantum Theory level if one is building off of a substrate that is not actually static.

The 08 crash was a wave of decoherence evidenced at a quantum/atomic level that is still reverberating through markets today.

Instituting a false sense of market stability with stock buybacks and QE Infinity leads to low VIX readings when in fact volatility is rampant but just not recorded with the VIX.

Should the Quants & Algos commit themselves to the firing squad?

YES.

MOU

“All markets, and so-called ‘metrics’ are now in a state of decoherence of the wave function if we are to take a different perspective that is intuitively counterintuitive and the obverse of macroeconomic measure in time.”

Just one question …should I buy or sell?

What is Warren Buffett buying & selling?

And I hope you listened to RBS three years ago and decided to SELL EVERYTHING because the NYSE has never in the history of trading had such nosebleed levels of overvaluation on stocks.

If I actually had two dollars to scrape together I would not invest in the stock market. And if when you look around the poker game table you cannot find the sucker it is likely you that is the sucker in the game. If that’s the case SELL.

Heck, after selling everything for the last few years I have learned to enjoy selling more than buying.

MOU

AI can probably put a good value on the market, and if you follow the last Hussman charts, (The Arithmetic of Risk) you can appreciate how value and reality can diverge. A competent value driven AI program should be selling this market at every opportunity. The caveat to Hussman’s value thesis, is money flow, and any AI program should know how much money is being printed, how much is available for investment, how much that money can be leveraged, and which markets seem most suitable. In a global economy measuring these things is a daunting task. In my OP the FED solves this problem by reducing their definition of what an economy is, (there is more economic activity than anyone imagines). So where does the data that feeds AI come from, answer, the Fed.

AI uses lots and lots of data, however it’s still up to humans to pick the data set because if you use all the data, all it tells you is that shit happens and you’ll get wiped out occasionally ……. and maybe, just maybe it’s better not to trade.

It’s those naughty swans again, not even the black ones. My surmise is that liquidity is entirely unpredictable unless other machines with well known algorithms are providing said liquidity. So assume equilibrium as suggested in an earlier post or just forget about AI.

AI does not exist of course. And it’s not clear whether it can ever exist.

Government is artificial intelligence, and it exists, especially on K-Street in DC.

MOU

AI recognizes patterns in data. It will see patterns that humans can’t see. Give it a giant data set and a problem that can be modeled as a linear equation (of any size) and the results are amazing.

The hard thing is the selection and procurement of a good data set.

If the tool is trading autonomously, you need a terrific and very clean data set. Else you need to set constraints and tell the thing to stop trading when things look strange or out-of-the-box. I believe the latter is what the hedge funds have set their algorithms up to do — “S–t is happening! Pull the chute!” That means you need a human on standby to make or save the money in a crisis. The algo is your everyday earner.

Okay, I am sure some PhD’s have set up nonlinear models. But I doubt they can be relied upon.

Bulls eat, & bears eat, but pigs get slaughtered.

Old Wall Street dictum.

Non-linear operating model of Wall Street for over a century.

MOU

I would add that “pattern” recognition is the wrong application of AI, correlation is not causation, and data tends to mirror the programmers bias. In short most work on “cyclical” patterns in stock markets is BS. If patterns work how is that conventional TA shops at the big brokers were shut down. Not even fundamental research matters, what matters most is liquidity, and should liquidity contract it might be that old metrics will be found useful.

The days of retail buying and public participation in the market is fast vanishing. How can we expect the common public to understand the mechanism of machine learning, the almost infinite permutation of decisions and then try to front run these decisions. No way can they profit from participating. The ground is now the domination of those few who can now influence the index, the trend, the transactions, the prices etc. Watching the market these last 2 months provide the feel of this happening. Some news, quickly taken up by the main media, the up and down response almost immediate. Nothing with business performance. The eco trading system is very akeen to the bitcoin environment.

Many years ago while teaching in a business school I wrote a Management Game. Tunable parameters, business climate algorithms, responses of participants algorithm accessment and hey presto there a new scenario. Yes profit manufacturing and mining. Only for the privilige

few . The rest please stay out.

Programmer bias, the AIs were probably ignoring the FED months in advance warnings about their rate hikes, and the effect even such small hikes would have in the economy.

So when they unplug and with the little liquidity in markets, someone finds a buyer but for 50% less, does the panic start? Computers cannot account for non-linear behavior.

AI seems like a logical solution to an illogical market, and herein lies the problem. AI may take the emotional element out of trading, but expecting it to work any better than the sophisticated mathematics developed by Long Term Capital Management wizards is wishful thinking. LTCM solidly beat the market for years, until it suddenly succumbed to a “random” event, almost bringing down the US economy with it. Sadly, many of the mathematic geniuses that developed the algorithms had all their money invested in LTCM, and then had their head handed to them. So, with AI, here we go again……

Actually, this is a simple matter of correlation. The AI scientists probably went to the same school. For that matter many of the programmers as well.

They all did the same model, with some little differentiation here and there, but either way when one AI fund says sell, the others probably are selling too, bringing each other down.

Exactly correct. Irrationality and black swan events will always mess up your AI model. If AI worked, it would have been doing a bang-up job of predicting earthquakes, avalanches, and hurricane paths with great and improving accuracy over time. AI may work for medical diagnosis and other logical decision-making, but good luck trying to predict a black swan event BEFORE it happens. We all desire a predictive model to comfort us, but for now tea leaves and my trusty 8-ball are right 51% of the time. Ask again later…….

I have to say there are some excellent well thought out posts made on this board!

I have been in computers since the late 60’s and have seen it evolve exponentially since that time, especially the hardware, and the computers then would execute 250k instructions per second, and took a whole floor to house the equipment, but today you can buy off the shelf high-end computers that executes well over 150 billion per second, and with a high-end graphics card it’s 11 trillion per second!

In the mid 70’s we were told by the year 2000 us programmers would be replaced by chimps – LOL, and AI was heavily discussed then, all the way up today where it’s a household concept and name.

Computers are still doing the same thing they did years ago except incredibly faster, and will add the graphic interfaces (GUI) have made things more transparent and easy to use.

However all that said, I will add that AI is still in it’s infancy and yes like some of the message boards I follow when it’s a bull upward market the AI and all the fancy TA indicators work real well, but when you have the Fed announcing increases of the interest rates, unforeseen economical events (tariffs, defaults, fraud, trade wars, defaulting countries, investor sentiment changes, cyber attacks, politics, wars, etc, etc) – that can never be programmed for, only how to react to a falling market can be programmed.

These programs are still using linear logic in a non-linear world – simply stated, – that are being used for market buys/sells.

When it comes to Watson and medical research, etc, and things of that nature then it will be able to make huge discoveries, medicines, and treatments, etc, etc.

There will become a time probably within the next 10-25 years that AI will have learned enough the hard way as us adults have, and have more advanced parallel capabilities like humans have, and exceed a human minds exponentially – but it will be a long process, but it will happen, and every invention man has ever made has been used as a weapon, just like the internet has, that I predicted would happen over 20 years ago, and that’s talked about everyday!