But after the last two times, there was a “financial event.”

There has been a lot of hand-wringing about junk bonds this week, that they have gotten clobbered, that losses have been taken, that this is a predictor of where stocks are headed, etc., etc., because after a steamy rally in junk-bond prices from the February 2016 low, there has now been a sell-off.

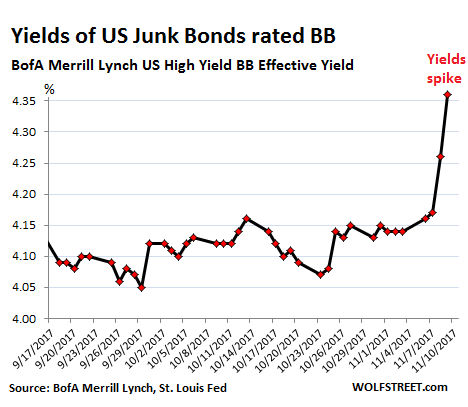

When bond prices fall, bond yields rise by definition. And the average yield of BB-rated junk bonds – the upper end of the junk-bond spectrum – did this:

No one likes to lose money, and junk bonds did lose money this week, an astounding event, after all the easy money that had been made since early February 2016. But how far have yields really spiked?

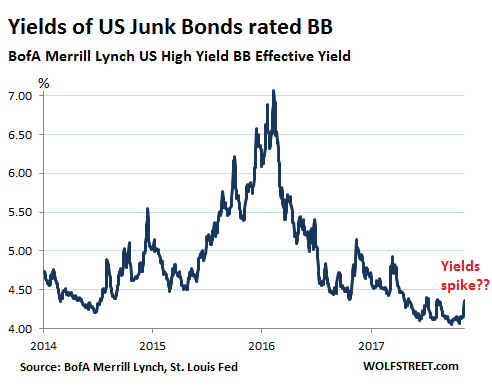

The chart below shows the same BofA Merrill Lynch US High Yield BB Effective Yield index, but it puts that “spike” into a three-year context:

For further context, the BB yield spiked – a true spike – to over 16% during the Financial Crisis, as bond prices crashed and as credit froze up. Currently, at 4.36%, the average BB yield is off record lows, but it’s still low, and junk bond prices are still enormously inflated, given the inherent credit risks, and have a lot further to fall before any hand-wringing is appropriate.

The low BB yield means that risky companies with a junk credit rating can still borrow money at near record low costs in a world awash in global liquidity that is trying to find a place to go. This shows that “financial conditions” are very easy.

The market has now four Fed rate hikes under its belt and the QE unwind has commenced. Another rake hike is likely in December. Tightening is under way. By “tightening” its monetary policy, the Fed attempts to tighten financial conditions in the markets. That’s its goal.

But that hasn’t happened yet. While short-term yields have responded to the rate hikes, longer-term yields are now lower than they’d been at the time of the rate hike in December 2016. Stocks have rocketed higher. Volatility indices are near record lows. And various yield spreads have narrowed sharply – for example, the difference between the 10-year Treasury yield and the 2-year Treasury yield is currently just 0.73 percentage points. In other words, raising money is easy and cheap.

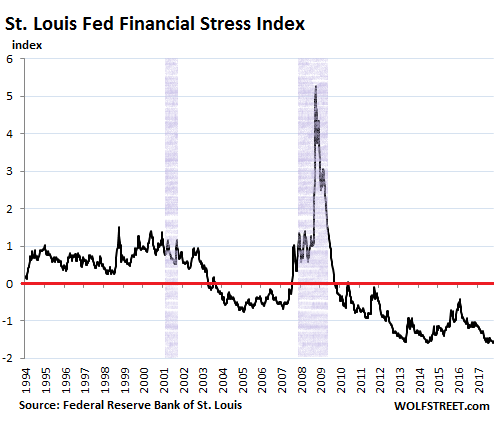

And “financial stress” in the markets, as measured by the St. Louis Fed’s Financial Stress Index, has just hit a record low.

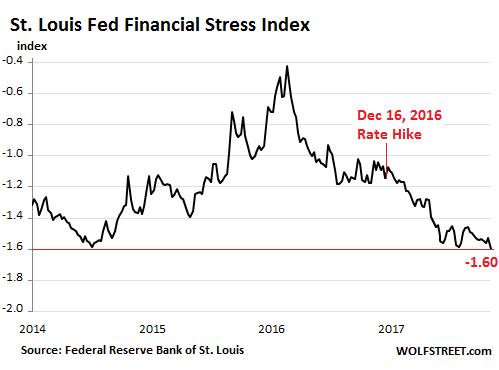

In the chart below, the red line (= zero) represents “normal financial market conditions.” Values below the red line indicate below-average financial market stress. Values above the red line indicate higher than average financial stress. The latest reading of the index dropped to -1.60, by a hair below the prior record low in 2014:

In other words, financial conditions have never been easier despite the current series of rate hikes, the Fed’s “balance-sheet normalization, and the hand-wringing about junk bonds this week.

The chart below shows the Financial Stress Index going back to 2014. In that time frame, all values are below zero. Financial stress in the markets was heading back to normal in late 2015 and early 2016, as a small sector of the total markets – energy junk-bonds – were getting crushed and as the S&P 500 index experienced a downdraft. But in early February 2016, everything turned around:

While the index is not a predictor of anything, it is an excellent thermometer of financial conditions in the markets overall as each of the 18 components “captures some aspect of financial stress,” the St. Louis Fed explains. These are the components:

Seven interest rates:

- Effective federal funds rate (the Fed’s target)

- 2-year Treasury yield

- 10-year Treasury yield

- 30-year Treasury yield

- Baa-rated (investment grade) corporate bond yield

- Merrill Lynch High-Yield Corporate Master II Index (junk bond yield)

- Merrill Lynch Asset-Backed Master BBB-rated yield (low end of investment grade)

Six Yield Spreads:

- Yield curve: 10-year Treasury yield minus 3-month Treasury

- Corporate Baa-rated bond minus 10-year Treasury (corporate credit risk spread)

- Merrill Lynch High-Yield Corporate Master II Index minus 10-year Treasury (high-yield credit risk spread)

- 3-month London Interbank Offering Rate–Overnight Index Swap spread (3-month LIBOR-OIS spread)

- 3-month Treasury-Eurodollar spread (TED spread)

- 3-month commercial paper minus 3-month Treasury bill (commercial paper spread (3-month))

Five other indicators:

- P. Morgan Emerging Markets Bond Index Plus

- Chicago Board Options Exchange Market Volatility Index (VIX)

- Merrill Lynch Bond Market Volatility Index (1-month)

- 10-year nominal Treasury yield minus 10-year Treasury Inflation Protected Security yield (breakeven inflation rate (10-year)

- S&P 500 Financials Index

So markets, as tracked by these 18 indices, have blown off the Fed’s tightening measures. But that too is normal. There is usually a fairly long lag between when the Fed begins tightening and when markets react.

It happened the last two times.

The Fed started hiking rates in June 1999, from 4.75% to 6.5% by May 2000. Stocks surged until March 2000. It took 9 months before financial markets reacted. And they reacted with a financial event – the dotcom crash.

The Fed started hiking rates in January 2004, from 1% to 5.25% by July 2006. Throughout, stocks surged and the housing market ballooned. It took nearly four years before this tightening phase too became a financial event.

Eventually markets react. But not yet. Not today.

New York Fed President Dudley is quitting. If Yellen decides to leave in February, there will be five vacancies to fill on the policy-setting FOMC. Read… The New Fed Could Be Off the Charts

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The only thing that is going to take down these Ponzi markets is some exogenous geopolitical event that throws these rigged, broken, manipulated markets into turmoil, possibly through causing a new oil shock (MidEast scenario) or disrupting shipping lanes (China making a power play in the South China Sea) or the shock to Asian markets if a war breaks out on the Korean Peninsula. None of these scenarios appears imminent, though that’s not to say a black swan could take wing with little notice. Otherwise, with central bankers continuing to expand their balance sheets by at least $2 trillion a year, global markets will keep grinding higher, ignoring central banker jawboning about mythical dot plots or unwinding their grotesquely bloated balance sheets by inconsequential amounts.

Central banks are reportedly printing money at the rate of $300 billion per month without the Fed, or at the rate of $3.6 trillion per year.

Unless there’s a rigorous audit of all the central banks – a forlorn hope – none of us mere mortals can possibly know the extent to which they’ve been propping up the Ponzi markets and asset bubbles they’ve created. Only that they’ve created monstrous distortions in asset prices, rigged the game in favor of their oligarch cronies, and set the stage for The Mother of All Global Financial Crashes.

Assets keep climbing, currencies keep falling. Nothing will change. The Fed has talked about normalizing rates for years yet rates are still at an emergency level of 1.125% and well below even the official rate of inflation. Taken as a group, the developed market central banks continue to flood currency into asset markets and they will continue forever because it’s needed to monetize government deficits.

I keep hearing central banks “are out of dry powder”. What nonsense! Central banks have a limitless capacity to create new currency and they will never stop. Eventually people will lose confidence in currencies and there will be a monetary crisis but central banks don’t appear to care because they consider the alternative worse (defaults, bankruptcies and liquidation) – wealthy people would take a hit if that happened, can you imagine (never gonna happen).

I don’t understand why anyone would still cling to the meme of central bank tightening. You can choose to believe this fantasy if you like – be sure to tell me how wrong I was if interest on savings ever exceeds the rate of inflation, but don’t hold your breath it’s never going to happen.

Yes, and I know some people are tempted to say that our disbelief is exactly why the Fed will seriously tighten (we’re “throwing in the towel” as they say).

However, I also know that WHEN there is a downdraft, they will ride to the rescue again so V_D_B_R’s comment is still accurate, short term antics not withstanding.

That is correct, central banks never run out of dry powder, they can theoretically create enough currency units to buy up the entire planet. They will create currency units until there is a currency crises, and then they will create more.

You are right. They are not out of powder. The Japan Centraol bank is buy ETFs. The can prevent a crash from ever happening again. Of course it may mean they own all the stock of all the companies listed on the Nikkie. lol

South China shipping lanes are really only important to China, and they can always ship goods to Europe by rail now at least. Oil shock sounds like the most likely scenario although that will throw up renewables stock. The baby boomers retiring might be an issue (as pension funds and private buyers have to start liquidating stocks/property for more immediate funds but the younger people trapped out by automation gig economy don’t have funds to be buying them. No demand at that price and holders can’t afford to sell and take losses

People–all people–are terrified to bring this on, because when it happens it won’t be a recession–it will be a financial black hole which wrecks the supply chain. As if anything else matters: all eyes are on the supply chain, because that determines whether or not the society collapses.

FDR asked: what are bonds doing? That is not the question now, the question is: what is the supply chain doing? And everyone knows it. How much dark money is there, 6 quadrillion? 20 quadrillion? It doesn’t matter, we have passed the point of no return.

I think it was Tocqueville who said, Sire, we are dancing on a volcano.

Now what?

“The Fed started hiking rates in June 1999, from 4.75% to 6.5% by May 2000. Stocks surged until March 2000. It took 9 months before financial markets reacted. And they reacted with a financial event – the dotcom crash.”

“The Fed started hiking rates in January 2004, from 1% to 5.25% by July 2006. Throughout, stocks surged and the housing market ballooned. It took nearly four years before this tightening phase too became a financial event.”

In the first paragraph the stock market actually topped out in March 2000 one month before rates topped out. In the 2nd paragraph the stock market topped in October, 2007, one year three months after rates topped out. The stock market peaks in both cases came much sooner than the later known “financial events” became known.

The markets can stay irrational longer than you can stay solvent, but the longer they stay irrational, the deeper they fall.

Incorrect. My unleveraged ag and au physical long position can stay solvent longer than the markets can stay irrational.

Death to the money changers.

Haus, you sound like a believer the government can handle the fall. The main asset will be population cohesion that helped survive wars, starvation and hyperinflation. Some had it, some lost it.

You seem to put a lot of faith in humans valuing gold in the future. Consider:

1) There are tons of the stuff laying around in vaults

2) it has no value as money (just try buying groceries)

3) If it appreciates the government taxes it at a 30% rate

4) Governments can make (and have made) it illegal to own

5) It’s easy to counterfeit (gold plated tungsten anyone – a good reason why it will never be used as money again)

6) The younger generation does not seem to hold the same fascination for gold – when was the last time you saw someone under 40 wearing gold jewelry (they’ve even started to wear wedding rings made of other material).

I don’t much like Buffet, but I think he is correct about gold.

Precious metals are the ultimate hedge and protection against the debasement of the currency by the central bankers. Once producers start refusing to accept debauched FedBux and other backed-by-nothing fiat currencies, the rush into the safety of physical precious metals is going to be epic. Let the government declare them to be illegal – good luck trying to confiscate people’s gold in a scenario where we’ve had a total economic collapse thanks to the criminals at the central banks and the profligate tax-and-spend clowns on Capital Hill. You want my gold? Come and take it.

1) All the gold ever mined is about the third of the volume of the Washington monument.

2) Gold and Silver still continues to be used as currency in economies that have tanked.

3) Other items have increased in value and can be taxed as well. Even soda in some areas is taxed.

4) Making something illegal has not worked in the past. Just see how much gold was seized the last time that happened. How effective was prohibition? Or the war on drugs? All of these things were highly liquid.

5) Designer clothing is counterfeiters all the time. Do people still want designer clothing? The same thing of olive oil, truffles, fish, and other items as well. As for authentification, there are many different tests when used in conjunction with one another makes fakes much easier to find.

6) Gold is still huge in the East, and that is where the money is flowing. If it is valuable there, it shall remain so worldwide. Tell me, if it isn’t worth anything why does the US and other central banks claim to hold so much of it?

Silver and platinum both have industrial uses including in smart phones tablets computers and are much harder to recycle than gold. So silver may well hold value better than gold in a collapse (at least you can use it to purify water)

Yes but….

I was talking with an entrepreneur friend tonight and he is expanding in a big way. All due to his belief (rightly or wrongly) in the better business environment after Obama.

Personally, I think they are all the same lying, self-serving puppets and it doesn’t really matter if their name is Bush or Obama or Clinton or McCain or Trump.

But if enough people feel as my friend does… good things happen and a virtuous cylce is born.

Another interesting diet is that of Warren Buffet who is 87 years old. It was reported that he said, ” I eat 2700 calories a day, a quarter of that is Coca Cola. I drink at least five 12-ounce servings. I do it every day.” You can google this quote.

Each 12 ounce can of coke has about 17 teaspoons of sugar in it. This means that Buffet eats 85 teaspoons of white sugar each day. His body must be a veritable sugar cracking refinery. I tried this for a couple of days thinking perhaps I could get smarter like him and make more money in stocks. After two days of drinking 5 cans of coke per day, I got sick and had to quit. My stock picking didn’t improve either.

I agree with your friend. Something is different this time around.

Something is different indeed . But unlike CfD’s friends opinion .. its gonna be anything but good … guaranteed

Nothing is different, it’s been a slow grind down for 2 decades and I don’t see that ever changing. I’ve been in recession since Q3 2014…………AND one of my main customers is getting REALLY worried as the work as all but disappeared.

there is no future, the is no hope.

I’d call the expectation of happy days being here again due to a more “business friendly environment” a plan to join the pyramid scheme early. Consider, say, the “Asian Tiger” and Celtic Tiger” economies.

Financial deregulation unleashed the Asian “Tiger” economies, and generated lots of paper profits. When investors discovered that the profits were all illusory, and resulted from scams of one type or another, those markets crashed. (Smart people got in at the beginning, and got out before the truth came out.)

Same thing with Ireland’s Celtic Tiger economy: capital flowed in, triggered a boom based on optimism rather than financial analysis. When the optimism dimmed, the “pump and dump” aspect of the boom became visible, and massive losses resulted.

We’re seeing the same thing now. Chris from Dallas’ friend probably sees the pumping phase of the pump and dump starting, and plans to buy while the pumping is beginning… and selling before the inevitable crash.

I guess my friends are different then your friends. I don’t sense a lot of optimism around me, just a sense of being left behind as others seem to be getting rich and worry over how they will get by if their incomes are so meager compared to everyone who is doing so well.

They don’t have fear of missing out what I sense is fear of already having missed out and what will they do now that their income and savings are trampled by the flood of new money from speculation and $300K software jobs. They cut back and save everything they can but know it won;t be enough.

I was in the mall yesterday. Santa is already there and the place was busy. All the Xmas stuff is out on the shelves. Things do seem to be picking up.

Gershon and Maximus Minimus (above) may very well be right. I suspect they follow the markets closer than I do. I no longer pretend to understand what markets do, which is why I read Wolf and many of the commenter here. As I have written before, I got out of the market several years ago and now only invest in businesses of people I have watched for a while and can talk to. So far so good and now I am bringing one of them into some of my real estate properties and considering some other joint ventures.

I can’t speak for Maximus, but it’s less a question of following markets than of a sound appreciation of cause and effect. The tsunami of central bank funny money since 2008 has created epic asset bubbles atop a vast mountain of debt and unsustainable economic distortions. While the central bankers and their “No Billionaire Left Behind” monetary policies have created the illusion of a “wealth effect,” the financial strip-mining of the productive economy has created a wealth inequality and seething hatred of our financial and political elites that does not bode well for the long-term viability of our former Republic-turned-oligarchy.

http://www.scmp.com/business/companies/article/2119084/cheap-and-nasty-money-whats-keeping-zombie-global-economy-afloat

If you are invested in real estate you are still in the market

I see your point. My definition of market may be too narrow.

I disagree Jon. I have been a single family home landlord for 30 years. I bought for cash flow, not capital gains. During the ’07 housing crash, my rents continued without problem. The housing resale market does not affect rental property in much desired neighborhoods. In fact, housing price crashes provide some nice deals to buy.

With a twenty year plus track record on my current rentals, (low leverage levels, BTW) I am only “in the market” if rents dry up. Even then, people still need places to live, and many want to live in the nicer areas.

They’re both “markets”, but they are different markets.

The market for financial instruments is not the same as the real estate market.

Both stock market and real estate have been super inflated due to availability of cheap money

Real estate used to be same but not any more and it us super frothy as many of wolf’s articles pointed out

Gone are the days where you but real estate and make money…

It’s all about timing

People would pay rent when they have money

If not it’s gonna be multigeneration households

@Jon: Still, the stock market and the real estate market are very different. Besides the many differences arising from one being a soft asset and the other a hard asset, as Bruce point out, serious real estate investors (not flippers) buy for cash flow, not speculation (basically the opposite of how stock market participants have been behaving in recent memory). Also, as he points out, rent (or in other words, cash flow) tends to have a fairly stable course even through varying economic conditions.

Investing in real estate is about math (dependable cash flow/ROI) and quality (in real estate this usually translates to location), assuming of course you’re willing to take up the hassle of being a landlord. The stock market on the other hand has long ago abandoned all semblance of accounting for math and quality (aka value). However, eventually cash flows suddenly matter and when that dawns on investors you get a Wile E. Coyote moment… once they realize the repercussions of the fact that earnings multiples have been stretched so much. The serious real estate investor on the other hand always has cash flow on his or mind. It’s a different mentality than stock investors, at least in recent times.

Bruce makes a good point about housing values going down but rents keep coming in. Despite that, in 2008, both stocks and housing took a beating and now more artificially inflated than in history with ZiRP. I too had several prime San Diego rental homes and sold off all over past 2 years. Would rather go back and buy these properties at 60-70 cents on the dollar after next crash. For now, I am on side lines in half cash and half gold/silver/PM’s/Miners/Royalties as they excelled post 2008 until FED intervention but if timed right, ride the metals/miners high, sell off into cash and then into ??? Liquid cash will be well spent on whatever survives/thrives post upcoming Crash. Not going to go thru another 2008 at my age. Good investing to all……..

The Treasury wants to cushion the effect of the Fed’s tightening on the long end.

https://www.bloomberg.com/news/articles/2017-11-09/treasury-s-surprise-debt-maturity-move-eases-sting-of-fed-unwind

Mnuchin realized that no one wants his silly “ultra-long bonds”. I’m buying more TLT. It’s better yield than than some overpriced stocks.

Good article Idaho . The issuance of long dated debt over 30 years might raise the yields of 30 year bonds. The treasury doesn’t want to “rock the boat” . In regard to the above mentioned article : A few significant haircuts in this market perhaps ignited by “retailageddon” will result in a significant increase in yields.

The Stock Market doesn’t need an event to take it down! If everyone is invested, selling can feed on itself and that’s simply all it takes! That’s my take..now watch and see.. soon I think it will happen, if it hasn’t begun already!

OF Course, the news media will say it fell for this or that reason, but that will not be the reason.

Fed credit for the week ended fell by US$2.6 billion.

I’ve seen stats that indicated it took $18 or so of credit to increase GDP by $1 under the massive QE going on around the world.

How much will GDP fall once the QE unwind begins? What will $1 of credit removal do to GDP? Will $1 of credit unwind cause GDP to fall by $18 or even more?

How much will ‘growth’ fall once QE unwinds?

How much will asset prices fall once QE unwind begins?

In other words, short 3000 shares of TESLA or 1000 shares of AMZN and you could either go broke or make a killing………………

Maybe throw 5000 shares of NFLX short as well…………..

TESLA to under US$30 a share and AMZN at US$1125 today to $100 a share and both would still be overvalued. NFLX – not worth a red cent either. From US$192 today to nothing.

Too bad I don’t have the bucks to do that……….TSLA is down around $70 a share since I mentioned that short a while back……

Some people are going to make fortunes shorting the crap in the market as it finally corrects.

“Too bad I don’t have the bucks to do that……….TSLA is down around $70 a share since I mentioned that short a while back…”

Look into buying LEAPs, specifically long-term out of the money puts.

The Fed believes that low rates enable stock buybacks and stock buybacks enable a booming stock market, which creates a wealth effect that eventually trickles down to the rest of the economy. It’s funny that the Fed doesn’t have a counter-theory called the poverty effect, caused by Fed policies that penalize savers, which has held back from the consumer economy tens if not hundreds of billions of dollars from people who would actually spend it. But then again, the Fed never intended to improve the economy for the benefit of average Americans, did it?

It’s about time we take “trickle down theory” behind the wood shed. I can’t believe politicians are still trying to sell that bag. Snake oil salesman – all of them.

Why are tax benefits to the .1% always direct, whereas benefits to everybody else must trickle down? As long as that applies, our economy is nothing more than a Kingdom with serfs and peasants who live for scraps and pay taxes to rulers who grant the right to exist.

How about we start passing tax cuts to the middle class, who will spend. Business owners will then have to produce and hire to meet that demand. Anything less is a handout to the already wealthy.

Finally, who are these “job creators” people speak of? Is this some pre-ordained authority granted to trust fund babies? It looks that way, given they are proposing to eliminate the estate tax.

Because the 0.1% disproportionately donate/bribe politicians and own the media, so they speak louder than everyone else.

If you deliver broad-based benefits to the population, the 0.1% would get richer. But the rich aren’t going to bankroll economists to invent trickle-up economic theories, even if they work, and their media mouthpieces aren’t going to promote it.

“that eventually trickles down to the rest of the economy”

The operative word there is “trickle” and in my years on this rock i’m still fucking waiting on my little bit of trickle to reach me.

Assume the Stress Index is a measure of the Feds Stress test for banks, which measures reserves, and derivative exposure. Almost all derivatives are on interest rate securities or currencies. Almost none of the currency derivatives are registered, so what you have here is a door with no house around it. In the old nonintegrated global economy, currencies were a zero sum game, when they actually reflected trade deficits. Every loser had a winner, now a coordinated devaluing would bring chaos should the global monetary base begin to contract (as it must) And currency is valued according to interest rates and policies.

The US with lower debt to GDP is actually better off, which is why they (SNB) keep buying our (US) stock market, in order to devalue CHF. Firewalling your house will work when everyone else is on fire.

Conditions are easy and will remain easy until at least 3% Fed funds assuming credit spreads don’t explode.

Snippet from The Rise of Money (N.Ferguson)

‘The tech stock of 1929 was RCA. At the height of the mania it had a PE ration of 78’

‘Ration’ should be ‘ratio’

No it was a “ration” because at 78, you were only allowed a small amount of that.

An exciting new world out there…

(a) India taking cash-currency out of circulation to INCREASE transparency, when logically you’d think the opposite – and now the country is off the growth charts again.

(b) Trump using the young, new Saudi Salman Family as a proxy to push back the Obama-supported advances into the deep mid-east of the Persian empire. Hopefully it works without, u know, unintended consequences…which could be horribly grave.

(c) the US’s high-stakes good cop/bad cop routine to finally undermine 30 to 40 wrong-headed years US appeasement to the sick Kim family.

(d) And, the new unknown — how does the new fresh-faced Fed Chair roll back 6 years of helicoptered-monetary policy (necessary, so to speak, to fill the fiscal-policy void of the last eight years) in a new world of more fiscal policy and less monetary policy.

very exciting with world equities jumping out of their socks…PJS

Ps — forgot to add the new trump military policy to entrap, ensnare & annihilate ISIS now…and the Taliban later!

pete,

b) pro-West reformers in the Middle East and South Asia have an astonishingly reliable record of getting assassinated. I’m guessing MBS won’t survive for too very long either in this part of the world where nobody can be trusted and anybody can become a suicide bomber.

c) nothing has happened to Kim’s ICBMs and nuclear bombs, he still has them. Care to start a nuclear war to try to get rid of them? That would be very bad for the stock market.

d) Trump’s appointees will uniformly favor less bank regulation, which means a repeat of the risky lending practices and bank failures of 2008

Sunni ISIS was defeated in Iraq and Syria only because Iran sent 100,000 troops to Iraq, and thousands to Syria. So Iran is now the dominant power in that corner of the Middle East.

how confoundingly interesting is this?

not since ’72!

Toleration in the mid-east…impossible, especially as ‘Trump literally has no idea what he’s doing and has no integrated strategy’ the NY Times & Tom Friedman say..pjs

https://www.nytimes.com/2017/11/14/world/middleeast/saudi-arabia-lebanon-maronite-patriarch.html

If you deal in rumour, hunch, hearsay and politics then this will be confoundingly interesting. I only look at economics and try to avoid politics as there are no ultimate right or wrong answers there

The economics is indeed “interesting”, lets see what equity and bond markets look like at end 2018 along with the state of the economy.

OMG – Saudi Arabia again ‘coming out’ of the closet…another small step in a possible mid-east revolution (for the better) and who knows…maybe fraternité in our time…PJS

https://www.nytimes.com/2017/11/17/science/saudi-arabia-gates.html

“Financial Markets Are Still Blowing Off the Fed”

Well , they will be. Job vacancies to unemployment numbers are almost equally matched (6.09 million to 6.52 million respectively in September).

This happened in 1955, 1965, 1972 and 1999. Each time this phenomenon manifested it was followed by a rise in labour cost growth

In 1955, 1972 and 1999, the unemployment rate converged with the job vacancies rate but didn’t fall below it. Next the economy y weakened, the gap between vacancies and unemployment rewidened and the rise in labour cost growth reversed.

This should put upward pressure on “core inflation2 that CB’s follow and downward pressure on profit margins which are currently highish historically although they have fallen back since 2014.

So, it looks like profit margins are taking more of the strain, suggesting deteriorating economic prospects and rising recession risk. Markets have probably read the financial runes the same way I have and will be looking where to go. In this situation I like Treasuries deaspite a likely near term inflation increase. Ceteris paribus this will continue steadily building until about the middle of next year when labour costs will really start to increase at which time expect GDP growth to slow significantly and unemployment to rise where those sitting in Treasuries that look expensive now will be sitting pretty then.

One exception is that in the 4 earlier episodes globalisation and the ease of moving productive capacity around the globe was not as pronounced as now so this might act as a barrier to labour costs growing out of hand at which point GDP will continue with maybe a slight softening, notwithstanding Trump’s protectionist policies. This is an interesting experiment.