Oh, the revisions.

The US economy, as measured by “real” GDP (adjusted for a version of inflation) grew 0.74% in the third quarter, compared to the prior quarter. That was a tad slower than the 0.76% growth in Q2, but up from the 0.31% growth in Q1.

GDP was up 2.3% from a year ago.

To confuse things further, in the US, we cling to the somewhat perplexing habit of expressing GDP as an “annualized” rate, which takes the quarterly growth rate (0.74%) and projects it over four quarters. This produced the annualized rate of 2.99%, or as we read this morning all over the media, “3.0%.”

This was the “advance estimate” by the Bureau of Economic Analysis. The BEA emphasizes that the advance estimate is based on source data that are “incomplete or subject to further revision by the source agency.” These revisions can be big, up or down, as we’ll see in a moment.

The BEA will release the “second estimate” for Q3 on November 28 and the “third estimate” on December 21. More revisions are scheduled over the next few years.

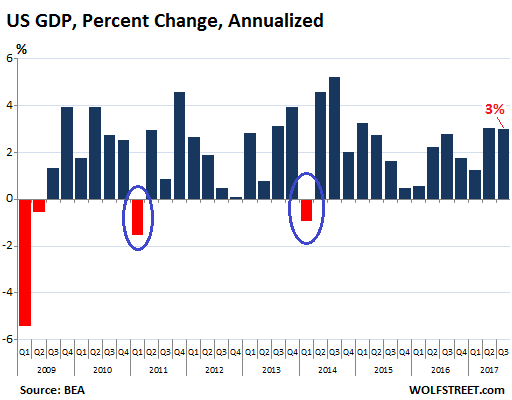

So 2.99% GDP growth annualized, or 0.74% GDP growth not annualized, or 2.3% growth from a year ago… is pretty good for our slow-growth, post-Financial-Crisis, experimental-monetary-policy era, but well within the range of that era, that goes from 5.2% annualized growth in Q3 2014 to a decline of 1.5% in Q1 2011. So nothing special here:

I circled Q1 2014 and Q1 2011 in blue to show how much GDP estimates can get revised as time passes: both of these decliners showed growth in the “advance estimate.”

The “advance estimate” of GDP in Q1 2014, released on April 30, 2014, showed a growth rate of +0.1% annualized. That was a measly growth rate. It was terrible. It caused a lot of hand-wringing. But it was growth.

By the “third estimate,” released on June 25, 2014, GDP growth had been revised to a sharp decline of -2.9%. And it continues to be revised. The most recent estimate put it at a decline of -0.9%. From +0.1% to -2.9% to -0.9% are dramatic revisions. Throughout that time, no one knew exactly how the economy had been doing in that quarter, except that it had hit a rough spot.

Q1 2011 is an even starker example of the revisions. The advance estimate, released on April 28, 2011, figured that GDP increased at a rate of 1.8% annualized. By now this “growth” has been revised to a decline of -1.5%! So on first sight, the quarter looked decent. With years of hindsight, it looked terrible.

After serial revisions, there are now two quarters since the end of the Great Recession when GDP had declined, but the “advance estimates” for both had shown growth.

But up-revisions are also common: The advance estimate of GDP growth in Q2 2017 came in at 2.6%; the second estimate at 3.0%; and the third estimate at 3.1%. As far as revisions are concerned, rather unspectacular.

The BEA points out in its GDP press releases that the “average revision without regard to sign” (so growth or decline) between 1993 through 2016 is a massive 1.3 percentage points from the “advance estimate” to the “latest estimate” which can be years after the fact.

In other words, we won’t really know how the economy did in the last quarter until we have a lot more hindsight.

Point one: It’s devilishly hard to estimate what’s going on in the vast and complex US economy. The BEA comes up with an “advance estimate” to give economy watchers a feel, but it concedes that there will be many and substantial revisions as more data become available, and that initial “feel” may be wrong.

Point two: Equally complex economies, such as China’s, are equally hard to estimate. Yet China’s National Bureau of Statistics comes up with one big-fat figure that is always very near the number the central government had mandated earlier. It publishes its GDP number less than three weeks after the end of the quarter, and a week or more before the BEA’s advance estimate. For example, on October 18, the National Bureau of Statistics reported that GDP in Q3 grew 6.8% year-over-year. And this figure – however hastily concocted, inflated, or just plain fabricated – becomes etched in stone. No one believes it.

At least in the US, after many revisions and years down the road, GDP becomes a credible number. In China, you’ll never get there.

And point three: GDP is a terrible measure of the economy. It measures what money gets spent on and invested in. It’s a measurement of flow. Among other shortcomings, it doesn’t include the source of money – whether it’s earned money or borrowed money. This leads to the distortion that piling on debt is somehow good for the economy, when in reality it’s only good for GDP but will act as a drag on the economy down the road.

Nevertheless, to estimate the overall economy, GDP is the measure we’ve got. And until something better is widely used, we’re stuck with it.

No, our American consumers didn’t suddenly perform a miracle. Read… What the Headlines Got Wrong about Retail Sales

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The magic words: “adjusted for a version of inflation.” Without the

hedonistic adjustments ( the politically motivated BEA Fix ) an

honest calculation would result in a NEGATIVE GDP. The networks

repeat belief until the public accepts it as fact. The truth, uttered

by a widely recognizable and trusted source would, crash both

bonds and stocks.

Isn’t it obvious by now that this report is nothing more than a report on a Ponzi scheme? It is like a quarterly report on Madoff’s bond fund. That grew too. The real question is, what will cause the collapse of the Ponzi scheme called the U.S. government. Like Madoff’s Ponzi, the Government has no victims, only coconspirators. It shouldn’t be long now.

It would seem that any statistic that treats as equal, money spent by the government and money spent by the free market, when attempting to discern real economic growth, as being hopelessly flawed. And that such a flawed statistic would be much loved by statists everywhere.

Jeff Snider addressed this today:

“What saved the day, so to speak, for the GDP headline was nothing more than inventory. Without it, Real GDP grew by 2.21% in Q3, down from 2.89% in Q2 and more like the deceleration we find internally. Unless something happens during the current quarter to turn this around, businesses may find that inventory more of a hindrance and therefore an economic drag rather than a boost.”

http://www.alhambrapartners.com/2017/10/27/even-less-inside-q3-gdp-especially-where-it-counts/

This has been a common refrain of ZeroHedge. Inventory inventory they scream quarter after quarter, and yet consumers have managed to drain these annoying inventory q after q. Another common complain is the amount of debt within the US economy and yet, credit card deliquencies have yet to be alarming.

If GDP is a poor measure, then what’s a good measure for the quiet strength of the US consumers?

https://www.marketwatch.com/story/us-households-will-soon-have-as-much-debt-as-they-had-in-2008-2017-04-03

This how inventories are drained: ZIRP at the top and NINJA at the bottom.

GDP is a poor measure.

So is using channel stuffed inventories.

Bitcoin seems to be the only real price discovery mechanism available. Once global FX is pegged back to a closed system, non-rehypothecated collateral base value, the real value of fiat (which is historically zero) will be realized, if systems theory is at all correct.

Personally, I trust systems theory much more then prognostications from BLS, BEA, or any other mouthpiece of status-quo technocratic-statist metrics.

Either MarketWatch authors read wolfstreet and the comment section or it was a pure coincidence. A commenter stated the importance of looking at the per capita spending statistics and shorty thereafter this article appeared.

https://www.google.com/amp/www.marketwatch.com/amp/story/guid/05C86F40-B28C-11E7-B158-683ECF325DAA

The dynamics are most important, assuming the Fed follows the GDP number, and assuming it is wrong the Fed might make a mistake. The Fed might disregard the GDP while it is essentially accurate and make a mistake. The Fed could awaken from its slumbers and realize that if their forward looking policy is correct then GDP will improve and the current GDP numbers mean nothing.

In other words, you can’t fuly trust this data. And remember this grow also includes growth in the US debt.

I expected an improvement in GDP. As far as I’m concerned it is all from food prices. It should be the food stocks going through the roof, not the tech stocks.

I spent the day at the mall earlier this week and several popular chain stores had 40% off everything sales and they were empty. I didn’t buy anything from any of them.

hedonistic. ah yes, good times for all.

yes, it measures flows. without flows, everything congeals.

hooray for flows.

what does 3% men for most people? a little flow, that’s all.

At some point, do you expect more people to take up gardening?

If I qualify as “you”, no, I don’t.

It’s dirty physical work and the harvest is not instantaneous.

Planted the garden for this year’s vegetables – hopefully we’ll have a decent late spring and a normal summer without many 100 degree plus days.

Our cherry trees were full of flowers and as long as we don’t get crazy wind it looks like we’ll get a huge harvest again this year.

Maybe 100 pounds or more.

Peaches …don’t know about those as they are picky.

Apple’s – don’t know how many yet as the pollinator and other tree were off in timing.

In a normal year we’ll save thousands on our food bill.

Fresh is best.

IF … you like to potter around in a garden, then gardening is a win. You can grow collards year-round here in Northern California and just keep them from going to seed, and you have a nice green to boil. You can plant fava beans over winter in your corn field and when it’s not winter, grow any of a number of varieties of corn, beans, and squash. Zucchini squash normally grow over 2 feet long and you harvest those, take out the seeds and toast them and they’re delicious. There are just any number of things to grow, but yeah, it’s some work and if you don’t at least kind of like gardening, and veggies, you’re better off getting your stuff from the store.

Keeping chickens is the same. A little work but in exchange you get the best eggs ever.

It is all a com game now. From the central bank’s to the government to companies that use shonky accounting.

Billions in market cap increases based on fake numbers.

The equivalent of the gambler’s saying of: “If you don’t know who the patsy is, then you are the patsy (being creamed)”, is that: when almost everyone is cheating, it only means those who don’t are the ones being cheated.

Wolf’s article has already shown hints of fake numbers from government GDP numbers. Here’s a recent article that hints of fake earnings (non-GAAP) numbers from listed companies:

https://www.marketwatch.com/story/why-stock-market-bulls-should-be-wary-of-rising-tide-of-earnings-shenanigans-2017-10-28

Worth a read, although all of this is should not really surprise us anymore.

Fact is, this con game didn’t start yesterday. It has been going on ever since the concept of money was invented as a store of value.

You just have to be cognizant and roll with it or be steamrolled by it.

If US debt was growing exponentially (compounding magic) then so would positively reflect on GDP?

There is an inflection point of diminishing returns on the debt to GDP equation. From the math I’ve looked at, we passed that point a while back.

The Falling Productivity of Debt:

http://www.acting-man.com/?p=51628

If the GDP deflator is fake which is a fair bet in the long and ongoing housing inflation, it could mean decades of decline. Misery index would be a better indicator.

Using a ‘deflated’ deflator has been the way to tackle the debt problem. In order to depress interest rates you need to show that you inflation is subdued or that you even face a deflation. So what you get is a lower inflation figure and a higher “growth” figure. The debt, presumably, should not be growing in nominal terms, because the interest rates are close zero and negative in real terms, and it should be shrinking in percentage terms, but instead it has been growing both in nominal and relative terms.

“at this point what difference does it make”

American alone can print or mint (electronically) dollars which the rest of the world chases around like a dog chases a ball.

IF America gives a $1000 check to everyone to spend – the GDP will grow since most of the goods are manufactured overseas.

Moreover it is not as if America can’t pay back $ to China. They demand a trillion – Ms Yellen transfers it instantaneously.

—————————————————————

I understand that in most countries what i mentioned above is a recipe for disaster. But not America because it can print $ to spur purchases and grow GDP.

——————————————————

Admittedly I can’t imagine why America cares about debt esp. to China, Japan etc. since $ is free to mint out of thin air. (IF it were Bitcoin or GOLD – it would be a problem since both are finite).

Can someone please explain why America cannot rise GDP in the scenario i described assuming the handout $ were restricted (Somehow – let’s accept that) from purchasing limited quantity items – food, houses, gold, land etc… so free to buy jeans, shoes, watches from China and grow GDP w/o raising inflation on (limited quantity) essential items?

The miscalculation of this comment is not actoring the intrinsic difference in “credit monies” and “debt monies”.

If America gave me a $1000 check to spend, I’d spend $450 of it for the TechShop deal where that gives me 3 months’ membership and 2 classes, take the two woodshop classes I’m interested in, and get going making things here, from American-grown wood. I’d actually be able to consider starting a business, which I can’t do now, because I lack that $1000.

The other $550 would be put in the bank, saved for the taxes poor people like me pay about 20% of their gross income in.

Sure, you can manipulate GDP numbers in a variety of ways.

But what matters is the productive economy.

You $1000 has been implemented, in a sense. Fed printed 3.7 trillion (based on its current balance sheet) that is over $1000 per each US national. That helped (if you believe the official statistics to add just under 40% to the nominal GPD (much leas than 20% in real terms, after adjusting for inflation and population growth). China’s economy grew threefold over the same period of time (its hard currency reserves jumped 4 fold) with other Asian countries’ growth being impressive too (India’s economy doubled!). So, as it seems, most of that additional money supply went to boost Asian growth with the US GDP mostly growing thanks to the supply of Asian (mostly Chinese) products being resold in the US, where this was used to sustain the living standards. The rest went to finance such money-losing things as shale, Tesla, renewables….

And that is only within a span of less than 10 years!

Anyone wants to repeat that experience?

Maybe all of us the skeptics are just blind; we know that reality died long ago, and now virtuality has taken the place of reality. So, maybe we should forget about reality ever coming back.

Today, Amazon popped $128. Now, let’s see, the PE is 280. A value company is supposed to have a PE of 10-15. For Amazon to be considered a value company, it must increase its profit by about 20 times. For a company which has hardly ever been profitable becoming 20 times profitable is equivalent to proving bigfoot does exist.

But who cares about reality? After all Amazon’s AWS is all about virtuality, not reality.

RIP reality.

Actually….Bigfoot does likely exist. Probabilities are over 99%.

Forest service, CIA and sundry goons and spooks keeping the lid on tight.

Yeah, CIA has nothing better to do than playing hide and seek the bigfoot. Why would CIA give a rats ass about whether bigfoot exists or not? Oh, no bigfoot will help Kim Jong-un; we better stop bigfoot!

Agreed Wolf these GDP calculations are a complete waste of time.

Exactly the same in the UK, last quarter our GDP has risen by 0.4% (party time), interest rates to rise next week.

Same with the unemployment numbers, the lowest they’ve ever been but that doesn’t include millions of people for whatever reason.

In reality-physically companies are cutting back on costs (advertising-i.t-capex and unfortunately people or at lower wages.)

We need a Public ruler with which to measure “The Economy”.

Sometimes it gets Compressed.

In china its reading is preordained by the Overlord/Emperor. So worthless for that Mafia State.

It is however the commonly used ruler in the west. No matter its flaw’s.

I see that Fed credit fell by $5 billion last week and narrow money fell by $20 billion.

Wonder if the next week’s numbers will show a big enough drop to reflect the Fed’s balance sheet reduction?????

It’s truly hard to believe that the Real GDP number somehow captures the true size or growth of the economy. It has more psychological value than as any kind of real statistic. Probably an accurate measure of the relative size of the economy is the air transport freight carried. You can see a chart on the World Bank website:

https://data.worldbank.org/indicator/IS.AIR.GOOD.MT.K1?locations=US-CN-EU&view=chart

You can see the most recent recessions in the data, and the stagnation in the last ~10 years.

Good call on air transport freight, another element is Shipping cargo which I believe there’s a huge excess of spare tankers-boats doing nothing currently.

Wolf:

Melbourne auction clearance rate for the weekend auctions was 72%. Total of 1695 auctions.

An ok result.

Thanks for the update!

“This leads to the distortion that piling on debt is somehow good for the economy, when in reality it’s only good for GDP but will act as a drag on the economy down the road.”

I hear this all the time but don’t understand it. Suppose I need a car to get to work and mine is on the verge of collapse. You have a decent one on sale for $10,000. I borrow $10,000 and buy your car.

I can now confidently get to work and make money to pay down the loan. Yes, I have a debt that will impact my future expenditures. But you now have $10,000 that you did not have before that allows you to positively effect the economy.

I see it as a wash. I get a car, good. I get a debt, bad. You get $10k, good. The bank’s shareholders get my interest payments as spendable income for them, good. Where’s this drag?

When a loan is made, cash is transferred from a passive saver to a spender, so economic activity is increased.

Your example uses the best possible use of debt. If you borrow money to acquire a productive piece of equipment (a tractor for the farm, a basic car — $10,000 in your example — that allows you to go to work, etc.), it’s a long-term positive for the economy because you’re producing something with it.

But if you take on debt for consumer or luxury items that don’t produce anything – that $100,000 car when you only need a $10,000 car to go to work — the debt just sits there and some of your resources go into debt service instead of other purchases. For consumers, most credit card debt is generally in that category. Auto loans fall partially into that category, as do many student loans (sure, if you get an income-producing profession out it, it’ll work out OK; if not, well… see our current student loans fiasco).

BTW, Housing debt – the largest consumer-debt item – is a different story. If you purchase a house, the acquisition cost itself does not get added to GDP. So consumers go deep into debt to buy that home at an inflated price, and it doesn’t add to the economy, but then have to make mortgage payments, and those mortgage payments prevent them from spending more on things that would add to the economy.

Does rent instead of mortgage add to GDP?

People need to live somewhere.

Yes, rents are included as are “imputed rents” – an estimated montly amount that an owner-occupied home would rent for. So the actual purchase price of a home is not included in GDP, but the monthly “imputed” rent is included.

As the BEA says, this falls under “personal consumption expenditures” (PCE) which include the “consumption of housing services by persons who own the housing that they occupy (referred to as “owner-occupants”) as well as by those who rent their housing. The imputation ensures that GDP will not change if a house is rented by a landlord or is lived in by its owner.”

https://www.bea.gov/national/pdf/nipa_primer.pdf

The notion of non-productive debt was debunked a long time ago. Greenspan recognized the pull through consumer debt exerts on the service economy. All productive lending is an assumed liability. A home is a liability, a car.

Creating liability is the key to the workings of the socialist economy (see Netflix) When a criminal commits a crime it takes dozens of policemen, attorneys, judges, and finally correctional officers to house him. He has created jobs, and if the crime is a financial crime, his work is doubly productive. To that end Bernie Madoff is an American hero, and Donald Trump only a pale imitation, but give it to the American voter, who recognizes greatness.

This is how most economists rationalize debt. Consumers think otherwise.

“Where’s this drag?”

You get replaced, by a machine/Girl in india/china, Vietnam, @ 15% > of your wages. To increase your corporate masters profit, so default on your loan.

Both your clunker, and your repossessed unit, are still in the system hogging potential new sales.

GDP measures just enough for the Fed to convince the public that it’s succeeding, even though it’s not. The most important sector of the economy, which occurs in the secretive “investment” arms of the banks, is ignored completely, even though it almost brought about the destruction of the world economy. Someday, trained historians will sort out how financialization distorted the economy. At the same time, academic economists will be writing mathematical equations about the price of cheeseburgers.

The Economist does use a ‘Big Mac PPP’ index to measure purchasing power parity between nations using the price of a Big Mac as the benchmark.

http://www.investopedia.com/ask/answers/09/big-mac-index.asp

Wow, I thought I was being sarcastic. So they measure Big Macs, but not the effect of exotic bank deals that can bring down the economy. But is that a Big Mac with or without cheese? The fate of the economy depends upon it.

“Wow, I thought I was being sarcastic. ”

The BM PP index is an old index now.

It is however accurate as a PP comparison as a BM is a BM in Tokyo manila, Beijing, or NYC.

How many you can buy for the average weeks wages, in each place, evens out a lot of State statistic, economic fairy stories.

The way we compute the GDP is totally flawed. We have allowed numbers that mean “nothing” to seep into how the gross domestic product (GDP) is calculated all in an effort to create the illusion of growth. More on this subject in the article below.

http://GDP Number Is Master Illusion.html

Air freight to measure GDP ? Too frivolous.

Railway freight is the backbone of this country, from raw materials to most finished products. From the worldbank site referenced above:

https://data.worldbank.org/indicator/IS.RRS.GOOD.MT.K6?locations=US-CN-EU&view=chart

A straight line drawn from the beginning of US data to the end shows a consistent 35-yr trend. The run-up beginning about ’03 to ’07 was an unusual bubble ?

Even China’s data is back to long-term trendline.

GDP must be read with GNI (National Income).

And by including “Government” as “production” in the national economy, every year the parasitical nature of government shrinks the rest of the GDP.

I think that most classical economists would be amazed to see Government and FIRE taking up so much of the GDP pie. Rentiers drawing away value from the actual producers.

“GDP is a terrible measure of the economy”.

Not only “terrible” but has become all but useless.

DEBT.

The US Treasury debt has increased $595 billion in just the past 7 weeks. It increased a further $14 billion as of this past Thursday.

The markets were flat to down 7 weeks ago, until September 8th when the US debt was increased by $318 billion in one day! Since then the markets have been on a melt up, setting new all time highs.

So GDP is responsible? Not so much. Amazing what a little over $600 billion in debt will buy you!

GDP should only measure goods and services, not overhead. The Personal Consumption section is ridiculous. It basically bakes in asset inflation in the form of housing.

The real economy is the spending that occurs outside of overhead: basic living, feeding, transportation, and health costs. Show me how that’s going year-over-year and then you’ll have a good measure.

Health costs reflect scam effectiveness more than they do gdp. For example, raise the price of a fifty year old drug from one dollar to eight hundred. gdp has gone up.

Why should US GDP grow at 4% rate y/y ?

The Fed support bank loans and prevent debt deflation.

The Fed reduced rates to zero to encourage RE inflation.

The Fed policy of savers suppression, have sent the $SPX from 666

to almost 2,600 and will do everything it takes to fight an assets

collapse to of the rich & the upper middle class.

The Fed, actually, is the fire department of the F.I.R.E. department.

The F.I.R.E hate the useless CAPEX.

Ca fire + police department retiree can collect over a Million dollars

in annual pension.

Is that how you grow the US GDP ?

I haven’t dug into the details, but I suspect the 18 million annual rate vehicle sales number lifted consumer spending, which bumped GDP. Where did that vehicle sales growth originate? Hurricane replacement. So the 3rd quarter GDP reflects the broken window economy to an extent.

https://www.bloomberg.com/news/articles/2017-10-30/u-s-consumer-spending-rises-most-since-2009-on-auto-purchases

This much illusion.