But the ballooning National Debt has disappeared from the agenda.

The S&P 500 has soared 20% since the presidential election, the Dow Jones Industrial Average 26%, and the Nasdaq 28%, in about 11 months. Understandably, everyone is taking credit for the surge in stock prices, including President Trump, who according to CNBC, has tweeted “more than 20 times since the election” about the stock market, “extolling the market’s gains,” including this gem on Monday: “Stock Market has increased by 5.2 Trillion dollars since the election on November 8th, a 25% increase.”

The folks in Congress are heavily invested in the skyrocketing stock market, and unless they pass the tax cut, their gains could be eviscerated — that’s the warning that Treasury Secretary Steven Mnuchin has thrown their way in an interview with Politico.

Sure, everyone wants a tax cut – the lucky ones that get them. Especially since we no longer have to worry about how to pay for it. The reason we don’t have to worry about it anymore is because the ballooning US national debt has miraculously disappeared from the agenda.

Nevertheless, the kinds of tax cuts proposed by the White House are not a clear-cut deal in Congress, and like other proposals, it might sink into political quicksand.

So here comes the political weapon to force Congress to act: money.

Mnuchin told Politico that the surge in stock prices since the election is largely based on hopes that Congress would pass the tax-cut bill, and if it doesn’t, part of the recently obtained paper wealth could just evaporate. Not only would the folks in Congress see part of their wealth disappear, they’d also have to answer to their constituents who’d be in the same debacle.

So Mnuchin in the interview:

“There is no question that the rally in the stock market has baked into it reasonably high expectations of us getting tax cuts and tax reform done.”

“To the extent we get the tax deal done, the stock market will go up higher. But there’s no question in my mind that if we don’t get it done you’re going to see a reversal of a significant amount of these gains.”

So the tax-cut deal is “priced in, in anticipation,” he said. But there’s more good news: “I don’t think it’s priced in 100% certainty,” he said. “So I think the market will go up” if the deal passes. But if it doesn’t pass, duck for cover.

Politico interpreted the warning this way:

If that sounds like a threat to Republicans — and perhaps some Democrats — to pass a tax bill, that’s because it is. In fact, some analysts on Wall Street say that if a tax overhaul falters, a big correction on Wall Street could help push the legislative process back on track.

“If it suddenly looked like a tax bill was dead, stocks could sell off sharply. Then the blame game would begin,” said Greg Valliere of Horizon Investments. “I think Trump would hammer hard at Democrats, blaming their intransigence for a stock market sell-off. A half-dozen Democrats in the Senate, fearing a defeat next year, would waver.”

But really, there is nothing to worry about, according to Mnuchin, who gave an “absolute guarantee” that Trump would have the deal on his desk and sign it by the end of the year.

This is the same guy who earlier this year had promised that the tax-cut deal would be wrapped up and done by August, a deadline that came and went without anything but a continued surge in the stock market.

Trump is a little more sanguine about the timing of the tax-cut deal. “I would like to see it be done this year,” he told reporters on Monday. “But don’t forget it took years for the Reagan administration to get taxes done — I’ve been here for nine months. We could have a long way to go, but that’s OK.”

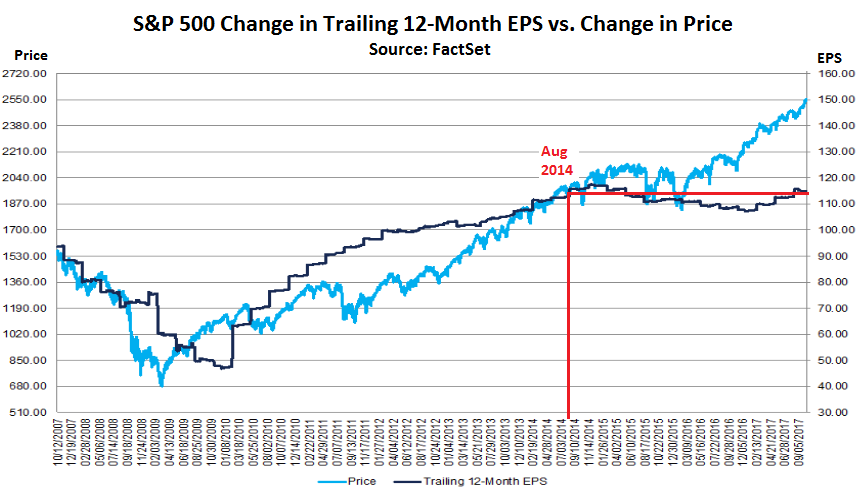

But the reality is this: The stock market doesn’t need a fundamental reason, such as increased after-tax earnings, in order to surge. Earnings, or more precisely earnings per share (EPS), are the primary fundamental reason that should drive stock-market valuations. But as this chart by FactSet shows, aggregate EPS (black line) for the S&P 500 companies have stagnated since August 2014 even the the S&P 500 index (blue line) has soared (click to enlarge, red marks added):

So what gives? We know that fundamentals no longer matter. And corporate tax cuts are part of the fundamental data set. When they didn’t happen in August, stocks didn’t blink. And if they don’t happen in December, that fact alone won’t crash stocks.

Something will eventually drive down stocks, but it won’t be a simple one-item fundamental thing. The fundamentals have been lousy for years, as the above chart shows. Instead, excess liquidity is trying to find a place to go. Investor enthusiasm is at record levels, volatility at record lows. Market powers have been lulled asleep on the certainty that nothing can go wrong anymore. But that “certainty” can change direction without notice, and to do so, it doesn’t need the failure of Congress to pass a tax bill. It’s going to do it when it’s ready and on its own terms. And then not even an Act of Congress can resurrect it.

Here are the numbers. Is this peak chase-for-yield by institutional investors? Read… Asset-Stripping by Private Equity Firms Is Booming

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I know we are not supposed to get “political” here, but as we see, politics and economics are inextricably intertwined. The sleaze balls in Congress will always find a way to line their pockets, stock market or not, as we see with the Clinton uranium deal.

Yes, Wolf should end fact free comments that go political, like yours.

There’s condescending Lee again who thinks only his comments are worthy of allowing

Lee, there are several commenters here who post under “Lee.” One of them has been here for years (the American dude who lives in Australia). Could you put an initial or number behind “Lee” to make it unique? Thanks.

YES they get confusing at times.

Is that better, Wolf? You do need to keep the political snipes down. I have been avoiding the comments lately, because it’s getting tiring with them and there are probably visitors that don’t come back after reading them. If this “as we see with the Clinton uranium deal” is fine then I and others can have a go at the current President, but that’s what twitter is for.

Don’t worry Wolf, you’re just being standard contrarian/realist, not political.

This is like when Louis XIV said that after me comes the flood . It did, the French Revolution happened.

This Admin though, may not get out of the WH before the tsunami hits.

But the truth is that economics and politics cannot be separated. The economy does not follow any natural law, it is the result of political decisions.

So yeah, you cannot talk about real economics unless you take into account its political dimension.

Neoliberal pundits would love us to think that this dimension does not exist and the outcomes of the economy are solely the results of inalterable natural laws, but that’s not gonna happen.

Hiho Exactly. Economics is the hammer, Politics is the hand that swings it. Even in a laissez-faire economy there has to be agreed upon laws to set out measurements, money, and contracts.

Ditto!

The economy overrides politics unless the pols make a really huge effort, and then the outcome is often worse than it would be if they’d done nothing.

Former Rep. Billy Tauzin did in fact get to line his pockets thanks to his generous treatment of the big drug companies when he wrote the seniors drug benefit bill back in 2004 (Medicare Part D). At the end of 2004, he resigned from Congress and joined the Big Pharma lobby group in 2005 where he made millions of dollars in the following years. It was his reward for putting the interests of the drug companies ahead of the interests of seniors across the country. You can read about him in Wikipedia.

Buy on the rumor, sell on the news.

The news could be something passes or does not pass….

IBM went up 8% today after reporting declining revenues for the 22nd straight quarter, but they beat earnings “expectations” by 2 cents/share. The question is who creates these expectations and why.

According to Mnuchin, if the rich don’t get a tax cut IBM shares will crater. Sounds like a good idea to me.

I heard on the business channel that the IBM money came from a tax dodge, not from operations. They claim IBM had a negative tax rate of over 20%. More financial engineering.

For fiscal year 2016 IBM reported 12.33b in income before taxes.They paid 449m in taxes

First quarter 2017 1.42b in income before taxes

IBM received (not paid) 329m

2nd quarter 2017 2.44B in income before taxes

IBM paid 111m in taxes

IBM is the poster child for INEPT financial engineering ,having bought back over 150b in stock in the last 15 years The biggest asset on their books is the GOODWILL,which actually is no surprise considering how much they have overpaid for acquisitions

IdahoPotato and Petunia,

IBM net after-tax income fell 4.5% year-over-year, and earnings per share fell 2% (thanks to share buybacks).

But they “fell less than expected” due to the tax dodge.

As always, IBM put out the hope that sometime in the future, its revenues are going to stop falling. Same song and dance we’ve seen for years.

i’m a shareholder. int’l biz machines.

remains to be seen.

This is the slow suicide that US Corps – and probably many others worldwide too – are committing.

I thought La La Land was just a movie. When big owners of the stock market decide they want currency instead of an entry in a database, this downturn will be something for the history books, if we don’t burn them first.

When the tax plan was first published I calculated that I would have to pay income tax on another $800 of income. That was because we would lose the deduction for our adult dependent son. Now they say that there will be a tax credit of $500 per dependent up to four dependents. The tax credit would make the plan slightly better for us, but I still can’t find a published version of the plan.

I like the idea of simplification, on that basis alone I would support the plan. But who knows what’s in it. What bothers me the most is that these guys spend months coming up with a plan that looks like it was done over lunch.

1) There is no published or otherwise version . Even congressmen and senators do not have one . Just a lot of bloviated words and promises

2) If simplification were the intended goal more on both sides of the aisle would be in support along with myself . The real agenda though is drastic tax cuts for the corporations and the 1% .. falling back on the ole much failed ” Trickle Down ” economic theory that magically and mystically always seems to trickle upwards

3) Saying they formulated this ‘ plan ‘ such as it is over lunch is being much too kind . Suffice it to say had they even put that minuscule amount of thought into it it might stand a better chance of doing some good

Which is to say in conclusion… as with the tax etc cuts of 2001 … the 1% will gain massively … the likes of Wolf and I will see some benefit … whereas the average Joe/Josephine will be taking it in the shorts ..

“But who knows what’s in it.”

Republicans want it to be a big surprise for their loyal, um, voters.

You’re not a member of the state syndicate, so you can expect the worst. Just follow the trends. You’ll get there.

Do you expect they’ll be able to crash the real economy without crashing the financial markets? The former is a foregone conclusion, you know. And how much can overseas tax havens expect in deposits from this tax plan? How will they pay for the next tax cut for the rich, since gutting Social Security won’t even cover this one?

Let’s find out, shall we?

Petunia: ” we have to pass the bill so that you can find out what is in it away from the fog of the controversy “.

All sarcasm aside, it is disconcerting that our economic success as a nation is gauged by stock valuations.

Particularly since stock valuations have next to nothing to do with the real economy.

Which is why you can expect stocks to continue their ascent even after the economy starts tanking, which is probably what it is already doing, depending on whose statistics you prefer to believe.

These things are written Tabula Rasa for the attorneys to interpret. When Pelosi says pass the bill to see whats in it? There’s nothing in it. They’ve been doing this since Medicare Part D, pretty much. I knew someone who was given that bill to read and she said it was gibberish. So you put out meaningless words on paper, the bill breaks along party lines and the lobbyists buy up the swing vote to make a majority. That’s how bad law is written.

I work in local government and I am occasionally forced to read federal laws. And your friend is correct, most of it is gibberish. Our County Attorney worked in a federal agency in the Bush II administration. I asked him why the laws are written the way they are.

He said the reason is because there is no provision for automatically sunsetting old laws. So new laws have to explicitly state where they supersede the sometimes 100’s of old laws on the same subject. All of that language requires hundreds of attorneys to review for correctness. So when you read these things, you get these little nuggets of information between mountains of “subsection 3.2 replaces “should” in paragraph 2.a of subsection 5.2 of HB 1147 (1952) with “shall not blah, blah, blah”.

There is no way, and I mean no way, that your average Senator or Congressman ever read these things. And none of them have an expense account big enough to hire the hundreds of personal attorneys that it would take to really understand what they are voting on.

It’s the system. Now, why they don’t want to change the system, I’ll never understand.

Never seen that number before but even if it were a real consideration. Its not much simpler. It does however shift the value of the dependent tax break to poorer families even though it is slightly worse by itself than the current exemption model.

A personal exemption even the the 15% bracket, nets you 607.50 back per head, including yourself. So a $500 credit is pretty close unless you can’t count yourself as a dependent.

At the 25% level that becomes worth $1k per head.

But still if they combined that with a standard deduction of $24k it starts to push that into the green for an average family of 4.

The caveat I have heard is that they are willing to increase the size of the child tax credit.

Supposing that your son is someone who does need you and isn’t just an immature milennial, this is exactly the type of cruelty the same money people who tried to stop Meals on wheels engage in.

What will bring the markets back to reality ?

That hideous bloodthirsty unavoidable Black Swan hovering overhead that no one thinks exists never mind is possible regardless of whether or not Munchkin & Co get their precious tax cuts that in the end will benefit no one including themselves . Suffice it to say history is on the side of the Black Swan and nothing within our misconceptions of American Exceptionalism and its perceived immunity to history will save us .

Finally … in my never humble opinion … I’ll take a guess that on a countdown of ten … we’re now firmly in the grips of three edging rapidly towards zero .

You know, sometimes I wonder. 2008 was a nasty little black swan that showed up when investment banks were keeping smelly MBSs on their books too long. Credit freezed up and panic was in the air.

But now the Fed has shown that they have the ability and willingness to ensure that credit won’t freeze up again. They’ll happily monetize any bad debt on bank’s books. What if that’s the deal from now on? Outside of full scale nuclear attack by the commies on Wall Street, what black swans are nasty enough to knock this thing down?

My concern is that once the Fed says “we can print enough money to always have your back”, you kind of have new rules for the game.

“People just keep buying the dips and following the money up. When you have been doing this for over 50 years, when you see those similarities, you say the last time it got like this it didn’t end well.”

Everybody frequently forgets ( not including Wolf and Myself)

A lot of that money in USA stocks, is not US money.

What if something makes it “Go away”

The FED can and will Protect the banks.

Thats its job.

It may again protect some first tier house lenders, due to the securitiseation features of the US economic system.

Boing a BOJ and buying bulk Stock is not in its mandate no-matter what the FED haters scream.

So It can and something will happen to US stocks, just as it can and will happen to china.

Lot of chinese money in US stock’s.

OT see lots of PBOC local stock buying after the XI attempt at a Castro record.

Hows much US stock does the PBOC clandestinely hold???.

“Outside of full scale nuclear attack by the commies on Wall Street, what black swans are nasty enough to knock this thing down?”

Well, that’s kind of the whole point of black swans… by definition, they are a surprise, unexpected, and rare. Certainly you’ve still got many of the usual suspects… China (reminder the market dropped 20% in a month and a half in 2016 when China devalued), geopolitical strife in Europe, conflict in the Middle East, etc. Any one of these could pop off in a bad way.

“My concern is that once the Fed says “we can print enough money to always have your back”, you kind of have new rules for the game.”

They haven’t said that.

Here’s a hypothetical. Just a thought experiment, since my crystal ball is broken. How will Mr. Market react if, hypothetically, the Fed continues with their planned rate hikes and tapering of their balance sheet, inverting the yield curve and sending the economy into a recession in 2018 or 2019? Yeah, the Fed can walk that back, they can cut rates, they can resume QE– but what message does that send? Keep in mind the Wall Street narrative has been that we’ve been in “recovery” for years now, and global growth is finally “synchronizing” ( increasing populism/nationalism > and ultimately increasing discontent in society. While I know that most Americans couldn’t tell you a single thing about the Fed, I think the Fed doesn’t want to step in front of that train if it approaches. I remain unconvinced that they’ll pull out all the stops to prop up the markets. Heads would roll, and they know that.

” I remain unconvinced that they’ll pull out all the stops to prop up the markets. Heads would roll, and they know that.”

Why would they do more than Jaw bone for the markets. Banks are in their mandate the “Markets” aren’t.

As long as their actions “Taper tantrum” Are not directly responsible for the market negative action.

There is currently no Market negative response attributable to balance sheet reduction policy.

Kent,

I’m starting to think that Dick Cheney was right when he said the deficits don’t matter. I don’t think the fed cares and neither does congress. I heard some wonks on tv say the fed is now buying all the long term treasuries. They are expanding the balance sheet even while rolling off MBS. It looks like they will fund the tax cuts, the wars, social security, student loans, and Wall St. It gives new meaning to “free markets.”

Dick( Darth) Cheney right ? Evil is more accurate

There is no question that Dick Cheney was right. Whether it is used for good or evil is totally dependent upon the quality of the electorate.

PBOC floated all those chines Dollar bonds.

FED is simply ensuring demand for US notes as the PBOC is trying to Reduce Demand for US notes.

Then The FED can choose who it might allow to have some.

“They are expanding the balance sheet even while rolling off MBS”

NO They are remaining neutral on the balance sheet there will be a gradual decline, not a big dump in the size of the sheet.

The sheet will probably wave down, not Directly ramp down. IMHO.

All subject to any change in FED admin 2018.

It’s not about the black swan, the trigger, but the whole world being so fragile that a tiny event can start the chain reaction.

‘Nothing to worry about’. Thats rich coming from Steve Mnuchin!

When you consider that he made his money from government intervention in business. By using tax payer money to buy mortgages that were distressed, then to foreclose on tens of thousands of families, through a failed bank he bought for pennies on the dollar during the 2008 financial crash. What a nice guy. Not.

It would seem the current tax course is a back-handed way of providing extra profits for high net worth individuals and corporations, while throwing the poor people a scrap of bone to keep them placated.

– Taxcuts for the rich. Not for the common US citizen.

What do you expect. He is another Skull and Bones “Tool.” Arrogance is baked into these guys.

I’m the idiot who failed to buy the 2012 dip because of the fundamentals. I expected PE ratios to hit single digits, due to loss of trust as a result of creative accounting revelations at the time. Buying at a “healthy market” 14:1 risked a possible 50% loss of principal, should the market overshoot as it tends to during times of economic crisis. My family can’t sustain losses like that. But as it kept ramping, I kept thinking “This has gotta pop at at some point; people can’t really think they’re getting value.”

But here we are. I still can’t bring myself to buy, but it looks like the DOW really could go to 30,000. This is why I’m still a piker.

I got spooked in 2007 and sold my house. But I didn’t buy a house in 2011 (thought hard about it) and continued to rent because I was expecting a return below the historical mean — not a return to 125% of mean and then ramp back up from there.

I’m not smart enough to play the technicals game. I simply don’t have the capacity to understand all the nuance, or to try to successfully compete against computer-based day trading. Basically, I’m just an average guy who’s trying to do the right thing while also not get left holding the bag. Clearly, it’s not working. I’m a bag-holder paying out the nose for rent now, with a 401k that has almost no meaningful way to fund a retirement.

I’m pretty sure I’m not the only one. And I’m 100% sure this is — paradoxically — why we have Mr. Trump as President and Mr. Mnunchen as Treasury Secretary. The worse it gets, the more voters double-down and hope someone — anyone, even the crazies — can make a big broad swipe to clean and reset the system.

But the reset we’re going to get from Mr. Mnuchen won’t benefit his boss’ voters. If there’s any proof that bald arrogance has no consequences in today’s political climate, this is it.

I don’t think you are an Idiot MF. You sound pretty rational and capable of coming to a logical conclusion. Everything you said, and have done, sounds sensible. It sounds honest, too.

Best of luck as this unwinds. (It will).

When the game is rigged and you are not an insider, any winnings will be the result of sheer luck.

Markets can remain irrational longer than you can remain solvent, and karma can stay unbalanced longer than you can stay serene.

This isn’t investing. It’s gambling against insider cronyism.

Well said.

Exactly hence the only little guy option is to trade the index, not individuals.

All the indices are way overpriced. There are pockets value amongst individual stocks.

Dosent matter what the price on an index is.

You are long or short, for the movement. Nothing more.

You dont buy and hold the index in hope. Or at least I dont.

Thats Almost as bad as buying individual stocks, as again you are long term Betting (not Investing) in a rigged game, or. Possibly even a Ponzi.

I worked out some reasonable indicators for the S&P. I trade it at certain times for certain movements. I always run a 2 to 1 RR with tight trailing stops. so only have to be correct 40% of the time to make money.

I tend to have better than 40% average.

The most important rule. If it isnt going your way GET OUT NOW.

There is always a tomorrow.

“Dosent matter what the price on an index is.

You are long or short, for the movement. Nothing more.

You dont buy and hold the index in hope. Or at least I dont.”

This is bad advice and exactly the type of thinking that manifests itself at the top of a market.

That is literally the Greater Fool theory. Price doesn’t matter, just get in, get your returns, and get out.

You are not thinking about what is being written.

Average time of those trades is 90 Minutes.

Money at “Managed” risk, is all from previous profit.

The “Greater fool” and “Risk Management” are incompatible.

MF-

I’m exactly the same as you! Saw the crisis coming in 2007 and sold my house and stocks a few months before the big crash. I made out big as the markets tanked.

Still renting today. Still don’t own any stocks today.

Whatever skills I had that allowed me to see the top of the last bubble have been targeted and completely thwarted by the Fed and their cronies. I just thought assets were still too risky at the last “bottom.” I knew the Fed would try to re-inflate the bubble, but I thought they didn’t have a big enough “bazooka” and that there would be societal push back.

Boy was I wrong.

I surrender. They won.

If your aim is to make money holding assets.

After you dump.

You need to buy back in at a lower possibly temporary bottom, with at least your profit from you last sales or rising assets will inflate away your gains.

You should have been able to obtain some foreclosure property at a reasonable rate.

Now you ar4 stuck with the hope it goes back to the 08 -10 bottom buy price.

not likely.

“Now you ar4 stuck with the hope it goes back to the 08 -10 bottom buy price.

not likely.”

You do realize that the S&P went LOWER than its 2002/03 lows in 2008/09, right?

Stop giving “advice.”

Real Estate didnt.

House’s/Real estate was the core of the thread, as the poster “Sold his house” and his still renting.

American stocks are not assets and have not been for some considerable time. They are a Ponzi waiting for the music to stop. Just like paper gold.

I trade both. I hold neither.

It is most Unfortuitous that the Original poster did not buy back into real estate. In the low after he sold.

Now he needs GOOD HOUSES to return to their post 08 lows (which is unlikely). As even he realises.

I feel you. No matter how difficult the feeling is, you still need to check the facts, ask yourself what is true and what is best option.

The facts are

1. The store of value is destroyed. If you save you will bleed 3% a year minimum.

2. If you were herded into the Casino and start to speculate at levels so far away from fundamental firm ground, you know it is 10-90 game where wealth of the 90% will be transferred into the hands of the 10% after it all said and done. You know you are one of the 90%.

So either you bleed 3% to death slowly or you become the turkey and risk getting cut in half when thanking a giving day arrives although it appears you get fed every day and you gain weight.

I will take the slow death. Maybe i still have a fighting chance when they screw up.

Yes, the reckless debtors have robbed responsible savers through the fed policy for 10 years. Maybe one day those debtors will turn on the FED like all of those women turn on Harvey Weinstein, and put some bankers on guilotine like they did in history when the shit do hit the fan.

I feel for you as well. I’ve been waiting on the sidelines for the last 2-3 years while watching people buy properties and rent them out, flip properties, join the cryptocurrency gold rush and lately, hearing young folks getting back into the stock market. It’s an insane world where the sane trying to swim against the current are losing.

I begin to think this is the new normal that will last a while still, long enough for the majority of younger folks, stay-home moms and retired dads to feel excited enough about the stock market again to get back in the game.

Then, the big wealth transfer will happen… again. It’s a rigged game where the majority cannot win; otherwise, no one will wake up every morning to go work their ass off. The system can’t function if everyone wins big at the casino.

I think that you think too much. This is not an Investment market, it is a Trading market.

A Trading market is like moving down a semi-frozen river on ice-skates, jumping from ice float to ice float and knowing that there is a waterfall somewhere up ahead, one cant carry too much and have to keep moving to not sink or get stuck on the road to the waterfall.

An Investment market is like packing a canoe on the other side of the waterfall, one can put 200 kgs of camping stuff and food in there and drift lazily for maybe 2 weeks until food runs out or boredom sets in.

In a Trading Market one (i) looks not for value, but Volatility. Not too much (random), not too little (Booring or about to blow up). One keeps a portfolio of securities with some diversification and a suitable degree of volatility. Then one will continuously allocate money across the pack according to what the volatility is each day / week and maybe with some trend lines added and some stop orders. The trick of course is to have one foot on the ground when the waterfall arrives, so one is never leveraged and rarely fully invested.

The Investment Market / Opportunity only presents very rarely and it is important to really commit when a “good thing” is spotted. I look for a large company in trouble, one where there is loss after loss, scandal after scandal, CFO’s leaving in disgust, which keeps dropping the share price relentlessly. One where it is fairly clear that (assuming they didn’t totally cook the books) the business has reserves to likely survive the continued failure for several years.

What happens, always, is that at some point, more scandals are exposed yet the stock price drops only maybe 1% over it. This is the time when all the risk has been squeezed out and the actual “value” it there in the market.

This situation one should unconditionally buy! But only half the investment sum, often, there is More: With the stock-options now in another galaxy, unreachable, the business might say: “Fuck IT, We can’t take this” and make a final huge dump of write-offs and skeletons from the inner closets. The stock here drops maybe 5% maybe it goes up. The people who now have the stock are hard hands, they are never going to sell.

Then one must pile in!

With a clean balance sheet and roundly tarred & feathered by everyone “who knows about investments” the business will earnestly over-perform for a least 4-5 years before the in-built stupidity begins to cause drag again and it takes maybe 2-3 years further before the stocks notice.

These Investment Stocks only comes once every 10 years or so. These situations still can go bust on one, SwissAir did, but ABB and Ericsson more than made up for that loss.

The Investment Stocks are easy 10-baggers, and one doesn’t have to do anything but sit there and look at the landscape!

Anyway, that is what I do.

My father would have agreed with you.

I think he would be right.

Dear Wolf,

Would you be kind enough to right a short tutorial on how to short the market via short PUTS?

There has to be a way to profit from this kind of news.

Of course you will have disclaimers on potential loss of money.

Thanks

Just the idea of shorting this crazy market gives me the willies. People have lost fortunes shorting crazy markets. Once markets have reached irrational levels, there is by definition no longer a rational limit.

On fundamentals, this market should have turned south a long time ago, and it started to in late 2015 and early 2016 (S&P 500 dropped 19%) but then bounced back to even greater irrational levels.

Someday someone is going to get the timing correct in shorting this thing, but until then, it will be a widow-maker trade.

Wolf,

You might want to take a look at the following report – some very interesting charts and figures in it:

https://www.scribd.com/document/361951821/Fasanara-INVESTOR-CALL-Market-Fragility-How-to-Position-for-Twin-Bubbles-Bust-1

I absolutely agree Wolf.

In fact I think that now the stock market is probably bang on close to.

Debt, unfunded liability’s and state municipal and corporate debt are out of control.

The dollar is losing its reserve status, day by day, piece by piece.

The prospect of US growth, even reaching a point that can account for debt service, population growth, inflation, the real inflation mot the fantasy, demographics like health and ageing, lack of funds for retirements for millions reaching that point with zip in the bank, corporate profits sliding now for over 3 years, entrepreneurial and new business formations swirling down the toilet and consistently falling ever faster than corporate deaths.

Leaves me to believe that eventually only thing can happen.

Print, Print my lovelies, print like before will be the cry.

And just like Venezuela and Zimbabwe the stock markets will boom as the economy dies

Been there, been squeezed. I do think that whichever way you believe the market is headed you should own that position. If you must hedge use options, so if you really believe the market is going lower, take short positions, and hedge them with calls. That said a short position is only a loan, and they can call the shorts anytime. (or just outright ban) Shorts held at a major brokerage are preferred since they actually borrow the shares. Most bears probably think, oh I’ll wait for the break and buy the triple leveraged bear fund. Bear market rallies are the best, rallies that is. I don’t think anyone knows how it would unravel if it does, its seems that while 2007 was a FINANCIAL event, this might be more of a market event. The financials have been propped up with plenty of QE. Reagan pulled a rabbit out of a hat in 87, and they might have another even bigger global surprise, but this president has screwed up the NFL when there was nothing wrong with it, what’s he gonna do when a real problem comes along?

Some of the newsletter sellers talk about buying long dated puts, charging you a pretty penny for their picks of course, but I havent done it.

yngso, thanks for commenting. It seem you’ve not had a chance to look at our new commenting guidelines. So here they are. Please note #3:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

You can short the VIX which is at historic low…because the risk has disappeared. I have no idea how, but the point is; the stock market can go to heaven, but the VIX is bound by zero. Wait…so is the interest rate.

Shorting the VIX is a good way to get your face ripped off. That trade is so lopsided from the blatant “banging the VIX” to goose the markets that sooner or later Da Boyz are going to take the other side of that trade and slaughter a bunch of retail muppet VIX shorts. In addition, these Ponzi markets appear to be ripe for a pump & dump that would cause the VIX to soar. TVIX is up 6% pre-markets as there seems to be some kind of disturbance in the force.

I own a tiny position in a short VIX ETF or ETN. That’s all the risk I’m going to take on…

The stock market used to be a random walk. Now it is carried in a palaquin

Moar tax cuts financed by moar public debt. Standard operating procedure for Republicans.

“Yippey °°° Ki °°° Yay !!”

It’s like the public, as representative as John McClane … trying to deter the bad guy, either in government, or out ….. only to find a new menace pop up in his mist .. as they each, in their turn, vie to be the one to pull the bomb trigger !

…. Sigh …

Your comment about ‘ballooning national debt’ implies that you believe it to be a problem, e.g. “saddling our children with a huge liability.” I guess you are unfamiliar with, or disagree with, modern monetary theory’s explanation of how a fiat, floating exchange rate currency works in relation to government/non-government balance sheets and sector flows. The so-called ‘national debt’ is strictly an artificial restraint on the government’s ability to spend. The federal government is not required to tax or borrow in order to spend, since it has an unlimited ability to create dollars, and any dollars paid to it simply cease to exist. If you are not already, I urge you to become familiar with MMT as an accurate macro-economic description of how our system actually functions.

“Modern Monetary Theory” is an economic religion that requires that you take that leap of faith. If you don’t, it makes no sense whatsoever. MMT only makes sense to true believers.

MMT is like QE which is part of it.

And JAPAN popped that QE balloon. As anything but an emergency measure that opens cans of worms, nobody, has had to deal with before.

Or even has proven cures for .

Which makes MMT GUESS WORK at best.

The Japanese model says at lest 2 generations after the last guy stops easing CB’S may be able to look back and start to model big QE.

Europe and china still got taps at high flow if not fully open.

Japan has shown us this QE thing is much much harder to unravel gently, than it is to commence. It has become clear. If it is not unraveled gently, it will create a bigger mess, than it was attempting to avoid.

Only when everybody has cleared their balance sheets after stopping QE can a post mortem Analysis even be considered, let alone started.

I will be dead before then, and so Mr Richter, will you.

The difference between the US and Japan is that US answers to no one. Japan’s economic miracle after the war was allowed to happen by the US, their benefactor. When Japan’s industrial might became too much of a nuisance to the US’ own economy, the US and its proxies (IMF, central banks) exercised pressure and tactics on Japan to change its domestic policies. Japan’s crisis of the 90s was planned and self-inflicted. See “princes of the yen”.

Ignore the theory how does the thing work? Their method is to spread risk as thin as possible, whether its Mortgage securities, or derivatives. So arsenic is poisonous at X ppm, so dilute the risk down to acceptable levels. (Now if the only the Bank of Mars would take these derivatives) and seriously their answer will be an off balance sheet solution, the Iraq war prepared you for it, now you get the complete package, the entire national (and global?) economies will go off balance sheet. and I bet you’re thinking, “they can’t do that”. That phrase is always the lead in to even greater folly. and the average red state voter is saying just save my 401K. so what’s an off balance sheet whatsit?

What’s the leap of faith you’re saying MMT requires? The core insight of “governments that print their own currency can never run out of that currency” is pretty undeniable.

The leap of faith is that this will not destroy the currency. For illustration, see all the currencies that have been destroyed in this manner… most recently, Venezuela, but also Argentina, Zimbabwe, etc.

Lampoon : I don’t know where to begin , but this MMT ideology has reached the point of diminishing returns . If the national debt is just a spending limit parameter why are we paying interest on this debt ?

MMT has nothing modern about it: has been tried – in the Weimar republic.

There is nothing remotely similar to Weimer in the current situation.

1. Germany lost a major war and had to pay reparations to the victors.

2. Germany lost a major war and almost 2 million working age men out of a population of 65 million.

3. Germany paid for the major war by selling war bonds to the public.

4. German industry was entirely focused on war production up to the end, after the war production had to be reoriented to civilian production. A large share of that production was sent to the victors.

5. When the German war bonds came due and was paid, demand far far outstripped supply and workers were in a very strong position as the war reparations had to be paid.

Do you think excess consumer demand is a problem in the current situation?

Meanwhile, the revolving door between the singularly worthless “enforcers” at the SEC and the banksters they’re supposed to be overseeing is whirring like a steam turbine.

http://www.zerohedge.com/news/2017-10-18/sec-hires-jpm-banker-its-most-important-markets-regulator-may-blow-hft-dominance

Wolf, thanks for keeping the debt in our sights. The debt, to me, is the elephant in the room. I am convinced that it is the debt that will ultimately bite the hardest.

I’ll try to keep it on the agenda :-]

At the end of this month, I’ll post another article dedicated just to our pile of debt.

This is a message that needs to be shouted over and over again until at least some people start to listen!

I have absolutely no proof, but my suspicion is that money is leaving the bond market and moving to the stock market based on a building fear that inflation is ready to take off and that the Fed is way behind the curve.

There have been a few reportings of wage growth here and there, which is the real key to a substantial and sustained rise in inflation.

I’m still in the stagflation camp, but inflation is a very difficult child to understand sometimes.

I am wondering the same thing. The name of the game is for the Central Banks to monetize and guarantee all debt. Search U.S. money supply on Google. Then search Venezuelan. Not much difference. What if we are about to go on a big inflation kick.

National Debt does not matter….print…print. 50k Dow here we come in not time at all.

2007 and 2008 was a liquidity crisis. The Fed has a solution for that now. What could honestly stop inflation right now.

“Search U.S. money supply on Google. Then search Venezuelan. Not much difference. What if we are about to go on a big inflation kick. ”

They’re not even remotely comparable.

And the U.S. money supply has grown at a lower rate in the post recession era than in the pre recession era. So you’re wrong, generally and specifically.

I absolutely have no proof, but it seems that the Wall Street is breaking one record after another record highs since the proposed tax cuts for the wealthy class were introduced lately to threaten the congress: pass them or we’ll force the Dow and other indexes go down faster than we made them go up. Mnuchin just verbalized it.

The oligarchs are no longer running the show from behind the scenes. Thanks to Swamp Creatures like Mnuchin, they ARE the scene. All hail Goldman Sachs!

If Mnuchin is suggesting a market decline is inevitable if a tax cut (for the 1%) is not passed, there is no reason it should do more than take the Dow down to where it was when Trump took office. But Mnuchin is a very sinister figure: Trump put a portrait of Andrew Jackson in the Oval Office- he likes him because he was tough, and Trump would have you believe he is also a populist like Jackson, but the truth is that neither he nor Mnuchin give a damn whether the budget is balanced, and one of Jackson’s great virtues was that he swore to never run a deficit, and he never did. Mnuchin, like Jack Lew before him, publicly came out in opposition to Congress’ having any input as to an expansion of the national debt limit. That is as dangerous as it gets. The Caracas stock exchange did not outpace all others (they took 3 zeros off the index in October because it was so ridiculously high) because their economy did well- it was pure inflation.

Q3 saw $36 billion in net OUTFLOWS from equity mutual funds and ETFs, and 2017 as a whole has seen net OUTFLOWS from equities.

As for inflation, just watch the long end of the treasury curve. The bond market is expecting low inflation and low growth.

Just about every major risk on the horizon is deflationary. There is a negligible risk of a major spike in inflation. Wages aren’t going anywhere anytime soon.

It’s tough for me to imagine where a big inflation uptick could come from. Inflation results from too much money chasing too little production. So inflation would have to result from the people currently holding big piles of money to start spending so much of it that productive capacity has a hard time keeping up. What would prompt them to do such a thing?

Your inflation theory is nonsense. See Venezuela and Argentina.

hmmm.. zero rates, price starts to go up.. I better hold real stuff like toilet paper and soap as opposed to paper cash since they are just going to buy less. Paul does it, then Paul’s neighbor, before you know it, grocery are all gone..

That’s one way for Inflation to go up.

By the way, that’s why FED is targeting 2%. Any thing more than that on a not expanding economy will drive people to dump cash and horde real stuff.

There is a psychological line, and if that is crossed, avalanche.

One major gripe I have with impending changes is that if taxes are at all passed in the form proposed will basically remove any tax break for average home owners, short of having a jumbo loan mortgage.

The removal of personal exemptions normally paired by most families with the mortgage deduction and with the standard. That along with the removal of state income tax deduction all but removes any incentive to take the mortgage deduction.

If their goal is to kill this deduction, which may not be a bad thing, I think they need to phase it out for those people who recently purchased. Why? Because once they kill this we will see people lose value in their homes and see their taxes go up. Its a double slap in the face. If you are going to force the housing market to correct for a lack of a mortgage deduction, at least cushion the blow by giving some continued tax advantage to new home owners and phase it out slowly. New buyers wont get it, but housing prices will adjust down as well.

Alternatively, if they both want to keep a tax incentive to purchase a primary home and simplify the tax code, then they need to make the mortgage deduction a tax credit claimable in conjunction with the standard deduction. They can argue about capping the value and making it progressive.

In any event, if they try to change any of these details, a lot of people are going to get shafted no matter what they chose to do. You simply can’t modify a tax code that has been in place this long without creating losers. As someone on the verge of buying a home, I feel like I have coin flip odds of tax changes being a stick in the eye.

Phasing out the mortgage deduction is an interesting idea. As it stands now, the mortgage deduction amounts to a subsidy for the owner(s) of up to two homes with one million dollars of mortgage – if married and filing jointly. I have enjoyed a slight tax break in the past with this, and I understand the reasoning, but IMO it is used by the affluent at the expense of those that have no mortgage; either because their home is owned free and clear, or they rent. If a married couple buys a million dollar home with 25% down, and a 330k second home also with $25% down, every dollar of interest paid is tax deductible!

Thank you Wolf for reminding us about the $20T monkey on our backs. It will be $30T in nine years according to the CBO, and at the current GDP growth, the GDP will be around $23T then. Now we’re close to the debt and GDP being equal.

One aspect of President Trump’s proposal is to reduce the corporate tax rate of 35% to “No higher than 20%.” Any opinion on this readers and Wolf?

I have posted these facts before regarding mortgage tax breaks and debt to GDP. Perhaps I am the broken record??? Sorry if I am, but they seem appropriate to this topic.

To me the takeaway here is not ‘what will the stock market do’ or ‘what will the politicians do’ but just how insanely far removed all of this Washington maneuvering is from anything that matters to a large majority of Americans.

It’s like an argument about what animal shape to trim the hedges at Versailles into…

On one hand, interest rates rising are killing Unicorns and hollowed up companies (well in the later case killing them faster). But in the other; highter interest rates means is easy to raise money if you are investing the money or lending it instead of just asking for money. Hence part of the stocks going good is in answer to rate hikes that the FED is kindly enough to announce several months in advance.

And interest rates is something the Stock Market never ignores.

Of course that’s not the only reason, but is the most visible one.

I think however is in charge in the FED next year will get a lot of pressure to keep raising rates.

But then again with the current Commander in Chief in the USA, who knows?

Yellen for the win! Kick that can CnC ZIGZAG

Gosh it only seemed like yesterday when I used to try to take the Micky out of T-pit? Everybody used to argue about how the central bank was going to “run out of money before inflation really kicked in” to now “The Central Bank is the ultimate buyer at the highs” 4ever! Problem is the Central Banks are trying to beggar their bosses into buying back their junk? Spreads will have to widen?

The Federal reserve must test the patience and cohesiveness of the public – private partnership and induce its owner bankers to do the right thing and claim the mortgages still on the Fed balance sheet and spend currency to extinguish the liabilities?

Hi Wolf,

Question from the UK.

I keep hearing about these tax cuts, I presume they are Corporate and Personal tax reductions?

From a Corporation tax point of view what tax reduction are they looking for (i.e from 40% to 25%)?

The Government are stating that if the tax rate goes down then all this company money (trillions of dollars) repatriated elsewhere (probably in tax havens) will come back into the US? I just don’t see it.

Also with their reduced tax bills Companies will take on more employees (I just don’t see that either).

What’s the logic, apart from an increased budget deficit?

Best Regards

Steve

Mainly corporate tax cuts , a lot for the upper %1, some for the upper %10 and some but very little for the middle class.

Current top corporate Federal tax rate =%35.They are looking to reduce it to between %20 and %25.But because of loopholes the current effective corporate tax rate =%27

There will be a special deal for companies to repatriate their overseas cash at rates ranging from %10-%15.While this cash is held in the name of foreign subsidiaries,it much of it is probably held in accounts in the US.

Lower tax rates will result in some marginal projects being profitable,but the proponents vastly over exaggerate this number Most of the increase in after tax earnings will be given to the shareholders in terms of higher dividends and and more buybacks..And what group are over represented among shareholders.The upper %1 ,especially the upper 1/10 of %1

The logic is very simple.The Republicans control the Senate,the House and the Presidency.It is their one chance to change the tax code so that their backers such as the Koch Brothers reap billions of dollars in lower taxes

Very few seem to care about the budget deficit at this time

Thanks r cohn for the detailed reply.

Much appreciated.

Regards

Steve

Had the estate tax been eliminated in 2012, the heirs to the Edgar Bronfman Sr. fortune would have been among the big winners of that “tax reform”. Edgar died in 2013. Prior to his death, he had been a regular on the Forbes 400 list. Even with the estate tax, his children were well provided for. His two youngest daughters have given away about $150 million to an organization run by a spiritual growth guru near Albany, NY. Read about these heirs here: http://forward.com/news/385486/bronfman-sisters-secretive-self-help-group-nxivm/?attribution=home-hero-item-text-3

The Bronfman sisters will not make America great again.

Repealing the estate tax is an affront to the idea of democracy. Inherited wealth is an affront to democracy; it is the very creature that establishes an aristocratic class over time.

The estate tax should be made MUCH larger, and estate planning techniques that allow you to escape it should be reduced.

Some of the Founding Fathers believed that whole estates should be dismantled upon the death of their owner, as allowing them to grow in perpetuity means an ever growing share of the country’s assets (real estate, financial assets, etc.) go to an ever shrinking group of people. We’re there today, and yet poor Republicans are still fighting in favor of reducing taxes for the wealthy with the misguided idea that they will eventually become one of them.

“A power to dispose of estates for ever is manifestly absurd. The earth and the fullness of it belongs to every generation, and the preceding one can have no right to bind it up from posterity. Such extension of property is quite unnatural. There is no point more difficult to account for than the right we conceive men to have to dispose of their goods after death.” – ADAM SMITH

Allowing estates to remain untaxed served “only to raise the wealth and importance of particular families and individuals, giving them an unequal and undue influence in a republic” and promoted “contention and injustice.” Taxing estates, on the other hand, would “tend to promote that equality of property which is of the spirit and principle of a genuine republic.” – North Carolina law, 1784

Thomas Paine suggested that owned land be taxed heavily upon death, with the proceeds being distributed to ALL CITIZENS at the age of 21, “as a compensation in part, for the loss of his or her natural inheritance, by the introduction of the system of landed property.”

BMW Is an excellent example, of absentee ownership inherited wealth, hard at work. And doing reasonably well.

Wolf – I agree with you that fundamentals no longer matter in todays market.

That said, I think Mnuchin has it wrong and that investors anticipating his tax plan will sell equities regardless of whether or not it passes in congress. Most of the largest U.S. corporations employ aggressive tax strategies and pay nowhere near the Federal corporate tax rate on their income. Cutting corporate tax rates would probably have a negligible impact on after tax earnings for companies that use these strategies. If there is any rise in stock markets related to the Mnuchin and Cohn tax plan, its most likely the possibility of a tax holiday which allows the repatriation of ‘overseas’ corporate profits at a discounted tax rate. The last tax holiday we had in 2004 allowed Microsoft to repatriate $32 billion, which it immediately (before Bush even signed it into law) announced as a special dividend to its shareholders. I think the current amount of untaxed ‘overseas’ corporate profits is five times what it was in 2004, and includes the largest an best known names in many U.S. stock market indices:

https://aflcio.org/paywatch/tax-avoiders

With numbers like these and prior experience, its conceivable that some investors might rush to be stockholders of record at these firms before a tax holiday results in the declaration of a special dividend. Technically this money is not ‘overseas’ but in U.S. bond markets, which apparently means Apple owns more bonds than PIMCO.

https://www.bloomberg.com/news/articles/2017-05-04/apple-buys-more-company-debt-than-the-world-s-biggest-bond-funds

A tax holiday would probably liquidate these bond holdings, and distribute the proceeds to stock holders. This is basically just moving money from the bond market to stock holders. Whether any of this happens or not, stockholders buying for a one time dividend will sell as soon as they get the dividend. This means stock buyers anticipating the passage of a tax plan (with tax holiday) will sell if the tax plan does not pass, or sell after the tax plan passes and they collect their dividend. Same result either way.

Just overlay a chart of total world wide holdings of Central banks over a chart of stock markets.

If the FED actually starts reducing its balance sheet and foreign central banks lower the amount that they buy.,the market will go down big time

in most bull markets near the top the leadership narrows, since the advent of indexing those investors will still receive gains but greatly watered down. The DOW usually takes over leadership, 30 vs 500, so if CBs reduce the global monetary base the first effect would be even higher market values, additionally this is what hedge funds have been trying to do, to go long the leaders and short the rest.

I don’t think reducing the amount of global QE will have an immediate effect, also consider that liquidity once introduced can slosh around and rehypothecate for quite some time. To that end Fed policy has always been to open the discount window, to recycle existing liquidity (rinse and repeat)

Note that when there are fewer leaders than laggards, when there are more shorts in the market (quants) it could involve a sea change to net short for investors. The problem has always been how do you collect at the bottom, when the seller on the other side is tapped out, and normally you hope that Uncle Sam will reliquify the losers who sold you those shorts, and everyone would be happy. That’s when it gets a bit dicey because short sellers are basically evil pond scum, and more so when they are right.

Most Republicans only get concerned about the national debt when they are the minority party.

My takeaway from this article – logic and common sense have been outsourced to China and other countries, what is left is what we call “Wall street”.

Why does everyone expect a black swan to reset the stock market? Nate Silver, in his book, describes about how the poker market worked. There were three tiers of players — the expert players, the mediocre, and those who sucked at the game. During the boom years, the experts and the mediocre players made money off those at the bottom rung. At some point, the bad players figured out they were the patsy and left the market. The experts then started eating the lunch of the mediocre players. Nate silver figured out he was lunch during the waning years of the poker boom in aughts and left.

I am guessing the same thing will happen in the market soon, if it is not already underway. The market will be pumped up with volatility thrown in for a small stretch here and there to grab the assets held by those with weak stomachs. When the markets drop for a few days, the cautious investor will sell and after the carnage, the markets will continue to rise. New bait will enter and get ripped off by by the 1%ers.

The trick is to get a constant stream of new entrants. I expect the papers to tell us how indices are going up in the average and the poor worker bee will be able to remember only that as his manager harangues him. He will feel good about the market in general but won’t remember the daylight robbing unless he is a victim.

The claim made by Mnuchin is laughable. When the fate of the market is completely controlled by the Fed, who cares what kind of news breaks? Irrespective of tax bill failure — I am betting on this —, I foresee the market rising up with intermittent transfer of wealth to those at the top.

You are ascribing a bit too much exactness to the Fed’s level of control I think. They definitely have the capacity to generally open or close the money-spigots, which in the long run matters immensely, but there’s no capacity for the sort of day by day manipulation of market ups and downs that you’re describing.

d wrote on Oct 18, 2017 at 9:49 pm

“”Everybody frequently forgets ( not including Wolf and Myself)

A lot of that money in USA stocks, is not US money.””

I have been wondering if much of the money that is driving the stock market up is coming from the EU and South America – along with some ill gotten gains from other places – trying to find some sort of “safe haven” compared to the rest of the world.

Could that be the case?

It believ it is.

There has been a steady movement to safe haven since mid/late 2016 and the US $ and US Markets are is always part of that safe haven. There is not enough CHF to go round. And its expensive to hold.

Reverse Yankees Etc.

The Japanese Brought up a lot of the pacific rim, then they had to dump it in the late 80’s early 90’s. Which gave other Liquidity a better place to flow to.

A lot of the Money in the “Market’s” “Junk Bond’s” is only there as it can not find a safer/better place to flow to.

Unless something bad happens very soon, everything will be getting baked in for teh holiday season, until the next programmed event which is “New FED 2018”.

Which thentakes us out to the 2019 Eu issue and the US 2020/24. Before a lot of the political fear drivers are Possibly removed.

Dependent on Mr Muller, that is getting much quieter, which means it will die, or bite somebody/s very hard.

Yay, more blackmail from our leaders!

The biggest blackmail in history was, “Bail out the banks or else things will be really bad! Just like, because.”

Now we have a new one:

“You better cut taxes for the rich or else!”

One of my favorite things in tax discussions is when the Mnuchins of the world point out that the rich pay most of the income tax anyway. Of course, they never include the income figures along with the claim.

And of course, no discussions of regressive sales tax and social security.

It’s only a matter of time before someone goes into Davos, the EU, Congress, and/or the Fed with a flamethrower.

In the movie “The Usual Suspects,” one of the characters, Verbal Kent said, “…the greatest trick the devil pulled was to convince the world that he didn’t exist.” Magicians and illusionist are successful, because they trick you into watching their right hand whilest the “magic / illusion” happens in the left. In this case, the FED and congress for that matter don’t care which way interest rates or the market goes.

Before you pounce… they don’t care as long as they control (or at least have the inside scoop on which direction) the entity that causes the directional change. Why? Money can be made in any market – up or down. And our congressional leaders (both sides – red and blue) have been making money hand over fist. Ever see one leave congress poorer than when they entered – if ever at all? Leave that is. No the game is clearly rigged.

Consider this… the FED claims to be able to “control / reverse” a recession through monetary policy. If true, then why do we have recessions at all? Why not use that “power” to never have recessions? The answer to that question is simple… the only way for the insiders (FED, congress / politicians, Wall Street, and cronies) to have all the marbles is manipulate the market direction.

The one indisputable fact, if their lips are moving…they’re lying. With their words / posturing they want you to look at the left hand (illusion) and forget all about the right (magic). Pay no attention to what they say (or the man behind the curtain) watch what they do (if that’s even possible).

So what’s the answer? Maybe we should embrace the Founding Fathers, who did not believe there should be career politicians. Rather ordinary Americans to represent the average American for a term or two (remember civic duty) and then return home to their respective businesses and families. Politicians got us in this mess and have absolutely no interest or desire to get us out of this mess (think conflict of interest). Our best hope IMHO is term limits. Something no current politician would go for (remember…they’re making money hand over fist). Every incumbent needs to be thrown out of offic at the polls. Failing that, and perhaps a more certain course is an Article 5 Convention of the States.

In the words of George Washington, during his farewell address, inferred context – may we as Americans enjoy, “…the benign influence of good laws under free government…”

Wolf thank you, it’s like sitting in the Oval Office!!!

Respectfully.