Extraordinary asset price inflation in all its beauty.

The term “housing bubble” to describe the housing market that peaked in 2006 and imploded with spectacular effects has been gradually fading out of use. The current theme is that years of asset price inflation have “healed” the housing market, and that the crazy peak of Housing Bubble 1 is now just some sort of normal base. Oh my…

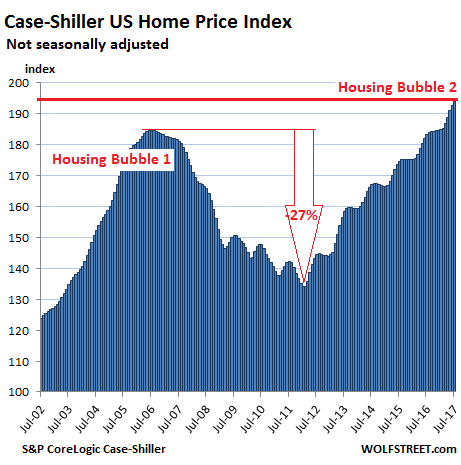

The S&P CoreLogic Case-Shiller National Home Price Index for July was released today. The not-seasonally-adjusted index jumped 6% year-over-year, by far outrunning growth in wages and household incomes, which it has done for years. The index has surpassed by 5% the crazy peak (I mean, the normal base) in July 2006:

While real estate is subject to local dynamics, monetary policies have a massive impact, particularly in places where the money flows to, which creates local housing bubbles. If enough local bubbles balloon at the same time, it becomes a national housing bubble – as seen in the chart above.

Below are the local housing bubbles of major metro areas in all their magnificent beauty:

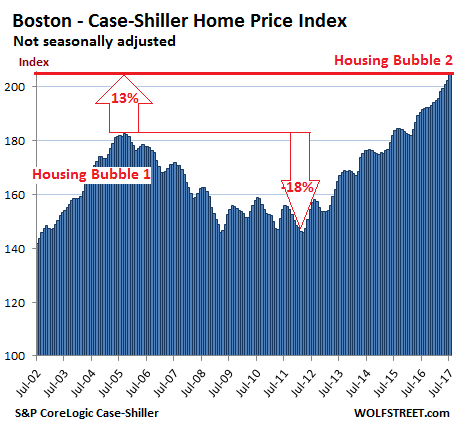

Boston:

In the Boston metro, the index soared 82% from January 2000 to November 2005. That was crazy. Then the index declined 18%, which wasn’t all that much. Since then, it has re-soared and is now 13% above the peak of Housing Bubble 1:

The Case-Shiller Index is based on a rolling-three month average; today’s release was for May, June, and July data. Instead of median prices, the index uses “home price sales pairs,” for instance, a house sold in 2011 and then again in 2017. Algorithms adjust this price movement and add other factors. The index was set at 100 for January 2000. An index value of 200 means prices have jumped 100% in those 17 years.

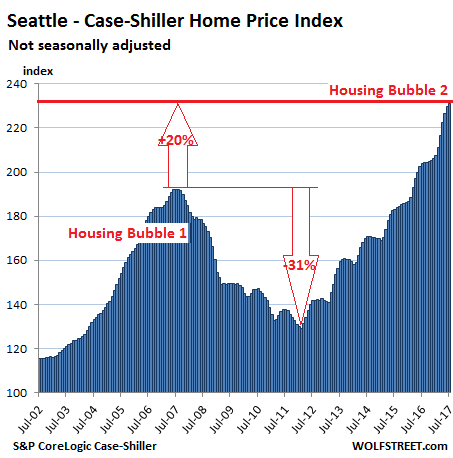

Seattle:

Home prices in the Seattle metro have spiked since the spring of 2016, pushing the index 20% above the peak of Housing Bubble 1 (July 2007):

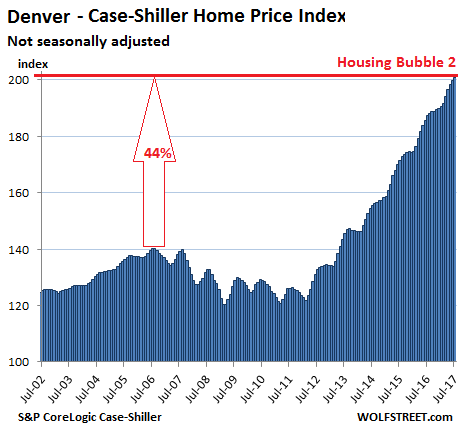

Denver:

When Housing Bubble 1 was blooming in many big markets, home prices in Denver were just edging up, and people felt left out. But then from the peak in August 2006, the index only fell 14%. The drama didn’t start until 2012, when Housing Bubble 2 lifted off with a vengeance. The index has now soared a stunning 44% above the prior peak:

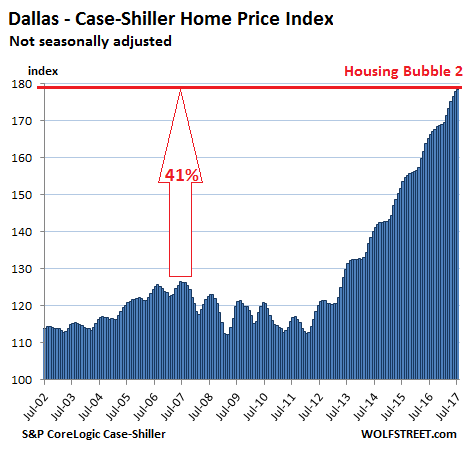

Dallas-Fort Worth:

People in the Dallas-Fort Worth metro also felt left out during Housing Bubble 1. Prices rose only 13% in five years. The house price crash mostly bypassed Dallas as well. It was the way a housing market should be, with some ups and downs. But North Texans know how to party when their time comes. The index has now surged by 41% above the peak in June 2007:

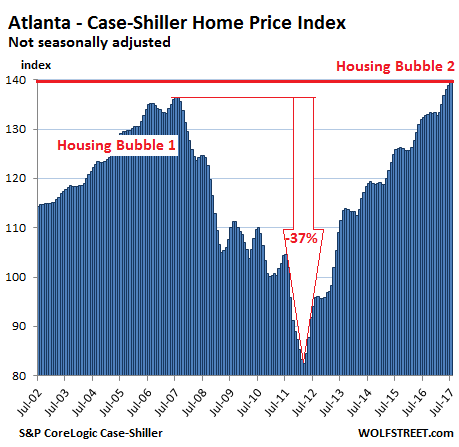

Atlanta:

In the Atlanta metro, where home prices had plunged 37% after Housing Bubble 1, prices are now 2.4% above the prior peak:

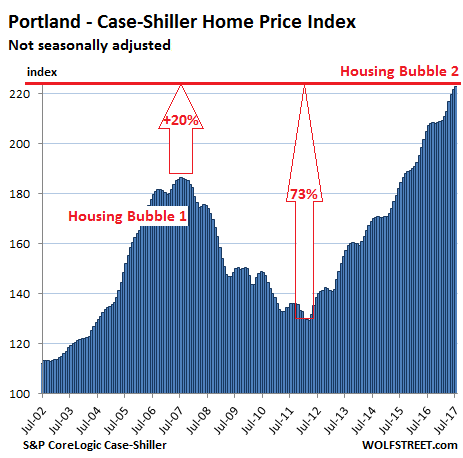

Portland:

Portland’s home prices have detached from any sense of gravity since 2012, with the index soaring 73% in five years. The index is now 20% above the peak of Housing Bubble 1 and has ballooned by 123% in 17 years:

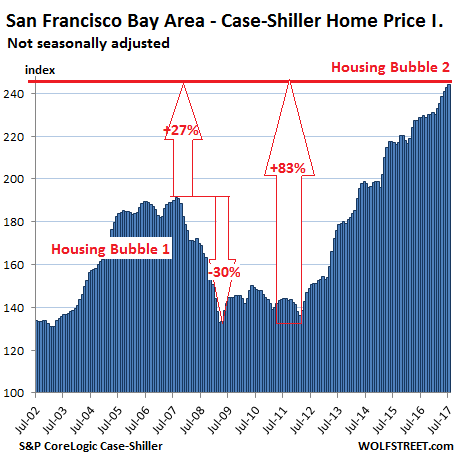

San Francisco:

The Case-Shiller Index covers five counties of the Bay Area and not just San Francisco. There are two indices for the area – the “High Tier” index and the overall index. And they behaved differently. The High Tier index (not pictured) tanked 43% during the housing bust, but has now surged past the prior peak by 10%.

The overall index peaked in in August 2007 and then plunged 30% by March 2009. It stayed in that range for three years (however, another measure, the median price, continued to zigzag lower until January 2012). Since then, years of global monetary craziness has sent liquidity from around the world tsunami-like to the Bay Area, and the index has soared 83% from the bottom of the bust and is now 27% above the prior crazy peak.

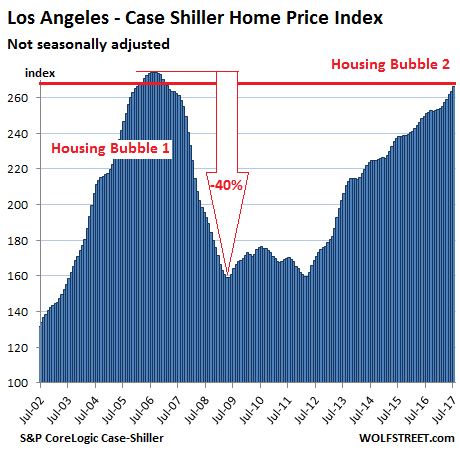

Los Angeles:

Few housing markets can hold a candle to LA’s beautiful creature. Home prices skyrocketed 174% from January 2000 to July 2006, before plunging at a dizzying rate and giving up much of those gains. Then, fired up by global liquidity, they soared again. The index is still not quite back at the peak level of July 2006, though it’s back where it was in February 2006 (the “High Tier” index for LA, not pictured, is already 4% above the peak of Housing Bubble 1):

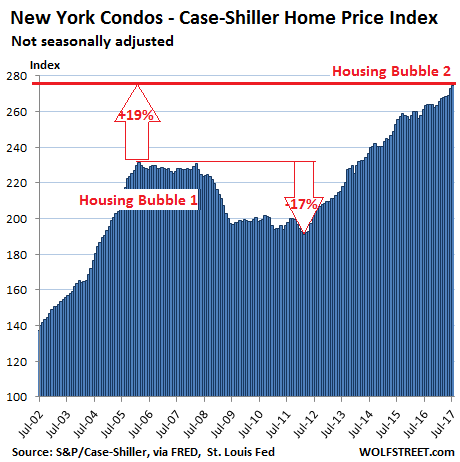

New York City Condos:

What’s hot in New York City? Condos. The Case-Shiller Index for condos in New York City soared 131% from January 2000 to the peak of Condo Bubble 1 in February 2006. That bubble barely deflated (-17%) before the Fed’s Wall Street manna arrived, flushed through the appropriate bank accounts, and reflated the condo bubble. The index is now 19% above the peak of Condo Bubble 1. Over the past 17 years, the index has soared 175%:

These are the visual effects of asset price inflation. A home whose price increases by 50% in five years didn’t get 50% larger or nicer. Instead, the value of dollars with regards to assets has gotten crushed. QE and ZIRP produced no wage inflation, moderate consumer price inflation, but extraordinary asset price inflation.

People who make money with assets (capital) came out ahead. People who make money with their labor got whacked. Not only did they not see the income gains that capital enjoyed, but they saw the fruits of their labor shrink when it comes to asset purchases such as a home. Every year, they can buy less and less in assets for the money they earn with their labor. The more politically correct term in the housing market is “affordability crisis,” but it’s a direct result of central bank policies.

The Fed seems to be worrying this scheme might have gone too far and poses risks for banks which use inflated assets as collateral. Since late last year, the Fed has acted like clockwork. The QE unwind starts on October 1. The next rate hike is coming in December. “Low” inflation, no problem. Read… This Fed is on a Mission.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s insanity. I only seem to know people who are inheriting houses. AND I know a ton of them in their 40’s that are “taking care” of mom or dad while still living in their childhood home.

Most never had any sort of career cause they didn’t need to. They KNOW they will get the house once the parents kick the bucket. Some guy just rented the unit next to my office and he’s using it just for “storage” when I asked what he’s doing there. And he offered that he was “taking care of dad” who’s really sick and dad has “a bunch of RE in the area he has to “manage”

So many here in socal have essentially won the lottery but what happens when the parents do pass….these people have never really had to manage money in their lives. How does this all play out?

If I sound jealous I am, I’ve had to compete with China for the last 20 years and that translates into actually dropping my shop rate while prices for RE head for the stratosphere. The thing is I couldn’t make better money doing anything else but still don’t have the income to qualify for a $630K starter home.

Inheriting a property in SoCal doesn’t help much unless you are willing to sell it and move somewhere else. You could sell an $800k inheritance and buy a nice house in Ohio and live on $40k a year for the rest of your life.

But then you’d be in Ohio.

What’s wrong with Ohio?

Ohio’s okay. It’s just a little change in lifestyle from SoCal.

I’m just gonna drop this very interesting map in here…

http://www.equality-of-opportunity.org/

The site (Reddit) I found it on was bagging on the deep South, which probably deserves it, but look at the Midwest. The lighter the color, the more social mobility on this map. And the Midwest is a sea of pale yellow.

I’ll admit, if I wanted to start a company that did not depend on local sales because I’d be producing a product that’s sold online, the Midwest would seem to be a good place to do it.

It is plain in Ohio…

I live in coastal Orange County, CA. Where else, apart from San Diego to Santa Barbara, could I move to with the same quality of life, climate and amenities?

Certainly not OH…

I thought the same before I moved from the Bay Area to Idaho.

I live in Ohio-was relocated here back in the 70s. I had separated from a wife and it was a real opportunity. Yes, Ohio’s not California-no earthquakes to mention, seasons, a government that isn’t TOTALLY crazy, reasonable prices for everything. I have visited California (San Diego and LA) and was quite happy to go back to boring Ohio. We do have the Buckeyes, pretty good roads, and lower taxes.

Once upon a time there was something called California dreamin. It was a genuine lifestyle that died somewhere back in the 1990s. I lived it, loved it then left.

Now So Cal is super crowded, expensive, car congested- I mean it really really is bumper to bumper all the time , while back in the 90s it was a grumbling complaint.

Gentrification means homogenization and the soul of so cal is deader than dead, trampled over by the new Chinese rich that are buying up every vacant lot.

The people have become much much meaner and self centered, and after traveling the globe I can say that southern Californias are pitiless and even cruel. . But the nastiness is always delivered with a smile!

The air sucks, the crowd sucks, and any natural beauty is almost gone.

But if you visit Ohio and the midwest you’ll still find the good people that once made America great.

So, I would suggest no one move to California because you’d only make it worse. Just sit in ohio and have a drink with those very fine people and pity the people in So. Cal who think sunshine is the only reason for living.

Mitch – you’re talking about my relatives, there.

And I agree 100%. I’m literally typing this from the office in a rickety warehouse with no running water in a bad part of town, while they’re literally sitting, or probably sleeping at this hour in multi-million dollar houses. I mean, more then one or two million, we’re talking “several”.

I’d not expect them to support me, of course, but geez … I could literally show up at their doors starving and they’d call the cops.

http://www.zerohedge.com/news/2017-09-26/heres-how-much-space-you-can-rent-1500-worlds-most-popular-cities

The article says that you can get the same amount of space in Tokyo or Sydney.

Just shows how ridiculous Australia and Sydney in particular have become.

And on that note, do you know that we have a NG shortage here in Oz?

Yep, we export so much that there isn’t enough for the domestic market and as a result NG prices have soared.

The solutions was to restrict some exports and ship the NG to NSW and Victoria, but at a cost.

How much you ask? The transport charge just to move the gas is going to cost, are you ready for this……

An extra A$2.44 per mcf…………..

We have planned to put in a wood heater before he end of the year. This so called solution just makes it even better from and economic point of view.

@Lee

The fact that prices are the same in Tokyo and Sydney shows how much laundered money is allowed to enter the country scot-free. Did the government launch a study into the matter, yet?

I’d say it helps a lot, compared to the person who inherits nothing.

You could:

1. Sell it and pay no capital gains since the property’s value is stepped up to the current market value.

2. Keep it as a rental and enjoy both the prop 13 low property taxes and the income stream.

3. Live in it yourself and take advantage of the low property taxes.

1) You are likely to take a tax loss on an inherited house in CA that you can offset other gains.

The basis is reset to the time of death but you will likely have expenses to sell the house.

ie

Mom bought the house in 1972 for $40K and sadly, she passed away, leaving her house to you.

Appraisal at Mom’s death is now $1.2M and the house basis has been reset (Poor taxman. If Mom would have sold it before she passed away, the taxes would have been >$150K to the IRS).

You contact a RE agent who graciously offers to lower his commission to 5%. The house sells for $1.2M in 2 days. and you are now a millionaire tax-free. The RE agents collect $60K.

That $60K “loss” can now be used to offset any other gains that you made in stocks, etc OR $3K per year for 20 years can offset any earned income.

The lesson is: The best way to help your kids after you are gone, has been to own a house in CA.

Move and relocate…then buy a small rv or fifth wheel and park where it is warm a few months of the year. Northern States or Canada is very nice for 6 months of the year, so so for 2, and worth leaving for 4. However, the more I see what the weather is like for southern states, including Socal during the burning season, the nicer other places look. I’ve spent time during summers in Montana, Idaho, WA, and Minnesota. I grew up to leave CA in the late ’60s. California is way past the ‘sell by’ date, and I don’t just mean the RE prices.

But hey, I’ve lived on Vancouver Island for the last 50 years so what do I know? :-)

List the house, take the money, run, and get off the hamster wheel, imho.

regards

Paulo – you have to literally be a millionaire to move to Vancouver, plus isn’t it hard as hell to get citizenship?

alex,

The northern part of Vancouver Island was very reasonable until now (I just let the secret out, sooooorry :-) I’ve gone fishing up there off Texada Island years ago when I lived in the lower mainland–spectacular scenery, nothing better IMHO.

Vancouver city on the lower mainland is for multi-millionaires now, wasn’t always like that.

And to get citizenship, just walk across the border anywhere, it’s happening every day.

Jack – You mean, I could simply visit Canada, and ask for citizenship?

I’d like to see your sources! My understanding is if you’re not in a much-needed profession and worth at least a half-mil, fuhgeddaboudit!

alex, I was being a little facetious when I said, “just cross the border…” only because the Haitians et al have been doing it all year:

https://www.reuters.com/article/us-usa-immigration-canada-border/quebec-border-camp-swells-with-asylum-seekers-from-u-s-many-haitian-idUSKBN1AQ2OU

http://www.cbc.ca/news/opinion/haitian-asylum-seekers-1.4236104

@ Alex,

If you are from the USA, it could be hard, but if you first emigrated to a turd world country, your chances would improve a lot.

Some people in Ohio have turned down several good employment opportunities in California, because, well, it’s California and not somewhere that many people from Ohio would ever consider living (but not to worry, I’ve turned down opportunities in North Dakota too).

It keeps you in a house. You can sell and make a lateral move. You will get shafted for taxes, but that’s not always a huge deal if you can buy another house in full.

But retires definitely need to leave the state if they want to tap some of that equity for anything except another home.

And also of course naturally, children of property owning parents in high cost areas are all but guaranteed to get a fairly healthy inheritance even if they have to split a home sale with a sibling. Its not a terrible deal to get a windfall of a million dollar property sale in your 50’s or 60’s.

Thats a form of lottery winning. Probably not useful in early adult hood assuming the best case and not morbidly hopping for a parents early passing.

Hahaha I actually saw up close, a guy get about $400k from the sale of his mother’s house.

It took him two whole years to blow through it all.

Well, today Ms Yellen explained her latest reason to keep from raising interest rates significantly and so that should goose both housing prices and stock prices some more. The bailouts/QE/etc have failed to restore the economy to health and so in typical governmental civil service fashion they will continue to do more of it. Do I understand correctly that Japan did something like this for 20 years with little effect?

I’ve always assumed it wasn’t supposed to restore the economy to health as much as keeping it from completely collapsing into mass unemployment and civil war.

The Fed, for over 100 years, has understood how to debase the currency – a 1913 dollar is worth less than 3 cents, in 2017 – and create bubbles. That’s all anyone needs to know…

Don’t forget the muppets, they played along too. The Fed is just another institution. Why didn’t the muppets stop it 50 years ago?

More to the point, modern Fed policy is to enrich the wealthy at the expense of the general population, short of inducing insurrection.

Fed bailouts/QE function as intended, to restore and enhance the finances of the very wealthiest at the expense of the real economy. Restoring the real economy is avoided because that would tend to empower the general population, reducing their value as desperate wage and debt slaves. Bailouts, such as those received by the auto industry, are always on condition that worker compensation is heavily truncated. It’s not as if it’s any secret.

Taken to its logical conclusion the flow of economic refugees to the US will ultimately be reversed. No wall will be needed except as a pork project.

Yellen said the Fed should be “wary” of raising rates “too gradually.” While she is at the helm, rates are rising.

Real inflation is outstripping the Fed’s piddly .25 rate hikes.

Agree.

Asian markets are calling BS on Yellen’s supposed rate hikes. They, like me, will believe it when we see it.

Wolf, her messaged seemed mixed. She said that the Fed was not going to predictably raise rates and seemed hesitant on not taking away the kool-aid if things looked like they would sour.

If ypu were a betting man, do you think she is saying that just to sooth the markets or is genuine about her intentions? Basically what do you think would cause her to change course?

I’m just looking at December. I have little visibility going forward into next year. Vice chair Fischer is leaving in Oct. Yellen may not be reappointed Fed chair. There are already some unfilled slots on the FOMC. So we could look at an entirely different Fed next summer.

I completely ignore Yellen and her flying monkeys when they engage in their serial dissembling about mythical rate hikes. Bilking savers out of an estimated $500 billion a year in interest income and forcing them to play in Wall Street’s rigged casino is too lucrative a racket for the Wall Street-Federal Reserve Looting Syndicate to ever voluntarily relinquish. So Yellen will go on with her played-out “Lucy and the Football” routine of insinuating pending rate hikes, then always coming up with some creative pretext for why “the data” indicates now is not the right time.

I can’t wait till these central banker charlatans are exposed as the frauds and criminals that they are.

But don’t you know about the wealth effect, and that all the wealth generated for a tiny sliver of society will eventually trickle down to you? No? Then apparently you aren’t a trained economist, and thus not an intellectual pinhead who believes a theory that has been thoroughly disproved over the last ten years. Maybe we should all get degrees in economics so we can appreciate the faith based nature of this particular area of study.

Somehow it seems like most economists are the modern day shamans throwing their bones to read the future…

Many economists–notably, Krugman, but also many others including Wolf, I believe–reputed ‘trickle down,’ ‘supply side,’ ‘wealth effect’–whatever you want to call it–years ago. It’s the GOP that keeps flogging that long-dead horse.

Can you stamp your feet for us?

These dudes must be coordinating these statements. The Bank of Canada apparatchik just made a similar statement.

This, in effect, is an illegal mandate: giving speculators forward warning about their moves.

Dallas and Atlanta can grow in almost any direction. A bubble is ridiculous. Denver is against the mountains so I can see the issues with growth westward.

For the homeowners I know in these bubble cities, I am happy for them. Especially the ones nearing retirement.

I hold four real estate properties in two states, so I’m really in favor of all these bubbles.

All these places can grow toward the sky – and they’re doing it. Take the space of ten homes and put 400 condos on it.

I wouldn’t want to be in a steel-frame building during a blind-thrust fault earthquake, such as the M6.9 in Encino/Northridge in 1994. It caused many newer structures to develop cracks and had it been stronger, could have caused some to fail.

Steel-framed buildings are designed to “sway” during a slip-strike fault such as the ones that occur along the San Andreas, but blind-thrust faults have proven impossible to design protect against to date. Not that the Federal and CA governments haven’t tried: hundreds of millions have been spent, so far, to no avail.

Bottom line, yes, in most places, high rises can be built and provide significant increases to the housing supply. But in places such as downtown LA and much of So CA, they are a very risky place to live in the wrong fault line breaks.

I’d much rather be in a steel-frame high-rise than in a 4-story stone, brick, or low-rebar concrete building during the big one. In fact, I’d rather be somewhere else entirely during the big one :-)

Recent-model Japanese steel high-rises did well during the 3-2011 earthquake.

Minneapolis has quite a lot of high-rise apartment and condo construction now. Most of it is along the light-rail lines and near downtown.

According to Trulia, median sale price for homes from May through August was $248,000, and the average price per square foot is $226, which is up 7% compared to the same time last year.

Interestingly, the Kenwood neighborhood, which is the highest priced has gone backwards. Current average listing price is $1,432,900. Current median sale price is $653,121, and that’s down 12.8% y-o-y. Current price per sq ft is $256, and that’s down 20.5% y-o-y.

Could of said the same thing about Atlanta and Dallas back in 07-08 as well.

Yes it’s the great change of the last 40 years that thinking only about yourself, not of the greater good, has become not only socially acceptable but indeed desirable. Greed rebranded as ‘aspiration’ in order to try to imbue it with some air of nobility, and side-step the thorny problem of sinning.

There’s a lot that can be said about that, but put succinctly it’s one of the defining characteristics of a society that’s deep into its decadence phase. All the other characteristics are there in spades, too.

Which is precisely why global power is transferring to a part of the world where they are working hard to produce and export, rather than smugly sitting back, collecting rent and living off money that they’re done nothing to earn.

beautifully done, MD.

thank you.

x

Dallas-Fort Worthis growing in every direction, but so it traffic. The population is increasing every year and lots of companies are moving in ( Toyota from CA ).

30 miles is about the farthest you can live and have a commute that won’t kill you.

– “A bubble is ridiculous”. Yep, that’s what they said in Florida as well in 2003 when Harry Dent told them that the housing market would peak that year. (Dent was off by 2 years because the US housing market peaked in 2005).

– People in Florida, Miami, Vancouver, Toronto, ……….. all said that they were different and home prices in their neighbourhood never would go down. But they all did fall eventually.

– What’s also VERY detrimental (for e.g. Housing) is rising interest rates. Just ask the good folks in Southern Europe when from say 2010 up to 2012 interest rates rose in those countries. My personal opinion is that (long term) rates here in the US can go lower for a short while (say 12 or 18 months max.) but that then rates are going to rise. Even a small increase to say 4 or 5% (from the current say 2%) is very detrimental for housing. (Remember the warning form Fitch ???).

While Denver has some land constraints, it doesn’t have to be doom and gloom. Housing prices in the area, in sheer dollar amounts, may seem like a bargain compared to say the Bay Area, or other high costs areas. However, when wages are factored in, affordability is a real and growing problem in the area–not merely “growing pains” that some of the tone-leaf leaders claim it is.

With proper planning and increasing density, the area still has a chance of keeping a modicum of affordability. However, if the NIMBY crowd, wins out and prevents much need housing construction, Denver is going to go the way the way San Francisco, where affordability is concerned.

My God this collapse is going to be breathtaking.

Agreed. Especially since the Fed has already blown its wad with nine years of “emergency” measures and trillions in printing-press “stimulus”, and the sheeple may not bend over for Wall Street with quite the same alacrity they showed in 2008 with their votes for pro-bailout Wall Street stooges Obama and McCain.

A hell of a lot of people didn’t have the wisdom to get born into the property owning class and are having to do things like this:

https://boingboing.net/2017/09/14/lemonade-from-others-lemons.html

American society working the way it does, I have relatives living in multi-million dollar houses and as the saying goes, they’d not p!$$ on me if I were on fire.

I’m in Seattle. On my block, I know the circumstances of 8 families. Two are renters (thinking that homes are too overpriced). Three are retirees who could not afford their own homes in today’s market. One is a recent immigrant from China with a good job. One is a working family just getting by. And one family is what I would call wealthy, with no money cares.

I think that says a lot about the housing market here. The prices are supported by a few buyers on the margin, like the family from China.

That explains why housing demand is at record lows and falling.

As Seattle knows better than most and influx of high paying tech and engineering jobs definitely jacks up home prices and fuels high prices in desirable areas, especially when not enough people are selling and interest rates are exaggerating affordability.

Look at all the cities on that list and they all have healthy growing levels of high paid work. Dual income engineering families with 1-2 kids buy $800k homes with relative ease after they make it past the child care hump…

The rest of the people rent or buy in less local or desirable areas.

The only city I know right now where high paid engineers hesitate to buy right now is San Francisco.

Well the Chinese government has banned bitcoin and it is not easy in today political climate.over there for regular folk to convert over yuan to hard currency. I would really like to know what avenues people currently have to get their dough out of the country because it looks like that is now the deciding factor keeping that housing bubbles going.

Most people with money here are not trying to get their money out of the country, unless they are under investigation for corruption. It is easier to start a company and get rich here than in America. The poor, the middle class, and the rich all see themselves better off every year. There is no reason to go to America where things are too uncertain and sliding backwards.

This describes my Pasadena neighborhood exactly – the very same numbers of folks you listed!

I’m sincerely wondering everyday when this bubble will burst.. 1 year? 5 years? Who knows…

It would be my hope that things stay stable in the SFBR for a while. My three-generation family has outgrown my tiny, ancient 2br 1ba Sunnyvale home. I would need to go into debt to do an addition/remodel. I have offers (as-is cash from investors; not on the MLS so far) that should allow me to get into a 3-4br 2ba home in Fremont/Union City without going back into debt. The Sunnyvale situation has gotten absurd; average successful overbid in Aug for my greater neighborhood was $186,000! It’s a whole different thing being in the middle of this situation than it is just looking at it.

Reno, NV has a 62% bottom to top to bottom to top pattern… I know our economy has fundamentals which support a rise in house prices, but we have nearly 1800 Notices of Default right now or 3 full months of supply at the crazy high sales volumes we’re experiencing right now.

Were the fundamentals why you didn’t include Reno Mish?

Source: https://www.washoecounty.us/assessor/real_property/SalesHistoryChart.php

Wolf. Sorry. I read Wolfstreet and Mishtalk regularly. This post was the kind of post we commonly see on Mishtalk so I got confused…

No problem . I get confused all the time :-]

Here in Santa Monica prices are heading down with more and more for sale signs in all 4 directions.

Cheer Yellen on to keep raising interest rates and unwinding their balance sheet. They have screwed us long enough with ultra low interest rates never before seen in the last 5000 years, it is time to correct their socialist, Keynesian wet dream.

sberbank pays 6.5%

Cheer Yellen on to keep raising interest rates and unwinding their balance sheet.

Cheer Yellen on? The Federal Reserve is the greatest swindle ever perpetrated on the American middle and working classes. You should be working to get it audited, then abolished, not “cheering on” these gold-collar criminals.

It’s great to be ambitious, Gershon. But by golly, sometimes it’s OK to take the low-hanging fruit, rather than nothing. This economy needs higher rates more than anything. I doubt Congress will abolish the Fed in my lifetime. But I’m already seeing (slightly) higher rates… :-]

The economy needs higher rates?

No sir, we need a reset. I am w/ Gershon and LAPilot – the coming downturn will be a gully washer.

We have had maybe two 25 bp increases by the Fed and now everyone is buying Yellen’s schedule? People have a normalcy bias or some other psychological malady. The FEd will do what is good for their private banking cartel.

Nominal or real?

If interest rates were 10%, the Fed would probably inflate at 11% or more.

Otherwise the real cost of debt is too high to afford and the party stops.

We need sound money and let honest market to tell us where the rate should be.

People will say many bad things about messy free market, but please understand that when money is NOT sound, nothing works for people who have no access to unsound money, even free market will lead to bad consequences for people who works to get money. The only people who gets reward would be folks who have access to unsound money.

Nope. These dudes are in telegraphing business these days, and they are telegraphing (to speculators) no rate rises.

The median house has historically been priced at 3X the median income. Even with Yellen and her Keynesian counterfeiters and racketeers at the Fed presiding over the biggest asset bubble in history, people simply cannot afford to keep buying houses at these nosebleed levels. A correction to historic norms is coming, and it’s going to be brutal for the FBs who over-leveraged themselves to buy insanely overpriced housing.

Greg Hunter has an interview with a guy named Gordon Long who said exactly that A correction to the trendline is coming and he says within the next year or so

With the end of cheap credit, the credit freezes and lots of people losing their jobs, there will be less and less buyers.

Wow this CDOs are back?

https://www.bloomberg.com/news/articles/2017-09-26/as-synthetic-cdos-roar-back-a-young-citi-trader-makes-her-name

So pensions are buying into a category of synthetic CDO which basically uses leverage to amplify what would otherwise be pretty meh gains…

Holy shit some people are gonna get hammeres whend inevitably some start taking leveraged losses…

I wonder how many of these “property bubble” locations will go the way of Detroit, where they end up destroying tens of thousands of abandoned homes that people can’t live in because of a chronic lack of jobs. Like parasites killing the host.

LA has tent cities like crazy – I joke that they’re the new “affordable housing,” as studio apartments are crazy expensive even for a median-income earner like me.

Spot on. 10 years ago there was no such thing as tent cities, now I see them in San Francisco, Oakland and beyond. Up until now, I use to only see tent cities in developing world, now we have them, everywhere. These housing bubbles are destroying the middle class. Many people can’t afford to buy a house and those that can end up spending all their money on the thing, stagnating the rest of the economy.

Bubble in the USA – depression in the country areas of Japan.

Presented for you is a free house in Japan and the owner will throw in 500,000 for you to help clean out the place.

Now all you people have to do is somehow get a visa, a job, and learn the language……………….

http://tinyurl.com/yb4aw5xh

Over on another financial blog the person who runs it claims that house prices are now at about 2004 levels when you adjust for inflation (SA-seasonally adjusted). So according to his analysis the bubble has not reflated as inflation would dictate the prices moving higher, as they have. This is not to say another bubble may be forming, but we could still be in the very early stages of said bubble. Of course isolated pockets of silliness (think San Fran) are possible bubbles.

Anyway he uses the same case-schiller reports and paints an entirely different picture once inflation is factored in.

I would name the blog, but I am not sure if that is copacetic here.

Consumer price inflation as measured by CPI is about 13% since late 2007. So take that 13% off the top, which shows that some cities are above the prior peak and others are just below it. The national average is just below it.

But remember: the prior peak was when things blew up. It wasn’t some sort of serene state of calm.

But I agree, it could go on for a while, given that mortgage rates are still so low. There are lots of problems already cropping up in the Bay Area beneath the surface, including plunging pending home sales (I’ll post on that later today). So the Bay Area market is already running into trouble. Prices will be the last thing that moves down.

The “median” price in San Francisco shows a flat-lining pattern since the peak in late 2015. The Case-Shiller (different methodology) has not picked up on this.

CPI is a bad joke when it comes to measuring real-world inflation.

Agreed. Moreover, Miami and Vegas condo prices are down at least 10% since the peak. I think Miami is having the most difficult time of all (excluding the hurricane.)

I would guess NYC apartment prices are down at least 5% from the late 2015 peak. Not good for flippers.

Once Los Angeles and Seattle roll over, then that’s it. Also, Amazon is looking to build HQ2 in a different city. That should dampen the appeal of Seattle to east Indian and Chinese immigrants as a shiny and new, livable wonderland.

Wolf,

That’s interesting that the Case-Shiller methodology has not picked up on a flat-lining pattern. Since the Case-Shiller index is a “repeat sales index”, could it be that renovations play into the seemingly increase in prices? A house that, for example, has 200K dumped into it will obviously sell for a higher price. Or does the index somehow account for this? (When renovations are done without permits, I don’t know how you’d account for the work.)

Thanks,

Rose

The Case-Shiller uses algorithms to account for all kinds of things, including deterioration, renovation, etc. It has to put many of these observations into an index to obtain year-over-year (and month-over-month) price change out of pairs of transactions that took place years apart.

Here is the methodology (35 pages… so have fun):

http://us.spindices.com/documents/methodologies/methodology-sp-cs-home-price-indices.pdf

The median price is a lot simpler, and is not impacted by algorithms, but it is subject to other things, such as shifting buying patterns. For example, if more people step down into lower price categories because they cannot afford to maintain the status quo (same home, higher price) when they move, while more expensive homes aren’t selling, this could push down the median price, though actual home prices might not have changed or might have gone up. This could be a factor in San Francisco, but I don’t know.

Also note that the Case-Shiller is always behind (yesterday’s report was for May, June, and July. Next week, we’ll get the median data for September!

Neither method is perfect. Each home is different. And homes are sold in small volume. There are only 300-500 sales in San Francisco a month. In August, there were only 402, down significantly from prior Augusts going back to 2012 (down 25% and 29% from Augusts 2013 and 2012).

So it’s hard to produce housing data that accurately describe what’s going in the market, unless the market goes solidly one way or the other.

I just compared my charts of San Francisco home prices: Case-Shiller v. median… They look very different for the past two years, though they both agreed on the timing of the low point of the housing bust. I might write an article about this someday because it always comes up. Not that I have any answers as to “why”… but we at least know that this is happening :-]

Here’s a few in my vicinity which I’ve been watching as I’ll be selling in the near future. On almost all of them there was an accepted offer the Monday after a one-day open house on Saturday or Sunday:

http://tinyurl.com/y8u48ut2

http://tinyurl.com/yaw5xxo8

http://tinyurl.com/y88lquhy

http://tinyurl.com/yb2yg8oh

http://tinyurl.com/yb4zkxec

Note the typical ‘on Redfin for X days’ was around 20 days; and the listings usually show up at least a week or two before an open house, and closing usually takes up to a month after a deal.

“… There are lots of problems already cropping up in the Bay Area beneath the surface, including plunging pending home sales”

I live in the BA and read pretty much every article on this topic, and there are many. The conclusions are invariably that the ‘plunging’ home sales are due to lack of supply, not lack of money. What’s your take?

Lack of “affordable” supply, LOTS of new supply of higher-end condos (and apartments too) — do you see the towers going up in various pockets around the Bay Area? — and employment numbers that are now declining for Santa Clara County year-over-year, and that are nearly flat year-over-year for the other counties. The employment charts for the Bay Area show that the great employment boom is withering.

Oh, and Chinese money inflows may have slowed due to the crackdown in China. I have no numbers on this, brokers told me… so to be enjoyed with a grain of salt :-]

Housing is complex, but those are at least some of the factors.

I’m in the bay area and all I see are for sale signs on empty houses.

@plunging, which areas of Bay Area are you referring to?

Cast your mind back to 2004 & 2005. Do you remember the lack of inventory narrative during those years ? Because i do. Right here in Seattle.

Moreover, there was a glut of inventory in 2006 and 2007. Right here in Seattle.

I am guessing California was not that different.

Price eventually follows volume.

“I’m in the bay area and all I see are for sale signs on empty houses.”

You don’t suppose that’s because people often move out before they put their houses up for sale? And, they remain empty–except possibly for a ‘staged’ one- or two-day open house–until the new owners move in?

How long are these ’empty houses’ on the market before a pending sale is notched (note that realtors often don’t bother to put a ‘pending sale’ or ‘sold’ sign on houses that are going to close in 30 days or less)?

EMPTY

I’ve given a list of houses in my area that have sold and are now, presumably, EMPTY, waiting for closing so the new owners can move in. Can you provide a list of links to the EMPTY houses you are citing?

You posted links to your clients website. You’re welcome to visit any MLS and see everything you’re looking.

The way the CPI is measured by the government is fraudulent. It allows them to keep federal and military salaries and pensions lower. If you use the methods employed by previous administrations you will get a much higher figure.

Shadowstats.com has the numbers.

People are too worried. When the bubble pops, it will not leave millions of bodies strewn across the landscape. It’s only money. People will just have to pick up the pieces and move on. In the Nineties I ended up two years pay upside down in my mortgage and seriously in debt because of the RE bubble collapsing. I was getting divorced in the middle of all this. Nobody dies. You just suck it up and do what you have to do. It’s easier to do it the second time.

“Nobody dies” – except for all those poor saps who ODed on oxycontin, drank themselves to death, ate a bullet, or threw themselves off a building after they lost their home or job. There were literally guys defenestrating themselves in 2008. The other deaths were slower, less showy, but it’s not “only money”. It’s a big chunk of the reason why the American white middle class is literally killing itself.

They will always have an excuse. People kill themselves in good times, too.

S’what happens when you lose your industrialists (aside from those making things to kill people) and you hand your economy over to financiers lock,stock and barrel.

They do what they do best – flood society with debt.

Politicians do nothing because:

a) debt produces a temporary illusion of prosperity which makes it easier to get re-elected

and

b) they want to go and work for said financiers after their political careers are over(or indeed work for both at the same time).

A house is now a cash dispenser, enabling the owner to take on more debt secured by the value of his house.

Lazy, easy populism from the cabal of politicos and financiers and their friends in the media.

Used to be called USURY but that word has been removed from the lexicon…

Another issue I see happening here is that mortgage payments are starting to blow past rental prices. This means we are getting into another situation where people will not be able to rent their houses out to cover their mortgages if they need to sell or move but have no buyer. This was a big problem during the last bust. The incredible thing is that this is happening at 4% interest rates!

The condo complex we are in is basically there but it is hard to get a gauge on real rent. Not sure I trust zillow. But basically it claims our place should rent for $2400 to $2700 a month. It’s a 2 bedroom condo and I know for about $3000 I could start to rent some 3 bedroom single family homes.

Our exact unit has revenly sold twice during the summer for $510k and $520k… with 20% down and then adding on a $300 HOA and taxes the full carrying cost is $2800…

Tax breaks might bring you down to parity for awhile, but parity is not a great place to be considering maintenance hasn’t even been factored in… renting would definitely not be for monthly cash flow unless you could put down well over 20%. I suppose 25% for a rental condo may be more common.

And even with our interest rates being higher here in Australia than the USA it is still cheaper to buy than rent in many places.

With Sydney being ridiculous people are leaving there and moving to Melbourne because of the high costs:

http://www.theage.com.au/business/the-economy/victoria-booms-as-nsw-leaks-residents-by-the-thousands-20170927-gypper.html

It’s been a sellers market in San Diego since at least 2013 or for about as long as I’ve been married…

I really need a correction and a shift to a more balanced housing market so I can buy a home that isn’t a total price gouge.

Existing housing is catching up with new construction, looking at vacant land in SoCa, you see some real bargains. albeit one ad said price (low) is based on HIGH COST OF DEVELOPMENT.

The municipal planners are getting their cut. I hear stories of developers mailing in the keys to land they bought after they run into a wall with city planners. A vacant parcel is a liability. You pay taxes based on the neighborhood, and you can’t do anything with it. If you ask them they will say, you can donate it to us for a park.

These city housing bubbles are because of the inflow of foreign investment. Plenty of countries prohibit foreigners from owning property but the U.S. thrives on it. No seller wants to be limited to just working Americans that are already maxed out on consumer debt.

Since the Fed will start taking out 10B a month for the next three months, won’t that affect the Bay Area directly?

The Fed money is the reason a lot of start ups with no viable business models have sprouted. This has led to an employment boom, which in turn has led to a hike in rents and boom in multitenant structures. I realize that the Fed had stopped feeding the fire a year ago, but the liquidity they created is still sloshing around in the system.

So I am expecting that starting October, we will see a lot of start ups that are simply transferring wealth from VCs to people will start folding. And this should lead to a drop in employment, drop in rents, and subsequently a drop in home prices as people either sell, default, or find that the market is not giving them what they expected. I am hoping for short sales and defaults so that the housing market is flooded the way it was in late 2007.

Am I the only one smoking some hopium?

In Portland the real estate agents are very careful not to leave a house with a “for sale” sign more then 2 months. They take houses on and off the market in regular intervals. This especially goes for anything above the 450k mark, which are hard to sell.

I mean the pressure is immense, from both the agents and the community. They control the exposure of their inventory to the public meticulously, leading large groups of buyers into believing there is an ever present rush to sell. For example I know 3 cases where people waited 9 months to complete a sale, whereas people who are new to the business sell me the “…it sold in a day story”.

In short…they know…it’s not if, it’s when the Mortanic (Mortgage – Titanic) will hit the next iceberg. And the new FED interest rate hike just got us a bit closer to the northern waters.

Meanwhile, the enabler of these monstrous asset bubbles, the Federal Reserve, continues with its Kabuki-theater dissembling about mythical pending rate hikes, knowing full well there’s no such thing as tapering a Ponzi.

http://www.marketwatch.com/story/feds-rosengren-backs-regular-and-gradual-interest-rate-hikes-2017-09-27

Even the captured financial media can no longer conceal the reality that housing prices have become insanely unaffordable for buyers in our oligarch-pillaged economy.

https://www.cnbc.com/2017/09/26/stop-sugarcoating-the-housing-market-economist-warns-that-buyers-face-increasing-troubles.html

Maximus Minimus:

No look into foreign money coming into Australia, but the States and Federal government have raised taxes on foreign buyers and foreign buyers who leave their property empty for a certain length of time.

They have to be seen to do something about the so called ‘problem’. The States also implemented more handouts for first home buyers as well which of course will push up prices higher!!

Typical dumb government action:

1. RE and construction are one of the few growing areas in Australia and by applying more tax they will slow down these areas thus reducing employment and their overall tax take.

2. China hit people with restrictions on taking money out of the country which has hit RE and new construction here.

3. The problem is supply and not demand. There is lots of demand for RE so what do the idiot governments do? They increase that demand by handouts to first home buyers. it pushes prices up and in turn makes RE harder to buy for the same people they are trying to ‘help’.