Even before Hurricane Harvey, Houston’s economy was struggling.

Auto sales collapse but will surge.

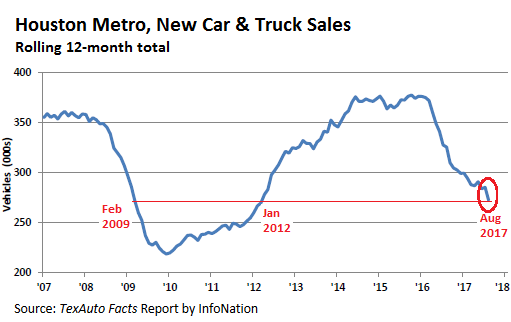

Auto sales in the Houston metro, first battered by the oil bust and now by Hurricane Harvey, plunged to levels not seen since the depth of the Financial Crisis. New vehicle sales were already at Financial Crisis level in the 12 months before the hurricane hit, with dealers selling 284,000 units in the 12-month period, down 25% from the levels in late 2015 and early 2016.

This was already an ugly reality. Then, just when people thought that sales might finally pick up a little in August, Hurricane Harvey approached. During the week before landfall, new vehicle sales plunged as potential car buyers had other things to worry about. And for the last week of August, when Harvey was pummeling the area, sales dropped to essentially zero.

So for all of August, new vehicle sales plunged 45.5% from the already beaten down levels last year to just 15,473 vehicles, according to TexAuto Facts, published by InfoNation, and cited by the Greater Houston Partnership.

It brought sales for the 12-month period to 272,575 new vehicles, down 27% from the 12-month levels in late 2015 and early 2016. For the 12 months through August, sales are now back to where they were in February 2009 (chart by the Greater Houston Partnership, red marks added):

About 300,000 new and used vehicles were likely damaged in the Houston region as a result of Harvey, amounting to $2.4 billion, or about $8,000 per vehicle on average, InfoNation estimated. The report:

Since not all vehicles will be covered by insurance or recorded as flood damaged, the number of totally damaged vehicles will never be accurately known.

Auto sales in early September were also dismal. But demand for new and used replacement vehicles going forward will be strong. Without a vehicle, people can do very little in Houston. So this is a priority. Dealers have entered into a mad scramble to get vehicles into Houston from other parts of the US. And an entire industry has sprung up to repair flood-damaged vehicles. They’ll be for sale around the country — with and without flood titles….

The housing market gets squeezed.

Single-family home sales in August plunged 24% year-over-year to 7,077, according to the Houston Association of Realtors (HAR), cited by the Greater Houston Partnership. Sales of homes below $150,000 plummeted 40%, the most of any segment. Sales of homes over $750,000 fell 17%, the least of any segment.

But the median price of single-family homes rose 3% to $231,700. HAR Chair Cindy Hamann:

“Hurricane Harvey dealt a severe blow to the Houston area and Texas Gulf Coast and it will probably be several weeks until we can gauge the storm’s full impact on our housing market. Home sales were humming throughout the first three weeks of August, but the moment Harvey struck the region, everything came to a screeching halt.”

That said, David in Texas wrote in an email:

One of the listings is my mother’s house. She’s downsizing, and we were working with the realtor to get the house on the market before Harvey. As it turned out, the listing went live a couple of days after Harvey. We got two offers almost immediately: one cash and one conventional financing. We went with the cash offer since she wants to get this done, and it is supposed to close tomorrow. 17 days from listing to closing!

There is demand for undamaged homes. For potential sellers, times are good. And homeowners who’re staying put and whose houses came out of the storm unscathed, they will see their house rise in value, and they’ll eventually feel flush and call that house cleaning service in Katy, TX, to shift the work of getting that place cleaned up to someone else.

And demand for rentals surged in August. Leases for single-family homes jumped 9.4% year-over-year, and leases for condos and townhouses soared 17%. Average rent remained unchanged for single-family homes at $1,857, while rents for condos and townhouses fell 2% to $1,551.

A leading indicator for production plunges.

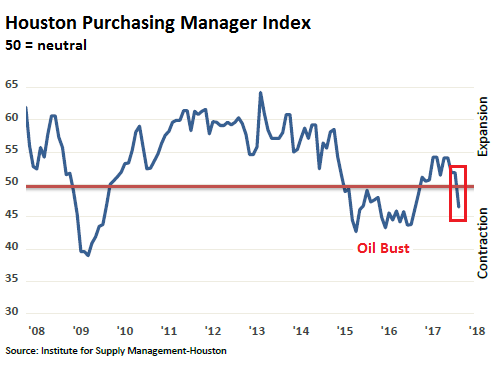

The Houston Purchasing Manager Index (PMI) for September, a near-term leading indicator for production in the Houston region based on surveys of local purchasing managers in manufacturing, healthcare, electronics, finance, energy, and other industries, plunged 5.3 points from the prior month, to 46.5. Below 50 indicates contraction over the next three to four months. I marked the September plunge (chart via Greater Houston Partnership):

The report added:

The August survey was administered after Hurricane Harvey hit the Houston region and reflects the initial impacts of the storm on the economy. Respondents across the board noted short-term disruptions to their industries due to Harvey but expect activity to increase as the region recovers.

Employment was already weakening before Harvey.

The most recent employment report for Houston that the Texas Workforce Commission released on September 15 was based on data gathered prior to Harvey. Nevertheless, in August, the Houston-Woodlands-Sugar Land metro area lost 3,900 jobs from July.

“The loss came as a bit of surprise,” the report explains, adding:

Only four times in the past 25 years has the region logged job losses in August, and those losses coincided with overall weakness in the economy.

Most likely, the August data suggests that despite robust 12-month job growth [53,500 jobs created], Houston is still recovering from the downturn in the energy industry.

Harvey’s impact on Houston employment will emerge in the data to be released in October. “Historically, Houston employment falls the month after a storm then rebounds over the next two to three months. The Partnership expects post-Harvey employment to follow the same pattern,” the report said.

The impact of Harvey on chain restaurants in Texas was so steep that it has dragged down national sales to add to the worst downturn since 2009.

In total, 4.3 million properties with nearly $700 billion in outstanding mortgage balances are located in FEMA-designated disaster areas in Texas and Florida. The losses on the mortgages will be significant. And someone is going to pay for it. Read… Who Gets Hit by Mortgage Losses in Harvey and Irma Areas?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So how many people will be forced to love in their cars or buy a used car to live in?

Make love in their cars? You know the old saying ” Don’t come knocking if the vans a rockin” seems to be relevant here

“Fordian slip”

If the house is a’rockin’ don’t come a’knockin’

https://m.youtube.com/watch?v=-G84P5K-W1c

What is happening with the detoxification response to the petrochemicals in the homes, buildings, infrastructure, dirt, food, and water?

Or is that not considered part of the clean up?

“High levels of chemicals found in air around Houston refinery after EPA told residents not to worry”

ahttps://thinkprogress.org/refinery-underestimated-chemical-release-f5b9cdc251e7/

What pollution?

Petrochemicals aren’t pollutants. They’re vitamins.

I was forced to love in a car once in high school. Wasn’t so bad in retrospect..

In all seriousness though, it’ll be interesting to see how ‘disaster capitalism’ works in our present era of scarce capital..

“I was forced to love in a car once in high school. Wasn’t so bad in retrospect..”

forced…FORCED? WTF?

The cold hard numbers from last months jobs report is this. . The untold unadjusted numbers that the media refuses to tell anyone is that 894,000 jobs where lost Nationwide. If you all look into the jobs report it is buried in it. the feds again have cooked it with the so called ” jobs created” Mike Shedlock and others have even said it was the worse jobs loss since the financial crisis.

Matt,

In August, nonfarm employment NOT seasonally adjusted rose by 211,000. And there were 2.1 million more jobs than in August 2016, NOT seasonally adjusted.

You’re talking about July, when nonfarm payrolls fell by 1.09 million jobs not seasonally adjusted. A drop in July is normal after the June peak. This July’s drop was somewhat larger than prior July drops. For example, in July 2016 employment dropped by 979,000. But that’s not a huge deal, given how volatile the unadjusted data is.

I linked a chart of the NOT seasonally adjusted payroll numbers. Note the mega-plunges every January of nearly 3 million jobs. That’s why if you compare not-seasonally adjusted numbers month-to-month, you get tangled up in seasonality.

Not seasonally adjusted numbers should be compared year-over-year. In August, year-over-year, total nonfarm payroll was up by 2.1 million. And in July year-over-year, total nonfarm payroll was up 2.11 million.

Here is the chart of NOT seasonally adjusted total nonfarm payrolls. Use the time slider at the bottom of the chart. Move it to the right to get the more recent detail. Note the regular seasonality in the numbers:

https://fred.stlouisfed.org/series/PAYNSA

matt,

I may be naïve but your note is the first I’ve heard that the employment numbers provide a false impression. how can I learn about the 894,000 jobs lost nationwide and track this?

thank you,

larry

https://market-ticker.org/akcs-www?singlepost=3426525

Wolf, since Hurricane Irma left Florida I’ve noticed a slew of new car ads on TV. “GM cares about hurricane victims” promising even larger incentives than were already on the table 2 weeks ago. Nissan is giving everyone in the state employee pricing and no payments for 6 months. Etc.

That’s really interesting. I figured the incentives would be at least curtailed due to a surge in demand for replacement vehicles.

Something to keep our eyes on…

Harambe – that reminds me of ’03, “go out and buy” was the Official Word, I got a Saturn Ion for 10 grand and no payments for the first 3 months or something.

Prepare to have “rebuilding efforts” that end with a lot of people losing their homes when they can’t pay due to overcharges. Not to mention people being charged for rebuilding that wasn’t done.

Honesty considering things living in a van might not be such a bad idea if you lost your home. Even if you have the cash to rebuild is gonna take months. But then if you have cash why would you live in a van?

My car got flooded in Beaumont. 15 months ago I bought an 2014 Impala from Hertz Sales in Houston. My insurance settled quick and I got another Impala (2016) from them. They had moved their cars to a parking garage. Only difference this time was they weren’t holding cars with deposits. Too many people looking for them.

So, the glazier is going to buy himself a new pair of shoes from the cobbler, and the cobbler will then by himself a new shirt from the haberdasher, what with all that FEMA money? Sounds like a solid economic plan.

Looks like Puerto Rice is really going to benefit from strong, errr, something. Lucky them.

Thank goodness for hurricanes, otherwise the numbers would really be in the sh*tter.

PR is toast regardless of the storm Time to cut the lines and set err adrift

1) The media discuss RE losses, car losses, one number was hushed :

how many people died in hurricane Harvey, does anybody know ?

2) If you have no choise, you will drive a car with corroded floor, you are not going to fall.

Today WTI > $51. Today energy stocks are soaring.

The rise of oil is not sustainable, the LT trend is still down.

For Houston, the hurricane season is NOT over.

Houston, unfortunately will cont to be oppressed by Murphy law.

Oil companies have made a lot of cutbacks since 2014. These will be felt soon. WTI should be on the up and hopefully bring back some jobs.

WTI will rise due to a falling dollar but the extra revenue will buy the populace less Chinese junk Gold and Silver are looking attractive since Mr Yellen little coffee klatch yesterday

I’m afraid Hurricane Maria will have more impact on Florida than Irma. How a bankrupt Puerto Rico will rebuild its state owned electric utility is a mystery. It can’t borrow the money while it is defaulting on its current debt and 3.4 million Puerto Ricans aren’t likely to sit around for 6 months with no power ( how can they work if they even have jobs?) so the depopulation of the island will only accelerate. Grabbing a flight to Florida or New York is the fastest way to restore ‘power’ for your basic Puerto Rican.

Puerto Rico might end turned into tourist trap to pay for the rebuilding. Think Vegas mixed with Miami.