Private equity firms did it again.

Brick-and-mortar retail meltdown strikes again – this time, Toys R Us. In what is a classic sign, the company has hired mega law firm Kirkland & Ellis, whose bankruptcy-and-restructuring practice is considered a leader in the now booming bankruptcy-and-restructuring industry.

Toys R Us, with 1,694 stores globally, has $5.2 billion in long-term debt, according to its latest quarterly report, and sports a negative equity of $1.3 billion. Quarterly sales declined 4.8% year-over-year, to $2.2 billion. This isn’t a one-quarter dip: sales are down 15% from the same quarter in 2012. And the net loss jumped 30% year-over-year to $164 million.

The company needs to restructure its debts, particularly $400 million that is coming due in 2018, and a bankruptcy filing is one of the options, “sources familiar with the situation” told CNBC on Wednesday.

The company, long teetering under its massive pile of debt, has been trying to refinance its capital structure. In early 2016, it disclosed that it was working with the biggest investment banks on Wall Street – BofA Merrill Lynch, Goldman Sachs, and Lazard – to do so. Last year, it was able to refinance some of its debt, but that wasn’t enough. Now lenders are shying away from overleveraged brick-and-mortar retailers, given the ongoing meltdown of overleveraged brick-and-mortar retailers, particularly those owned by private equity firms and hedge funds.

In response to CNBC’s questions, a Toys R Us spokeswoman responded with corporate blah-blah-blah:

“As we previously discussed on our first quarter earnings call, Toys R Us is evaluating a range of alternatives to address our 2018 debt maturities, which may include the possibility of obtaining additional financing.”

“We expect to provide an update about these activities, as well as the many initiatives underway to provide an outstanding customer experience in our global retail locations and webstore during the holiday season, during our second quarter earnings call” [on September 26].

As in so many cases in the brick-and-mortar retail meltdown, there is a private-equity angle to it. PE firms Kohlberg Kravis Roberts (KKR), Vornado Realty Trust, and Bain Capital Partners acquired the publicly traded shares of Toys R Us in a leveraged buyout during the LBO boom in 2005 in a deal valued at $6.6 billion. They funded the acquisition in large part by loading up the company with debt — hence “leveraged buyout.”

Even at the time, the toy retailer was struggling with competition from Walmart, online retailers, and brick-and-mortar toy stores. Competition is a good thing, but not if the company has too much debt.

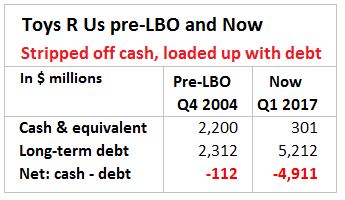

So here’s what the three PE firms did to Toys R Us: they stripped out cash and loaded the company up with debt. And these are the results: At the end of its fiscal year 2004, the last full year before the buyout, Toys R Us had $2.2 billion in cash, cash equivalents, and short-term investments. By Q1 2017, this had collapsed to just $301 million. Over the same period, long-term debt has surged 126%, from $2.3 billion to $5.2 billion.

This table shows the astounding results of asset stripping and overleveraging. It takes a lot of expertise and Wall Street connivance to pull this off. So whatever happens to Toys R Us, the PE firms already extracted their wild profits:

Over the same period (2004 through 2016), annual revenues have remained essentially flat at just over $11 billion.

Bain Capital is also the PE firm behind the 2010 leveraged buyout of children’s clothing retailer Gymboree with 1,281 stores, which filed for bankruptcy in June.

After extracting enough cash from Toys R Us and loading it up with a debilitating pile of debt, the three PE firms tried to unload it to the unsuspecting public in an IPO in 2010. They were hoping for an additional payday, the icing on the cake, so to speak. But they had to scuttle their efforts due to “challenging market conditions.”

Yet toy industry sales have been “robust,” growing by 5% in 2016, and by a compound annual rate of 5% since 2013.

Incapably managed by the PE firms, Toys R Us has been losing market share in its struggle with online retailers, particularly Amazon, and with Walmart at every level, and with other toy stores. Nevertheless, if the company weren’t overleveraged and didn’t have PE firms leeching off it, its slowly declining revenues and thinning profits turning to losses wouldn’t be the end of the world.

But once PE firms sink their teeth into a company, there is no margin for error. And once lenders and bondholders finally get skittish – often the same whose connivance made the LBO and the asset stripping possible – then the whole house of cards, so to speak, comes tumbling down.

This baby is going down the tubes at an ever faster speed. Read… Sears Revenues to Hit Zero in 3 Years. But Bankruptcy First

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This isn’t even the first time that private equity destroyed a toy retailer.

KB Toys went bankrupt twice under the ownership of Bain, the last time resulting in liquidation.

http://www.berkshireeagle.com/stories/bain-capitals-role-in-kb-toys-demise-still-a-point-of-controversy,275080

KB’s website and IP are now owned by Toys R Us.

I will miss buying my toys there although I am in my 70s.

There’s one toy I’ve wanted since I first got to play with one. It was a plastic undersized electric guitar, about the size of a ukulele, but get this – it had steel strings (about as tight as the strings on a uke because of the small size) and a real pickup. Turn the knob past 2/3rds and it’d get some nice gnarly crunch to the sound, too. It was awesome. It belonged to the 12-year-old son of a guy I worked for, and my understanding is he got at at Toys-R-Us.

Sell cool toys, and the world will beat a path to your door!

The fertility rate of today’s young couples is falling off a cliff – as kids become rare so will toy stores.

But the article makes a good point about PE firm’s parasitic behavior and a society of people slowly losing their motivation to work as they watch connected elites gain ever more money for nothing while the average worker is driven into debt to pay medical co-pays, why bother to work?

I’ll bet that Mittens the Kitten Romney got a lot richer after asset-stripping and raping these companies. In any sane country practices like this would be highly illegal. But, in the United States destroying jobs and leaving workers destitute qualified him to be President.

Because capitalism best ism, always.

This sort of predatory capitalism is economically and socially destructive and should be criminalized, but so are a lot of other things predatory capitalists do. Unfortunately they’ve bought off the pols and are running the show.

The failure to rein in their corruption must ultimately prove to be suicidal. They will burn down civilization to rule over the ashes, one piece at a time.

Shall we also criminalize predatory government policies? Shall we start with the Fed?

It works for me !

Mr. Fallacies, is it you?

Yes we should. We should criminalize predatory crony capitalism, should it come from private sector or from public officials colluding with private profiteers.

Perhaps we should think of LBOs like a sort of corporate hospice where debt is palliative even to the point pf death. Except in the LBO as opposed to the hospice, economic death is actually the point. The capital is extracted, customers gone. Bankruptcy doesn’t end the process but merely shifts it to different venues. Rinse, repeat.

The Fed is not part of the government. It is owned and controlled by the big banks who hold stock in it. Nice try, but it’s false equivalence at its most deceptive.

As the saying goes, it’s no more federal than Federal Express.

A lot of us commie ratbastards know this and are all for “public banking” IE, banks owned by “the people” the way the Post Office is.

Yes, it should be a capital crime for any elected or appointed official to accept anything valued over $1 from anyone or any entity, or connected to anyone or any entity affected by any possible government law or regulation and for a period of 10 years following their time in government.

People who buy cheap plastic junk, especially Chinese-made toys, should be slapped with a fee steep enough to reflect the the centuries that plastic junk, once discarded, will spend in a landfill slowly degrading the environment.

Actually there is an active secondary market for certain toys. You can buy Legos by the pound online or in garage sales. I sold the thousands of dollars worth of Legos, we bought our son over the years, for around $60.

Jeeze .. you sold it off ? Really ? By the pound no less ? Hell I’m in my 60’s and still buying LEGO .. albeit Architecture LEGO … as in ArchitectureStudio as well as the individual buildings ( FLW etc ) kits

FYI ; LEGO is not made in China but rather in Denmark and Eastern Europe ..

My fave toys are guns’n’knives, made in the US and Switzerland.

Even as a kid, I thought the ultimate toy was a pocket knife, because it was a meta-toy that could be used to make other toys.

Or the oceans. Legos are an exception.

Environmental costs are still a kind of Lemon socialism. Look at Houston. Developers built up and down the floodplain, making especially good profits from cheap land. I am also still waiting for people building on the coast to bear the cost of insurance. It used to be that people built on THE BACK of barrier islands, not the front where a total wipeout is guaranteed eventually. But who cares? Taxpayer!

Everything old is new again. Joe Kennedy was one of the pioneers of asset stripping, leaving shareholders with nothing but an inflated share price. As FDR said when he hired Kennedy to found the SEC in 1935: ‘ I set a crook to catch crooks’.

Then came the LBO-by-management cycle of a generation ago.

And now, the private equity rampage.

But rather than the politically loaded term predatory captitalism, better to describe it as financial engineering, or maybe buccaneering.

Capitalism is about creating wealth, not destroying it.

“Capitalism is about creating wealth, not destroying it.”

Too bad that the United States isn’t a capitalist country. Then maybe I’d be in favor of capitalism. As it is we have predatory Crony Capitalism. They have plenty of money, funneled through the Goldman Sachs Feral Reserve System and The financial system, to obtain all of the political parasites that money can buy. And it buys up all of them.

The world has grown to hate Capitalism because of the behavior of the Capitalists. Greed always produces destruction.

I think toy sales has peaked. Lego, who is NOT under PE laid off 1800 people.

Game Over, Toys R Us.

Lego’s problem is different, yet almost as common as PE ownership: they not merely expected but geared up for irrealistic and everlasting sales growth. Then the unthinkable happened: sales flatlined and then started to dip.

They hired too many people, expanded production too much, put too much faith in “emerging markets” and when Europe and the US, their breadwinners, refused to grow as much as Lego had expected and then showed “signs of weakness, the problems cropped up.

To this it must be added Lego spent a lot of money to get a slice of the franchise business, which is quite expensive to get in and where breaking even is not exactly guaranteed. Disney extracted more than a pound of flesh from Lego for the Star Wars franchise and it wasn’t even an exclusive deal, as Hasbro is holding on to their decades-old license and refusing to let go.

Lego will make it through just fine, albeit they will have to scrap their dreams of double digit growth year after year.

All about growth and margin at Lego.

Its net margin of roughly 23% wasn’t enough that’s why there getting rid of 1,400 jobs. 23%!!

Sad to see something which was classed as an ethically decent company showing its true colours.

Don’t even get me started about companies wrapping themselves in ethical colors.

In 2009 I bought an air compressor for work made by Atlas-Copco. It was wholly assembled from Made in China components provided by third party vendors. I honestly doubt Atlas-Copco sends people around Chinese factories to check labor conditions and environmental practices.

Oh, and it almost ran out of oil after a few months because they put in it the thinnest, cheapest stuff they could find in China. It has been running (more or less) great on ordinary engine oil ever since.

To get back to Lego. I seem to recall their revenues dropped by 5% or a similar figure the first semester, worsening a similar trend from last year, yet nobody suggested cutting margins a bit to slash prices. With double digit margins you have a lot of meat to cut, differently from many industries which are down to the bare bones.

Suffice it to say for many reasons too complex to discuss in such a limited format there has been a sudden change of ethics and behavior internally and externally with LEGO of late . So its not LEGO’s true colors showing but rather its most recently acquired ones

They’re apparently expecting the new $800 Millennium Falcon to save them from the evil galactic banking empire.

R.I.P. Toys weRe Us

Who hold dept bag? what idiot would lend to LBO? Is it the Banks that are TBTF so they can pass the loss do to pions? I want a piece of that …wow

Acquiring a company should require the BUYER to take on the debt, not the acquired company. Next house I buy I’m gonna have the house assume the mortgage, not me. I will use the PE acquisition model.

If you’re in a non-recourse state, that is exactly what happens.

Is there any country were doing this breaks the law?

Off the topic:

Wolf, what you think will be the trigger for the meltdown? Many thought the debt ceiling fight would be the catalyst. But it’s becoming very clear that debt ceiling will either be suspended or increased whenever they wanted.

As I’ve said many times, the debt ceiling is a charade. Congress will not force the US into default. It has never happened, and it won’t happen.

There is no guarantee that there will be any kind of market meltdown. My best guess is a very long zigzagging lower that can last years. There is way too much liquidity out there right now for a real meltdown. There is way too much money lined up to capitalize on a meltdown. So once stocks start sinking, the money will jump in and buy stuff and stop the meltdown. So I think we could see years of lousy performance without sudden meltdown (in my book, a meltdown is something in the ballpark of -50%).

It’s pretty clear people aren’t afraid to buy the little dip of 3%-10%, but lets see what happens where there is a bigger dip.

With all the boomers out there, many of whom are in stocks, I wonder how much patience they’ll have. For somebody in retirement or near retirement, a drop in stock prices can cause a lot of anxiety. I think most retirees will exit the game when things get dicey.

Like Tyson says, everybody has a plan till they get punched in the face. Human nature.

I have some liquidity, but I won’t be the one trying to catch a falling knife after a 10% dip.

“So I think we could see years of lousy performance without sudden meltdown (in my book, a meltdown is something in the ballpark of -50%)”

You may be right, but with margin debt sitting high up there, along with all those newly created Algo ETF’s since the GFC, it really is chartered territory. Oh, and broad S&P 500 valuations are higher than 90% of the last 20 years… and the last 20 years were expensive from a 100 year historical perspective.

For some context : As you know, the S&P 500 dropped 56% from the October peak in 2007. Valuations are higher today than they were in October 2007.

The great equity-debt swap has already happened. Retial investors aren’t driving the market. It’s corporate buybacks, which are funded by a surge in corporate debt through corporate bonds.

https://thefelderreport.com/2017/08/30/the-great-equity-for-debt-swap/

The fit will hit the shan when the leverage becomes unsustainable. It may happen soon (which Jeremy Grantham calls Purgatory), or take a long time (which he calls Hell). I have increased my bond allocation.

Hi Wolf,

I agree about the debt ceiling–total kabuki, and even more, the Republicans got to emerge as “victims” which they needed for political survival.

As for “meltdowns”, a term I would reserve to describe the behavior of children, I would suggest the more neutral term, mean reversion. And given the addition of human, emotional responses, stock prices for example seldom merely revert to the mean. They often undershoot wildly. In my experience, 80% down moves peak to trough should also be considered possible in “frothy” markets.

The problem with your scenario is that far too much of the market is now controlled by Bots which only see bargains not the reasons why rather than human beings who’s emotions , reason and logic could come into play .

Suffice it to say if logic and reason were to suddenly come to the forefront this Potemkin Village market would come crashing to its knees faster than you could say Jack Sprat .

Lets see what causes the decline. There may be a lot of liquidity – maybe, but there is certainly a tremendous amount of debt. Let’s see what happens if asset prices get below debt held against said asset – lets see how liquid buyers really are… There will be initial dip buyers – lets see what happens when they get decapitated and margin debt starts to get called or tightened.

It just seems that with all the mal investment from PE acquisitions, stock buy backs and just extreme leverage out there, there has to come a time when what is happening with Toys R Us becomes more common. So many retail corporations expanded not because of an increased market but to steal some of their competitors market share.

And what new products are there to grab the attention of the public. Ever greater everything like phones with real little new abilities, just new and more expensive.

So we have nothing really new and exciting. Lots of debt that in many cases can not be repaid. Wages for most people flat. Not enough savings by the 99%er. Earthquake swarms around Yellowstone, the west is burning up, Harvey, Irma, and now Jose.. The fish out of the Pacific are all contaminated with radiation from Fukushima. The wheat, corn and soy are all contaminated with Round Up which has finally been declared a carcinogenic. N Korea wants to annihilate our electric grid..

No what could possible go wrong and cause the markets to tank!

Oh and way to many pension funds are on the brink as are the municipalities that are responsible for them.

Nothing to see here.

I agree… I think there will be a massive debt restructuring at all levels, from munis to retailers, I just don’t think it will happen at once in a crisis-type environment. I think it will be fairly orderly. Investors will lose their shirts, but gradually. There will be ups and downs, and new money will jump in (see energy), and then evaporate, and so on. I think it will take many years, and in sum total will be very unpleasant.

economicminor – What’s funny about the Roundup thing is, when I was living at the “permaculture” survivalist place, we practically bathed in Roundup. Some serious weed-spraying had to be done, and the head survivalists’ pump-up weed sprayer was a big metal cylindrical one, that leaked. I’d end up with my feet soaking, and good amounts of it on other parts of me. I finally convinced him to get one of those “backpack” ones, which was almost fun to use, and got less on me but still got it on me.

So, so glad to be out of there.

Isn’t it comforting to know that Roundup is applied to crops just prior to harvest?

Happy Cancer!

“Isn’t it comforting to know that Roundup is applied to crops just prior to harvest?

Happy Cancer!”

Cancer is the least of your worries.

That S()* causes birth defects, Hereditary, Weight, and Mood Instability.

Just as Agent orange cause hereditary birth defects.

The defects caused by both these agents can be fairly termed, genetic mutations.

Monsanto knows which is why there are various splits occurring to insulate the rest of the business bond and shareholders, from the Glosphate section.

Exactly.

when all the excess liquidity is drained, the potential for a melt, is actually stronger.

The big issue is still a black swan based on outside forces.

Curious…I was with my sons in a ‘Toys R Us’ in Nanaimo just last month and remarked to them that a)the place was practically EMPTY, one cashier working; and b)prices were HIGH.

I predicted to the kids that…you know…going under.

I got the same feeling in Target, in the same city, a couple years ago before they closed up all their Canadian locations and folded up their tent. VAST aisles, fully 30′ wide, devoid of customers and with selection similar, and prices higher, than Wal-mart.

Have interest rates gone up yet? What’s a quarter of a point on $5.2 billion?

5.2e9*.0025

That’s $13million they have to find, over and above the usual expenses. That’s one reason for point b).

Yeah the Toys R Us where I live is pretty empty at almost all times. There’s just not much compelling to get there.

– Video games can be bought digitally

– Legos seem to sell, but if there is an actual lego store that is 10x better

– Board games can be found at big box retailers, local game stores will have more niche items

– Bikes and sporting goods can be obtained at better quality/prices elsewhere

The meltdown may be caused by the end of cheap credit. Is gonna be a “Sweet Christmas.” if people is more conservative with their holidays expending.

This year’s X-mas sales over all will be interesting. Are the sheeple maxed out or will they use their plastic until the pieces are glowing red hot ? Will delivery services have a busy time or not ?

Toys R Us and Lego might have nothing to do with brick and mortar meltdown and more to do with responsible parenthood breakdown. Until five years old it could be Lego, but then it’s full steam online games, most of them probably violent.

I didn’t realise Toys R Us was in such a mess. Interesting to see what happens with Christmas around the corner.

Shame the PE firms have killed it with the debt and sorry for the workers.

On the other hand though especially over the last two years you got the sense at the stores something wasn’t right, they’re shoddy-untidy, nothing had been spent on them, not very welcoming, you got the sense the heart had been ripped out. Explained with this excellent article.

As for Lego, somebody said to me the other day the reason Lego’s sales have gone a bit static is down to things such as their selling price and Minecraft. My six year old son used to be Lego all the way, now its Minecraft.

Who can afford toys let alone kids these days PLEASE

On tv they were touting an upcoming Legos set that costs $800. I think the toy bubble just burst.

Like I said Wolf when I sent you the article yesterday. When they started closing stores quietly several years ago. When I started reading the amount of debt. The sales starting to fall . The Fact the birth rate is falling. Standing at lowest in recorded history for almost a year. Add in a ton of other factors economic wise such as record high rent. WE never recovered from the Financial crash. It was a matter of time indeed

Rent is murdering Everyone – Sweden is now the most expensive country in the EU (by a good margin, 60% above EU average) to build in:

http://www.gp.se/nyheter/sverige/färska-siffror-sverige-värst-i-byggklassen-1.4591028

There is no doubt a solid cartel formed on building materials too.

Despite the “branding”, living and working here in Sweden one will experience the kind of business dealings that normally only happens in movies about people from Sicily!

When the credit-boom finally runs out, the “splat” here will be something to see, especially inner Stockholm. The housing market is already creaking a bit from a lack of buyers caused from a sudden change towards stricter lending standards and more amortisation last year, but I think it will take more to really tank it.

Fahjensen – In the USA here we have something like 22 empty houses for *each* homeless man, woman, and child. And our rents are crazy too. It’s gonna be the splat heard ’round the world.

Hopefully the banks that fund these PE takeovers can write these losses off on their tax returns. And hopefully Congress will be able to reduce their taxes overall. Poor dears.

Banks sell these loans to your pension plan or mutual fund after collecting hefty fees.

I don’t doubt PE’s role in finishing off Toys R Us but the migration to screens off all shapes and sizes is the underlying reason why kids are less interested in toys. The extractive tribute demanded by PE will accelerate the demise of this company but the time spent on screens by all of us leaves little time for anything else.

Keep up the good work Wolf!.

Wolf,

KKR and Bain in one article. I’m holding a crucifix and wrapping myself in garlic garland.

Maybe I should try that :-]

Actually Petunia … methinks I’ll do the same .. along with holding a silver cross , keeping a silver bullet in the ole 9mm as well as a handy wooden stake … or three . Can’t be too safe you know as the ” Nosferatu(s) ” roam the dark alleys , pits and dungeons of the financial world …. ;-)

PE analyses doubtless include planned endgame scenarios with BK after cash extraction targets are met. How are those scenarios discussed with the IB and legal facilitators, including fee levels and timing?

The deal books would make fascinating reading for legislators and BK judges, even if only for future reference when the trigger events occur after a clawback period.

In light of the vintage *cough secondary market cough* in Legos, why not in those deal books and spreadsheets? (Nothing against Legos, bought many as a kid, and more for my kids, just a handy comments example) Imagine the scarcity value of such books, and the bragging rights.

“Yessirree, I bagged me a Toys R Us First Edition PE book with the original confidentiality agreement, showing the projected partner returns after the pre-planned BK. That baby now has pride of place above my mantel!”

I’ve commented before on the potential conflicts which exist when a company has both a PE arm and a management consulting arm. A cynical person might conclude that the PE arm can exploit what the management consultants got paid to evaluate. Building a PE book for such a target is stealing candy from a baby. Taking the PE book or consultant’s report to another PE firm can also be a slam dunk.

When buying a used computer, always swap the hard drive out and try to perform a data recovery on the old one.

First, one does *not* want to be un-wittingly carrying something that the DHS may find interesting across borders,

Second, there might be some good / entertaining stuff on the old disk if the “recovery” business or the business disposing of the computer for them didn’t erase very carefully.

Third, sometimes one gets lucky – I knew some people who bought a used disk array at an airline bankruptcy auction. On there was all the leasing agreements for the fleet of planes. They sold it back to the receivers for very good money!

Digital age – new Opportunities :).

It would be interesting to see the real math and timelines behind one of those leveraged buyouts. I guess, banks provide short-term buyout loans which then get rolled over onto the company books once acquired with the banks extracting fees at every turn. It must be at least as lucrative for the banks as for the PE outfit. But the PE outfit gets all the bad rep.

Ever price a ticket to legoland park they will be okay.

Hi Wolf,

Off topic.

Please can you explain to a lay person like myself why the ECB is continuing with QE-bond buying when the European Market is doing well.

Please can you explain to me also what happens when they start tapering.

Best Regards

Steve

I’m not Wolf, but the explanation is blindingly simple.

The ECB has no choice but to keep buying bonds with printing-press “stimulus,” since the instant it stops, its Ponzi markets and asset bubbles – and illusory “recovery” – are going to crater. There’s no such thing as tapering a Ponzi; therefore, the ECB and the rest of the Keynesian fraudsters running our central banks for the exclusive enrichment of their oligarch patrons will try to keep their Ponzi markets and asset bubbles levitated until they collapse under the weight of their own fraud, debt, and artifice.

Best Regards,

Gershon

That lot are Neoliberal, not Keynesian. The Keynesian approach would be to give money to people and business who would spend it. Keynesian policies would specifically avoid helping “Rentiers”.

Rentiers was a big thing back then. Now … their well being are the very foundation and the essence of “capitalism”, according to the neoliberals.

Tapering is when the Fed, or other central bank, sells bond they currently own. This decreases the money supply. And removes cash from the economy. It works sort of like a hike in interest rates.

That is not what tapering is. That’s unwinding the QE induced positions. Tapering is the slowing of bond/asset purchases, and that can be to zero purchases.

The reality is that CBs are in a coordinated effort to keep this scheme going, so they take turns. It was the Fed for a bit, then Japan, then ECB, and then….

As I noted below, there *has* to be credit growth to keep this Ponzi scheme going.

Thanks Gershon-B Tilles-Variance Doc,

So in the example of the USA, Trump goes on about reducing the balance sheet in effect by presumably unwinding-selling these bonds to financial institutions?

In the example of the ECB QE which they’re continuing at 60 billion a month for now, the ECB have been buying up bonds from various countries. I presume within that there are a load of rubbish from for example Greece.

As Variance Doc stated above credit growth has to keep going, once interest rates start going up-normalising there’s only one way credit will go and that’s down.

Define “doing well”. From where I sit as a quant at a bank, nobody is doing well.

To the main point of your question:

Effectively every currency in existence has a coupon. FRNs, Euros, Yen, etc. All of them.

To illustrate, take the FRN. The Euro is the same.

The FRN is merely the manifestation of some debt somewhere else. Most of those debts are in e-form. It makes no difference as they were ALL borrowed into existence by somebody at some point in the past.

Without MORE borrowing in the future the interest owed on the debt that created today’s money can never be paid. Or, it can, but then there is inadequate remaining money to repay the principal.

This is very simple math.

Printing money is the only way to solve this math…literally, it is. Central Banks have to print the coupon because there is no credit growth that can pay it!

In other words, if P is outstanding now, and P+I is owed one year from now, SOMEONE *must* borrow that extra I in order for it to EXIST in a debt-money aka currency system. If nobody does, the entire system is in default. So ECB (and other central banks) has printed up I.

It is either that or currencies snuff themselves out of existence and cease becoming “money”. Note there IS a difference between currency and money.

In short:

Currency is debt.

Debt has a coupon.

That system is represented as P + I. I does not presently exist, only P does. P is the aggregate credit base. I is owed in the future.

Ergo, FUTURE P must be = present P + I. QED, debt must grow. That is why the answer is always more debt.

Toys have been replaced by tech. Kids don’t want kid toys. They want the latest electronics.

Thank God I grew up in an era when kids could still be kids, and no one had ever heard of “helicopter parents,” and any kid who wore a helmet while riding his bike would’ve been mocked as a Nancy-Boy.

Soooo the “leveraged buyout” masters have done their damage once again.

Those criminals (thieves) should be prosecuted and stripped of ALL their assets – both known and unknown – and put in prison for life.

When will this come to a end?

FYI, These crooks will still be stealing wealth hand over fist, from your children and descendants long after you’re gone. As long as you insist on voting for it.

Wouldn’t workers being displaced by store closures be lumped into the service economy, as opposed to the manufacturing sector?

I’m sure this is great news for GDP given it’s based on the metric of consumption.

OBTW, Consumption used to be a wasting disease.

Lego is doing quite well, Lego movies, TV series and videogames are selling good. In a way is going the way of Pepsi, that means they no longer fully depend on their main product. Just like Pepsi diversified and is getting more and more of their snacks sales, Lego is getting more and more out their growing media empire.

So sorry guys, Lego is not gonna die yet.

finance is evil. nothing new here.