With peculiar consequences.

Today the bond market had its second bout of nervousness about a US default. It showed up at a “dismal” auction by the US Treasury Department of four-week bills. And the one-month yield shot up to 1.30% from 0.96% on Friday. That’s a huge one-day move. These bills mature on October 5 — after the official out-of-money date on September 29, that the Treasury department has announced to Congress.

September 29 is the official deadline for Congress to raise the debt ceiling so that the Treasury can borrow more so that it can spend the money that Congress ordered it to spend.

If Congress fails to raise the debt ceiling, and if the US Treasury runs out of “extraordinary means” with which it has been scrounging up money from other internal sources, and if it then decides to default on its debt service, rather than on payment obligations such as Congressional salaries and the like, the Treasury would then not redeem those one-month bills or any other maturing debt on October 5, and investors would have to wait for their money until Congress gets its act together.

That’s a lot of ifs. That kind of default, if it drags out, could tear up the global financial system, and so it’s not going to happen: Lawmakers are political animals and they use the debt ceiling as a form of extortion, but they’re not stupid – knock on wood, fingers crossed.

And they have a little more time. In all prior debt-ceiling standoffs, the end-of-September deadline came and went, and the Treasury had enough means into mid- or late October. This time will not be different. So the nervousness in the markets is just slight. Nevertheless, these tiny doubts are creeping into the minds of those risk-averse investors that invest in one-month bills.

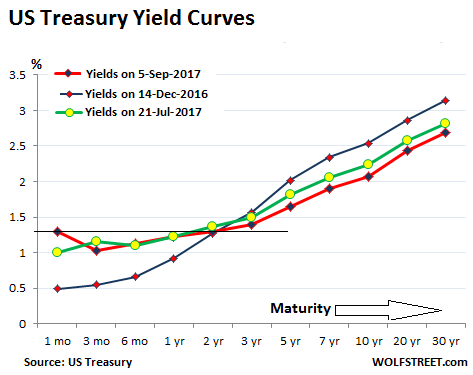

Today’s spike in one-month yield to 1.30% is peculiar because it’s now exactly the same as the two-year yield (1.30%) and just a notch below the three-year yield of 1.40%.

Longer term yields dropped today, as investors seek to dodge the problems caused by a default in October. In the process, they bid up securities with longer maturities (when yields drop, prices rise): The 10-year yield dropped to 2.07% and the 30-year yield to 2.69%.

This is producing a yield curve that is inverted at the short end, with the one-month yield higher than yields of maturities up to two years. And it further flattened the long end of the yield curve.

In this chart, today’s yields (red line) across the maturities contrast with the yields on December 14, 2016 (blue line), when the Fed got serious about tightening, and with yields on July 21 (green line). More on that green line in a moment. Note the hiccup in today’s yields at the left – the one-month yield and the inversion of the curve:

The green line shows the first scare on July 21, when the three-month yield jumped to 1.16%, while the six-month yield remained at 1.1%. Thus the curve inverted just a little in that maturity range. These securities would mature in October, just as the government might have to default, and security holders might not get paid for a while. The nervousness in the market was barely a ripple and disappeared within days.

Now it’s a little more serious – but still just at the jabbering phase.

Ratings agencies have been warning about a US default in various ways. During the debt-ceiling charade in 2011, S&P cut the US credit rating one notch from AAA to AA+ and has refused to raise it since. During the debt ceiling charade in September 2013, it threatened to cut the US credit rating to junk in case of a default. Fitch has already warned of a downgrade recently but in milder language, as has Moody’s.

Today Moody’s added to the jabbering in a question-and-answer document. It figures that the Treasury would prioritize payments after the out-of-money date, making debt service payments “to preserve the full faith and credit of the government, and to avoid disruptions in the financial markets,” but defaulting on other payments. And it added:

“In the unlikely event of an interest payment not being made as a consequence of the debt ceiling, we would expect the default to be short-lived and to be cured with a recovery rate of 100%.”

So investors would get their money but would have to be patient. And it would cause a downgrade, but “a subsequent upgrade would be unlikely while the institution of the debt ceiling, and the political environment which had given rise to the missed payment, remained in place.” That’s the point S&P reached in 2011.

But the threat of politically damaging chaos is “likely to force a timely increase in the debt ceiling,” Moody’s said.

The bond market also thinks so for now. But doubts are creeping up. Once the bond market gets serious in the assumption that the US government will default on its debt in October, even if only temporarily, panic will be setting in, and short-term yields might spike to 3% or even 4% as no one would buy these securities without a good risk premium, given the uncertainty of getting your money back. And that 18-point decline today in the S&P 500 will just disappear as a squiggle in a major downdraft. At that point, decisions in the real economy would be put on hold, hiring would freeze, expansion plans would be shelved, and everyone would just try to stay out of the way as all heck would be breaking lose in the financial markets.

That scenario is, according to the bond market, not yet credible. But it has appeared on the distant horizon today for the first time in the 2017 debt-ceiling charade.

If Congress does its job and raises the debt ceiling, we’ll be in for a big surprise though. Read… US Gross National Debt to Spike by $800 Billion in October?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Very nice analysis, Wolf.

Well worded too! Re: Hissy Fit

After all it is money that they already agreed to spend in previous budget bills and other appropriations. It isn’t like it is NEW spending.

But who knows with the dysfunction we have been seeing in Washington DC leading up to this anything is possible.

Congress left this up to the last minute. Want to add another what if… What if Irma just brushes along the east coast and ends up shutting down Washington with enough damage that it takes weeks to put the city back together. It was built on a swamp. I was there one August day when there was a thunder storm and some the streets were flooded. I can’t imagine what the type of rain from a Harvey would do to DC.

How would Trump drain the swamp if Irma happened on DC?

On a serious note, mark my words – the default will not happen as the deep state would not let it happen, despite their disdain of Trump.

It would really topple America from its narrow mantle as the most stable economy in the world.

You could be right (“On a serious note, mark my words – the default will not happen as the deep state would not let it happen”), but as I recall, the last time we had a businessman of German extraction- a self made millionaire named Hoover- in the White House… it was called the Great Depression

The oligarchy has no allegiance to any particular country. If the U.S. goes under, the other countries owned by the oligarchy will do better. It’s called oligarchial diversification.

Parasites have no allegiance to their host. When one is sucked dry, they find a new host to stick their blood funnel into.

One August day back in 1814, a burning DC city was saved by a tornado and rain.

https://historicaldigression.com/2012/03/26/a-tornado-saves-washington-during-the-war-of-1812/

But what if the debt was illegally incurred? SUCH an inconvenient question, at SUCH an inconvenient moment.

More like banks and insurance companies getting clobbered as Florida gets blown into the Atlantic.

The administration could buy some time for playing hardball by copying a play from Eisenhower’s days, ie revalue the gold supposedly stored in their vaults. Thus they could aquire probably more than 300 billion and thus time to play hard ball with congress. Based on a Roosevelt era act from 1934 they could revalue the gold reserves, the treasury then issues gold certificates that are transfered to the FED who issues the required amount of digital money transferred in return to the treasury. That would buy some time and if they start shutting down parts of the federal administration and start laying off people, well, a lot (most ?) working in most branches apparently are supporting dems, that do open interesting possibilities for a real circus …

“The administration could buy some time for playing hardball by copying a play from Eisenhower’s days, ie revalue the gold supposedly stored in their vaults.”

NIXON put and end to that play when he took the US OUT of bretton wood’s.

Very possible indeed for the administration to do this, revalue the gold to market price, issue gold certificates for the difference new value minus old value, send these gold certs to the fed and they issue the same amount of currency that they transfer to the treasury. Nixon or no Nixon ;)

Non manipulated true market price is around high 200 an OZ.

what you suggest is gold bug false economics not reality at all.

And not possible, as the world outside America (the world that counts) already values the US reserve, at current gold spot.

President Trump needs to impress upon a lethargic & reckless spending EU – that they need to spend more on defense – for how long has he urges a 2% spending on defense & only Poland has see fit to knowledge it’s responsibility.

Article 5 of NATO’s 1949 founding charter states that an attack on any member is an attack on all , & allies must render assistance, military if need be.

For the layabout ‘nouveau riche’ Israel – it is a case of being lavishly loved with extravagant gifts of money & other expensive miscellaneous’ by their US Daddy Warbucks.

When will the US dreamers awake from their state of enchantment – the US needs to break free form the medieval spell that has it bent over with it’s trousers around it’s ankles to The Old Charms of Europe & Zion.

Prudently we ask

Albeit – that the US committed itself to being the Great & Glorious Defender of all Things Bright & Beautiful – for Europe & the Jews of Europe with the Gimme, Gimme, Gimme, mentality.

Fools Rush In

But some fools are smart enough to leave their credit card at home.

Not so the US.

Agreed R Davis,

The only reason Poland pays 2% is that it gets 20 billion euro’s a year off the ECB for whatever reason.

For Angela Merkel to stand up and have a go at America & the UK no longer being a friend after all it has done for Germany after World War 2 (Loans being written off) and around the Cold War (air bases etc etc) is a disgrace. From the point of loans it should have paid every cent back.

Germany is more than well off now to pay its fair share of defence budget.

As for Israel again going forward it should be given no more financial aid.

IMHO, Germany does not need a defense budget. They face no military threats.

In that case, perhaps Germany should do the right thing and set an leadership example by exiting the NATO alliance?

Merkel has done more to destroy Europe through her ‘immigration program’ than the communists and Russia ever did during the cold war.

The real Manchurian Candidate.

The real Manchurian Candidate.

No just a compassionate mother who made a mistake.

Admittedly a very big one.

The USA has been trading whilst insolvent for years. Living off borrowed money. Only able to keep up appearances because it as got too big to be allowed to fail

One day someone will call the bluff. And then where will you be? With Greece?

Or bought by China.

You shouldn’t confuse the US financial system with the global financial system. True, some Americans have been trying very hard to make the two indistinguishable ever since Bretton Woods (or longer). But they have not been wholly successful.

In my opinion, one obvious reason for a lack of enthusiasm for US investments could lie in the recent BRICS meeting at which several speakers made it perfecly clear that their nations will be working to get right out of the US-controlled financial system as soon as possible. If enough nations do that, the US financial system will collapse.

It is ironic that we are getting upset when we know the whole thing is a Ponzi scheme.

It will be the greatest mass case of cognitive dissonance the world has ever seen.

We know the king has no clothes but are afraid to admit it out loud as it would wake everybody up and spoil the party.

The term “rearranging the deck chairs on the Titanic” is fitting.

Actually what it would do is rearrange the deck chairs on the Titanic.

Many who appear to be on top would find out their investments were virtual and only on paper. Owning a billion shares of something that makes no profit is only an asset when others refuse to admit that the emperor has no clothes. As long as the band plays and everyone is dancing, no one notices that there aren’t enough life preservers or life boats.

I keep hoping that one day I’ll wake up and see the headline “Phooooooof” or “Up in Smoke”. It would be nice to finally get a return on my savings, and it would also be nice if corporations couldn’t conduct financial shenanigans with low rates and actually had to invest in jobs and production to make money.

Annnd it’s GONE “d” says the true value of gold is around 200 USD per ounce More ridiculous a statement has never been made on here

This whole Debt Ceiling thingy is a sham. The government can ONLY go broke by deliberate design such as this law limiting the debt ceiling. It is completely and absolutely unnecessary, a sour tribute to political and economic incompetence!

Treasury does not borrow to spend. It instructs the Fed to buy its debts, simply by marking up relevant reserve accounts in the fed. Just like bank loans the numbers that become money come from nothing, except for banks it is a liability, but not for the Fed, which can buy whatever is for sale, and no debt ceiling is necessary.

It is a mechanical impossibility for the government to spend taxes to pay for its expenditure. We have to earn money first before we can know our tax obligation and pay it. It’s amazing this obvious problem is not recognised. Tax comes after spending.

If there were no requirement to increase the debt ceiling, legislators would have no interest in passing a budget. They’d run the country without a budget.

“…but they’re not stupid…”?

Then we we’d best wish they were.

You, I and every sentient individual who is not a consumer turnip knows that cheap money, deficit spending, counterfeiting money & credit and rewarding of spenders and borrowers rather than savers must END.

The status quo is destroying economic vibrancy, expanding the state, creating a cycle of dependency and sending inflation soaring.

A little ‘wrecking’ would work wonders.

That wrecking should have come back in 2008 but better late than never I suppose Assume crash positions people Got Au?

00 not 08.

The stave off in 00, simply made 08 worse.

“expanding the state,”

This has been going on, in big way, since 1914.

The State Entities/Bureaucrats, like all entities, put their survival, well-being, and continued expansion, at the foremost of THEIR concerns.

It is the root of so many of the global problems today as these “State ” entities, do not serve the interests of the State, or the people who pay for the State. Both of who they are supposed to serve.

The pay in many state entities used to be lower than that in the Private sector. So State employees were trained in the work, and could then move into the private sector and be useful.

Today the Total remuneration and job security of most State Employees in most western democracies, is Better than in the private sector, and the Incompetent Bureaucratic minions, are staying with the state entities for life.

A further problem within state entities, is that they promote by seniority, to the level of incompetence, then they retain. Instead of moving out the employees. who have been promoted to their level of incompetence.

Hence most of the west is burdened with, ever expanding, bloated, expensive, incompetent, and constipated, State Entities.

In America many of the Republican Politicians signed onto the no more taxation “STARVE THE BEAT”. The beast being these state entities.

However they stopped at “No more taxation” and took no action to enforce the application of laxatives and diets to these entities, systematically, on an entity by entity basis. Which is the only way to possibly complete such and exercise..

Trump is at least targeting certain departments for “reductions” (the business man in him at work). However the targets are not the correct ones, and the objectives are not clearly iterated. They are also being carried out in a Partisan manner, which is not “Competence based”.

Republicans ran into an ugly reality. Most of the expenditures of the BEAST went to defense contractors, the elderly, and the medical-industrial complex. There primary supporters. What’s left isn’t enough to shake a stick at.

your obfuscating use of semantics does miss the point. using the word State for two different entities, the federal government and the states government. its the essence of the republic that they AINT THE SAME THING. there are some states which receive more money from the federal government than they pay in and they are mostly republican states, and these people naturally hate washington dc more…. republicans used to be on a quest to reduce the union to its precivil war status, but lately not so much. the elected officials in Congress are in charge of getting their pork barrel filled, and since tax revenues don’t begin to meet that requirement, the magic of debt, which republicans used to be against, becomes okay, and why McConnell promised to pass the debt ceiling no problem, so his state government can continue to function.

Missing a debt payment would be an international catastrophe. The US dollar would collapse along with the American economy. China would become the new financial center of the world. All based on the vote of the yahoos we elected to Congress.

“The US dollar would collapse along with the American economy.”

You believe this.

Then you have a problem. You do not understand the FED and its relationship with the $

The Chines love the FED.

They understand the US Govt can default and the USA $ remain stable, due to the FED.

If get that information from the same chinese who fund OBOR projects with tons of printed CNY/RMB they know is worthless. I learnt more about the FED and its application, from them, than American’s.

Conversly.

THE FED

A private entity, can fail, leaving the US Govt, Solvent and Stable.

Various nation states will not allow that to happen.

If Trump arranges the default he has campaigned he wishes to (he is after all personally a profession bankrupt and fraudster).

There will be BIG “issues” but not the financial global catastrophe many predict.

The US Treasury bond is the world’s primary financial asset. Those assets are highly leveraged around the world. Calling into question the actual values of those assets will cause an immediate collapse of bank lending and most businesses.

Of course central banks can monetize most debt. But will they? Do people know they can? I say no.

Not so sure about that. Treasuries might continue to trade above fundamental value, just like treasuries and stocks have been doing for a long time. Treasuries may tank only when the market starts worrying about fundamentals. In this environment, where fundamentals don’t matter, the markets may soar on news of a U.S. default (if recent experience is any guide). A U.S default doesn’t seem like much of a trigger, as long at the market price of treasuries stays inflated and the “extend and pretend” game is still going.

More can-kicking. However, in a finite world, there are finite limits. It a matter of “when”, not “if”. The Western world is addicted to debt as enabled by digital “money” and the Central Bank. As history has shown, this will not end well.

“Gold is money, all the rest is credit” – JP Morgan testifying in Congress in 1912

“The greatest shortcoming of the human race is our inability to understand the exponential function.” – Albert A. Bartlett (1923-2013), Professor Emeritus in Nuclear Physics at University of Colorado at Boulder

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.” – Kenneth Boulding, economist

“Trees don’t grow to the sky.” – Louis Rukeyser

Stein’s Law: “If something cannot go on forever, it will stop.” – Herbert Stein (1916-1999), Economist

einstein’s three rules for success:

work, play, keep your mouth shut.

all else is credit, indeed.

and what is wrong with that?

Hi Wolf,

Your article reminded me of an old Popeye cartoon character, Wimpy, of “I will gladly pay you Tuesday for a hamburger today” fame. Do you loan him money for his preferred meal of sliders? If he’ll pay you back, sure. If not, no dice. In the bond world this dilemma is referred to as the probability of timely payment of principal and interest. As your article suggests, perhaps the US government bond market just experienced a “Wimpy” moment.

We have already experienced two Wimpy moments in less than a decade. The first was in 2008 when the entire govt Wimped Out and then the MF Global fraud when the govt Wimped Out again. The Wimps are now firmly in charge, sort of.

Remember when the markets were sustained by confidence? If I squint I can sort of remember.

The first was in 2008 when the entire govt Wimped Out and then the MF Global fraud when the govt Wimped Out again.

The government didn’t “wimp out.” Both political parties, as well as regulators, enforcers, and the judiciary, have been bought and paid for by a corrupt and venal .1% in the financial sector. This ensured that not a single banker would ever go to prison for causing the 2008 financial crash, and that Jon Corzine – Obama’s former “bundler” for campaign contributions – would never see the inside of a jail cell despite ripping off MF Global account-holders for $1.6 billion.

The sheeple have sanctioned this corrupt crony capitalism with the votes for the status quo, so they have no right to complain.

The sheeple applauded as the police went out and beat down the Occupy protesters who were demanding the government hold the bankers accountable.

They’re not sheeple, they’re complicit scum.

Kent Which sheeple applauded? Evidently everyone I know are NOT sheeple because none of them applauded the police I was there and cursed them personally

The sheeple got tricked into giving up their mortgages because the American money center banks were so little compared the HSBC and /or BCCI?

Get back to work and we are are starting an investigation on your Friends! You owe us 10 trillion dollars or equivalent , enjoy the rest of your day.

also known as investing in cocaine futures.

I’m astonished that investors don’t demand a higher risk premium for buying US Treasuries, given the Keynesian fraudsters running our monetary policy and the dysfunctional, profligate Republicrat duopoly on Capital Hill.

… and yet today 9/6 – 9:57am the Bots come to the rescue once again pushing the numbers back into the green despite all evidence indicating otherwise

Welcome to automation hell .

And folks actually want to depend on automation … in their cars ?

The market-rigging and manipulation has become increasingly blatant, yet the complicit or criminally negligent SEC turns a blind eye. Remember when we had vigilant, conscientious regulators and enforcers who looked out for the public interest and ensured we had honest markets?

Neither do I.

What will the Fed do if no debt ceiling deal is reached by end of Sept?

The Fed holds over $2.4 Trillion of US Treasuries.

What would stop the Fed from just forgiving portions of this debt mountain as needed to reduce the debt ceiling?

Well, for one thing, the ratings agencies might finally start ACTING like credible ratings agencies by downgrading the ludicrous AAA rating assigned to the U.S., in light of the fact we have a criminal private banking cartel controlling our money issuance and a pathetic bunch of “elected officials” who only serve their billionaire donors. A ratings downgrade would make it much more costly for Uncle Sam to borrow money and engage in deficit spending. It would also force Yellen’s hand on interest rates – she would have to start pretending to be a responsible central banker instead of a Goldman Sachs adjunct. Of course any interest rate hike would set off a chain-reaction meltdown of the Fed’s asset bubbles.

FED and foregiveness in the same sentence I don’t think so

Drone money?

Its the junk mortgages with no banker on the other end?

The Fed owns another ~$1.5 Trillion in mortgage-backed securities in addition to the $2.4T of Treasury debt.

I’m referencing the Treasury debt pile that the Fed could theoretically forgive. Probably not all at once, but could be touted as another “extraordinary measures”

why not trade them for cuba?

The US government would have to default on many other obligations before it could legally default on bonds or notes that have a higher legal priority.

Missing any payments would just be an extreme form of political grandstanding and extortion at the expense of the credit ratings, future interest costs, and the value of the Dollar. Political posturing and manipulation does move markets, but to actually make a shortsighted move like failing to service existing federal debt should never have to occur unless tax revenue falls below 2X the debt’s carrying costs.

its time to raise taxes, and get off this debt today which becomes a debt ceiling crisis next year. pay forward, and a VAT on high end goods and services is a good start. remember in the 60s the income gap between professionals and blue collar workers was much more narrow than it is today. and a tax break for working people would encourage more people to work (and pay taxes). the last point to turn the Reagan tax break around and use that logic for a tax hike.

+1

Congress approves the budget and spending priorities but Congress won’t approve the funding. Is Congress sending a message or should we send a message to Congress?

The latest indicator of our bizarro-world: gold drops even as Trump, the Democrats, and Republicans prove yet again how fiscally irresponsible our “leadership” has become by punting on the debt ceiling, yet again. Said fiscal irresponsibility is exactly why people should be buying safe haven assets.

http://www.marketwatch.com/story/gold-retreats-after-president-trump-agrees-to-raise-debt-ceiling-2017-09-06

I will be buying big any substantial dip On that you can believe Dry powder is burning a hole in my pocket

Anyone starting to get that ‘Major Kong’ resigned kinda feeling, riding both the financial and geo-political timebombs into oblivion ??

I sure am !

One of these days Yellen’s handlers at the Fed are going to take out massive shorts against the Wall Street-Federal Reserve pump & dump, then order their albino hobbit at the Fed to hike rates and implode the Ponzi.

http://www.zerohedge.com/news/2017-09-06/things-have-been-going-too-long-lloyd-blankfein-says-hes-unnerved-asset-prices

” Albino Hobbit” You’re too kind brother