Bay Area housing affordability nightmare hits home, so to speak.

What happens in a large urban market when a young couple with a household income that is far above median cannot afford to buy even a modest home? What happens to that local economy? That’s what everyone wants to know, because this is precisely the fate San Francisco, Silicon Valley, and surrounding Bay Area counties are contemplating.

The Housing Affordability Index (HAI), released by the California Association of Realtors (CAR), has some bad news for these people – and possibly for the trends in the local economy and the housing market.

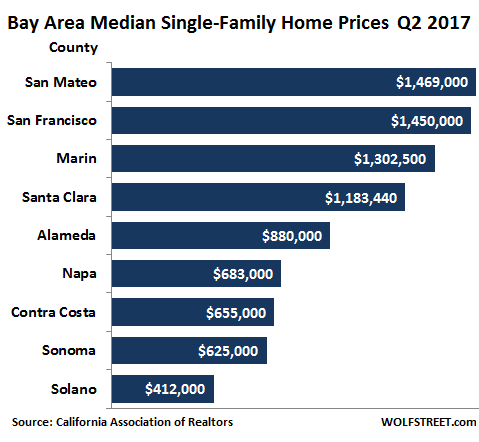

The median price – 50% cost more, 50% cost less – in San Francisco of a single-family house hit $1.45 million in Q2, according to CAR. This does not include condos, whose prices are somewhat less deadly. It puts San Francisco in second place in the Bay Area, behind San Mateo County, which comprises the northern part of Silicon Valley. Santa Clara County, in fourth place, comprises the southern part of Silicon Valley. In third place is Marin County, just north of the Golden Gate Bridge:

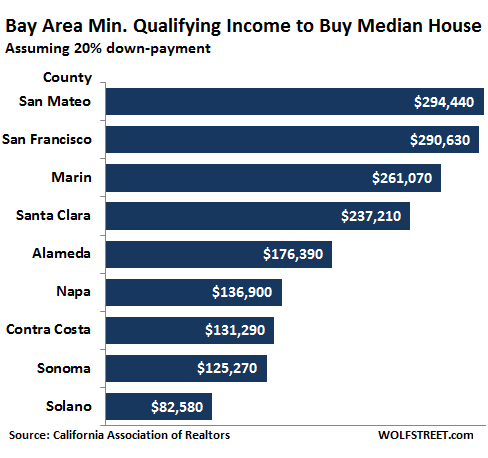

The HAI measures affordability based on this median price of a single-family house (not condo) by county. It figures mortgage payments based on a composite of national effective fixed and adjustable mortgage rates to finance 80% of the price of the home.

The remaining 20% would be that elusive down-payment – elusive because for a median home in the counties of San Francisco or San Mateo, that down-payment would be nearly $300,000. If you live in an expensive city, it’s devilishly hard to save $300,000. So generally, forget that 20% down-payment. Maybe go for a 3% down-payment ($43,000). In other words, realistically, the payments are going to be much higher and affordability even lower.

After assuming the existence of that 20% down-payment, the HAI then figures the monthly burden of owning that home: the mortgage payment, property taxes, and insurance. It does not include the tax effects of the mortgage interest deduction.

Given historically low mortgage rates – 30-year fixed-rate mortgages are still quoted under 4% – and that elusive 20% down-payment, the minimum qualifying household income needed to buy a median home in the counties of San Mateo and San Francisco would be nearly $300,000 per year:

The report also points out that these minimum qualifying income levels have about doubled for most of these counties since Q1 2012.

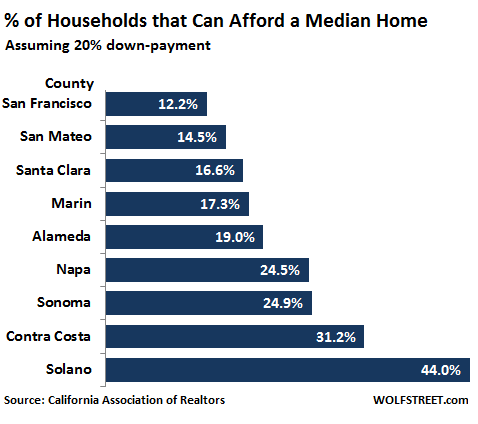

So here are the percentages of households in each county that can afford to buy a median home, despite historically low mortgage rates and that elusive 20% down-payment:

This poses an absurd situation: that for example in San Francisco, only 12% of the households can afford to buy a median home. Median means 50% are higher, 50% are lower. In a balanced housing market, about half of the households have the minimum qualifying income to buy a median home. But if only 12% can buy that median home, who is going to buy the remaining homes?

Granted, people can always move down into cheaper digs. And that’s been happening. But there are limits. At some point you’re at the bottom rung of the housing ladder and there is no place to move down to. And people making over $200,000 a year don’t necessarily want to live in the only dump they can afford.

And that too is happening. There is a lot of anecdotal evidence — and some of it is starting to show up in the data. Everyone knows people like that. I know a young couple with a newborn. They live in a one-bedroom condo in San Francisco but want to move to a larger place that gives them some space for the family to grow. Their household income is more than double the median income in San Francisco. They looked in San Francisco but cannot afford a space that is large enough and decent enough. So they’re looking outside San Francisco. And they’ll pack up and leave. There are a lot of people like them. Many people are leaving the Bay Area altogether.

Companies are in a similar boat. Some like Charles Schwab, have kept their headquarters in San Francisco but have reduced their footprint over the years, moving as many jobs as possible to cheaper states. In November 2016, Charles Schwab said it was planning to move another 5,000 jobs to its campus in North Texas. At the time, Glenn Cooper, a senior VP of corporate real estate for Charles Schwab, told the Dallas Business Journal, “We are channeling all of our growth now to here.” Until that move, its largest campus outside California was in Colorado, which now too is getting expensive.

Other Bay Area companies are moving their headquarters altogether. So far, these have been mostly smaller companies, such as Varo Money, a fintech startup, which in July said it would move its headquarters to Salt Lake City, citing high home prices, among other reasons.

The costs of housing in the Bay Area have risen to such a level that it’s expensive and difficult to lure professionals to the Bay Area even as the exodus picks up speed. And these developments have started to show up in employment growth. Since 2010, San Francisco and Silicon Valley were powerful job-creation machines, producing enormous employment gains. But this is now coming to an end. Read… These Job Trends in Silicon Valley, San Francisco Bay Area Will Hit Real Estate, the Economy, Municipal Budgets & Hype

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Isn’t this what should happen? It’s ridiculous for one city or one state to have all of the job growth and to have to supply all of the housing. Spreading business, growth, opportunity and infrastructure throughout the country would be better for everyone including residents of California who are growing weary of traffic, water restrictions and density so deep the bedbugs are complaining about crowding.

Visited San Francisco for the first time in 30 years after having once lived there. Took me 2 1/2 hours to drive from downtown to a meeting in southern Marin Co. Riding the BART from the airport to downtown was equivalent to being in a classroom full of feral youth scratching the chalkboards with their fingernails because the Transit Authority couldn’t be bothered to grease the wheel bearings.

Why would anybody actually choose to live there even if housing only cost $800 per month?

Thor’s – hehe we’ve got a small sledge hammer here in the shop I think of at Thor’s hammer, it’s useful for “tunking” things.

Anyway, yes! Someone else acknowledges how painful it is to ride BART. That screech is awful!

However, I chose to live here when a studio apartment was only $800 a month, in 2003.

Right now, rent is free. I pay my share of “the electric” which generally is around $50 a month. Silicon Valley internet is crappy and expensive, so I did without for about 4 years. Finally my employer decided to pay for it (it would amount to about 10% of my gross income, no thanks!) and it’s a bit better than dial-up; just barely adequate.

Pros: I can practice my trumpet anytime, hammer and nail and saw stuff, and my commute to work is nonexistent. Cons: No running water, kind of a scruffy neighborhood.

End Prop. 13 is what “should” happen.

Why should WE have to subsidize YOU?

Yup. Giving more tax dollars to the CA state government to spend is the solution.

Maybe they could properly maintain the state’s dams (nah – the federal taxpayers will do that).

As a non-Californian, why should We (federal taxpayers) have to subsidize YOU

Who are you subsidizing, Ricardo? Californians pay a lot of taxes. If you end Prop 13, it’s not just homeowner’s taxes that might go up, apartment bldg owner’s taxes go up (rents will go up even more to cover it) and commercial bldg owner’s taxes go up (rents for businesses will go up). All for what? What do you think would happen in your utopian society where there are no unintended consequences?

“Colorado, which now too is getting expensive”

Not to be an a**hole, but what happens when every locality gets to be like that?

(you can dismiss that as absurd, but remember everyone once that zero interest rates were impossible, and many other examples)

There are many many towns and cities across this country that have shrinking populations.

Yeah, but who wants to live in Detroit?

Well, you can at least afford to live in Detroit and they’ve already hit bottom. S.F. is just reaching the peak of the roller coaster.

Either way, they’re both victims of a half century of left wing party rule. Just different sides of that same coin.

And they also have no jobs that pay over minimum wage–.

+10. Hyperinflation is the final endgame of the US. It’s the ONLY way everyone gets paid. Short of the Opioids finishing off the pensioners, but that won’t be fast enough.

For people coming to the US: “abandon all hope, all ye enter here”.

This is not “absurd” at all. They’re chasing the greener grass until their’s no green grass left. Still, a big company like Schwab has to go where they can find a talent pool that is deep enough and big enough. This isn’t everywhere. Dallas and Denver and some other big cities will do. But this won’t work in a small town or rural area, for example. However, their call centers can be anywhere (and they are!).

A lot of small manufacturing can be just about anywhere too. Say you make birdhouses and sell them on Ebay or Etsy or through your own site. You can live in flyover cheapville.

Then of course you find yourself living in flyover cheapville, which may not be worth it to you, but there are TONS of places in the US that are cheap.

Unless you are straight, white and a Fundamentalist Christian, life in parts of flyover country can be lonely and alienating. Two of my younger relatives live in a college town in Wyoming. The young mother (two kids under age five) has been desperately trying to make friends with other young mothers. First questions on acquaintance always seem to be about her religious beliefs.

So far, her only friend is a gay, minority dancer who teaches at the university. (She herself is a dancer, now retired) Her sense of isolation is sad to hear about and she’s fearful about what will happen to her sons in this closed environment.

Mary,

Making close friends in a closed minded society isn’t the only problem. I can bear witness to the fact that if somebody living in Redneck USA wants to remain employed they need to become skilled in never letting their beliefs and values come to the surface. Football and guns are the only safe topics.

Mary – Thank you! You’ve just said what I’ve left unsaid. Unless you’re white, straight, Christian and better be the right kind of Christian (no hippy Jewish Jesus Christ welcome; you’d better believe in Aryan Supply-Side Jesus) you’re gonna have a hard time. Where “a hard time” may mean anything up to being burned alive in your “devil house”.

Get your True Religion here: https://www.youtube.com/watch?v=Gc-LJ_3VbUA

Your supposition is interesting, but Google just demonstrated the same thing applies to Silicon Valley

India.

If manufacturing jobs can be offshored… why not do the same with it? It is even more logical as there is no physical flow of materials.

After all, the TISA treaty is all about that.

I saw this happen in New York City with the Wall St. crowd in the 80’s. The companies were having trouble attracting people and started to move to the suburbs where the people lived. That’s how Connecticut became the capital of hedge funds. The guys already lived there and there was no state income tax. Now that Connecticut is taxing them on the income and property side, they are leaving in droves.

I read that Puerto Rico is attracting some of them because there is no federal income tax there.

I left Florida because they raised my rent $200. Everything has a limit.

Shell Oil moved its US headquarters to Texas back in 1972, taking 2,000 jobs with it. It is the first big move to the southern US that I can recall. Since then, lots of companies have left the New York area e.g. Exxon, Mobil, JC Penney, AT&T.

Lots of variables have been going in the right direction for a long time:

-Immigration from China and India

-Influx of Chinese investment capital

-Technology industry boom/rising PE ratios

-Stock compensation

-Ultra low interest rates

-Lax loan standards in banking industry

-Mortgage interest deductibility

-Fear of missing out

-Bailouts seem routine and expected

Makes me wonder what happens when one or more of these variables shifts the other way, if that could ever happen in this corrupt society.

Maybe the banks and gamblers can get taxpayers to pay off the debts again.

Corruption will stop until the host die. That is when food stamps can NOT buy food. Those carriers floating on the ocean stops moving. Weapons built by US can not reach further or blow harder than other nations. Then the nation will get down to its knees and start talking about clean up the corruptions. Until then, people will vote to let the next sucker buy their house and let other people to pay their medical bills and let other people bail out their debt.

I think US is still far away from the end of corruption. Until then, enjoy decay.

Really, this contradicts everything Wolfstreet have been saying, “housing collapse” retort for years on this site, time to admit the economy and housing are getting better not worse as per data.

I don’t think there is a contradiction here. At some point, there is a critical mass, a tipping point, some such thing. At which point, one of two things need to happen, either everyone’s wages come up so that the 12% number Wolf quote becomes 50%, or the alternative is that the pricing drops like a rock.

The current situation is the definition of unsustainable. The only thing propping up the markets (housing and stock) is the Fed, and eventually, that has to give.

You’re confusing the websites. WS has never run articles about any kind of “housing collapse” in the Bay Area or elsewhere in the US, period. We have for years described housing bubbles in different cities (prices soaring to irrational levels … which is the opposite of a collapse). We have described what is called the “Housing Crisis” in San Francisco, with homes getting too expensive to buy or rent for the middle class. We have recently described that rents are coming down in some of the most expensive markets, including San Francisco … they’re coming down by a few percent to 20% (in Chicago). But we never called this a “collapse.” That is just silly.

We are however studying the data to look for turning points – because that’s what is ultimately important. Turning points are hard to identify in real time. Three years after the fact, everyone can see them. But by then it’s too late. So we point out some of the things that might conspire to form a turning point — large amounts of housing supply coming on the market due to a historic building boom, for example, or jobs leaving due to high housing costs… or both at the same time.

There are plenty of other websites that constantly talk about a housing collapse, or some kind of collapse. But not WS. We’re kind of focused on data here. I know it’s confusing out there.

Don’t mind the underwater specu-vestors Wolf. They’re losing money every month. Prices would have to double from here just for them to break even.

Wolf he probably as you confused with “Dr. Housing Bubble” which while ostensibly about California real estate, is populated with flyover residents who talk more about how unGodly* California is than any useful information about real estate.

*Where “unGodly” basically means, out here we don’t believe in Aryan Supply-Side Jesus and actually don’t freak out when a brown person says “hello” to us.

High living costs in the SFBR are nothing new. The Boston-based company I started work for in 1994 had to pay its West Coast field service engineers 20% more than their service engineers in the rest of the country.

As of a few minutes ago there were 71 new residential listings for Marin and Sonoma Counties combined, that’s over the prior 24 hours.

There were 45 price reductions over that same period and 18 properties came back on the market.

I primarily work the Western Part of Sonoma County and inventory is very heavily skewed to the high end with little inventory priced below $750K.

A lot of the properties I see have aspirational pricing, agents will take listings at a price they know is too high because they are hungry, someone else will take it at that price if they don’t.

After it’s been sitting a while most sellers will lower their price to where the market is and you have a sale.

Yes, there are still plenty of cash buyers, but they are getting picky.

Interesting times…

Thanks, Tom, for the update.

Wolf I live in Denver Area (Denver Tech Center, DTC) and what you say about large companies needing a large talent pool is correct. I am an IT professional there is a great demand in the Denver Metro area for people with my skills (Big Data, database development, etc.). Schwab just finished building it’s campus in Lonetree (south of the DTC) to house all of it’s IT back end folks.

Housing as compared to Cali is still reasonable if you are in the IT realm. You can get a house in my part of town for $$500K to $800K with 2500 to 4800 sq ft in Cherry Creek school district (best in the CO, one of the better one’s in the US). So that couple that is making significantly more than the median income in SF could make less money in the Denver area and have the home that they could afford.

Example, my daughter who has her Master’s from UC Davis and is working at a start up in South San Francisco pays $2400 per month in Oakland, CA for a 2 Bd room. We have a 2800 sq ft house in DTC (with unfinished basement) that we pay $3000 a month. We will be looking to buy a place next spring in the the $550K to $600K range with 4,000+ sq ft.

Yes housing has gotten more expensive in Denver, but compared to Bay Area, LA area and even Seattle it’s still cheaper.

Hi Wolf,

Where is the co-relation data that proves increased home prices to reduction of employment or lack of job growth?

I am not disputing that home prices are not through the roof. I am challenging that people are still moving in SFBA in droves. They maybe H1Bs from India or China who may be resigned to live on rent forever or a long time.

So while natives may not move here or move out; there is a long line of foreigners that make up for the loss of native immigration. While they may not be able to afford houses; they genuinely can afford rent.

If you ever see 880 South or 237 West (to Silicon Valley) or the Fremont BART line – you wouldn’t see a drop in traffic or BART passenger count. In fact it has been getting worse and worse.

Please account for immigrants who mostly are in tech and these are (relatively) much higher paid than natives.

I believe they are not getting paid even 50% of the “native” rate. “60 Minutes” just did an expose on H1-B visa abuse, showing UCSF employees getting the boot, replaced by IT workers from India, under contract (as in, NO benefits) for 50% of the “native” IT, twenty-year employee rate.

Young single people from a foreign land, a very crowded foreign land, are much more willing to share accommodations and split the rent six ways, compared to a middle-aged worker with kids in high school.

You are correct about underpaid workers stacking up.

After we sold our SOMA condo, we lived in an apartment while we prepared to escape from the junkie needle infested City and County of San Francisco. After moving in, we discovered that the apartment complex housed a bunch of shabby looking young men from India, stacked up to 6-8 per bedroom. These were not the handsome, well mannered and attractive Indians that are typically found in law, medicine, finance and management. They were all part of the same organization I noted as they were rotated among different apartments in the complex. The two apartments next to mine were also occpuied by members of the same gang for about six months until they ALL sudenly went away, to my relief.

So $4,000 apartments, split 6-8 ways and rent isn’t so bad for the boss. And it can be tax deductible for an organization if structed as a business expense, unlike common folk.

I am grateful every single day to be free from that whole area.

Please check out the link at the bottom of the housing article above. It takes you to an article with charts by county for total employment and year-over-year employment growth (decline).

So you don’t have to go back up and click on that link, here it is again…

http://wolfstreet.com/2017/07/22/job-trends-hiring-silicon-valley-san-francisco-bay-area/

The deal with H1-B is that Indians get paid around 33% of what American citizens get paid. Chinese H1-Bs get around 50%. Irish, German, and Australian H1-Bs get 100% of what an American gets.

I know a nice Canadian couple who got hired straight out college to work in Mountain View (he does IT, she’s a physical therapist). No way are they going to stay more than 3-5 years. As soon as they have enough money saved, they will go back to Canada. They are both on TN-1 visas, getting paid like North Americans.

Most H1-Bs are from a third-world Asian country. Anyone who tells you that the average H1-B gets paid as much as an American is lying to you.

None of these people are “Immigrants”. They are what we call “Guest Workers”. That appears to be the near-term solution for un-affordable housing in the Bay Area.

This article makes me think of Mark Hanson who runs a great blog like this one. He’s a Bay Area expert and remains steadfast in the believe that pricing always reverts back to what end-user shelter-dwellers can afford.

That’s the part that fascinates me.

It’s clear that people with serious money have decided to become America’s landlords. And while some of them are all cash landlords, there are plenty of others who bought with borrowed money. That includes China. What’s going to happen when these people aren’t getting rents that cover the asset mortgage?

1) Ridiculously low cost of borrowing.

2) Tons of new landlords, not shelter dwellers.

3) Only a decent job market. Not good, not horrible.

4) Healthcare costs soaring every year.

5) People paying an absurd percentage of their income towards living costs.

6) Less money for other goods/services.

7) Our big new success stories:

Amazon: Relies on people’s spare money for goods/services.

Google: Relies on money from goods/services businesses that make less and less money and are starting to discover that the pay-per-click data isn’t always accurate.

Uber: Suckering low income people into being 1099’s for very little money… and still running out of money and in the midst of an internal board of directors fight to the death.

8) CEO’s who couldn’t care less about their companies long term health and work only to manipulate short term share place for personal gain.

It’s such an absurd era. Feels like an enormous game of musical chairs. Everyone’s waiting for the music to stop, ready to fight for their chair. And yet, it just keeps playing.

(Sorry, my fingers typed “believe” instead of “belief”.)

“(Sorry, my fingers typed “believe” instead of “belief”.)”

At times, I too long for an edit function after I have posted.

“”At times, I too long for an edit function after I have posted.””

You are not the only one….!

There are something like 2-3 empty houses for every homeless man, woman, and child in the US so I say let’s tax empty houses, “Ghost Houses” they call them locally, heavily.

The Use-It-or-Loose-It law:

If a house remains unoccupied for at least 50% of the time for a two year period the title reverts to the State Housing Authority free of all encumbrances.

Said Authority shall be required to offer the property for rent at a price less than the average for the entire state. If it remains unrented for a year the Authority shall be required to tear it down and donate the land for a community garden.

The UILI law would do wonders for freeing up the rental market everywhere— even more so in places like Tahoe and Aspen where nobody lives in their houses for more than a few weeks a year—.

“Loose” means not tight. As in, “The rope was not tight, is was loose”.

This idea that “lose” is spelled “l-o-o-s-e” is an internet phenomenon that I cannot understand. Where would that come from?

Apart from that, the idea of a draconian government dictate about control of private property certainly is not possible in a country that cannot even study firearms deaths.

“The Use-It-or-Loose-It law:”

Use it or lose it, huh? So, if I have a shirt that I don’t wear every day, can the government take that from me and give it to some vagrant?

Private property is just that. Just because someone doesn’t use it to a level that satisfies *you* (or anyone else who doesn’t own said property) doesn’t mean that they should lose the title to it.

When I was in the Navy, I spent approximately 2/3 of every year deployed at sea. I was single back then, and owned an older single-wide mobile home (or manufactured home, as they’re fashionably known as now). By your reasoning, I should be punished for not using my personal property to some standard that *you* have arbitrarily set. Almost every year I would have to go out and purchase a new residence because you think someone else deserves it more than I.

We have five vehicles in our stable. So, what is the minimum amount I should drive each before YOU decide that I should be stripped of its use and given to someone else?

When you talk of stripping property owners of their homes you are heading down the path of communism. I think that experiment has been tried before in other countries. Perhaps you’d like to move there and try out that system of government control?

Nobody “deserves” to be *given* a place to live.

T-struck-

You’re really conflating issues. The issue isn’t your own dwelling, only with housing intentionally left empty with the goal of distorting market values. Everyone needs a place to live. No one is forcing you to buy housing as an investment, income property, or get-rich-quick scheme. Housing is a public good, a necessity. Imagine if a cartel bought up all agricultural land and decided not to grow food in order to jack up prices, or bought up all the roads and decided no one should be able to use them. When private property is used in socially-destructive ways, the owners of said property should face consequences. If you want to horde property, consider buying more guns to cabbage patch dolls, neither of which is a public good or necessity. If you seek a libertarian paradise, consider sunny Somalia.

TWO BEERS-

I’ve conflated nothing. If you would have read through the post I was replying to, you would have eventually gotten to the point where you can see the entire point was to wrest control of summer houses away from the affluent who visit Aspen and Tahoe. Sure, I can see how if some folks didn’t have *any* housing of their own they’d be jealous of someone who can afford a summer home in a popular tourist destination, but to suggest that the PRIVATE PROPERTY of that person be forcefully taken by some government is just so unbelievable as to be only compared to when a socialist coup occurs. It’s all pie-in-the-sky unicorns and skittles plotting to punish “the rich”. In the end the wonderful country dachas are still occupied by select party apparatchiks and the common plebe is sequestered away in dull and dreary state-owned high occupancy dwellings.

To take one of your examples given – if I, or anyone else buys up farmland and decides to let it lie fallow, that is our choice. You cannot force me to grow crops on it. It is mine, and mine alone. Now, here in Texas if you buy farmland or cattle grazing land and don’t use it for agricultural production, there are tax penalties involved that “encourage” you to return it to production. As an example, on the 45 acres I own I raise cattle. My taxes on that land are less than $1,000 per year. Should I decide to use it for a hunting lease instead, my taxes would jump to around $4K per year. That is an incentive, but not a regulation. The truth is, I could more than make up the added taxes by leasing the land out, but I prefer the taste of my own grass-fed beef and not having crazy city “hunters” driving all through my creekbeds. When the government tries to take over agricultural land and drive production, you end up with marvelous results like when the Soviet famines dominated the news.

The example you tried to use about roads is a poor choice indeed. Except for private toll roads, the rest are typically owned by a governmental agency of one flavor or another. Sure, it could be privatized and sold to a toll road operator I guess – but if they close it down they would be poor businessmen and likely to lose the property to the lien holder (selling agency?)

Land and homes are NOT a given right or a guaranteed entitlement. They are commodities like any other tangible item. Yes, just like tulips, cabbage patch dolls and firearms.

I don’t need to relocate to Somalia. I live in a country where I am free to buy as much private property as my heart desires – and to use it to whatever means I see fit. Sure, there may a whiner here and there that thinks that THEY deserve some of what I have, but I ignore them. They can babble on about the “common good” and other socialist talk about why *I* should be relieved of my property to benefit *THEM*, but most see through that drivel for what it truly is – class envy.

I think that maybe you should have stopped at…. Two Beers.

Wilbur58: Great summation of all the factors; all these factors are creating asset bubbles everywhere.

Wolf,

Can you please post the median household incomes in these areas instead of just showing the percentages that can hack it?

The report didn’t list them in its data set. So here are median household incomes for the top five counties — gleaned from the most recent estimates by the Census Bureau (for 2015).

San Mateo County: $93,623

San Francisco: $81,294

Marin County: $93,257

Santa Clara County: $96,310

Alameda County: $75,619

Thanks, Wolf.

Wow, my god. How are these incomes supposed to pay for these homes? Unreal.

Those are medium income. The house price and speculation boom is sustained by a small portion of home buyers. Those earning 200k plus. 10-15% of the Bay Area I recall. And the foreign all cash buyers as well.

Shawn – Not “medium” income, the correct term is “median” income. Median income means half make more, and half make less. It’s different from average income, say, the average between Bill Gates and myself is many millions, but it does not mean I make many millions; I make about $12k a year.

There’s still some kind of a “long tail” or something going on here in Silicon Valley because I can tell you that I’m doing better than a ton of people at $12k a year.

I have made this comment before, but Standard Oil of California, now Chevron, was noting the inability to land top engineers fresh out of college, in the early 1980s. The company headquarters was in an iconic building, at 225 Bush St., since the 1920s. But a decision was made to move the company East, to San Ramon, on a whole-owned campus, and to move out of much office space it rented close to 225 Bush. New hires at least had the opportunity to commute from “only an hour away”. Temperatures in the Central Valley can top 100 degrees F as the high, for many days in a row, while in San Francisco, summer temps seldom rise above 75 degrees.

“What happens in a large urban market when a young couple with a household income that is far above median cannot afford to buy even a modest home? ”

A foreign family on a temp visa will gladly live 4 to a room to displace this theoretical ‘couple’. Please visit your local Target or Walmart or Frys around San Francisco Wolf. You’ll see that there’s no need to accommodate any idealistic notion of providing for future generations.

It’s all churn, burn and get onto the next lot of cheap, easily exploitable labor. I see no evidence of anyone building a bridge to the future unless its the aristocratic, cronyistic civil servants who rule over California and ensure there will be never ending pay raises and largess for their ‘kind’.

I live the reality, not the padded headlines. Anyone who lives in a gated, exclusive community should get out more and see what’s really going on around them instead of catering to PC, identity politics that ignores reality.

SF and the entire West Coast is a desirable place to live because of the benign weather compared to the rest of the country. Because of this prices will always be higher than the norm.

As for the high real estate prices in SF, the average worker may not be able to afford to buy but the “average” Chinese investor can, which will keep prices up for quite a while, especially since Vancouver, BC put restrictions on foreign buyers forcing their money south.

I’m near the San Jose Airport and the weather today reminded me of nothing so strongly as Newport Beach!

Prices fell 45% here in the Bay area during the last minor adjustment. I expect a much deeper and longer correction this time.

It’s both Chinese and Canadian house speculators and Prop 13. The former is well documented, the latter, means Californians pay just $1 for every $100 of house value. In SF, it is 1.2%. Thats a joke, it is any wonder why we have such shitty roads and schools.

The state receives more money in taxes since Prop 13 than it did before because real estate is still changing hands and at higher prices. There is more than enough money for roads and schools- more money doesn’t translate into better quality. There is also a real pension and bond problem that eats into budgets.

While Prop 13 does favor people who came to California in previous decades or were born here, so does rent control. People will just need to decide if they want policies that favor natives and early settlers or open borders (this includes from other states) & the free flowing movement of people and capital. Right now we have a weird and dysfunctional mix of both.

https://calmatters.org/articles/despite-proposition-13-california-property-tax-revenue-soared/

Well, they’re also paying for a $100,000,000,000 high-speed train from SF to LA

Coaster – I have lived different places. I was born in California, family moved to Hawaii where I lived until my mid-20s. But I had most of a school year in Newport Beach when I was 17. And after leaving Hawaii for California in my mid-20s, I lived for periods of time in Arizona and Colorado. But I’ve always come back to California.

I tried moving back to Hawaii in 2003 and I lasted 4 months. Too many bad memories and plain old rock fever.

I’ve said enough about why I don’t choose to live in flyover country however cheap it is, and while California’s expensive I get by fine on a frankly microscopic income.

And I love California. Living here is like being of Japanese descent back in Hawaii. I can walk anywhere, go anywhere, I’m not questioned. I am the “default human”. A striking example of this is how the other night, I was walking back to my shop with a part I’d taken off of a library carrel sort of thing I’d “harvested” from the parking lot of the Education Dept. where they’d thrown out some furniture. A big police SUV came by, and hell’s bells, they didn’t even look at me. I’ve been stopped by the police for just walking with a light colored skin in Hawaii. I’ve been ticketed for jaywalking, for being the lone white in a large shoal of brown people who decided to jaywalk. All the little stuff, being followed in stores, etc., that just doesn’t happen here in California.

Yet, I’m kind of olive-skinned, so in places like Gilroy, I guess I pass as a light-skinned Hispanic, and no one knows the wiser until I talk. I’m just the right color to live in California, and my family roots are pretty deep here too.

Yeah, it’s expensive as hell but it’s a hell of a congenial place.

I lived my first nineteen years in Berkeley and then, in 1967, moved to the south bay. Two weeks after I moved, I went back to Berkeley and found I was already a tourist. Screw that.

Proles, meet your future: “Nano-flats” as decent housing becomes priced out of reach thanks to the runaway speculation encouraged and enabled by central bank ultra-easy credit policies. See the Fritz Lang movie “Metropolis” to see what the Masters of the Universe have in store for the 99%.

http://www.scmp.com/property/hong-kong-china/article/2106852/three-out-10-hk-flats-under-construction-are-now-mini-flats

And for those who cannot afford a nano-flat in the world’s least affordable city, Hong Kong (according to Demographia International Housing Affordability Survey 2017: http://www.demographia.com/dhi.pdf)

there’s still the cages:

https://www.theguardian.com/cities/gallery/2017/jun/07/boxed-life-inside-hong-kong-coffin-cubicles-cage-homes-in-pictures

California should just do away with the U.S. dollar and embrace the bitcoin as its currency. Easier to come up with 20% down when the bitcoin exchange rate is $4059.99. Then homebuyers just need a few e-bucks.

In NC we have many remnants left of family farms that have been reduced to a few acres. Many of these have several residential homes as once an older family dies out the old home is not torn down but typically used as storage. The property owners usually are property rich but cash poor. By good fortune I met one of these owners and rented one of the old homes. With a little cleaning and repair its been one of the best housing choices of my life. All in costs are roughly $600 per month including utilities. Its a wonderful lifestyle for the right person. Its as close to being free as I have ever been as you basically can do what you want on a family farm without any government employee or neighbor caring. In my younger years i did the big house and mortgage thing like most people, but for me this is a happier, healthier lifestyle. Was able to retire at 50 with this choice. Now 61.

So anyone planning to move to Solano? Seems to be the only place with decent under 500.000 $ houses.

Spoke with someone who works at Varo Money. And apparently people who are already working here will continue to work here. So basically that info of people moving is no good.

I left the Valley last year. Our family had outgrown our condo, but the only options were:

– Move further out. This did not sound appealing as my 25 mile, all interstate, round trip commute was already a 2 to 2.5 hour proposition.

– Buy Bigger locally. We had enough equity to do this, but mortgage payment would be ~50% more and property taxes would be 2x-2.5x more. That would mean no more saving and eating lots of Ramen, and home would be at risk if an economic downturn cost us a job.

So we moved far away. Bought a home 3x as big for 1/3rd the price and now work remotely. In theory could retire as much as 15 years early with the proceeds from the CA condo sale.

I know of others doing the same. They either use leverage to work remotely, or transfer to an office where cost of living is more reasonable.

We will not have honest markets, sound money, or responsible monetary policies until we end the Fed.

See. There are enormous costs for a community in allowing rampant price speculation in housing. People are leaving, businesses are leaving. My kid’s school in SF can not find enough kids to enter into K because families are leaving the City. the Canadian provinces of BC and Ontatio, have identified the problem and are, at least, trying to do something. We live in Prop crazy corrupt California where where nothing gets done because everyone at every level of government has their hand in the cookie jar.

IMF warns China over dangerous levels of debt. Why is it that the central bankers and IMF who have enabled and encouraged such insane levels of debt and speculation are now, years too late, sounding the alarm?

https://www.theguardian.com/business/2017/aug/15/imf-warns-china-debt-slowdown-financial-crisis

“But the IMF expressed concern at the methods used to keep the economy expanding rapidly – an increase in government spending to fund infrastructure programmes and a willingness to allow state-controlled banks to lend more for speculative property developments.”

The only reason why the Chinese economy is still growing. If China doesn’t devalue its manufacturing sector its going to hollow out. GDP growth, if you can believe their stats, has been declining for years.

“China now has one of the largest banking sectors in the world. At 310% GDP”

Didn’t the PBC expand their balance sheet by 15 trillion dollars?

Conclusion, expect to see median (not medium, sorry for typo above) SF /San Mateo house prices to top 1.7m by next year.

One in seven elementary school children in NYC will be homeless due to soaring housing costs as the Fed’s asset bubbles continue to inflate.

Heckova job, Ben and Janet.

https://www.nytimes.com/2017/08/15/nyregion/report-says-elementary-students-homeless-new-york.html

The everything bubble will crash. I don’t when otherwise I’ll be rich. Soon.

Debts are sky high and savings are at all all time low, it’ll end very badly.

What I don’t know if debts will be inflate away or they will do the right thing and let the market that care of them. I sense that the Fed and politicians will give up on the dollar. That will have terrible consequence for the world as it is still the safe haven.

I’m worried. Very worried. I’m a city dude, but buying a piece of land and becoming a self sufficient farmer is in all my nightmares. That’s how worried I am.

I think China will be the trigger. It’s like 1997 all over again with the Asian financial contagion. A few years later we had the dotcom bubble burst. It would be interesting to read the opinions on this matter of people who know more about this than I do.

“subprime is contained” – Ben Bernanke

“We would never directly monetize the debt” – Ben Bernanke

“Once unemployment goes below 6.5% we will begin to normalize interest rates” – Ben Bernanke

Why hasn’t this gold-collar criminal and his accomplice Yellen the Felon been locked up for financial crimes against the 99%?

I am curious as to what the ACTUAL Replacement Cost New for the California 1 million dollar house would be in the midwest? How about the 2 million house??

I suspect the RCN number for a new build would be 1/4th to 1/3rd of the California prices… On a much bigger lot….