The incredible credibility conundrum.

By Bianca Fernet, Argentina:

Trying to figure out what’s going on with Argentina’s Central Bank’s monetary policy right now is about as exact a science as checking out the horses as they parade around the paddock before a big race. There are clear favorites, a few dark horses, and until someone crosses the finish line it’s all guesswork. Except a lot less enjoyable because horses are cooler than politicians.

Argentina’s currency market hiccuped last week at the prospect that former President Cristina Fernández de Kirchner has an actual shot at becoming a national Senator, representing the Buenos Aires Province. After hovering pretty close to AR $15 for the better part of the year, last week the US dollar exchange rate reached AR $18.

The Central Bank jumped into the market on Friday and sold US $305 million, pushing the rate back below the so-called “psychological barrier” of AR $18. But the “blue” or unofficial exchange rate is still hovering above this barrier, and it seems that political, financial, and economic commentators are all obliged to pile in with ominous commentary in an attempt to legitimize our existence as soothsaying, fortune-telling gypsies who can predict the future.

So without further ado, let’s take a look at what exactly is actually going on with Argentina’s exchange rate.

Game of Currency Regimes: The Central Bank and Monetary Policy

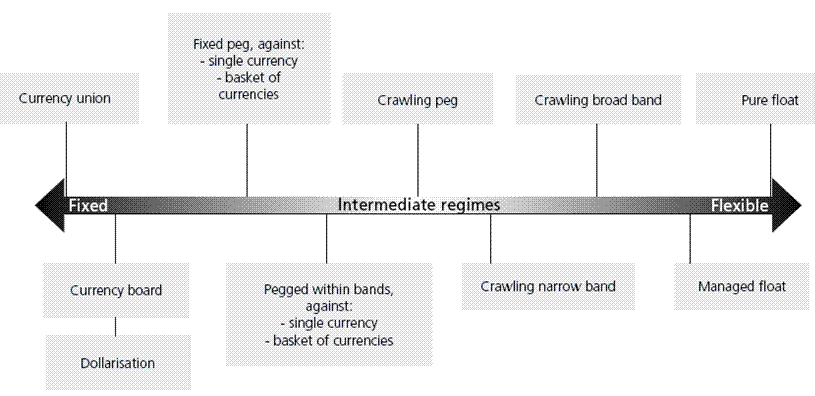

Argentina’s currency regime is what we call a “managed float”. All currencies live somewhere on a spectrum between a completely free market float on one extreme, and a fixed rate where a country gives up any national currency whatsoever. Countries outside the United States that use US dollars, like Ecuador, are to the far left of the chart below. Argentina is on the flexible end of things with a managed float.

If people want, or demand pesos, then they will become relatively more valuable vs. the dollar. This would happen if investment were flowing in and everyone thought Argentina was just the grandest, stablest, most attractive place to invest. Sadly for me, that’s not the Argentina in which I live.

Due to a number of factors completely outside the control of the Central Bank, people are not exactly queuing up for pesos. To grossly simplify the government’s relationship with the economy, see the chart below. When the fiscal side of the policy equation is out of sync and the government spends more than it brings in via taxes, something has to give. In Argentina’s case, the government is financing via raising debt overseas as well as letting this pressure leak over to the monetary side.

As Argentina’s Central Bank, the BCRA has certain tools at its disposal to effectively “manage” the peso’s float – but in in economics as in life, none of these tools are free.

Furthermore, the stronger and more sustained the pressure on the peso becomes, the less effective these tools end up being. So when former President Cristina Fernandez de Kirchner comes up ahead in the polls for a Senate seat, that ambiguous variable of dreaded political instability takes a front seat.

The return of Cristina makes a lot of people not want any pesos.

Enter the BCRA

This blip in the political radar has basically thrown a wrench into the BCRA’s already fairly difficult task to make people want pesos, and not fear the imminent collapse of the economy.

While financial journalists try to sex up their writing material by referring to central bank operations as “firepower” or “ammunition”, trust me the actual sex appeal of selling dollars, buying bonds, and moving exchange rates is limited to a very small pool of weirdos who would make you feel uncomfortable in an elevator.

Besides selling US $305 million into the market, the BCRA also raised short term interest rates on short term treasury notes, principally the LEBACs (Letras del Banco Central), which are bonds with maturity between 30-273 days that are actively bought and sold in a secondary market.

By raising the interest rate on the LEBACs, the BCRA gives people and companies a higher return for taking the risk of holding peso-denominated instruments, while at the same time takes pesos out of the market. Win-Win, right?

Wrong. Raising short term interest for extended periods of time can damage the real economy, and rates can only go so high.

High short term interest rates also give capital market investors the incentive to engage in what’s called the financial bicicleta, or bicycle, between currency and short term bonds rather than spending or investing those funds in a longer term, actually productive investment.

Flipping cash from place to place to protect against currency movements does not create jobs or lead to economic growth.

Companies can combine LEBACs with dollar futures to create a situation that insulates them against peso risk.

The high interest rates keep people from fleeing the currency, but they also ensure that inflation remains high and that money loops around in an endless financial bicycle rather than fueling the real economy.

So what happens now?

It really depends on how people perceive Cristina’s return to politics, and how triumphant she is.

The currency market has pre-election jitters. These recent fluctuations are not likely symptoms of larger, non sustainable macroeconomic problems.

Whether or not the BCRA is independent from the government doesn’t really matter, because its ability to intervene in the currency markets only exists if the government retains credibility.

Cristina’s return to the political sphere in any form does not exactly scream credibility. Macri’s brand of economic reform has been truly painful to bear, and it’s understandable that his government should face opposition from candidates that address these issues.

But reasonable people, and it appears currency markets too, should conclude that Cristina Fernández de Kirchner should not be that candidate due to her incredible track record of (allegedly) shamelessly stealing money and shouting down anyone who disagrees with her.

The incredible credibility conundrum

For now, stability seems to have returned. People have faith that the BCRA has the willingness and ability to intervene as necessary to keep the peso around the AR $18 mark.

But history shows us that governments lose their credibility towards the end of an administration, not at the beginning. In three of Argentina’s most spectacular currency crises since 1981, the Central Bank intervened hand over fist but it wasn’t enough to stop a cycle of loss of credibility. The closer Macri gets to the end of his term, the less credible he becomes.

Logic dictates that even though Cristina leads in the PASO primary election polls, she would still lose in the final elections because the votes from one of her competitors would surely go to Macri’s Cambiemos candidate.

But Argentina is neither a country nor a culture that’s very logical at all. In fact, I have found great peace and tranquility in my life here since I stopped trying to use logic to explain this place. A Shakespearian willing suspension of disbelief combined with hope in a deux ex machina has been much more mentally productive.

Just two years ago, logic told us Macri didn’t stand a chance at being president.

So rather than try to figure out what will happen, I recommend you pull up a seat and enjoy the races. Placing a bet on either side is a gamble. By Bianca Fernet, Argentina.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Although I’m sure that mainstream American media do not give a true representation of the real facts on the ground in these South American nations, a typical (thinking) American might come to the conclusion that the majority of voters in these nations are politically suicidal in their voting decisions. Perhaps the media communications internal to these nations are totally biased and rigged for the crooks (like in another country that I will not name) or most people do not have access to the facts. In any case, they seem to consistently make bad choices that are detrimental to their lives (i.e. Venezuela).

i.e., US

I’m one of those Americans who has come to the conclusion that the majority of voters in these nations are politically suicidal in their voting decisions.

While I do not have a PhD in Latin American studies, I do have 70 years of watching these folks time, after time, after time, after time. after time cast suicidal votes.

They repeatedly blow up their own currencies, use their army to kill their own citizens, politicians loot national treasuries, or install dictatorships (and that’s just the last 35 years). Argentina may be the only Latin American nation to use its army to actually kill somebody other that their own citizens in the last hundred years.

And these guys wonder why they have zero influence with the rest of the world…

You have no idea how the world actually operates…May I recommend Confessions of an Economic Hit Man by John Perkins…..Oh figure out what a false dichotomy is while you’re at it because I am sure you do not understand the concept…

Ha Ha,

Aren’t horse blinders for the eyes and drugs for the mind wonderful inventions for maintaining the illusion of superiority? And for forgetting American elections like Bush/Gore, when blatant electoral fraud and family cronyism bought the election? Or Ohio four years later when exit polls and official results (by Diebold) differed so radically that if an international commission had been observing it would have called for an investigation? Or a two party political system that presented the voters a choice in 2016 between an infantile blowhard who lives in a world of imaginary reality and a sociopathic grifter who had sold her soul to the military industrial surveillance state and every foreign nation willing to contribute to her election coffers?

Latin American banana republic indeed—-.

You’re missing just one little detail Chip, Argies have as much sway in electing a different leader/political party as we in ‘Merika can vote against Goldman Sachs or the MICC. Short of outright revolution here, there, anywhere the only “choice” is the one you’re given. I’d say you don’t need a PhD to figure that out either. Think again.

“The high interest rates keep people from fleeing the currency, but they also ensure that inflation remains high”.

Can you tell that to the central bankers?

Someone corral that currency!

Chip, if you are Murkin, look in the mirror… ZH has an article listing the odds of our next president. Distressing to say the least – look at those names. The Dollar’s day of reckoning will arrive.

I am not providing an alibi, but read The Shock Doctrine… Many countries have been raped and asset stripped. Arguably, the Shock Doctrine template is beginning to be applied here with austerity soon to be foisted on the sick, poor and aged. Our stated national debt was like $4T in 2001 – look where it is now. What are the unfunded liabilities? Still feel so superior?

Is generally agreed the only reason the Argentine government, that has claimed many times that they want a dollar at a higher price, is putting a leash on the dollar is because is an election year.After the voting in October the dollar will most likely rise.

In a small country like Argentina once people loose faith in the currency inflation can skyrocket in a very short time (just like the 1980s). Their only salvation may be to scrap the peso and use the dollar which would cause its own set of problems, but probably not as much as hyperinflation.

Don’t even joke about it. A lot of Argentine current ecomic problems is because for about a decade, an argentine peso was worth a dollar. And every country that uses a currency they have no control over as thrir main one gets into big trouble. Just look at the eurozone were most countries adopted the euro, and many countries are starting to regret it.

Thanks Bianca, ( and thanks Wolf)

I have thoroughly enjoyed your commentary on life, from the perspective

of a resident of Buenos Aires, ever since your post on Ms Cristina

appearing , dressed all in white, during the final days of her presidency/regime.

Somewhat sadly, sound money type policies are, despite the reflections

of some, equally as rare, anywhere, as they are/have been, in Argentina

Was the recent hike in the oil price a consequence of the Dollar’s weakness?

Argentina lets the rest of the world study macro economics like in a lab. The future will be both interesting and volatile.

No.

Argentina oil prices always go up at least two times a year, even in the era of one peso = one dollar that was the case. In fact they barely went down when petrol prices went from one hundred dollars a barrel to about 30 dollars.

Is a big nacional scam.

it,s a nice country but the economy is really doing bad when people compare with chile a country where the economy is doing much better all the argentinians are going to chile for shopping because prices are so much cheaper.The argentinian pesos is going to slide to 20-22 pesos in the coming months.There is a lot of inflation in buenos aires everything is so expensive the rents are very expensive.only tourism and agro export are doing ok but the people have no money nobody is buying anything.