Ballooning Condo Glut ensnares preconstruction speculators.

Miami-Dade’s spectacular condo flipping mania is in turmoil, with sales plunging, inventory-for-sale soaring, and new supply flooding the market. It’s not like Miami hasn’t been through this before.

In February, existing home sales of all types fell 10% year-over-year, to 1,835 homes. These sales “do not include Miami’s multi-billion dollar new construction condo market,” the Miami Association of Realtors clarified in its report on March 23.

And this new construction market that is not included has become distressed.

Sales of single-family homes fell 10% in February, to 881 houses. The report blamed the shortage of properties “in popular price points.” Prices have been rising sharply, and at the price points where people could actually buy a house – below $250,000 – few sellers were playing ball. Hence a stalling market. Sales of high-priced units rose, but they weren’t enough to pull out the totals.

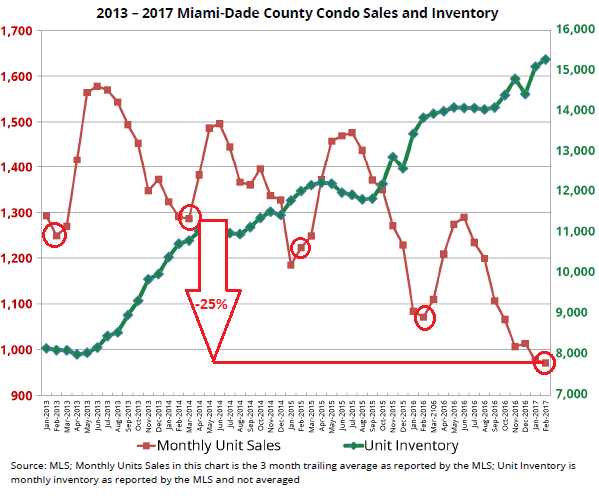

Condo sales fell 10% as well, to 954 units. This time, the report didn’t blame the lack of supply. Instead: “Existing condo sales are competing with a robust new construction market.” At the same time, inventory of existing condos for sale, not including new units, rose 10% to 15,289. At the current sales rate, supply soared 29% to 14 months.

This chart by StatFunding shows the plunge in sales and the surge in condos listed for sale. I circled the last five Februaries on the sales line (red). From February 2014 to February 2017, condo sales have plunged 25%. Andrew Stearns, StatFunding’s founder and CEO, calls the resale inventory – the dark green line that has soared 90% since early 2013 – “scary”:

Even this “scary” inventory understates the total number of condos for sale. It only includes units listed for sale on the Multiple Listing Service (MLS). But developers normally don’t list their new units on the MLS, and thus they’re not included in the above chart.

This is the distressed market that preconstruction condo flippers are facing.

Preconstruction condo flippers make a highly leveraged bet. They buy the condo from the developer during the construction phase. The initial deposit is small. Additional payments are required as construction progresses. But in a booming market, lenders are eager to lend. Then, often around the time the building is completed, flippers try to unload the condo at a profit. This bet has been hot in the condo construction boom around the country. But in Miami, the bet is now collapsing.

During good times, developers sell all their units either to end-users or to flippers within a few months of completion. But now, developers are getting stuck with unsold units, which, as Stearns points out, marked the “inflection points of previous condo cycles.”

The 12 large developments completed between late 2015 and late 2016 have added 2,743 condos to the market. Developers still own 433 of them (15.8%).

In addition, preconstruction flippers are also trying to unload their units. In those 12 developments alone, 451 condos, or 16.4% of the total, have been listed for sale on the MLS.

Here is the granular detail as of March 22 per StatFunding (sources: MLS, Miami-Dade Recorder; completion date in parenthesis):

Echo Aventura, 190 units (8/2015). Developer sits on 13 units (7%) and took out a bridge loan secured by those units. 36 units have appeared on the MLS.

Crimson, 90 units (12/2015). Developer is stuck with 30 units (34%!) and has sold only 1 unit since December 2016. 12 units listed for sale on MLS.

Peloro Miami Beach, 114 units (3/2016). Developer has sold all but 2 units. This includes 3 units sold via bulk sale this year. But 38 units – 33% of the total! – are listed on the MLS for resale.

CityCenter Reach, 390 units (4/2016). Developer is stuck with 46 units (12%). Meanwhile, 47 units have appeared on the MLS for resale.

Le Parc Brickell, 128 units (6/2016). The developer has listed the 9 units that haven’t sold yet on the MLS, in addition to 23 units listed on the MLS by condo flippers, for a total of 32 units – 25% of the total!

Centro, 352 units (7/2016). Developer sits on 34 units and has not sold any in 2017. Meanwhile, 56 units (16% of total) are listed on MLS.

Bond, 328 units (8/2016). Developer still has 23 units, including 12 that an affiliate of the developer purchased in bulk in March. And 72 units (22%) have been listed for sale on MLS.

Grove Grand Bay, 98 units (8/2016). Developer owns 7 units; 31 units (32%!) have been listed on MLS.

CityCenter Rise, 390 units (9/2016). Developer still sits on 212 units (54%). According to Stearns, “developer closings have slowed to a trickle, and it appears the initial sell-through is nearly complete.” Already, 24 units are listed on MLS.

SLS Brickell, 450 units (11/2016). Developer is down to 8 units, four months after completion. “This is what a successful sell-through looks like,” Stearns says. Condo flippers have listed 55 units for sale.

Casa Brickell, 81 units (11/2016). Developer sits on 22 units (27%); 8 units (10%) have already appeared on MLS.

Porsche Design, 132 units (12/2016). Developer still has 27 units (20%). “Initial sell-through closings are slowing,” and only 4 developer units sold in March, Stearns says. But 40 units (30% of total) have been listed for resale on MLS.

This sort of data poses the question: How many people actually live in units they own in these buildings?

For developers, the equation is getting dicey. Stearns:

Stuck with unsold units, some developers have not repaid their construction loans, others have taken out bridge loans to carry unsold units. The developer is responsible for taxes, maintenance fees, and insurance for unsold units, and unsold units are probably negative carry for the developer.

Developers may resort to mark-down liquidation or bulk sales of unsold condos as the cycle progresses….

Part of the problem? The market teems with foreign buyers. But the Treasury Department’s Financial Crimes Enforcement Network has figured out that there is a large amount of money laundering in housing. It has started making noises. And cash deals are plunging in Miami-Dade. In February they were down 17.5% year-over-year to 580 condo deals, or 61% of all condos sold. Other money-laundering hotspots too are being targeted, and answers are starting to emerge. Read… How Much Money Laundering is Going On in the Housing Market? A Lot

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yes, the people in Miami have certainly been through this before. For people who love to read fiction, I heartily recommend the novel “Condominium” by John D. Macdonald. It is set in 1977 but could have been written today.

https://www.amazon.com/Condominium-Novel-John-D-MacDonald-ebook/dp/B00E2RXHUW/

I’m a Los Angeleno who moved to S Fla almost four years ago. I knew immediately there was something about the condo market/boom in Miami that just didn’t make sense, add up. Which is the utter disconnect between the day-to-day citizens of the city, and the endless and ever-sprouting row of towers along the water, and clusters downtown. How could you have a boom that has little or nothing to do with the actual residents of the city the boom is in? That is to say, there IS NO local market for these condos. So it was clearly a speculation/futures play that would end when, what a shock, there’s nobody to buy them. It’s a city of 400,000 that builds like it’s 4,000,000. What could go wrong.

Travis McGee would have been smart enough to stay on his houseboat.

Indeed. Among other things, houseboats float – a valuable feature as the sea level rises…

At some point, they’ll have to make them so cheap that the HOA fees will be higher than the mortgage payments.

This won’t happen when it matters though – when the condos are still for sale by the developer. See, if the developer has to raise HOA fees, he is still responsible for paying on the units he hasn’t sold. So the goal for developers is to price high and keep HOA fees low to entice buyers. Then, once the community is sold out and turned over to the owners and they realize the HOA fees aren’t enough to pay the bills, they have to raise them.

So now they paid high and have high monthly maintenance costs. It is horrible any way you slice it. It comes back to one prevailing theme – real estate should really be viewed for long term holding, not as a quick flip or investment. That’s where people get in trouble.

Even long term the losses on housing are crushing.

Its all about timing… Even with long term holding, real estate losses can be crushing..

If the market price of an average home is $500k and most people

can afford only $250k, the swap, the gap between those two numbers

is too large. If real wage growth stall, equilibrium will not be found in the middle, it will be near the bottom.

It means that that the market will be dead for decades.

Affordable home price formula is a function of two important parameters : interest rates and real wage, the real family income.

Short time duration of interest rate, lately, was pushed up by the market, not by a great US economy.

A move in 30 years mortgage with 20% down, from 4.5% , up by 2%,

to 6.5%, an increase of 45%, push affordability down by 8%.

Yes, 5% to 6% is low by the boomers / 80’s standards, but it’s a huge hit on the market.

If we will enter a recession, RE is a sector to stay away from. Including an investment in home builders. Banks don’t like an unexpected change

in real wage, as result of layoffs in recession. they contract their balance sheet, cut lending. That’s always the case at the end off an economic cycle.

$500k for a house?

You answered your question as to why ‘the market has been dead for years’.

And keep in mind affordability rises dramatically as interest rates in creas.

Hi Wolf,

Do you think any of this has to do with the fact that certain streets in Miami already are uunderwater twice a day? Even short term flippers could get hurt with a hurricane or storm surge if they have to hold inventory longer (for the duration of repair).

Also, from an infrastructure perspective their long term water supply is vulnerable given intrusion of seawater. A veritable American Atlantis.

B Tilles

Florida has some of the best water management in America. I lived through 5 hurricanes without any flooding. They spend a lot of money moving and treating water, and do it well.

Miami is at sea level and some streets are below sea level. The ocean isn’t rising and these same streets flood every time it rains. Everybody in Miami knows which streets to avoid when it’s raining, they are in the older parts of town and there are basically two stretches that are well known. In order to fix this, they would have to condemn some of the most beautiful mid century houses in America, which is why they haven’t fixed it.

If you take a close look at the new development, the high end is still ocean front. If these buildings were sinking into the ocean, there wouldn’t be any ocean front condos along the entire coastline of Florida.

But, a hurricane could be a godsend to these flippers because it could postpone the closings until the buildings get repaired. They might come up with a plan B by then.

The ocean is rising, and everyone knows that there is going to be a point when Miami real estate becomes uninsurable. They just don’t know when that will happen — people investing in Miami real estate are simply betting that there is time for one more sucker to buy their unit.

Tulips, anyone?

https://en.wikipedia.org/wiki/Tulip_mania

Much like CA and insuring against earthquakes.

Petunia,

While it is hard to get specific data on the rise of sea level, (lots of predictions and extrapolations), I did find these solid numbers for the last 19 years. The article is from Wired.

I’m quite sure the denial about rise is mostly to keep people complacent and building.

Some quotes:

“But the flooding is already happening in Florida. At the University of Miami’s Department of Atmospheric Sciences, Brian McNoldy and other researchers have been accumulating sea level data from Virginia Key (a small island just south of Miami Beach) since 1996. Over those nineteen years, sea levels around the Miami coast have already gone up 3.7 inches. In a post updated yesterday, McNoldy highlights three big problems that follow from those numbers—and they should worry all of us.

and: First: Sea level rise is accelerating—perhaps faster than the IPCC has projected. When McNoldy tracked the average daily high water mark, when flooding events are most likely to occur, he saw it increase over time—but he also saw the rate of that increase go up. The last five years saw an average increase of 1.27 inches of water per year. If that rate holds steady for the next 50 years (and if McNoldy is right, it will only get worse), high tide levels in Miami would go up over five feet.

Second: Predictions about day-to-day tide levels are less accurate than ever, threatening the city’s ability to plan for weather events. Tidal predictions are made through what’s called “astronomical factors”—essentially the moon’s orbit around the earth. But these don’t take into account factors like weather or sea level rise—so as climate change exacerbates sea level rise, tidal predictions will be more and more unreliable. While water levels in May 1996 typically were close to predicted values, McNoldy observed that the same values in May 2014 were consistently higher than predicted. That kind of discrepancy can’t be caused by weather alone.

Map of the Miami area, where colors indicate the depth to the water table. A lot of area is covered by 0-4 feet, including all of Miami Beach.Click to Open Overlay Gallery

Map of the Miami area, where colors indicate the depth to the water table. A lot of area is covered by 0-4 feet, including all of Miami Beach. Keren Bolter, Florida Atlantic University

Third: Besides creating higher risks of flooding, sea level rise is creating an unexpected danger: saltwater intrusion into aquifers used to extract freshwater. Almost 90 percent of south Florida’s drinking water is supplied by porous limestone aquifers. As sea levels rise, the saltwater exerts more pressure on the fresh water in the aquifer, and fresh water is pushed off further from the coast. Already, some cities have shut down wells because of saltwater contamination.

Based on what scientists can glean from sea level data from the past 20,000 years, McNoldy estimates that the world could still have up to 100 feet of sea level rise to go. He believes even if humans were to slow down or stop the man-made factors contributing to climate change, “we’re already pretty well committed to significant sea level rise. We would be more prudent to consider how to adapt to those conditions.”

regards

Paulo,

I’ve been going to Miami since the 70’s and the beach is exactly the same. If the sea had risen 3 inches the entire state would be under water. I know the liberal agenda pushes this crap, but go and take a look yourself.

BTW, the joke in Florida is that FAU stands for Find Another University.

Petunia,

It is not the same beach. The beach from 1977 is long gone. Miami-Dade, the State of Florida, and the federal government spend billions every year restoring Florida’s beaches.

I live up the coast in Brevard where every year the County has to vote to spend millions on our beaches. In-land residents complain about there tax dollars going to pay for the view of rick folks on the beach. But I’d feel they didn’t Cocoa Beach and Kennedy Space Center would long have been under water.

Excellent reminder Bill. I pass by downtown Miami most everyday on my way to K.B. and just as Miami Beach, a wander into it, only if I HAVE TO. Both are in my s~^*t list. I couldn’t get paid enough to get trapped at either end of the rush hour. And that’s not even accounting for any normal summer rain. Good luck with that. Then you may be forgiven for thinking of Miami as the “Venice of So Florida” and not Ft. Lauderdale, as it likes to call itself. A long overdue hurricane aimed straight at the “Magic City” would go a long way to tame the animal spirits of the R.E. casino.

But who remembers that? Let alone a problem that seems to belong in Arizona: water scarcity in So.Flo? Hallandale already pipes in water from somewhere else because of salt water intrusion.

The condo bubble and glut today in Miami is the result of market conditions and the infamous condo cycle. It’s something that plays out over a few years.

Rising sea levels play out over many decades and have little impact on day-to-day changes in the market. It has been a well-known issue for a long time.

That said – low-lying areas along the coast in the US and elsewhere are going to face challenges over the next few decades. According to my understanding (I don’t live there to see it happening), regular sea water incursion in parts of Miami only occurs during king tides at this point and affects only small parts of Miami. But king tides are a regular occurrence, unlike a hurricane. As sea levels inch up over the decades, they can be dealt with in Miami (sea walls, pumps, etc.), though it will cost a lot of money.

There are many populated areas in the world that are below sea level, protected by dikes and sea walls, including parts of the “Delta” in California, parts of New Orleans, and parts of the Netherlands. But protecting populated low-lying areas requires a lot of resources.

Physically speaking, sea walls and other solutions may be less applicable in South Florida than elsewhere — because the limestone beneath them is very porous. Technical solutions probably exist, but they haven’t been developed yet, and their economic viability is unknown.

One thing to remember — and I’m sure you do, I just want to emphasize this — as that the effect of sea level rise on places like South Florida is not really physical. Long before we get to the point of actual innundation, they will have an economic and legal impact. That’s because so many of our financial mechanisms presume a ‘future’. However, what does insurance mean when the future becomes foreshortened? How does the uncertainty of insuring a house affect a region’s economy and institutions? Just like sea level rise doesn’t actually require a flood to impair the economy, the economy doesn’t require a total lack of insurance to stutter to a halt. What will happen when a single large insurer announces that they will no longer consider properties within X kilometers of the Florida coast?

So much of what we do financially assumes that the rules of the game won’t change — even the chance that they will in the future changes what we do today.

I have a relative who’s been flipping condos in Southern Florida on large scale for two decades now: he’s mostly active in Fort Lauderdale and Miami-Dade.

The problem right now appears to be twofold.

The worst part of it is the enormous glut in supply. After prices started to soar around 2011, the construction cranes started multiplying at an every increasing pace, especially east of the I-95, where prime property is usually located. Hundreds of condos and dozens of prime detatched house are coming onto the market now and will continue to come onto the market well into 2019.

The other part is buyers are, if not exactly drying up, becoming far less abundant than they were until a few years back.

My relative specializes in flipping prime condos, if and when possible at seaside. We are talking big money, not some cheap mini-flat for starving Millenials.

Foreign buyers may not be the majority of buyers, but drive the market as they tend to pay cash (Southern Florida is the king in RE all-cash transactions) and prefer buying quickly to haggling.

These foreigners have never been deterred by hurricanes and storms. Never. As they haven’t been deterred by very high maintenance/HOA/whatever fees (seaside property is expensive to buy and more expensive to maintain) and the hefty property taxes Miami-Dade and especially Broward County slap on non-residents.

We often joke Canada is the place where shady Chinese money end up, but South Florida was like that well before the first Chinese tour agency took prospective buyers to Vancouver.

While often “South Americans” are pointed as the most enthusiastic buyers, it seems the reality on the ground is truly multinational. I remember meeting “investor buyers” from Germany, Italy, Israel, Russia, Brazil… you name them.

It’s these buyers who are drying up of late, ironically while they are the most needed to prop up prices in front of a monster glut.

Some of these buyers have started shifting their preference to South-East Asia, where property is cheap, maintenance and the costs of living even cheaper and local authority don’t start probing around where your money came as long as you pay your taxes. Quality healthcare in countries such as Thailand is a factor as well.

Others may have been scared away by the Treasury’s recent moves.

But I think the problem is the supply of those who wanted to be an investor owner in South Florida is drying up.

MC

There are now massive capital controls in Europe and China. Officials can go on any account without permission from a judge. It is virtual impossible to transfer a larger sum without being noticed from officials. It is also not possible to carry more than Euro 10.000.- physical cash. Any airport control will confiscate larger cash transfers.

As this will slow down the black market, it will definitely slow down significantly the art and property market in Europe and US.

Back in 2010 I became interested in picking up some of the distressed high rise condos for sale in Tamp and Ft. Myers. In the event I didn’t, despite the low prices on the Tampa units, because the HOA would only allow 25% of the units to be offered as rentals. As for the Ft. Myers property, the developer wouldn’t let the units in the tower he had put up for auction go for the prices offered and withdrew the units for sale.

I’m wondering how enforceable were/are these prohibitions on renting units by a HOA? If your goal is to flip a unit and have no buyers and the HOA won’t allow you to rent it then you are really and truly stuck with foreclosure your only escape route.

Rental restrictions are definitely allowable and enforceable. The premise is that high investor ratios in condos can impact the ability for new buyers to get a loan since some lenders do have underwriting guidelines with respect to investors.

Thus, if someone moves in and rents when the building is already at the 25% threshold, the management can impose a fine on them which continues to accrue daily until the problem is fixed. If the fine is not paid they can place a lien on the property. In some states that lien can sit ahead of a mortgage company, meaning – it is paid first.

I follow your articles on a consistent basis & I must say you’ve outdone yourself this time! This article was so informative I can only say thank you.. I am thinking of buying a vacation residence in the Miami area but now I know to stay away until the carnage runs its course..keep up the amazing work, best regards.

I recently read an article about a young professional couple with a 120K income that couldn’t find a house to buy in South Florida. This is a good income for the area, much higher than average, and nothing was available in their 300k target price range. Less than 2 years ago houses sold on my South Florida street for 245K and 275K.

This is just crazy which leads to another article I just read about local people leaving Miami. Miami is experiencing a net migration out, of local residents who can’t afford it anymore. I left last year and don’t miss it.

I left Detroit sixty years ago and I don’t miss it, either.

Petunia, I don’t live in Miami, but do have to commute most days from Ft. Lody because my client base is in Key Biscayne.

The traffic congestion has been going from bad to worse y.o.y. but in the past 6 months it’s just gone worse than the California I came from.

I mean bad as in insanely bad, nightmarish, a life-sucking force the size of the newly built monstrosity called “City Center” smack in the middle of well, the fin district.

I’ve been here for 25 years, that is to say all my friends/work/life is anchored at this end of the geographical appendix.

Yet, everyday I hit the road I find myself confronted with an inescapable choice: get the f*~/ out or die in the vine.

Every fact on the ground points to a terminally failed city. From the incongruity of condo canyons sprouting with no end in sight to the lack of even a hint at implementing any kind of mass transit system.

Nope. The little Einsteins at the Dpmt of Transportation and Public Wx have come up with two express water transportation routes that would save commuters 20/40 mins “not counting time FINDING PARKING SPACE”, to drop your 2 ton paper weight. Good luck with that. On the other hand…water transportation could be a visionary thing: at this rate of sea rise, water transportation is within site for ALL of Miami and Miami Beach…

meant to say “within sight”.

Florida doesn’t plan transportation. Transportation plans Florida.

For all you Floridians in love with the bugs and oppressive heat of your chosen homeland there is an alternative. Nueva Vallarta on the Mexican Rivera, carved out of a mangrove swamp over the past 20 years. Condo developments that rival anything in Miami, except that they are surrounded by extensive tropical gardens. Waterfront properties with the yacht tied up front, Lauderdale style. Sam’s Club and Wallmart 15 minutes drive away on a crowded freeway so you’ll feel at home. Most of the owners are from Canada or US, and prices for most things about 50% of US.

Summers are nearly as humid and unbearable as Miami, but the probability of eventually being hit by a Cat 4-+ hurricane is not 100% as it is in Miami—-.

When I was there a couple of weeks ago the PV newspaper announced that a Portuguese developer plans to clone Nuevo Vallarta a few miles further up the beach with an investment of 500 billion dollars over the next 15 years, so you can have your Progress as well—-.

Thanks for the tip but no thanks. I was in Pto. Vallarta in mid 70’s when there were a few houses being built and it was little more than a fishing village. I camped out on the beach for a full week and would help the fishermen pull out the nets in the morning, such abundance of fish I had never seen. So I take it that Nuevo Vallarta is itself a clone of P.V. ready to metastasize, American style…I despair about the idea.

This run away growth cancer is killing the planet.

I’m rather setting my sight on the Florida Panhandle where there still is affordable land to be found, away from the big city and particularly, Wartmart.

Anyway, as Jim Kunstler likes to say, the happy motoring life and the trips to Walmart have no future. It was all a one time shot. And most folks don’t know it yet.

Left Hallandale two years ago, it became unlivable due to multiple new condo towers all around Hallandale, Hollywood and Sunny Isles. Traffic is so bad that you have to go to Golden Beach to get to the end of the line to the bridge. And they keep building and building and building…

Here in Bangkok is one of the best transportation in the world with nice people and no need for the 2 ton paper weight. BTE, AirLink and plenty of river boats. BTW you can go all the length of Chao Phraya River for 17 Bhat or ~ 50c I’m not mentioning the food…

It’s all about milking the cow ’till the cow is dead. And it’s been going on for a while, back in the 70’s Joni Mitchel was calling it like so “they paved paradise and put up a parking lot…”

You said goodbye to all this nonsense and good for you Quack! I didn’t know Bangkok had such a good transport system.

Best

Petunia,

I left Sarasota county thirty years ago, which was very liveable back then. I don’t miss the burning and oppressive summer heat. I enjoyed the fishing and scuba diving and beach going and all that back then but enough was enough already.

The thing about the Miami-Dade area that I don’t like is their proximity to that Turkey Point nuke plant, just east of Homestead, completed in the early ’70s. That’s way too old for my liking. Those nukes have caused a 200x increase in tritium levels in Biscayne Bay (Univ. of Miami, March 8, 2016 ). They survived hurricane Andrew but the next one, who knows.

I don’t see how Miami could be experience a net migration out, when the traffic is steadily increasing. There is a lot of new building, and even if only half get quickly occupied, that’s still more people.

Nice post Wolf. Here in Houston we have a much smaller condo market, but the market we have is awash in luxury condos and highrises, upwards of two or three YEARS’ worth of inventory in the upper price bands. We currently have 11.5 months of new and existing highrise properties on the market, 175 months (Not a misprint!) of new highrise inventory in Houston. Absolutely hilarious!

Developers have made no bones about advertising the fact they are catering to foreign money. We’re way past due for a foreign investment tax of some sort to curb the money laundering.

Looking at the Houston employment sector, it is obvious local residents are not buying all of these high-end luxury properties…

http://aaronlayman.com/2017/03/houston-texas-employment-february-2017/

Wolf,

Since real estate is a huge employer in South Florida, especially real estate management, does your source have any info on that aspect. Are those jobs disappearing because of the downturn. Many people we knew sold real estate, managed real estate, or worked maintenance type jobs. Some of the biggest RE management firms have a big presence there. Are they being affected by this slowdown?

I don’t have access to this data. But typically, as a RE downturn plays out over the years, there are job losses associated with it. This includes construction jobs, as projects are delayed, cancelled, or are just not happening. A lot of people in RE sales are essentially contractors. They’ll continue working but they’ll make less money. Experienced people know this and are prepared for the lean years. As you know, RE downturns are very tough on local economies.

What is happening in Miami is a condo market downturn – and it’s just the beginning. So it’s too early to see job losses.

But that’s where much of the construction has been concentrated in. There is a parallel to it: the apartment market. Multi-family construction also saw a huge boom in the area. Condos that cannot be sold often end up in the rental market. So those two markets are linked.

My biggest worry would be construction jobs, and those in supporting industries. But this won’t be an issue for many months. Buildings that are far enough along the way will be completed, either by the developer or by the lender. But new projects might not see the light of the day.

Also, there is a lot of financial activity in the sector – and there might eventually be some job losses too.

hi wolf.

an important tipping point for s fl real estate fall will be the ending of socialist governments in venezuela, ecuador, brazil, and in the case of peru and argentina is has already ended. much capital took off to s fl to survive from these oppresive so called socialist gov. imagine when all those people and money can return back to their native countries…

Yeah right.

The looting operations that goobmints are, South of the border, did not cease the day “socialist” leaders were voted out of power or as in the case of Dilma in Brazil, took down by a soft coup d’etat. The latter replacement, Temer, being a case of Ali Baba and the 40 Thieves. Ditto Macri in Argentina, of Panama papers fame… This new “white hope” of the Argie Oligarchs and middle class didn’t disappoint, it declared a tax amnesty for big evaders including himself. Arguably, such a sweet deal laundered quite some capital back into the country but overall, the history of evasion and outright theft with its attendant trophy RE acquisitions in the Latin Mecca, Miami, ain’t gonna stop any time soon. It’ll ebb and flow as it’s always been.

university of miami study of sea levels. the fact

http://www.eenews.net/stories/1060052255

Thank you! I posted some links like this in the comment section a while back because this keeps coming up, and some people just don’t believe that sea levels are rising. But it seems, even charts and data don’t persuade people to take this seriously.

The UM was run by a flaming liberal globalist, I would expect Madeline Albright to fully support any and all liberal agendas. After being a visitor to Miami since the 70’s and living in South Florida for 15 years, never more than 10 minutes from the beach, I say hog wash. If the sea was rising and the beaches disappearing, I would have been the first one screaming. I would also like to point out, that the average person buying beachfront property along the Florida coastlines IS NOT BLIND.

Petunia,

Taking your stand to its logical conclusion then, sea level rise is a hoax, is it not?

There is a pattern here. Boom and bust. Boom and bust. Boom and bust. Rinse and repeat. Anybody with a ten year memory can see it.

How to get rich: buy low and sell high.

How to go broke: buy high and sell low.

It’s not rocket surgery, folks.

Man is the only animal you can skin more than once. James Garner. (1928 – 2014) American actor.

—–

It’s called pricing yourself out of the market.

Given that the “safe” residential mortgage has historically been, and continues to be, 2.5 times annual family income, that family median income has been stuck at 50k$/yr (adjusted for inflation), and that housing should cost about 25% of the consumer budget, it is insane to think we can have a stable housing market where the median unit price:income ratio and housing costs are consistently much higher, particularly with the rise in other debt such as credit cards, vehicle, and student loan, coupled with the loss of employment benefits such as a defined benefit pension plans, either through employer withdrawal/bankruptcy or under-funding, and job stability.

As in so many cases the regulatory/taxation authorities are failing to “do their job,” largely because of the new market conditions and environment. One suggestion would be the imposition of a “vacant residential unit” tax, with steeply progressively higher rates based on both the “value” of the unit, and the length of time it has remained vacant. This is specifically designed to discourage overbuilding, speculation, and market manipulation by the creation of artificial shortages. [There being no Constitutional guarantee of the right to make a profit by real estate speculation…]

How much is this fiasco likely to cost the taxpayers at local, state, and federal levels THIS TIME? How much Freddy/Fanny funds are at risk? How much local urban development funds, tax increment financing district bonds (for road and utilities), tax abatements, etc. are at risk?

“Man is the only animal you can skin more than once.” James Garner.

That was a great quote.

http://www.mybudget360.com/the-magical-2-housing-ratio-between-median-nationwide-home-prices-and-household-income/

2.2 is the national average. House prices ALWAYS revert to the mean.

Some areas have a higher or lower ratio. It is not hard to find. Get a chart of median household incomes for a given time range. Get the median house price for this same time period. Realtors have access to this info on the MLS computer. This makes spotting bubbles easy.

“One suggestion would be the imposition of a “vacant residential unit” tax, with steeply progressively higher rates based on both the “value” of the unit, and the length of time it has remained vacant.”

Unintended consequece: More arson.

I thought you folks would get a kick out of these condo listings in a nearby village where I live. What a comparison!

The closest city for major shopping is 50 miles away…paved 2 lane hwy. It takes about 45 minutes to get there…but watch out for elk!! Little traffic for sure….maybe a vehicle every few minutes during the day, none after dark (usually).

Pics and info: https://www.sayward.ca/

We know a few people who live on a limited pension who own a Sayward condo. One lady spends 6 months here, and 6 months in Costa Rica.

most expensive: $41,900.. cdn

Top floor Condo in the village of Sayward . Well maintained Corner unit with 2 bedrooms 1 bath, views over looking the park and pond . Close to rec centre , tennis courts , clinic , marina , pub . Sayward is the gateway to the Eco-tourism of the North Island.

mid priced:

$36,500.00 | 2 bedrooms | 1 baths

Property Information:

For the thrifty buyer or for those seeking a recreational getaway, this 2 bedroom ground floor unit is located across from a park in the peaceful village of Sayward. Outdoor recreation is at your doorstep, skiing at Mt. Cain is just up the road, golf course and rec centre are close by, a marina within walking distance. Move to this friendly, small community on the ocean and enjoy the many walking trails, great fishing and whale/bear watching tours. Only 45 mins north of Campbell River and the airport. The building has secure entry, shared laundry, and the unit has been freshly painted. Rentals and small pets allowed.

Budget:

$27,000.00 | 1 baths

Property Information:

Bachelor unit in the Sayward Towers. Great little condo for a summer getaway , just bring your personal belongings. Minutes to the Marina , across the street from the Indoor Pool and Fitness Center as well as Tennis Courts, Clinic, Hotel . Condo has had lots of recent updates including roof and windows. Sayward is the gateway to the Eco-tourism of the North Island.

Paulo, you’ll be sorry now that you gave away your little secret ;-) Expect the money laundering hordes soon.

On my way!

As a retired CFO, I certainly understand the profit motive. But bankers lending business-as-usual to condo RE in an area that predictably cycles endlessly thru boom & bust cycles is beyond dysfunctional, especially since corporate executives have a fiduciary responsibility to shareholders.

So, ok, I get it – greedy shareholders force [weapons-grade stupid] bank management to participate in a “greater fool” market.

Where are the regulators in all this? How about some protection for the taxpayer who frequently gets hit for cleaning up predictable nonsense like this?

For example:

1) No condo pre-sales until building has certificate of occupancy (otherwise, you’re selling “futures”, not real estate). Effect: transfers significant taxpayer risk back to the developer.

2) Development permit to requires escrow deposit equal to 3-years of appropriate HOA maintenance expense (refund prorated as units are sold). Effect: transfers market risk & cost back to the developer to maintain “salable” property.

3) Minimum retail buyer deposit of 30%; buyer also must pay 6-12 months HOA dues at closing (just like property tax & insurance). Effect: increases buyer equity & reduced bank risk (may also reduce flipping).

4) Increase bad debt reserve for commercial condo development loans and retail condo loans; increase. Effect: increased cost & decrease bank appetite for what everybody on the planet knows is risky lending.

These won’t solve the problem, but they’ll do a lot to protect banks and taxpayers by moving more of the risk & cost to developers and condo buyers.

All excellent suggestions showing considerable thought into the source of many problems resulting from Real Estate bubbles.

There should also be some preventative measure for the “Build it and they will come” syndrome/delusions suffered by so many developers.

One way would be a steeply progressive sliding scale fee structure for building permits, where the price point of the proposed units and the projection of [likely] occupancy would be considered. The higher the projected sales price of the proposed units the higher the cost of the building permit, and more overbuilt the particular sector/area is, the higher the permit fee. This is specifically intended to minimize overbuilding when socioeconomic and demographic trends are considered. Because of the great expense, many times with bond funds, to provide roads, utilities, and in many areas, schools, for the expected occupants, the collapse of a real estate bubble effects far more/larger groups than just the developers, contractors, and their employees.

Check it out:

https://oceandrive.com/tour-miamis-most-expensive-condo-on-the-market

Fantastic! I want it. I’ll wait a few months for it to drop to $1,000,000…

It would be like living in the reception area of a commercial office building. Not very comfortable or warm in my opinion. Waste of money.

Seems very cold and sterile.

rx

” The initial deposit is small. Additional payments are required as construction progresses”

Forgive me if I’m wrong here, but it appears you could start a corporation to buy up these ‘early phase deposits’ then use the collateral of the rising property values ( value rises as building progresses), to serve as collateral for even more purchases. That is, the collateral of the rising property value

serves as the deposit for new properties. No new real cash required.

I’m not sure here who owns the home, the builder or the incremental ‘buyer’.

Until you close & get a deed, you don’t own it. You have just given somebody some money.

i am not sure if the sea is rising or if florida is sinking[subsidence].

after all, over the last 10 years, the quantity of high-rise buildings east of A!A has been rising to the point that if one were to look south from hollywood, one might think that the land east of A!A was manhattan.

another interesting issue is how sand moves south. when the diplomat hotel was erected a decade or so ago, it had a 1/8-1/4 mile beach.

then the cruise ship channel was enlarged in ft lauderdale. the rip-rap bordering the channel arrested the movement of sand south.

within two years, the diplomat had no beach. and that building took a seaward leaning. there is much more of a political scandal involving the hollywood city council and the union that owned[owns] this hotel.

suddenly, ft lauderdale had trapped a huge beach. and every municipality south of the rip-rap lost sand replenishment.

that combined with how the pressure of the high-rises squeezed the remaining sand out to sea resulted in many communities having to truck in sand for replenishment[miami beach is a prime example].

broward and dade counties are a much more complex real estate/political history/scandal.

than can be discussed here.

I totally agree that political policy has had a huge effect on the South Florida coastline. Breakwater construction causes extreme beach erosion and this is a constant problem for beach front properties.

However, none of this has anything to do with global warming or rising sea levels. It is all caused by the level of donations to local politicians.

The subsidence is occurring in the Everglades but not in the coastal areas.

The sea level rise recorded in S.F. in the past 20 years is about 1.25 inch per annum if memory serves me.

Miami Beach is the poster child for this insanity of sticking to the “psychology of past investments”, $400 million of public worx to keep former swamp land and mangroves from going under looks eerily similar to shuffling the chair on the deck of the Titanic.

The huge pumps installed to move water back out to sea are kinda keeping the boat afloat but e.coli has hitched a ride and now the levels of it in the sea water where tourists swim are alarming. Murphy’s law at work.

The sand replenishment programs common to all coastal cities in SoFlo are hitting the wall, apart from the fact that they’ve all been a Sisyphean task as you explain Albert, they are hitting the wall: the millions of cubic ft. that were available to Fisher in 1920 to dredge freely from Biscayne Bay and build up M.B. outta swamp and mangroves, are not longer there nor 100 miles out. Soon, the cheap oil to move ’em, neither.

But since the show is run by the money changers and developers, try they must.

Send that glut of inventory to Seattle please…we need serious inventory and price/rent relief!!! No signs of anything slowing down despite huge numbers of new apartments coming online, each month and each year the competition just gets more and more intense and rents and for sale prices just keep going up double digits.

Problem is nothing is selling here in Seattle. Tons of inventory for sale, no buyers.

haha, I wish. Inventory is down 25% YOY and going way over list, many properties are listed for double what they sold 5 years ago…but I am sure you know.

What if the inventory is very low but the prices are very high ?

Would people still buy ?

Bubble 2.0. Price Controls, Inventory Controls, Bad-door bailout schemes, corrupted back-door dealings through both institutional and insiders… Every sleaze bag trick pulled out to bailout the banking cartels and their lackeys. Best part of this nightmare is that the real estate system is nothing better than a meat grinder for most people. Serves no purpose to families any longer. Just extending bad policies and super criminals to line their own pockets at the expense of the entire populace. Parasitic garbage should be proud of the systematic destruction of the country’s economies across the world.

Bravo, Sir. Well said.

It would take a heart of stone to read about these poor flippers getting their heads handed to them, and not laugh.