First cracks appear in Seattle’s crazy Rent Boom.

Median asking rents in some of the most expensive markets in the US have started to decline on a year-over-year basis, with landlords throwing incentives into the mix, even where incentives are rare. This has hit the formerly hottest rental markets: San Francisco, New York City, Boston, Washington D.C., Chicago, Miami, and Honolulu.

At the same time, rents are still rising in other cities. In Seattle, the median asking rent jumped 10% in November year-over-year, but even there, cracks are appearing. More on that in a moment.

I’ve been reporting on this spreading phenomenon for months, most recently for November rents, based on rents in multi-family buildings, often owned by institutional investors. These markets are experiencing historic construction booms of apartment and condo towers (many condos end up on the rental market).

But rents of single-family houses are not included in this data. That market tends to be the playground of mom-and-pop investors, though Wall Street and the financialization of rents have also muscled into it. This market is subject to different dynamics and has not experienced the same kind of construction boom. In San Francisco, for example, virtually none of the new construction over the past few years has been single-family.

I’ve been told that single-family rentals are still doing well even in places where multi-family is not. But now, according to a report on single-family rental markets in the US by HomeUnion, a real-estate investment management firm, the biggest markets with declines in multi-family rents are also seeing declines in single-family rents.

The report compares the rent of single-family houses in November to the rent of the same houses a year ago. And it also outlines the bifurcation now taking place in the US, with some markets still red-hot, and with other markets, particularly the formerly hottest markets, now turning dreadfully cold.

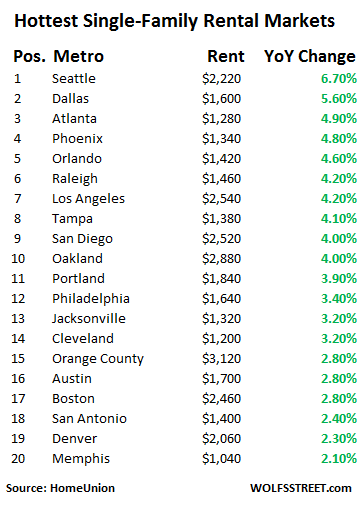

Here are the hottest 20 of the major markets:

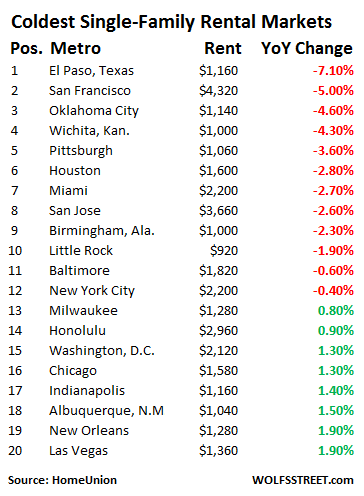

And here are the coldest markets:

Every market has its own dynamics. For example, Oklahoma City and Houston are getting slammed by the oil bust, hence rents of single-family houses fell 4.6% and 2.8% respectively. Miami is suffering from an apartment and condo glut of monumental proportions that is now bleeding into single-family rentals and pushing rents down.

San Francisco and San Jose, the bookends of Silicon Valley, have experienced soaring rents for years. San Francisco has become the most expensive large rental market in the US. At the peak of the craze in October 2015, the median asking rent for a two-bedroom reached $5,000 a month, or $60,000 a year, which might require $80,000 or more in pretax income (depending on how good you are with your tax situation) just to cover rent.

But that was the median asking rent, for median incomes, not for the wealthy. The wealthy don’t like to live in median apartments. Clearly, this math doesn’t work. Since then, asking rents have dropped, for a two-bedroom by 10%. Plus, landlords are throwing incentives, such as one-month free rent, into the deal. Rents are suddenly negotiable. But it’s just the beginning. These things take years to play out.

And despite various assurances, the single family rental market has not been spared: house rents fell 5% year-over-year in San Francisco and 2.6% in San Jose.

A special word is due Seattle. In November, rents in multi-family buildings soared over 10%, making it the hottest large rental market in the US. HomeUnion reported that rents for single-family houses rose 6.7%, so roughly in line with the multi-family surge.

But cracks are appearing. Tom Cain, whose Apartment Insights surveys the five counties in Central and South Puget Sound, wrote in his Q4 report of “a significant deterioration in a rental market that has been booming for the past five years.”

“Fourth quarters are typically slow, but this one is markedly so,” he says. The report focuses on buildings with 50+ units.

Vacancy rates “shot up” to 4.7% in King County, which includes Seattle; and to 4.4% in Snohomish County; from 4.0% in Q3. The overall vacancy rate, including properties in lease-up, for both counties rose to 6.1%.

Average “rental incentives more than doubled,” to $14 a month from $6 a month in Q2 and Q3, with the number of properties offering incentives jumping from 12% to 20%.

Rents dropped by $12 to $1,576 per month. Year-over-year, rents still rose 7.9%, which is in the same ballpark as the 10% increase for multi-family rents in Seattle above. But now the trajectory has bent.

And the construction boom continues. This year, 9,447 units have been completed or are to be completed, though a few might move into 2017. In 2017, 13,876 units are scheduled to be completed, which has a “very good chance” of breaking the record set in 1989, Cain writes. The preliminary count for 2018 is 10,744 units, “a number that will get larger as we get closer to 2018.” The total number of units in various stages of the pipeline is 69,365.

Cain summarizes from the landlord’s point of view: “This quarter’s performance is discouraging. Average rents dropped and the vacancy rate took a big hike.” He adds that “the sudden and significant increase in rental incentives doesn’t bode well either.”

Seattle, the hottest major rental market in the US, might well join the growing list of cities where rents are declining on a year-over-year basis, now including San Francisco, New York City, Boston, Washington D.C., Chicago, Miami, and Honolulu. Under the impact of the Fed’s monetary policies, rent increases have been extraordinarily large, even as renters were struggling with stagnant real household incomes, leading to terms like “Housing Crisis.”

For renters in these markets, especially renters able to negotiate, these dynamics are a welcome shift, though it would come with a lot of pain for property owners and developers that got into the game late – or rather for their creditors and stockholders.

But the housing market overall is facing a new era. Read… How Will Homebuyers Swallow these Mortgage Rates?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Lease rates in San Francisco seem to be deteriorating faster than anticipated, sharp increase in vacancies and the word is that there’s a lot of negotiating and haggling with regards to lease amount. Real Estate agents and REIT’s are getting nervous..

Looking at graph after graph, I sometimes wonder if we are not just going to sink into a black hole depression without the advance warning of a crash. Twerking the numbers has gotten so pervasive it hardly gets any comment any more. Trends reverse without any contributing data, or data just changes by itself.

But then I realize it’s all just the fake news-itis at work. Market mania is hard at work, as usual, sucking in the bottom feeders before the melt-down. I wonder how you run a cashless society in a black hole depression???

In cashless society, blackhole depression run you !

We’ll have to see how many people get flushed out of warehouses, garages and illegal in-law units in the Bay Area, if not other cities around the US in the aftermath of that ‘Ghost Ship’ fire. Even if liberal city governments try and turn a blind eye to the issue I doubt insurers or lenders will.

The other issue I have with single family rentals is the issue of upkeep. A multifamily apartment complex will hire a landscaping company to keep the place looking good and have on site maintenance to make repairs. That’s hard to do when you have lots of single family homes spread out over a metropolitan area. This tends to make neighborhoods with a lot of rental housing look shabby as renters don’t typically do more than, perhaps, mow the lawn.

I got to see the maintenance issue up close renting a house from a mega landlord. They had a subcontractor firm handling their repairs and not only were they cheap with the fixes, but they had every incentive to create even more problems. The more stuff that broke, the more money they made. It was a stupid business model and nobody was supervising the subcontractor. I think the large single family rental business has a lot of costs that are being hidden from their investors. One of these companies has changed their ownership structure/name three times in one year, never a good sign.

To go along with my other comment below, my landlord uses a management company and got fed up with the repairs set up by the management company, so I’ve been instructed to go around them and call the landlord’s own handyman. I worry that the landlord thinks his management company is up-keeping the yard.

If your landlord only has a few rental properties you can get away with using a handyman for minor repairs. The problem is when you have dozens, hundreds or even thousands of single family homes. They were built in different years by different builders using a variety of different brand fixtures.

It is impossible for maintenance people to have, in stock, all the various components needed to make repairs. They can’t even cannibalize a vacant unit to make repairs in an occupied one. They will have to go to identify the parts they need, go to the stores they have accounts at or get purchase order from the office to order what they need to make a repair. Meanwhile the tenant has to wait for the parts to come and maintenance to return.

I’m living proof of this. I rent a single family home in Portland at a bit of the higher end of the scale. At this price range, I’d never been responsible for lawn car in any rental in the last decade, and my current lease says nothing about me being responsible, but, upon moving in, my landlord’s management company said I’m required to mow the lawn.

I reluctantly bought a lawnmower and currently mow it, even though I don’t feel it is my responsibility…however, this is (or was) a highly landscaped, beautiful property that requires weekly professional maintenance at the least, and, after two years, it looks awful. It frustrates me, as I rented the place assuming it would be kept up, rather than becoming an embarrassment. At least now I know to ask before leasing. All the other local rentals in this price range apparently include it, so I guess we got unlucky. At least the owner will be glad to know we do pay for interior house keeping, so the house looks great inside.

The mega landlord rental we had in FL had a small pool with the maintenance included on the first year lease. On renewal they wanted $115 extra a month for pool maintenance. When I complained that they were already increasing the rent, they said this wasn’t part of the rent increase, it was extra pool rent. I’m glad we moved.

You are correct, and with the sub contractor shortage, maintenance costs are going up. I have quite a few single family rentals, and because my tenants have stagnant wages, my rents are stagnant, too. What is not stagnant are my property taxes, which have gone up 34% in the last year.

Same thing in Perth rents are dropping and house prices are falling. Lots of for sale and for rent signs

I thought the rents in South Florida had peaked last winter, when we had to leave, but I was wrong, they are even higher now. I think it will end soon because the incomes are not there to support it.

I’m in flyover country and even during Xmas you can see that jobs have been cut everywhere. Target had one cashier this morning, which was fine because the store was dead. We actually spent more this year on Xmas only because prices are higher everywhere. The financial guys on tv are waiting for the Dow to hit 20K and that is just a parallel universe to the rest of the country.

i ADORE you Petunia for living in the REAL world. san francisco is like living with your nose pressed against the window of that parallel world. it’s unnerving to put it MILDY; it’s maddening to put it WILDLY.

Wolf, i read your post today aloud to James before breakfast like yuletide christmas stories.

Thanks for covering our situation up here in Seattle. It looks as though our market may go though what San Francisco is starting to go though – many units coming suddenly online driving average rent down. It would be a welcome relief.

In the meantime, I can just say anecdotally, there are more cars than ever in my central Seattle neighborhood with California license plates. The Bay Area exodus to the Pacific NW continues…

I know a couple of Bay Area households that moved into your neck of the woods – housing cost refugees.

I use to consider myself one of the rent poor, but housing refugee is a much better description. We have moved due to housing costs a few times now, and we were always very long term stable homeowners. As we see more and more people do this, I know there will be unintended consequences for the country, due to this practice.

I read that the people who own in Dallas are already considering leaving to avoid the pension crisis that may impoverish the working class homeowner. The system is fracturing, the effects are spreading, and it looks like everybody will be affected.

I live in Oregon and we are facing a huge unfunded PERS system. The liberal politicians haven’t got a clue how to even begin to deal with it. All I know is that the money has to come from someone and I know that means my pockets will soon be picked. We used to be homeowners but sold a couple of years ago in order to keep our options open. The ability to stay mobile and scurry off to other states or even countries when yours gets intolerable is very attractive these days.

Yep, not having a lot of “stuff” and being able to bail your state/country is looking attractive. Many states will feel like the walls are closing in with their unfunded pensions – you already see it with rising property taxes and insane permitting and infrastructure costs to build. Its one reason I’m so happy I left Clownifornia over a decade ago – and I’m one of those who have a pension coming to them, albeit from the University of California. If they were honest they would shut all the pensions down, distribute assets accordingly and have everyone left go into a 403b, 401k or IRA if they no longer are employed by the institution/government.

Whenever I pass by downtown Seattle I try and count the cranes but there are so many by the REI store and neighborhood, (Cascade and South Lake Union), that to try and count them all risks an accident. If rents really are weakening then by the time these, too numerous to count easily, high-rises are built it will be into a bust..

Unemployment is super low in the Bay Area and yet rental is inching down. That can’t be good.

I’m not so sure about that. There are a lot of hidden unemployment. On top of that if the job market was so great, then companies wouldn’t be so eager to fire or layoff even top notch software engineers. The only reason that they are so eager to fire or layoff people with high skills is that they can find someone else in a couple weeks for a lower pay.

Trees don’t grow to the moon. One thing I noticed in Austin (besides ever rising water bills and IMO eventual shortages) was home builder activity kept the price of older homes from increasing.

That was two decades ago.

Consider though, if Obamacare is abandoned, there will be some repercussions elsewhere? I’m not convinced the 95% are making headway with the scraps left for them by elites?

I instructed my Austin property management firm to consider lowering rent on one of my properties to avoid losing the tenant. On another property, I’ve avoided any rent increases to keep the current tenant from having an incentive to leave for the past three years. I suspect Austin rental market is at risk of softening like Houston and other parts of Texas. But the long-term trend is great here! I’ll be buying another property here soon.

– If you want to see a housing market crashing then look at a city called Vancouver, Canada.

– The chinese government imposed stricter laws on money tranfers to foreign countries and with only a small delay home prices in Vancouver started to stall and already the 1st signs of falling home prices are popping up.

– Our government made it worse by imposing a 15% “foreign buyer” for foreign buyers. But this happened AFTER home prices started to sag.

– And yes, we see the already seeing the first signs of desparate home owners. Those owners are also introducing incentives in an attempt to get speed up the selling process.

Perfect. It should have happened two years ago.

Mind you, it (the housing boom) did help stampede people into buying property and a commitment they should never have even considered thus allowing the Libs to dole the money back in blatant electioneering.

People should know on this site that the BC Govt is now lending money to prospective 1st time buyers for their initial down payment up to $37,000. I would imagine they hope it will gather some votes from millenials.

Why is it that people willingly get on a bus, by the thousands, driven by Thelma and Louise?

https://www.google.ca/search?q=images+thelma+and+louise&biw=869&bih=367&tbm=isch&tbo=u&source=univ&sa=X&sqi=2&ved=0ahUKEwjaiujpoojRAhXowlQKHd77Bq8Q7AkIJg#imgrc=XewZY4zXeT2wZM%3A

from what I understand Vancouver is already trying to pump up the bubble again using new government subsidies, only this time more aimed at the local ‘small fish’ (people buying houses up to 750K, if I remember correctly) than at Chinese multi-millionaires and scammers.

Most taxpayers love it when the government props up home prices like this, they feel rich thanks to rising valuations; until the bills come due which could be in the form of strongly rising property taxes, but more likely the HUGE bill when the bubble burst and all that mortgage debt proves to be a black hole that annihilates the whole economy.

Election May 2017. It’s always about power and increasing the wealth for the insiders.

I haven’t looked on mls but there may not be any single detached houses in Vancouver for under 750 thousand dollars

It’s crazy how financialization and bad government incentives are screwing the housing market.

Doing some research this week I noticed that some of the cheapest homes in the Dutch free rental market (non-subsidized, no official waiting lists etc.) now require at least 1.5x median income and have extreme requirements for the renter that almost no one can qualify for these days. This is weird if only because with more than 1x median income you cannot rent in the social housing sector either (and even with a low pay job the waiting lists are endless due to migrants etc.).

At the same time, some local realtors are now advertising for homes as if they are rentals, mentioning just the monthly payment of 200-300 euros and explaining how you can afford a home even if you live on social security (no down payment required and all downside risk guaranteed by the taxpayers). These are homes that are a bit smaller and older than my own free sector rental apartment which costs 850 euro per month (and would cost 1500 or so per month in the big cities).

Such a big difference between buying and renting can only occur thanks to government intervention. Undoubtedly this is by design: make sure that everybody who doesn’t fully depend on the government for renting buys and keep the whole market under extreme pressure, maybe with the idea that this keeps the market going up for ever or to make everyone a debt slave.

Unfortunately we don’t have the feverish building activity that occurs in US hotspots sooner or later, due to zoning and other government meddling with the market. Only for vacation homes there is a huge building boom (but you are not allowed to live there, although probably many people do this anyway; and most of these homes are very expensive anyway because they are primarly ‘investments’).

Gov’t intervention has limited new condo construction in a California city I own a condo in. For me, I get to rapidly climbing property values, oh, and capped property tax increases. The gov’t induced distortions of the market amazes me.

The number of adults under age 30 has increased by 5 million over the last decade, but the number of households for that age group grew by just 200,000 over the same period…WSJ

Toss in those living in warehouses, garages or a box in someone’s living room and there isn’t a shortage of demand for housing just a shortage of housing people can afford.

Highrise towers are expensive to build but there is no land left in our major urban centers for low rise high density housing either. We may need to think about converting cruise ships or building floating housing to get the costs down to what people can afford for housing.

Years ago I proposed that a mothballed troop ship stored on Suisun Bay be brought down to San Francisco and used to house the homeless at one of the rotting piers the City owns. They had all the necessary amenities including kitchens, dining and sanitation facilities. Today the need is even greater and goes beyond providing a warm bunk for winos and drug addicts. An retired cruise ship, if no longer sea worthy for ocean voyages, could still provide low cost housing for 2 or 3 thousand people in cabins and if hooked up to city water, power and sanitation do so at reasonable rents.

One of the Dutch housing corporations (who are supposed to build homes for low income families, but lately often build villa’s for wealthy buyers and well-connected renters) realized the plan you are proposing a decade ago, for housing low income families (those entitled to subsidized housing) using a huge retired cruise ship in Rotterdam.

Only problem was that the project was a tiny bit over budget, by 2000% or so. The housing corporation would have gone under if they had not been rescued by the other housing corporations in Netherlands, causing rent increases for many Dutch renters. Despite the cost (over 100 million if I remember correctly) the ship was sold off for next to nothing some years later and then purchased for 100.000 euro (!) by a former high end realtor with the right connections, who now rents it out to the government for housing refugees to the tune of many million euros per year. Nice business if you can get it ;-(

I doubt it is a viable idea, the experience seems to be that the upkeep of these ‘floating homes’ is far bigger than anyone imagined.

Sir, you have obviously never lived on a ship where you were responsible for maintenance and conducting daily activities. (period, full stop)

Your ideas remind me of those little Ivy Legue farts who went on national TV explaining that the Titanic only had tie her anchor around an iceburg to avoid sinking.

Perhaps you can provide them with something more familiar with like a Liberal Limousine.

I noticed a marked decline in our SFR rental market about 6 months ago while the sales price and volume was rising. Not only in the time it takes to get them rented, but also the financial situation of those applying to rent them. I’ve sold half of them and rest are being put up for sale this spring. I track available homes for rent in the area and its steadily rising as well.

I wanted to keep an eye on rentals in the whole SF Bay area, and so I started to keep an eye on the number of rentals on Craigslist under $1600 within a 30 miles distance from a specific zip code; here is the link: http://sfbay.craigslist.org/search/apa?search_distance=30&postal=94061&max_price=1600

In June 2016, there were only 600 of such units available. Just a few days ago the number hit 1200; now due to Holidays, the number is lower, but I think the number will go back to 1200 and above after the holidays. So, within about 6 month the number of available rentals in that price range has doubled. By June of next year, there will probably be 3 to 4 times as many on the market. That’s a huge move within a year.

Just to add, both the old building that I lived in a few month ago, and the new building that I live in had about 30% of their apartments empty, and yet they do not advertise on Craiglist since they are managed by large property management companies and these companies are sleazy enough to know that if there are a large number of online rentals, then rents will fall faster.

Also search for “1 month free” and “2 month free” rentals on Craigslist. This is also the invention of larger property management companies so that although they give incentives to renters to rent their apartments, but they don’t officially cause the rents to drop.

In the tony neighbourhood of Rockridge in Oakland, where people happily pay $22 for a bowl of ramen, I have been watching rents fall as people have to re-list at lower and lower rents. Then today I saw a “Free Month!”

http://sfbay.craigslist.org/eby/apa/5910138235.html

I would never go for the 1 or 2 month free incentives since they are just trying to maintain the high rent with these geemics. They want to give me an incentive, they better lower the rent a lot more than they already have.

The main reason for declining rents in the SF Bay Area is a steadily deteriorating job market. Mortgage availability and jobs are what is going to crack this housing bubble.

Shawn,

I think you forgot to mention excess supply. From Fremont down to Santa Clara and Sunnyvale are housing projects, most high density residential. Wolf has documented this in his SF backyard and its evident in mine. These projects are only eclipsed by the amount of commercial real estate construction. This is going to be the mother of all cracks. Rental housing will only be one of the casualties

if you can find 50 decent houses in washington dc for rent for 2120 or less a month, call me.

if you can’t, that’s why the phone isn’t ringing.

Wolf, have been reading this site for a long time. I dont want to get caught up in the doom and gloom but have been working in the bay area for one of sf”s larger employers for 28 years it has been okay but we just recently signed a contract after 4 years(after each one of these a major economic scenario hits for the not good) I agree with all i am seeing and reading here and decided that me and the wife are pulling up and taking a transfer out of bay area and california for all of the reasons mentioned here and more. My sense is this bubble here is popping or deflating soon because a great % of your buyers are one paycheck and done, I see it here at work! So when the job losses start adding up i say look out !!

Nodak Its called reality and welcome

Wolf, it becomes even more interesting seeing how the problem has become localized here in Boston. Now that the “safe” neighborhoods in the city have stagnated in rent growth, certain localized depressed neighborhoods like East Boston and Dorchester are seeing gentrification. In the suburbs and exurbs, rents are continuing to skyrocket relative to the city. I’ve seen some apartments increase their rents by a car payment relative to last year. Even the poorest city in the state, Lawrence, has rents in 2 bedroom apartments that exceed $2000 a month.

Yes, same thing going on in the Bay Area, with rents in Oakland and other places still soaring, as people are pushed out of SF, Palo Alto, etc.

The reason for the big increase in rents in Seattle was the Chinese. With the 15 percent foreign tax on Vancouver (Canada) properties the Chinese diverted money to Seattle thus driving up property values and rents.

I just returned from Honolulu and Maui. I can’t speak for rents on a month to month basis or long term lease but home prices are still “overvalued” IMO. A shack, fixer upper home in Honolulu was over two million dollars that was in the hills overlooking other homes that were built in 20s, 30s and 40s.

At the same time due to global warming many ocean front properties are available on the north side of Oahu, and all over Maui. In Hawaii they call it beach erosion. LOL.

As for vacation rentals, asking prices next year are up approximately 3 – 5 percent for 2017 for holiday periods.

Great info Wolf, in most of those highend cities the cost of that rent is still lower than the cost to finance those properties. With the rents falling, it only stands to reason that the property values must also adjust in tandem to some degree.