The bond market is doing the math.

Traders got even more nervous on Friday, after having been twitchy all Thursday, and they alleviated this condition by selling government bonds.

In July, government bonds were sitting ducks with their low yields, and perfectly ripe for a good plucking. This plucking has now proceeded relentlessly and has entered its sixth week in a row, after an already rough four months.

The price of the 10-year Treasury note swooned on Friday. The 10-year yield, which moves in the opposite direction, rose 6 basis points to 2.47%, the highest yield since June 2015. Since early July, the 10-year yield has jumped by 1.08 percentage points! That’s a 77% move (via StockCharts.com):

The 30-year Treasury yield jumped 7 basis points on Friday to 3.15%, the highest yield since June 2015, which elegantly crowns a 50% move in six month (via StockCharts.com):

US government bonds are considered among the most conservative investments in the world because they’ll never default. They will always get redeemed at face value since the government, via the Fed, can always print enough money to take that risk off the table, though the bonds’ purchasing power might get crushed in the process.

Investors buy 30-year bonds to get some extra yield. But now they experience the bitter irony of duration risk. The CME CBOT 30-Year US Treasury Bond Price Index has lost over 8% since the election, and 15.4% since July 2015 (via StockCharts.com):

There’s real money involved – not just percentages. In November alone, the Bloomberg Barclays Global Aggregate Total Return Index lost $1.7 trillion in value, “the deepest slump since the gauge’s inception in 1990,” as Bloomberg put it.

And investors have gotten the memo. They’ve yanked $34 billion out of global bond funds over the past six weeks straight, according to a weekly fund-flows report from Bank of America Merrill Lynch, cited by MarketWatch. This amounts to the longest period of declines since the infamous Taper Tantrum during the summer of 2013 when it dawned on the bond market that QE Infinity would not be “infinity” after all.

Some of the hottest bond funds saw the biggest outflows, including those focused on emerging markets that investors loved because they offered slightly higher yields in a low-yield era. And losses are beginning to mount.

The Emerging Market fund EMB, after the red-hot rally from mid-February to early September, has since lost 7.4%. But even much lower risk funds, such as PIMCO’s Total Return Active ETF is down 4%, and back where it had been during the selloff early this year. And PIMCO’s Long Duration Total Return fund is down 11% since July.

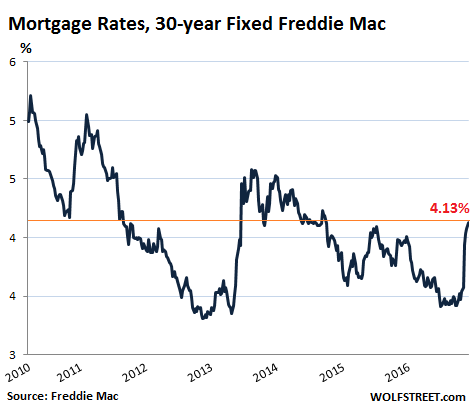

Mortgage lenders have responded in kind. On Friday, the average lender hiked the 30-year fixed rate conventional mortgage for top tier borrowers to 4.25%. According to Freddie Mac, the average 30-year fixed-rate mortgage rate rose 5 basis points to 4.13% during the December 8 reporting week, the highest since July 2014:

But home prices have soared in recent years. Since July 2014, the last time when rates were at this level, home prices have risen by well into the double digits in many markets, making the median home in some of the horrendously expensive markets even more unaffordable for the median home buyer – thereby creating demand problems.

On Friday, bond traders were particularly edgy. The Fed will meet next week. Fed-funds futures have elevated the chances of a rate hike to near certainty. It would be the first rate hike in a year, and the second rate hike in almost a decade. The Fed has been making noises about more rate hikes in 2017 and beyond, and there’s a sense that since the election, the Fed has turned more hawkish – even the doves.

Stock markets are blissfully ignoring the possibility of higher costs of capital, and what that would entail for companies, but bond markets are not. They’re going through a condition variously labeled with propitious terms like “bloodbath,” “rout,” “carnage,” and “meltdown,” something that is likely to continue in some form or other, though there will be the inevitable bounces.

Why? Because the bond market is doing the math. Read…. Get Used to Lousy Growth AND Rising Rates: Fed Dove Dudley

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I was wondering when that absolutely farcical rally in EM bonds would end… as all bad things it lasted far too long and lulled far too many people into a sense of security.

At the present those dollar denominated bonds face two distinct problems.

On one side you have bonds issued in mostly commodity-heavy economies, such as Chile, Nigeria and Venezuela: they don’t account to much but local foreign currency reserves are running dry.

On the other you have countries where dollar-denominated bonds are more than sizable in GDP percentage figures: 12.5% in Turkey, 12% in Vietnam and Brazil, 9.5% in Greece, 8% in India, 7.5% in Indonesia and so on.

Again, it may not look like much, but these economies have grown a lot and fast in the past two decades: India, Brazil and Indonesia are among the top ten economies in the world.

And as local central banks tighten their monetary policies to attempt cooling down inflation or achieve one of the other wondrous effects claimed by central planners worldwide, emerging markets turn increasingly to US dollar and euro bonds as a source of cheap financing: just to stay in Mexico, just this week Pemex sold three tranches of US dollar-denominated bonds carrying different maturities worth in total a staggering US $ 5.5 billion.

And here’s the really funny part: one billion of these bonds carries a yield which is defined as 3 month LIBOR (US $) + 3.65%: should the Fed stop wasting everybody’s time and hike rates, these bonds would become not merely even more expensive to service in domestic currency terms, but interests paid to (almost exclusively foreign) bondholders would skyrocket as well.

But as Mario Draghi promised just this week, the ECB will extend its QE program to the end of 2017 and “most likely” expand it as well to include even more corporate bonds.

Draghi is playing a big gamble here, because he needs to perform true acrobatics due to the highly volatile situation in Europe: with the three largest economies in the EMU all going to vote over the next year (yes, even Italy, whether people like it or not) and given the ECB’s obsession for micromanagement, this will be fun to watch unfold, especially if emerging economies will start piling on the SS Draghi to take advantage of repressed rates.

I want to watch this, I’ll get the popcorn.

I doubt Draghi is worried about the coming elections in Europe. First of all, most votes against the EU establishment in referendums and elections have been completely ignored, e.g. the Dutch votes against the EU Constitution in 2005 and the Ukraine Treaty this year. It would not surprise me if in the end Brexit doesn’t happen either, or only ‘on paper’.

Secondly, most of the populist parties LOVE the policies of Mario and his gang, because many of their voters love living on other peoples money. Whether it is the Fivestar movement in Italy, Podemos in Spain, PVV in Netherlands etc.: they love free money and although they are very much against the EU establishment, if push comes to stove most of them do not want to leave the EU because that would require huge sacrifices.

In Netherlands and Germany the opposition against Mario’s policies from the bankers and other finance officials is growing more vocal, but that too IMHO is just for public consumption. The EU and the plunging euro with its negativev rates allows looting the populace (the middle class) like never before; if the EU falls apart this stops so they will never allow that to happen.

“many of their voters love living on other peoples money”

If these people agreed with Mario’s policies, they wouldn’t have voted for the populist parties in the first place. Few of the so-called free money reaches the real economy. Can you spell assets bubble?

95% of the people who vote for these parties have zero understanding of finance and economics. The only thing that matters is their entitlements and they will vote for the party that best caters to this. The establishment is no longer trusted so they vote for a party that is against the establishment and the most convincing (the most populist, usually). 5-Star in Italy makes financial promises they can never deliver, Wilders in Netherlands doesn’t have any credible plans for the economy except throwing out parasitic migrants (that would help, but it would not change much for the many other problems that we face in Europe).

And as detailed here many times before, it is NOT just the 0.1% that profits from these asset bubbles. Some of the hoi-polloi profited hugely as well, and some of the ‘elite’ suffers (if they have the wrong balance of assets and debts, like some of the ‘old money’).

Many people in my country with about zero capital made more money from the housing bubble for many years (during the nineties, and now again in some parts of the country) than from working in a normal job. This isn’t just virtual gains, they had a party lasting years and others will get the bill. The same happened on an EU wide scale, most of the people in Greece who purchased Porsches, luxury yachts or just a lifestyle way beyond their means are not going to pay one cent back because the money has already been spent – others who didn’t party, mostly taxpayers in Northern Europe, will get the bill.

Here in the US, the mortgage rate next February will be important as this is when much of residential home construction kicks off for the year. A 5% 30-year fixed rate could put the brakes on an already stagnant economy.

One could only wish for a 4.25% 30 year mortgage.

Here in Oz the ONE YEAR ARM is at 4.87%.

Thirty year fixed mortgages……………..what are those????

One could only wish!!

“95% of those Voters have no understanding of Finance and Economics” REALLY? I find that to be a crass and arrogant Statement only an Elitist would offer. help me here,they are most likely Racist and Global Warming Deniers as well,right? how dare they revolt against an all knowing all loving unelected Eurocrap Assembly of wise Men,you go tell them NHZ!

You are making it hard for we elites to keep tolerating you. Here in the US, I would say 95% not understand economics and finance would be too high. But, from watching the actions of many of my fellow Americans, a majority either don’t understand, or just don’t care.

But then, as the recent election demonstrated, a lot of folks here are not fact based.

In the recent election, 95% of the people had no viable choice and voted with anger and frustration for hope and change and again were fooled.

The system is stacked against the majority.

There is just one party in the Netherlands with plenty of global warming deniers and that is PVV, the party of Mr. Wilders.

Just to be sure: I don’t want to tell these people how to vote, and on many issues I agree with them; I certainly agree with their anti-EU sentiment and the general disapproval of the current migrant policy. I’m not a fan of the EU and euro at all (where do you get this idea???) but unfortunately there is zero chance a Dutch government is going to drop out of the EU; the two last Dutch anti-EU referendum votes were conveniently ignored.

PVV voters see a lot of things that go wrong at the local level and need change, pretty similar to many Trump supporters in flyover country in the US. But when it comes to the economy, the influence of central banking etc. they are mostly clueless (like voters for most other parties, really).

And for the record: IMHO most economists and politicians are clueless about how the economy works as well, and the ones who DO understand are even more dangerous.

Most voters indeed have no understanding of financials. Same for politicians ( most are law graduates, well educated is talking half an hour without carrying any understandable or meaningful message ). Banking nowadays is a legalized Ponzi scheme, especially “central” banking. What THEY do is legalized forgery. In its essence, things boil down to something very simple : if real inflation is 8-9%, interest rates on bonds are 2-3%, then you LOSE each and every year 6% in buying power. So, if you want to preserve the buying power of your savings, invest in hard assets which are difficult to tax, easy to hide, do never go bad, carry no third party risk and are easy to transport : precious metals. End of the story, any 12-year old kid could figure out this.

Rates are not high enough yet to really squeeze the housing and stock markets ,but another 50 basis points probably will start having an effect.

Since the election 10 year inflation expectations have increased from %1.73 to over %1.95(as of 12/8) while the real return component for 10y bonds has increased from 15 basis points to 51 basis points.

Higher rates attract more money to the US and strengthen the dollar. Foreign individuals,companies and governments which have debt denominated in dollars have been adversely affected;The higher rates the more pain that they feel.We are probably not too far f tom a crisis in emerging country debt.And if this results in counerparty defaults,we could be facing another world wide financial panic.

As many have already pointed out, another 50 bp would mean the end of the 30-year downtrend in rates. If that sticks (and it doesn’t prove an anomaly) that would be a MAJOR event, given the historic leverage in almost every financial markets. Almost everything that speculators have learned over the past 30 years, starting with gobbling up debt, would start to work in reverse.

I would love to see that happening but in Europe it isn’t even on the horizon.

“There’s real money involved -”

Really? More like real fiat digits held by the bankster’s.

There is only one “real” money account, physical gold.

“purchasing power might get crushed”

Might? No “might” about it. It will. Just a question of how much.

What good are your fiat based bond investments, when it will require you to fill a wheel barrow full of them to go and buy a loaf of bread?

Stand back and look at what is occurring in “real” time.

A certain country is now weighing cash, rather than counting it!

At last look the largest bill, a 100 Bolivar note is worth 2 cents.

Bolivar = Venezuela

Yikes a 100 bolivar note worth just 2 cents in US currency.

Actually there is another country currently weighing their money although they aren’t weighing actual money but India in the rural parts has had to revert to a barter system and one youtube image I saw was a person with a set of scales. One person put rice in one tray while the other person put vegetables in the other tray. The owner of the scales held the scales up to show all interested parties that the produce was of an equal balance and the transaction was done

Personally I would choose scenario number 2 where produce is weighed. However I guess it all comes down to where you live….. urban or rural.

Time to get out of the large cities ? Yes !

Well i’m stuck in the City,Ricardo but i hear you,have considered various Contingency plays just in case. following that India Story closely as i think this is very under estimated in it’s potential Ramifications. having the second most populated Country in the world that was reliant on Cash for 90% of Transactions forced into a digital payment System overnight is certified Crazy but these are the globalists wet Dreams put into Action.Bill Gates and his Neo Fascist Cohorts are in Talks with the Modi Gov to corner the future Payment Systems as we speak. the Goal: total Control of the unruly Masses and a Bonanza in Tax Revenues. of course it never goes according to Plan as the “Deplorables” are are getting pissed off and starting to hit the Streets.watch this one closely…

Yes there are two sides to a coin but for Mr Gates and his ilk they only want one side …… their side.

Coincidence that Mr Gates should be in India at the time the large denominational money is

withdrawn ?

Maybe, but I’d be inclined to say maybe not.

Good to hear you have made a contingency plan/plans. We should all have a plan B and even C.

It would surprise me if they succeed with this policy, but if they do Africa is probably next because it relies heavily on smartphone payments nowadays. Colonialization 3.0 brought to you by the saints from Mickeysoft and all the other US zio-fascist software giants.

And maybe it is not a coincidence that lately the European Commission is on the roll with pushing all kinds of social media and digital control and payment options for the masses in Europe, in order to drum up support for Europe. Cheaper calling especially across the border, free wifi everywhere, Facebook access anywhere on the planet all the time… who would not LOVE that and love the EU bureaucrats who make it possible. Join the matrix, vote EU!

Regarding India, the demonetization of the 500 and 1000 rupia notes might have some quite insidious, surprising and long lasting effetcts.

For example, if my memory isn’t playing tricks on me, this was done at the time when local small farmers need to pay for the seed used to sow winter crops. Add to this the fact that the local money lenders ( note not banks ! ) have difficulties to exchange enough demonetized notes to legal tender ( absence of banks, maximum amounts allowed etc ad nauseam ) and you can expect that there are areas where the winter crops will be diminished due to smaller areal sown, thus causing economic and other hardship for the rural population. And when the crops are diminished or nonexistent, then the next crops will be affected, too. And due to diminished crops, food prices will at least locally increase but probably this will happen over all in India -> the poorest of the population will be hardest hit.

We are getting plenty of city refugees here, so much I have been mulling about leaving for less crowded shores. Timing would be about right to sell and that window won’t stay open for long.

Note these people are not doing this not because they are survivalists, but because cities have become too expensive, too crowded and outside very prime areas they are going to heck.

God bless them, but I remember when my grandfather had to deal with some of the very first city refugees back in the days. It’s not people I’d want living anywhere near me.

The DXY is marching upward. A growing equity market and a rate hike will propel it even higher. This will be hurting EM’s with USD debt while at the same time making USD products more expensive. We may even see the US equity markets make new highs while US corporate profits are declining. Add to this that the poor financial condition of the US consumer is becoming more apparent every day.

This is starting to get very interesting.

… but the US equity markets will still badly lag those of Venezuela and Zimbabwe ;-)

Funny you mentioned Zimbabwe,NHZ,i purchased this 100 Trillion Dollars bank Note a while ago,has risen in Value quite a bit since then. think i will frame it,would look great on my Wall! LOL http://www.apmex.com/product/51560/2008-zimbabwe-100-trillion-dollars-waterfall-buffalo-unc

“This is starting to get very interesting.”

Just STARTING? For me this is absolutely fascinating! Has been for a over a decade now. The rabbits being pulled from the Magician’s hats and the intrigue couldn’t be a better show. Better than any of the Original Series on any of the streaming or mainstream networks.

The only really outside outlier for me has been the election of the Trumpster. And even that is so damn entertaining and comical that I can’t wait for the next episode.

Although none of us are out of harms way and IF wishes were Fishes…… I would have had things turn out much differently than the road we are on.

Btfd

We are not going anywhere any time soon!

Yield has backed up nicely for the fed and treasuries are again competitive against global bonds?

The global reach for yield is now dead and growth is back because the guy not yet running the country says so!

The fed might sit back and let the selloff continue and even raise rates a bit.

But the need for stability will take over as the fed continues to salivate over the fresh supply introduced by the weak hands running 4 the hills?

If I had to guess, I’d agree with your prediction. There will not be growth. Trump will not deliver. This trend in treasuries will reverse within 6 months. The rise in the cost of money and the USD will be so domestically and globally destructive that the Fed will head south in a hurry. But, I’m going into USDs as quickly as I can right now.

Everybody country is wearing out the printing press except America, which has returned to close to normal operations since 2014.

I expect this attitude in America to change. Preach a strong dollar from every rooftop and print like crazy?

With the cabinet full of billionaires who is really left in the markets to really keep them crashing for more than couple of weeks?

I like anything in pesos!

You should talk to Greatful,Tom,he’s doubling down on the Dollar,perhaps you can make a Deal! but i agree with you on one point,since i do own a few gorgeous 50 Pesos 1947 Gold coins,heavy Buggers too! happy trading

Trump won’t be ABLE to deliver.

Kind of depends on how much spending the Trumpster gets thru Congress in his first 100 days. If he get a lot, then the demand for dollars will increase, unless the FED acquiesces and takes on a few more Trillion$ onto is balance sheet.. Hard to keep the rates down if the demand exceeds the supply.. And in the mean time, lots of Rogue Waves could capsize the ship too! Including Italy or anything in Europe or China or Brazil or ,,,, boy the list of highly leveraged under preforming assets is pretty long. And those are the knowns and not the unknowns.

Your Comment doesn’t make much Sense,Greatful,if you’re convinced the Economy goes for the Crapper and the Fed will go “south” by witch i assume you mean cut or keep Rates,why would you be long the Dollar? you sure you’re up to this Trading “Thing”? best of Luck though and don’t play with the Rent Money!

Oh, because I want to take advantage of the trend of the strengthening USD. I think this trend will go on for a while despite the attempts that will be taken to counteract it.

It’s kinda funny you mention this as I had a similar exchange with someone here about 6 months ago when the DXY was at 95.

You’re right though, I’m not much of a “trader”. Terrible landlord as well. But rent money is what I collect rather than pay. I’ve sold 3 of my 6 houses over the summer and trying to sell the others right now. Yeah, they’re in fly over country, so not real expensive, but none have a mortgage.

Well,”terrible Landlord” is better than no Landlord my Friend,wish i would have held on to my Rentals i sold in 2008. in Californica of course,you can imagine my Regret! we live and learn but to be honest i got tired of dealing with Renters,it only takes a few bad ones to sour the Fun. i was buying RE when NOBODY wanted it,1990,think you’re doing the right thing selling now as the Cycle will repeat…

This hot, steamy stock market is in

a buying climax. By the mom&pop investors,

by corp. buying back.

The big guys are providing you a tasty desert.

But, soon, there will be a situation like

the FED raising rate and China deliver an automatic

response, undressing the DOW, just like on

Aug 2015, when the dollar was too difficult to get.

It will be even more difficult to get next week.

China is not devaluating. Chinese CNY:USD is

just returning to it’s old home base.

So, maybe the stock the stock market will

move up and down, like a ping pong, for

for some time and things will still be fine.

Agree, you can solve many problems with deficit spending and QE. The net effect of that is money printing. The money printing creates inflationary forces, but there is natural deflation that offsets it. This natural deflation is caused by globalization exploitation of low cost labor, automation, demographics in developed markets, etc.

The deficit spending doesn’t increase government debt if its bought by central banks and effectively retired, even though it may show as asset on the Fed’s balance sheet. A debt the government owes to itself is not a debt.

The central banks do have an interest in making sure there are no big movements in key variables, so they’ll talk down this stock bubble about 10% from here if the December rate hike doesn’t do it. Anybody buying stocks as these levels is likely headed for a quick short-term loss. The ironic part is people are buying stocks because they think there’s a Fed put. However, the Fed works against the market after stock market spikes like this. Anybody who believes in “don’t fight the Fed” should be selling right now.

The Financial Press is giddy this weekend with the prospect of a 20K Dow.

Every year at this time the National Space Administration requires all. ALIENS to register. … Those without forms must appear, HOWEVER BRIEFLY, and the Bureau’s Astral Offices on Nooker Street.

And after all the abuse the Fed and other CBs have taken for ZIRP, why continue to break all the rules of traditional banking AND be unpopular?

Apparently even U.N.C.L.E is critical- an organization whose existence I’d forgotten. (The first letter stand for United Nations…don’t know the rest)

Who’s next, the Red Cross?

But let’s see just how popular a return to the average rates of the last hundred years actually turns out to be.

My prediction- not very popular.

It’s all good, the housing crisis has been solved by Mr Wonderful who BTW I’m surprised to learn hasn’t completely displaced humans.

https://news.slashdot.org/story/16/12/10/1915259/struggling-workers-found-sleeping-in-tents-behind-amazons-warehouse

When Amazon, Ikea or other big retailers set up their operations, local authorities will usually cut them some fiscal slack we can only dream about if they hire people living in a 5, 10 or 20 range from their warehouse/store.

This is usually done as late and with as little grace as possible because, plainly put, these poor devils are seen as a burden, not as an asset. But, hey, a tax break is a tax break.

Ikea (at least until recently) was a registered charity in the Netherlands, they paid ZERO taxes for several decades despite billions in profits. Amazon in Europe probably pays less taxes for the whole operation than one small EU bookstore. These large companies eliminate jobs by heavily cheating on taxes, if they hire back a few people for minimum wage jobs that doesn’t even begin to compensate the damage they are doing.

But I guess local authorities still will be proud if they can ‘work with Amazon’ to ‘create new jobs’ (while ignoring all the lost jobs, of course).

Using tax loopholes isn’t cheating unless you count the reason for the loopholes, tax loopholes are mechanisms for political elite stealing from the public.

Of course the public gets bought off temporarily by increasing the social safety net to compensate for lost employment opportunity, up until ballooning debt outstrips dwindling tax receipts and collapses the entire ponzi scheme.

No one is speaking about why yields are rising.

Bonds and bond investors do NOT like uncertainty. Uncertainty is what is taking yields up. Just look around you, the USA, the world. Stocks are a gamblers paradise, not Bonds.

Is there any place in the world that is calm, secure, and of low risk? NO. Even in the USA, this challenge by hook, crook, and every measure to unseat the apparent winner, clean up to the leader of the country, is creating immense uncertainty.

Since the Stein recall, our business if off 90% and it should be up in December. And, no we are not affected by Christmas buying and more than Caterpillar is.

Now this BS floating around about Russia, when you have California, Illinois, Iowa, Maine, Maryland, Massachusetts, Minnesota, Nebraska, Nevada, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Vermont, West Virginia, Wyoming, and Washington, D.C. all require no identification before voting, and the public sees disturbed messages because their quasi-stable country is not stable, or secure at all. Now the war drums are, once again, being pounded.

The American public is unsettled, that is uncertainty. Now look at Central and South America, now look at Italy, Turkey, the EU, the Middle East, India, the Far East, Eurasia, Oceania…. do you see any stability there, and any thing that would make a bond investor at easy? From the ghetto streets to the highest levels of governments, there is sever infighting and power struggles.

There may have been enough ‘security’ for chasing bond yields before, but not now. We are in a new day, and it is not stable, secure, or certain. Cash is king right now. No one want to buy a bond when the yields are on the rise. No bank wants to lend a mortgage when rates are on the rise….just like the early 80’s.

As a voting Minnesotan, I always show my DL to the vote clerk when signing in. I am looked at, like,”What the hell you doing, eh?” by the clerk and others around me, but I do it anyway! My precinct in Longfellow neighborhood Minneapolis has an incredible turnout of over 90% registered voters casting a ballot, and I trust things are legit-in my own little sphere anyway.

Minnesota has permanent paper ballots!

In IL, you sign a card which is compared to the signature on file.

What’s a stein recall, defective beer mugs? Is the turnout in states not requiring a DL or some ID statistically higher?

We were assured numerous times pre-election, the process was in no way rigged.

It’s those evil Russians again! Who would have thought that they could manipulate the US elections undetected and put their Trump puppet on the throne. And now they are going to do the same in Germany, the German political establishment is already shuddering – just imagine that a non-tribe member sits at the helm of one of the major EU countries! Unpossible!!

It is really sad when people believe such BS, and politicians and media have to resort to such blatant lies in order to ‘win’ the elections.