It’s not just the oil bust.

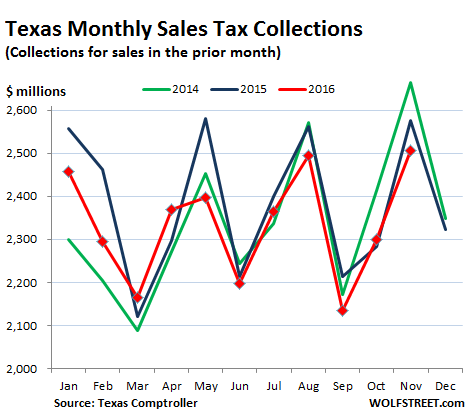

Sales tax collections in Texas in November fell 2.7% compared to November 2015 and are down 5.9% year-to-date, according to the Texas Comptroller of Public Accounts. And they’re down 2.2% from collections in November 2014, and down 0.14% year-to-date compared to the same period in 2014.

This is the first time since the depth of the Financial Crisis that year-to-date collections are lower than they’d been a year earlier, and even two years earlier.

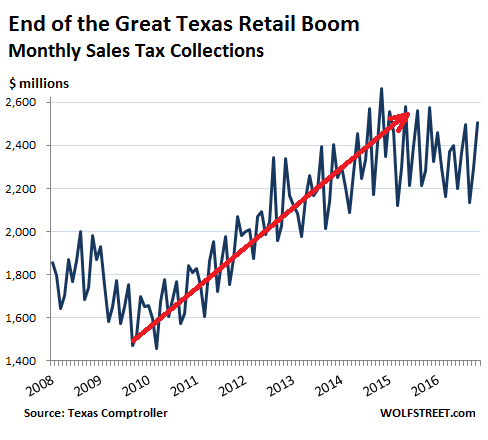

What was at first expected to be just a blip in the data when it appeared in June 2015 – the first year-over-year decline in monthly sales tax collections since the Financial Crisis – has turned into the end of the great Texas retail boom.

This chart shows sales tax collections for 2014 (green), 2015 (blue), and 2016 (red). The sales tax data, researched and complied by “David in Texas,” is not seasonally adjusted, hence the strong fluctuations. Sales tax collections lag sales by one month; hence, collections reported in November were for sales in October:

On a per-capita basis, given the growth of the Texas population (up 8% since 2010), it looks even worse: year-to-date per-capita sales tax collections fell nearly 2% from two years ago.

Sales tax collections aren’t an ideal gauge of retail sales. Many food products are exempt. Taxes on motor vehicle sales and rentals are reported separately. The data is not seasonally adjusted, so it can only be compared to the same months in prior years. But online sales are taxed in Texas and are included in this tally. So tax collections are an unvarnished approximation for a large part of retail sales.

Sales tax collections boomed for five years, starting in March 2010, soaring 46% through the first half of 2015! Given the size of the Texas economy, it helped prop up overall US retail sales. But by May 2015, ten months into the oil bust, retail sales began to take a hit as layoffs and uncertainty were spreading through the Texas economy.

This chart shows sales tax collections from 2008. Note the decline during the Great Recession. By comparison, the current decline looks relatively mild, but it’s starting to drag on:

The Texas economy isn’t monolithic. People in North Texas (the Dallas area), in Austin, and some other places are scratching their heads; the economy where they are is doing well. So retail sales may not be all that strong either, but exuberance still reigns in the housing market. Big companies are moving operations into the Dallas area, and total employment in October was up 3.5% year-over-year, to 3.59 million, though that was down a smidgen from September. There aren’t many dark clouds in sight – as long as the housing euphoria holds up.

Then there’s the Houston metro where the dark clouds have form a storm (below data via Houston.org, and the Bureau of Labor Statistics). The oil boom years ago triggered an enormous office construction boom in Houston. When the oil boom turned to bust, office leasing fell apart, sublease space soared off the chart, and the construction sector, with some lag time, entered collapse mode.

Commercial buildings: In the Houston metro in October, contracts for nonresidential buildings plunged 34% year-over-year and are down 13% year-to-date. Permits for new nonresidential buildings plummeted 58% in October year-over-year and are down 32.8% year-to-date.

Residential buildings: In October, contracts for residential buildings rose 20% from a year ago, but year-to-date are still down 14.5%. Permits for new residential buildings collapsed 30.2% in October and 31.9% year-to-date.

However, permits for additions and alterations, nonresidential and residential, are rising. Now’s the time to fix up that old office building or house.

Home sales are hanging on, edging up 0.7% in October and 0.6% year-to-date. The median price still rose 6.3%, even as active listings jumped 9%.

Goods-producing sector sheds jobs, government on hiring binge: Total nonfarm payroll employment for the Houston-Sugar Land-Baytown area edged up 0.4% in October year-over-year, to 3.023 million, and jobs in the service sector rose 1.6% year-over-year. But jobs in the goods producing sector (oil & gas, natural resources, construction, and manufacturing) dropped by 4.4%.

The lucky sectors: Government jobs (the second largest category after “Trade, Transportation, and Utilities”) rose 2.4% to 398,900, a new record. Education and health services gained 3.6% to 389,400. And Leisure and Hospitality jumped 4.4% to 319,200.

The hardest hit industries:

- Mining and logging jobs, which are mostly oil & gas, fell 8.9% in October year-over-year, to 86,400, down 23% from their peak in December 2014. Many of these jobs were highly paid engineering jobs.

- Construction jobs dropped 4.3% from October last year which had been the peak, to 217,900. That’s just the beginning. Workers are still completing buildings started during the boom. But with contracts and permits plunging, the future for these jobs is getting somber.

- Manufacturing jobs, often tied to the oil & gas sector, dropped 2.8% year-over-year, to 232,100, and are down 11.5% from their peak in December 2014.

- Information Technology jobs, many of them tied to the oil & gas sector, dropped 3.8% year-over-year to 30,500, and are down 9.5% from their peak in December 2013.

- Professional and Business services jobs fell 1.1% year-over-year to 466,200, and are down 1.9% from December 2014.

Foreign trade gets hit. Exports measured in dollars plunged 14.1% in September year-over-year and 19.2% over the first nine months. Imports dropped 4.0% in September and 25% over the first nine months.

The transportation sector feels the pain: Port of Houston shipments in short tons rose 19% in October but are down 1.6% year-to-date. Air passengers at Houston airports in October were down 3.7% from a year ago and 0.6% year-to-date. Air freight was down 0.4% for the month and 9.2% year-to-date.

And consumers are closing their wallets. Retail sales fell 3.2% in October and also 3.2% year-to-date. The major category: New vehicle sales (measured in number of vehicles) got totally crushed, down 17% in October and 22% year-to-date, with new car sales down 30% year-to-date, and even truck and SUV sales down 17% year-to-date.

Houston is big, but it’s in a big State, and its weakness cannot alone explain the decline in sales tax collections across Texas that started in May 2015. Whatever the reasons, consumers across Texas have begun to curtail their spending.

But a relatively new phenomenon is now in full bloom: the financialization of rents. Read… Foreclosure Crisis Comes Full Circle? Biggest Buy-to-Rent Landlord Plans IPO (Despite Red Ink Everywhere)

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Re: ‘it’s not just the oil bust’

Many of the sectors mention the connection to oil, e.g. office building construction which in turn is connected to a dozen sectors.

Of course it won’t ALL be oil related but it would seem virtually impossible to ‘back out’ oil.

The sudden oil bust also affects the confidence of all consumers.

Or to put it another way- how would Texas be doing if oil was still $100?

With our ecosystem collapsing – 100 million dead trees in California, melting Arctic ice, warming oceans, droughts and floods – our days of happy motoring are over. We can either deal with our fossil fuels addiction or let our ecocide run rampant.

Or at least make a start by not using coal to generate electricity when we have a super abundance of cheap nat gas.

Obama was making progress but I believe the new guy has promised to save coal.

From a July 13, 2016 article linked below: “Chinese energy companies have been starting two coal power projects a week”.

Where’s Obama’s progress on this? Oh, that’s right, what’s polluted in China stays in China, just like Vegas baby!

http://energydesk.greenpeace.org/2016/07/13/china-keeps-building-coal-plants-despite-new-overcapacity-policy/

If he’s serious about slowing the rise of the oceans, why doesn’t Obama demand the Chinese cease building coal fired power plants? Especially in light of the fact they have an overcapacity of them. After all, the Chinese have great respect for Obama:

https://www.theguardian.com/world/2016/sep/04/barack-obama-deliberately-snubbed-by-chinese-in-chaotic-arrival-at-g20

He could draw a “red line” like he did in Syria, yea, that’s the ticket!

Since you ask- he’s not the President of China.

Have you heard any Chinese recommendations on US internal policy lately?

Now was that hard?

Oh and lest we forget, the new guy wants to boost coal right f%cking here, let alone China.

Why don’t we take things a step at a time and worry about the things WE control?

as to China: for sure the Chinese are not going to keep coal power plants running if they don’t need the energy …

Here in the Netherlands many new coal power plants were constructed over the last years despite strong opposition from environmental groups, all thanks to wrong EU subsidies and other bad government incentives (many of the plants were build by foreign companies). Most of these plants were promised to have ‘clean technology’ for filtering, CO2 storage etc. but of course none of those clean technologies have materialized as the dirty coal burners were mainly build to burn EU subsidies.

It’s now clear that there is no demand for all those coal power stations because the projected energy consumption didn’t arrive, but consumers have to pay anyway and will probably have to cough up billions to get these new powerplants decommissioned. Of course, the big players with their friends in politics can never lose :-(

https://www.technologyreview.com/s/602051/fail-safe-nuclear-power/

My understanding is that the ‘clean technology’ filtering of coal burning power plants does help air quality, but it transfers pollutants into the waterways and aquifers instead.

@Dan:

depends on what is done to the filter residue. There are some solutions that at least delay the inevitable leaking into the environment e.g. the ash can be used to make bricks for building, pavement etc. The naughty stuff is contained in glass-like structures in the bricks that should keep it mostly confined until the material is pulverized at some time in the future.

It’s not a final solution of course but the ashes are probably far more dangerous when leaking as small particles into the air, especially given the radioactive residues etc.

CO2 similar story although the technology is still experimental. Production of cement/concrete is currently one of the BIG sources of CO2 release (and very energy intensive). Instead of releasing CO2, it could be made using CO2 from power plants and the production would probably be CO2 neutral or even negative. There are several types of ongoing trial but probably nothing that is really profitable or proven. But if the technology works it could make even coal power environmentally competitive (production of solar and wind gear also produces naughty pollution). Maybe that’s something Trump should look into ;-)

Unfortunately, my country seems to have decided that they are going to store CO2 in old gas fields (despite some failed trials …), which makes future use for manufacturing far less attractive. Probably all a trick to hand massive amounts of tax money to oil and gas companies like Shell ;-(

The Libertine Swamp

https://ourfuture.org/20161207/trumps-epa-pick-scott-pruitt-literally-built-the-swamp-himself

“The EPA is about to be weaponized against the environment.”

4th Generation Nuclear Power, endorsed by James Hansen (the guy who really started the C02 Global Warming debate).

There is no logical reason to use coal, oil, OR natural gas to generate our electrical power when safe, clean (4th gen) nuclear power is the intelligent way.

But who fights against clean nuclear power? The Saudi Government, who also finances such radical groups that are “pro” environment but are really front organizations of the oil/coal/gas industry.

@Me:

safe and clean nuclear power is a pipe dream. And I know what I’m talking about unlike most commenters …

It is ‘safe’ in the sense that the plant cannot blow up like in Chernobyl or Fukushima, the fuel is not attractive for making nuclear warheads and the total amount of nuclear waste should be less than with conventional nuclear power, but apart from that the problems are very similar. And the technology is unproven, all the recent experiments with new reactors design are WAY over budget and many years behind on schedule; it is only ‘intelligent’ on paper, just like current neo-keynesian stimulus is an ‘intelligent’ strategy to improve the economy.

Just like nuclear fusion has been 10 years from ‘breakeven’ for the last 60 years or so, despite ever growing budgets.

http://www.thegwpf.org/gwpftv/?tubepress_item=j5M1qtN62yk

Yeah, I’m all for ‘saving the planet’………

We can start by having the green types practice what they preach:

Stop driving cars, stop using electricity generated from fossil fuels, gr their own food, and wear hessian sacks.

Even better yet would be to totally eliminate their damage to their beloved Gaia by removing themselves from the planet.

Yeah, I say save the Earth: Compost a greenie!!!

“Yeah, I say save the Earth: Compost a greenie!!!”\

That’s actually what eventually happens to most of them.

now you polluting sob’s are different yo have closed mind’s and deny the obvious.

I say put you all on Submarines, as exposed deck cargo.

You first, bub.

Ha. Ha. Ha.

I bet you think you’re very witty, don’t you?

Go skinny dipping here next summer

Thousands of Montana snow geese die after landing in toxic, acidic mine pit

https://www.washingtonpost.com/news/morning-mix/wp/2016/12/07/montana-snow-geese-searching-for-pond-land-in-toxic-mine-pit-thousands-die/

Unfortunately most of the greenie crowd is made up of a bunch of snowflakes that are a “do as I say not as I do” crowd.

They live in the inner CBD in high rise apartments that have elevators to take them to their apartments, take free public transport (powered by coal fired electricity or diesel for buses), and eat all sorts of imported food and drink their fancy coffees imported from impoverished countries.

They don’t grow any of their own food, never planted a tree in their life, don’t have solar panels or solar boosted hot water systems.

They want to close down coal generated power plants (Congrats to the greenies here in Victoria for getting the Hazelwood power plant to close in 2017 thus increasing electricity prices by some 10% starting on 1 January) and move to renewables.

Yeah, how is that working out for the people in South Australia when the wind doesn’t blow. Oh, that’s right you depend on that great big Hazelwood coal fired power plant to keep you out of trouble.

Well I can hardly wait for summer 2017 and see what is going to happen when the entire system shuts down when the wind doesn’t blow and temps soar as they usually do in summer to around 105F………..

(PS: Eventually is too long, they should take immediate action and remove their footprint from the planet – save it sooner for the rest of us.)

Not many people want to change to electric cars.

http://www.businessinsider.com/ford-ceo-biggest-problem-for-electric-cars-2016-12

Ford Motor Co. plans to lobby President-elect Donald Trump to soften U.S. and state fuel-economy rules that hurt profits by forcing automakers to build more electriccars and hybrids than are warranted by customer demand. “In 2008, there were 12 electrified vehicles offered in the U.S. market and it represented 2.3 percent of the industry,” Mark Fields, chief executive officer of Ford, said in an interview at Bloomberg’s Southfield, Michigan, office Friday. “Fast forward to 2016, there’s 55 models, and year to date it’s 2.8 percent.”

“how would Texas be doing if oil was still $100?”

When gas is $4/gal or more 90% of Americans get into dire straits, the remaining 10% live in Texas.

I once did the math on the price of gas and the price of having my truck.

The actual price of the gas was insignificant to all the other costs of my truck. My insurance, per year, was HIGHER than the gas. etc.

I’m buying a new car (actually ordering it). A 2017 Durango and I never even considered the price of the gas. It is not significant. The dual DVD players was the important aspect.

@Me:

“dual DVD players”. Hilarious, thanks.

No reason for one to live in Houston unless one has no other choice.

No kidding.

Still probably better than Midland.

Pity poor New Mexico. So far from Heaven. So near to Texas.

I went to school there in the 1970’s, back when it was America and not Northern Mexico.

IT was awesome, fun, exciting and I have noting but good memories.

Just this last summer, my brother, who works in LA, flew into Orlando to buy my sister’s car (she got married, again, and they didn’t need it). He drove it home to California and made a point to NOT STOP ANYWHERE in Houston.

He did his research and learned from various web sites and blogs to avoid the City, since if you didn’t know it well, you may exit off the I-10 and end up in a NO GO ZONE. Hell, even Sweden has 50 NO GO ZONES.

Lived in Houston for approximately 6 months in the early oughts. What a $hithole. Never been back.

since gov’t is really the only thing steadily relentlessly growing while the tax base completely collapses only means one thing,u guessed it, massive tax increases ,fee increases cross the board,gov’t produces nothing so the massive amount of cash it devours gotta come from somewhere (guess)

It’s like that everywhere.. to clever. I think the nongovernment/healthcare economy in Tulsa has collapsed too. I’ve been saying the streets are empty for at least a year, it’s like a goverment holiday every day out there, or like Sunday. It’s bizarre, there’s hardly a line at restaurants, parking lots are empty, my customer base is smaller than ever. I put my business name and number on my truck and have not gotten even one call. There is still money here and from what I see it’s retired people with pensions, city, state workers, education, big religion and medical. Also the people with government pensions and a depression and anxiety disorder seem to be doing well. They have know that every three months or so they need to check themselves in to the mental ward for the weekend in order to keep the free 3x a week housekeeping service. It’s interesting to try to find new business I’ve parked across the street from the hospital, the whole foods lot, I’m thinking the education service center would be good.

Good observation. Government and legal and medical often to justify disability benefits…..all paid for by government seems to be the only game in town. California is really no different if you are not in silicon valley.

Funny how government never even thinks of cutting spending…

Actually, government at all levels cut personnel costs after 2008. Many economists blame those cuts for keeping the economy lower for longer. Government employees aren’t some “other” who live in a vacuum. They are tax payers and consumers as well. They consume the whole range of products, just like real people do. And also do many things that the citizenry demand from government.

I work for a County government in Central Florida. Personnel count is still down 20% from the start of the Great Recession.

Americans conflate local and state government with the federal government. They are completely the opposite. State and local governments have to live on their revenues. When revenues decline, so does spending. And Florida is a conservative, Southern state (at least outside of Miami). Jacking up taxes is not an option.

The federal government always has revenues for whatever level of spending it wants. Either from taxes or issuing treasuries.

I no longer trust auto sales figures. Here in Canada, Alberta is in a major recession, actually you could call it a depression. Car sales are down almost 50% according to on the ground people, which fits with other industries which are reporting a decrease in foot traffic of 40-50%.

And now Vancouver is in a state of shock for 5 months, with the housing bubble popping. So we have two provinces, equal to around 20+ states in USA in serious decline, but apparently Canadian auto sales hit a record in November.

Even if it were only Alberta, that would be like 10 states being in a severe recession. No way US auto sales would hit a record in that case. So, along with government stats, I now add automaker stats as fraudulent.

Things are still moving along in Ontario, at least for now. People seem to be naive to what is happening out west right now.

House prices in the outter burbs have gone parabolic in the last year. With the new mortgage rules, the sales have slowed, just not people’s opinion of the long term value of their homes. Seems like everyone would rather be naive than realize houses never go up forever.

It’s been 25 years since the last meaningful correction in Canada. 2008 was so long ago and inconsequential for the majority of people that their houses haves gone up even higher from the Great Recession.

I am from Canada too and I stop believing in statistic a long time ago,. If everything is so rosy why don’t they raise interest rate. Only part jobs are created in Canada, does not sound like a strong economy to me.

Canada is so broke that we even don’t have the money to build new navy ship. Canada economy is mainly made of the auto sector and a big housing bubble .

I am pretty sure if their shipbuilding industry were half as big as South Korea’s or even Japan’s they’d be ordering destroyers and corvettes like they were about to fight the Battle of Jutland.

As a Minnesotan who played hockey, I feel for Canada. They haven’t had the Cup since the Canadiens won it back in 1993, eh?

Why the hell does Canada need a Navy? To attack Nova Scotia? Huh?

The Canadian banks are arguably the strongest in the world. They suffered in 2008, but the US sector would have collapsed without the FED.

US shorting them have had their asses handed to them- Scotia is up 32% this year.

No one lost a dime in a Canadian bank in the Depression, when several thousand US banks failed taking the deposits with them.

The US debt is considerably larger than the Canadian debt per capita.

As expensive as Canadian medical is, the US is much worse while delivering less.

NO it is not

http://business.financialpost.com/investing/outlook-2016/canadians-household-debt-highest-in-g7-with-crunch-on-brink-of-historic-levels-pbo-warns

Everything you see about financial matter is a lie, including bank profits. Big money printing is going on right now around the world and it is pumping the strock market up and the bank.

Talking about money printing and stock market going higher with high banker profit. The world is turning into Zimbabwe style currency devaluation with record stock market indices and record bank profit while the little guy get nothing.

ECB extends its bond buying, but ‘tapers’ amount

http://blogs.marketwatch.com/thetell/2016/12/08/all-eyes-on-ecb-ahead-of-key-meeting-live-blog/

5,000 US banks failed, but they were all independent, small banks, that the Government and the Federal Reserves wanted out of the way, to make room for the 5 National bank corporations we have today.

The Charter of the Federal Reserve Company, was to prevent bank collapses, as we had in the past. That is the reason for an “elastic” currency, so the depositors would not lose.

BUT, when these very same banks asked for help/credit, etc from this Corporation, they were ignored. Thus 5,000 banks were intentionally killed off.

Yes, Houston is crashing but Dallas is BOOMING.

Malls are PACKED.

Massive construction can’t keep up with demand. This includes all types of construction (except retail)

=> Roads, bridges, parks, offices, industrial, storage, apartments, houses, hospitals, stadiums (e.g. a $70mm high school football stadium and a $500mm Texas Rangers stadium to replace a stadium that is only 20 years old), etc., etc., etc.

Salaries are up 20-50% for unskilled and semi-skilled construction labor. Toyota, Liberty Mutual, State Farm, and hundreds of other companies are moving here and bringing tens of thousands of jobs.

Friends are quiting their jobs without having another one and finding a new job in days to weeks.

Prices for entry-level housing is 40-50% HIGHER THAN THE PRIOR PEAK.

…So I am being cautious and fixing up and selling some of my rental houses.

Demand is incredible. I listed a very nicely fixed-up condo the afternoon before Thanksgiving at the highest comparable sold price.

The phone EXPLODED. Had a higher-than-full price written offer WITHIN 2 HOURS.

Received 9 offers within 72 hours.

The lowest was an all-cash offer at 100% of asking price. 6 offers were 10%-20% over asking. And 3 of those were conventional loans with 20% down payments.

! ! ! UNBELIEVABLE ! ! !

Dallas is booming: must be because of all the millionaires that the Dallas police and fire department pension fund is generating these days ;-)

I’m amazed they still have 20% down payments in Texas. I don’t think there has been any loan like that in my country for over 20 years, on the contrary for a long time 120% mortgages were the norm. Homeowners are complaining loudly that next year the standard mortgage will be reduced from 104% to 103% of the closing price (the 3% is for all closing costs).

They say the best economic indicator is how many Irish you have. Here in Oz you couldn’t move for the brogue in the air. That was 2 years ago. Now there’s nary a lighthearted soul to be found. Things can change fast.

One thing not mentioned in the article is the effect the giant Amazon is having on the American economy. Texas may collect sales tax online but it is way too easy to just order online through an out of state based company and avoid that tax. And as more & more people shop online, more & more retail businesses will close down. If people do not support their local businesses & economy, there will be no local businesses or economy left to support. The retail jobs remaining will be through Amazon who hires less people and pays less. Be prepared to reap the rewards of our actions.

This solution to the Sales Tax and internet ordering is soooo simple.

Just charge every internet sale , let’s just say 5%. Then their computers keep track of the address of the order, and then, once a year, the internet sellers sends each State a check. Or once a month. No problem

Any high school tech geek could write this soft-ware in a day. Every single internet “store” could link to one data base which can keep track off all the sales, all the Sales Tax and which State gets it. It would be so simple that the States could be “wired” their portion every night,electronically, to a State Internet Sales Tax account.

Once it is set up, virtually NO HUMANS need to be involved, other than bugs and glitches, but no humans would have to do anything.

it’s not simple at all I’m afraid. The EU has had this system for many years and there was widespread fraud and for internet shops constant harassing from the tax authorities because there were ‘errors’ (caused by their own systems, because all those different databases never match).

Of course, different countries want to charge different VAT, just like different US states are probably going to demand that they can decide about their own online VAT. Also there are exemptions e.g. though normally a shop would charge the same VAT online as is normal for their country (and not the VAT for the buyers’s country, some large internet sellers can do it the other way round which

I have no experience from the last 6 years with the EU crossborder VAT tax system, but it would surprise me if all the fraud and problems have disappeared.

Apart from that, it is impossible to tax the huge flood of stuff that is being imported from China. Officially we now have no VAT for imports worth less than 40 EUR or so, but this too is an invitation for fraud. People are still buying very expensive stuff over the border without VAT, you just have to know the tricks or have some luck.

No.

Charge a straight %, like 5%. No exceptions. For nobody. none.

That solves that problem

Next, I addressed the soft-ware issue. Only one system that all internet vedors (easy to do, they are on the Internet) link to and then all 50 States like to the same system.

See, it is simple. That is the problem. It is too simple and complexity is where the money, graft and corruption is. (Like Medicaire…..complex as hell and thus easy to cheat)

Texas sales tax applies to many industries. Retail provides less than 30% of the total. The percent of each industry sales that are taxable also varies. Makes it difficult to interpret what is driving the decrease without looking at industry details – which can be found on Comptroller website.

A long-term problem for state and cities is that the taxable mix has been changing in unfavorable ways. Sales tax covers less economic activity than it used to and not all of that is from changes in retail. Also from change in the mix of industries in the state.