Foreclosures suddenly spike most since the last Housing Bust

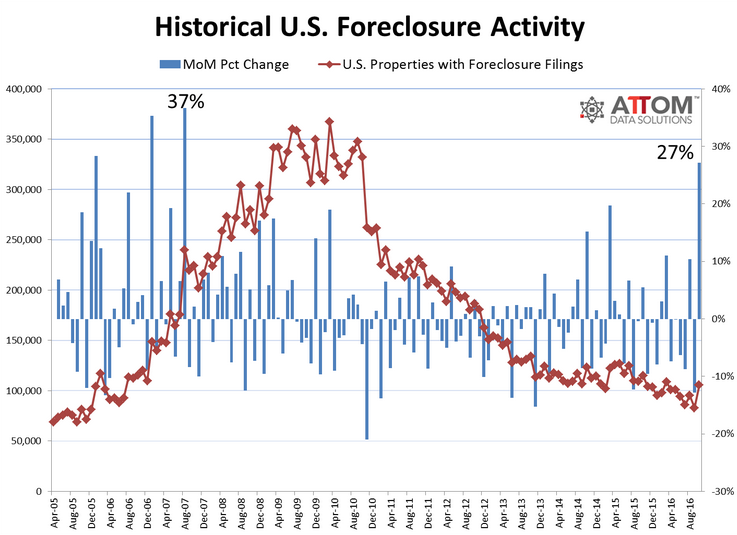

The total number of homes with foreclosure filings jumped 27% in October from September, when they’d been at the lowest level since 2006. It was the biggest jump in monthly foreclosure filings since August 2007.

Compared to October last year, homes with foreclosure filings still decreased, but this nationwide decrease is covering up what is now happening in 28 states and Washington D.C., according to the Foreclosure Report by ATTOM Data Solutions. There, the inventory of homes with foreclosure filings is beginning to rise even on a year-over year basis. And in some states it soared year-over-year:

- Colorado +64%

- Georgia +22%

- Pennsylvania +20%

- Arizona +17%

- Virginia +15%

- Massachusetts +11%

- New York +10%

When home prices rise for years, foreclosure filings become rare because defaulting homeowners can usually sell the home for more than they owe and pay off the mortgage. The problem arises when home prices fail to rise locally, and it balloons when home prices fall. We’ve seen that last time around. After bouncing along super low levels during Housing Bubble 1 through 2005, foreclosure filings skyrocketed during the housing crash starting in 2006. At first it was just an uptick that no one paid attention to. By 2008, it helped take down the financial system.

Foreclosure filings peaked in late 2009, began dropping in 2010, and then tapered down to 2006 levels as foreclosures were processed, and as the home price surge of Housing Bubble 2 made new defaults less likely. But the spike in October stands out as much as those in the early phases of the housing bust in 2006 and 2007. Note the blue bar on the right:

While some states are still trying to digest the foreclosures from the last housing crisis, according to Daren Blomquist, senior VP at ATTOM, “the foreclosure activity increases in states such as Arizona, Colorado and Georgia are more heavily tied to loans originated since 2009”:

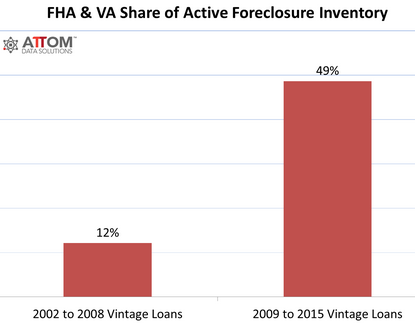

“The loans used in this housing recovery that appear to be most susceptible to foreclosure are those such as FHA and VA with low down payments. Our data shows FHA and VA loans combined represent 49% of all active foreclosure inventory for loans originated in the seven years ending in 2015.”

This chart shows the soaring proportion of FHA and VA mortgages issued since 2009 among the active foreclosure inventory.

On average across the nation, the foreclosure rate was one foreclosure filing for every 1,258 housing units. But in some states, the foreclosure rate was much worse. Here are the “top” ten:

- Delaware: one in every 355 housing units

- New Jersey: one in every 564 housing units

- Maryland: one in every 679 housing units

- Illinois: one in every 704 housing units

- South Carolina: one in every 801 housing units

- Nevada: one in every 826 housing units

- Florida: one in every 895 housing

- Ohio: one in every 930 housing units

- Pennsylvania: one in every 1,018 housing units

- Georgia: one in every 1,028 housing units.

And here are the “top” ten highest foreclosure rates among the 216 metropolitan areas with a population of over 200,000:

- York-Hanover, PA: one in every 274 housing units

- Atlantic City, NJ: one in every 301 housing units

- Rockford, IL: one in every 481 housing units

- Columbia, SC: one in every 498 housing units

- Trenton, NJ: one in every 499 housing units.

- Reading, PA: one in every 542 housing units

- Chicago, IL: one in every 571 housing units

- Dayton, OH: one in every 573 housing units

- Philadelphia, PA: one in every 597 housing units

- Salisbury, MD: one in every 625 housing units.

These “foreclosure filings” are based on data that ATTOM gathered in 2,200 counties where over 90% of the US population lives. They include data on the three phases of foreclosure:

- Foreclosure starts: lender issues Notice of Default (NOD) and Lis Pendens (LIS)

- Auction notices for future public foreclosure auctions: Notice of Trustee’s Sale (NTS) and Notice of Foreclosure Sale (NFS);

- Real Estate Owned (REO) properties that have been foreclosed on and were repurchased by a bank at auction and are now held by the bank.

Broken down based on these three phases of the foreclosure process:

Foreclosure starts jumped 25% in October from the prior month, to 43,352. While still down 11% year-over-year, it was the highest monthly increase in foreclosure starts since December 2008.

Foreclosure starts increased even year-over-year in 23 states and Washington D.C. In some states they soared. The “top” five:

- Colorado +71%

- Arizona +48%

- Ohio +34%

- New York +15%

- Virginia +15

Auction notices jumped 30% from the prior month to 43,815 (in some states, these are foreclosure starts), the biggest monthly increase since January 2006. While still down 6% year-over-year nationally, auction notices rose year-over-year in 25 states and Washington D.C. The “top” five:

- Pennsylvania +66%

- Indiana +37%

- Illinois +34%

- New York +12%

- New Jersey +6%

Bank repossessions (REO) jumped 25% from the prior month to 34,288 homes, the biggest monthly increase since July 2015. While REOs were still down 6% year-over-year nationally, they increased in 22 states and Washington D.C. The “top” five:

- Massachusetts +104%

- Georgia +53%

- Wisconsin +45%

- Texas +38%

- Virginia +17%

The fact that mortgages issued since 2009 are now seeing rising defaults again is worrisome enough. It’s doubly concerning that 49% of these foreclosure filings are on homes with low-down-payment mortgages backed by the FHA and VA and issued since 2009. Recall that low-down-payment mortgages played a big role in the last housing collapse.

ATTOM VP Blomquist tries to remain sanguine: “The increase in October isn’t enough evidence to indicate a new foreclosure crisis emerging in these states, but it certainly demonstrates that this housing recovery is not completely devoid of risk.”

So take this as an early red flag, the kind you might have seen in 2006 when no one paid attention to red flags in the housing market.

Some of the same characters that played leading roles during the last housing bubble and bust are back in their full glory. Read… Housing Bust 2? Low- and No-Down-Payment Mortgages Surge, “Shadow Banks” Dominate

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Obama is on his way out. No need to sugar coat data anymore.

No, we need to sugar coat the data for a few more months, then we can lay it all on Trump.

Remember, there is no liberal echo chamber, only fundamentalist conservative ones, in the words of Hillary: “those basket of deplorables.”

The Data will be Sugar coated for a few more months and then Trump can publish the real data and maybe even exaggerate it a little and blame it on the Democrats who have been power for 8 years. We will then get a sense of how bad it is. The new Government always has the opportunity to clean out all the junk and drain the swamp and blame it all on the previous government. But loser will always be the general public. And the game goes on….

Perfectly put..sad but true . And the liberal ticks will believe whatever lefty propaganda the media spews out.

Cookie nailed it. My friends in the RE and CRE industry said that they were holding on to foreclosures in 2016 until AFTER the elections. Once October rolled around the filings increased. For the rest of Q4 2016 and Q1 2017, look for a major spike and inventory increase in every state, especially Florida where there is a high demand for housing even though cash investors have cooled down.

Wow, you people literally do live in a delusional bubble. It must be terrifying with liberal boogey men living around every corner.

Not sure what point you are making? Do you have one?

let loose the dogs of war, the moratorium is over.

House buyers are pushed to stretch to buy as much house as the low interest rate lending market will allow, while at the same time we live in a time when there is no such thing as job security. Low interest rate mortgages have made it more affordable to buy a house, and non-bank lenders are standing by to make those sketchy loans happen and then sell them. The casino is open and the dice are rolling!

… jus’ like grandma … throw everything under da bus … including da kitchen sink ….

Mr. Trump had two question ready as he made his way thru his new home.

If the check was once a month or bi- weekly and if he could deduct melania on his taxes as housekeeping?

Mr. Trump has made it clear that he will not be accepting the 400K a year salary as President. He will not take a penny.

We know that hilary never said such a thing..If she got in she would vote herself a raise as did obama.

Michelle obama bought very expensive dresses for herself and took very frequent and expensive vacations with her mother and WE THE PEOPLE PAID FOR IT ALL including the Secret Service agents to protect them 24 /7 and what do we hear from her mouth? Bitching and complaining. While people starved in the streets obama sent for Kobey meat directly from Japan at hundreds of dollars a pound for him and all his friends at the white house potties.

Remember obama sending back, the Bust of Winston Churchill , which was a gift and had been in the WH for many years?

Remember when obama invited his gay friends to the WH and they took a photo of themselves giving the middle finger to the painting of Ronald Reagan? Do you remember these things or do you even know about these happenings.

Foreclosures !

We speak from time to time of a cleansing crash — cleaning out ( so to speak ) the accumulated deadwood of the prior years and years of economic and financial excess. For those of us that consider such events to be a qualified good thing — the FED’s interference, their continuous prevention of corrections, is an unqualified bad thing.

I see low and no down payments as an unqualified bad. Such things are closely correlated with real estate bubbles.

One “invests” more wisely with some skin in the game. TWENTY PERCENT skin in the game assures clear-thinking about the risk of buying this or that house.

My son is a millennial with slight hope of buying a house here in Massachusetts, inside the beltway. He has $50K saved for a down payment and that is nowhere near enough to buy anything decent. ( He should look in Spokane, I think ! )

Foreclosures have thus far presented him with his best opportunity of getting into a decent starter home.

I am not cheering for anyone anywhere to lose their home. To me, that would be second to a death in the family, or a catastrophic job loss. But such things do happen, and those who will benefit is just a small bright spot in the deep gloom. Again, I do not hope for or cheer anyone losing their home — that is a thought too bleak for me to consider in any way.

SnowieGeorgie

Please stop assuming that the foreclosures are due to people who put down low down payments. I know people who owned their homes outright and lost them when they lost their incomes. First you lose you job but hope to get back to work soon, then you run out of savings, and you are forced to borrow against your house when you can’t sell it. And then its gone….

But some foreclosures might be associated with low down payments.

I would like to see a comparison of prevailing rents with size of loan payments in the high-foreclosure locations.

It might “pay” to forfeit a down payment and walk away from a mortgage and look to rent.

It’s not an assumption at all. The data are there for all to see.

FORECLOSURES OCCUR ACROSS A SPECTRUM OF CIRCUMSTANCES. And a large component of that spectrum consists of the low and no down-payment participants.

I know there are a thousand sad stories in the big city, and I am sensitive to that. Just because I call out ONE OF THE MAJOR CAUSES does not mean that I lack the intellect to see that there are many causes.

BANKS THAT DID NOT GIVE OUT LOW AND NO DOWN PAYMENT MORGAGES survived the real-estate bubble bust. And they survived it well. Again, this is backed by data collected by responsible and truthful agencies.

There are actually banks that went through he bust with almost no foreclosures, just because they eschewed low and no down-payment mortgages.

This is the danger, and the difficulty in having a conversation in a comment thread — and I have to live with it : whatever you say, someone will respond sharply, “Not that but this” .

Well it can be both, but the comment that was originally posted was addressing the first and not the second.

So when you say “Please stop assuming . . . ” YOU ARE ASSUMING THAT I HAVE MADE AN ASSUMPTION, which you cannot possibly know.

But I do take your point totally – – and I was addressing such sadness in my final paragraph where I said this : “I am not cheering for anyone anywhere to lose their home. . . . . . ”

Indeed I am not, and I have deep empathy and sympathy for all who have lost their home due to job loss, or a medical crisis or just the vagaries of these difficult economic times we live in. In fact, any cause at all, because surely nobody tries to lose a home.

Like I said, I take your meaning completely, but I was not attempting to cover any and all causes of foreclosure. But I don’t have the time to put a series of disclaimers in every post . . . .

SnowieGeorgie

Well,i bought my first Condo in San Diego in 1990 for 32.000,golf course view and underground parking. my monthly payment was less than 300.00. the realtor who owned it was begging me to to take it off his hands,real estate was a dirty word at that time and the average working stiff could easily afford a home of his choice. my point is: people have completely lost perspective as for the real value of “things” and RE is cyclical,always has and always will be,save your cash and wait for the next opportunity,it’s not too far off!

1990 who cares?… that was before the INTERNET and before GLOBALIZATION…

That changed the game!

Now you got Chinese buying up property, Hedge Funds buying SFHs, plus California population increased alot…different times.

Not so different. Global trade has been going on for centuries as have the flows of foreign money.

It is only someone who has grown up with the internet that thinks that the world didn’t exist before.

That was before Greenspan get the biggest Ponzi scheme going. Now is the aftermath.

Snowie, My son is a millennial also and there is no way I would allow him to buy a home now. Be patient and wait for the bust.

Trump won Pennsylvania by getting half the votes in Philadelphia, a highly democratic city. I was wondering why his numbers were so good there, now I know. The city has been going upscale in the last few years, with many new million dollar condos in the downtown area, but I guess that was hiding the real story.

Downtown Philly is greatly improved. There is still a large no go zone that is speading into the northern suburbs. This is where the foreclosures are

Petunia,

Where is your source for Trump getting half the votes in Philadelphia? When I googled I found that Clinton got 82% of Philly.

The CNN election map on tv.

Well, I don’t have a TV but if I go to the CNN page and click on Philly it says 82%

http://www.cnn.com/election/results/states/pennsylvania#president

I didn’t see California on this list, but my son just read that Los Angeles has outlawed sleeping in your car on residential streets. If homelessness is that bad in LA you know the markets will crash there soon.

So LA is going to make it against the law to be poor?

Are they planning to build refuge camps to house all the lost souls.. or just imprison them and divide up the families?

And add more souls to the debtors and drug addicts prisons? For the benefit of whom?

More of the California you cant afford to live around here. In what used to be your home, so get out, attitude.

So prevalent in that state.

Where are the trumpvilles going to be, Arizona and New Mexico government land???

In Cali you have to get away from the coast. The more to the east and into the deserts you go the more affordable the housing with the exception of Palm Springs. If you wouldn’t like to live there in Cali that is where you can afford to live. Real estate on the west side of the coastal range is expensive.

You miss or deliberately missed the point.

The California attitude is, if you are not wealthy, leave and close the door quietly as you do.

This is a bad attitude, possessed by bad people. Now abusing the law, and money, to drive out the original residents.

P45’s policy’s, particularly his tax and welfare policy’s make trumpvilles as serious possibility. The NIMBY Californian law machine. Is already making sure they are NIMBY.

P45’s policy’s are not simply Capitalist, they promote Laissez-faire Capitalism. Which America got away from with FDR. And has been creeping back towards, since Reagan.

Laissez-faire Capitalism is even more harmful, than socialism, which is something I loathe with a passion.

As with either system, the man in the middle, who works and pays taxes, looses the most, however under Laissez-faire, the poor and doniothings loose as well.

All forms of Capitalism require demand and the US consumer has been that demand since WWII. Laissez-faire Capitalism is cyclic. Capitalism runs in cycles. When those cycles are prevented due to massive monetary intervention, all that does is make the cycles bigger and bigger. Sort of like holding a river beyond the capacity of the dam.

In the later stages of this Super Cycle, demand was fueled by debt instead of wages. The US consumer has an all time high historic level of debt and flat to falling incomes. P45 can not change that. The Neocons and the Neo-Keynesians have screwed the cylic changes and collapses of the normal cycles for 30+ years now.. The dam is going to break.

There is absolutely nothing or NO one that can change the physics of what is going to happen. Right now it is all about timing and not only the time that it all becomes apparent to the masses but in the time it takes to unravel. The first no one can do anything about. It is already happening. The second one could be ameliorated and we will just have to see how smart the arrogant P45 is. I personally think he is an Intellectual Yet self centered narcissistic Idiot. We’ll just have to see. Hope I’m wrong. Just another Marie Antoinette!

All very true,

However it dosent change the fact that the attitude and behavior of California to its poor, is unacceptable.

Its the same as what Brazil did during the Olympics.

And as bad a china painting the grass in Beijing, after they shut down the factory’s for teh period of teh games, so the visitors could actually breath the atmosphere.

When lending is easy many homes are sold that wouldn’t sell at all in a slow market, houses with bad floor plans, poor construction quality, outdated mechanical systems etc. Most first time buyers know nothing about construction quality and nobody is there to educate them. When they have to sell these poorer quality homes often won’t sell. Lenders get sloppy and lend on this junk, but then they get picky after the boom ends. It’s sometimes the case with new houses as well, many new homes are sold to the unwary, cheapest materials possible, very low quality.

Animals are out protesting in the streets threatening violence.

Animals??? A group of maybe 200 young people (mostly women) just marched by our place in San Francisco, blocking two lanes of traffic with police escort. They were holding signs and chanting “NOT OUR PRESIDENT.”

They didn’t look like animals to me. Just frustrated young people (mostly women) who expressed their dissatisfaction much more civilly than we did when I was in college.

I heard there were threats of violence? There isn’t anyone out in front of my house so I can’t report boots on the ground.

Are you 100% sure that is what you see Wolf? Look at this article and some proof that not all the protesters are young and naive college kids : http://www.activistpost.com/2016/11/looks-like-george-soros-funding-trump-protests-just-like-funded-ferguson-riots.html

The article you linked described events BEFORE the election, when power brokers still tried to influence things.

Now the die is cast. And the power brokers will have to pull out their checkbook and influence things the normal way (lobbying). No one cares about these kids anymore. But they care. And that’s nice to see, actually, as long as it’s done civilly without violence, threats of violence, vandalism, etc.

Also, the protest I saw was small – just a couple of hundred people. This isn’t going to change anything. Just people airing their feelings.

A semi-truck got hung up in the traffic jam, going the other way (against the flow of the protesters, so he could read the signs and hear their chants. He blew the horn, and all the young women yowled, like their team had just scored! It was great. SF at its best.

I don’t know what happened in Oakland. It might have been different there.

Oakland is a different story, and frankly just weird. Win a football game: riot, judgement you don’t like: riot, your candidate lost: riot, figure if Hill won, they’d riot too. And burn a few cars and such… cause, why not.

Right on, wolf. I explain it as a display of self-determination .

I just learned: they were high school kids. It was totally unplanned. They just walked out of school and started marching across the city, trying to get to the GG Bridge. It’s a LONG walk.

Police stated that they wouldn’t let them get on the bridge.

Even though the kids had no permit to do this, police was “cooperating” and let them do it. They’d put some kind of impromptu police escort together, kept them in line, and blocked traffic for them.

They already looked pretty tired when I saw them. And it’s about another 4 miles to the GG Bridge. And then they’d have to get home, or maybe call their folks for a ride.

democracy at work. nothing wrong with peaceful protests. iif you dont like the sight of them walk around them. i have a feeling there is a lot more to come. with all the things that we read about here, that are going on or going to happen, there will be lots more to come. bashing heads makes things worse.

I had a smile on my face when I saw them. To see high school kids get involved politically – no matter in what direction – is a great thing to see.

Hope they did not burn down the headquarters of Wolf Street. :)

Ah yes, the sky is once again falling. When equal opportunity does not become an equal outcome, the children are frustrated and dissatisfied. Throwing tantrums. Forget about merit or performance, choices need to be made on race, gender and being PC. Who didn’t get the memo?!

You think there’s equal opportunity in the United States? And you think outcomes have been determined on merit? Whoa, you’re living in another world…

Take a look at gov hiring and all affirmative action has done in the las 40 years. The world I live in and the same as all the trump voters line in, sees this very clearly. PC speak and all the nonsense it’s created is emotionally based and not Data related. It’s the knee jerk responses like yours that’s what so sad about it.

Many recent defaults are from “professional” investors (often themselves banks!) who were unable to rent foreclosed homes they acquired in the last cycle. Investment Housing is beginning to look like the used car repo and consumer paper businesses in many ways. OPM is often blind.

Whoaa! Stop! These foreclosures are from the LAST bubble prick. Housing is peaking. The banks got a huge BYE from the Fed and QE and now (finally) they are unloading. It’s not recent purchases.

Historically, low down payments are not indicative of defaulting on mortgages. Losing income is what usually does it. The Fed did a study on mortgages defaults back in 2010 and discovered the majority of people underwater on their mortgages kept paying as long as they had an income with which to make the payments.

What’s interesting on defaults of mortgages originated since 2009 is that the qualifications were so incredibly onerous for these loans. Probably the toughest in 30 years.

Since you refuse copy editing services, here’s the last freebie:

thake = take (Para 3).

Regarding the content:

O-oh! Here we go again!

My effusive gratitude for the heads up.

Thanks for the free typo alert!

:-]

I was curious to know what the reason for the foreclosures are by percentage. And what is the percentage the taxpayer owns through the federal government. I heard Trump will privatize Fannie Mae and Freddie Mac but probably with government guarantees meaning it is not really private and the taxpayer will end up losing. Again, reward no risk for the gamblers.

That said, it is extremely sad to lose a home. About 50% of bankruptcies are health related. There is no end to these problems and weren’t we just here?

I would never buy a house now at the probable top of a market. But who knows with the Fed and these policies if this is a top or a blip with lower interest rates and more QE.

Peaceful protests are appropriate and the american way. Whats going on in Oakland is not appropriate.

Regarding foreclosures, We must be near the top of the market value for this cycle per Wolf’s kind observations. Therefore there will be an attempt to unload as many foreclosures as possible without flooding the market with supply.

Impossible. The Wall will fix everything wrong with this country. GDP +50% at least. The first version will be buggy, so we’ll employ even more people to tear it down and build it up again. And we’ll do the same up in Canada.

I haven’t been so hopeful about the economy in years.

Wow, +50% eh? Once jobs destruction is stopped that’s the target?

Some people don’t understand sarcasm. You need a neon sign and a bullhorn.

About that wall. Now there are more Mexicans moving back to Mexico than coming in because they can’t make it in America. Wouldn’t a wall just slow things down?

“Now there are more Mexicans moving back to Mexico than coming in because they can’t make it in America. Wouldn’t a wall just slow things down?”

No you dont need current visas, to leave.

Better Border security will keep out more of those, who do not understand, that the people smugglers, are lying to them.

America has to do what Australia has, get tough on people smugglers, by making it impossible for the illegals brought by the smugglers, to ever settle there legally.

America cant do this, with a porous border.

In the current economy, illegal immigration, is an important issue.

As although many of the corporates wont admit it, the ever expanding population model, of unsustainable consumerism based capitalism, is already dying.

One of the hard facts, Obama was not will to concede.

d, I think you missed the sarcasm in this: “Wouldn’t a wall just slow things down?”

I did miss that one.

Interesting How Many times..Virginia comes up in the above statistics..a Leading ‘Politically-Induced’ Indicator…? lololol aloha and thanks for reading

In spite of his campaign promises; Trump has very little wiggle room to act.

America has painted herself very tightly into a corner. The best solution is to wait for the paint to dry. Unfortunately, that will take at least another decade, if not longer.

I think you are correct Mike,this will play out similar to the 1980’s where we had to go trough the Carter induced recession until Reagan’s pro business regime unfolded one epic growth period in the late 80’s. i fear we have to go through that “adjustment” before we see the sun shining on this great country once more. of course i will be retiring in some third world paradise by then,so for you youngsters,hang tide!

Reagan growth was driven by an explosion of the deficit.

Whatever happened to Republicans caring about deficits?

I had two young neighbor families that told me they were getting squeezed out of their house because they had stretched their budget to get into a better school district and then increasing real estate taxes and family health plan insurance caught them by surprise. They naively planned these costs to remain static in the short run and when they ramped up they went into the red every month.

Propping up house prices is a way to inject money into a staggering economy. Into equity markets – the same. Zero interest rates? The same. So far all of these have been done and sorta worked. Trump says he wants to pump money in by creating jobs. Could it be that investors are liquidating to create cash in case the money spigot moves to a different watering trough?

“Could it be that investors are liquidating to create cash in case the money spigot moves to a different watering trough?”

The decision to foreclose is made weeks before the event sometimes month’s.

They see the normal cycle of recession due with a new president.

Next years numbers will be those made after the result.

Donald should select Sheila Bair.

Good call on Sheila Bair.

Selecting Bair would be an excellent and canny choice, but don’t the probabilities suggest a fellow swindler or enabler?

Then again, Donnie has confounded us every step of the way. He couldn’t win the nomination, but he did. He couldn’t be elected President, but he was. He is portrayed as an idiot (and usually does an excellent job, as seen by this fellow New Yorker who’s been observing him for forty years), yet here we are, with him selecting a Cabinet. Whether by intellect or intuition, he had a deep understanding of the currents and dynamics in play, leaving most of us smarty-pants analysts (professional and lay) looking like the idiots.

He was also lucky, since his opponent was a highly-flawed, weak and vulnerable candidate, who made some terrible strategic mistakes.

If he successfully puts enough people back to work in the regions that voted for him (and infrastructure spending is a way to do it), makes good on his stated desire to ratchet-down overseas interventions, appears competent and is semi-disciplined with the graft (“honest” and otherwise), then he has a chance to bring about a political realignment that we can’t begin to figure.

Hard to imagine he can or really even intends to do those things. But it’s also hard to imagine that he’s President.

York-Hanover? There have been some recent plant closures, including Sylvania, and Harley Davidson is cutting back.

https://www.wsws.org/en/articles/2015/05/04/york-m04.html

This isn’t just about kooky loans, but about working class people losing good manufacturing jobs.

(I know, that publication is a little odd, but as far as I can tell, the stats in the article are true – I live about 25 miles from York)

Thanks FHA and VA! “We’re from the government, and we’re here to help…”

I’ve even noticed a few foreclosures in this California market. At least a few more than the norm of the past 4 years.

I expect with the elimination of the Frank-Dodd act that housing prices may get some support that would last a few more months until the demons of past economic decisions come home to roost.

If rates continue their march upward on expectations of higher inflation and large deficit spending by Trump, it would seem housing is going to be negatively affected.

Could Trump’s fiscal plan be the pin that pricks the bubble via higher rates?

I’m skeptical of the return of inflation– a lot of has to “go right” for inflation to substantively pick up. I also tend to think his policies in regards to trade and immigration, to the extent that they may be enacted (which I’m skeptical of as well), have a large deflationary aspect.

“If rates continue their march upward on expectations of higher inflation and large deficit spending by Trump, it would seem housing is going to be negatively affected.”

Before the TBTF institutional and FED intervention, interest rates were set by the markets. The factors in a free market interest rate are demand vs availability of capital, the RISK factor, the inflation rate and a reasonable return on you capital.

Why I am stating this is because this because inflation is only one of the true determinates of rates. I think that with rising foreclosures and lowering demand leading to business failures and defaults too, you could add a large amount for risk also enter the equation..

As all this is inner connected, when the shit starts hitting the fan, interest rates should sky rocket. You start wiping out the asset side, availability will plummet to.. That was the FED’s only real reason to exist, to provide liquidity in times of stress.. Except this time they will be hampered by their already bloated balance sheets..

They could even become insolvent as the bonds they own collapse. Especially the MBS and other non government securities.

We better all hope this takes a while to happen so all can adjust.. But Harry Dent says it will happen quickly because all the major cycles are in harmony.. going down together..

“We better all hope this takes a while to happen so all can adjust.. But Harry Dent says it will happen quickly because all the major cycles are in harmony.. going down together..”

Even a broken clock is correct, twice a day.

I see P45’s policy’s causing stagflation, or worse after a short burst of prosperity for the few.

It would be nice to be wrong.

We shall have to see if he makes it Harrys time.

Wolf! just now heard Richard Wolff give you credit on his radio show, “Economic Update,” for researching the fact about all that corporate money still being in the US and not off-shore after all! i was so proud, yelling to James, “yeah! he da man!”

Richard Wolff gave the most sober reaction to the trump win that i’ve heard on the radio or TV. people are losing it here. staying home or having heated arguments in the gym parking lot. everyone thinks their brains are going to be eaten.

i love that Richard Wolff says trump (or obama etc) can’t fix everything or much of anything. it’s capitalism. the system. any one person can do so much as the system dictates everything.

It’s getting really bad in Arizona. Home prices are dropping, and wages can’t support mortgage payments.

well I’ve been in recession since Q3 2014 so……..looks like the “greatest economy never told” isn’t all that and a bag of chips.

I sold my house in the Denver metro area last month for pretty much top dollar after investing a substantial amount of money to recondition it. (the usual paint, carpet, new roof, replacement windows, etc.) . I’d watched similar homes sell in a matter of a few days- even hours(!) throughout the preceding year and yet this house sat on the market with NO interest for 26 long days. Imagine the sense of panic I was beginning to feel.

I knew then that what I had been suspecting was true- the Denver market is at it’s peak. I’m feeling extremely lucky to have sold and joke with people that I have “escaped”. I’m not really joking though since the number of homes available here has been increasing by roughly 10% per month since way back in June.

Bubble? Yes, I believe so. Me? I’ll be safely ensconced in Florida after Thanksgiving in a big ‘ol ranch house on an acre and a quarter of lawn- which I paid cash for with funds from the equity gained from this place.

I wanted to warn the poor kids who bought this house- Don’t buy this house! It’s a TERRIBLE time to buy real estate here on the front range!

rx