So no “major, major collapse in housing?”

By Angela Johnson, Vancouver, Canada, for WOLFSTREET.com:

“The pundits have been raising red flags on the Canadian housing market for more than five years – and have been consistently wrong,” former Royal Bank of Canada CEO Gord Nixon told BNN today, in response to the federal government’s new mortgage rules designed to tamp down on risk in the housing market:

“I appreciate why policymakers have been moving in the direction they have been moving but we have yet to have – and I don’t believe we are going to have – a major, major collapse in housing.”

Comforting words.

It is always been said that the Canadian housing bubble cannot implode in the manner the US housing bubble did because mortgages are more conservative, because subprime doesn’t exist, because down-payment requirements are stiff…. And now there are new mortgage rules to make it even harder.

But there are ways and means of getting around the new mortgage rules and other requirements to get what you want in Canada’s delicious housing bubble. And in some cases: no down-payment, no problem.

The new policies – covering mortgages that qualify for the government-guarantee program and the lower rates that come with it – elicited pronouncements of being everything from “somewhat overdue,” from Toronto Dominion Bank chief Ed Clark, to “premature,” from Gary Mauris, president and CEO of Dominion Lending Centres.

The latter is a mortgage broker that negotiates with “shadow banks.” These mortgage finance companies, that include the less-regulated private lenders or mortgage investment corporations, offer a variety of loans, including for low-ratio refinancing, jumbo mortgages, long-term amortizations, and investment or rental properties. These “alternative” mortgages include subprime mortgages.

Mr. Mauris’ unfavourable review of the new rules may have something to do with the amount of business squashed therewith.

Dominion Lending Centres Chief Economist Sherry Cooper said that some lenders declared, “Until further notice, until the dust clears, we are no longer making loans, we are not making renewals.”

Ouch.

Shadow banking covers 12.5% of the $1.3 trillion Canadian mortgage market. Lenders like Merix, Street Capital, First National, Canadiana, and True North Mortgages don’t take deposits as banks do. They fund these mortgages by issuing bonds or mortgage backed securities. These monoline lenders who “can churn out approvals in as little as 4 hours” are not where the government mortgage insurer, Canadian Mortgage and Housing Corporation (CMHC), intended priced-out house-hunters to go, especially now that that it finally raised the housing market alert status to “red.”

No down payment, no problem.

On the Metro Vancouver scene, media was set abuzz by developer Townline Homes Inc. offering a “grant” to qualified lower income buyers in late January 2016. The CMHC approved the 0%-down offer, in which there was subsequent “overwhelming interest.”

These units were pre-sold for 8% less than the third-party appraised value. That 8% was essentially a grant from Townline and became the buyer’s “virtual” down payment. So the lending bank and therefore CMHC would be on the hook for 100% of the purchase price, in the event of foreclosure. The purchaser not having any skin in the game is a scenario that makes more fiscally conservative Canadians positively shudder.

VanCity, a Vancouver credit union, has also developed some creative mortgage products particular to the idiosyncrasies of the local market. For example, when buying a place with a housemate or two (true story) or two families are buying a place together (also not unheard of), VanCity offers a package deal called a Mixer Mortgage, with financing and legalities taken care of to ensure each party is only responsible for their share of the mortgage.

Then there’s its Springboard program: the fine print reveals that it is 100% financing. “Innovative” indeed. Straight from VanCity’s website (emphasis added):

Everyone deserves a chance to own a home…If you qualify, we’ll loan you the money for a 20% down payment, plus a mortgage for the balance of the purchase price…If you make all your payments within the first 10 years, you’ll have paid off your down payment.

While the red flags begin to wave, notice that the maximum property amount under this program is C$300,000. In Metro Vancouver, this will barely allow you to get your foot in the door of a 600-square-foot 1-bedroom condo.

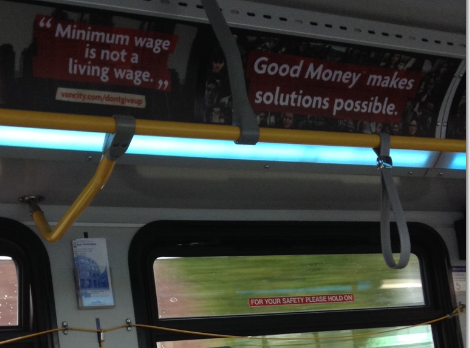

VanCity has the empathetic “Don’t Give Up” ad campaign. They understand how housing affordability is affecting Vancouverites; they also don’t mind signing people up for what some term “debt slavery” for decades to come: buying an essentially unaffordable home. This is one of their ads – “Minimum wage is not a living wage” – in a bus:

In Metro Vancouver, “Help Wanted” signs abound, at minimum wage cafes, fast food restaurants, and dollar stores. It would seem that the working poor are edged out by the affordability issues besetting Metro Vancouver.

Some mortgage brokers insist the products arranged with shadow banks are completely safe and even boring, far removed from the US housing bust and the glamorized scenes from the movie the “Big Short.” The fact remains that shadow lending has its slice of the mortgage pie and that no-down-payment mortgages exist. And house prices are more inflated than ever. By Angela Johnson, Vancouver, Canada, for WOLFSTREET.com.

But already, the housing market in Vancouver is in turmoil, even as Toronto spikes. Read… There’s No Plateau in a Housing Bubble, Not Even in Canada

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rat people on both the banker and client sides will always find a way to game the system and then when it all goes south it’s the solid working class people that are left with the bill.

Thats the way corruption works. Canada is no different than USA. Its an illusion of democracy. No institutions are democretic and held accountable. I feel shame for western economies and equally feel sorry for hard working tax payers. Liberals/Conservatives/NDP/Green party all are same drug in different capsules. It is high time canada needs a social revolution ….. unfortunately thats the only thing can save it…..sooner the better…..

No, not a major major, collapse in housing. A major general collapse in housing. Totally different rank. See, he didn’t lie straight through his teeth. Semantics people. Semantics. And fluoridation. Yeah. That’s it.

Is it possible that Canada will spare itself the ‘worst of the worst,’ when the bubble bursts, by implementing some limits beforehand?

What is also amazing is, after all the devastation that this type of lending inflicted on US “homeowners” there seems to be no shortage of people that don’t realize that when you go in for this type of loan late in a market cycle, your odds of being a winning flipper versus a pathetic bagholder are small and rapidly shrinking. We are clearly doomed to repeat the past, because Central Banks want us too, and their buddies love to participate in the post blow up looting. It’s truly disgusting.

Two or three years ago TD Bank (Toronto Dominion) started showing up in south Florida. They were building branches everywhere. No doubt whatever problems they may now have in Canada have some roots in the US market. On their website they show branches up and down the east coast.

hi petunia,

great observation and it’s bang on.

TD is in big trouble, same with BMO. the former and latter were also involved with ponzi purchases like M&I and BankNorth respectively: http://globalnews.ca/news/2485811/allen-stanfords-house-of-cards-how-td-banked-the-2nd-largest-ponzi-scheme-in-u-s-history/ http://business.financialpost.com/news/fp-street/bmos-deal-part-of-u-s-consolidation-trend

of course, this is all in addition to their ridiculous derivatives.

TD is also siphoning taxpayer dollars to finance the debt. the end game for both banks is to dump it on the Queen’s bank, The Bank of Nova Scotia, which holds the hard assets backing the (admittedly-teetering) gold standard of the Commonwealth currencies.

Bob Rae, a well-known politician in eastern canada who is suspected to have some very unsavoury ties (http://rense.com/general94/TSN1.pdf) was also involved in the attempted-privatisation of arguably the Commonwealth’s crown jewel among public services: education

https://books.google.ca/books?id=h3nT-W5EC6QC&pg=PA52#v=onepage&q&f=false

notice how BAB (that’s what he asks people to call him) was packaging provincial debt and selling it to Deutsche, Nomura and Goldman Sachs? this is not an accident. he was fully aware that these banks would be willing to inflate the debt to a number that rivals the hard assets held by the bank of nova scotia.

https://en.wikipedia.org/wiki/William_Lawson_(banker)

“As a member of the Nova Scotia House of Assembly, he introduced a bill chartering a public bank. The bill ensured that any bank directors were responsible for double the amount of their holdings in case of insolvency. ”

this was all made possible because pierre trudeau privatised the bank of canada in 1974, thereby introducing interest on internally-issued debt (provincial, municipal and federal).

https://geopolitics.co/2016/02/06/canadian-media-ignoring-titanic-lawsuit-vs-bank-of-canada/

from what i remember, the courts have ruled in favour of the people, but the media and powers that be are refusing to thoroughly disclose the progress. the lawyer who brought this case forward (rocco galati) has to be careful given the sensitive nature of the suit, so he cannot say more than he already he has.

i also want to mention that TD bank was founded in 1955–approximately one hundred years younger than the real leading banks in Canada. its inflated debt will not be “cashed out” on the Bank of Nova Scotia, as they originally planned.

they were seeking to use laws dating back to Acadia, which are responsible for the “interfacing” of the bank with the federal government. the disparities in typical between the Bank of Nova Scotia (given that it “holding the gold”) and ponzi banks like TD, you can see why they’d need a *lot* of overvalued debt in order to execute their plan. from what I have seen, BNS was originating energy loans where disaster scenarios were priced at $30/barrel for two years (maybe two years was a little low on duration, but they have the right idea):

http://www.wsj.com/articles/canadian-banks-cap-strong-earnings-season-amid-criticism-over-reserves-1456869318

why didn’t/won’t it work? well, i believe we’ll all learn that together when the time comes.

folks, consider some facts, then make your conclusions.

I live outside Toronto. a home I bought in 1995 for 200k is now 650k. while I should be overjoyed, I worry about my kids and others their age.

I will present you with facts, of friends or their kids who have recently purchased in the last 2 to 3 years.unfortunately I cant leave names.

1) young couple #1. makes 100k gross income bought a home for 800k, mortgage of 725k.

2) young man age 27, owns 3 condos. renting 2 of them, unable to brake even. he says that the prices will go up then he will sell.

3) young couple #2, part time jobs – total income 40k, just bought a home. mortgage of 375k. parents gave them 40k as deposit. the kicker – parents took out a HELOC!

4) young man age 29 owns a home, dad is paying the mortgage. dad unable to retire because of this.

5) I know of 4 couples who own multiple properties. they are not millionaires or business men/women.

I can go on and on – these are cases I know of.

what if rates go up 1%?

what if Canada goes into recession?

what if the Chinese who are just tipping the scales really that pushes the price up. they are still a small % of buyers.

my thoughts? I believe in gravity!

good luck to all those who extended themselves and can’t sleep at nights.

cheers!

I’m a little concerned with the term ‘shadow banking’ which to me implies unregistered, opaque, quasi- criminal banking.

The Canadian lenders are corporations and are regulated and audited.

That’s why their numbers and comments are in the article.

With the five Canadian banks operating as a cartel, it is not surprising that there are non-bank lenders.

The use of the term ‘shadow banking’ to describe both Canada’s and China’s alternate lenders might lead someone to think they were equivalent.

No one including the Chinese govt knows the size of its truly shadow, i.e. secret banks.

And so far Canada’s non-bank lenders aren’t requiring nude photos of young female co-signers to use as blackmail if payments aren’t made.

What’s your point?

If it’s not apparent from what I’ve said it won’t be apparent from anything I say.

I’m in Vancouver. It’s blowing up in real time. Shock and awe is how I would describe the mood in the real estate industry.

Regular people are still in denial but fear is setting in.

“Blowing up” real time? Price hasn’t dropped, has it? Last time I checked, it’s still up double digits year to year.

Look at the collapse in volume over the past two months. Sales are not happening because buyers suddenly aren’t interested in paying inflated prices, and sellers refuse to lower them. That’s a classic initial reaction when the market turns, every time, everywhere. Prices have essentially been flat on a monthly basis. But transactions aren’t happening.

Also this type of “No deposit 6-12 -24 months, no payments, no interest charged” Frequently vendor underwritten, third tier finance, is effectively a last gasp of air, pushed into an about to deflate bubble.

It is very Dejavu in the apartment and property market. if you know the global apartment, and for that matter, machinery and auto, boom bust cycles.

Signal or noise?

I guess we won’t know for some time.

Double hit for Vancouver market with the new Fed stress test rules on insured mortgages and the new 15% tax for non Canadians buying Vancouver real estate. The latter is huge for Vancouver with all the Chinese money pouring in. Early days still, but sales volumes down sharply, home price index down 1% month-over-month and sales to new listing ratio dropping rapidly. Self induced collapse from my perspective.

I’d like to ask a quick question.

In Spain I observed during their housing bubble (which they are attempting reinflating) most municipalities spent like drunken sailors, often using projected revenues from property taxes and junk fees to obtain long term loans to build what my Israeli friends call “Stuff we don’t want and don’t need”. Once the music stopped, the cycling paths, the public parks, the futuristic council houses etc were simply abandoned as terrified banks turned off the spigots overnight or went under (and were bailed out, but that’s another story).

Have the City of Vancouver and adjoining municipalities used the windfall from this stupendous housing bubble wisely, for example by building up funds to be tapped into in times of lean cows, or have they simply spent every penny like there’s no tomorrow?

Thanks!

Given Vancouver’s well-deserved reputation as the flakiest city of the Pacific Northwest, you can well guess what has happened. The Mayor of Vancouver, His Worship Mayor Moonbeam, aka “Gregor Robertson”, poster child of the Tides Foundation, has busied himself with such progressive projects as the re-introduction of chicken coops to residential areas of Vancouver (but no roosters, mind!), and the construction of endless miles of empty, rain-swept bike lanes, which nonetheless have succeeded in their intended purpose of causing maximum frustration and congestion for motorized traffic in the self-proclaimed world’s “Greenest City 2020”. In terms of personal conduct, Moonbeam has taken his cue from another Canadian mayor, Rob Ford, in disgracing himself by separating from his wife of decades and cavorting very publicly with a woman young enough to be his daughter, Wanting Qu, a native of Harbin, PRC, who by profession is a rock star. Ms. Qu’s mother has been convicted of corruption in China, where she faces the death penalty. But progress doesn’t stop there! In terms of inflation, Vancouver’s property taxes have been very progressive, in some cases going right through many of Vancouver’s leaky roofs.

“The pundits have been raising red flags on the Canadian housing market for more than five years – and have been consistently wrong,”

That includes Mr. Richter yourself. You have been predicting a crash for how many years? The market kept going up. The Canadian market is indeed totally different from the US which you have consistently tried to drew parallels. Please don’t put any spin on the mortgage market. In Canada, 90+% of the mortgages are held by the big banks on their balance sheets. They are not securitized like the US subprime which are sold around the world. Most mortgages are conventional, meaning homeowners have more 20% in equity or the Canada Govt insured the mortgages.

I’ve been documenting the bubble for a couple of years. This summer we started documenting the decline in Vancouver. Everyone who promised that Vancouver would not see a house price decline is now directly looking at it.

Some other cities in Canada have already experienced house price declines.

All bubbles will eventually deflate, but I focus on the data and show what is happening – on the way, and on the way down. I rarely make grand predictions myself, though I might quote some folks every now and then.

Note: bubbles are bullish by definition (prices rise) – until they deflate.

Wolf –

Maybe some hard data would help.

NHA Mortgage-Backed Securities

Currently as of 2016-09 (latest data) there are listed 88 Canadian issuers of Canadian mortgage-backed securities, in 11,666 pools valued in the amount of $441,430,783,163.75 CAD

To those that think Canadian mortgages are not packaged into derivatives (mortgage-backed securities) please do your “due diligence” in a little more depth. This info is out there in the public realm for all to see.

https://www.cmhc-schl.gc.ca/en/hoficlincl/mobase/upload/mbs-r120-current-principal-balance.pdf

Thanks!

True…Canadian banks securitize a portion of their mortgage book. But unlike US, only insured mortgages qualify for the NHA MBS program so it’s not like the Canadian banks are pawning off their credit risk. If a mortgage within a Canadian MBS defaults, its the gov’t (ie CMHC) that will be out of pocket.

Also you need to split the market “stat’s” in all the property boom city’s globally. As the apartment/condo stagnation’s and implosion’s, are hidden to some extent, by the owner occupier market of stand alone dwelling’s where there is still demand.

We have seen this in Auckland and Sydney in particular TO MANY TIMES. All these Apartment /Condo bubbles are the same, no matter the location even in Manila. Where Apartments are the only property, non native born Philippine residents can 100% own.

The promoters are running round screaming, “the sky isn’t falling, property isn’t down” as Apartments and Condos are loosing 50 + % of their previous retails sales prices (Note I say sales price, not value). In every location, every-time.

This is really past dejavu, it predictable and boring.

The only amusing part is watching those who wont listen, get slaughtered.

“The only amusing part is watching those who wont listen, get slaughtered.”

there’s nothing “amusing” about it because we’re firmly chained to them. there’s nowhere to go. that’s the thing no one GETS. there’s no finger pointing or gloating. there’s no safe “space” from which to watch and eat the proverbial popcorn because they done peed all into all your popcorn, too.

Not in mine they didnt.

I will simply sail a bit further off shore, and watch the fun whilst I fish. I dont eat popcorn horrible stuff.

Neither do I have my reserves in cash, banks, gold, or land.

24 trillion dollar bailout funny!

my dear Cheryl, these things take time.

let me give you another example.

a friend of mine got divorced 2 years ago and bought his spouse out. has a mortgage of just over 200k. This is important – he makes 125 k per year, which happens to be in the upper middle class range of income.

he barely affords a decent life. he is not a big spender – just everyday bills, a bit of leisure time with the boys etc.

you see my dear, there is a plethora of such folks around – and one day – something is gonna “shake that tree”. I think the brilliant minds call it a black swan – and when it happens – there is going to be a run for the exit. I have seen this story played in 1981/82, 1997 and the next one cometh because of the banks, not in spite of the banks. the equity in the houses will drop like a rock — the big mortgages, ah well that’s another story. Wolf is correct. he is just being kind. watch it happen as it has started.

I can tell you exactly what a 200 K mortgage costs at 3.69 % because that’s what I had when I sold in 2014- 800 per month not with taxes.

So if yr buddy is a 125 K guy he should be ok as far as that goes.

Other expenses?

yeah, he was being super kind. but i guess that’s what’s needed when the Normals come into your house with teeth clenched, insisting santa claus is still real, motherfucka. you’ve gotta talk ’em down kindly.

My niece had her condo which she rented sell about 3 months ago for 350K

it sold again a month ago for 470K -20 over list.

Just before the regs changed.

I think those guys are stuck- not only can they not flip it, I don’t think they could get 400K

BTW: seller and buyer have the same address- mom’s been snooping.

Are they chinese.

Bet you bottom dollar they have taken their profit and equity out by finance, and the finance company/bank ends up with the condo/Apartment in any correction event..

Old top of market move.

350 with a 20% down = 280 on finance.

470 with a 20% down = 376 on finance

They get a cheque for 94. And safely put it beyond reach.

They have no capital in it.

With less than 20% down they get a bigger cheque.

Your anecdote(s) do(es)n’t really underline the point(s) I think you are trying to make. Unless you don’t have a mortgage you don’t own the the home. Yes, people make money in the modern world by essentially using the double entry book keeping process to leverage property as an asset and then waiting for the progressive inflation of fiat currency to make a buck. The bad news is nothing lasts forever. The good news is nothing lasts forever. And in this case the ‘nothing’ is fiat currency, the property ‘markets’ and ‘home ownership.’ Btw if you want a counter anecdote a ‘friend’ has a 2 million dollar plus property portfolio but he truly owns his properties (free and clear, no dead pledge)… He’ll be cashing in soon before the wheels come off the global (property) ‘market’. Problem is then of course where you park the ‘cash’ which is no more real than the illusion of home ownership for the majority…

On the ‘foundations’ of fiat currency and double entry book keeping Wolf’s predictions are of course a safe bet…

at first i wanted to bite you to defend Wolf. now i want to tuck you into bed with a teddy bear and tell you to have sweet dreams and that everything will be alright. i understand, woman. oh do i! i’m scared to death because there’s no living underground anymore, and out of the way of all this that i FEEL coming.

Sorry- I should have added that this is in downtown Vancouver

The raising price of electricity in Ontario is getting out of hand. I am not sure how long people will be able to service all their debt. Raising everything, especially electricity price + Canadian currency getting ready to go lower.

http://www.huffingtonpost.ca/2016/07/21/ontario-hydro-rates_n_11107590.html

Eventually something will have to give

Basically Canada is broke. This is the reason why Canada cannot afford to build new navy ships. Ontario is totally broke and need a constant stream of revenues to pay for the interest of their debt. They had to sell part of hydro Ontario to the private sector therefore losing control of the price of electricity. Banker and financiers have moved in and are now extracting all the remaining wealth from the Ontarian citizen and Canada. Without Ontario, Canada does not have much of an economy.

Ontarians see higher hydro bills s consumption comes down

http://www.cbc.ca/news/canada/toronto/ontario-hydro-rates-1.3669731

Ontario and Quebec combined owe more than the Canadian Federal government- heading towards $1 Trillion. And like all governments there is so much off-balance sheet debt that what they claim they owe is nothing but a crude lie.

As per one of the first comments the fundamental issue is one of “home ownership” in the modern world. You don’t own your home, the bank does; unless you own it free and clear. The process of double entry book keeping by which commercial banks create money out of thin air when you apply for a mortgage is fundamentally illogical. Think back to the wild west days. If a couple wanted a house they applied for a ‘free’ lot of land and if granted via the land registry built whatever they could afford. Later, if houses changed hands they did so for ‘real’ money. Thanks to Nixon and much that went on before money has no inherent value. And thanks to modern banking mortgages and hence home ownership are also an illusion. We need to get back to a real economy. The big reset will presumably do that. Ain’t gonna be pretty though…

Even if you pay in full for a house, you don’t really own it either. A paid up house can be confiscated by the govt for other uses, it can be confiscated by the taxing authorities for not paying taxes, and finally the “value” is totally dependent on the “value” of all those other mortgaged properties. That paid in full house is never under the total control of the so called owner.

“Even if you pay in full for a house, you don’t really own it either. A paid up house can be confiscated by the govt for other uses, it can be confiscated by the taxing authorities for not paying taxes, and finally the “value” is totally dependent on the “value” of all those other mortgaged properties. That paid in full house is never under the total control of the so called owner.”

Now we are on the same page.

Which is why as the Socalists and Communists have repeatedly shown us.

land is not the safe haven it used to be for those other than lord’s who always ran the risk of sovereign confiscation.

i adore you, Miss Petunia!!!! i’ve been noticing the same thing with eminent domain around here and the TAXES!!!! –also complexity of systems and mistakes. like if the authorities fuck with you in some way (like my having two different bank accounts accidentally locked up twice for little mistakes..i’m TERRIFIED if i actually made any money or did owe those made up estimated taxes they “assumed” i owed with their own projections!!!)

i don’t trust even having “too much” anymore. i see how people lose things on little signatures or things running away from them in the fine print.

but yeah! i don’t even trust “owning” anything anymore, either. glad you said this.

So, this Bay Area no down payment scam–oops, norm–isn’t really equivalent to the article’s example, but I want to post it anyway because, as a teacher who has been dutifully saving for two decades in hopes of having enough of a down payment in hand to buy a place of my own (no matter that prices have kept increasing at speed to elude me), I was appalled to discover how down payments here are waived in toto for tech elites!

Reading the article I link to below was one of those Homer Simpson “D’Oh” moments for me–and also made me understand that my straight-ahead trust that if I worked hard and saved, then I could manage to gain the American Dream, even here, in la-la-land, was a self-delusion.

So, all of us ordinary folk in the Bay Area are supposed to come up with a 20% down payment, while competing against people who don’t even have to make any down payment at all?? None whatsoever, because, you know, nudge nudge, wink wink, they work for Google and Apple??

Wolf, do you know about these perks?? No wonder median prices here are stuck at $1,000,000+!!!

https://www.bloomberg.com/news/articles/2016-07-27/zero-down-on-a-2-million-house-is-no-problem-in-silicon-valley

The only reason those people need loans, is that they don’t have that much cash on hand now.

They are the premium bank target, the loan customer who dosent really need it. The safest, bet in a room full of bets. So the union’s are stealing the potentially best/Safest bet, loan customers, from the Bank’s.

I dont have the current information but historical those sorts of loans have repayment schedules that are simply out of reach for normal earners, especially in the first few years.

Quiet a few of the may also have employer underwriting on them.

None of this is unusual.

Banks traditionally dont like lending to new immigrants, unless they are High Income Earners ,with good employers then, all sorts of rules get bent in their favour.

Money goes to money, you should know that, by now.

The reason most tech workers can’t afford to live in Silicon Valley and need help with home financing, has a lot to do with how they are paid. Those tech salaries are quoted as high dollar figures, but they are not all paid in cash.

A $250k salary may be half cash and half in stock which is vested over a 4 or 5 year span. This is why you often hear about young techies making $150K and living in their cars. A tech worker may not stay in a company long enough to vest their first year’s compensation in its totality. The longer they stay the more of the salary they accrue, unless they get fired.

I do understand how stock options work. In my comment, I was simply registering my dismay over the standard down payment rules being waived for tech elites. I have long watched the housing prices escalate here in the Bay Area, and wondered: who has $250,000+ lying around to make the 20% deposit on those Million+ “median” houses and condos? Why, of course, “certain clients” not only don’t have to put that much down, they don’t have to put anything down–just a phantom earnest of their future wealth. I guess that’s the only way such clients can compete against the all cash buyers from China. The rest of us? We don’t have a chance. So yes, money goes to money, indeed.

This practice was also common on Wall St. where they refer to it as the golden handcuffs. There the firms would extend the credit outright against future earnings. If you want to leave you need to settle your debt to the firm.

Your focus on the Canadian problem with Shadow Banks and Dark Money is admirable but the fact is the same is going on in the lower 48 . Here in the Denver , CO market alone best estimates are some 65 – 80% of all residential homes purchased in the last 36 months have been financed by Shadow Banks [ mostly private equity ] as well as being shored up by Dark Money [ money acquired from loan sharks , pawn shops etc for either down payments or to make up the now vast difference between the selling price and the appraisal or both ] .. FYI ; These facts come directly from a Gannet investigative reporter who he , along with all his colleagues has been banned from reporting the story by the Gannet overlords due to the influence of all the Real Estate advertising dollars coming in . Suffice it to say in my opinion a Bubble awaits us on the immediate horizon as well .

I don’t have any evidence, only my observations and suspicions, but I think the big corporate renters are selling houses they can’t rent. I have seen many houses in the last few months that have the particular look of a big corporate owned house. This includes certain paint colors, carpeting, appliances, and fencing. I can’t prove they are dumping houses, but I think they are.

Here in Denver Private Equity and individual investors are at present gobbling up the majority of current rentals as well as residences to be rented like there is no tomorrow and that the boom/high rent is going to last forever . Despite I might add the fact that everyone from the NYTimes to the WSJ to Bloomberg right on down to MSNBC Financial is claiming a major real estate bust is on the very near horizon for Denver . At one point discerning buyers such as ourselves [ wife and I ] called this a hard core overly optimistic Sellers Market . Now anyone with half a brain [ including our personal banker , F/A and CPA ] are calling it an abjectly insane Real Estate market

“These facts come directly from a Gannet investigative reporter who he , along with all his colleagues has been banned from reporting the story by the Gannet overlords due to the influence of all the Real Estate advertising dollars coming in.”

Link to article?

I don’t mean to be rude and with no insult implied or intended but .. what part of they not being allowed to publish or report their findings upon penalty of losing their jobs if they do do you not comprehend ? Which is to say .. there are no links to be had in order to protect those revealing this information .Perhaps I should of made it clear(er) that the information gained was thru direct conversation [ not internet trawling ] with a friend/associate at Gannet and his two associates in strictest confidence intended to benefit my wife and I in our quandary as whether or not to purchase a home in this market that I have now chosen without naming names or even so much as implying which aspect of Gannet they work for … to share here .

“what part of they not being allowed to publish or report their findings upon penalty of losing their jobs if they do do you not comprehend?”

I didn’t doubt you. I misinterpreted what you said as something that had been released but later censored which might allow it to be found in Google’s cache. From a post below, I see that you have this from insider info.

On a previously APPROVED for release bit of news, did you hear that the Iraq war will pay for itself? Also, the inner party has promised that choco rations will definitely not be reduced.

FYI Winston . Sub Prime mortgages in the greater metro Denver area have gone ballistic over the last 16 months after the Federal Regulators clamped down on the ‘ banks ‘ overly optimistic property appraisals in late 2014 early 2015 bringing in an entire phalanx of Private Equity firms acting as Mortgage Brokers with little or no regulation in order to fill in the gap left by a whole host of under qualified buyers being turned away by Federally regulated banks

And just in case you think mine is a case of sour grapes . Our credit rating is over the moon [ 5 point shy of a perfect score ] we are as the Harvard School of Business has labeled us OWMNB [ out with money not buying ] with cash /liquid reserves on the high end of six figures etc etc etc . In other words .. we are every lender/seller/real estate agents dream .. assuming we ever finally decide to buy … ;-)

I intentionally didn’t buy a home during the 2001-7 OBVIOUS housing bubble and I’ve long been waiting for the second crash after this bubble, suspecting that there simply can’t be a third bubble after this one without destroying currencies, but I’ve been waiting a very long time now, amazed at how long they’ve been able to keep the Ponzi plates spinning.

“In the ruin of all collapsed booms is to be found the work of men who bought property at prices they knew perfectly well were fictitious, but who were willing to pay such prices simply because they knew that some still greater fool could be depended on to take the property off their hands and leave them with a profit.” – Chicago Tribune, April 1890

“Shadow banking covers 12.5% of the $1.3 trillion Canadian mortgage market.”

Gee, that’s only $162.5 billion. Why worry? ;-)

Winston –

You may very well be assured, that the amount of mortgages in the shadow banking sector have been sliced, diced, into derivative tranches and sold on down the mortgage-backed securities pipeline. Derivatives.

Who buys these derivative packages? Do you currently receive a pension? Do you bank at a community friendly credit union? Is your insurance company on solid financial ground in case you submit a claim?

These are the types of locations that the derivatives end up at, because of low/negative rates manipulated by central banks, force these other wise conservative investors into risky search for yield.

“Why worry?;-}” When the bottom falls out – look down quick to see what you are, or are not standing on!

“Why worry? ;-)”

I guess I should have said:

“Why worry? 8-)”

Or an even more insane looking emoticon. Perhaps then it would have been more obvious that I was being facetious. $162.5 billion is a great deal of money.

I heard that online banks such as Synchrony and Ally invest in toxic subprime auto and home loans which is how they are able to offer 1% interest on savings. There is truly nowhere safe to keep your money and make any kind of return. I was hoping my local credit union was safe but it sounds like, alas, it is not.

Winston –

Check the link in my post above about the current months totals for mortgage-backed securities. The $162.5 billion you mention is peanuts compared to the notional total that is hanging over everyone’s heads.

Realist –

Click on the link above to a pdf document, which lists all those financial organizations (88 in all) that issue MBS derivatives. You will find many credit unions listed. Is yours there? If so…

Contained already!

Mark Carney with an assist from the queen!

How much gold will my lord require?

Again, the “Canadian” government has a very simple plan to keep the housing bubble well inflated:

http://news.nationalpost.com/news/canada/chris-alexander-announces-tory-leadership-bid-wants-canada-to-boost-immigration-to-400000-a-year

How many immigrants into Canada from 2000 to 2015?

Year……,# of immigrants

2000…….227,455

2001…….250,638

2002…….229,048

2003…….221,349

2004…….235,824

2005…….262,241

2006…….251,642

2007…….236,754

2008…….247,248

2009…….252,172

2010…….280,636

2011…….248,748

2012…….257,903

2013…….258,953

2014…….260,404

2015…….271,660

____________

Total……3,992,720

The estimated population of Canada in 2015 was 35,749,600.

In addition to foreign housing-market speculators, why are Toronto and Vancouver’s housing markets so hot?

http://en.wikipedia.org/wiki/Immigration_to_Canada

From the above:

“Immigrant population growth is concentrated in or near large cities (particularly Vancouver, Toronto, and Montreal). These cities are experiencing increased services demands that accompany strong population growth, causing concern about the capability of infrastructure in those cities to handle the influx.”

What is “our” Big Business-controlled government’s plan to deal with all of the myriad of problems created by such high immigration?

Cut corporate taxes, cut government services and cut the number of government employees. Let the “free market” determine everything ……………. EXCEPT the number of immigrants that Big Business wants in order to keep labor costs low and the housing market from collapsing. For that, “We” need a plan!

http://news.gc.ca/web/article-en.do?nid=851049

From the above:

“May 23, 2014 — Toronto — Today, Canada’s Citizenship and Immigration Minister Chris Alexander met with business leaders in Canada’s financial capital to discuss plans for a new immigrant investor pilot program that will make significant investments in Canada and fuel the growth of our economy.

The government is seeking advice from business leaders across the country on the key elements of a new Immigrant Investor Venture Capital pilot led by Industry Minister James Moore. Today’s meetings in Toronto are the first of a series of stakeholder roundtables that will be held in Halifax, Montreal, Calgary and Vancouver over the coming weeks.

These roundtables will advance the government’s proposal in Economic Action Plan 2014 to terminate the outdated federal Immigrant Investor Program (IIP) and Federal Entrepreneur (EN) Program, eliminate their longstanding application backlogs, and create new innovative pilot programs that meet Canada’s economic needs.

………………….”

“Free market economy”?! B. S.!

And, on a perfectly-related topic, how is “Canada” going to reduce its total greenhouse gas emissions and reduce water pollution and reduce its energy consumption and reduce hospital emergency room waiting times, etc. etc. while at the same time Big Business orders its political slaves in Ottawa to INCREASE “Canada’s” population, come heII or high water (or human-race-eradicating high temperature)?

And the $ 18 Billion Federal Deficit we had last year before Baby Trudeau took over as Prime Musher is now $ 30 Billion and climbing with more “drunken sailor on shore leave” spending to follow. I think he took lessons from “Bab” Rae and the fustercluck he made of Prov. of Ontario’s finances back in the early 90s as Premier.

Not sure if I should be using the rose colored glasses or the beer goggles these days. (roll eyes)