Spending the same to end up getting less.

In all the hoopla about consumer spending – which accounts for about two-thirds of the US economy – and how lethargic its growth has been, despite some months when it perked up and gave rise to hopes that “escape velocity” would finally kick in, something got lost: how totally range-bound, for the past four years, discretionary spending has been.

This measure of discretionary spending excludes household bills and major items such as cars or homes. It hasn’t budged in dollar terms for four years, despite inflation eating into the purchasing power of the dollar.

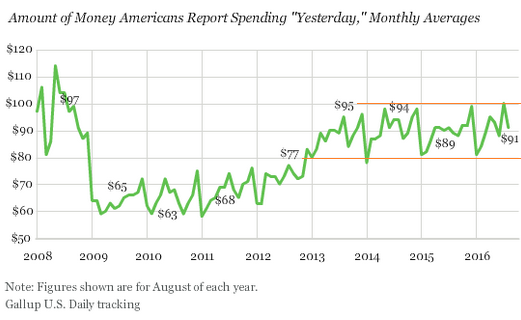

In August, spending by American households dropped once again, according to the Gallup US Daily survey released today. As part of this broad survey, based on telephone interviews (60% cellphone, 40% landline) conducted in August of over 15,000 adults, Gallup asks how much they spent “yesterday” on items excluding normal household bills and major purchases such as a home or car. Gallup calls it an “indication of discretionary spending.”

So in August, the tally dropped to $91 spent “yesterday,” from $100 in July. Keep in mind, this includes households with more than one earner and/or more than one spender. In terms of the prior three Augusts, that was below average ($92.7):

- 2016: $91

- 2015: $89

- 2014: $94

- 2013: $95

But it was up from the Augusts during the catastrophe years of the Financial Crisis:

- 2012: $77

- 2011: $68

- 2010: $63

- 2009: $65

And it’s still down from August 2008, when it was $97! The data series started in 2008, so this is as far back as we can compare. But it sure would be interesting to see comparable numbers for August 2006 and 2007, before the Great Recession kicked off.

In the four catastrophe years between 2009 and 2012, spending in all months ranged from $58 to $77, when households, hit by the ravages of unemployment, had tightened their belts on discretionary items and focused instead on the things they had to take care of.

Then something happened, and households opened their wallets, and spending broke out from that range. Since December 2012, the range has been between $80 and $100.

In July, when spending had jumped to $100 once again, there were hopes that this time, it would break out, that households would finally start to splurge, but those hopes were once again dashed in August, when spending on discretionary items fell back into the four-year range again, and below the August average of the prior three years.

I have added the two red lines to Gallup’s chart to delineate just how stubborn this four-year range has been:

These spending dollars are not adjusted for inflation. Despite all the deflation fear mongering, inflation since December 2012, as measured by the Consumer Price Index for all urban consumers, amounts to 3.8%. Thus, consumers have spent within the same range only to end up buying less as they’re getting less for their dollars. A quagmire.

But, but, but….

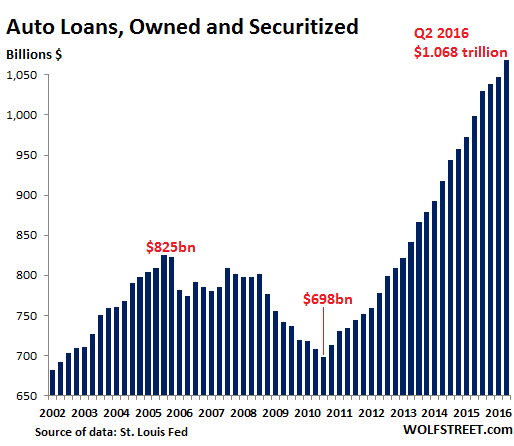

Consumer spending overall has increased over the period. So what have consumers been spending their money on? Well, the other items: household bills such as soaring rents, and major purchases, such as cars and homes, much of it with borrowed money. Auto loan balances outstanding, for example, encouraged by ultra-low interest rates and loosey-goosey underwriting standards have soared to $1.068 trillion by the end of the second quarter. New vehicle sales in units might be down this year, but given the higher price tags and extended loan terms, auto loans are decidedly not:

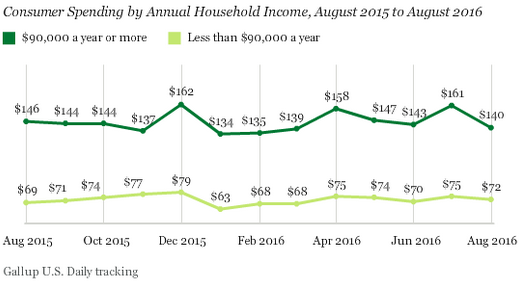

Gallup provides some more detail by household income:

Both higher- and lower-earning Americans reported lower spending on average in August than in July. The drop was more pronounced among Americans whose annual household incomes are $90,000 or higher, whose self-reported daily spending average fell $21, to $140.

That’s $6 below August a year ago!

Spending dropped less in August among Americans whose annual household incomes are lower than $90,000. Spending among this group dropped only $3 to an average of $72.

And that’s up $3 from August a year ago.

Many of the households earning less than $90,000 are still making far above the median household income in the US of $53,657 (2014, Census Bureau). Even on average, their spending on Gallup’s discretionary items has been in a very narrow range over the past 12 months, as “splurging” for them means something entirely different than for the top earners:

Gallup puts it this way: “The average for spending in August is still on par with the 2016 average so far, and remains healthy compared with sub-$80 figures from 2009 to 2012.”

And this is how far escape velocity has been reduced to a sad joke: To show improvement, you have to compare spending to the catastrophe years of 2009 through 2012, and compared to those years, household spending on discretionary items is “healthy.”

But it has stagnated since then in nominal terms and declined in inflation-adjusted terms, as non-discretionary items, such as soaring housing costs, have eaten an ever larger slice of household incomes, and as major debt-funded purchases, such as cars, are setting new records, if not in unit sales, then at least in terms of debt accumulated.

But in terms of rents in some of the largest markets, there may be some relief on the way. Read… It Starts: Rents Drop in 10 of the Top 12 US Markets

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The feds benefit from zero percent interest rates and for those who managed to do the right thing by saving for retirement we end up financing on own ss benifits by not getting interest on our savings. Uncle Sam is not our freind. We the people for the people? my Ass! You can say the same thing about medicare. The feds pay 850.00 each to the insurance companys and they take 121.00 each from our ss check and we pay 69.00 each for supplemental insurance and still we are the hook for the first 4.000.00. Thats not insurance! Again we pay for it with zero % interest on our savings.

Stop paying for all the extra insurance. If you ever get sick the govt will sue your estate for everything you own. You should divest yourself of your house if you own. Buy a house under your kid’s name and rent from them, it is the only way you will be able to pass any assets to them if you die from any illness. Get all your assets out of your name before they take everything.

Excellent comment. I often comment to friends/beer drinking buddies that modern healthcare is an elaborate attempt to strip mine the baby boomer generation of any remaining assets.

Regards,

Cooter

Miss Petunia-

Wow. there you go AGAIN…

you are one of those geniuses who knows too much and ends up gnawing on the edges of furniture to keep from punching folks in the face, huh? that was brilliant about the gov’t suing because i’d already heard that was happening here with old folks in their old (valuable) homes and how the gov’t could put a lien on a house until the kids’ paid their parents’ outstanding medical bills.

and then this what you wrote about climate change being bs. i’ve gotta admit that from everything i’ve learned or known, it doesn’t sound like a wacky conspiracy theory because NOTHING does anymore: “They paid a bunch of college professors to write research to support the idea of global warming. This is the research they are always pointing to as proof of global warming. When they got outed as liars because the earth wasn’t warming, they changed the meme to climate change. It is all a way to tax everybody, by forcing companies to buy climate derivatives as a ransom, to do business.”

and i’m sorry about the florida salt rings around the palm trees. worse than getting a thread wrong is that it’s anecdotal to even THAT. if it was you, it’d still fit under what you say about managing waters.

See…nothing is broken, the system works just fine

I think buy under children’s names and renting won’t work. The Feds now go after the children for the parents bills. But getting assets out of your name is the way to go.

Better yet, do NOT get sucked into the big pharma 5 by 50 (five prescriptions by the time you’re 50) scam. The entry is high blood pressure, high cholesterol and diabetes. All of these can be dealt with via alternative health practices, especially diet.

Stay away from doctors, eat organic whole foods, get enough sun, sleep and exercise. You’ll never need an md, except for a car accident. That’s all they’re good for anyway.

If you move your assets some years before you get sick they can’t go after the assets. I used to be 2 years, now I’m not sure. They can’t sue children for the parents assets unless the children agree to pay the bills in advance.

BTW, my dead inlaws are getting sued by the state of NJ. This is the state where Gov. Christie gave Trump a 25M break on back taxes. That 25M could have gone to medicare.

Changing around a Robert Hall commercial of the 1950’s to describe the stock market.And the prices go up up,up and the values go down,down ,down

https://www.youtube.com/watch?v=ZJ33DWK2Ids

Politicians and central bankers: you gotta love ’em. Tax people higher. Get them into debt right up to their credit limits. And then complain bitterly that they won’t borrow money and spend more!

well the long and short of it is i don’t have any discretionary money to spend……I’ve been whittling away at savings for normal life spending for 6 months now.

2 more months and it’s going to start eating into my retirement.

It’s an asset pump and dump orchestrated by the FED on behalf of their employers self interests, same as it ever was.

I don’t even know where to start with these numbers. I think Bill Gates must be one of the respondents. I understand this is a snapshot and should average out over time but the numbers seem way to high to me.

Here’s my snapshot on spending, last weekend went to the outlet mall, spent $50 in two stores and left. No point in even browsing and yes, I did need the things I bought.

Last week, accompanied my son to the school bookstore where I spent $476 on two books, which will take me six months to pay off. I was one of several moms accompanying their adult children, in the book store, to pay for books. This was my discretionary spending for the rest of the year.

Petunia – could you not rent the books for the semester? My kids started doing that when the prices got so outrageous. They also shared books with other kids in the class and then studied for tests together. I know these ideas are not always applicable and I HATE what the college book bandits get away with…….

Renting is only about $20 cheaper. He can get more back selling the book back to the school, hopefully. So including the resale amount, it is cheaper to buy new.

you can get a lot of textbooks pirated online. My daughter used to go to the library and read the books instead of buying them. course books are usually on reserve…

Don’t you guys (everyone in your entire household) buy food, medications, gasoline, household items like toilet paper, detergent… and get haircuts, go have a drink, get the car fixed, get new prescription glasses or contacts….

I consider gas and grocery shopping part of the monthly bills. We have to spend that, we have no choice, it is not discretionary to us. As far as medical expenses, I have needed glasses for almost a year and was about to get them, when my son needed the money for books. I bought readers at Big Lots instead for $5, not too bad. My husband gets the monthly haircut, my son and I wait. We ate out for our wedding anniversary and my birthday, it was my gift.

This is how a middle class family lives these days. I grew up in a working class family, my father worked a union job, and things weren’t this bad.

You always pen interesting view points that are so on target that most just can’t grab.

Ok…I will divulge my location…Key West. The folks that have had the silver spoon of the Fed money in glod spoons to feed from have been buying up the town. Now please tell me why a brand name family name ‘bandaid” company needs 12 houses in this town that sit empty quite seriously 12 months out of the year of a population of 25,000? Why milti-family are turned into single family and sit empty. Why a house renovated last year is being renovated this year and no on has lived in it one day? And, has been this way for at least 4 years. This is everywhere here, to the point that ‘the service people’ are living in row boats off shore (like in Nassau) and suffering the harassment of this state because of complaints by…well guess who?

Now we have a new problem, not that there are not 1,000 still unsolved after 40 years of the same old yak from the elected. The NAVY, God bless them, SOLD off the properties that the US tax payers bought, which housed maybe 50% of the Navy off base, to a company in the UK,. The NAVY, God bless them, NEVER told the city about even offering the property for sale…so hush hush it all was. And Folks, you had best look at your home town and see if this has happened to you. BECAUSE they don’t pay real estate taxes, because of a sweet deal on the ‘ownership” !!!! BALFORE BAITTEY… There many even be some American names in that stock holder list.

So OK, all this US tax payer property was sold off with no one knowing not one damn thing about it. Fast forward two years..the NAVY,God bless them, wants to house some Star Treck unmanned mega plane DRONE called ” Trident’…you know like the nuclear sub, right here in crammed to the rafters Key West. Well that bird takes 900 Navy guys ( God Bless the Navy) to do the up-keep. 900 more families…not single men. There is no place to put them since the Navy sold off the housing to ….corporationishion. NO PLACE TO HOUSE THEM!

Should you even be surprised? Why!

If you come to Key West, please tip well or stay home. A two bedroom in a closet of a house or ‘multi-unit’ will set you back 3 grand. and IF you want to rent it for a week….DRUM ROLL…$22,000 right smack on Southard across the street from 5 Brothers where the local police hang( God bless them too, they are the best).

GO somewhere else. YOU have destroyed our town, our reefs, our fishing, our sober husbands, and leave your plastic trash on our roads, beaches, and in the guts of the fish. But you left your pennies behind and that we shall bow down and kiss the earth for….right?

meme Imfurst,

I was in Key West 2 years ago and I couldn’t get out of there fast enough, even though the drive down from Miami was great. My first trip to the keys was in the 70’s when it was still a great town. I know the navy base you are referring to on one of the keys. The developers have wanted it for decades. Now the navy will have to rent it from the brits.

Petunia & Meme,

I grew up in Fort Liquordale, I mean Fort Drugdale in the 70’s. The partying was great, but I couldn’t stand the endless sameness, tourists, demographics, and screw-everybody mentality that I saw all around me even way back then.

But I absolutely LOVED going up and camping on the beach in Jupiter and down in the Keys.

SO SAD ABOUT THE KEYS AND KEY WEST. I have always had them on my Best Places to Retire List, but not at those prices.

P.S. Now your screen name makes EVEN MORE SENSE.

Jupiter is still a very nice town, great beach, and seafood restaurants. Just don’t go below Palm Beach Gardens, which is also nice, great mall, shopping, etc.

My discretionary spending for the last couple of years has revolved around prepping, long term food storage, guns ammo, TP, water filtration, food dehydrator, silver, last month I spent about 600 on long term supplements, as well as good tennis shoes, and yes I still go put to eat and see a cheap movie once in a while. This month my plan is solar power, not huge bit enough to run my collidal silver generator and keep the short wave radios powered up. The reason I am onto this is I think our economy is going to crash big time. Driving around Tulsa everyday is like Sunday traffic, it bizarre for anyone paying attention, and also as a housekeeper I see first hand that no one has any food, the 3 day estimate is wildly exaggerated people I know have no food.

Just a note to preppers based on the Baton Rouge, Louisiana disaster, now called the Great Flood of 2016. The flood was wide spread and went further and higher than ever recorded. ATT lost the ability to service mobile calls early on, their substation was flooded. Power went out over much of the city. If food was stored in freezers, it was lost. If your house got flooded, all supplies were lost. Don’t count on FEMA they still haven’t collected the debris in much of the city. They also were not the ones to evacuate or shelter people. It was mostly neighbors, churches, and local law enforcement. Keep a bag with food, water and important papers handy, maybe a change of clothes. That might be everything you can take if something bad happens.

I have learned so much from prepping, like how to preserve fresh vegetables when they are on sale. Not to long ago Sprouts market had on the vine tomatoes on sale for 48 cents lb. I bought 24 lbs and chopped them up seasoned with garlic and Himalayan salt and dehydrated them. I got about 6 quarts of wonderful tomatoes I use on pizza, sauces, or just eat plain. Someone brought me a half a bushel of fresh porter peaches and I dried them. It’s a great way to save money and make wonderful food. And no matter what happens no one can take the knowledge away.

Sounds delicious.

I remember borrowing books in college and taking them to a copier. That was in the early 1980s. Get the pages I needed copied. College txt books can be a pretty big expense and are often a rip off. I had all kinds of ways to cut costs.

With a cell phone these days you could probably take pic of every page needed in pretty short order.

Having taken college courses recently (I graduated with my BS in the 90s) the books are one vector by which they separate as much money as possible from the students. A couple hundred bucks isn’t abnormal. The publishers version the books very regularly, so chapter questions and such don’t match up, requiring a whole new batch to be bought. They do this to combat the secondary market.

Typically a book/edition will circulate for a year, maybe two, then it will be replaced. The last accounting book I had was “Principles of Auditing and Other Assurance Services, 19th Edition” circa 2013. The 15th edition was from 2006.

Amazon had it new for 290 and used starting at maybe 20, but I doubt it is being used anymore. I bought mine for 80 in 2015, the same year they released the 20th edition.

If there isn’t sufficient supply of used, both the used costs go way up and sometimes new is the only option. As the used inventory goes up, prices go down, but they push out a new version and reset the timer.

Let’s face it – how many books really cover subjects that change so drastically as to require a new edition every two years? Did the principals of auditing really change that much?

So, the students who get these books towards the end of the revision cycle are stuck with a book that has declining demand and lower resale value (if any).

That said, it is much more common now to get web based stuff that goes with the book as well (i.e. a key for an online account at the publisher – typically good for a period of time roughly equal to a semester). This account is required for online assignments up to and including midterm/final testing, all of which is provided by the publisher.

My complaining aside, I do like some of the online tools and feel if I am getting value for my subscription I am much less prone to complain. I really liked Wiley in that regard.

Anyway, it is just part of the overhead of going to school these days.

Regards,

Cooter

Ha Ha Ha ! – Love it…. Yah, $400. for two books is amazing. I finished school in ’90 and $200. for all my books for 1 full semester was a good deal, most were used.

I guess a LOT of people go to the store Every Day ! I don’t think I got anything for 2 weeks, except for food. I did an oil change 2 weeks ago $20 for the oil, and $20. for 3 filters…. 1 this time and 2 more later. I get them that way as to avoid wasted trips for 1 item, in 1 direction…. I’m 55.

Right, there must be a buncha Gates’s in there to really help in averaging out all the zeros….. But then, they don’t call me for the surveys…. The never call me….

Wolf – all of the above every month except drink at home – cheaper! Number one item that has increased astronomically over last 5 years is food. And here in Oklahoma almost 10% sales tax on everything.

Stagflation. In spades. There will continue to be inflation in everything we need because the Fed is printing money. There is deflation in everything we don’t need and used to want.

This can go on for a very long time economically. Socially, not sure where the break point is.

Look at how small a cage a canary can be kept in and still wish to live one more day. Get on that ‘smart phone’ (while driving PLEASE) and all the care of living vanish on that Facebook page.

Are you talking about something like this? I must warn you that all fatality crashes are disturbing to view so sensitive folks should probably skip this. There are some trucker sites like CDL Life and LiveTrucking where I cannot bear to watch the crashes, because I see enough as it is just moving down highways of America.

Putin’s Official Limo Involved In Gruesome Crash In Moscow, President’s Chauffeur Killed

http://www.carscoops.com/2016/09/putins-official-limo-involved-in.html?m=1

Some “KID” in his 20’s driving 60mph cuts into my lane and pushes me on to the emergency pavement. I blow my horn to wake him up. He gives me the finger and returns to ‘texting’.

The only reason you can STILL text while driving a car or truck is because some corporation wants it to stay legal.

Thank God for you at least having some emergency shoulder, we sure would be sad if something were to happen to you. You folks are all pretty darn awesome, be safe all and I’ll read you when able. Off to Arkiefornia to p/u and then to University Park, IL…

Marty is an inspiration, like Hillary Clinton should seek him out, the doctors seem to be messing her up. Like more toxic… ttyl

Lies, damn lies and statistics.

Some days I feel like I time-travelled far, far into the INFLATED future.

According to PEW and Wolf above, median household income has increased from about $41-42k from 1970-1980, and then to $53,657 in 2014. So about a 27% increase in 44 years.

The number of hours of work for this income (according to the BLS from ’75 – ’95):

“Trends in hours of work since the mid-1970s.

Although there has been little change in the average number of hours worked each week since the mid-1970s, the proportion of persons working very long workweeks has risen, and there has been a growing trend toward year-round work among women”

–> http://www.bls.gov/mlr/1997/04/art1full.pdf

And according to Gallup our average workweek increased to 47 hours in 2013 (before ObamaCare):

–> http://www.gallup.com/poll/175286/hour-workweek-actually-longer-seven-hours.aspx

Meanwhile by my simple calculations the cost of most things have gone up 500% – 1,000%.

As my first example (to cover food, farming, agricultural science, automation, distribution, improvement in modern management, etc. …)

… let me present the unchanged BIG MAC = Perhaps one of McDonald’s most iconic menu items, the Big Mac has experienced a drastic price change over the years. From 1968 to January 2015, the price of a Big Mac jumped from around $0.49 to $4.79, according to Desert News and The Economist = 978% Inflation.

There is no doubt that autos are still a HUGE part of our economy so for my 2nd Example, a BASE 1970 FORD MUSTANG HARDTOP (without options) = $2,822 MSRP -VS- the BASE 2016 ECO-BOOST (lowest model and again without ANY options) = $25,390 = 900% Inflation.

For energy, let’s use the average residential KWH cost in 1970 @ $2.20, 1980 @ $5.40, 1990 @ $7.83 and 2011 @ $11.80. Hey, WHAT A DEAL! If we use 1980 we only had 218% inflation.

For shelter, let’s use the median cost of a new home in 1970 @ $23,000 and in 2014 $188,900 = 821% increase.

For fun, let’s use the average cost of a movie ticket in 1970 = $1.55 vs. $8.66 in 2016 = only 560% inflation.

Of course, to be fair I would have to offset all of these by the HEDONIC improvements in all the other areas of our lives, like how much better life is with 500 channels of Cable TV, Facebook, Amazon, Google, ATMs, electric wheelchairs, less chance of nuclear war (but might have to think about this one), 24 hour shopping, etc.

A very financially astute friend of mine (in college he kept a log of current beer prices, by brand and store, per ounce) pointed out some eye-openers for me at the time. It was the early 1980’s and he pointed out how the cost of living was rising and how many families had become two-earner households by necessity, not choice. The only choice left to most regular folks, in an attempt to maintain the American Dream lifestyle, was the increased use of credit. He was spot on and we know how the song played on. And now a lot of folks are played out.

We have skated on thin ice for a long time now. Either the central bankers are truly geniuses of the first order and can keep juggling chainsaws indefinitely. Or the CBs have a tiger by the tail and no idea of how to turn it loose.

@Chris from Dallas You are calculating your inflation rates wrong. You need to subtract 100% from all of your total increases in inflation rates. So a big mac would have 878% inflation for example. Your point is still valid though.

Welcome to what happens after 35+ years of trickle-down/supply-side Satanomics.

This is the real story of economic stagnation in the west as globalization and neo-liberal economics has out sourced jobs and cut wages in terms of inflation and practically. Private debt, businesses and households, is close to double that of the public sector, governments, and has reached a saturation point. The economy cannot expand unless debt also increases under the current monetary system. If debt is being paid down then the economy shrinks correspondingly. Pre 2008 debt was increasing by about 15% per year. Post 2008 debt was actually being paid down but has seen a modest increase in America as the population begins to borrow again but at substantially less levels than pre 2008 levels. This means that economic growth will not attain pre 2008 levels of growth and if debt fueled spending decreases, especially at the base economy level of necessities, then recessionary forces will prevail and an economic slow down will result. Two primary exits to this situation exist. One, a lengthy depression until private debt levels are substantially reduced, through bankruptcy and pay down, as happened during the 1930s or some form of debt jubilee takes place with perhaps debt free ‘helicopter money’ being issued and directly programmed to paying down private debt. There is a third ‘rail’ type of option being the reform of the monetary system wherein debt free money positive numbers are injected into the economy by government issuance on infrastructure or social programs to counterbalance the negative numbers produced under banking debt-money negative issuance. This was the system practiced in Canada from 1935 until 1974, with an average ratio of 35% – 65% debt free to debt money numbers, which built the national social and practical infrastructure despite its small population. Post 1974 the Bank of Canada entered into the BIS system in a much larger way and the Canadian total debt has grown astronomically in all sectors of the economy, private and public.

https://www.youtube.com/watch?v=KIaXVntqlUE

“The economy cannot expand unless debt also increases under the current monetary system.”

Welcome to page one of the manifesto for the Central Banks. The whole idea is to make you spend what you can’t earn, and make ‘saving’ an anti-American activity.

I am so glad to read that EU countries and now some Asian countries are seeing the horror of these proposed “trade agreements” which only help corporations and NOT countries or their people. Shameful Politians we entrusted with our futures have done their best to enslave us..

Miss Petunia-

damn, you are a courageous fearless woman to be so naked about your financial situation. americans tend to keep things vague so they don’t feel like they’re backsliding, til there’s no choice but to scream in agony or rage.

i’ve quit haircuts, too. working with my wild and natural curly big hair thing. i wear contact lenses for 4-6 months instead of one before tossing ’em out. my only girly indulgence is keeping my toenails and fingernails painted.

i joke that i’m working out and lifting heavy weights to “get ready for the revolution,” but it’s actually kinda true. i don’t trust doctors at all anymore, and through lifting weights, i’m able to do all sorts of things i’m not supposed to be able to do “physically” with my bad knee, bone touching bone. musculature is strong enough to bypass the typical agony.

and i see how people treat old folks, poor, indigent, mentally weak in america and i figure i’m gonna get old fighting.

i saw this homeless woman preacher in a wheelchair across from the supermarket, with cracked teeth and gorgeous painted nails. the cops came and took their tent and they were waiting to be taken somewhere.

she was old. and she sweetly said to me, “but honey, i’ve been preparing this for my whole LIFE.”

she knew this was all bigger than her. she had church services with other homeless people in a coffee shop near the grocery store til they cleared her tent away.

Miss Petunia, your grace and audacity reminds me of her.

One of the reasons I am so open about my financial situation is that the financial press is worthless and has sold out to corporate interest. I got tired of hearing I lost my home because I bought a house I couldn’t afford. I bought the house with a 40% down payment and lived in it for ten years before I couldn’t afford it. I was also not the only one in the same boat. I got tired of all the financial propaganda. I’m still tired of all the financial propaganda. No, the economy is not great. It is great for some people. Yes, I resent immigration because it is taking away our jobs. I just paid my no contract phone bill and the store had a sign, in Spanish, that they were hiring bilingual only. We live in the deep south and don’t share a border with Mexico. That is just ridiculous. Somebody had to start telling the truth about what is going on. So here it is.

petunia

solve your problems move to canada we let anyone in and we have the best social programs in north america

free housing food medical and education if you qualify also we are very nice people

vancouver has help wanted signs everywhere we need way more people

you will love it here best weather and great restaurants and shopping malls

plus we control our guns and we have a way better looking leader than you guys have ever had.

Nice idea but immigration to the North/Canada is not that easy.

very easy take a course at any college that will let anyone in hundreds of privates colleges here in bc alone

you do a 2 year program pay the bill apply for permanent staus gauranteed your in .

i know tens of people that are doing just that cheapest and easiest way to get into canada

come claim your loot we have tons of social programs

Why are Central Banks around the world making a complete hash of everything?

There are housing bubbles around the world that anyone with two brain cells to rub together knows will collapse with terrible consequences.

What is the problem with Central Bankers?

They are all neoclassical economists and being an expert in neoclassical economics means you just don’t see a lot of things especially bubbles.

The neoclassical economist assumes the market is rising to a new stable equilibrium because this is what their economics tells them.

They don’t realise the market is rising to an unsustainable level and it will then fall off a cliff as it goes through a “Minsky Moment”.

Irving Fisher looked at the debt inflated asset bubble after the 1929 crash when ideas that markets reached stable equilibriums were beyond a joke.

Fisher developed a theory of economic crises called debt-deflation, which attributed the crises to the bursting of a credit bubble.

Hyman Minsky came up with “financial instability hypothesis” in 1974 and Steve Keen carries on with this work today.

2005 – Steve Keen sees the private debt bubble inflating

2007 – Ben Bernanke can see no problems ahead

It gets worse.

Neoclassical economics assumes one person’s savings gets lent out to someone else and so debt can never really cause any problems.

This is not true and so our Central Banker’s do not really understand money and debt and you start to see why they let debt reach such ridiculous levels.

They don’t know what the problem is.

Money and debt are opposite sides of the same coin.

If there is no debt there is no money.

Money is created by loans and destroyed by repayments of those loans.

As you are going into your housing boom, everything looks great because there is lots of new debt and lots of new money is being created which feeds into the general economy.

The good times are here again.

All you are doing is inflating the price of things that exist already with debt.

You head into your unsustainable boom and the neoclassical economist thinks everything is rosy.

He is not looking at debt in the economy and assumes the housing market is heading to a stable equilibrium.

Eventually you go through the “Minsky Moment” and the bubble bursts.

The neoclassical economist says “How did that happen? It must be a black swan event”.

He hasn’t got a clue.

As the bubble bursts repayments start to overtake new debt and now money is being destroyed and sucked out of the general economy turning it into a vicious spiral (debt deflation).

The bad times are here again.

Experts in neoclassical economics, manning Central Banks are a recipe for disaster.

The excessive debt in the system ensures there is going to be no recovery anytime soon and the Central Bankers don’t even understand the problem due to neoclassical economics.

Pumping money into the banks keeps the asset bubbles inflated for now but fundamentals always win out in the end.