Benefiting hedge funds and banks that had front-run the fund.

Abenomics is facing elections on July 10 for the less powerful Upper House.

But Abenomics hasn’t fared very well. It engaged in the biggest (relative to the economy) money-printing and bond buying extravaganza the world has ever seen. The securities the Bank of Japan has bought, now at ¥426 trillion ($4.15 trillion), amount to 85% of GDP. About $8 trillion in Japanese Government Bonds sport negative yields. Even the 30-year yield is just about zero. The JGB market, once the second largest government bond market in the world, has frozen. The BOJ’s primary dealers are in revolt. Some have already pulled out.

Savers are scared. Sales of safes to be installed at home have soared. There have been no structural reforms to speak of. Japan Inc. has benefited enormously, through various tax benefits and special stimulus packages, including foreign aid that is channeled back to Japanese companies. Government deficits are gigantic, providing additional stimulus for Japan Inc. And yet, the economy is languishing.

So Abenomics is facing its voters again. Few people on earth are as cynical about their elected officials as Japanese voters. Any remaining illusions have been wrung out of them years ago. In polls, voters have explained that they have not benefited from Abenomics. Yet, Prime Minister’s Shinzo Abe’s position remains strong, mainly because the opposition is so flimsy.

His conservative Liberal Democratic Party (LDP) has been in power since its beginning in 1955, except for an 11-month stint in 1993/94, and from 2009 to 2012. At the end of 2012, Abenomics was installed.

But there’s something that makes the Japanese nervous: how politicians handle their pensions. Particularly older voters. They make up a big part of the electorate. So the government decided not to rub the effects of Abenomics in their faces and rile them unnecessarily just before an election.

In April, it announced that it would delay the publication of the annual results of the $1.36 trillion Government Pension Investment Fund (GPIF), from the usual date in early July, to July 29. At the time, the election date hadn’t been set yet, but it would have to be before July 25. So July 29 was a safe bet.

The election “has absolutely nothing to do with it,” explained GPIF spokesman Shinichirou Mori at the time. His excuse was that the fund would be reviewing the results of the past 10 years and needs a little extra time to put the report together.

But like so many things of Abenomics, it too flopped: after rumors of huge losses had been swirling for months, the results were leaked.

“A person with direct knowledge of the matter,” and “speaking on condition of anonymity,” told Reuters that in fiscal 2015, which ended on March 31, the GPIF lost between ¥5 trillion and ¥5.5 trillion (between $49 billion and $53 billion).

This was the fund’s first annual loss since the Financial Crisis. All asset classes got hit, except – with hues of a bitter irony – Japanese Government Bonds (JGBs).

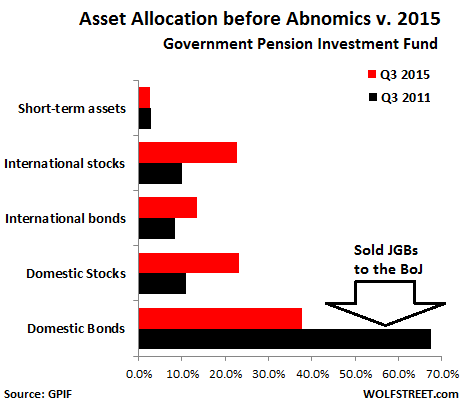

In 2014, after Japanese stocks had soared for two years powered by Abenomics money-printing and hedge-fund speculation, GPIF management buckled under political pressure and announced that it would shift from its conservative investment allocation focused on JGBs to one focused on stocks and other riskier assets, in line with Abenomics.

The GPIF began selling its government bonds to the BOJ and started buying stocks. It became the biggest buyer of equities in Japan, driving up prices further. Other pension funds followed the model. In June 2015, the Nikkei hit its recent peak of 20,868 (still 47% below its all-time peak in 1989). But over the past 12 months, as the GPIF curtailed its purchases since allocation goals were largely met, the Nikkei has plunged 25%!

That plunge coincided largely with the fund’s fiscal year, which ended on March 31.

The fund showed ¥33.3 trillion in cumulative investment income from fiscal 2006 – when it was converted into an independent administrative agency – through fiscal 2014. And in just one year, the fund’s new focus on stocks annihilated 16.5% of the total gains accumulated over nine years!

The source told Reuters that the preliminary results had been presented to the fund’s investment committee last Thursday, June 29. So the fund could have published the results as usual in early July. But no.

At a regular news conference, Deputy Chief Cabinet Secretary Koichi Hagiuda denied any link between the delay of the publication of these fiasco results and the Upper House election. The final results were still being compiled, he said.

The funds mega-losses were picked up by the opposition, which lambasted the government’s decision to plow the future of retirees into risky assets.

“I’ve been warning about the problem of GPIF doing risk-high investment,” Katsuya Okada, president of the Democratic Party, the second largest party, told reporters, according to Reuters. With stocks falling, “things are developing in the way I had feared.”

“We’re seeing a serious situation where pensions could be cut in the future,” he said. “I’m also worried about GPIF’s huge presence in the stock market. As a free-market economy, it’s undesirable to have a situation where the government could influence stock moves,” he said, having apparently forgotten for a moment that the BOJ is already buying stocks to “influence” them.

Here’s how the allocation has changed from Q3 2011, the last third quarter before Abenomics came into being, and Q3 2015, the last quarter available. Over the four years, the allocation of “domestic bonds” declined from 67.4% to 37.8%, while the allocation of all other assets jumped, with the allocation of international stocks and domestic stocks more than doubling:

Alas, since April 2015, European and Japanese stocks have plunged, while US stocks have gone nowhere. But the reviled JGBs that the BOJ is buying with all its money-printing might rose.

The decision for switching into stocks in 2014 could not have been better if the main objective had been to squander the pensions of Japanese retirees for the benefit of hedge funds and banks that had been able to front-run GPIF’s well-announced equity buying binge, only to dump their darlings at peak prices into the lap of the eagerly buying GPIF, where they’re now festering with losses.

This is what Abenomics has done to retirees, which Shinzo Abe is now loathe to explain to them before the election. No wonder Japanese voters are the most cynical in the word.

Now, with central banks flailing about wildly, mo one knows how to back out without blowing up the whole system. Read… NIRP Absurdity Soars after Brexit, Hits $11.7 Trillion

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sounds like Abe’s 3 arrows have landed in the behind of Japanse retirees.

There are no accidents and no incompetent politicians. That’s media spin so it won’t cross your mind that they’re doing this on purpose.

They’re not stupid or incompetent, they’re thieves and liars.

Don’t worry about losses to your pension fund that we may, or may not have had. I’m feeling pretty good about my chances at the casino tonight. So pay no attention to not having received your account statements. We are still trying to come up with something you will believe, I mean making sure they are properly prepared.

If you are sane enough to say you are too crazy to take a “flier”….you aren’t crazy and therefore must play. No I haven’t read the story but I know what Catch 22 means :)

Brexit is old news…Now why is silver going up???

Not much different from the situation in Europe: the value of pensions now fully depends on the largesse of the ECB, and you can bet that Mario and his mob will do everything they can to keep those pension buffers growing nominally so adjustments to pensions will be minimal and the problem will be shifted into the future as much as possible. After all, pensioners are a significant and growing percentage of the voters.

Union representatives and politicians are working together to arrange funny rules that suggest the pension funds are richer than ever, and there is no reason to cut pensions for the current boomers with their often gold-plated pensions (especially for government workers). They are still assuming 7-9% yearly gains on their investments, which is totally impossible in the current environment.

Savers sustain most of the damage for now because even if you keep your money at home in a safe to avoid NIRP, you still have the inflation problem which in reality is closer to 10% than the 0% of the Ministry of Truth. But savers are politically unimportant, less than 5% of the voters have significant savings and the elite probably has very little cash in euro currency, they put their money in RE, stocks and foreign currencies.

When the BOJ and ECB finally lose control of the market the losses will be epic and all these pension funds will be bankrupt; the boomers will have collected most of their promised pensions and the young generation will get nothing. It’s telling that they have been getting away with this policy for so many years already.

Of course the RE market isn’t much different, there too the market will crater when interest rates revert to historically normal values (in my country that would be at least 6% instead of the current below 1%); everyone with a significant mortgage would be nominally bankrupt (in my country almost every mortgage from the last 10-15 years is more than the value of the property). Just like with the pensions, politicians will decide what happens and I don’t have any doubt that savers, renters and future pensioners will pay the bill.

Dude, you are bumming me out. I’m not saying that you are wrong. But it really is a bummer. I am as diversified as one can get, but in the current environment, it doesn’t seem to matter.

i second your point. in the long run, though, quality lasts. doesn’t mean quality comes at a good price right now.

i vaguely remember S & Ls moving into junk bonds and real estate speculation because…..there weren’t nuthin’ else worth a darn doin’.

seemed like a good idea at the time.

It may time to revisit the CAFR asset scandal. Anyone remember this? I recall an investigator discovered governments keep two sets of books, one on cash-flow and one on accumulated assets. What was discovered was many governments (states, cities, locals) have enough assets to run for a decade or more without collecting a single cent in taxes.

This may be a bit counter intuitive but a good way to increase the returns for a pension fund may be to not invest for significant periods. If they don’t play, interest rates will have to increase to attract that money, and they also don’t have significant market losses during that time. The draw downs may be smaller than the potential losses from new paper.

Their remaining pool of assets may actually increase in value because they are being held, and therefore, seem more attractive than those assets being openly rejected in the market.

I would also extend this to individuals always chasing yield and losing money. Just hold on to the money and give up the yield and the losses. Eventually, they have to increase interest rates to bring you back in. Every woman knows to catch a man, you have to stop chasing him.

Fund after fund has, in black and white, that money must be invested somewhere, somehow. IF 95% of the people and pensions invested in available “funds” saw that the money was sitting and doing nothing, the phone would catch on fire.

They may well cry at a lost on the bottom line each quarter, But money idle…no way would the masses stand for that and ‘miss’ an opportunity, nor fund managers loosing that 3-5% commission.

Japan is a test run for what comes to America. Just look at the track record.

yes, that’s a factor. More and more governments are forcing their pension funds, directly or indirectly, to buy more government debt (and paying the government for that ‘privilege’).

But even if the pension funds and individuals stopped buying, the central banks would simply buy even more. They control the game and it seems all big players have decided that nobody will blink and the absurdities will continue increasing forever. After all nobody will lose as long as the game continues and pretends everything if fine in the financial universe.

The “financial universe” will meet the realities of Main Street. When one domino falls, the whole illusion will shatter. Many of the financial universe will run for the exit — everyone for himself. The first ones out will make a lot of money but many will find themselves with only a fraction of their assets. This is the very nature of the financial universe — its DNA. Even with a concerted widespread fraud to keep the illusion running, it can only delay the inevitable (as shown in 2007-2008). Someone will blink.

What a horrible article. Terrible information. Depressing.

Yesterday, I finally bit the bullet and sprang for a new barbecue. (I am retired, with a pension and fair savings put away. We have no debt. Almost Japanese-like.) I first looked at all the local sales flyers online, including WalMart. I then read reviews and researched at the products. I went to a Canadian store, (not Walmart), and ended up buying a more expensive but better quality product…a low-end good one. It did NOT say made in China, and the literature was obviously written by a native english speaking technical writer. I then went to the local (Unionized, but low prices) Canadian Superstore. I was going to buy some steaks, mushrooms, etc for our inagural flame-up. This pensioner, having reviewed the online flyers, decided the steaks were still too expensive. They were not as advertised. There were no mushrooms left. So, we are having ground sirloin burgers tonight. The prices of everything were as deepressing as this article. The bright side is that I prefer a good burger over a steak, anyway.

The savers of Japan are doing what all savers do. When someone works out how to gouge you out of your hard-earned dinero, you say, “No thanks”, and don’t buy. You substitute products and reduce consumption. It is a reinforcing downward spiral.

By the way, when I got home I researched the barbecue more thoroughly. The actual product was/is mostly made in China. It was shipped to the US, and rebranded. The assembly instructions were obviously written here. I tried. I partially failed.

With most of the big economies facing demographic decline ( more than 25% of Japan’s population is over 65 ) pension funds are going to be in an untenable position. As the number of retirees grow the funds will have to shift from being net accumulators of assets to sellers of assets to meet their obligations. While Central Banks may back stop the sale of pension fund bonds for now that may not be true in coming years. Where pension funds are heavily invested in stocks they become the biggest players in those markets too and it is impossible for big pension funds ( as a group) to out perform the market when they are, in effect, the market. Even worse, they will face the same shriveling of contributions occurring at the same time as their payments to retirees soar. This will make them net sellers of stocks with all that entails for prices and liquidity.

Aren’t central banks the biggest player in the market by now, if you include all their indirect buying? Even most buying of e.g. company stock is in effect central bank purchases. Then maybe the pension funds CAN outperform the ‘market’, because the only other player doesn’t care if they win or lose nominally, the ALWAYS win.

Politics and central bankers can decide to continue on the current course whatever the cost, and push prices of bonds, stocks and RE in the stratosphere. Savers, renters and the middle class will get killed but they are just roadkill to the politicians and banksters. When that part of the plan is accomplished, they may crash the market and kill the pension funds and RE speculators (including all people who though they ‘own’ a home). There would be almost nobody left to profit from the good deals that come after a crash, so the elites would be able to buy up the whole world economy for pennies on the dollar, and make everyone a debt slave (because there would certainly be hyperinflation along the way).

Mr Ponzi could not have come up with a better scheme!

Why are the central banks doing these things.. what do they fear?

they fear that the people will see that the emperors of central banking are wearing no clothes – and ditch them for good.

it’s all about the elites clinging to power (and money).

Indeed. Creative destruction. Creative for the elites, destruction for everyone else.

CBs are really buying sovereign debt in large amounts in the last 5 years. Buyers of last resort? Bad banks?

I guess if there’s a default at least it’s all play money.

I look at the whole world and all I see is one big game of strip poker, and no one knows what you have on under the table to bet with.

When people bet against each other, it is called a game. When companies do it is called business. When nations do it, it is called war.

THE deal is loaded, the winner still has to get out the front door whole.

It is all grasshoppers above ground now, no place to hide.

Even more than pensions there is a bigger calamity coming.

Since most retirees’ overwhelmingly biggest asset is the equity in their home anything that diminishes the number of owners has awful consequences.

To summarize an article on Yahoo this morning:

entry level homes are still selling in normal quantities but almost half (and increasing) are being bought by investors and turned into rentals. Thereby raising the entry bar because rents and prices keep rising faster than people can save. Which attracts more investors, and raises the bar even more, etc.

Add in the fear from the last crash keeping owners from buying and the new RENTAL INCOME BONDS adding huge amounts of low cost financing to the fire and the share of renters vs owners will continue to grow to the detriment of all except the 1%.

While I don’t want to drift from the article, although I am sure some of those bonds will end up in pension funds, I will point out that the event you speak of has happened before, many times.

Many examples exist where a real estate buyer for rentals has lost his shirt….Baltimore, DC, Chicago, Atlanta, city after city. When the renters, block after block of them decide to take the neighbor back by not making it so desirable, refusing to pay rent and the courts get back logged, all sorts of methods to dog the owner, the owner/investor walks away and writes it off or sells dirt cheap for tax offset. A $40,000 house in DC in the 1960’s sells for $5,000 in the 80’s and some for $1. …I saw it. You could buy a townhouse two blocks from the US Capitol for pennies a only few years ago. Easy to buy, harder to sell. Just ask all those doctors, lawyers and coupon clippers the joys of rental properties.

It will happen again.

I think the big corporate renters and their bond holders are heading to very restrictive rent control. They have seriously overplayed their hand and you can see the political writing on the wall. This massive political wave is heading towards affordable housing, affordable healthcare, affordable education, well, you get it.

i live in dc, and, am in the real estate business, and would sure like to know where this fellow found/finds these deals. maybe i need to go to the right seminar.

Petunia,

I hope you are right. However, I have lost faith that savers and the prudent will be protected. Savings is no longer necessary when your government has decided to be Zimbabwe.

I started saving in first grade with a bank account started in class. We deposited 10 cents a week if we could. The habit continued and I owned my own home and car at 30. Every single cent I ever saved is gone along with the house. This is what I learned the hard way. Spend it while you can because otherwise they intend to take it from you in taxes, market manipulations, and outright theft. Lease it because if you don’t own it they can’t take it. Stay mobile.

agree: savers and renters are vermin for the current politicians and bankers, because they can be independent if they chose so.

My country used to have some of the most idiotic renter protection legislation in the world, where even people who didn’t pay rent for years and demolished the property were fully protected by the courts – causing nightmares for landlords. But no longer, despite almost no changes in legislation: nowadays many people end up on the street when they haven’t paid rent to the housing corporation for 3 months, while people who are 1 year behind in paying the mortgage are not even counted as being ‘behind’ (we don’t want numbers suggesting there is something wrong with the housing market …) and in some towns even get the government to pay their mortgage while they splurge their high incomes on useless crap.

For savers it’s the same story: although some bankers and politicians pay lip service to the ordeal that EU savers are experiencing it is clear that they will do absolutely nothing to protect them. In Netherlands there is a yearly 1.2% tax on savings accounts (30% tax on an assumed 4% interest on savings accounts), while at best you can now get 0.5% interest – so even without taking inflation into account, you lose 0.7% every year plus risk having all your savings confiscated to save some banker a**holes. Our current government is even planning to increase the 1.2% tax for people with significant savings because it is ‘easy to make 8-10% return on investments’ – at the same time they admit that for pension funds it is difficult to make more than 2% in the current environment. Apparently every saver is assumed to be an investment genius ;-(

Yes, and the yen is now trading at around 102 per buck.

Those Japanese houses I was looking at are now about 30% more expensive in Australian dollar terms than they were just a little while back…………..

The overseas assets of Japanese have fallen by a huge amount as the yen has increased in value from the 125 per dollar level to the 102.

Another failure of Abenomics as shown in results of the investments of the fund.

I received a meme via text a while back with a picture of Heath Ledger as the Joker that said something to the effect that when you’re young and idealistic Batman is the hero, until you get older and wiser and you realize that the Joker makes more sense. Dark humor indeed, but as with all humor there is an element of truth. Especially when living in a moral inversion.