Dollar “hegemony” meets NIRP

Our favorite death-of-the-dollar gurus will have to remain patient for a while longer, it appears. Not that they don’t have plenty of reasons to be confident. But right now, the much maligned dollar is hot – on every level!

With its top two competitors – the euro and the yen – now mired in negative-yield absurdity, investors are fleeing to greener pastures where yields are still higher. And the greenest pasture of them all with the most liquid government bond market is the US.

Foreign demand at the 10-year Treasury auction on Wednesday hit a record high of 73.6%, beating the prior all-time record of 73.5% in May. And they sold at a yield of 1.702%!

Why are investors – including central banks – so eager to buy this 10-year paper at this minuscule yield? Because it’s still the best deal in town. Of the major sovereign bonds, the 10-year German bond yield just hit an all-time low 0.023%, and the 10-year Japanese Government Bond yield just touched the record low negative -0.15%. Those yields suck. And investors seek solace elsewhere.

The 30-year Treasury auction on Thursday was also a barnburner. The bonds sold for a yield of 2.475%. A lot of things can happen in 30 years. A bout of moderate inflation might wipe out much of the purchasing power of that bond. But hey, it’s the best game in this central-bank-run town.

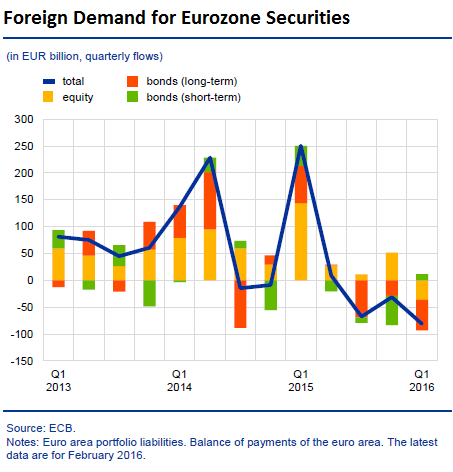

This comes as foreign demand for euro-denominated debt and other securities has evaporated. The chart by the ECB shows the quarterly flows by foreign investors. Over the last three quarters, foreign investors have been fleeing long-term euro bonds (red) and other securities. Overall securities (blue line) hit the zero line in Q2 2015 and then dropped into the negative – hence, net outflows, as foreign investors shed these securities:

In its June 2016 report, “The international role of the euro,” the ECB admits what’s to blame: the “environment of low – and, in some cases, negative – euro area bond yields.”

The big spike in Q1 2015 came “in the wake of the announcement of the ECB’s asset purchase program.” After the front-running by foreign hot money was completed, the selloff in equities commenced, thus the outflows.

While foreign investors “rebalanced their portfolios away from euro area debt securities,” the ECB was buying them; an overeager bidder – and prices went up as yields dropped. Much of that foreign demand has shifted to US securities – and thus the dollar, even if it is losing some of its luster in other areas.

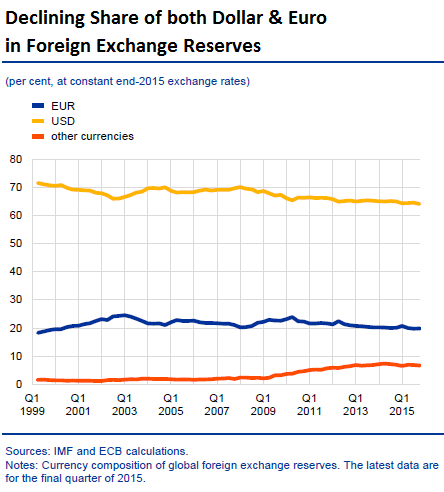

The dollar’s and the euro’s share of foreign exchange reserves held by central banks has been declining, while the share of other currencies has risen, based on the numbers disclosed by central banks (not all foreign exchange reserves are disclosed).

In 1999, the dollar’s share was over 70%. In 2015, it fell again, this time by 0.9%, to 64.1%, a new low in the data series. It’s down over 5 percentage points since the beginning of the Financial Crisis in 2007. Central banks have learned a lesson: diversify!

When the euro started out in 2000, it had a share of just under 20%. Policymakers at the time were dreaming of parity with the dollar. The euro’s share peaked in 2003 at 25%, but then lost steam. It has fallen nearly 3 percentage points since the onset of the euro debt crisis in 2009 and is back at 19.9%, the lowest since 2000.

Central banks have diversified away from the dollar and the euro into “non-traditional reserve currencies,” such as the Australian dollar and the Canadian dollar. Between 2008 and 2015, their share ticked up by 4 percentage points to 6.8%.

For reasons no one can seem to remember during the inevitable debt crises, countries and companies issue debt in foreign currencies. Nearly $10 trillion in dollar-denominated non-US debt is outstanding. This debt can wreak havoc when the country’s own currency, with which it has to service that debt, dives. Mexico, for example, has had plenty of experiences with this sort of debt crisis.

Still, the government of Mexico issues debt in dollars, euros, and yen. On Thursday, for instance, it completed the sale of $1.25 billion of yen-denominated Samurai bonds with maturities from three to 20 years. The 20-year bond sold at a yield of 2.4%. NIRP-tortured Japanese investors are so desperate for visible yield they’ll buy anything. And they’re all hoping that the IMF, other institutions, and taxpayers will bail out bondholders once again – as they’d done during the 1994 Tequila Crisis.

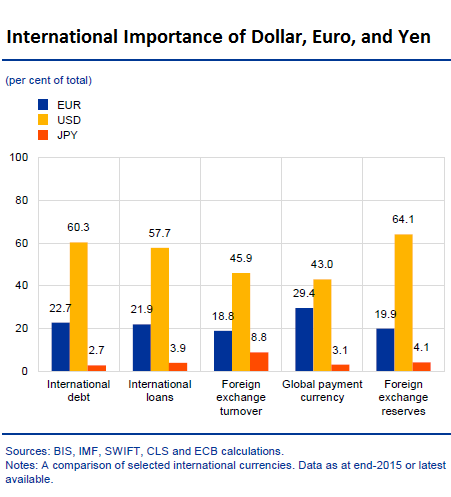

Why does Mexico do it? Because it can! Because it’s cheap! Because investors are desperate. Mexico has to pay a much higher interest to sell peso bonds where buyers fear inflation and devaluations. But most of Mexico’s foreign currency debt is in dollars. Globally, 60.3% of foreign currency bonds are denominated in dollars, but only 22.75% in euros, and 2.7% in yen.

The dollar also dominates in international loans with a share of 57.7% compared to 21.9% for the euro, and 3.9% for the yen. This chart by the ECB shows just how relentlessly dominant the dollar still is in four of the five categories;

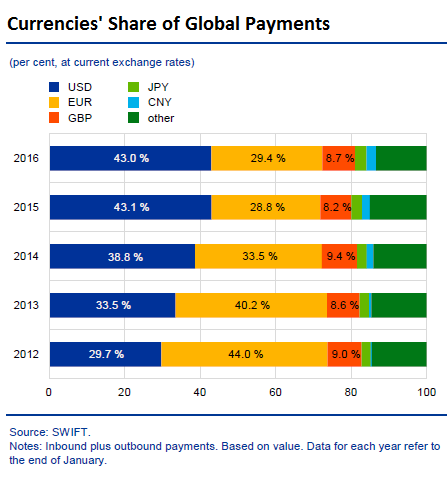

And the dollar has gained share as a global payments currency for the past five years, from just under 30% in 2012 to 43.0% in 2016. The reverse happened for the euro: its share dropped from 44% in 2012 to 29.4% in 2016.

In the ECB’s chart below, note the appearance of the color baby-blue. That’s the Chinese Yuan (CNY) which is picking up heft from next to nothing in 2012 to a still nearly imperceptible 2% in 2016. It’s moving slowly, but it’s moving inexorably. It’s already close to parity with the yen (light green):

So the dollar’s dominance continues to hang in there on all levels as other central banks are now mauling their own currencies even worse than the Fed has been mauling the dollar, and as NIRP-tortured investors and other fearful folks send their money fleeing from their own currencies and jurisdictions into dollar-denominated assets.

An apparently government-backed Revolt against NIRP-Obsessed Draghi is just now playing out in Germany. Read… ECB Gets Clocked by the Two Biggest German Banks

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“It’s good the be the King.” – Mel Brooks.

“It’s good to have the Reserve Currency.” – The USA

“Until you don’t and it isn’t.” – Me

Very interesting that nations issue bonds in foreign currency. It is a risky idea because that foreign currency may be sitting idle in the central bank [and being paid interest], but in reality that currency is moving and out of control of the issuing nation.

So when the time comes to repay it may not be in the same exchange rate. and it always seems to be to the nation’s disadvantage. The nation can create the money it needs to pay the difference, but it seems unpopular and this distorts the advantages the idea might have. Governments are not supposed to make money, but why lose it too?

Some don’t have a choice. For example, there isn’t any international demand for bolivar denominated Venezuelan debt or peso denominated Argentinian debt.

Others are required to pay a risk premium for local currency debt. Interest rates are probably much lower for dollar denominated Mexican debt as opposed to peso denominated.

A pity is that a monetary sovereign nation can build its economy without bank borrowing. All borrowing does is raise the dollar figure to double or triple the actual cost. But Banks seem to have sewn up the idea it can’t be done without their involvement. It’s just not true.

Local debt should not be subject to interest as the government simply buys it ad hoc. It is after all creator of the currency and is not constrained by tax revenue or borrowing that affect non MS governments.

Also the treasuries, misleadingly called government debt are not actually spent. The government has no need for them as it never has to save or borrow its own currency. To pay for imports it just has to pay the spot price at the time of sale.

All this depends on the full faith and credit in the nation’s government.

So don’t stuff that up! Hyperinflation etc will follow.

Venezuela and Argentina have followed this model over the past few years. And look what their currencies have done. You think there are free lunches just because the government can issue its own currency. But someone is going to pay.

I don’t want to live in a country like that, and I’m sure you don’t either. What you’re spreading is sheer propaganda.

I do not know if you are referring to the hubris that sometimes crops up on the internet that the government should just ask the central bank to print money to cover it’s expenses at zero cost.

Now, that would be just nice: government unconstrained by market how much money it could spend.

I know, the current QE, NIRP, ZIRP market destruction forces are conducive to that idea, and people sometimes want to give up in this madness.

But consider the opposite, which would become a new normal.

The problem with both private sector and public sector/government created credit is, what is the money going to be spent on?

The housing bubble and crash was a private sector created problem, in conjunction with Fed mishandling. Fraudulent lending was done by the private sector. Fail.

WWII in the US was a public/gov funded operation. Government created credit and spent it into war production. To help prevent inflation, gov soaked up funds by bond sales, along with price controls, instead of using massive taxation (although there was of course some taxation). Success.

So there are examples like these, as well as private sector successes and public sector failures, like the hyper-inflations of history.

So it boils down to ‘what is going to be done with the money?’.

As I and others have noted before there would be virtually no external demand for Mexican bonds denominated in pesos. The US investor who is tempted by the higher yield would not be so tempted that he would settle for payment in pesos. The peso is convertible to US$ but it has a history, e.g. the Tequila crisis of losing value against the reserve currencies very quickly, more than wiping out any interest from the bond.

When Mussolini was told the treasury was empty he said, “Print more money!”

Hee Hee! What could be easier? ^,..,^

The Mexican government has to buy dollars. Whatever the cost they can do it since they have unlimited pesos to spend. The interest they pay on the bonds is also just a number in a reserve account and can always be met.

It’s not a free ride as there has still to be confidence in the government.

It’s entirely a confidence exercise, for every nation. A federal government cannot go bankrupt in its own currency, but it can in a foreign one.

True, a government cannot go bankrupt in its own currency, but it can destroy its own currency, which has an impact that is even worse than going bankrupt. In bankruptcy, you just stiff creditors; when you destroy a currency, you stiff creditors PLUS everyone in the country who works in order to earn this currency or who owns financial assets in this currency. And even mundane business relationship became bogged down trying to figure out how to get around the problem of a collapsed currency. For example, in Argentina, apartment leases are negotiated in US dollars and then paid on a monthly basis in pesos at the current rate.

Ethiopia has its own currency …. I’ve been to Addis Ababa …. it’s a pretty grim city …

Perhaps someone should tell them that they really need to print more Birr… or maybe they know that but they just don’t like having enough food to eat … decent homes… education …. medical care…. maybe prosperity is just not for them…

As we all know — prosperity can be had with a few strokes of a computer key (sarc)

Basically we agree. A hyperinflation threat should cause the country to limit it’s money creating elements to the real resources available. As long as the resources are there and can be brought into production inflation will stay controlled, right up to full employment levels.

Right now western economies are facing deflation, showing there is a lot of room for deficit spending without excess inflation risk.

Risky, faltering nations must get good advice. Keep away from the World Bank and IMF.

For those who have forgotten, the German inflation of the 1920’s saw thousand million face value notes printed and children played with stacks of money like blocks. People would use wheel barrows to take money to the grocery store.

These photos are available on line.

Shortly before the fall of the US Confederacy, Richmond was the last holdout and Confederate paper money was losing value by the hour. One woman remarked: These are strange times. I used to carry my money in my handbag and my provisions in my basket. Now I carry my money in my basket and what I can buy in my handbag.

Zimbabwe is a recent reminder of the end game for a currency. For a dollar or two, some coin shops have the hundred billion note- I forget the name of the currency.

For an outfit that doesn’t want to get into astronomical numbers, the end comes more quickly when it can’t afford the paper and ink. By this time these are only available from outside the country and have to be purchased with hard currency.

Zimbabwe gave up and accepted what everyone was treating as money in the black (real) market. It dollarized- adopted the US dollar.

Re: the flight to the US ‘safe haven’

After watching with some concern and some amusement the antics in the EU complete with political stresses, the US seems headed for its own political instability.

I realize this is a finance and economics site but the US economy is not immune from political stress.

The apparent victory of Donald Trump for the Republican nomination is a ‘black swan’ event.

There has never, at least in modern US history been such a divisive nominee to suddenly arrive on the national stage. One measure of the difference- the opposition from his own party. The last candidate, Mitt Romney not only won’t endorse him, he won’t vote for him. Pretty much all the rest of the leadership expresses varying degrees of unhappiness. Mitch McConnell endorses him (I think) but adds that he’ll need an experienced VP because he ‘knows nothing about foreign affairs’

Paul Ryan reluctantly endorsed, and then described Trump’s remarks as ‘text book definition of racism’.

Most of this was before the news that two state AGs had dropped probes into Trump’s ‘University’ and later received contributions.

Whether this was a quid pro quo, or payoff is not known.

The case in Texas was exactly that- ready to go to court. It was prepared for months at great expense, including undercover students. The claim alleging civil fraud was for 5.5 million.

When the verbal order came to drop it, the senior prosecutor has stated he was so sure the fix was in he copied the file and took it home.

The Florida ‘event’ is in one way worse. It was never a prepared case, or even a formal investigation. It was a statement that the office was thinking about joining New York’s case, described by its AG as one of ‘pure fraud’.

But while the Texas AG got his contribution three years after dropping the case, the Florida AG’s group got 25 thousand 3 DAYS before deciding not to investigate.

This is too short a time line to shrug off.

Whether anything will come of it, who knows? But one thing is certain- the New York case is NOT going to be dropped.

So the GOP goes into the campaign with the nominee fighting a government filed class- action suit for civil fraud.

And now CNBC has a story about his Atlantic City casino days where they were put through bankruptcy like sheets through a laundry-one 5 times. Each time either bond holders or shareholders would take a haircut but Trump made money. The legal expert on bankruptcy reporting in the piece says some of the diversions to Trump look illegal.

I have read that the Petro-dollar will disappear, not because of the collapse of the dollar, but because of the depletion of our petroleum reserves.

The dollar as a reserve currency might of course survive this change. The faith of the euro seems to be more uncertain though.

“”… the peak of production will soon be passed, possibly within 3 years. … There are many well-informed geologists and engineers who believe that the peak in the production of natural petroleum in this country will be reached by 1921 and who present impressive evidence that it may come even before 1920.”

– David White, chief geologist, United States Geological Survey (1919)”

““The average middle-aged man of today will live to see the virtual exhaustion of the world’s supply of oil from wells,”

– Victor C. Anderson, president of the Colorado School of Mines (1921)”

And there’s been a great many such hopelessly wrong predictions ever since, right up to the present day. Of course oil isn’t infinite but in reality we have quite a large and resource rich planet and there’s no credible evidence we’re in imminent danger of any such depletion.

http://peakoildebunked.blogspot.com/2006/07/307-confessions-of-ex-doomer.html

Oil will NEVER disappear – it will just get too expensive to bother extracting what is left

Which is where we are now – which is why growth has stopped – which is why we are seeing insane policies from governments and central banks to try to keep the economy from collapsing…

Let me walk you through this:

FACT #1.

HIGH PRICED OIL DESTROYS GROWTH : According to the OECD Economics Department and the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

This paper was released after oil went from 12 bucks in 98 to $35 in 2003.

FACT #2. Directly related to Fact 1:

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH – For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil production has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

There can be no disputing the fact that high oil prices destroy growth. When prices spike people buy less goods and services.

FACT #3.

OIL PRODUCERS NEED $100+ OIL

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

Ya ya – I’ve seen the numbers that supposedly contradict the above – that break even costs are 50 bucks… or 20 bucks… depending on the source of the oil.

That is just plain bullshit.

The Saudi’s can probably break even at under $50 IF they paid no royalties, eliminated exploration budgets, paid no dividends – and did not require the profits from the oil fields to run their country.

So to say the Saudi’s break even cost is $30 or $50 is a bald faced lie.

It’s like saying Apple’s break even cost on an iphone is the cost of the components and labour to assemble the phone – which is of course ludicrous.

But that is what we are told.

The reality is of course different – production costs have gone through the roof in the last decade — because we have run out of low hanging fruit.

If you had a lot of low hanging fruit left would you be scraping the bottom of wells for shale oil? Would you be drilling many miles under the oceans? Would you be sucking asphalt out of the ground in Alberta with steam?

Give your head a shake — of course not!!!!

We never bothered in the past because we had lots of cheap to extract oil left.

THIS is what Peak Oil looks like — it is not a scenario whereby we are out of oil — there is plenty left.

It is a scenario where the oil production costs have skyrocketed — the break even point is so high that it breaks the economy.

This knocks back demand — which causes a plunge in the price of oil ….

Which as we have seen threatens to bankrupt the industry (see the billions of losses by big oil in recent quarters — see the Exxon downgrade)

We are between a rock and hard place — high prices kill growth – low prices kill the industry.

Welcome to the beginning of the end of age of oil.

I am sure you will continue to disagree with me – in spite of the facts.

That would be Mr Cognitive Dissonance kicking in to protect you from clinical depression.

Because to recognize and accept what I am telling you — means intense despair — it is to understand that you are soon to perish – that your children are soon to perish — your grandchildren.

Fortunately your defense mechanisms are good at overriding facts that threaten your mental health.

So I completely understand why you will reject the facts — and you will likely attack me for presenting them.

All I ask is that when the end comes — when you see that there is no recovery – no reset…

When the electricity goes off and the shops empty – forever — the riots start — the starvation begins to bite — when you are cowering in the dark frightened and cold….

Please don’t blame the central banks for your plight — it is not their fault — in fact they have done an outstanding job of buying us some extra years…

Do you remember what Bernanke said when he stepped down?

He said to the effect ‘I know a lot of people hate me – but when you see why I did what I did — you will thanks me’

You can interpret that as ‘I did everything I possibly could to delay the end of civilization — I tried to keep the economy functioning in the face of the end of growth caused by the end of cheap to extract oil —- I could not tell you why I did what I did because it would have caused panic —- so I can understand why you hate me — why you will think I destroyed civilization — but when you realize WHY I did these things — you will thank me’

Thank you Ben – and Janet – and the rest of the men and women who are working round the clock to delay the end of days.

Thank you for 8 years of life. May you come up with ways to get us a few more years. A few more months.

Please do WHATEVER IT TAKES.

so Bernanke gave you dope for 8 years and now you think the whole world will go cold turkey just like you.

I dont disagree that the transition will be messy but we should not thank these people for not using the powers invested in them to change course when icebergs came in visual range.

He did not give me dope.

What he did was enact policies that offset the end of growth that high oil prices caused — and at the same time ensured that the oil industry remained solvent.

Quite brilliant accomplishments if you think about it.

But alas — all good things must end — the policies are failing. The string is getting read to be pushed.

Oil break even costs are in excess of $100

If oil sells for $100+ growth stops.

If oil sells for under $100 the oil industry collapses.

If you were Bernanke what would you have done?

Oh you mean like when Matthew Simmons predicted in 2007 oil was “going to go higher, going to go way higher, it’s not a bubble”, just before oil prices crashed. https://www.youtube.com/watch?v=rkzETN8qfzw

As a former peak oil believer I get it, it looks scary we’re doomed, blah blah blah. But none of these doomsday predictions ever came true, none of the theories proved to be true. Of course “half the industry needs $100+ barrel oil prices” looks scary but how many of these are fracking startups that didn’t exist 10 years ago? A large number I’d say.

That’s a very Malthusian viewpoint you put Thomas.

Why so serious?

I guess I am just pissed at the fact that I did not anticipate the Green Revolution — that threw off my prediction by over a century….

Of course there are those that mock me by pointing to the Green Revolution — however I will get the last laugh.

All the Green Revolution did was allow us to grow huge amounts of food — and expand our population dramatically — but it is all based on finite inputs (petrochemicals) that kill the soil …

So now we have way too many people – and soon we will have no food.

On second though .. I suppose I shouldn’t be laughing.

Do you have any clue how much oil Russia is sitting on in Siberia alone? I think you don’t, any more then what is under the Artic…soon to be ice free.

By the way, when those methane gas lakes in North Russia let go for real, the last thing you need to be concerned about is oil.

“Thank you Ben – and Janet – and the rest of the men and women who are working round the clock to delay the end of days. ” you are kidding right?

Why not thank the Goldman alumni too. “Please don’t blame the central banks for your plight — it is not their fault — in fact they have done an outstanding job of buying us some extra years”

Wolf…help!!!!

As I have stated – there is a LOT of oil left — massive amounts.

BUT – it is too expensive to extract.

Again – if the total production costs are over $100 (and they ARE) then you have to sell the oil for over $100. I sure you will agree with that.

BUT when oil is sold for over $100 as I have explained that destroys growth.

Think of it this way — let’s say the Hubble zeroed in on a large planet in another galaxy and we saw that it was covered in an ocean of oil. Would Exxon be celebrating?

Or perhaps this will help — let’s say there was 5 tonnes gold particle in Lake Superior — the cost to extract that gold would be $20,000 per ounce. I sell you the rights to all gold in Lake Superior. Would you celebrate?

This is really a very simple scenario – I am sure an average 8 year old could be made to understand this.

Most people on this site I would assume are quite intelligent — far more intelligent that the most intelligent 8 year old.

If you are unable to understand this then blame Mr Cognitive Dissonance. He does not want you to understand it.

Because his job is to protect your sanity.

The end of oil means you and everyone you know will suffer horrifically and die.

When the central bank policies push on a string – you starve – you die.

Like I said – this is not rocket science.

So…… “running out of easy to extract oil = the end of the world” ? My dear Sir. the world did fine for thousands of years before we started getting most of our energy from petroleum. I think you seriously underestimate the human race.

There are 7.3+ billion people on the planet now.

Nearly 100% of all food we consume is grown using petrochemical fertilizers and pesticides.

When you farm using these chemicals you destroy the soil — if you want to return to growing without them it takes years of organic inputs to repair the damage.

The global economy IS going to collapse.

The oil industry is going to end.

Petrochemicals will no longer will be available.

What will 7.3 billion people eat when that happens?

This time is different. This is brutal, comprehensive famine on a global scale.

This is quite probably an extinction event.

FYI: when I recognized what the true nature of the predicament we are in — I stopped stupidly blaming the central banks and realized why they were doing what they were doing — I moved to a fairly remote part of the south island of New Zealand from Asia (where I continue to operate a few different businesses) and I set up a small farm. I doubt that will do me a whole lot of good because there are still hundreds of thousands of people within a tank of gasoline from me. But hey – at least I get to spend the short time we have left in a healthy environment with a huge range of outdoor activities nearby.

Enjoy the time you have remaining – wherever you are — because this is without a doubt – as good as it gets.

Thomas Malthus …no sorry the global economy is nowhere near collapsing. Indeed, the global economy continues to grow. I live/work in Africa/middle east…populations here are indeed growing quickly, as is the middle class. Consider, Africa’s economies are growing an average of 5% a year, millions are entering the middle-class every year. Development is happening, efficiency is increasing.

Claiming there is a shortage of food is also a misnomer….there is plenty of food being produced, but it’s unevenly distributed, and due to lack of technology (mainly electricity and modern storage) as much as 30-50% of food produced doesn’t make it to the market. Therefore, along with massive expansion in agricultural land, massive increases in efficiency along the entire chain, from the field to the store will increase food availability.

So…no doom, and we’ll still be adding another 2 billion people to the planet over the next 15-20 years.

As we can see — cognitive dissonance is an extremely powerful defense mechanism.

This is really very simple if one stops thinking money is money.

Money is something that has value in itself. Today, we use printed paper. It has the value of….printed paper…….MONEY is, in reality, things like GOLD, CATTLE, WOMEN, DIAMONDS…..basically anything than can NOT be created by Male Men. (Women create women). The money item itself has value at best equal to it’s nominal money value.

So, with the potential of unlimited paper printing (keyboard entries), the concept and use of “money” needs to shift. The US Dollar, the Euro Euro and the Nippon Yen……………are…..NOT…..money. They are digits.

Next, who is buying the bonds? Or better, why is “who” buying these bonds and for “whom” are the bonds being purchased? The buyers are brokerage institutions, banks, pension funds, etc who compete in the retail environment. They MUST offer their retail buyers (City of Detroit, School Teacher Pension Funds, Police Pension Funds, Firemen Pension Funds, City of Chicago Pension funds) a return on their money. Broker “A” shows the City of Detroit Teachers Pension Fund a bond fund of 3%, while Broker “B” shows them one with 2.5%. They don’t care if the funds are destroyed in year-15 of the 30-year Bond Fund, (with names like “Secure American Primary World Bond Fund), they want to make a commission and the City of Detroit Pension Fund wants to show the stupid teachers that they picked the highest return.

The Bond Fund sellers make their commission, and the pension managers of the Chicago Teachers Union Pension Fund get their pay checks….(and wonderful vacations and cruse-ship seminars)…..and who gives a damn about the future?

Nobody gives a damn about the individual’s money. Nobody. (except me).,

Thomas. you have what psychologists call “selection bias”. It means you can only see what supports your profound obsession and blind to anything that contradicts it. It is the basic mechanism behind paranoia and fanaticism. I think you should try to reverse some of your extremism and investigate things that are not related to your fears. You will end up destroying your peace of mind and condemning yourself to permanent incurable unhappiness if you don’t. I have envisioned many of the same things you have but i recognize that they are not inescapable certainties but the projection of linear trends that may well change direction in the near future.

Even if the worst happens a good part of the human race will survive albeit in harsh circumstances and civilization will survive in some form too. There are better things in life than being a professional prophet of doom. Try exploring other things and see what you find.

What I am seeing are the facts.

Oil needs to sell for over $100 or the industry blows up — big oil is losing tens of billions each quarter — it is blowing up….

But if oil sells for $100+ the economy blows up — we saw what happened when oil climbed over 100 to 147 in 2008.

Am I missing something?

Feel free to point out what it is.

“Am I missing something?”

YES, Big Oil dosent need $ 100 a barrel to maintain supply.

It just says it does, so it can operate the uneconomic wells it prospected.

At a BIG profit.

Even worse, you believe them.

Or they pay you, to say, you believe them.

Even worse.

You expect us, to believe the BIG OIL Propaganda. You keep spouting.

Solar panels now produce more, energy than it takes to produce them, in their economic lifespan, and they are still getting better. They are now cheaper than oil powered Electricity.

Wind and Water turbine Energy production has reached the same point in its cycles.

Thorium reactors are almost at commercial testing point. (They were held back by the weapons industry’s needing plutonium)

All these sources can be used to produce transportable Hydrogen.

Oil and coal are finished. The Monopolists Dinosaurs that control them, are slowly having their grasping claw’s and tentacles removed from the tiller.

Get on board with reality and the future.

If you really want to be realistic, you need a comparison that allows you to see the scale of our energy industry.

Look up in Wiki “Cubic Mile of Oil”

Today we use the energy equivalent of nearly 3 Cubic miles of oil. In petroleum terms 1 CuM is about 300 days consumption. To put renewables into that operation would – just in Hydro capacity, require 200 dams each the size of China’s 3 Gorges Dam.

Get the picture?

Renewables are like a coat of paint on the bin holding 3CuM.

It’s just not a viable option, except locally perhaps.

Oil is largely a transportation fuel (it’s also crucial in the chemical sector).

Renewables are used for electricity generation. They compete with coal and natural gas, among others — not with oil.

Until electric cars become a major force, those two will largely remain separate, and oil will remain the primary transportation fuel.

But renewables are starting to have a massive impact on the power generation sector!!!

Yes a massive impact — by that I assume you mean a massive negative impact — as in a disastrous impact???

In a couple of places ‘renewables’ (better to call it alternative energy – because solar panels do not grow on trees) have gained some traction …

And as we can see where it has — electricity prices are some of the highest in the world — see my comments re Germany and Denmark.

In the ultimate paradox the more traction alternative energy makes — the more economies crash.

Because as I have pointed out (perhaps you missed my earlier comments) — solar does not produce energy when the sun is not shining — and wind produces nothing when the wind doesn’t blow.

So you end up having to operate to completely separate generation systems — one involves alternate energy — the other involves good old reliable fossil fuels.

Twice the cost — for the same amount of power.

Brilliant!!!

Well done Germany! Well done Denmark! You have worked out the way to massively increase the cost of electricity!!!

Duh – an 8 year old could have told you that your foray into alternative energy was going to have this result.

But nope — you charged ahead — hundreds of billions of subsidies later — and this is what you get

A complete and total disaster — and the cancellation of any further alternative energy projects.

Alternative energy initiatives are proven paths to bankruptcy.

Just ask Spain :)

No End In Sight For Spain’s Escalating Solar Crisis

In 2007, Spain paid a premium of $556 per megawatt-hour for electricity that rooftop solar panels supplied to the electric grid, compared with an average $52 paid to competing coal- or gas-fired power plants.

By 2012, a whopping $10.6 billion in subsidies were paid out to the renewable energy industry, rising by about 20% from the previous year, and covering more than one third of all electricity generated in Spain.

http://www.forbes.com/sites/williampentland/2013/08/16/no-end-in-sight-for-spains-escalating-solar-crisis/#5f1d3beb627c

“Because as I have pointed out (perhaps you missed my earlier comments) — solar does not produce energy when the sun is not shining — and wind produces nothing when the wind doesn’t blow.”

Both of those systems can be used to produce hydrogen which is a store-able and transportable fuel, just like oil.

We need oil for transportation, only as BIG OIL has transportation vehicle production, and refueling, locked up in its tentacles.

Yes, the data in the article needs updating to account for alternatives, like gas. However renewables are not gas, which is another fossil fuel. It takes up another CuM [there are about 3 in total]

I don’t think renewables have even a remote chance of taking up even 1 1CuM, ever. For starters the total resource consumption is accelerated by renewables. They have to function alongside the existing system for a period and they are maintenance heavy. Wind turbines at sea need helicopters, etc. Their life cycle is counted say 30 years max before major maintenance costs occur. It’s not far fetched to see this will be problematical as a grid failure would be a major catastrophe. Renewables make the likelihood more likely. Feel good, but not viable outside local areas, IMO. I wouldn’t trust them.

“All these sources can be used to produce transportable Hydrogen.”

We dont need oil for transport, the oil companies say we need oil for transport..

Replacement of oil by alternative sources

While oil has many other important uses (lubrication, plastics, roadways, roofing) this section considers only its use as an energy source.

The CMO is a powerful means of understanding the difficulty of replacing oil energy by other sources. SRI International chemist Ripudaman Malhotra, working with Crane and colleague Ed Kinderman, used it to describe the looming energy crisis in sobering terms.[13] Malhotra illustrates the problem of producing one CMO energy that we currently derive from oil each year from five different alternative sources.

Installing capacity to produce 1 CMO per year requires long and significant development.

Allowing fifty years to develop the requisite capacity, 1 CMO of energy per year could be produced by any one of these developments:

4 Three Gorges Dams,[14] developed each year for 50 years, or

52 nuclear power plants,[15] developed each year for 50 years, or

104 coal-fired power plants,[16] developed each year for 50 years, or

32,850 wind turbines,[17][18] developed each year for 50 years, or

91,250,000 rooftop solar photovoltaic panels[19] developed each year for 50 years

http://en.wikipedia.org/wiki/Cubic_mile_of_oil

And you deliberately left out Hydrogen again.

YES, Big Oil dosent need $ 100 a barrel to maintain supply.

> The marginal cost of the 50 largest oil and gas producers globally increased to US$92/bbl in 2011, an increase of 11% y-o-y and in-line with historical average CAGR growth. http://ftalphaville.ft.com/2012/05/02/983171/marginal-oil-production-costs-are-heading-towards-100barrel/

> Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

> Here are the break-even oil prices for 13 of the world’s biggest producers.

Libya needs the highest price, above $US180/barrel, to break even. Qatar can get by with oil below $US80/barrel. Russia and Saudi Arabia’s break-even prices are both around $US105/barrel, and Iran’s is neary $US130.

http://www.businessinsider.com.au/break-even-oil-prices-for-all-the-major-producers-in-the-world-2015-7?r=US&IR=T

http://static.businessinsider.com/image/55acfaa92acae7c7018b7e62-1200/image.jpg

How we doing so far?

“Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said ”

Thats what they want, with a big fat profit margin, big fat salary’s and big fat dividends wound into it with plenty of big fat contractors rake offs and plenty of big fat crony backhanders.

It is not anywhere near what the lift price is.

And not anywhere near the low amount they need to produce, and make a reasonable profit.

$20.00 oil is not smart, $40.00 works for everybody except the oil executives who want to earn millions a year for sitting in an office. $100 oil is theft , with a huge iranian supply fear factor wound into it, that destroys national economies

You keep trotting out the same big oil needs story, that has been debunked time and time again, and your level of sarcasm is getting to the unacceptable, the idiot in the room, can be found, the next time you look in the mirror.

Thorium reactors are almost at commercial testing point. (They were held back by the weapons industry’s needing plutonium)

> Been hearing that for how many years now. Reminds me of the bar with the sign ‘free beer – tomorrow’

Oil and coal are finished.

> Alas we agree on something. We have run out of cheap to extract oil therefore the global economy is going to collapse. And with it goes the era of fossil fuels — and that thing we refer to as civilization.

I can imagine that most of the people on this blog will still not understand what has hit them when the system implodes…. you’ll continue to blame the central bankers to your last breathe.

Or maybe… just maybe…. you will open your eyes and say – damn that Thomas Malthus guy was right all along…. how could I have been so blind.

Not to worry – even if you grasp what to me is obvious — there is no action you can take to hedge. There is no way out of this situation.

“We have run out of cheap to extract oil therefore the global economy is going to collapse. And with it goes the era of fossil fuels — and that thing we refer to as civilization.”

http://www.telegraph.co.uk/motoring/green-motoring/2740900/Hydrogen-island.html

https://en.wikipedia.org/wiki/Yakushima

http://www.autoblog.com/2016/03/11/honda-clarity-japan-only-200-units/

Everybody hits on Bankers (Particularly on this blog) yet ignores the MAJOR Criminals that make bankers look like angels. Oil Companies.

Another fact you Ignore the diesel engine, was designed to run on, (and still will run on) Vegetable oil.

Until oil companies forced their way into the diesel engine project. Burying it with their Petroleum profit project.

High Speed Diesel (Vegtable Oil) vehicles have only become a realitry in the last 20 years thanks to Oil price Manipulation. By Speculating oil companies and their trader’s.

The Majority of Urban Japanese taxis run on Compressed Methane GAS recovered from sewage Treatment Plant’s.

Oil Cartels lent their Mantra to Micro$oft, along with most of their business model.

“MAKE THEM NEED US”

It used to hang on 1 wall of the DOS development lab.On the other was the purely Micro$oft Mantra.

“DOS is not done, until Lotus, will not run”

Oil Cartells And Micro$oft. The two biggest Criminal Cartel Group’s, on the planet.

.

“but because of the depletion of our petroleum reserves”

in 1922 the USA had 2 decades of oil reserves left….and then……

There is/are MORE oil reserves today than in anytime in the past.

The world is loaded with oil. Let me give you an interesting example.

Remember that BP Horizon oil spill in the Gulf of Mexico a few years back? HUGE volume of oil pouring out. So bad, that people had already projected the destruction of all sea life in the Gulf and eventually this HUGE oil slick would enter the Atlantic and kill everything. HUGE oil leak from the floor of the Gulf?

Oil poured out for days, weeks. MILLIONS of gallons each day. Eventually it was capped. Capped? Why? This shows an incredible volume of oil miles down BENEATH the sea bed. They capped the well and so far it is still capped. Why? Why are so many oil wells capped?

Another question. Off the coast of Brazil, under about 2 miles of ocean and about 3 miles of sea floor dirt, they have found, again HUGE quantities of oil. Why is it there?

If oil is from dead dinosaurs, or dead trees, or dead algae, how did these things get 3, or more miles, UNDER the sea floor? And why so much of it. Research the Millions of Barrels a Day that we pump out of the ground. We have been doing this for 100 years and the World’s Oil reserves are HIGHER now than ever before. Why?

Why is it that depleted oil fields are producing oil again? They become depleted. The field is ignored, and then, magically, 20 years later, oil is there again? Why?

Why the deeper the well, the cleaner and lighter the oil?

The world is not running out of oil. The world is running out of conventional crude. The conventional crude reserves are depleted to the tune of 87 percent today.

The problem with the pre-salt jelly-oil off-shore Brazil, the extra-heavy oil in Orinoco Venezuela, the tar-sands in Canada and the shale-oil in the U.S is that they are too expensive to produce.

When it takes the energy content of one barrel of oil to produce (extract, process and distribute) one barrel of oil… then its too expensive to produce that barrel.

When our conventional crude oil reserves are depleted then oil will no longer be able to provide us energy.

This not a money problem, but an energy problem.

The South China Sea has an entire Persian Gulf worth of conventional crude, completely untapped. Iraq still has gigantic proven reserves that were mostly untapped because of the sanctions in the 90’s.

To help clear up the to and fro of oil supply read Gail Tverberg’s blogs;

Basically oil is either too cheap and the oil Companies go to the wall, or too expensive and customers can’t afford it. Either way the oil will end up staying put. Sheik Yamani forecast this would be the case by 2030.

https://ourfiniteworld.com/2016/05/12/the-real-oil-limits-story-what-other-researchers-missed/

Yes of course Finite World provides the best analysis of the energy situation.

There are other blogs that attempt this — but they generally provide a way out — a happy ending — and they often ask you to pay for it.

FW does not sugar coat.

Tverberg states point blank that ‘renewable energy’ is nonsense and explains why…. so don’t think FW is a green energy jamboree of stinky hippies banging on tambourines and drinking organic beer….

She connects the dots between the energy crisis and the ongoing financial crisis….

Very much so.

THE PERFECT STORM (see p. 58 onwards)

The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy.

But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.

http://ftalphaville.ft.com/files/2013/01/Perfect-Storm-LR.pdf

The Los Angeles basin was a giant oil field in the late 19th early 20th Century. But then the oil was depleted and the oil fields were replaced with endless suburbs. Now the oil is creeping back, recharging the oil fields. But since petroleum in the LA Basin comes close to the surface(remember the La Brea tar pits?”), this is causing real problems. i have seen videos of parking lots flooded with crude oil, flames erupting from cracks in sidewalks and old buildings blowing up sky high when methane leaks into the basement. California authorities, needless to say, are not drawing attention to this phenomenon but you might find it interesting to investigate for yourself. ^,..,^

and in 1945 an engineer named Walter Fuchs wrote a book titled, “When the Oil Wells Run Dry”……:0

M.King Hubbert predicted that the conventional crude production would peak in the U.S in 1970… and it did.

He also predicted that the global conventional crude production would peak around 2000… and it did in 2006.

How’s this for an exacting prediction:

Global production of conventional oil will begin to decline sooner than most people think, probably within 10 years

Feb 14, 1998 |By Colin J. Campbell and Jean H. Laherrre http://www.scientificamerican.com/article/the-end-of-cheap-oil/

On July 11, 2008, oil hit an all-time record high of USD147.27 per barrel.

Colin Cambell would be expect to know — he has a PHD from Oxford and worked for big oil for decades.

Hmmmm … remind me what happened to the global economy shortly after that peak.

Must have been a coincidence :)

Looks like you have to pay to read that…

Free option:

http://dieoff.org/page140.htm

This does partially explain why there is no significant inflation in the US. Everyone is flocking to the dollar as a safe harbor due to nirp and a lack of confidence in their own economy. To be sure, consumers in the US are not borrowing very much (other than the auto finance industry). We are in a deflationary stage in the US. Of course, this all comes to an end if nirp ends and/or dollar hegemony ends or even wanes significantly. There seems to be precious little to be optimistic about for the forseable future.

If I can finance my new $75,000 corvette (Burnt Orange color) at 1.9% , 84 months, through GMC fianance….what do I care. Let the Chinese or Arabian worker worry about the exchange rate.

“We are in a deflationary stage in the US”

except in RE, where a crap shack in a so so neighborhood sells for over half a million dollars…..at least where i live.

“There seems to be precious little to be optimistic about for the foreseeable future”

i see nothing positive about growing old in the USA and there is ZERO opportunity for young people.

Indeed, there has been inflation RE, but that’s the case with almost all major asset classes thanks to central bank induced debt binges. However, this isn’t confined to the US by any means and in fact many countries like China, Canada or Norway are far far worse. The whole world will experience deflation, real deflation when this baby blows.

flood of cheap consumer goods + large foreign trade deficit = low inflation.

Just don’t look at rents, transfer payments, gov deficit, finance sector, capital account etc. Sticker shock has not gone away.

What deflation? The sofa I wanted to buy just went up another 10% while I was waiting for a sale. Everything in the dollar discount stores went up at least $1. Gas is up 25% in the last three months. My bargain hunting is getting harder and I am making more trips to the thrift stores.

“Recent reports of my death seem to be greatly exaggerated”.

– Mark Twain

The same may be inferred on the US dollar.

There will be no night and day scenario. You won’t wake up one morning and find the dollars in your pocket became valueless overnight. This changing paradigm is a very slow affair. Taking generations to come full circle. You may see it in your lifetime and then maybe not.

What is more concerning is the form these dollars take. Governments want the physical form of “cash” to disappear. To be replaced by “digits” which are much easier to control. We are almost there.

Actual physical currency (notes,coins) $1.38 trillion

Bank accounts (digits) $10 trillion

Stocks (digital certificates) $20 trillion

Bonds (digital debt) $38 trillion

Derivatives (hypothecated debt) $220 trillion

Therefore it is prudent to have actual physical cash under personal control. Its the only category on your list that cannot be increased or decreased with keystrokes.

I was under the delusion that renminbi is going places. 2% in 4 years is big deal but it is only 2%.

What is still interesting is that US treasuries yield 1.7 percent while German bunds yield almost zero. Would not that indicate that investors are piling more to the bunds than the treasuries?

Maybe it is the trust in the government premium?

The Euro may collapse, but the German government would still pay in the new currency, while not unnerving the world by a government shutdown when it hits a self imposed debt ceiling.

It’s pretty much a mystery to me how these things work in the real world. Despite my best attempts , I am no closer to understanding how the financial sector operates than 8 years ago.

For example…I was under the impression that when debt was sold (bonds), the ones with the best rating sold at a lower return than the riskier ones that sold at a higher one.

Does this mean US Treasury debt is now riskier than German bund debt?

The only thing I am sure of is that it is ALL debt and the world is choking on it.

The name of the game is manipulation. It has always been so.

The current state of affairs in the markets (stocks, bonds, currencies, metals, real estate) is just made easier with the adoption of new technology. Cheaper manipulation and fewer barriers to entry.

It has happened over time. Shave coins, debase coins, issue paper certificates for gold, print money, and now with ‘digital’ money all it takes is a few strokes on a keyboard.

How long would it take and how much would it cost to shave a little bit of silver off billions of dollars of silver coins (if they were still around??) ?? In reality under the old system it would be impossible.

Now all you have to do is press a few keys and hundreds of millions of dollars of silver futures get dumped in the middle of the night.

Old ‘rules’ and ‘laws of economics’ can be thrown out the window and no longer apply. Money in the tradition sense no longer exists.

Take the Yen for example. With the current mess in Japan, one that now visible to everybody, the Yen should be falling like a rock. Huge QE, debt, negative interest rates on bonds, and an economy that is hardly growing and as shown in the above charts, a tiny international exposure.

Yet the Yen has been increasing in value. From a recent low of around 125 per US$ it has increased to around 106 yen per US$.

That is a huge gain of over 15% in less than a year. Some of that can be explained by the huge fall in energy import costs and the change in the different measures of trade and funds flows from investments, but really?

In 10 months has the value of “Japan Inc” really appreciated by that much?

Pricing, value, and the discovery mechanism of traditional economics no longer exist under the current system of manipulation which explains why we have so many distortions and ‘funny’ markets when looked at that point of view.

Good luck under such a system for the ordinary person because you’ll need it.

If you happen to be on the selected few that can undertake massive manipulation under the current system, the world is your oyster………..

The usd is on the rise. For many good reasons. I like mine.

TRUST, CONFIDENCE.

These are the two major factors that make a reserve currency.

A reserve currency.

They are always Ignored. The EUR and the CNY are in the same basket, fundamentally flawed in one way or another. So they do not have a large TRUST, CONFIDENCE component.

USD, CHF, JPY, GBP, these are the currencies of Trust, consistency so Confidence. Even though some of them have flaw’s.

The Japanese have fought for decades to prevent JPY replacing the US $. Unsuccessfully in SE Asia. The SNB similarly in Europe..

The dollar will be replaced, as soon as something possibly better comes along, as there are too many Envious anti American’s, for the sake of being anti Americans, on the Planet.

I dont see anything new on the horizon in the next 20 years, as, it will take at least that long to establish a reserve confidence, in any other currency.

The EUR still has not crossed the fundamental flaw of Currency union without Fiscall union. And draggis damage (which he is still inflicting) will take several decades to unwind.

CNY is still controlled by communist liar’s, who physically print huge quantity’s of cash to pay their monthly accounts, and do not adjust the circulation figures to show the truth. Secondly you never know when the PBOC and CCP will change the rules, to their advantage, without warning.

Anybody who hold’s CNY as a reserve, deserves to see it turn to toilet paper, and it will one day ( By CCP design) the RUB is probably a safer bet.

So what on the Horizon replaces the dollar????????

If it looks like the USD will implode, take a basket of: GBP, CHF, AUD, NZD (if the buying price is wright), JPY. As there is no other MAJOR currency on the Horizon in the next 20 Years. Today.

You could buy silver on good dips, either it will go up, or more likely manipulated gold will return down, to the old 15/20 silver to 1 gold ration, pre the USD leaving the gold standard.

The dollar is being Murdered by Leftists like O bummer and his taker’s.

What replaces it when it dies???

Massive question, with NO ANSWER IN SIGHT.

Usually I read Sci-Fi and Mysteries(for Lent I read The Report on The Shroud of Turin by Heller), but two nights ago I was stuck because there was a 2 and 5 year old outside my door, so I picked up The Big Short by Michael Lewis. As I was finishing the book my main thought was, omg I could substitute dollars and treasuries for mortgages and CDOs and tell the same tale. Alas I know no way to sell the dollar short (but i agree with d about silver).

My post about Thorium must have been too old. I sincerely hope it is true that the Chinese will have a Thorium reactor going within two years, because I also agree with T. Malthus about energy and civilization. google search terms for the info are: Thorium Chinese Oakridge under both ‘all’ and ‘news’

“Alas I know no way to sell the dollar short”

Borrow a non US address and bank account from a relative or friend open an FXCM Forex Trading account.

Short the straight dollar index.

US citizens are forbidden by law from trading the US $ index if they are domicile in the US. However a borrowed foreign address will get you round this. Various other trading accounts have a straight dollar index.

If I had a friend I trusted who was married to a non-American citizen that might work, hmmm…but I was actually being even more cynical than that…betting against the dollar would be like betting against CDO just bundled from Aaa loans. Why stop there? I would love a bet against ALL fiat in their terms. And if it was a bet that helped real industry I would be even happier.

2 simplest indexes to trade, US $ and S&P 500.

If you are only correct 4 trades out of 10 and always run a 2 to 1 (1 Risk, 2 Reward). risk reward ratio, you will make still money.

It is easy to average over 5 out of 10 on S&P index trades. If you give me another contact address or use a blog with PM that I can easily join I will give you a simple strategy for that.

Thorium is always ’20 years away’

Wind farms and solar are now competitive with natural gas, the renewable revolution is here.

Locally maybe, renewables will work. but world wide the thought is just showing how little is the renewables idea understood in the face of the actual consumption figures. It’s just not viable and to build renewables we double up on the consumption as both systems have to operate at the same time. That’s OK only if we just want to spend our limited resources and crash the system sooner.

They have 700 engineers working on it now. But I am not putting my hope in princes.

https://www.technologyreview.com/s/542526/china-details-next-gen-nuclear-reactor-program/

50th anniversary of trying to make this work. I wouldn’t put the champagne on ice.

I take my King Dollar$ and buy cheap real estate in motherland Canada, works for me. :)

I still prefer to stay in gold and gold stocks, despite the dollar’s relative strength. I track over 150 gold stocks. All but 14 are up for the YTD, and 136 of them are up 50% or more. Price to book value is 2.50 or less on 104 of them, despite the huge rise. We don’t have to have all the investors move a portion of their investments to gold, just a small portion. I’ll wait.