Credit bubble reflates. PE firms back at it. Investors go blind.

“Leveraged loans” that banks extend to junk-rated over-leveraged companies are too risky to keep on their books. They sell them to institutional investors. Or they slice and dice them and repackage them into Collateralized Loan Obligations (CLOs) and sell those to institutional investors. Leveraged loans trade like securities. But the SEC, which regulates securities, considers them loans and doesn’t regulate them. No one regulates them.

The Fed has been jawboning banks into backing off for two years. Banks can get stuck with leveraged loans. They did during the Financial Crisis, which helped sink the banks.

During the credit upheaval that started last summer, leveraged loans ran into trouble. And issuance of the riskiest type of leveraged loans came to a halt.

As so often, there’s a private-equity angle to it. Companies owned by PE firms borrow money from the bank in order to pay a “special dividend.” It’s a favorite form of asset stripping. This way, if the company goes bankrupt (we’ll get to an example in a moment), the PE firm and other owners got a big chunk of profit out beforehand.

Dividend-backing loans are particularly risky because the proceeds are not invested in productive activities that would generate cash flow and allow the company to service the loan. The money just disappears, the debt stays.

These dividend deals are the litmus test for a hot credit market. They die when reason begins to ripple through the credit market, when lenders tighten the screws and look askance at deals that hollow out an issuer’s balance sheet.

But they thrive when investors and banks go on a frenetic search for yield, when balance-sheet risks that had been clearly visible a moment ago suddenly dissolve into ambient air, when, in other words, investors have such an appetite for loan paper that they will eat anything.

This is now happening once again.

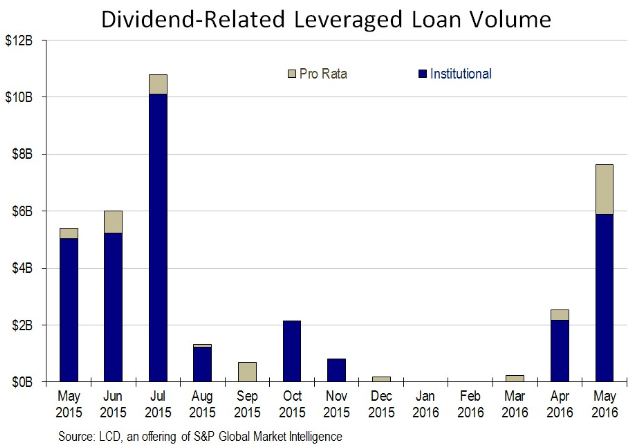

Back in July last year, nearly $11 billion in leveraged loans to pay dividends were issued. Then the credit market spiraled down. In August, less than $2 billion were issued. Activity petered out, and almost none were issued between December and March.

But by that time, central banks had begun to panic. The Fed flip-flopped about rate increases. The Bank of Japan entered negative-interest-rate absurdity. The ECB promised new and even crazier goodies…. And voila!

By April, $2.5 billion in dividend-backing leveraged loans were issued. And in May $7.6 billion, the most since July last year, and up 40% from May a year ago!

“A serious comeback,” as LCD put it in its report. “Investor appetite in the U.S. leveraged loan market was on full display last month.” And this is what the sudden resurgence looks like:

In practice, a leveraged loan to fund a “special dividend” can turn out like this: San Diego-based Millennium Health, the biggest drug-testing lab in the US and owned by its executives and private-equity firm TA Associates, issued a leveraged loan of $1.8 billion in April 2014. It was during the peak of the credit bubble. JPMorgan syndicated it. The pieces were gobbled up by Oppenheimer Funds, Fidelity Investments, Franklin Resources, and other institutional investors. Millennium used $195 million of the proceeds to pay off debt that TA Associates held and $1.297 billion to fund a “special dividend” to its owners, including its executives and TA Associates.

Then it got very messy. By June 24, 2015, the loan was trading at 41 cents on the dollar. On November 10, the company filed for bankruptcy, “after settling federal claims that it improperly billed the government for running urine tests on dead people and checking senior citizens for angel dust,” as Bloomberg put it at the time.

And in January 2016, as the company emerged from bankruptcy, the San Diego Tribune added this about the deal the judge had approved:

It also contained an unusual provision that shielded the former owners of the company – including founder James Slattery and some of his family members, former directors and executives, and the private equity firm TA Associates – from any future lawsuits stemming from a $1.8 billion loan the company got in 2014.

About $1.2 billion of the loan was used to pay a “special dividend” to TA Associates and Slattery, court papers say. Slattery, through a holding company and various family trusts, got 55 percent of the money, more than $600 million.

The company restructured. Creditors (including retail investors with loan mutual funds) took a licking. But the recipients of the “special dividend” were able to keep the money. That’s why PE firms love “special dividends” funded by these leveraged loans. And that’s why they’re a sign that investors, driven to near-insanity by central bank policies, have once again closed their eyes to risks in order to make a tiny buck.

But in the real economy, things aren’t so rosy. And in Texas, sales tax collections, a raw and unvarnished measure of retail sales, just experienced their worst plunge since the Financial Crisis. Read… Consumers in Texas Begin to React

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Again proving Santayana’s observation “those who will learn nothing from the past are condemned to repeat it.”

Why are the regulators still allowing this type of fraud? IIRC this was one one the contributing factors in the bankruptcy of GMC.

Even if it does not bankrupt the company, the deductability of interest as a business expense means the taxpayers are subsidizing about 1/3 of the interest cost. While the tax deductability of interest *MAY* be justified when the debt is incurred for investment that expands or improves the business, thus increasing employment and the tax base, debt based dividends are simply counter-productive “asset stripping.”

Throughout history, when contemptible behavior and despicable acts are viewed as sport, what you’re really watching is decay.

The special dividend is simple theft. It has the patina of legal ritual and a lexicon all its own, much like our government corruption. All in all the financial world is a mechanism to facilitate theft and leave the patsies wondering yet again how they were so misinformed as to make yet another poor “investment decision.” It takes a long time to destroy a country like this but it is well underway and it rots from the top down.

Gosh this sounds just like the sales pitch to Wyoming to join Medicaid expansion………..Like a parent co-signing a balloon payment loan on a Ferrari with a teenager.

Agnes: At least Medicaid expansion does help some of the regular folks. It doesn’t just stuff the pockets of the super wealthy and their banker buddies. In my state many rural medical facilities face closure without Medicaid expansion. I don’t believe this is the situation Wolf is calling our attention to. As a taxpayer, I accept that taxation is inevitable. As such, I had rather see my taxes used to benefit the citizenry, than to prop up the Wall Street debt creation machine which has been of little benefit for the average American in a very long time.

Being involved in the Medicare-Medicaid Fraud Business, I need to disagree with you.

For those with any doubt, take a day off, or just the morning. Put some nice sandwiches in a bag, hot coffee in a thermos, and cold drinks in a cooler. Then drive over to any “clinic” that has a Medicaid base of “patients”. Park in the parking lot where you have a nice field of view…….and enjoy.

Watch who and what drives up. Take a really good look at the cars, etc. Take a really good look at the people, the clothes, shoes, jewelry, cell phones, etc. etc.

There is a fortune to be made by “practicing” Medicaid and Medicare and it is ALL LEGAL. Not moral, not ethical. But Legal. If your practice Medicaid/Medicare according to the “law”, you will never get in trouble, (don’t get greedy), and you can make a lot of money.

Florida is the medicare fraud capital of the country. Once a doctor or clinic gets hold of your information, they will bill and bill for services. This information is easily bought from the workers in those clinics and traded all over the place. Yes, the govt knows which doctors bill in the millions, but they rarely do anything about it.

You seem to really hate poor people for some reason. Are you blaming them for the current crisis?

EH: Not saying there aren’t problems in the program. Please ferret out all the fraud you can and take appropriate action. But the answer isn’t to harm those with legitimate needs. We need to make sure the taxpayers get the most bang for the buck where ever tax money is used, at what ever level of government is spending.

excellent debt market analysis as usual

The scheme has been going on for decades under various names.

Joe and Jane simply cannot believe that such a simple form of criminal activity is legit, but like you can bet on futures on the stock market, a type of investment that encourages you to manipulate the system in your favor.

The fact that the practice described in the article exists demonstrate the power of kickbacks. Want to be a billionaire? Anytime, pal, just hop on the wagon!

I find it funny that the business people who hate government intervention and regulation pull these kind of stunts. I am for big government our tax dollars working to try to help small investors. I dont understand how there are not more lawsuits against fraudulent documentation all these companies that put out false numbers and the government that allows this to continue. If i go to a lawyer and he gives bad advice u can sue him. He has a fiduciary responsibility to his client. This has always surprised me. Or do we wait for another failure and when the dust settles head to do anything about it. I guess this is just me. I would rather lose my own money than pay a professional to lose it for me.

Most lawyers are not good at math. Most prosecutors are not either. Trying to explain a complex model to them may be impossible. They have no way of discerning if the model was intentionally built to commit fraud or was simply flawed. From experience I can tell you a flawed model is one where they lose money, everything else is intentional. If the prosecutors don’t have a handle on what is happening, how are they going to convince a jury, probably more mathematically challenged then they are. Complexity

is intentional and it is how they get away with the fraud. Staying away is good advice.

Very true. That gets back to my comment about Medicare/Medicaid.

There is an Ophthalmologist in Florida who bills $10 Million a year. He is the 2nd highest Medicare “billing” practice in Florida. (The #1 guy is in Miami-Dade which is the #1 Medicare fraud capital of the world.)

It is all legal.

For example, there are 16 “codes” for an Eye Exam. 16 different billing amounts, from about $78 to $258. The “exam” is basically the same, BUT if you ask additional questions (like do you drink or smoke), you can “up code” and bill more and get paid more but one does absolutely nothing more. (Ever wonder why there are all those stupid questions on the forms you fill out?…to “up code”)

Also, ever wonder why Grand Ma has to keep “going back” to the medical practice over and over? Well, there are 2 basic reasons.

1) The practice can perform the exact same test up to 4 times a year (but it is not really necessary.). So Grand Ma shows up 4 times a year, for the same test done by some $12/hour 18 year old, and the practice can bill Medicare $300 and get paid 80% of that……$240 for 5 minutes of “work”. Four times a year.

2) There are some tests you can not do on the same day. (Makes no sense). If you do them on the same day you can only bill for one. Therefore, do one today (bill $$$) and then have Grand Ma come back next week, do the other test (s) and bill….$$$$. Rinse and Repeat.

Oh, one more thing. Medical practices (all of them) are paid for TESTING, not diagnosis. So, you run the patient through a bunch of fancy pieces of equipment, bill for each, but you don’t even have to diagnose correctly. AND, to make it better, after you exhaust all of the testing you can think of, you can then send them to a “Specialist” who legally can REPEAT everything you just did…………….then around Christmas, your “Specialist” friends will send you a great invitation to a great party AND you’ll get some really, really nice gifts for you and your family,.

All legal. All immoral. All unethical. But all legal.

It is a scam, but the stupid, and I do mean STUPID, public just won’t look at it. Promise the people something for “free” and they will NOT look into how it is done. The Medicare patients do not want to know that it is a rip off system,either. They are the “Greatest Generation” who made Europe safe for Islamic invasion, and deserve “free” health care……

I almost feel bad telling you all the truth.

But wait … I got the same treatment when I was insured by a big-name insurance company (and insurance premiums doubled over a two-year span, that was six years ago). Now we’re with an organization that is both insurer and healthcare provider (you can guess the name) – a world of difference, and a lot cheaper.

So it’s not just Medicare/Medicaid but much of the healthcare industry that’s playing that game. One of the problems is that healthcare providers and payers are different organizations, and each benefits in its own way: the provider gets to make more money from unneeded tests and treatments; and the insurer gets to increase premiums.

I am on Medicaid and I get a lot better care than when I was on ObamaCare. As good as i got when I had regular insurance with an employer. I live where there are a lot of poor people and they really need Medicaid and an awful lot would die without it. You seem to take the exception and claim it is true for the whole.

The government is at fault for allowing the system to be abused, not the patient.

I think this happens because lobbyists from the health care mafia have bought off the senate and congress.

Sorry about the double post above. Apparently this Mac has a hair-trigger.

Massive fraud caused the crash of 2008. Those responsible are still in business. As William Black stated, “if you don’t punish fraud it will spread”.

Like the cancer it is it will continue until once more it takes down the economy, only in a more comprehensive way.

They control the regulators so there can be no “savior”. They will have their way with us until we are all exhausted of our wealth, then they will rest until we revive. Then they will start all over again.

That is where Capitalism leads. Always off the cliff. I counted 15 times in America since 1897. The only difference these days is that the “banksters” have learned to control any and all potential threats to their “game”.

Again, look at who President Obama appointed to be Attorney General!

As Max Keiser says “Fraud is the business model”.

Legalized looting. They knew exactly what they were doing. I just can’t believe they keep the money stripped from the company. Didn’t Mitt Romney invent thise scheme in the 80s? Owning the government sure pays off.

A few years ago, in Palm Beach County, a commissioner was convicted of taking a bribe which was 10M in land. Part of the punishment was jail time, fines, and confiscation of the land.

After getting out of jail he sued to get the land back. This is how corrupt the system has become. They believe they are entitle to keep what they steal.

“LAW” has absolutely nothing to do with Justice.

I remember my attorney, whom I have used for at least 35 years, telling me, in a moment of honesty, that there is No Law.

The “law” is what the Judge says it is. So, the entire point of legal practice is to get the Judge to side with you. It is also why Laws are vague. The practice of Law does not want clarity. You can’t have 3 years of litigation, etc. if the LAW is clear.

Dang! My dad is a lawyer and you are absolutely right.

Columns like this are why I keep coming back everyday to check out Wolf Street. You have an extraordinary ability to pick apart Wall Street’s legalized thievery and present it in understandable form.

Thanks Wolf

Call them for what they are –

DERIVATIVES

Over The Counter Collateralized Loan Obligations

These “financial products” are just a small part of the dozens and dozens of “products” that make up the bulk of the global derivative sector.

Most of these “products” have been given a triple ‘A’ rating, equating them to the most desirable bond to own.

The only thing that these “financial products” produce is bankruptcy.

“Slattery, through a holding company and various family trusts, got 55 percent of the money, more than $600 million.”

How is this not considered straight up fraud?

If I tried to kit a check for several thousand dollars without having the means to back it up I would be in jail.

This strikes me as the same dam thing. But of course, at the level these people operate normal rules of ‘justice’ obviously just don’t apply.

And they wonder why the proles are so pissed off.

It seems inconceivable that these famous and ‘respected’ investment funds, would be back at the trough pigging out on this junk. Maybe some twenty-something manager might be young enough to error, but the trail is not yet cold from 2007 education.

The country has become ‘buyer beware’ from the top down, law and order, ethics, trust, fiduciary integrity….. are just ghosts now.

If one was a pessimist, One would think that the Central Banks, Wall Street, and the government actually want the economy to collapse.

Of course, the get-out-of-jail card it always ” I used bad judgment”.

MI: Well said. Your get-out-of-jail-free card comment reminded me of Steve Martin’s take on Spiro Agnew’s tax evasion defense. He called it the “I forgot” defense. As in, your Honor “I forgot that not paying taxes was illegal”. Seems more true for our financial Master’s of the Universe today, than it was then.

Baffle ’em with bullshit economy.

Theft through legalese.

If you want to understand PE firms that hollow out companies with leveraged loans, watch the following scene from Goodfellas.

https://www.youtube.com/watch?v=ZPtjyqgZAUk