And yet, China’s total debt goes parabolic.

By Chris Hamilton, Hambone’s Stuff

If a business could foresee that it would have a declining consumer base (declining number of total potential customers), that would likely be a pretty good reason for serious concern and significantly lower growth expectations. However, when it comes to China, the shrinkage of its under 65yr/old population and particularly of the 20-59yr/old population is somehow coinciding with the story of China transitioning from an export-based to a domestic consumption-based economy?

To wit, with a declining population, China will transition from exporter to consumer, while all those grown one-child-policy adults support their 65+ year-old parents, and still grow 6%-7% annually? Inquiring minds wonder how it’s possible a declining base of consumers would consume more.

In a word…CREDIT! And, the growth of credit in China has gone parabolic. It’s highly unsustainable and likely ruinous.

The Details:

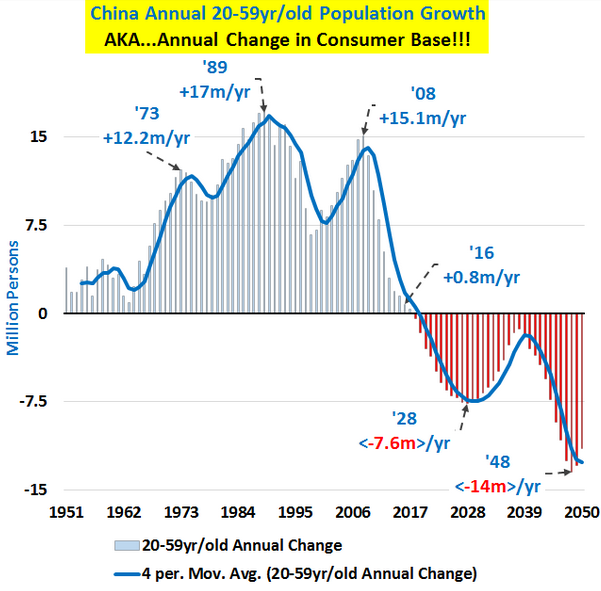

Each bar in the chart below represents annual growth or decline of the Chinese adult population. The blue line is a 4 period moving average of the population change. From 1973 through 2008, an additional 12.5 million Chinese adults entered the Chinese economy every year. That meant 12.5 million more consumers, home buyers, car buyers, potential job seekers, etc.

But since 2008, annual population growth has decelerated by 95%. By 2017 or 2018, it will begin a long decline. Every year from 2018, the adult 20-59 year-old population of China will decline by millions for at least two decades and likely far longer. This is no forecast or “gloom-n-doom” fantasy, but simply counting the number of people born and tracking them through the population (plus, China has net emigration).

All this means the charts below likely show a best case scenario although the population data could be lower if greater emigration occurs or a higher mortality rate ensues due to illness, environmental, or global disturbances (aka, war).

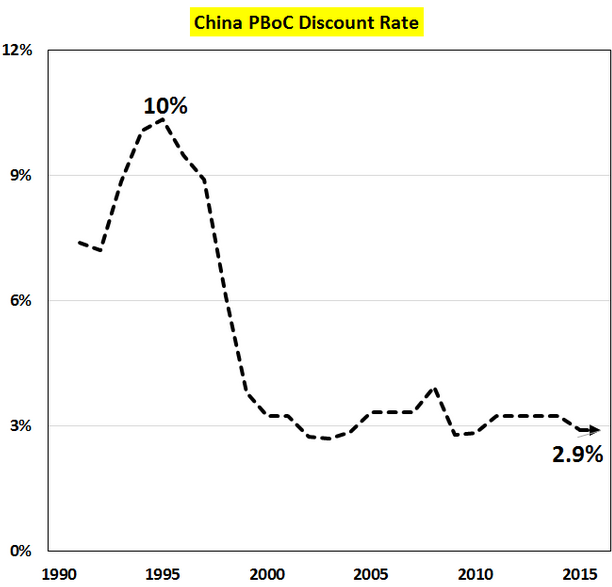

The People’s Bank of China has been pushing rates down since the Chinese population growth peaked and began decelerating (just like the majority of the developed nations central banks).

In China, the adult consumer population growth peaked in 1989 and rates peaked in the early ’90’s and have been declining since (chart below) to incent a slowing rate of population growth to consume more — and consumer above the level wages and savings could support.

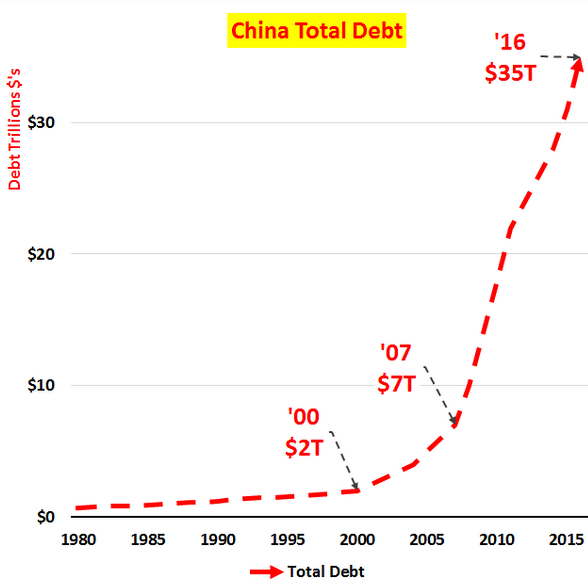

And the impact of the lower interest rates above combined with China’s capability to push loans out has had an amazing impact on credit creation! The hockey stick chart below of total Chinese credit creation is a monument to the mantra, “build it and they will come.”

The problem is the Chinese have used the lower rates and massive credit bubble (aka, debt) to build out infrastructure, apartments, factories, shopping malls, etc., for a population base that is never coming!

Credit has been used to build millions of generally unaffordable apartments for a middle class and overall population that has already peaked and is fast receding. Building out somewhere from 50 to 100 million excess apartments and likely trillions of excess retail square footage for a population of under 65-year-olds in fast decline is the insanity only award-winning PhD economists could applaud.

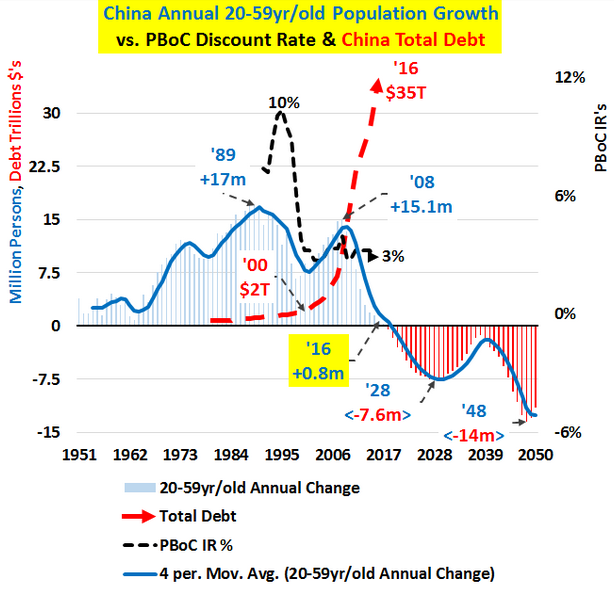

The chart below puts all the pieces together so the inter-relationship can be clearly understood. Population growth slows and credit is made cheaper to incent a level of growth via debt beyond the populations general capability. As the population growth slows more dramatically, rates must be lowered in kind and debt ramped up to maintain “growth.”

What happens next as the adult consumer depopulation begins (simple fact…not forecast) should be obvious: NIRP, QE, and all the kings horses, and all the kings men will try to put Humpty Dumpty back together.

Beginning in 2018 and accelerating thereafter, there will be millions fewer adult consumers in China every year. On the flip side, the needy 65+ year-old population will swell until China’s total population peaks around 2030 and begins its Japanese style long-term depopulation. All this while interest rate policy plus debt creation are both already effectively exhausted.

There simply is nothing more to build when there is already such overcapacity and growth in non-performing loans. The Chinese determination to add new credit fuel in excess of $1 trillion alone in the first quarter of 2016 is the stuff of hyper-monetization — with money fleeing China and creating bubbles the world over — and potential hyperinflation. Sometimes reality bites…but pretending all is well is simply no longer a viable option. By Chris Hamilton, Hambone’s Stuff

The export and manufacturing powerhouse of the world, the locomotive – along with the US – of the global economy, and an indicator of the global economy itself, disappointed economists once again. The operative word in the media was “unexpectedly.” Read… China’s Furious Stimulus-and-Debt Binge Backfires

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Does going into debt for false teeth make one an indentured servant?

It can be the root to decay

Don’t forget we are talking about the Communist Party. Maybe it will have Solution for this excess of old people.

“People! It’s… people… solyent green is people!”

And if it was China and their insatiable demand for stuff that dragged us out of the last big recession, who is on deck to save the global economy and take their place during obvious times of demand destruction?

Answer: That’s why i do not own real estate where i live – Canada

Mr R.

Maybe they’ll harvest some Syrian taxpayers, er,… uh,… refugees, just like we’re doing in canada.

Why worry about China? Look around the demographics of the U.S. or Canada. None have planned well, all are debt whores. Who is going to feed your needs when social security can only deliver 75% of today’s check in less than a decade? Oh, you didn’t read the actuarial papers? Too bad…

@ JP-

Yeah, China’s problems are tiny compared to the US demographic bomb. Millenials can’t make a living to get into apartments and the govt thinks they’ll pay Boomer Social Security? Meanwhile Trump’s enlisting Christie & a Soros employee to help his campaign out? Yikes!

This all sounds familiar…pushing massively increased debt uptake to solve the imaginary problem of “insufficient aggregate demand”.

“Demand” never goes away. It’s always there. So the Keynesians figure we need more “spending power”. This is money-printing, pure and simple.

And what will the Chinese get? Same as the west: massive overcapacity made even more massive and wasted capital…all of which zombies will have to be supported forever by even MORE debt…

I predict the Chinese will go on an “infrastructure” binge, as is now being posited in the west.

Is there any way this ends without massive price inflation SOMEWHERE…?

That is well possible, albeit China already has enough infrastructure to last them a decade of real yearly 7% GDP growth.

Perhaps they’ll embrace the latest folly, Maglev trains? So far they’ve only been used for metropolitan railways, but Japan (who else?) is building a Maglev railway (chuo shinkansen) between Tokyo and Nagoya. 268km, 90% of which will run underground. As the project is bound to be completed in 2027, we can call it the Mother of All Pork Barrel.

May be China can build something similar but bigger?

Or perhaps they can start tearing up all the unused high speed railways and airports they built in 2009-2013 and build new ones?

Many intriguing possibilities here!

Or dig holes and fill them in again.

But maybe the “broken window” parable doesn’t apply when new money & credit is being printed constantly, thus supposedly enabling both legitimate investment AND repairs to the “window”…

OTOH, ‘something from nothin’ IS an impossibility. Price inflation will have to appear in more than just housing, stock prices and bond prices…

Recently China admitted it’s one child policy was a mistake.. Are they now going to encourage more children per family and would it make any difference if they did? Probably not because one of the hallmarks of a prosperous society is the desire to have fewer children..

To Jack in Canada: The Syrian’s that you’ve disparaged are now opening their wallets and homes to the refugees fleeing Fort McMurray.. “Canadians have given us everything and now we need to pay them back” Seems to me they were a good investment..

I don’t think Jack was disparaging them. Quite the contrary, he was stating in slightly different words that they were exactly as you have termed it — an “investment”. IOW a variation on the theme of bringing in migrants to forestall organic population decline.

David, I was not disparaging those people at all; I’m sorry if it sounded that way. Our current boy Prime Minister, during last October’s election was basically “anteing” up the number of people he would bring in to Canada as an election ploy. He was completely irresponsible in saying he’d bring in 25,000 refugees by Christmas 2015. He didn’t even bring in one-tenth, or if he did, that was all.

It was like baby Pierre was outbidding PM Harper at an auction, like they (the Syrian refugees) were some kind of commodity. So I was just being cynical in echoing what’s been spouted by the left-wingers in this country.

Sorry Jack.. Canada was my mother country (Campobello, New Brunswick) so I get a little touchy.. Still, it was easy on the ears to hear Syrian, Rita Khanchet, say it was time to pay Canada back for taking them in..

To Wolf’s point about Chinese debt: I don’t trust any numbers coming out of China. I owned phone company stock for about 20 years but sold that off 10 years ago. I realize they have hefty reserves, which I understand are shrinking, but are there any reliable figures on their indebtedness? I read recently ( a few months back) that Chinese growth is about on par with the Mao years. If that is true all the debt in the world (it could be that bad!?!) isn’t going to move the needle.. We could all end up being hosed..

A mistake realized only about 20 years too late.

Real inflation for raising kids has a tendency to explode disproportionally with respect to a country’s economic growth. In Singapore, I would need to spend at least US$300K just to raise one to working age excluding my own expenses, and unfairly deliver them into a world that is certainly going to be economically worse off than now.

And politicians frolicking with their CB partners in luxury yachts wonder why global birth rates are dropping off a cliff.

Another significant change was to the policy of retirement. As of now, retirement is just about mandatory for women age 50, and men aged 55, in most occupations. But last year the Beijing announced that an increase would be phased in, to age 55 and 60, respectively.

So you have an additional problem, of how a collapsing working-age population can support a surging elderly class.

The one-child policy was redundant, given China’s urbanization. Move hundreds of millions of people to crowded cities, and nearly no families can afford nor even wants more than one child.

Japan’s stock market crashed the very month their working-age population peaked. Exactly one year later, their property market cracked, and began a long, grinding nosedive that they will never recover from.

And last year China’s working-age population peaked, along with the stock market, which tanked 40% or so in three months. If history repeats, the China real estate market is on deck, very, very soon. I live in China, and will have front-row seats.

Somewhat bogus argument. Sure the under 65 population is decreasing, but all other things are not being equal. Would an under 65 living in a old country shack like to live in one of the new apartments? Sure, so here is demand without increasing the population – economic mobility. Can he afford it? Probably not, but that is an income equality factor and not necessarily a demographic factor.

That works for a little while – if urbanization continues. But the migration of workers into cities may now be in trouble because there isn’t that much work for them in cities, and so they’re returning to their villages.

Here’s some more info this and other problems:

http://wolfstreet.com/2016/04/09/china-push-world-into-economic-crisis-end-of-chinese-miracle/

yes, I was going to comment that a declining total population can go hand in hand with a growing urban population, which could justify building millions of urban apartments (note that despite the extraordinary growth of China’s urban areas in the last four decades, there are no third world style slums to speak of, and the government deserves a lot of credit for that). still close to a hundred million empty apartments does push credibility

‘although the population data could be lower if greater emigration occurs or a higher mortality rate ensues due to illness, environmental, or global disturbances (aka, war)’ is almost entirely gratuitous – there is zero chance of an attritional WW2 style conflict which would put a meaningful dent in the population level, and what kind of epidemic or environmental disaster is the author fantasising about? I mean, the basic thrust of the article is entirely correct, but some of the things it says are absurd

RE: …still close to a hundred million empty apartments does push credibility

Sounds like a natural for Japanese assisted living/retirement communities. Also provides many service jobs for the Chinese.

Collapse already.. I’m sick of waiting :-/

Demographics are very slow moving. Watching grass grow is by comparison high-speed excitement. These things play out over years and decades.

Or…to quote the Archdruid, John Micheal Greer : “Collape Now And Enjoy The Rush!”

The Chinese have plenty of consumption. It is merely deferred. The author strangely neglected to castigate the Chinese for their high rate of saving, as Draghi has recently done for Germans.

As for the issue of supporting an aging population, they could follow the example of U.S. policy, which both reduces the middle class to poverty and reduces the life expectancy of the poor. No point in wasting resources by maintaining non-performing assets, eh?

Disclaimer: I myself happen to have a relatively low marginal propensity to consume.

Never mind.

“Credit” is a highly addictive drug, with serious consequences from long-term use/abuse. It is unique in that it is a tranquilizer for people, but potent stimulant for the “economy.”

Debt is a ‘potent stimulant’ for the economy only if it is necessary to increase investment to meet demand. Otherwise it is economically impotent and potentially destructive, which describes a great deal of the debt generated under so-called ‘supply-side’ policies.

The problem for both the U.S. and China is an inability for the policies of either to sufficiently stimulate demand, which is needed to provide a financial justification for debt-generated investment in supply. Not that either bothers with such justifications: supply-siders rush in where Keynesians fear to tread. The ‘build it and they will come’ paradigm has certain serious shortcomings.

“Credit has been used to build millions of generally unaffordable apartments for a middle class”. Absolutely untrue. Except in a few first tier cities like Beijng, Shanghai, Shenzhen, and HK, housing is affordable to the growing middle class. The vast majority of Chinese cities are not like the ones mentioned above.

Here’s a Forbes article which mentions many of the points I have made on ZH:

http://www.forbes.com/sites/wadeshepard/2016/03/30/how-people-in-china-afford-their-outrageously-expensive-homes/#25cbc94d4aa5

The birth rate in China is moving closer to most First World countries. People all around the world voluntarily limit the number of children because it is the prudent thing to do. Even with the lifting of the One Child Policy, few couples are choosing to have a second child. The Chinese So-Called Baby Boom is a minute fraction of 1% of couples who are having a second kid.

“The birth rate in China is moving closer to most First World countries. People all around the world voluntarily limit the number of children because it is the prudent thing to do.”

Not because it is prudent, but because it is in their interest to do so. Children are regarded as a kind of social insurance policy, as their parents expect their children to support them in their old age – and will overproduce children to ensure it.

It has been recognized since Roman times that people tend to have fewer children as their personal security increases, even to the point where fecundity falls below the replacement rate. It has been clearly shown that birth rate, and population, can be decreased with social programs, for example. For obvious reasons the rentier class opposes such policies because it reduces the supply of labor, increasing its price, and reduces consumption, regardless of whether they’re required to pay for those social programs.

It has also been clearly shown that elevation of the status of women reduces the birth rate, as it enables them to raise children with more success and with less personal and economic cost, which is one reason why the rentier class tends to denigrate the status of women. It has been surmised that the humane approach to global overpopulation is to elevate the status of women. This approach also limits economic growth and can result in an economic steady state, and unfortunately rentier capitalism absolutely requires economic growth, even though it is not sustainable.

Hear! Hear!

If you can build cities without people, why not a consumer society without consumers!

China invented fiat money. Nuff said. Maybe those returning urbanites know how that story ended. Maybe they figure that a patch of land to grow some rice on is worth more in a disorderly degrowth transition than a sand-walled apartment in ghostville, inner mongolia.

“China invented fiat money.”

That was a thousand years ago, before they could acquire patent protections.

Fiat currency makes inflation and hyperinflation possible through an excessive supply of money, but it cannot cause an excessive supply of money. Monetary policy does that. High inflation and hyperinflation occurs when the issuing body loses the will or the ability to assure its value, which requires the issuing body to be subject to corrupting influence. The issue of fiat money by itself is not actually relevant.

What anti-fiat activists neglect to mention is that it can be equally disastrous to back a currency with a commodity, such as gold. A financial crisis can lead to hoarding and a catastophic reduction in money velocity, which can motivate private entities to issue their own scrip – fiat currency – so as to continue to do business by assuring the value of the scrip.

The real issue here is not fiat money or hard money, but financial regulation.

“China’s Population Dooms the Transition to Consumer Economy”

Well, no, it doesn’t.

The conjecture assumes that personal consumption is sufficiently a function of age demographics, which simply isn’t a valid assumption. Plenty of consumer-dominated national economies evolved while their populations were aging.

Sorry.

Give me some examples of these national economies.

Venice? I can’t think of any others…

Heavens to Murgatroyd.

Okay, I’ll give you a couple of hints.

1) What happens to age demographics when life expectancy increases?

2) What happens to consumer spending as an economy modernizes and real wages increase?

Can you think of any countries where both of these occurred at the same time in the last hundred years?

You only have two dots to connect here. You can do it. I have confidence in you. I would not be doing you any favors by just giving you the answers, and I would be remiss to forego this opportunity to encourage you to develop your own insights.

Glad I could be of assistance.

There aren’t enough wives for men…so they changed the policy(females were not preferred to survive until about 2008). This information comes from my co-worker and friend and from my sister-in-law, both Chinese who are first generation immigrants and who were surprised at the turnaround in visits back to China at that time (around 2008 and 2009). Doctors are now forbidden in China to tell the parents the sex of the child from the ultrasound(Chinese colleague in 2016 regarding his children’s ultrasounds–they are 9 and 4 years old).

In1975 the population of the U.S. was roughly 216 million(round down to 200). Suppose we wanted to stay at that population forever. Let us assume that a woman will bear 2.1 children (rounded off to 2.0) in 20 years between the ages of 18 and 38. That means that an average replacement birthrate would need to be, for each year, 2children/20 years= one tenth child per year times 100 million(only women bear children)= 10 million children need to be born to replace/maintain the population. When people live longer the population has a temporary bulge…or if there is famine or war there is a decline. But mainly we have increased our population by people coming here who were not born here…and because in 1978 practically every woman who had held off becoming pregnant changed their minds. In 1986 I visited a former grade-school that had one third grade, two second grades, three first grades and 4 kintergartens! This could happen in China also.

“There aren’t enough wives for men”

Pshaw. One is more than enough.

Never mind.

China will be fine. Sure there will be changes, the east coast and southern Guangdong will see millions lose vast fortunes and the changes will be dramatic, but a billion Chinese living o the farms in poverty life will go on.

There is no socialism in China, these people grow rice, rear chickens and survive, looking after themselves.

They don’t rely on bankrupt state pensions, or handouts or disability payments or the rest of the insane socialist claptrap foisted on dumb people.

But change always comes. nothing does on forever, but for Europe, and then UK, Canada, Australia and now the US there is no hope.

Especially Europe, The filthy evil of displacing family as the source of sustenance and survival in a community with bloated corrupt statist control means that there is no way back for more than 90 % of the populations.

They don’t have the land the knowledge or the temperament to survive a decades long agricultural existence reliant solely on family and a small community without govt pensions, healthcare child support or all the other socialist enslavement garbage.

Sure, a billion Chinese marvel at the 32″ flat screen TV for $40 they can buy, but for them $40 is still a lot of money, and they can get the DVD’s for a few cents apiece, but the electricity is random in many places and there is no internet, but they don’t care, life just grinds on for them.

The elites in Shanghai and Guangzhou, Beijing and Shenzhen will find the changes to their pampered lives very uncomfortable in comparison, but most came from the provinces and they will go back.

But Europe, they have none of that or the the rest of the so called rich west,.

When the demographic and debt bubble finally implodes and all cash becomes worthless and real poverty stalks, that’s when the time to become very afraid arrives.

I would rather be back in a beautiful small village in Yunnan Province than anywhere in the West as that day arrives because no matter how poor it is there will still be food to eat and a bed to sleep and no fear of rampaging marauder4s or martial law.

Wherefore you perceive that there is nothing better, than that a man should rejoice in his own works; for that is his portion: for who shall bring him to see what shall be after him?

Whatsoever thy hand findeth to do, do it with thy might; for there is no work, nor device, nor knowledge, nor wisdom, in the grave, whither thou goest.

No, I am not an economist.

In China when things go bad, you get the police state boot on throat, mass imprisonment, death camps, and starvation….in the West you get welfare handouts. I know which I’d choose.

So you you don’t think the police state hasn’t arrived in America?

You should bounce back and forth between China and the US like I do. You would change your mind.

@ Wolf – thanks for posting the article and maintaining a great site.

Thanks all for reading and a lot of great, insightful comments and discussion. I definitely learned from your comments (I hadn’t factored in a rising retirement age in China with obvious implications akin to what is taking place in the West…all net job growth taking place in 55+yr/old populations).

A couple of points I failed to mention regarding China – best estimates show China to peak in total population around 2030 or a little sooner (timing and birthrates depending on economic growth and stability…neither looking great for China right now). Regarding China’s birthrate and cancellation of 1 child policy, I don’t think this will be the answer (nor is a model of perpetual growth) nor will it have much impact. Important to keep in mind China’s birthrate with the 1 child policy in place is higher than many of China’s neighbors that have no such policy including Japan, Taiwan, S. Korea…and likewise higher than many EU nations. This is an blend of birth control and economics forcing couples to wait, reduce, or skip family formation altogether.

I have no strong notion of who is better or worse off; China, Japan, EU, US, etc. All have weakness’ and strengths and I don’t believe doom or collapse is the necessary outcome. Each nation has choices and options. The sooner there is awareness what is at stake, good information, and honesty regarding the menu of options the sooner a rebalancing can begin. Nothing will be easy or painless but still options exist that can have a positive outcome. Of course, its also easy to fall into the realist or pessimist camp that the challenges are so big, so global, so daunting that we won’t resolve it short of war or some other kind of very negative ending. Although I admit a worse case outcome is possible, I’m committed to pushing for the best for my kids and the generations to come. All the best.

Chris, I believe the population line decreases so rapidly for China because There are NOT 50% women in the critical age mix. I am sorry I did not make that clear. I also hope for the best….one reason my family called me names was because I was rather blunt and they had small children….I should not have scared them; I was only trying to help them be prepared and I was scared myself.

This article misses key points and doesn’t makes sense.

The debt is largely institutional/corporate/public to build cities where no one will live and mountains of pig iron no one will buy.

The debt is not household debt. China has enough of a rising middle class to generate 4-6% per annum in consumer spending growth, with their wages increasing every year (as more and more are employed in the service sectors, not industrial). Their wages are going up and they have a lot of savings to spend. In the next 7 years they will add about 100 million to the ranks of upper middle class, and spend about $2 trillion of new money on stuff. Mostly services, cars etc. To put into perspective, China’s households are basically adding, as we speak, an entire Germany and UK of consumer spending to their economy.

Eventually, the demographics of the one-child policy will catch up with them. China’s population will plateau in about 15 years, but middle and upper middle class spending will continue as their wage increases have no reason to slow down. The laid off industrial low income workers will be left behind, and that is the real problem.

Folks maybe don’t understand that China is really 2 economies. One debt-based to support public industrial policy and keep the masses employed, the other savings-based to buy consumer products and services – and to fund the former. Unfortunately that funding gap is growing and unsustainable – savings is 55% of GDP and public debt is 200% (but add in the current account surplus and it’s still positive)

Pete – I hear this meme quite often that Chinese middle class growth & wage growth will drive consumption growth to the tune of 100+ million to middle class and trillions of new consumption.

This begs the question of what drives that growth from poor to middle to upper middle and are the conditions still in place for the continuation of this trend? In an older linked article, I showed the changing nature of China’s growth…and how the conditions that made that wage growth and path to middle class lifestyle have ceased…and it has only been the quintupling of total debt in 8yrs time that have masked the transition. But my guess is China’s middle class has already peaked and demand and consumption are on a downward slope from here. China nor the world will be the same.

http://econimica.blogspot.com/2015/11/post-script-credit-population-and-wage.html

Chris, the path to income growth hasn’t ceased. China’s rate of growth in both wages and disposable income is slowing down, but from a very high (sure, boosted, in part, from binge public sector borrowing) level. But wages and disposable income are still growing, not declining. Given the number of people who are benefiting from this wage growth, it translates into quite a large nominal impact.

The wage and economic sector mix is changing. Industrial and farm, in both wages and output to GDP is down, while the service sector is increasing from 43 to about 53% of GDP. Consumer consumption is growing from about 40% of GDP to 60%.

Even if China’s GDP slows to half the annual rate of increase of what is might be today, number fudging aside, it still means 400 million people (nearly all urban) will earn another usd 15k or so per year than they do today, in 10 years. This doesn’t include reducing the rate of savings which will also add to consumption.

If you are inferring the middle class has somehow “peaked” and are going to be earning less (negative real incomes AND negative savings), the data just doesn’t point to that, it shows a slowing down of rate of increase, but still formidable in nominal terms. I would suggest that even if a “peak” was somehow looming close, the government would pull out all stops to replenish the consumer, with helicopter money if need be, sell off the trillions in the enormous capital account, devalue the RMB, etc.

The government has been borrowing huge sums from itself to lend to itself and watched it blow up. That is a problem, but not a “money in the pocket of Beijingers” problem. The debt you are referring to has been a huge waste of capital, the alternative was large unemployment and political instability from non-urban areas. When you owe yourself the money, it is much easier to deal with the problem than if you owe others.

Enabling the urbanites to continue their consumption spending growth is the single most important economic goal for the party. The most important goal of all is political stability. If the party can’t keep the urbanites happy (and spending), their system will collapse. If that happens, run for cover, because debating the timing of when or how the Chinese consumer will stop spending will be the least of worries.