This wasn’t part of the rosy scenario.

The Merchandise World Trade Monitor by the CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, tracks global imports and exports in two measures: by volume and by unit price in US dollars. And the just released data for January was a doozie beneath the lackluster surface.

The World Trade Monitor for January, as measured in seasonally adjusted volume, declined 0.4% from December and was up a measly 1.1% from January a year ago. While the sub-index for import volumes rose 3% from a year ago, export volumes fell 0.7%. This sort of “growth,” languishing between slightly negative and slightly positive has been the rule last year.

The report added this about trade momentum:

Regional outcomes were mixed. Both import and export momentum became more negative in the United States. Both became more positive in the Euro Area. Import momentum in emerging Asia rose further, whereas export momentum in emerging Asia has been negative for four consecutive months.

This is also what the world’s largest container carrier, Maersk Lines, and others forecast for 2016: a growth rate of about zero to 1% in terms of volume. So not exactly an endorsement of a booming global economy.

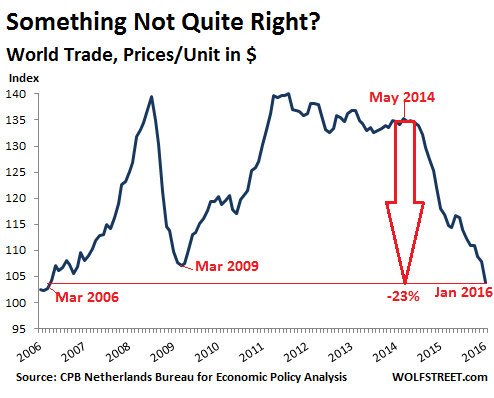

But here’s the doozie: In terms of prices per unit expressed in US dollars, world trade dropped 3.8% in January from December and is down 12.1% from January a year ago, continuing a rout that started in June 2014. Not that the index was all that strong at the time, after having cascaded lower from its peak in May 2011.

If June 2014 sounds familiar as a recent high point, it’s because a lot of indices started heading south after that, including the price of oil, revenues of S&P 500 companies, total business revenues in the US…. That’s when the Fed was in the middle of tapering QE out of existence and folks realized that it would be gone soon. That’s when the dollar began to strengthen against other key currencies. Shortly after that, inventories of all kinds in the US began to bloat.

Starting from that propitious month, the unit price index of world trade has plunged 23%. It’s now lower than it had been at the trough of the Financial Crisis. It hit the lowest level since March 2006:

This chart puts in perspective what Nils Andersen, the CEO of Danish conglomerate AP Møller-Maersk, which owns Maersk Lines, had said last month in an interview following the company’s dreary earnings report and guidance: “It is worse than in 2008.” [Read… “Worse than 2008”: World’s Largest Container Carrier on the Slowdown in Global Trade.]

But why the difference between the stagnation scenario in world trade in terms of volume and the total collapse of the index that measures world trade in unit prices in US dollars?

The volume measure is a reflection of a languishing global economy. It says that global trade may be sick, but it’s not collapsing. It’s worse than it was in 2011. This sort of thing was never part of the rosy scenario. But now it’s here.

The unit price measure in US dollars is a reflection of two forces, occurring simultaneously: the collapsed prices of the commodities complex, ranging from oil to corn; and the strength of the US dollar, or rather the weakness of certain other currencies, particularly the euro. It didn’t help that since last summer, the Chinese yuan has swooned against the dollar as well. So exports and imports from and to China, measured in dollars, have crashed further than when measured in yuan.

And these forces coagulated at a time of lackluster global demand despite, or because of, seven years of QE, zero-interest-rate policies, and now negative-interest-rate policies. It forms another indictment of central bank policies that have failed to stimulate demand though they have succeeded wonderfully in stimulating asset prices, malinvestment, and overcapacity.

World trade in goods is just one factor in the global economy. Now the global financial sector is getting hit too as the artful QE bonanza is bumping into real-world limits. And for global investment banking revenues, a key income source for “systemically important” banks, it has been one heck of a terrible first quarter. Read… The Big Unwind Hits Investment Banking

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Central bank policies have succeeded wonderfully in enriching the 0.01% uber-elite. The rest of us, not so much.

Replace, “Government of the people, by the people, for the people.” With, “Central banks of the banksters, by the banksters, for the banksters.”

Who are the banksters? Do we know them? We know they have their puppets in the goverments so this means we can’t get rid of them at the next elections. Why does nobody tell us this before we go to vote? All we hear how marvellous the country will be when so-and-so wins on polling day. I think we’re being conned but what do I do about it if everyone else waves their flags

Good question Peter. One of the banksters (as I’ve posted before) is US Attorney General Loretta Lynch. Lynch, a Harvard Law graduate, was appointed to US Attorney of the Eastern district of New York in 1999 by Clinton where she became the poster child for Civil Forfeiture. She also sat on the Board of Directors of the Federal Reserve Bank of New York, under then President of the Board, Geithner from 2003 to 2005.

Another place to spot banksters is the ‘Economic Advisors’ that Obama put in place in January 2009 as he took office. Lawrence Summers, Tim Geithner, Robert Rubin and Christina Romer were part of that cast and crew.

But the place to look is at the helm of Wall Street’s big five.

http://www.wallstreetonparade.com

will fill you in on the details.

The Fed is an opaque cartel of private banking families that have been given control of the issuance of currency in the US since just over a century ago. Its overlord is the BIS.

Banksters have been shaping the history of our nation since 1791 when the First Bank of the United States was granted a 20 year charter. This was engineered by Alexander Hamilton, who along with Isaac Roosevelt founded the Bank of New York in 1784. In 1811, the 20 year charter expired, and Congress would not renew it. Nathan Mayor Rothschild was not amused, “Teach those impudent Americans a lesson. Bring them back to colonial status.”

The War of 1812 was underway, and to pay for it, Congress granted another 20 year charter to the Second Bank of the United States in 1816. Same banksters, same story of where the issuance of our currency was controlled. With the Fed, it has stayed in the same place, if that is any consolation.

The Powers That Be will not allow the Fed to be audited, and that should tell us whether it is to be trusted or not.

The banksters… The Bank for International settlements; family and friends are private profiteering corporations. For generations they have owned all the world’s central banks; that’s the central bank in each and every country except three. The global central banking system owns the banks and therefore the governments in each country. It took them eighty years to get full control of the U.S. gov. and all its institutions nationwide but they did it. BIS is the mother ship. The heads of all the world’s central banks go to see the Barons of Basel every two months to get their marching orders about what they are going to do to the human population next. This is not a U.S. only problem; this is global devastation for all of humanity. IF the Sheeple can understand the problem… and that’s a huge “if”… what are they prepared to do about it?

I believe that the chart above corresponds almost perfectly with an oil price chart.

The demand is there, it’s the income that is not. Last weekend the parking lot at the mall was packed because JCPenny was having what turned out to be a really good sale. There were lines at the checkouts everywhere. A few days later the mall was dead. From the look of things, it’s the retailers that are stimulating the economy by cutting their margins.

Corprate debt rating at 15 year low: http://money.cnn.com/2016/03/24/investing/us-corporate-debt-rating-junk-15-year-low/index.html

Couple of items I have been mulling over…

Barclays is exiting Africa which means they know African commodities are going to fall further. Looks like they found the dead canary first.

SAB/InBev merger was created to tap the emerging growth opportunity in Africa. Someone must have put the growth chart in the prospectus upside down and missed the memo from Barclays.

YUM! brands is selling 20% stake of YUM China and spinning it off as it’s own entity. Sounds like big trouble in flat growth China.

Dow spun off several of it’s divisions. So did Monsanto. Appears they are battening down the hatches in case a spin off runs into trouble.

Lots of poisoning lawsuits against them in the hopper. Many Countries are banning their products.

There is a lot of scrambling going on.

There are more problems in Africa than just the fall in commodities- although that might be the trigger. Both the largest regimes, Nigeria and South Africa have major governance issues. The US for one has travel advisories on Nigeria. Lagos airport is not a safe destination.

Since I am in Semiconductor Manufacturing sector, one country I always keep my eye on is Korea as they are definitely a big player in this arena.

In one of my industry journals they predict a slow 2016 for chips due to an over capacity of TVs, phone, and PCs….as much as 25% oversupply already in the pipeline. If worldwide demand is already slowing due to recession and there is already a saturation point in the more developed countries; this over supply/over capacity could really cripple them.

Overall look at Korean economy:

http://www.economist.com/news/business-and-finance/21662952-steepest-year-drop-trade-2009-mark-sagging-global-demand-why-big-slump?zid=295&ah=0bca374e65f2354d553956ea65f756e0

Per capita income shrank last year:

http://www.koreatimes.co.kr/www/news/biz/2016/03/488_201135.html

Youth unemployment/underemployment: http://www.bloomberg.com/news/articles/2015-11-11/youth-unemployment-in-korea-is-pushing-some-job-seekers-abroad

Elderly going bankrupt at alarming rates:

http://www.southkoreanews.net/index.php/sid/242547255

Guess I will go open a cheap bottle of wine, eat a dark chocolate easter egg and just be happy I can do so. :-)

When I started my post-college career several of my first jobs were semiconductor related (e.g. mask layout/manufacture) before I figured out how labor markets work and retrained into mainstream programming stuff (Microsoft tech stack) for “liquidity”. I am adding professional accounting (and soon data mining) to that as I get older because, yes, I am that paranoid about what is coming.

I am eligible to take my CPA exams now (a goal I plan to work on later this year as work allows – a one year study commitment), but in the nearer term I am keenly interested in “data science”. I will probably drop cash on this program:

https://projectbotticelli.com/datamining

ASIDE: if you shop there, as I plan to, tell him you got a discount code “WolfStreet” and secure a kickback to Wolf. I bet the guy that does all the training would roll with it. I plan to, as work will likely pick up the costs (in negotiation – I wear a lot of hats at work) as I have a pilot project this year for revenue forecasting (proof of concept).

But, also, I looked very closely at this program:

https://www.udacity.com/course/intro-to-data-science–ud359

Those guys looks really solid and it wasn’t until I had a personal recommendation that I found Project Botticelli which just aligned closer to my situation. For me it was the specifics in the MS tech stack, which I am deeply invested, that made the difference. For any professionals out there that read WS, this is where things are going, so hop on that wave and ride it. The Project Botticelli site has several free videos to help introduce concepts, much better than UdaCity in that regard (see both data mining and data science).

I have no affiliation with either and am strictly a prospective customer weighing my options and future return on labor invested. But, hey, we all like data, charts, and analysis here, so I hope readers don’t mind.

Anyway, it was clear to me back in the late 90s that chips were going to commoditize and things were downhill from there. Just look at what happened to memory (they used to make bank in the 90s). It is the KWave thing I bleat about occasionally.

Automation in many sectors is going to wreak havok – it freaks me out really – I just hope I am as wrong about it as the “collapse” that hasn’t overtly happened. I would LOVE a collapse, late of course, when I am a fat, ripe age of 75 or 80. I could live with that. I don’t think I will be so lucky though.

We are going to have “bad harvests” for a while until things thin enough that something new and really transitional can happen – the next KWave – that can easily take years or even decades. Sorry to be negative, just how I see it.

Buckle up. It won’t be a crash with central management, but it is going to hell for sure.

Regards,

Cooter

“Kickback to Wolf” … I love it!!!!

Cooter-

Stick with the CPA. Online courses are worthless and you won’t impress anyone.

Online anything (except Wolfstreet of course) is worthless from a career perspective. A good college has employers lining up to get their grads but this is rareified air. The harsh reality is that most degrees are worthless and most colleges are worthless and even more worthless are the online time sinks.

Most HR zombies don’t beileve people can retrain beyond a certain age (I’d say 35 is the new 65). Most resumes are prescreened by computers and they’ll vaporize your application before its even read.

Obama is trying to give almost unlimited visas to foreign grads of US universities. Which ties in nicely with the housing bubbles we see across the country.

Good luck.

ww.breitbart.com/big-government/2015/09/28/obama-prepares-give-away-white-collar-jobs-citizenship-foreign-graduates/

As a (rare or unique) physicist with a CPA, the work of a CPA is very boring, even as CFO. The last thing any one wants is a really creative CPA. IRS regulations are a gigabyte of bad spaghetti code.

You guys didn’t watch those free videos. I am hot to trot for this stuff.

Data science/mining is really, really interesting stuff – but I don’t have saddle time, so, perhaps you are right.

Regards,

Cooter

P.S. I have an irreplaceable job, which I will hold on to until retirement – this is brain candy – and also potentially useful to my employer which helps with costs. :-)

Well played: ROK is the export-driven giant that never matters until it does, despite many of her companies being major players worldwide in sectors from consumer electronics to shipbuilding.

I’ve found the Economist article particularly entertaining: it seems ROK government officials think a yuan devaluation could be a boon for their economy. Apparently they haven’t noticed the fact that due to flatlining global trade and the timidity of the US Federal Reserve, fighting a currency war is increasingly useless.

ROK may see her industrial exports to China rise, short term, but Japan and Taiwan are not going to sit idly by the sideline. Perhaps even Europe may join the fray, and at that point some clueless/panicky action by the Fed will send the dollar plunging and everybody will be back at square one with a debased currency to boot.

A flat gobal economy is the true definition of beggar thy neighbor economics: growth, especially for big exporters such as ROK, can only come at the expense of other countries which will then feel justified in striking back with a vengeance through currency devaluation or other tools.

Given the present stagnation will stay with us for a long time or at very least until liquidation is allowed to do away with part of the malinvestments (starting from excess capacity in every single sector), i expect it will get really interesting among exporters.

Cheaper LCD TVs, smartphones, and appliances I’m OK with that.

It would be totally OK if you can eat and live in consumer electronics.

Compared my parent’s generation mere 20 years ago:

-Food costs at least 2x more

-Public transport costs 3x more

-Housing costs at least 5x more for 1/2 the usable area with far worse parking

Dear CBs, politicians and economists, just because you can scream deflation and post negative CPI numbers in your mouthpiece you called “news” doesn’t mean we are fucking stupid with recent history.

That’s a huge problem with electronic manufacturers, they can see plainly as day their products are getting increasingly commoditized and any marginal real utility against older stuff is dropping to next to zero levels yet they still follow the same beaten path because they have no choice but to paint themselves into a corner.

Like who cares whether their MS office PC runs a 5 year old i5 or a latest one when both are so bloody fast already they can’t even tell a difference.

You may not like Apple, but their at least their exclusive software ecosystem is a far more defensible wall against a sea of commoditized overkill hardware. Because they knew this for a long time that this will be the eventual endgame for a hardware only player.

Yes, but so what? The Real Economy can crash and burn so long as the Financial Economy does great because Economic Policy says that’s all that matters. And the Financial Economy is holding up because it’s based on trillions in free-money giveaways and isn’t all that dependent on the Real Economy.

Yes, but wait…. the “financial economy” isn’t doing so great anymore. Banks are laying off staff, earnings are dismal, bank stocks are down, and now this:

http://wolfstreet.com/2016/03/24/the-big-unwind-of-investment-banking/

How deliberate do you think it was for the Fed to stimulate asset prices? Did the CB’s not understand what would result from QE swaps?

To me it seems the Fed [ + all CB’s] are following mainstream economic dreams, unworkable models of a parallel economy where people act ‘rationally’ etc. By which I mean the Fed expected banks to act rationally . Well they did, their own rationality, not what the fed is supposed to have wanted.

All the FED did was help banks unload trillions of over-priced assets onto unsuspecting dolts. Those same dolts are left holding the bag and the bill while the insiders are rewarded.

They knew exactly what they were doing.

‘They knew exactly what they were doing.’

Hanlon’s Razor says one should not attribute to malice that which is adequately explained by stupidity, but these guys are anything but stupid and one can only attribute malice.

‘Yes, but wait…. the “financial economy” isn’t doing so great anymore.’

One can only hope the banking cartel is weakened to the point where the next U.S. president can do what FDR did and Obama blitheringly failed to do: rein in the banksters.

‘How deliberate do you think it was for the Fed to stimulate asset prices?’

Deliberate – and engineered. And they know full well that billions suffer by their venality.

America to Establishment: Who the hell are you people?

http://www.mcclatchydc.com/news/politics-government/election/article68042192.html

What is that which I should turn to, lighting upon days like these?

Every door is barred with gold, and opens but to golden keys . . .

The financial guys are stupid in the sense that they will always f*** with you even when it is not in their best interest to do so. If you understand that you can always beat them. That’s how Bear Stearns went down the tubes. They did it, when they shouldn’t have, and didn’t understand it was better not to.

Compared my parent’s generation mere 20 years ago:

-Food costs at least 2x more

-Public transport costs 3x more

-Housing costs at least 5x more for 1/2 the usable area with far worse parking

Nail hit on the head with that comment. High resource extraction costs – particularly oil — are what have destroyed growth.

All we have left is stimulus to keep things alive… that will fail

HIGH PRICED OIL DESTROYS GROWTH

According to the OECD Economics Department and the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

BUT OIL PRODUCERS NEED $100+ OIL

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH

For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil production has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

THE PERFECT STORM (see p. 58 onwards)

The economy is a surplus energy equation, not a monetary one, and growth in output (and in the global population) since the Industrial Revolution has resulted from the harnessing of ever-greater quantities of energy. But the critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel. http://ftalphaville.ft.com/files/2013/01/Perfect-Storm-LR.pdf

Thomas:

“Compared my parent’s generation mere 20 years ago:

-Food costs at least 2x more

-Public transport costs 3x more

-Housing costs at least 5x more for 1/2 the usable area with far worse parking

Nail hit on the head with that comment. High resource extraction costs – particularly oil — are what have destroyed growth.

Although the Economist magazine uses the “Big Mac” index to compare purchasing power between countries, I use the Big Mac index to measure inflation. In the early 1970’s McDonalds sold the Big Mac meal with “change back from a dollar. Today depending on the country, that same meal is 500% to 750% up in price. And no, I don’t believe “quality” has improved to a higher hedonistic adjustment.

Even governments know their inflation numbers are jigged and their are damn few on this planet that believe inflation is benign on the consumer level. Retail prices are very sticky on the downward side compared to commodities. In part because government supports its criminal cronies by restricting market access in nearly everything.

And I believe oil/energy costs are a side issue. The Fed and the other central banks have fed inflation, first by letting their criminal cronies front run assets- both paper assets and real assets- by edict through suppressing the price of money (interest rates). That is the only reason the billionaire class has multiplied while middle class savers are dying. It is theft plain and simple.

Let there be a free market price for money (interest rates) and get the Central Banks out of the theft from the small into the hands of the big and the economy might start to heal.

Peak mining & implications for natural resource management – Simon Michaux

Former career mining professional Simon Michaux gives a public lecture describing the onset of ‘peak mining’ and its various implications for natural resource management. This talk was presented in Adelaide by the environmental group, Sustainable Population Australia. The presentation looks at the looming energy crisis, and plots peak gas, coal, uranium and other energy sources as we head towards a time of resource scarcity and radical societal change.

https://www.youtube.com/watch?v=TFyTSiCXWEE

Again – we will never run out of resources – the issue is one of cost…. expensive to extract resources destroy growth.

What is larger? More dollars in the hands of millions of potential customers whose marginal propensity to consume is higher and represents 70% of total demand, or the 1% with a lower propensity to consume, who chase yield, and invest in ponzi schemes like Valeant?

Companies only invest when there is demand sufficient to justify capital expenditure. Total Demand $ = N x MPC.

Cheap money has only resulted in stock buy-backs and valuation bubbles.

Concentration of wealth siphons aggregate demand.

#But here’s the doozie: In terms of prices per unit expressed in US dollars

well i guess macro economics is not your specialty.

why is it bad or good thing ?

for an example,

in 2014 year consumer paid $ X for unit, in 2015 year consumer paid $ X * 0.95 (5% less..) why is it bad ?

for world GDP its doesn’t matter. oil is cheap , more money for importers, less money for exporters. and vice versa.

volume is totally different . yes, volume is down, consumption is down, quality of living is worse.

always amazed how people like LOWER PRICES for shopping, but seems scared of deflation all the time.

good luck

alx

Ever heard of “businesses”? They have to make a profit in order to hire and grow, but now revenues and PROFITS are declining. When that happens, many companies will slash investments and expenses, including employment. They’ve already embarked on slashing investments (revenues for other businesses!), and they’re cutting expenses where they can, and some have started laying off people. That’s when these dollars impact macro trends. Recessions get kicked off that way.

wow.

ever heard of ‘consumers’ ?

where do they find money to pay for ever increasing prices ?

pal, its chicken-eggs dilemma .

you just don’t understand simple macro concept.

lets say you ‘re owner of business making cars

of course you want to sell cars for higher prices,but as soon as you left factory and want to buy car YOU ARE CONSUMER , you want cheaper cars.

its called dualism of labor. as producer you want to sell higher prices, and as consumer you want lower prices.

so , thats why falling price for unit is not good or bad.

good luck

alx

Wow, you really don’t have a clue, do you? There is nothing without businesses: no workers, no consumers, no jobs, no products to consume, no money to pay for anything…. Businesses (from the small farmer to the big business) HAVE to thrive, or else everything goes to heck. No way around it.

You don’t need inflation or deflation to make that work. You need the possibility to make a sale and to make a PROFIT on that sale. That profit needs to be big enough so you can pay your workers adequately and pay suppliers, bankers, and everyone else, including the governments. That’s all.

Without it, nothing works. Without it, you don’t have workers, and you don’t have consumers, and you don’t have a government with the means to help the unemployed….

Good look to you too.

A flier I know, but is this trade IN $US we’re talking about here, or just measurement of it in $US as the currency?

If the former, would tend to suggest Brics, AIIB etc already cutting US out of trade, turning hegemony into more egalitarian trade blocs.

Still not the way I’d like things to go, but better than nothing.

Great pce btw.

https://hat4uk.wordpress.com/2016/03/21/analysis-old-world-news-from-the-new-world-order/

I’m in industrial bearings in the USA. We saw the first domino of this crash in April 2015. Oil exploration slows, no new wells, no need for well bearings or steel. Steel slows down, still have auto sales, but oil well based steel shuttered, fewer bearings.

Coal is being replaced globally with cheaper, cleaner natural gas, bearings are going away in coal generated power plants. Some bearings get installed in wind turbines, but that’s like handing you a 50 and getting a 10 spot back. Oil, gas and coal prices go down, no one orders wind turbines.

Other commodities pricing going down, ore prices, copper and aluminum down, production down, fewer bearings.

The only industrial production going well are those financed by paper. Hyper expensive cars being sold to subprime buyers on 80 month notes, creates artificial car demand. Food production still sells small bearings. Production for medical devices (spurred by Obamacare) still good. Paper production is down with the transition to digital, not out quite yet.

We are just now talking about employment cutbacks. They are coming until things change.

Thanks to ever increasing automation China will pretty much be the last country to manufacture their way to success and they are already feeling the pain. Even Singapore by 2000s knew financial engineering and real estate rent seeking pays better than good old manufacturing. The Asian Tiger growth model will never work for countries unfortunate (or stupid) that are still left behind.