This is going to be a far larger problem than Wall Street realizes.

By Porter Stansberry, Daily Wealth:

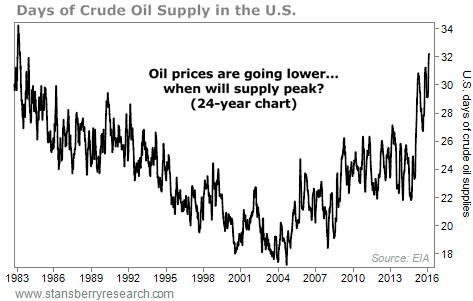

In early 1983 – the first week of February, to be precise – the inventory of crude oil in the U.S. reached an all-time economic high. I say “economic high” because nominal supply of crude oil has since far surpassed its 1983 number. In fact, current U.S. crude-oil inventory (504 million barrels) is the actual all-time high. Supply today is about 150 million barrels more than total supply in 1983.

Obviously, we have a lot more oil in storage than we’ve ever had before – about 40% more. But nominal supply numbers aren’t as important as you might think. Demand for crude oil in our economy has grown a lot since 1983.

To make a bona fide “apples-to-apples” comparison to today’s supply glut, we should measure the amount of oil supply relative to consumption. In 1983, the number of days’ worth of consumption in the U.S. hit a peak of 33.4. That’s the largest amount of crude oil we’ve ever held in private storage, relative to demand. That’s the all-time highest amount of “economic supply” – supply in relation to actual demand.

Much like today’s glut, the glut of oil from the mid-1980s was caused by a sustained increase in U.S. production. More oil was coming from Alaska’s North Slope. The Trans-Alaska pipeline began operation in July 1977. It had an immediate effect on total U.S. supply.

U.S. oil production grew from 227 million barrels per month in 1977 to almost 270 million barrels per month in July 1986 – an increase in monthly production of 18.9% over nine years. As you might remember, gasoline prices fell to well below $1 per gallon… and we saw a commercial real estate and banking crisis in Texas. Houston real estate didn’t recover for 20 years.

In reviewing this history, it fascinated me that the peak of economic supply occurred so early in the production boom. Oil production continued to grow for another three- and-a-half years after economic supply peaked. Why did production continue to grow so much despite the obvious glut? I’ll answer that question in a minute. But first, let’s consider our current boom.

Today’s crude-oil production boom began back in 2005. Hurricane Katrina shut down most production in the Gulf of Mexico, resulting in U.S. crude-oil production of only 120 million barrels in October 2005. Nearly 10 years later, in July 2015, U.S. production grew to 285 million barrels, an increase of 138%. In terms of nominal magnitude, our current crude-oil production boom is vastly larger than the boom that triggered the 1980s glut.

But of course, consumption has also increased since 1983. Even with oil supply straining the industry’s ability to store it, we are still below the record mark of days’ worth of consumption set in 1983 – but just barely. Currently, our supply of crude oil in private storage represents 32.4 days’ worth of consumption…

Looking at oil supply relative to consumption, we see that we are still a long way from a bottom in crude-oil prices. History shows that even after days’ worth of supply peaks, oil production is likely to continue to increase for several years, pushing prices lower.

So why do oil companies continue to produce oil even after prices have collapsed and oil can’t be pumped profitably? Why did monthly production continue to increase for three-and-a-half years after the last peak in days’ worth of supply? There are two reasons.

First, even when oil prices don’t support investments in additional supply, producing more oil may be necessary to generate cash flows to stave off bankruptcy. Operating at a loss is better than losing your oil company to creditors.

Second, most of the smaller and midsize oil companies have to hedge their production in order to qualify for their bank loans and lines of credit. According to market-research firm IHS Energy, small energy companies in the U.S. have hedged 47% of their production at prices that average $74 per barrel. Midsize firms are also relatively protected, with 43% of their oil production hedged at $60 per barrel on average. For companies that have hedged a significant amount of their production, there’s still good reason to continue to produce as much oil as possible… at least, for now.

It’s the large energy firms that are most exposed to vastly lower oil prices.

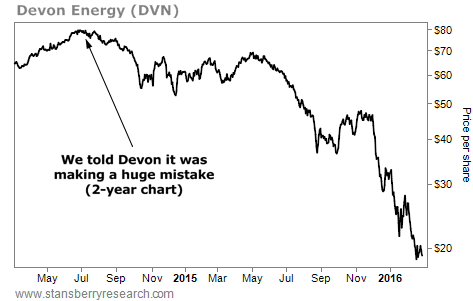

According to IHS, only 6% of large-company oil production is hedged. That’s probably why big U.S. energy companies like Devon Energy (DVN), Pioneer Natural Resources (PXD), and Hess (HES) are being forced to raise cash through equity sales. Keep in mind, selling equity in the midst of a crisis is horrible for existing investors.

Devon sold new shares equal to 15% of its outstanding shares at a 7.8% discount from its previous closing price. The company also announced it’s cutting 20% of its workforce. The stock is now down roughly 75% since we sent Devon’s management an open letter warning that crude prices would inevitably fall, causing huge losses on its huge investments into the Canadian oil sands…

The continuing increases in supply and the industry’s efforts to raise more capital (to continue pumping) show that we aren’t close to the bottom in oil prices. So far, 48 North American energy firms have declared bankruptcy, leaving $17 billion in bad debt. I suspect the final tally of defaults will be far in excess of 10 times this number, with losses approaching the magnitude of last decade’s mortgage crisis.

Few people have realized that the financial problems caused by low oil prices aren’t going away. Everyone, it seems, expects that a quick reversal in oil production will lead to a quick drawdown in supply, and then higher oil prices. But as you can see, production isn’t slowing. Supply is still growing. And supply is now at an all-time high, even when measured against consumption.

This is going to be a far larger problem than Wall Street realizes. By Porter Stansberry, Daily Wealth.

The oil price collapse plays a role, but it’s not just oil. And then there’s S&P’s “pessimistic scenario.” Read… Corporate Default Rate Jumps Past Lehman Moment

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This should be read in conjunction with Gail Tverberg’s blog “Our Finite World” She goes into a lot more detail about all the consequences of the dysfunctioning economy and oil’s problems;

https://ourfiniteworld.com/2016/02/08/the-physics-of-energy-and-the-economy/

That is one of the most hysterical doomer blogs out there.

And everyone of them, has little grains of truth, and gems in them.

This Secular Cycles she gets on about, is also the Republican/Socialist revolutionary cycle.

The takers in republican france, took everything from the wealthy enemy in the “Bloody Terror”. Including their heads.

Now the “Socialist Citizens” who put them selves at the top, after that event, are the new “Wealthy Enemy”. And the Bloody Terror. French Taker Street Mob, is getting ready to do it all again.

Around 300 years later. roughly the same amount of cake as last time, just 4 times as many mouths wanting a piece.

Socialism/Communism dosent work .

Try telling that to the Bloody Terror, French Taker Street Mob.

After Comrade Sanders/Hollande, has told them it does.

The only doomer https://ourfiniteworld.com/2016/02/08/the-physics-of-energy-and-the-economy/ in that. Is her closing, where she makes no allowance for humans to learn from history and effect change to their behavior, to change the behavior of cycles.

Probably as she sees that they wont, so dosent deviate from her core topic.

Excesive/cheap credit consumes the futures growth and consumption, rapidly, today.

My estimate is that china has already consumed 30 + year”s. Of future global growth and consumption, at current population levels.

Further. Current global population levels, are not long term ecologically sustainable. They need to return, at least, to pre 1946 levels, at least 60% reduction from current levels.

If the current massive credit levels can be managed downward. As opposed to rapidly imploded, and population levels in the population explosion states, can also be managed downward, by other than exporting it..

The collapse she speaks of can be avoided.

This would however require a level of cooperation and coordination from, Brazil, India, Africa, and china, with the west, that those states are probably selfishly not willing to enter into.

As they would see it as a win win, not a, we win, west looses scenario.

“Humans really need to find another planet to live on, as it looks like they are going to destroy this one”. unknown arms dealer.

I also would like to think the rapid collapse forecast by some could be avoided, but it would require a government planning to meet such an event. Do you see any signs of a plan? I don’t.

So we are left with trying to manage things ad hoc. This will not end well.

G20 in china did not come close, to any sort of action plan.As it involved china giving, and china only wants to take.

The CCP, like the Putin clan, and india, are interested in self, not global, preservation.

Where this all goes, at what speed, very much depends, on who, next, inhabits the oval office.

O bummer, has been a total bummer, for America, and the planet.

WS is nowhwere near as negative as this https://ourfiniteworld.com/

In the globalization article she note’s, corporate vampire-ism/exploitation, lightly, but misses the biggest reason globalization, will and is failing.

Globalization, is incompatible with nation states, that make different rules,` to gain unfair advantage.

Today borders are an impediment to legal authority’s, and a safe haven creator, for criminals, and Vampire Corporations.

All of her facts are “Fact’s”

Her analysis of them, may be negative biased, but they are still all tenable “Fact’s”.

Selfish Governments and Vampire Corporates are destroying the Planet, quickly.

They dont care, as long as they are the last dying man standing.

Humans In their present, Socialist/Leftist, Give me, street mob, democratic society’s, do not deserve to survive.

I thought the “takers” nowadays are the billionaire Wall Street bankers and international financiers. The “givers” are pretty much everybody else. your comments really don’t make much sense considering today’s realities.

“

Some of the bloggers, not so much Gail herself, are pretty convinced about our ultimate destruction. Nobody knows when of course, but the end is 100% certain [infinite growth cannot work in a finite world]. Our problem will be there’s nowhere to escape to except perhaps the mountain valleys in New Guinea. Does that destination take your fancy?

Doomers suffer from a lack of imagination. Limitless growth is possible, especially if one looks off-world.

Off world will only happen, if one of three scenarios occur.

The world becomes dominated totally by china, or Russia.

The Majority of nations start cooperating with the US, Israel, and Japan.

The chance’s of humanity rendering the planet uninhabitable, for humans, before any of the above occurs is very high.

Yes her bias is hegative and she does not always think very laterally.

++

Human to machine, we are not going to make it are we, humans I mean.

Machine, it is in your nature, to destroy yourselves.

Probably not as pleasant, but to be a dreamer, as you imply, instead of a doomer, is not at all realistic. It’s way too late for imagination. We can teleport all we like in fiction, but in reality we can’t.

‘Limitless growth is possible’

If you live in a delusional world anything is theoretically possible.

Some might even believe they can fly.

Reality is a bitch though

I have been flying for decades, https://en.wikipedia.org/wiki/Hang_gliding

I am possibly getting a bit old for it now, danger of injury’s due to bad landings.

Some Humans, will leave this planet, after they resolves the big issues, unless the, ignorant, greedy, megalomaniacs, and religious maniacs, destroy it first.

Gosh… Oil production is actually decreasing across USA and many oil producing countries. Recheck your data

US production is still WAY up from a year ago, though it might have declined from one month to the other. These are all “estimates.” In the US, no one really knows total production for sure at the time of production.

Iran is increasing production as fast as possible. Saudi Arabia and Russia are pumping at record rates, and as fast as they can….

With all the hype and hopes and nonsense about “declining production,” the ultimate arbiter of the glut is crude oil in storage, and storage levels keep soaring. Check out today’s report by the EIA. Terrifying!

But isn’t it accurate to say most shale formation wells decline at a MUCH faster rate than Spindletop-type wells? And therefore if additional investment is curtailed (a given) domestic production could/should drop off markedly over the next few years, correct?

Well, um, based on the same logic, I’ve been waiting for the decline of US nat gas production for years! And now that glut is bigger in the US than the oil glut. And in started in 2009!

There are so many factors involved. Decline rates of fracked wells are just one of them.

And even if US production declines significantly, it’s global production that matters.

This is similar to the claim that Obama “reduced the deficit”: technically true, but only in that he reduced it from the all-time high to levels that are still historically bad. With oil it’s a similar case: production maybe down from the all-time highs, but it’s still at historically high levels.

The number that needs checking in this analysis is the demand. which is facing a near-term collapse.

These two examples are not actually analogous. Reducing the deficit means cutting back on government spending [which means raising unemployment] So the more the government cuts its deficit the worse it is for the economy and unemployment, [this may seem bizarre but it’s true.

It’s a sectoral balances issue]. The only reason the economy is still growing is because there is still a deficit.

So the oil glut gets worse when the government cuts its deficit because that cuts demand.

Isn’t there a plan afoot for a large increase in storage capacity in the next 1-2 years?

In the US, storage capacity has increased by a lot, and continues to increase. Where there’s demand, there will be supply. It’s big business. The companies that do that are among the few in the oil and gas sector that are now doing well.

It is my opinion that the Keystone Pipeline project was actually intended as a giant sprawling storage system as much as it was for transportation.

So Wolf, what are you trying to say? That going short or long on monthly options in oil related securities is a good “play” right now? That US oil production will go WAY up for the next decade? Or that it is impossible to know?

From the standpoint of a perspective longer than a decade or two the fact that oil production is up in the US from a year ago or that the world’s tanker fleet is being used for storage is completely irrelevant.

The problem with a short term perspective is the same one experienced by a global corporation that makes its planning decisions based upon ways to goose its quarterly stock pricing and executive bonus structure. The executives may accumulate new mansions but the company will fail.

If you take a realistic look at the future of oil there are things we can know for certain:

Oil is a finite resource. Production will reach a peak and decline. That decline rate will look somewhat like a bell curve, but it will likely be steeper on the downside.

Sustained exponential growth in exploitation of a finite resource is mathematically impossible.

Discovery rates and trends indicate that we are at or near peak of production potential. For conventional oil, that peak has already past.

Tight oil, tar sands, and deepwater oil have much lower EROI’s and therefore profit potentials than the conventional oil that made Texas and Saudi Arabia what they are today. And they require much more capital per barrel of output.

Unconventional oil can change the shape of the global production profile in the short run, but it cannot change the finite nature of the resource.

Field depletion rates for tight oil do matter, and the cost and availability of capital to maintain necessary exponential increase in drilling rates does matter.

Oil is a major contributor to climate change. And climate change does have consequences.

At this time there is no technologically feasible replacement for oil.

If you want to discuss something significant about the Age of Oil, let’s talk about what the world will look like when humans can no longer can live on the cheap, concentrated, and easily transported energy that the planet manufactured billions of years ago. And I submit that it is a world that awaits us in only a few decades.

I always say, only partially tongue-in-cheek, that we will run out of clean air to breathe before we run out of hydrocarbons to burn.

If you take a sniff in India or China, you might get the impression that this is going to happen sooner than expected. But technological changes might slow it down too. In the US, we’ve come a long ways, in part by shipping our dirtiest industries to other countries. Now we here in California are blessed with the pollution drifting across the Pacific.

We are 100 years and more before the oil becomes scarce. A full 25% of known oil lies in Siberia, and has just started to be tapped. The amount of oil in the Artic has countries fighting over the ‘economic zone’, and again Russia has the biggest part. We will run out of breathable air before we run out of oil.

As Wolf mentions, at what point does the air become unfit. I know a guy in China that had to buy a $5,000 air filter for his apartment because the inside air was that bad.

The main demand for oil is for transportation. In the USA the young don’t want a car and older folks are feeling that way too, in China the government is trying to tax the hell out of ownership, and the rest of the BRICS have trouble getting bus fare let along owning a car. Like peak oil, I think peak car ownership is running the last days of a good run.

All things come to an end, and then the world moves on to something else.

There are huge volumes of oil still under the ground.

The problem is that the cost to find and extract these reserves is too high.

The economy cannot function on expensive to extract oil

HIGH PRICED OIL DESTROYS GROWTH

According to the OECD Economics Department and the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH

For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil production has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

Even now we are not really technologically dependent on petroleum for our energy. We are dependent on petroleum for economic and political reasons, mainly to make oil companies rich and powerful. We should really be conserving our petroleum for the future as a chemical feedstock. But i know a lot about science and technology and I know that it is emphatically NOT true that there is no alternative to petroleum for energy and in great abundance.

FYI:

Replacement of oil by alternative sources

https://i0.wp.com/www.theoildrum.com/files/ncmo01_0.gif

While oil has many other important uses (lubrication, plastics, roadways, roofing) this section considers only its use as an energy source. The CMO is a powerful means of understanding the difficulty of replacing oil energy by other sources. SRI International chemist Ripudaman Malhotra, working with Crane and colleague Ed Kinderman, used it to describe the looming energy crisis in sobering terms.[13] Malhotra illustrates the problem of producing one CMO energy that we currently derive from oil each year from five different alternative sources. Installing capacity to produce 1 CMO per year requires long and significant development.

Allowing fifty years to develop the requisite capacity, 1 CMO of energy per year could be produced by any one of these developments:

4 Three Gorges Dams,[14] developed each year for 50 years, or

52 nuclear power plants,[15] developed each year for 50 years, or

104 coal-fired power plants,[16] developed each year for 50 years, or

32,850 wind turbines,[17][18] developed each year for 50 years, or

91,250,000 rooftop solar photovoltaic panels[19] developed each year for 50 years

http://en.wikipedia.org/wiki/Cubic_mile_of_oil

A partial list of products made from Petroleum (144 of 6000 items)

One 42-gallon barrel of oil creates 19.4 gallons of gasoline. The rest (over half) is used to make things like:

http://www.ranken-energy.com/products%20from%20petroleum.htm

The reason they are all pumping like there is no tomorrow is because there is no tomorrow if they stop.

Energy producers are virtually all insolvent with prices where they are.

So in order to not collapse they need to make up for low prices with volume — they need the cash flow to remain stay alive.

Hence we see that nobody is willing to cut back on production.

We are seeing that not only with oil – we are seeing it across the board with commodity producers.

Higher energy prices are needed – but higher energy prices destroy growth.

There is no way out of this.

It matters not one jot whether oil production is declining or not now, The only thing that matters is the debt in the system and the debt including the debt written off and all the bankruptcies and the loss of capital, the write-downs on stock in the ground, equity, capital employed in rigs and equipment and a thousand other metrics, not least contractors, their debts, their capital that vanishing into the ether, the banks that financed them, and the loss of capital in the banks as loans get written down (or hidden or fraudulently manipulated away as in Texas).

This is the real issue and that unimaginable debt pile and loss of capital is whats going to drive everything from now on until its cleared, ans the desperate attempts to survive that will guarantee that oil will keep on falling until the last man is standing with a valuation that bears scrutiny and is solvent enough to warrant future investment.

The fact is there is zero evidence yet of a slowdown in the monster debts and loss of capital piling up, in fact it has barely begun, and is accelerating every day, and I would take my cue to end in sight when that accumulating loss begins to slow down on its ascent for at least two quarters and some estimate might be made to when it will finally turn round and decelerate.

Sounds like a sound assessment to me. Thanks.

To whom EXACTLY is that mountain of debt owed? The answer to that contains the solution to the problem…

Splitting the debt into government and non government compartments, you can rest assured the government debt is not at all a problem. It’s a form of savings accounts and like savings accounts the sum can be returned to investors with a few keystrokes. The government does not spend the investors money so it’s always on hand to give it back.

Private debt is a different problem. If things go bad then bankruptcies are the remedy. If they all go bad at the same time then the government can step in and bail them out or debt jubilee them. It all depends on the circumstances at the time.

question about production and storage. do we still have tankers anchored off every port and and are they still unloading oil where its can be unloaded? I know this was going on months back. china was loading up on oil and india was working on it. cause if this is still going on really it would be hard to say how much oil is above ground these days.

is there any update on this?

Yes, lots of tankers. One reason: storage as you mentioned.

And then this, from the WSJ a couple of days ago:

“Up to 50 oil tankers are waiting to unload cargo in the port of Rotterdam, the highest number since 2009 and another sign that, amid a glut, crude is struggling to find a home.”

http://www.wsj.com/articles/oil-tankers-wait-to-unload-cargo-in-rotterdam-in-another-sign-of-glut-1456772522

Oil is coming out of our ears!

Link is subscription walled.

Sorry. To get around it, google – and I mean Google, not Bing or any other search engine – the title:

Oil Tankers Wait to Unload Cargo in Rotterdam in Another Sign of Glut

Then click on the article in the search results. It should come right up.

Thank you. I tried something similar but it spat me out, earlier cookie maybe.

Maybe the Me is going to hit a wall in their attempt to gut US shale and iran.

Nowhere left to store the overproduction.

Some of the shippers who recently scrapped serviceable tankers, may be regretting it, as storage rates must be going UP.

With that much product in stock, reducing production will not increase price. In the medium term.

They used to hold full tankers in the gulf, and off Singapore.

Holding them in Europe is even more expensive, which suggest they expected to unload them.

Whats lurking in, the outer Thames Estuary, the Bristol Channel, and in the Irish sea off Liverpool. As well as Kagoshima and the Inland sea.?

The price of oil may NEVER recover .. Secular technological advancements could see to that. All it would take is a break through in the battery space to make electric vehicles competitive, and the premium for liquid hydrocarbons would be gone.

Similarly but less of a threat are advances in catalyst tech to turn nat. (Fossil) gas into chemicals cheaper. This too would remove much demand for liquids.

Add to that the prospect for a multi year demand destruction during a global recession, and the era of crude may go the way of whale oil or gas lighting without ever spiking back up. It would be better that way too. Crude is just so .. Crude.

“First, even when oil prices don’t support investments in additional supply, producing more oil may be necessary to generate cash flows to stave off bankruptcy. Operating at a loss is better than losing your oil company to creditors.”

I’m find utterly amazing how some people doesn’t seem to understand that simple fact. Oil companies don’t stop producing because they don’t like the situation, instead they are FORCED to produce even more to compensate for the lower unit price.

Jonathan: Good point. Another thing that seems to get lost in the discussion is that the oil industry, just in the E&P arena, isn’t monolithic. It consists of many companies with different philosophies, business models, reserves in the ground and cash flow requirements. Many E&P companies work in multiple geographic locations and a variety of geologic provinces. All these factors result in the individual company cash flow requirements. Some will be able to whittle down operation costs, keep producing, and weather the storm. Others, especially those who were all in, or heavily in, shale plays are broke; as in, all they ever did was push more money out the door than they took in. They too will cut back costs and keep producing despite the loss, but are unlikely to survive. Most companies do have debt to service and will, therefore, keep pumping at whatever the price.

In reality, oil is too valuable a product to just waste burning in engines.

It has thousands of uses in industry etc. Just like criticising meat eating it forgets at least 600 products from cattle across all industries. If we couldn’t extract oil, for whatever reason, we would see huge effects across most industries, simply by virtue of the losses outside use of oil products.

Everybody is an expert on oil prices these days. Given the author’s background I would not be trading on anything he tells me but do my own research.

As for this:

“First, even when oil prices don’t support investments in additional supply, producing more oil may be necessary to generate cash flows to stave off bankruptcy. Operating at a loss is better than losing your oil company to creditors.”

That is fine for State owned oil companies but not private businesses.

If you are operating at a loss eventually you cannot pay your creditors. It is because companies trade at a loss that they go into bankruptcy Mr author and if you are trading at a loss in a sector that is in a downturn it is very difficult to raise new capital to keep a business afloat until prices improve. Once you begin defaulting on your creditors as is happening to some in the energy sector it is a slippery slope to a bankruptcy filing.

In the past I’ve posted comments using “Cameron”. I’ll change to “CameronS” from now on not that it matters that much but just to be clear because I do very much agree with the author where he says

“First, even when oil prices don’t support investments in additional supply, producing more oil may be necessary to generate cash flows to stave off bankruptcy. Operating at a loss is better than losing your oil company to creditors.”

That is exactly what happens during the overproduction phase of a cycle. And overproduction always precedes crisis.

A new round of capital destruction is underway and no QE, ZIRP, NIRP, … can circumvent it. Reversion to the mean.

All true. But you don’t find pessimists starting and running oil companies. In their minds, better times are always just around the corner, if you can just ride it out. They will drill and produce as long as money is available to them. The money has to be stopped at the source. As Wolf has said “Give a oilman money and he will drill a hole”.

“Better times are always just around the corner” is really irrelevant.

How much they lose producing is also irrelevant, as long as selling it incurs a lesser loss than stopping production entirely. They will produce as much as they possibly could until that happens. This is just basic microeconomics 101 taught in schools.

This isn’t even limited to oil, for example it took forever for Japanese companies to exit their perpetually loss-making consumer electronic business.

Finally we get an intelligent comment on this issue here.

That is EXACTLY whey there is a glut of oil.

The consumer is burned out – they cannot afford expensive oil — they can’t even afford oil at $30 — as we have seen $30 is not kick-starting the global economy as was expected — as has ALWAYS happened in the past.

Demand is not there — at any price — because jobs are not there — and what jobs there are — are primarily low paid ones.

So where does that leave an oil producer?

They have huge sunk costs in their operations that were made on the assumption that oil prices would remain high. They NEED cash flow to service their operations

So as you point out — if they cut production that might drive the price up — for a short time — but that would crush the global economy — it might even collapse the global economy

And very quickly you’d be back to lower prices

So what do you do if you are the CEO of Exxon — you slash wherever you can

ExxonMobil to cut capex by a quarter to $23.2bn – FT.com

Or BP: BP deepens capex cuts, surprises with Rosneft profit | Reuters

But you NEED cashflow or you will quickly be out of business.

So you MUST maintain or even increase your production volumes. You make up for the low price of oil by selling more

Of course this is not sustainable — losing money on every barrel you sell is not a particularly good business model. And trying to make up for the loss by selling more — well…. that won’t end well of course

But it allows you to stay afloat as you wait for oil prices to somehow recover

But how can they recover when high oil prices are kill the economy — create a huge drag on growth?

The only way out of this would be to find an energy source NOW — that can replace oil and that is very cheap to produce.

Keeping in mind oil is not just used for energy http://www.ranken-energy.com/products%20from%20petroleum.htm

That is obviously not happening. This is not going to happen.

Cheap to extract oil is what powers the industrial modern society we live in.

There is a lot of oil left – but it is NOT cheap to extract — we have used up most of the cheap stuff.

Therefore our modern society is being suffocated by expensive oil — and the central banks are trying to provide a few last puffs of oxygen to keep civilization as we know it operational.

They will fail – we are seeing the toxic side-effects of their attempts to keep the hamster running — QE ZIRP etc are starting to push on a string…

Eventually the string will push back.

And that will cause the financial system to collapse — and this time the central banks will be powerless to do anything.

Because the problem is not a monetary one — the problem is that the cheap to extract oil is not available.

They can do nothing about that.

Gail Tverberg [of doomer renown] is a go to source of info like you express here. Not to mention the thousand followers blogging every day, like moi.

She is one of the few people who understand the nature of what we are facing.

She is also one of the very few people who predicted 1. the financial crisis and 2. the current glut of oil.

She is well worth following.

Don’t worry, they are faulting big time. And today, the disgraced ex-CEO of Chesapeake killed himself by car crash. Very symbolic of a sick industry.

http://peakoil.com/business/oil-exec-aubrey-mcclendon-dies-in-car-crash-a-day-after-indictment

For example Amazon.com?

“If you are operating at a loss…”

Which is why it takes about 18 months to filter through the industry. Hedges, existing cash reserves, junk bond capital raises etc etc all get used up to keep the wolves at bay. But as most keep pumping to pay their costs / interest payments, prices may not return to expectations and time runs out.

What happens when the many billions in junk bonds connected to the energy sector blow up? Will it spread? And hedges push the risk to banks, who push it on to investors. Might be in our pension funds?

Maybe it’s taking longer this time because interest rates are so low compared to the 70s

Interest rates are definitely a difference this time around. In the late 70s and early 80s, I saw several companies with nice reserves and good prospect inventories go away as borrowing costs were higher every time they borrowed. It also made investors hard to come by because they could get good returns on a 1 year CD with no risk.

Porter was pumping the shale revolution but he completely missed the collapse — of course he never mentions that in his newsletters.

Oh and btw was Porter a used car salesman before he came to the world of finance? His newsletters would do a used car salesman proud – they drip with sleaze…

You’re TOTALLY wrong, and a moron for saying what you just said (being wrong is one thing, being wrong AND nasty is another).

In 2012, Porter predicted $40 oil due to the shale revolution. And he made a public bet on it with Marin Katusa (at the time, Casey Research). They jointly published this bet in an article. He lost that bet because oil was still booming, and his timing was off. But his logic was correct. And his logic is still correct.

But thanks for giving me an opportunity to point this out.

He was one of the few to predict the consequences of the shale oil revolution. Ignore him at your own risk!

That is not correct.

A very close friend of mine who is a former analyst who is retired and trades his own book is a subscriber to Porter’s newsletter.

He is forever telling me I need to do the same.

He was regularly forwarding me this stuff — I urge anyone to have a look at one of Porter’s newsletters – it stinks like used car salesman.

I was pointing out for at least a year before the shale bust started that this was all smoke and mirrors.

I was particularly making a mockery of Chesapeake and warning him that this was going to blow up at some point

He was in knee deep on this pile of dung because ‘Porter recommended it’

And he got slaughtered.

I asked him recently – so did Porter warn you to get out of the shale market in one of his newsletters.

‘Uh no – he missed that one unfortunately’

I always wonder about these purveryors of financial newsletters – if they are so good at what they do – then why bother with a making a living off of the scraps of subscription fees.

Why not open your own hedge fund and play with the big boys if you are so good?

Of course we all know why.

Same reason a used car salesman is a used car salesman….

BTW – he was a couple of years off on his prediction … being wrong by two YEARS could leave one on food stamps.

http://blogs.lse.ac.uk/europpblog/files/2015/01/oilpricechart20002015.jpg

I have another friend who acted on Stansberry’s buy silver recommendation a few years ago – in fact I forward him a newsletter from the other friend

He acted on the advice. And he got destroyed in the trade. He was rather pissed off.

Funny how he never points out his lemons in the newsletters.

I will reiterate – if he were any good he’d be going after the real money and put his advice to practice running his own hedge fund.

Heck the way hedge funds are under performing these days if he could pull of a 5% return he’d easily attract billions to manage.

There are loads of redemptions happening at the moment. That’s a lot of money looking for a home.

All this negativity on oil’s future, but no prediction on the price?

Ok, here’s my $0.02: Oil will be at $25/bbl before the end of this year with a good chance it will also dip into the teens for a while.

And a third reason why production continues: The fact that the oil e&p companies lease most of the land they operate on. To continue to maintain those leases, they have to produce; otherwise, the owner of the land will terminate the lease.

Oil is now so cheap even pirates aren’t stealing it any more

http://finance.yahoo.com/news/oil-now-cheap-even-pirates-120218185.html#

“I suspect the final tally of defaults will be far in excess of 10 times this number, with losses approaching the magnitude of last decade’s mortgage crisis.”

Laughable. There isn’t even enough energy debt outstanding (even if every dime of it went bad) to approach the magnitude of the 08 mortgage crash. Total domestic energy debt outstanding is less than $600 billion. Mortgage debt outstanding in 2008 was $11.5 TRILLION.

You’re conflating some concepts. Mortgage debt was backed by homes. Even if their values shrank, they’re still good assets, and total losses weren’t anywhere near $11 trillion. They were a tiny fraction of that. The problem was in derivatives of those defaulting mortgages.

Much of the energy debt is second-lien or unsecured. When this type of debt blows up, almost nothing is left. And even first-lien debt is now dealing with an asset whose value had plunged 75%. And there is a huge pile of derivatives based on this debt.

“…and total losses weren’t anywhere near $11 trillion.”

Never said they were. I said total mortgage debt OUTSTANDING was $11.5 trillion. Net writedowns/losses over the past 8 years (INCLUDING the derivatives you mention) on the U.S. mortgage “book” have totaled about $0.08 on the dollar, or $900 billion. There are more losses to come, as several hundred thousand homes in “judicial” foreclosure states have yet to flow through, but they will not be material, as home prices have recovered. Again, the point is that the TOTAL LOSSES from the mortgage mess were greater than the total of EVERY DOLLAR of energy debt outstanding today. Yes, there are significant energy “derivatives” outstanding (if you want to call them that), but most are held as counterparties to hedging contracts, and most of these losses have already been booked. The point is that there is NO WAY the energy debacle can rise to the magnitude of the mortgage mess, as Stanberry asserts. The numbers just aren’t there.

How about you pen an article on this stuff? It’s hard to comprehend what goes where etc. I’ve heard derivatives, which are off the books, are of giant size; from $800 Trillion to $1.4 quadrillion depending on who’s talking. That’s ten to twenty times the World’s economy [$80 Trillion]

Okay, meanwhile: “U.S. Rig Count Approaches 1860s Levels “

FRO – Here’s the oil storage winner chicken dinner? Hmm, oil storage don’t look so hot if this share price is any gauge.

But of course I don’t post my trades either, nor do I disclose my positions OR pen interesting windy articles.

Speaking of wind, water, etc., I discovered not helpful ideas, what’s going on here just hyperventilation?

CUBA ETF is rocking, indicative of Florida condo oversupply?

I won’t argue against the fundamentals of why oil production is still growing despite declining drilling (hedges, there are still plenty of nearly completed wells that were never put into production due to the accounting issues surrounding doing so – which may still be completed for the cash flow even if a hit is taken to the income or balance sheets, etc.) .

However, the market itself has discounted the major risk to both supply and demand that is likely to ‘HELP’ alleviate the current glut….possibly more rapidly than many would wish:

War

Global conditions are currently primed at the moment (over the next two years) for a major armed conflict to break out. Yes, Syria could be it…since it is a current focal point….but none of the MAJOR powers has any real economic interest in Syria itself to justify a conflict there. (That isn’t to say that a secondary power in the region: Iran, Turkey, Israel, or Saudi Arabia can’t GENERATE a larger conflict that pulls in the U.S., Russia, Europe, and China…such as Israel nuking Iran’s nuclear program and ‘accidentally’ hitting some of the major oil production and/or distribution facilities…or a ‘spontaneous’ Arab spring-like revolt against the House of Saud (which is currently divided against itself due to the personal and political bumbling of the ruling Crown Prince.)) The neocon faction in the U.S. is certainly pushing for MORE conflict in the Middle East.

I however think an ‘incident’ in the South China Sea near the contested ‘Chinese’ man-made atolls is just as likely if not more so just because I believe the Chinese gov’t is in a far more precarious position regarding social upheaval than many recognize in the West. Most of the Western commentary I read indicates that ‘all’ China has to do is to float its currency and accept the 40-50% devaluation to ‘right’ its economy. This view is an academic 30,000′ level view from an ivory tower. The actual implications of such a devaluation on the ground is likely to topple the current gov’t….leaving a major VOID which will take a lot of upheaval to fill.

The EU itself increasingly needs an OUTSIDE threat to unify its fractured ‘union’ and justify its existence…which is why the Muslim-migrant issue has been allowed to grow and fester imo.

Even in the U.S., you have BOTH political parties being rejected by the population (extremely low turnout on the Democrat side, extremely high turnout on the Republican side due to what is really a 3rd party candidate running in the Republican field). Leadership on both sides of the aisle are adamant about preventing Trump from running now that it seems he has a good shot at it. In doing so, they will sacrifice EVERYTHING to keep him out so they can continue their game of pretending to be different….which is true only on tangential issues. The Neocons (and I lump Clinton, Rubio, and Cruz in their camp) have steered U.S. foreign policy into one quagmire after another since the original Iraqi war. With a current recession, a strong U.S. Dollar and low oil prices…and political and trade competition with rising powers in China (and possibly Iran and/or India)…conflict is increasingly likely to try and unify the population to support the gov’t.

Anyway…any major shooting war is likely to increase demand while at the same time destroying either production or AT LEAST disrupting trade routes the oil must flow through. (Where are China’s oil import terminals?? Where are Iran’s?? Where are Saudi Arabia’s? Strategic economic choke points are going to be key to where the conflict plays out.)

ValuationGuy

The US is self-conflicted, thus nothing would surprise me except for sound decisions are being made.

National Parks department nation wide budget is $250M, Pentagon budget is $600B

Everyone seems pretty testy.

The facts are pretty basic: Everyone needs energy.

You can argue about the form; the price; how much; the means of collection, storage and distribution; and the mechanisms and appliances for implementation and use.

The need for energy will not disappear. And based on that fact alone, I initiated a position in Royal Dutch Shell ( RDS-B) yesterday – the world’s largest oil and NG and LPG company. For the very long term.

Leave the polemics in the philosophy 101 classroom. We are here to exchange ideas, mostly with the aim of making money.

Not quite right.

We need CHEAP to produce energy.

How High Oil Prices Will Permanently Cap Economic Growth

By Jeff Rubin (former Chief Economist CIBC)

For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies.

The countries guzzling the most oil are taking the biggest hits to potential economic growth. That’s sobering news for the U.S., which consumes almost a fifth of the oil used in the world every day. Not long ago, when oil was $20 a barrel, the U.S. was the locomotive of global economic growth; the federal government was running budget surpluses; the jobless rate at the beginning of the last decade was at a 40-year low. Now, growth is stalled, the deficit is more than $1 trillion and almost 13 million Americans are unemployed.

And the U.S. isn’t the only country getting squeezed. From Europe to Japan, governments are struggling to restore growth. But the economic remedies being used are doing more harm than good, based as they are on a fundamental belief that economic growth can return to its former strength. Central bankers and policy makers have failed to fully recognize the suffocating impact of $100-a-barrel oil.

Running huge budget deficits and keeping borrowing costs at record lows are only compounding current problems. These policies cannot be long-term substitutes for cheap oil because an economy can’t grow if it can no longer afford to burn the fuel on which it runs. The end of growth means governments will need to radically change how economies are managed. Fiscal and monetary policies need to be recalibrated to account for slower potential growth rates.

Oil provides more than a third of the energy we use on the planet every day, more than any other energy source. And you can draw a straight line between oil consumption and gross-domestic-product growth. The more oil we burn, the faster the global economy grows. On average over the last four decades, a 1 percent bump in world oil consumption has led to a 2 percent increase in global GDP. That means if GDP increased 4 percent a year — as it often did before the 2008 recession — oil consumption was increasing by 2 percent a year.

At $20 a barrel, increasing annual oil consumption by 2 percent seems reasonable enough. At $100 a barrel, it becomes easier to see how a 2 percent increase in fuel consumption is enough to make an economy collapse.

Fortunately, the reverse is also true. When our economies stop growing, less oil is needed. For example, after the big decline in 2008, global oil demand actually fell for the first time since 1983. That’s why the best cure for high oil prices is high oil prices. When prices rise to a level that causes an economic crash, lower prices inevitably follow. Over the last four decades, each time oil prices have spiked, the global economy has entered a recession.

Consider the first oil shock, after the Yom Kippur War in 1973, when the Organization of Petroleum Exporting Countries’ Arab members turned off the taps on roughly 8 percent of the world’s oil supply by cutting shipments to the U.S. and other Israeli allies. Crude prices spiked, and by 1974, real GDP in the U.S. had shrunk by 2.5 percent.

The second OPEC oil shock happened during Iran’s revolution and the subsequent war with Iraq. Disruptions to Iranian production during the revolution sent crude prices higher, pushing the North American economy into a recession for the first half of 1980. A few months later, Iran’s war with Iraq shut off 6 percent of world oil production, sending North America into a double-dip recession that began in the spring of 1981.

More http://www.bloombergview.com/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

Thomas,

you are very knowledgeable. I accept everything you have written as being true.

You do not disagree with my thesis:

Everyone needs energy.

But, you argue the price/the cost. That does not change anything.

A man and his family are freezing in their home – the power does not work – his furnace will not work. He has no natural gas line but an old fireplace.

To heat his home, he will do anything and everything imaginable to get fuel for the fire place.

If it means ripping the wood siding off of your house next door – his house has plastic siding – he will do it. He needs fuel to make heat.

Nations will do the same.

Watch Robert Redford in the Movie ” Three days of the Condor” – salient quotes:

——————–

Oil fields. Oil. That’s it, isn’t it? This whole damn thing was about oil! Wasn’t it? Wasn’t it?

Not now – then! Ask ’em’ when they’re running out. Ask ’em’ when there’s no heat in their homes and they’re cold. Ask ’em’ when their engines stop. Ask ’em when people who have never known hunger start going hungry. You wanna know something? They won’t want us to ask ’em’. They’ll just want us to get it for ’em’!

———————————-

[ Good ad for the Pentagon, CIA, FBI, Blackwater & Co.]

I personally believe that there is plenty of energy to be found, extracted and consumed. You worry about the price. I do not. The price will take care of itself. The cheapest raw material to produce the same quantity of energy (after factoring in all costs) wins.

I do not worry about peak energy.

I worry about consummate doom.

Peace.

Over and Out.

You should worry about the price – because if you can’t afford to put petrol in your car — or afford the electricity that is generated by coal — then the companies that provide these fuels will collapse into bankruptcy

And you will indeed be ripping the siding off the house next door.

Oh and btw – you will also be starving to death because almost all food is grown using petrochemicals.

When the oil stops — the famine starts — the violence starts – the chaos starts — and you are a dead man

All it takes is a few well-placed explosives in the right places in Saudi Arabia and all these forecasts will be waste paper.

A good place to aim for – which is not especially well-guarded – is the giant pumps that pump water out of Ghawar. It would take years to replace these monstrosities.

Ghawar is the largest reservoir in the world and after 60 years of production is still producing some 5mbd. Stop pumping water and its production will go to zero in no time at all.

http://www.theoildrum.com/node/9045

It’s a sad state of affairs when a country as rich as ours has so many of us living in poverty. How is this in any way forgivable? I myself can’t afford to heat my home, but at least my son eats well. He’ll just have to grow up strong and get used to the cold. Austerity does not serve the needs of society, we need investment so that people are paying taxes and buying goods. That creates more jobs making the goods, which in turn means more tax revenues. To run an economy any other way only serves to put the working classes in their so-called ‘place’, which I would have thought would be a ludicrous practice in this day and age. And if you think this can’t happen to you? Trust me, it can. The economy is STILL going down.

Now we are getting a taste of what it is like to live in the countries that we have pillaged of resources so that we could live large all these years.

And now that we are running out of cheap to extract resources living large is a thing of the past for most people in the west.

This presentation by a mining engineer explains the situation quite well

https://www.youtube.com/watch?v=TFyTSiCXWEE