Political baloney doesn’t fix the fundamental issue.

By Matt Badiali, Growth Stock Wire:

Yesterday, a group of countries that include Saudi Arabia and Russia agreed in principle to freeze oil-production rates. On the surface, this sounds like a good thing. But it’s really just a bunch of bull.

As regular Growth Stock Wire readers know, oil prices fell from more than $105 per barrel in mid-2014 to about $30 per barrel now. That’s a 70%-plus fall in just 18 months.

According to the U.S. Energy Information Administration (“EIA”), the world’s oil supply rose from 91 million barrels per day in 2013 to 96.3 million barrels per day in October 2015 (the latest data available). That’s a 6% increase in supply in just two years.

Meanwhile, demand isn’t increasing as fast as supply is. World oil demand was 91.2 million barrels per day in 2013. The latest EIA estimate puts it around 92.8 million barrels per day as of September 2015 – an increase of less than 2%.

That means the “surplus” oil (supply minus demand) went from about -200,000 barrels per day to 3.5 million barrels per day. That’s why oil prices collapsed.

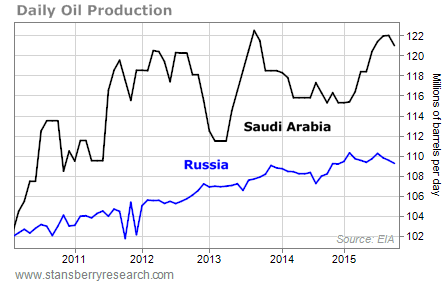

Many folks in the oil industry want this production-freeze deal to make a difference in the oil price right away. But it won’t. Here’s why… The deal is important because Saudi Arabia and Russia make up 24% of the world’s oil production. These two oil titans agreed to stop increasing production… except that the agreement is coming while we’re near all-time record volumes of oil.

In other words, these countries couldn’t really produce that much more oil anyway. You can see what I mean on the chart below:

The problem is, the one country that could massively increase oil production – Iran – hasn’t agreed to the deal yet. The deal is contingent on Iran’s agreement. And if you know anything about Iran and Saudi Arabia’s relationship, you know this deal is already in doubt. Saudi Arabia and Iran’s relationship is terrible, and Iran isn’t about to agree to restrict oil production right now after 35 years of sanctions.

Iran plans to increase production between 500,000 and 1 million barrels of oil per day. That will add much-needed foreign currency to Iran’s economy. If the deal between Saudi Arabia and Russia hinges on Iran, it’s dead in the water already.

The only way for oil prices to rise from here is if world demand increases and we’re able to consume the oil surplus. Oil-production freezes like this are useless political baloney. They don’t fix the fundamental issue… and that’s what really matters. By Matt Badiali, Growth Stock Wire

It’s all about the “crack spread.” Read… Downturn Now Hitting The Refining Sector

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Ok, so I am confused. The copy says that world consumption is 96.3 million barrels per day. The graph says that the Saudis produce 121 million barrels per day, and Russia produces 109 million barrels per day.

Somehow these numbers don’t add up.

Yes, indeed. Good catch. There’s a decimal point missing in the chart, right axis. For example, Russian oil production in December was 10.8 million barrels per day, rather than 108…

Unfortunately, I cannot fix the chart. It’s hosted on the author’s site.

The numbers (and decimal points) mentioned in the text are correct, however.

My understanding of this (not guaranteed to be the full story, or correct) is that the Saudis, as part of the Syria/Iran/Turkey/ISIS/CIA/Russia power play in the Middle East, approached Russia to ask for an agreement to reduce oil output and raise the price of crude.

The Saudis, under their new king and his batshit mad nephew, have been trying to establish Saudi Arabia as the new leader of the Muslim world, in competition with Erdogan in Turkey, Iran, and Israel. Maybe the Saudis fell for an idea from John Kerry that they could help the US and themselves by flooding the world markets with oil, drive down the price, and cripple Russia so Russia would have to bow down to Washington. By this means, the Saudis could maintain and even restore market share while disciplining other OPEC members to honor output limit agreements, force Russia to accept Saudi control over international oil prices, and then force up the price of crude.

At the same time, the international community was making a deal with Iran to remove the sanctions that had restricted Iran’s oil exports, and the Saudis wanted to exert control over Iran to limit their exports. Saudi threats of Sunni (Saudi and Turkey) vs. Shia (Iran/Iraq/Lebanon) eternal war were then raised for bluffing purposes, particularly since Russia’s support for Assad in Syria has allowed Syrian army, Kurd forces, and Hesbollah fighters to push back the Turk/Saudi/Qatari/Jordan/CIA/USA/EU/NATO supported ISIS forces in Syria, putting Turkey’s Erdogan, Washington, and the Saudis into a panic.

At the recent Munich summit meeting regarding a cease fire in Syria, Russia agreed to a cease fire only commencing in March, in other words Russia demanded time to finish mopping up the ISIS forces in Aleppo and to clear ISIS and Turk forces out of Syria, and move Syrian forces up to the Turk border. John Kerry accepted these terms and then immediately started repudiating it, railing against Russian “aggression”, just like he had done with the ceasefire deals with Russia over Ukraine.

This ceasefire deal was immediately undermined by Turkey, with encouragement from Washington and the Saudis, by shelling Syrian/Kurd forces in Syria from 155 mm howitzers on the Turkey side of the border. Syria has sent several protests to the UN over the shelling. Washington is playing the double-blind political game by announcing appeals to Erdogan to stop the shelling, but the shelling continues. The Turks and Saudis are beating the war drums, threatening to invade Syria with a 350,000 force of men with armoured battalions and aircraft.

Russia has withstood the oil price fall, and the war upon the Ruble, and the Saudis are seeing their financial house starting to get pinched, and are panicking over the success of Syria/Russia over ISIS, so they sought to call off the oil price war with Russia (using the threat of invading Syria in partnership with Turkey and escalating Russia’s cost of fighting for Assad against ISIS and the CIA).

However, any agreement to cut production would simply make room for Iran to try to fill in with exports, so any deal on production cuts would have to involve Iran. Iran had already said they were going to commence exporting as soon as export sanctions were lifted, and have done so. Also, Iran has been making deals with international oil companies to invest in oil fields in Iran and increase Iran’s production potential. The lifting of sanctions was the only thing delaying the start of work to increase Iran’s production potential.

So the Saudis came to Russia, needing a deal and thinking they had the Russians on the ropes over oil price and economic damage to Russia, but panicked by the Russia/Syrian success in fighting ISIS and being very close to surrounding ISIS forces holding Aleppo, and being close to cutting off the supply route from Turkey to Aleppo which is the ISIS lifeline there.

Russia, for its part, recognized the Saudi panic and the Saudi/Turk threat of invading Syria as a desperate bluff, played polite hardball, agreeing with the Saudis not to raise exports as long as Iran agreed not to raise exports (knowing full well Iran would not agree). In other words, Russia did not agree to a production cut, and agreed not to raise production “when pigs fly”.

In the meantime, US shale producers and Canada’s oil sands producers face bankruptcies, Venezuela faces imminent emptying of financial reserves to meet bond payments falling due, banks everywhere are in a panic over the oil loans on their books, and China is enjoying low import prices while killing their neighbor’s refining industries by increasing its exports of refined oil products. The fundamentals of crude oil supply and demand show a significant excess of supply, but the algos and traders continue head fakes and rumor mongering to keep the price of crude bouncing up and down, and to keep it from cratering too low. Oil storage facilities are reaching full, tankers for storage are expensive, storage for refined products is running out. Some serious rabbits out of hats magic will have to be performed soon to keep the price of crude from falling to a $20 handle. But war involving Saudi Arabia or Iran, or both, would be just the thing to excite concerns over supply, and push up prices.

To quote an old Johnny Carson Tonight Show line, “You are correct sir!”

It’s too bad that our Corporate Mainstream Media can’t and/or won’t tell it straight up like you have Al Tinfoil. Thank you.

Nice summary and logical conclusions.

Russia, Iran, Iraq and Saudi should all make a secret deal:

They each agree to blow up 25% of the oil production, then call for a cease fire. Shocked, I tell you , Shock !!!

Then meet in Paris for one hell of a party.

And don’t forget, oil producers cheat on allocations. There hasn’t been enough pain yet for a curtailment to stick.

You’re quite wrong. First of all, I don’t get where you got “CIA” thing, but in certain countries it is a normal thing (like Russia). BTW: maybe you missed it, but Russia is supporting Assad, not fighting against ISIS (but that’t understandable given the bias you showed). The conclusion is wrong in several points: Saudi Arabia – Iran war when none of them have money? Russia being the ruler of the World, when they miss money from high oil prices? Last time I checked your dear China – I can tell you they ALREADY have finantial problems. $$$ are dwindling because they have pegged currency. So … no … you don’t have a clue.

Wolf:

If we continue to discuss fundamentals -“supple, demand” we will continue to not understand and accept that the oil sector is resting on a cartel. What are those ramifications?

This control over prices ( let us say a surplus of profits now defunct) was

politically removed by the US neocons wanting to badly hurt Russia but not understanding the Russian ability to endure pain and deprivation.

If you understand the history and character of the Russian people in

fighting the Nazis, this attempt by Western financial interests ( including the saudis) to make Russia a vassal state, is a tempest in a tea kettle.

People who value money over ever thing ( international bankers and their ilk) do not understand the exceptional leaders ( putin) and

through organization and historical sense, their ability to fight

those who believe anyone can be bought and sold.

You are correct.

Give a Russian a bottle of Vodka and fur coat……………and he will beat you.

One contrary note: over the years I’ve noticed that 70% declines in any market typically marks the end of a decline. Think Japanese stocks after 1989.

Wolf – what do make of this latest report stating only 4% of global oil production is unprofitable at $35? Over the years I’ve come to believe the opposite, that only about 4% IS profitable.

http://www.businessinsider.com/wood-mackenzie-oil-production-report-2016-2

Mark, we’ve heard the same sort of thing about US natural gas for years, and now all US natural gas drillers are on the way to bankruptcy or have already filed. Turns out, it was just a bunch of industry hype to attract new money.

Once an oil well is drilled, and all you do is extract oil, the operating costs are usually low (Canadian tar sands are different; there, operating costs are extremely high). But if you include all the E&P costs, which is what ultimately matters to oil companies and their investors, oil is a money loser for most drillers around the world at these prices.

The estimates for this are all over the place. And I stopped believing any of them. But I do look at them carefully.

Wolf.

I trust Art Berman and he says that except for the every sweetest of the sweet spots US tight oil is uneconomic at <$80 per barrel!

The only problem that I can see with this is that more US companies haven't filed for bankruptcy yet! I believe it's down to hedges and the FED telling banks to forebear on foreclosing on the tight oil loans. I'm astonished that the US isn't deep, deep in the mire of a vicious recession yet. It must come this year surely???

I think Berman has a better handle on it than most, and he could very well be right on target.

Which is why the Majors are so happy. The independents have spent the investors money finding the oil. Let them go broke and buy up the proven fields for next to nothing.

What is happening today is exactly why Rockefeller, Flagler and Archibald had no choice but to form a Monopoly/Trust and combine the entire industry. Oil doesn’t work in a competitive market (Rockefeller: “Competition is a Sin”).

It why the Texas Railroad Commission “took over” Texas oil production and such. When oil was selling for 25 cents a barrel, nobody makes money.

There is too much oil, and technology keeps making it cheaper and cheaper to find. The Majors need to take back the control, cap the surplus wells, seal the tar sands and control the market.

That is the only sane business model for oil. One Trust. One Monopoly. One Standard.

Much of US production is unprofitable at less than $50/bbl, possibly even $60 and some even higher. Especially since so much of the new production is from high cost unconventional sources like shale. The cost of the recent deep water off-shore wells is also high. All that new technology you hear about is expensive and if it exists, it has to be paid for to be used. Don’t get caught up in the sales pitch hype. Oil production is supply and demand dependent. When supply exceeds production significantly, the price can only be jawboned up for so long before fundamentals kick in.

Oil producers are well known to CHEAT.

This ain’t no OPEC embargoes of 1973 and 1978. BTW – STAGFLATION of late 70’s was caused by oil embargo but thanks goodness those ME buffoons can no longer call the shot.

Simple economics as when the price collapses from say $100 to $30 they just got to pump 3X more for expected revenue. Otherwise there will be riots and blood on the street by the folks used to freebies in ME and marginal players like Nigeria, Venezuela, etc.

Besides the Iranians just got the nod to sell their crude after years of sanctions and if anything they will flood the market.

Remember the outcry in Saudi over a massive 50% over gasoline retail prices? From almost free of $0.16/L to a still almost free $0.24/L.

I don’t think there’s a more worthless bunch of collective citizenry on this planet.

BTW not to mention the upcoming LNG glut is going do something about the price of the black stuff in the near future, which is ironically caused by the $100/bbl prices in the near past.

Someone should run an analysis on the current USD denominated debt levels as well as other financial obligations of all the large oil producers. I think that may be a more telling cause of why they really are not in a position to cut production. It looks like They need the money!