Nothing goes to heck in a straight line.

Investors found some relief on Friday after getting flogged on a near daily basis since the miserably short and feeble Santa Rally ended on December 30. The bounce off the dreadful lows on midday Wednesday in the US carried through. Finally! We’ve been expecting this rally. We’ve been waiting for it. Nothing goes to heck in a straight line.

“Global stocks surged the most in 3 1/2 years, as US equities joined a rally that pushed oil to its best two days since 2009 on speculation that central banks will expand stimulus measures to counter turmoil in financial markets,” Bloomberg gushed.

So on Thursday, ECB President Mario Draghi said the magic words everyone wanted to hear: the ECB would “reexamine” its already massive QE program and its absurd negative deposit rate. That was enough. More stimulus is now expected in March. Central-bank optimism took over: central banks will stop this totally unfair bloodletting!

Then on Friday in Davos at the World Economic Forum, where he was hobnobbing with the world’s financial, corporate, and political chieftains, Draghi suggested that the ECB wasn’t, in fact, out of ammo. OK, major Eurozone stock indexes were in a bear market despite or because of QE, but hey, there could always be more QE.

“We have plenty of instruments,” he said in his inimitable Draghi speak. “We have the determination, and the willingness, and the capacity of the Governing Council, to act and deploy these instruments.”

“We are not surrendering” to global pressures, he said as he was surrendering to global pressures by promising markets what they wanted.

Bank of Japan Governor Haruki Kuroda was also in Davos, soothing rattled nerves and indicating that more money-printing was always a possibility. And China’s Vice President, Li Yuanchao, said that China would keep meddling in the stock market to “look after” investors.

That’s what markets needed, some assurances and a little prod. By Friday, it was party time. It started in Asia. Japan’s Nikkei soared 5.9% to 16,959, the highest level since, well, Wednesday. That huge move pulled it out of a bear market. Now it’s down only 19.1% from its high in June 2015.

China’s Shanghai Composite rose 1.3% to 2,917, the highest level since Thursday. It’s still down 44% from its high in June 2015. The Hang Seng rose 2.9% to 19,081, also the highest since Thursday. Now it’s down only 33% from its June 2015 peak. India’s Sensex rose 2% to the highest level since Tuesday.

All of them ended the week in the red.

In Europe, the rally had already kicked off on Thursday when Draghi’s vague promises were coagulating into hope of more money printing. All anyone needed was a conductor giving the buy signal, and the shorts got run over. The German DAX rose 2% on Friday. Now it’s down only 21% from its peak in April last year. The French CAC 40 soared 3%, which pulled it out of a bear market.

In the US, it was party time too. The S&P 500 jumped 2% to 1,907 on Friday, its best day in six weeks. It gained a measly 0.9% for the week, its first weekly gain since the week of December 21! The Nasdaq jumped 2.7% for the day and ended the week up 1.4%

The Dow advanced 1.3%, dragged down by American Express, which plunged 12%, its worst one-day loss since 2009. It reported a dose of reality: quarterly revenues down 7.6%, net income down 38%. It issued corporate speak about “intense competition,” “a number of cyclical factors in the broader economy,” and wanting to cut expenses by $1 billion. It was a mess. It confirmed the corporate revenue and earnings recession. And it left the Dow in the red for the week.

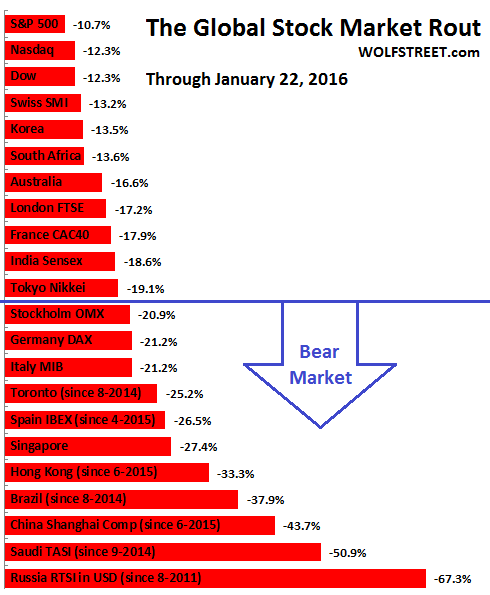

Despite this bout of party time, the major markets of the world are all down in the double digits from their recent highs. Many of them are down more than 20% (below the blue line). And as ironic as it might seem, the US markets are the least bad:

There was a lot of drama beneath the surface. As the rally from the lows on Wednesday turned into a self-fulfilling prophecy, shorts scrambled to cover their bets, and to do so they had to buy stocks, and the most shorted stocks surged the most.

Chesapeake Energy, the teetering natural gas driller and one of the most shorted stocks in the S&P 500, had dropped to $2.69 a share by mid-Wednesday, a new 52-week low, down 90% from its high in July 2014. But within in a couple of hours, shares soared 26%. And Friday within minutes after the open, shares spiked to $4.15, up 54% from their Wednesday low, wiping out shorts left and right. Moments later, it was over. Shares re-plunged 15% and ended the day at $3.51, down 1%.

Oil surged, with WTI soaring 17% from mid-Wednesday to $32.25 by Friday. These kinds of short squeezes drove this market. But the fundamentals are as dreary as they were Wednesday morning.

The Canadian dollar rose, now once again above US$0.70, ending Friday at US$0.7082. The Bank of Canada had yielded to a rebellion from Corporate Canada, which wanted a floor under the plunging loonie. So at its policy meeting on Wednesday, it didn’t cut rates. And that coincided with the surge in oil.

Even the ruble surged from its brutal plunge and record lows on Wednesday and Thursday.

$7.8 trillion in perceived stock-market gains around the globe have evaporated so far this year, according to Bloomberg. Now everyone is waiting for central banks to make their next moves that will somehow solve all problems and recreate that $7.8 trillion, plus some, which shows the ludicrousness to which market players and their soothsayers have stooped.

Alas, there may be some real reasons why the hot air is hissing out of the market. “Consumers just don’t seem to be showing up….” Read… Deep “Freight Recession” Hits Railroads, Trucking, Air Freight

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As much as I agree with 92.74% of what you write, Wolf (subjectively speaking) I think we’re into a rally from here. Oil is going up and so is the market. It’s irrational but then, so are people so it’s a perfect match.

Yes, the debt. Yes, the sponge-dried consumer. Yes, the emerging markets. But the counter argument? Boo! It’s boring. Markets up! I’m calling it; the whole thing is a sham, especially Technical Trading which is like examining your own entrails to offer the appearance of competency when predicting the future. We’re going to pay a price for this but as CXO’s like to say to each other in private, You Won’t Be Here, I Won’t Be Here.

I agree with the rally part. I just don’t think it will last very long. There are too many things wrong with this market. It has been seriously damaged.

But markets tend to teach us new lessons all the time – lessons that become useless as soon as we finally learn them.

:-]

Most of the investors, fresh and old ones, should have learned by now that whatever goes down will go up. A small but serious detail: borrowing to invest (leveraging) leads to turbulence that will ALWAYS favor the one who is bigger than you. Real economy will tell the trend, but it is the turbulence that will destroy you.

So, we now have a situation where the ECB is chasing commodity prices – lower oil prices that have ostensibly given the ECB a license to expand QE starting in March of 2016 – Saudi must be rubbing their eyes in glee and disbelief.

The brazenness and recklessness of Draghi’s posturing is astonishing.

He keeps saying that the ECB will do whatever it takes, within its charter (what is that charter, btw ?), to reach 2% CPI inflation, which is the magic number that will somehow ensure acceptable Eurozone/global growth.

Once lower commodity prices wash out from the data series, or actually rise year-over-year, CPI´s in Europe and the U.S. could easily spike to above 2%.

And then what, Mr. Draghi ?

How much tightening will be required to force the CPI down to 2%, to curtail inflationary expectations ?

And why would bond investors buy into a market with an overhang of trillions of Dollars in ¨Product¨ sitting on central bank balance sheet ? Anybody interested in catching falling knives ?

Put differently, why would savers/investors – i.e. the ones that saw their purchasing power systematically and ruthlessly eroded by QE/ZIR policies – step up to the plate and purchase back from the central banks´ bond holdings they are trying to offload ?

So, you´ll get a vicious, unpredicted, ´inexplicable´ rise in rates layered onto a precarious economy – call it the return of the bond market vigilantes.

As for Mario ´Make-my-May´ Draghi I hear the utter determination to destroy one asset class (cash/savings) in favor of bubble assets.

But what IS the exit strategy when the CPI spikes to, say, 3% or 4% ?

I pay €.0.95 for fuel right now: that´s down from €1.27 18 months ago. What happens to the CPI once that decline washes out ? Or, God forbid, fuel goes back to €1.20 ?

Silence.

Maybe the Emperor has no clohes…

easy, they will take oil or any other product out of the basket so the CPI remains subdued to their wishes all the time.

To quote House, MD “Let them have their little vacation from pain”.

I am taking the occasion to dump what little I still have left and strengthen my position in investment grade bonds and cash. Unless FANUC sinks a little more, I am not buying stocks for quite a while. Too risky.

The reality is central banks are trapped in the loop and cannot do more than adjusting knobs a little.

The ECB cannot drop interest rates much more because they’ve seen how much good NIRP has done for Sweden and Switzerland. At most they’ll announce a QE expansion which will include more bottom of the investment grade pile corporate bonds, adding to the massive distortions in the euro-denominated bond market. If you have eurozone denominated bonds selling them just before the next “disappointing” (because it’s never big enough for the vultures) ECB announcement may be a good idea to make a quick buck.

The Fed is trapped. According to their own numbers price inflation and unemployment are fully under control so cutting rates back to zero would mean losing even more credibility than they’ve already lost.

But at the same time they cannot increase them as promised, because it would risk sending the dollar on parity with the euro and hence wrecking havoc on already ailing US exporters and force China into more devaluation, with easy to predict consequences.

And the PBOC and the BOJ… well, they are already working at full steam. They only thing I can think off is Beijing may provide more credit to the Big Four to prop up Shanghai and Shenzhen even more.

In short, stock market are soaring on a wing and a prayer, nothing more.

But in the end, nothing matters. Let them have their little rally because fundamentals are deteriorating as fast and badly as they’ve been for the past year and a half. The glut in everything, from oil to rolled steel, from metallurgical coal to timber, is getting worse. Consumers are exhausted all around the world: only Amazon and eBay had any reason to uncork the champagne this past shopping season.

In the meantime take the occasion to make a little buck on the side. ;-)

Speaking of glut, scarcity and sure fire investments. It may be worth looking into bananas, as in fresh fruit, not as in what stock jockeys are smoking.

Many are probably familiar with the Panama Disease, a form of Fusarium wilt (forgive my technicality, it’s due to my education) which wiped out the old Gros Michel based banana industry around the 50’s, resulting in the present Cavendish monoculture.

The Cavendish gained its popularity both due being well-suited to long distant transportation and its resistance to the Panama Disease and constitutes the true backbone of the industry worldwide.

A mutant strain of this disease (designated TR4) appeared in Malaysia in 2012 after previous isolated outbreaks and started devastating Cavendish bananas. It took over a year to identify this disease and to realize there are no defenses against it, as it’s easily spread through means other than infected vegetable material, so bans on the importation of banana plants and quarantine just don’t work.

So far this particularly virulent strain has spread to all banana-growing areas, except those in the Americas. Given all Cavendish grown worldwide are clones, there’s no hope a TR4-resistant mutant may surface.

Now, I am unaware of banana futures, but it may be worth looking into agri companies. After the initial panic turned into downright fear, the race to produce a TR4-resistant cultivar is on as Fusarium wilt cannot be fought with pesticides. A viable alternative is successfully marketing a Cavendish alternative: Chiquita made an absolute fortune by convincing consumers that Cavendish were a superior replacement to the Gros Michel.

There are already extremely resistant cultivars out there but, since their texture is unfamiliar, they spoil quickly or they contain seeds, they are usually consumed locally, not exported.

If you are looking for a long term investment that can do no wrong, look no further.

I seem to notice, lately, a growing and a more vociferous questioning of the effectiveness of FED and ECB QE/ZIR policies ? You´re starting to hear it even on CNBC, including hardcore trader cynics like Cramer. It´s not deafening, but you hear it more than before.

So, my question is: when do financial markets – especially bond markets – start to price in the lack of a QE/ZIR exit strategy by the central banks ? And when will the outside world know ?

Or, conversely, what if holders of assets coveted by, say, the ECB start to say: ´We`re not sellin´´ You could just see some hedge trying to play hard to get and telling the central banks: sorry, mate, the price of that bond has just gone up by 20 bucks. Unthinkable ? Nobody would be that predatory, would they ?

Well, maybe.

Rememeber in the sup-prime collapse when the banks were conspiring to not mark down paper that was obviously in trouble, and everyone successfuly pretended that everything was just peachy ?

Sometimes, the whole thing is sort of like an orchestra which is losing performers in the middle of the piece. At first you don´t notice a thing, especially if you keep looking at the conductor (Yellen, Draghi etc.), but gradually the sound changes. And then the music stops ….

The sound is changing and members of the orchestra are starting to leave the stage. Yet, the conductor keeps gesticulating as if nothing happened.

And suddenly the sound changes, and listeners realize that the orchestra (insiders, hedge funds, mega banks) is gone. And then the music stops, and the audience is shocked and outraged.

What if markets stop looking at people like “Make-my-Day” Draghi, and start surveying the orchestra ?

“So, my question is: when do financial markets – especially bond markets – start to price in the lack of a QE/ZIR exit strategy by the central banks ? And when will the outside world know ?”

In the US, that would be when the Fed stops monetizing Treasuries, and that’s not happening any time in the near future. The Fed is still replacing maturing Treasuries at a serious clip. QE still lives.

“Rememeber in the sup-prime collapse when the banks were conspiring to not mark down paper that was obviously in trouble, and everyone successfuly pretended that everything was just peachy ?”

That “pretend and extend” tactic was only enabled after the FASB amended FAS 157, aka mark-to-market accounting. After that, banks were able to use (mark to make believe ) mark-to-model accounting.

Perhaps this rally is the beginning of the dead cat bounce so many have been predicting.

“The Dow advanced 1.3%, dragged down by American Express, which plunged 12%, its worst one-day loss since 2009.”

AMEX earnings could get a lot worse, once COSTCO replaces it with VISA in April.

“We have plenty of instruments,” he said in his inimitable Draghi speak. “We have the determination, and the willingness, and the capacity of the Governing Council, to act and deploy these instruments.”

Hey, Mr. Dreghi, how about giving us a few examples of those instruments? Oh, that’s right, once a magic trick is explained, it’s no longer magic.

According to some information I got from Fidelity Investments, they are dropping their branded Amex card later this year for a partnership with a Visa-branded product.

When the markets react only to Central Bank and Government stimulus… then it’s time to rename El Presidente to Comrade Obama ?

The Fed has today treasuries worth $2.46 trillion on its balance sheet.

Man I love the sidelines. Paid for beer and wine, a nice mattress, lumpy in spots, and I know where I had my boating accident!

May the farce be with.

I’m with Spencer on this. (Man, I would hate to be a short player these days). I love following the news and trying to guess what will happen. The only truth I can discern is how crooked it all seems, and how corrupt political and economic leadership really is. I suppose it has never been any different. After all, Joe Kennedy bought his son the Whitehouse and today’s crop of nightmares is trying to do the same. Nothing changes.

Yesterday, as I looked out on ‘our river’ from our humble but lovely home, I remarked to my wife, “How nice it is to be one of the little people. Let’s just make sure we keep our heads down and don’t tell anyone how great our lives are. Or else, someone will try and screw us out of it”.

No debts (check)

In cash (check)

Health (check)

Tools, food, and guns (check)

Scepticism in place (check)

The rise in the USD is really starting to take its toll. And this trend is gaining traction. When the news of debt default/restructuring starts up, the Feds reaction I’ll be telling.

Expected dead cat bounce to sell into while the buy at the bottom feeders conditioned like Pavlov’s dogs during 8 yr bull market fueled by QE and ZIRP and decent economy faces respite till the next leg down.

Simply put the CBs of the world are out of ammo or rabbit to pull out of the hat while the global economies (as seen by commodities and transport) point to markedly slowing economy teetering back into Great Recession II.

Look at what the ‘market’ has done since the Fed stopped QE: just about nothing. All it did was bounce up and down within an 8 to 10 percent range. It’s now basically doing the same thing only with a wider amplitude.

Market? There is no market. Welcome to perpetual mediocrity.

It’s over. The Foul Fecal Matter (FFM) has hit the Air Turbulence Generator (ATG). If you haven’t already it’s time to duck…

This is beginning to look like an amusement ride… Maybe we should all put our arms in the air and yell ‘weeeeeee’ :)

Zimbabwe 100 Trillion Dollar Banknote one can buy most likely on Amazon or ebay as a cruel joke and a reminder to harsh realities of fiat currencies.So what became of Zimbabwe after hyper inflation?