The Fed Speaks, Markets Come Unglued

After the Fed raised the target for the federal funds rate on Wednesday from nearly zero to barely above zero, stocks rocketed higher and hopes pervaded the market that rising rates would somehow be good for stocks, just like zero-interest-rates had been good for stocks – that in fact anything is good for stocks – a theory proffered in great detail at every sell-side corner of Wall Street. But it was a half-day miracle.

Then everything came unglued.

It didn’t help that the propitious moment coincided with the expiration of stock and index options contracts – “quadruple witching.” And so the normally quiet last Friday before the holidays spilled lots of red ink in heavy trading volume.

The Dow dropped 367 points, for a two-day loss of 623 points, or 3.5%. Volatility is back: over the 14 trading days so far in December, there were 12 when the Dow moved 100 points or more between the close of one day and the close of the next, the most volatile December since 2008.

The Nasdaq dropped 2.9% since the Fed’s half-day miracle and ended once again below that magic 5,000.

The S&P 500 dropped 3.25% since the Fed’s half-day miracle. The market has become skewed to the downside: one stock among the S&P 500 made a new 52-week high on Friday and 37 made new lows.

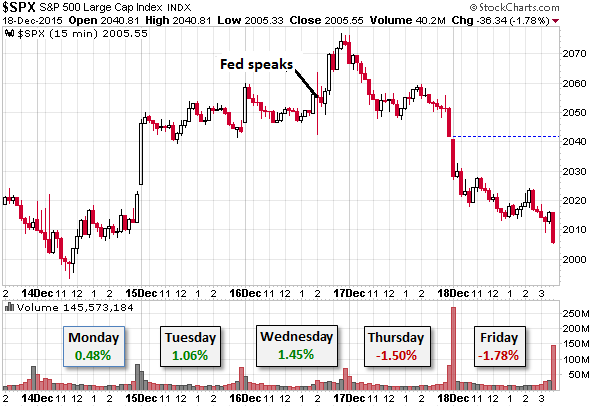

“Expectations of a Santa Rally did not become reality this week,” explained Jill Mislinski of Advisor Perspectives to introduce this five-day chart of the S&P 500. It shows the Fed rally and the debacle since then. Note the spikes in volume at the beginning and end of trading on Friday:

Another week with no Santa Rally.

For the week, the Dow fell 0.8%, the S&P 500 0.3%, and the Nasdaq 0.2%. Wall Street soothsayers promised there’d be a Santa Rally. They brandished calendars and probabilities to bamboozle people into buying. We need it desperately: stocks have gone absolutely nowhere since September 5, 2014. We’re already sorely missing QE. And now we’ve got to deal with rate hikes!

Contrary to the hype that financial stocks would benefit particularly from rate hikes, they got hammered on Friday. They were the worst-performing sector in the S&P 500. The iShares US Financial Services ETF dropped 2.5%, the KBW Nasdaq Bank Index 2.9%. JPMorgan fell 2.8%; Wells Fargo 3.0%; Bank of America 3.1%; Warren Buffet’s finance and insurance empire Berkshire Hathaway 3.3%.

And junk bonds, the harbinger for the stock market? They’d gotten bludgeoned in prior weeks. A week ago, the iShares High-Yield Corporate Bond ETF HYG hit the lowest level since the euro-debt crisis of October 2011, and the days of 2009. Then the first major bond debacle happened since the Financial Crisis… It Starts: Junk-Bond Fund Implodes, Investors Stuck.

The junk-bond debacle frazzled investors.

But Wall Street soothsayers came out in force to explain that these bonds where the buys of a lifetime, a rare opportunity to buy these superb investments at the end of the credit cycle, when the hot air is audibly hissing out of the Great Credit Bubble. Even Janet Yellen came to the defense of junk bonds, explaining during her press conference that the bond fund implosion was just a one-of-a-kind thing.

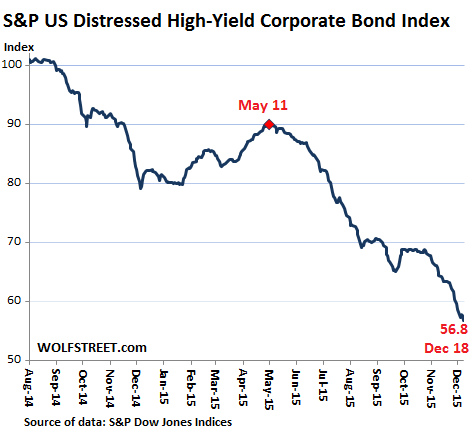

So junk bonds rallied earlier in the week. But by mid-week, they lost their footing again, especially at the riskiest end. And so the S&P U.S. Distressed High Yield Corporate Bond Index, which tracks bonds whose yields are 1,000 basis points (10 percentage points) above Treasury yields, dropped two more points this week, to 56.8, a 44% plunge from August last year. Looking increasingly ugly:

In the broader junk-bond market, a similar pattern appeared as investors, ornery as they are, developed a will of their own – and sold. The HYG dropped again, landing on 79.53, on its way back to the dreadful levels of a week earlier.

The already beaten-down Canadian dollar plunged to US$0.716, after 10 days of nearly uninterrupted declines, the lowest level since early 2004. It now costs C$1.40 to buy one lousy greenback. In 2012, they were at parity. The loonie has lost 17% year-to-date against the US dollar, the worst annual decline since crisis-year 2008, when it fell just over 18%. It’s all part of the Bank of Canada’s currency war, its very vocal, well-planned, willful destruction of the loonie.

Crude oil got knocked down too, with WTI losing 2.5% for the week, now at $34.55. US natural gas, which has traded below the cost of production for most of the past seven years, has gotten completely destroyed, hitting the lowest price since March 23, 1999. But fracking is costly, and the entire industry has begun the painful process of eviscerating its gullible investors.

This too is a Fed-induced phenomenon. Over the years, money kept flowing into the industry despite the low price of gas and endless negative cash flows. In this Fed-designed world of zero-interest-rate policies, when risks no longer mattered, drillers were able to borrow new money from banks and bondholders and drill it into the ground. Production soared, as did hype and hoopla on Wall Street, and more money poured in, and this money too has now disappeared. Read… Carnage in US Natural Gas as Price Falls off the Chart.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The stock market has been manipulated up with hidden support by the Fed and Treasury and since the low in 2009. They will continue to prop it up. Expect a rally before Christmas.

The ONLY scenario where the Fed couldn’t keep the market elevated is if there was massive, across the board selling. In that case, they would close the market until a strategy was enacted that would hold it up.

Left to founder at the low of 2009, the economy would have imploded. They felt they had no choice but to buy it up. Of course, all the selling was washed out of the system, so the first couple phases of levitation were easy and cheap.

This faith based religion central banking has ran its course. The only reason it persists? The mass hysteria that will ensue at its INEVITABLE demise.

So let´s see here:

– the US economy may be going into recession because of a flagrantly predatory supply shock by our second closest ally in the Middle East;

– there is visible stress in shipping, manufacturing and retail and in the junk bond market, as exposed by Wolfstreet on a daily basis

– Spain, the posterchild of economic austerity in Europe, has just become ungovernable because of that very same austerity, and of course, because of the same scourge all over the world: corruption and the relentless concentration of wealth and income

– Argentina is broke, desperately trying to float their currency, with no prospect of avoiding a harsh recession

– Brazil ditto

– Venezuela, ditto

– Mexico, ditto

– Saudi, themselves running a 12% of GDP deficit is having to provide Egypt with $7.5 billion in cash, and guranteed oil for the next 5 years

– Russia is in (a severe) recession

– China, ditto

– France has opted out of economic targets for 2016 (and the EU let them – did anybody else notice ?), presumably because of increased spending on security … well, they have been pushing that release for years, and the attacks in Paris were nothing short of the perfect excuse.

– high end real estate in the some markets is starting to teeter

– and the list goes on

As the saying goes, you can plug only so many leaks at a time before the ship starts sinking …

If things get grim, at least now the FED can now LOWER interest rates again to provide liquidity, and to stimulate the economy.

25 basis points down, anyone ?

The Canadian oil sector is getting smashed from both ends. The bench mark WTI crude price in USD converted to CAD is $48.37 yet Canadian producers have been forced to sell at a shade over $21.00 CAD!

The Canadian oil province of Alberta has asked Ottawa for relief and for the first time in almost 50 years, the province will receive an equalization payment from the federal government!

All along the border, in the states that border Canada, they have seen their cross-border shopping collapse, because of the strength of the green back. No Santa rally for them. On the contrary, their stockings will be getting stuffed with pink slips. Merry Ho Ho!

They aren’t selling WTI. Canada’s main grade is Western Canada Select, a much heavier crude than WTI.

BTW: that price (48.37) even in $C sounds a little rich for WTI- $36 ish US?

The big news of the week was THE benchmark, Brent, a lighter crude than WTI falling to about 38 US.

This is the moment we’ve all been waiting for, Wile E. Coyote just looked down. You can see the brave little smile forming……

JJ, I think the pre-2008 economy was the “Wile E. Coyote” economy. Many people didn’t see the end of the cliff before running off into space. I call this version the “Tinkerbell” economy, because the only thing that has kept it alive is believing. Believing in something most people have long known is unrealistic. So, believe with me Jim. We have to keep this thing alive long enough for the smart money to escape the carnage to come.

I think this also a “Wile E. Coyote” economy, but with a fifth of “Tinkerbell” chaser.

The rate increase had only one purpose: to save what’s left of the Fed’s credibility. It also doesn’t hurt that it strengthens the dollar and plays into punishing Putin for not cooperating in Syria (cf His Royal Highness Obama comment on how ‘he was right and Putin was wrong’ on Syria). Other than that, we have now arrived at the moment before The Mother of All QEs begins. You think all those junk bonds are gonna buy themselves?

Spot on.

“The rate increase had only one purpose: to save what’s left of the Fed’s credibility.”

That and it gives them a “whopping” 0.25% headroom to avoid a “need” for negative rates when a recession is declared shortly.

I’ve seen mention elsewhere of how giddy Yellen seemed during the rate hike announcement and the, IMO, totally incorrect assessment that that was due to her actually believing the economic recovery tripe used to justify it.

I firmly believe her good mood was because the FOMC had finally granted her that tiny amount of headroom to help with the time bomb handed to her by The Bernank who, just like Greenspan, formerly known as “The Maestro,” conveniently retired just in the nick of time.

The sooner the Dow drops below 10,000 the sooner people will begin to rebuild a stable economy that actually designs, creates, constructs, and sells necessary products and services to people/citizens. This financialization of everything so the Harvard MBAs can receive ever increasing bonuses with borrowed money for stock buybacks, and then call the trend healthy and an improvement in the economy, is as about as real as a Hollywood flick.

People, let me re-phrase that to ‘consumers’ who walk on two legs, have traded in realistic life goals for glitzy products and experiences they just have to have or by God what’s it all for anyway? When the facade crashes we can get on with life.

Hurry up already. And no, Cheevers, retirement in a Palm Springs golfing community is probably unrealistic as well as running the new cabin cruiser you have dreams about. And no, Cheevers, you don’t need an Audi or Mercedes, a Chevy will do just fine. Better yet, plan on walking and take some pounds off.

I am developing a new daydream of watching Matthew McConaughey driving away in his car add Lincoln, snapping his fingers to Sirius radio jazz, and plowing into an abutment in a flaming pile of twisted over-price metal. That is our economy these days…all fluff and image….and waste.

What is wrong in paying bonus to MBA crowd. It is funny how we try to survive on bottom feeders, isn’t it Wolf?

I’m with Mr. Richter in what I assume is his cautious, doubtful attitude toward the overall soundness of economic developments during eras of too cheap capital. Example: The FED itself has said they are puzzled by the slow productivity growth; no wonder when we haven’t had a productive recession in more than a decade to weed out inefficiency, where failing corporate institutions are propped up by cheap capital. Of course it was either that, give people money directly or let things become depression 2.0. This way produced the least distortions.

Yet having an unfettered recession now would still expose the economy to too much risk of unproductive damage, so Mr. Richter is right when he warns of excessive debt. Btw, in ten of fifteen recent financial type busts in other countries, economies never recovered to prior levels (per nate silvers book). It’s a deep mire, perhaps beyond monetary institutions to fix here in Dec 2015.

It’s interesting that the great recession neatly occurred with the presidential cycle, with mr. Obama serving to catalyzed hope and change for the entire nation. It’s my hunch that those in charge would be tempted to do the same thing as in 08′: let the nation swallow some bitter, necessary pills from now until election day. That way, voters can also decide the fate of the nation and have something to look forward to. The Spirit of our democracy shouldn’t be discounted.

IF that were to happen, 2016 could turn into quite an ugly year as painful adjustments are made. The question is, what sectors are bubbles now? Fossil gas is of vital National importance, silicon Valley one of the only sources of innovation left and autos are needed by everyone to get to work. However, car sharing is on the rise which might blunt a contractions impact, so my bet is that these kinds of sectors (like biotech too) might see more contraction than those sectors promising future growth.

To accomplish this selective weeding, policy announcements of fiscal support could be used to protect some sectors as others get mired in financial difficulty. This fiscal support happened to solar recently, for example, lifting it despite exposure to sub prime debt. It’s just an idea that this is what’s being planned, and as we all know there are plenty of unpredictable black swans circling our pond. Another example: Clinton (rightfully imo) brought down biotech. So I’m staying vigilant, watching the policy side of things and crossing my fingers that things stay under control at least here.

As for the Santa rally? Two thirds of my screen was green this Friday, the rest were my shorts:)

I think people are sick and tired of all the bad news. The new Star Wars movie at the expensive IMAX theater is sold out for every performance the entire weekend. We enjoyed it and paid $1.97 for gas as an added benefit. Blew the Xmas budget on something that was fun. Disney will probably have a good Xmas as a result even if the retailers don’t.

I don’t know what is bad news for you but trust me new Star War movie is not even considered Science Fiction to what is to come. Enjoy your Xmas and splurge on good wine, strawberries and chocolate.

Cheers.

actually it shows how people will lap up any kind of crap when they are in a trance-I outgrew star wars YEARS ago

…”And now we’ve got to deal with rate hikes!”…

But our friends the banks, the TBTF bunch,

…”The rate was raised from .25% to .50%, effectively doubling the amount of free cash flowing into the banks from their Excess Reserve’…

on 2.4 trillion no less.

Merry Christmas Santa

So if the ZIRP and the QE’s where used to realize the shale oil revolution, which brought the oil price down and now when that job is done the Fed decides to end the ZIRP and the QE’s which will strengthen the dollar, the oil price should fall even lower. All emerging markets with dollar denominated debt who are dependent on oil exports to service the debt will be hammered even harder than what have been during the last year since the oil price started to collapse.

Correct.

The “hammering” is starting to get close to home. Can you hear it?

South America, Mexico and now Canada. Their (basically commodities) economies and currencies are imploding against the strength of the USD. They can no longer afford to repay their debts in USD let alone import anything from the US because it’s too expensive. Can you hear anything?