Chesapeake Energy, the second largest natural gas producer in the US, after Exxon, is the biggest exclamation mark in a special Fed-designed phenomenon: for years, QE-besotted, ZIRP-blinded, yield-hungry investors kept funding an industry that dished out nothing but hype, false hopes, and losses.

Two natural gas producers have already thrown in the towel: Quicksilver Resources filed for Chapter 11 bankruptcy in March, listing $1.21 billion in assets and $2.35 billion in debts. Much larger Samson Resources has scheduled its date with bankruptcy court for September 15.

In 2007, the hype around fracking for natural gas got started in earnest, and billions poured into the industry month after month. The price of natural gas soared, and by June 2008 exceeded $13 per million Btu at the Henry Hub. Then the price collapsed. But not the hype and false hopes. Investors still cling to them.

By September 2009, natural gas was below $3 per million Btu at the Henry Hub, and that’s where it is today ($2.67). No one can profitably frack for dry natural gas at these prices, regardless of what they claim.

The most productive US natural gas field, the miraculous Marcellus Shale, where Chesapeake is a big player… well, there are pipeline constraints and other issues, and the gas is traded at local hubs, not at the Henry Hub, and prices are even lower.

At Tennessee’s Zone 4 Marcellus hub, gas traded for $0.78 per million Btu last week, according to the EIA. On the Transco Leidy Line, prices fell to $0.77 per million Btu. At Dominion South, prices fell to $1.22 per million Btu. Marcellus hubs service the densely populated East Coast areas from New England down to Virginia. Regardless of what the hype is, no driller can survive for long at these prices.

The Marcellus Shale is where money went to die the fastest.

Especially the “smart money” got fooled by the hype and false hopes of natural-gas fracking. Private equity firm KKR made two big bets on natural gas and lost $5 billion.

In 2007, KKR, TPG Capital, and Goldman Sachs masterminded the $48-billion leveraged buyout of TXU, the biggest electric utility in Texas. The “smart money” bet that TXU, which relied on coal-fired power generation, would gain a competitive advantage over the gas-fired power plants of its competitors as the price of natural gas would soar. In April 2014, the renamed Energy Future Holdings filed for bankruptcy.

In 2011, a KKR-led group of private equity firms pulled of the $7.2 billion LBO of Samson Resources. The “smart money” bet that the price of natural gas – at the time already below the cost of production – would soar [read… Big Natural Gas Driller Bites Dust, ‘Smart Money’ Gets Crushed].

So in terms of capital destruction, Chesapeake is in good company. Its annual free cash flow has been negative since 1994, even during good times, with only two tiny exceptions (Bloomberg chart). This business model left behind a mountain of suffocating debt. To hang on, Chesapeake has been selling assets for years.

As of June 30, it had $28.6 billion in assets, down by $13 billion from December 2012. But over the same period, its liabilities dropped by only $5.3 billion to $18.4 billion. Turns out, some of its assets were simply written off, not sold. Foggy numbers on the balance sheet that evaporated when they came in contact with sunlight.

To preserve $240 million a year in cash, Chesapeake announced on July 21 that it would eliminate its quarterly dividend. Its already beaten down shares plunged. Another great buying opportunity, folks said.

On August 5, Chesapeake reported quarterly earnings. Revenues fell 41% year-over-year to $3 billion, generating a net loss before income taxes of $5.6 billion. This included $5.1 billion in charges for “Impairment of oil and natural gas properties,” and “Impairments of fixed assets and other.”

That $5.1 billion had disappeared into the ether long ago. It just now became an accounting entry. These kinds of write-offs explain how assets plunged 2.5 times faster than liabilities since December 2012. It doesn’t take a genius to figure out where this is going.

When it announced those results, its shares plunged 10%.

And in the general mayhem on Friday, shares dropped nearly 4% to $6.87, the lowest since November 2002, down nearly 90% from their hype and false-hope peak in June 2008, when production soared and when the industry, infatuated with its own hype, explained to investors that the price of natural gas could only go through the roof. Shares are down 77% from June last year.

So in how much trouble is the company? Its bonds give an indication. When a company can no longer borrow under survivable terms, its lifeline gets cut off. And being permanently cash flow negative, it must raise new money to pay interest to existing bondholders. Once the new money dries up, the liquidity death spiral sets in, and eventually, creditors fight over the scraps.

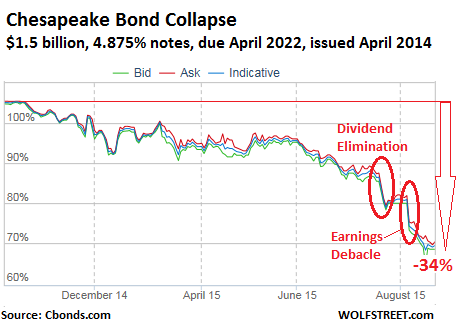

And Chesapeake’s bonds have crashed. Two examples:

In April last year, just before all heck broke loose in the oil markets, but years after the same heck had already broken loose in the natural gas market, Chesapeake issued $1.5 billion of junk-bonds due April 2022, with a ludicrously low coupon of 4.875%. By August last year, yield-desperate investors, blinded by the Fed’s shenanigans, bid them up to 105 cents on the dollar.

As of Friday, the bid (green line) was 68 cents on the dollar, the ask (red line) 70 cents on the dollar, and the indicative (blue line) 69 cents on the dollar (chart by Cbonds.com). Circled in red are the announcement of the dividend elimination and the earnings fiasco. Both caused the notes to plunge. Over the last 12 months, they have crashed 34%:

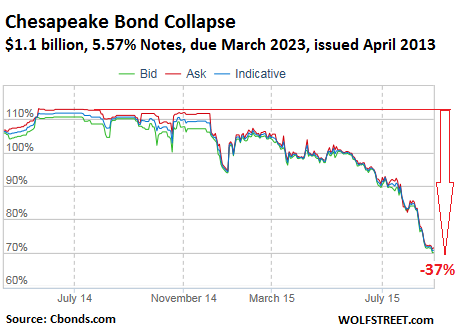

In April 2013, Chesapeake sold $1.1 billion in 5.75% bonds due March 2023. In June last year, they still traded at 112 cents on the dollar. On Friday, they were indicated at 70 cents on the dollar, down 37% (chart by Cbonds.com):

Chesapeake’s secured debt is faring much better. But holders of its unsecured debt are beginning to have serious doubts that the bonds will be redeemed. They’re calculating into the equation a significant probability that the company will have to restructure its debt, either in bankruptcy court, or outside, whereby shareholders would likely get wiped out, and unsecured creditors would be fighting over the scraps left over by secured creditors. This summer, expectations of that kind of wipeout have ballooned.

The easy money from the Fed was plowed into the production of natural gas until a glut and price collapse tore up the industry. Other commodities have crashed under the same principle, but natural gas was the first one out of the gate. Easy money and delusion kept the charade going for years. But now it appears to be coming to a head. And the full extent of capital destruction is gradually seeping to the surface.

After fracking, there’s offshore drilling. Read… Junk-Rated Offshore Drillers Headed into Bankruptcy: Fitch

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What a disaster. Mind you, I’m not weeping KKR got shellacked. But one day, the gas price will rise… one day.

Bad for Chesapeake investors but great for consumers of NG.

What is all this worry about? I am a short seller who tied up 200k in four stocks five years ago that have quadrupled thanks to easy Fed money. These four stock are dividend stocks and guess who paid the dividends. But I couldn’t care less. I buy with cash. I wouldn’t buy a stock Jesus recommended on margin. My home and vehicles are paid for and I have a 781 credit score. I retired at age 48. I am now 75 and my doctors says it is a sin to be in perfect health at my age. Want to know my secret? I do not worry, I live within my means and I pay cash. Oh, and I have a chest full of adult toys that my beautiful lady and I use almost daily. There is a heaven and I am in it.

how precious, hope it lasts forever.

Good for you, Bob! Watch our for looters…

“Foggy numbers on the balance sheet that evaporated when they came in contact with sunlight.”

Reminds me of the annual reserves hocus pocus exercise. Laughed so loud my boss asked what was up.

Foggy Numbers sounds like a song from one of those Film Noir movies set in San Francisco in the early 1950s. But to the point. While still working in 2009, I was in a State O&G regulatory agency where well permitting occurred. A gentleman working for a company involved in coalbed methane E&P was permitting 10 wells. It was well known the company was in the process of being acquired by a larger NG player. As I sat reviewing some documents, he received a call to which he replied “Tell them 10 permits have been submitted and should be ready to spud within 5 days. Go ahead an book in 10 BCF. So the uptake here is that they booked their reserves before drilling and completing the wells. Made me wonder how common that practice was/is in the unconventional plays. Or the industry as a whole?. Just pumping up the books ahead of a sale? Did he mean actually submit these yet to be developed reserves as an official proven reserves statement? I do not know, yet I am extremely dubious about numbers I see bandied about in the oil or any other industry.

As a young newbie petroleum geologist, I was enthralled by the reservoir estimates the PEs submitted. Geology was always plus or minus, based on the data, in my professional opinion. But the engineers had real numbers. So , one day I was early to a meeting and a senior PE was there. So I asked him how they could come up with such detailed data. He told me, first you reach up in the air and grab an assumption, after that, it’s just arithmetic. The only really good estimate is adding up the production after the well is plugged.

Amazing. I have a question. Once the shares have gone to zero and the bondholders get their haircut, or throat cut- will the productive resource remain available for a future shortage, or is it like some mining, oil wells etc. that deteriorate if idled? Should the Feds be involved re: energy security?

If there was to be a repeat of the 1973-4 OPEC embargo of oil to the US, could all this supply be quickly cranked up?

I realize that the US is a big place but (as in Canada) the persistence of coal- fired plants amidst a glut of ultra-cheap cleaner NG seems odd.

If the gas isn’t near the coal fired plant -can’t nat gas power plants be built near source of gas and then power connected to grid for transport – surely it’s easier to get permits for electric lines than the Greens’ main hate- pipelines.

In other words is the plight of NG just a market fact of life, like the disappearance of the buggy and buggy whip, or is there more to ponder?

Nick, in a restructuring, usually the creditors take ownership of the company based on the hierarchy in the capital structure. So these new stock holders will try to make the company function in a profitable manner, which should be easier since it will have a lot less debt than before restructuring.

So bankrupt and restructured oil and gas companies will continue to drill for oil and gas, though they may do so at a slower pace.

If prices rise by a lot, such as during a shortage, new money will eventually pour into the sector and production will jump. It won’t take all that long to ramp up. So there will be plenty of US natural gas, but the price will have to be much higher.