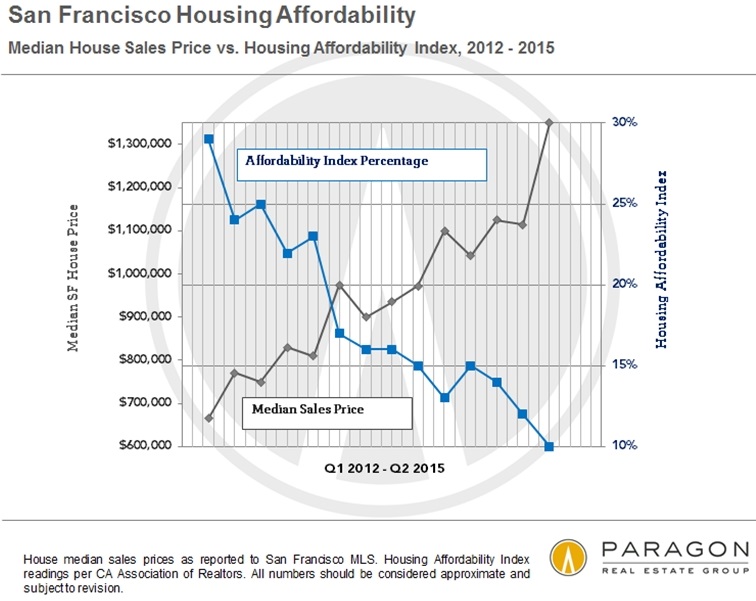

The median house price in San Francisco has jumped 103% since the first quarter 2012 to $1.35 million in July; the median condo price has jumped 74% to $1.125 million. These aren’t palaces; condos include 1-bedroom and smaller units!

And incomes in San Francisco, it turns out, haven’t soared in lockstep (the Census Bureau pegged the median household income at $75,604 in 2013 though it has risen since). A similar scenario has played out in other Bay Area counties. And thus housing affordability has plunged. “Housing crisis” – that’s what a lot of people call it.

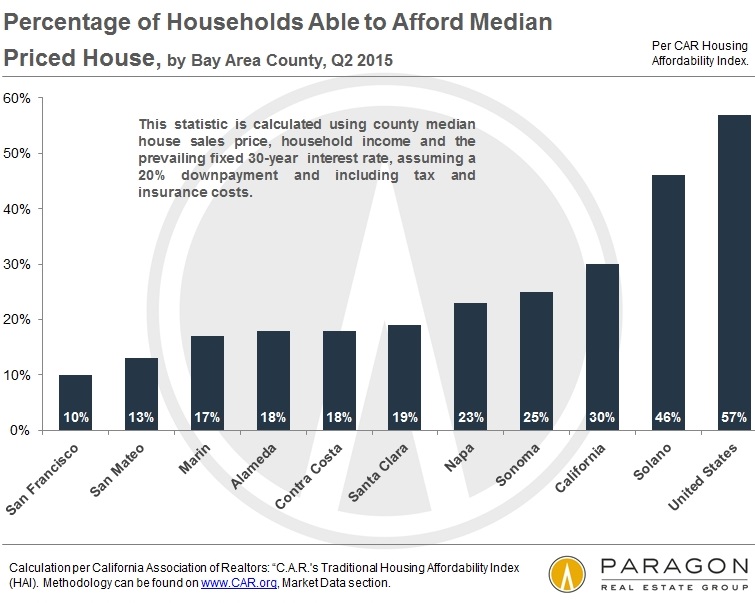

The Housing Affordability Index (HAI) for the 2nd quarter, just released by the California Association of Realtors, shows that only the top 10% of households in San Francisco can afford to buy a median house, and this despite historically low mortgage rates!

By comparison, 30% of the households in California and 57% of the households in the US can afford to buy a median home. To be considered “affordable,” the mortgage payment, property taxes, and insurance costs can’t be more than 30% of household income. This chart from a new report by Paragon Real Estate shows the absurdity in the 9 Bay Area counties, compared to California and the US:

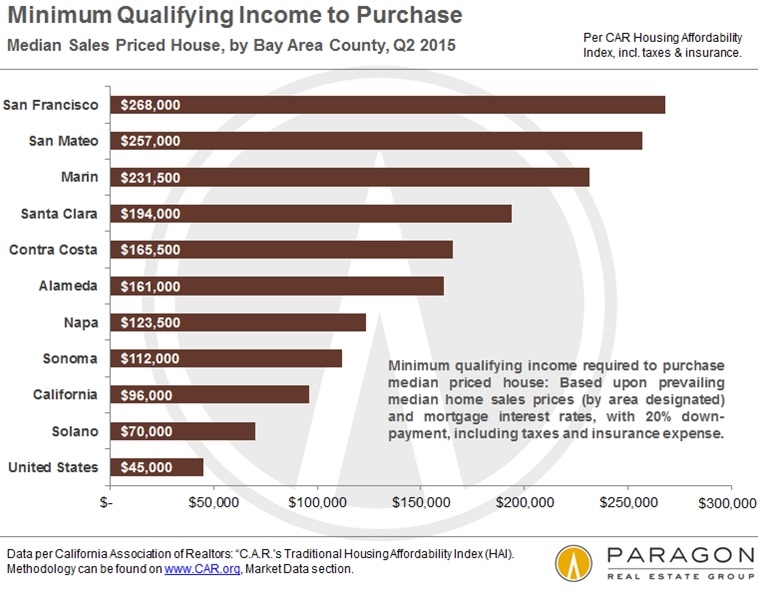

So how much household income does it take to be able to buy that median house in San Francisco? A chunk! The minimum qualifying income is $268,000 – almost six times as much the $45,000 it takes in the US overall. But household incomes are only about a third higher in San Francisco. Absurd?

It gets even more absurd. The Housing Affordability Index assumes “that a household can make a 20% down-payment on the median-priced home and that the mortgage would therefore be 80% of the median house price.”

Alas, that down-payment on the median house price of $1.35 million in San Francisco would be $270,000. That’s how much money this index assumes the median household, earning just above $75,000 a year, can save up even though life in San Francisco is extraordinarily expensive, and most people on median incomes can’t save anything, with the median asking rent these days at $42,288 per year!

OK, people living in a rent-controlled unit for the past 20 years have got it made, but they can’t afford to move ever into anything else because it would simply rip their entire budget apart. These people are stuck. I know a few of them. That’s the curse of a great deal (and it’s a different sort of curse for landlords too).

So if a household can’t come up with that $270,000 down-payment, it would have to finance closer to 100% of the median price, if they can get a mortgage under these circumstances. Mortgage payments would jump, and affordability would plunge further.

Even in Q1 2012, the recent low point in home prices in San Francisco, and the highpoint in affordability, only 30% of the households could afford to buy a median home. And this is what the relationship between soaring prices (gray line, left scale) and affordability (blue line, right scale) looks like:

What’s the secret sauce that has created this absurdity in San Francisco and the Bay Area, and what has kept it from imploding so far? The tech and startup boom, in at least two ways:

These companies, whether they have any sales or not, have created a lot of well-paid jobs in the Bay Area. And among some of the participants in the tech boom, household wealth has ballooned.

Paragon Chief Market Analyst Patrick Carlisle points at “gains from a surging stock market and such things as stock options and IPO proceeds at high-tech companies, which have generated huge amounts of new wealth over the past 3 years. New wealth, in particular, looks to invest in homes….

So what could prick the Bay Area housing bubble?

The same thing that has pricked it before: a swoon in tech, an end of the IPO boom, and a collapse of the ludicrous “valuations” assigned behind closed doors by a handful of players to startups. Individuals, such as employees, who are in a hurry to cash in some of their chips can sell their shares in special arrangements and turn these “valuations” into real money with which to buy an overpriced home.

But the entire construct depends on the exit doors: there must be someone else – either the public or a large corporation – that will buy the startup at these ludicrous valuations. That exit door always closes when the stock market swoons. The money suddenly dries up. Well-paid jobs get axed as money-losing companies try to hang on for as long as possible. Stock options become worthless, equity stakes meaningless. Sellers try to dump their no longer affordable homes on the market. Homebuyers evaporate. Hot air hisses audibly out of the housing bubble.

And there is another needle approaching the bubble. Paragon’s Carlisle:

Interest rates play an enormous role in affordability, and it is certainly reasonable to be concerned that affordability percentages are now hitting such depths while interest rates are also close to historic lows. For example, in 2007, when affordability percentages hit previous low points, prevailing mortgage interest rates were approximately 50% higher than today’s.

He warns when interest rates begin to rise, “there will be potentially dramatic effects on affordability, which could presumably affect demand and prices.”

San Francisco and much of the Bay Area cycle through booms and busts with legendary extravagance. The last two times, stock market crashes brought down the housing bubbles. This time is different. This time, not only are stocks teetering precariously at record highs in the midst of a mediocre economy bogged down in languishing corporate sales, but mortgage rates are near historic lows. And there is a good chance that, this time, both will head simultaneously in the wrong direction.

In San Francisco, the two sides are separated by the money line. Read… The San Francisco “Housing Crisis” Gets Ugly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

An article on housing affordability in San Francisco? Why not print one on the same subject for Park Avenue in NYC or The Peak in Hong Kong?

Why is anybody surprised that prices are so high? Does anybody think they will ever be a place where Joe SixPak or Larry Lunchbox and live?

Think the Yuan devaluation is a big shock? Welcome to QE4. The markets are all acting as if the interest rate rise is pretty certain, so the bigger risk is if the Fed acts to weaken the dollar instead.

China devalued the RMB a lot more in the first 4 months of last year, but there were no Chicken Little articles about China being trashed or the world being in shock. I understand the goal is 5:1 RMB:USD, but the path is not a straight line.

Yet people are paying way over asking price afraid they will be left out. Until the last person declares ‘enough is enough’ and won’t pay these prices nothing outside of a cataclysmic financial crisis or natural disaster will bring this situation to a halt.

Not necessarily about whether people are willing to pay, in the circumstances Wolf describes it’s about whether the bank will lend in those credit-contracting conditions. Mortgage availability is the primary driver of house prices

Over 50% of the house sales in the Bay Area are all cash, as in “$850,000, a check from my bank.” No mortgage. I think this article underestimates the influence of wealth and money exiting China, looking for safer real estate.

Here’s some info on this topic. I left it out of the article because in SF the topic is not among to top 2 risks to the housing bubble (end of tech boom and rising interest rates), though in other cities in the Bay Area it may be.

“Non-resident and foreign purchasers” make up “perhaps” 5% of all purchasers in SF, according to Paragon. In some locations down on the Peninsula, the percentages are much higher. I’ve heard as much as 30% in a few choice places.

There are only about 400 – 800 homes sold in SF every month, so a small number. It doesn’t take much to move those numbers. 5,000 people cashing in their stock options – or realizing that these stock options will never be worth anything – can have a big impact.

Most foreign buyers are buying top-end condos. They don’t go for the cheapo $1.3 million place. But it does raise price pressures.

Scoot – the same in Vancouver, there is a myth that HAMS (Horny Asian Males) are buying all real estate lifting the prices.

The last time I read about Vancity RE it is around 5%

or less buyers from China. The REagents are trying to create a buying panic that its better to buy now before a million of HAMs come to buy like a locust.

There was a funny case in Vancouver when they paid local Chinese immigranta already living already in Vancouver to pretend to be rich Chinese buyersfrom the mainland. The national TV reported on it showing them getting into helicopter to tour buying opportunities. The rich Chinese, flying helicopters, suitable commentary by ‘journalist’ and the bying panic was created until someone discovered the scam.

Over the weekend I was reading the NYC papers online and clinked on the real estate site advertised. Looking at the prices on the streets where I use to live shocked me. A new condo on the corner of the street where I grew up was $2.7M for a two bedroom. This was not an upscale neighborhood then or now. Another street where I lived as an adult, very nice area, was listing a two bedroom for $1.7M.

All my neighbors on both these streets were average working people. They worked as laborers or in white collar jobs. I don’t know how any average working person can afford any of this even in a city where jobs pay well.

The premise that interest rates will rise is incorrect. Sure the Fed will raise 1/4 point in September; that is purely a “cover move” purely for spin. They want folks to believe that all is well and things are going back to normal.

Readers of this site and others know differently. ZIRP and QE are game on for a very long time. I don’t know what form the next QE will take (they will get creative, I’m sure), but some form of indirect monitization of debt will occur.

As far as housing is concerned, this is an asset bubble resulting from the Feds policies. They now have no choice but to continue to feed it, and they will. High housing prices are showing up all over the US; some of which is being drivin by Boomers looking for the best places to retire.

If they can’t feed WAGES, then they can’t feed the asset bubble. It can’t go on forever.

Someone also mentioned ‘mortgage availability’. Are we going to have a situation where banks will lend for a 2 million dollar house (3bds/2bths) a 1.6 million loan over 30 years if you put down 400K? Who has 400K lying around these days?

If I had a house in SF:

Last year I would have researched and found new employment in a different area of the country. I would have considered it to be a ‘do over’, and explored all options.

6 months ago I would have listed and sold my home and pocketed equity.

3 months ago I would have started my new job and searched for new property.

1 month ago I would have rented a Uhaul and moved my family to our new beginning.

Today, we would be picking up a few things to fix up the new place the way we want it. We would also be picking up some school supplies.

The cash made from selling the overpriced SF home would be placed in a 1 year term deposit so I would not waste any of it while I scouted out some more property to buy in the next downturn.

I would plan my retirement.

I did this in 2007, the only difference being is that I bought the new place before we sold….mostly because it was so cheap.

Right now, as I type this I am looking out at the river my home is on….seeing if there are any salmon jumping and worth going for. It is a little early for Coho. The tide is ebbing and when the river drops it is the best time to fish. I don’t have to worry about going to work this morning because I sold my house in town and was able to plan an early retirement.

This excellent article reminds me of someone standing on a busy freeway, marvelling at all the expensive fancy cars whizzing by and wondering if………..splat.

Time to sell. Past time to move, imho.

regards

The fact that some people are selling means they are thinking along your line of thought.

Funny, I always figured that in every transaction there was a buyer as well as the seller.

Lucky you.

I’m in with the rest of the ‘slobs’ who cannot find decent work anywhere, much less in some out of town paradise. If I lived in San Francisco, even were I to have had a house or condo, taxes and fees would have driven me off well before the price bubble afforded a great bonus.

Until the “Upper Classes,” into which I bundle the Financial as well as Technological elites, process and admit that the health and wealth of those “below” them have as much influence upon their future prospects as do their own “efforts,” the future prospects of everyone are bleak.

There was a concept known as “noblesse oblige.” When this idea was accepted and acted upon, the system, whatever it was generally worked fairly well for all concerned. When the concept was forgotten or denied by the ‘elites’ of the society, disaster was not far off. In many ways, we have passed the top of the roller coaster ride. It’s all downhill from here.

Smart move but you have to remember not all of us is Grizzly Adams lifestyle crazy folks.

These prices might make some sense if you are talking about the tonier areas of San Francisco or homes with views of the Bay or Golden Gate but why someone would want to pay that kind of money for a condo in Polk Gulch or the fog belt in the outer Richmond is beyond me. Some entrepreneur might want to sell ‘views’ to those with nothing but an alleyway and adjacent apartments from the windows of the mult-million dollar dwelling by putting webcams atop the Mark Hopkins, Telegraph Hill or a Sea Cliff mansion along El Camino Del Mar and installing high definition TV screens over the windows to create artificial views.

I relocated to suburbs east of SF 4 yrs ago. There is no way I can afford to buy the house I bought in Sept 2011 now. It is getting almost impossible to recruit people outside the bay area due to exorbitant housing prices.

Well I’ve seen this movie before… Back in 1992 in LA and 2007 in west coast where the greater fool theory proves itself over and over again with very strong sentiment of housing price will go up never mind that the people simply cannot afford it. Then all of a sudden the bubble bursts.

We learn history so as to learn from it and hopefully not repeat it.

If you’re correct that it’s getting difficult to recruit people to work in area, and Wolf is correct in his comment that foreigners are a relatively small in terms of market share, who exactly is buying all these properties?

Somebody must be in order for the real-estate prices to be continuously going up over a number of years.

We’ve seen this movie before – what happens is that the foreign money sees something more attractive, or less risky, and flees. (If the Chinese government decides to trigger a confrontation with the US in the South China Sea to distract a restive population with nationalistic fervor, it seems likely that fewer rich Chinese would want to buy US property.)

Foreign all-cash buyers leaving the market starts the dominoes falling by reducing top-dollar demand. As prices begin to fall, people start reducing prices at the top. These price cuts ripple through the market.

Once buyers see price drops, they start thinking about waiting for future drops. This triggers further price cuts.

Meanwhile, if interest rates go up, fewer people can afford to buy. Less demand, expanding supply of unsold houses… some will be converted to rentals, but that just means owners can’t charge enough in rent to generate positive cash flow. This means deferred maintenance, less ability to absorb tenants who can’t pay their rent, and other financial pressures to sell at a loss.

Astute analysis.

My comment is about attracting people from outside the bay area. I have seen plenty of fresh graduates joining my company in core bay area (Mountain View). Perhaps it is difficult to attract experienced people as it appears only they care about cost of housing. Fresh graduates on the other hand don’t care about housing costs, as they only share the cost.

“The market can stay crazy longer than you can stay solvent.” — John Maynard Keynes