There’s a reason why it’s called a “housing crisis” – rather than a “healing housing market,” as some pundits might prefer. It boils down to this: Many middle-class people who grew up in San Francisco can no longer afford to live in a city where money from all over the world is now sloshing around knee-deep.

They have trouble buying or renting a halfway decent place, though they might be able to shack up with a bunch of people, and that’s great, it works for a while, especially for younger folks.

Those who bought a home or rented a rent-controlled apartment a long time ago are fine as long as they don’t move. For renters a move can happen when they’re evicted. Then they have to go find a cheaper town to live in. It’s not exactly the American dream. School teachers even.

Property prices have skyrocketed. According to Paragon Real Estate Group, based on MLS data through July 2, the median condo price has jumped 74% since Q1 2012 to $1,125,000 and the median house price 104% to $1,356,000.

If a household earns the median household income, forget buying. Leaves renting.

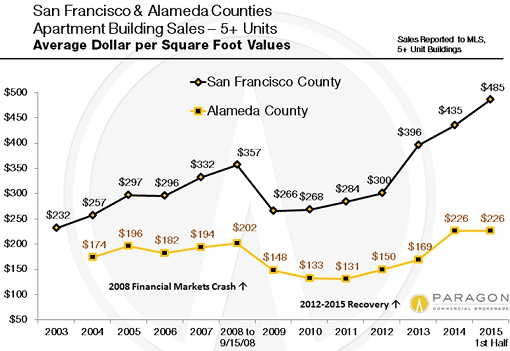

In its new SF Bay Area Apartment Market Report, Paragon found that in the first half of 2015, the average sales price of apartment buildings with 5 or more units has jumped 82% since 2009 to $485 per square foot.

The per square foot averages range from $394 in larger buildings (5-15 units) in the Mission to $845 in smaller buildings (2-4 units) in Pacific Heights. Prices are based on the interior living space and don’t include garages, basements, decks, and rooms or units built without permits.

Average asking rents have soared too, in a dynamic where higher rents lead to higher property values which lead to higher rents….

It works as long as rental units are in short supply, and as long as people from all over the world are following the siren call of startups with big valuations but no profits, where investors rather than operating profits fund some or all of the expenses.

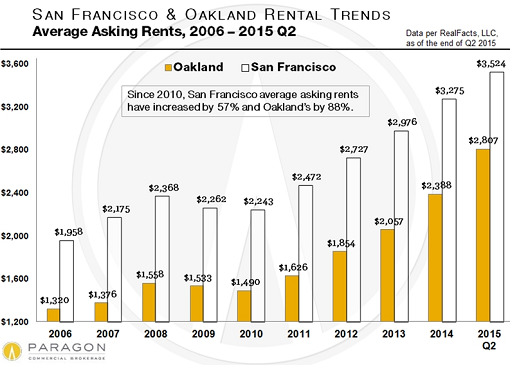

This money has triggered the “housing crisis”: Average asking rent in Q2 this year reached $3,524. That’s up from $2,243 in 2010, the dip after the Financial Crisis. A 57% jump in 5 years. Over the same period in Oakland (Alameda Country), just across the Bay, average asking rents have soared 88%.

Too little inflation? We’re better off ignoring these facts on the ground, apparently.

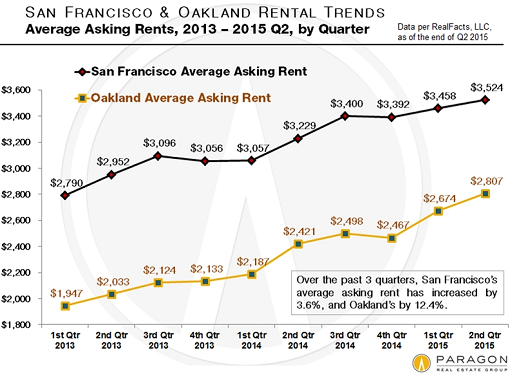

Since Q1 2013, asking rents in SF have risen 26%. In Oakland, 44%, including over 12% in the last three quarters alone!

Paragon Chief Market Analyst Patrick Carlisle explains that both cities have experienced “incredible appreciation” in rents. But Oakland’s increases have accelerated due to the “classic ‘overflow’ effect.” It’s now “a major go-to option in the face of SF’s extremely high rents.” Hence the insane price pressures across the Bay.

What’s next in the boom-and-bust cycle by which San Francisco lives? Enthusiasm, endless optimism, lots of money, and: a phenomenal building boom!

“There are hundreds of residential building projects in San Francisco’s development pipeline, totaling more than 60,000 potential new housing units,” according to a report by the San Francisco Business Times. About 9,000 units are currently under construction.

In 2013 there were 244,000 rental units in SF, according to the Census Bureau’s American Community Survey. So these units will move the needle. Paragon warns, “As they continue to hit the market, they may exert downward pressure on further rent rate appreciation, especially at the highest end.”

After the boom, the bust. That’s the rule in SF. But not yet.

The “housing crisis” is not a crisis for those on the inside, such as developers, realtors, current homeowners, people with enough money to easily pay for whatever they want, or for people in rent-controlled apartments who haven’t been evicted yet. And it’s not a crisis for the various levels of government because the associated activities throw a lot of taxes their way. For them, it’s nirvana.

But for the rest it has gotten so bad that SF’s darling, Airbnb, has been tarred and feathered in its hometown for single-handedly aggravating the housing crisis. So it felt obliged back in April to respond, showing just how beneficial it is to rent out units to tourists, rather than let locals live in them. This has “contributed nearly $469 million to the San Francisco economy last year,” it said; and Airbnb hosts were able to use the money “to pay the bills and stay in San Francisco.”

A month later, the City issued its own report that found that between November 2013 and February 2015, there had been between 5,249 and 6,113 Airbnb listings, even though these types of short-term rentals of 30 days or fewer were illegal in SF until February 2015.

An effort to tighten the screws on short-term rentals by imposing a “hard cap” was rejected by the Board of Supervisors in a 6-5 vote last week. But an initiative to limit the use of housing for short-term rentals to 75 days a year has qualified for the November ballot.

It boils down to an argument between two sides separated by the money line: those that cannot afford decent housing and those benefiting from high home prices and rents.

Airbnb is valued at $25.5 billion. It received $2.3 billion in investor money, part of which gets spent in SF directly or indirectly, including on housing that will drive prices and rents further into the stratosphere. Airbnb does what SF startups are supposed to do: lead the boom, hire a lot of people, offer them the sky, blow a lot of investor money, ignore the consequences, and somehow survive the bust that always comes.

The fact that this argument even exists in San Francisco and that it has taken on such importance shows just how crazy the “housing crisis” has become.

The forever-boom? Maybe not. Read… Home-Buying Panic Sets in, Housing Bubble 2 Soars, Industry Drools, But It’s Doomed, Says Zillow

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

That problem (the Elite with money to burn) will hit all the USA desirable homes, farmland, food stuff, etc.

I’ve always thought it funny that internet based businesses must be located in Silicon Valley.

You’d think a killer app would be a distance venture funding app.

The venture capital has always come from CA. The east coast money always saw the PC business as a hobbyist fad. CA is use to making money off of fads so they plunged ahead. Now they own the space.

Totally not sure what could pop this bubble. There’s so much money sloshing around even if the Fed were to raise a bit, it wouldn’t matter IMHO.

Credit.

Folks are not paying cash in most instances – the boom is funded with borrowed money. As soon as banks/lenders freak out it will start to unwind.

Regards,

Cooter

Nope, I don’t believe this. The Chinese buyers are paying cash, and they make up quite a big percentage.

To me Chinese money is Johnny come lately dumb money portending that indeed top may ne near.

Then the point at issue is which properties are cash only Chinese and which are not. The OP touched on many areas of real estate, such as multi unit dwellings, different parts of SF, rents/terms, and so on.

Is cash only Chinese buyers a factor? I think it is. But, it isn’t the driving force. I think if you had all the research results in front of you, I think you would find credit drives the bulk of the transactions and is thus the engine of ever-higher values.

Regards,

Cooter

Remember the Japanese buying up the storm back in late 80’s including the Rockefeller Center right before the mother of all bear market burst in 1989 both RE and stock bubbles in Japan?

Yep – watch out folks when the Chinese johnny come lately buyers may be forced to liquidate their US holdings (more liquid than Chinese RE) as the Chinese RE and especially the stock market are tanking and in a jam or 2 when it comes to free cash flow. Leverage is great when price rises but a real bitch when it goes south.

The Chinese ‘investor’ may be about to get their collective wings clipped.

China, with the help of host countries including the USA are going after the ill gotten gains that have been taken out of mainland China.

We may be seeing a bunch of off shore owned properties going up for sale soon.

Blame proposition 13. Housing costs can be divided into the cost of buying (high for owners, zero for renters) and the cost of owning/using (lower for owners, higher for renters). When one goes up the other goes down. Since Prop 13 lowers the cost for owning, it raises the cost for buying. In order to cut property prices SF needs to raise property taxes, particularly those on commercial properties including rentals.

So you fix the problem of expensive housing by raising the taxes????

That still leaves you with expensive housing son.

Housing can go up as long as there are plenty of lemmings lining up to outbid each other per the greater fool theory. There is this thing called gravity, supplies do catch up and dearth of fools willing to pay up dries, and more importantly history points to housing bubble popping like it did in 2008.

As for Chinese – let them buy/lap it all up near market peak!

“the Chinese are buying” hm lets wait a bit and see if they’re still buying.?

Governments are responsible for this. No one else.

They – and their central banking arms – are and have been responsible for the massive counterfeiting of money and credit that we now see sloshing around the casino, desperate for yield…

Wolf, are those that bought a home a long while ago getting hammered by property taxes? What are the property taxes due on an 1,400 square foot modest home in the Pacific Heights area? I would assume that taxes have skyrocketed with home values.

Yep good for the liberal city ran about bleeding heart socialist who embraced illegal aliens criminals, spend money like there’s no tomorrow while the schools are in bad shape, homeless galore with stench everywhere as well as to SF city ran by idiots like Lee and his leftist board of supervisor goons.

And yet San francisco is the No. 1 favorite city of foreign visitors. I wonder why they didnt choose someplace sensible like Kansas City or Indianapolis? ^,..,^

Don’t think there are many modest 1400 sq foot homes in Pacific Heights. That said, anyone who bought early enough to have received that nice prop 13 gift of no reassessment has a cushy arrangement, a 1975 assessment raised by the same annual allowance the recent buyers face. Lower baseline so the gap widens. No skyrocketing taxes for them.

Downtown Miami is full of condos purchased with foreign investor money. Even in the middle of the week, at lunch, the streets are mostly empty. After 6p.m. it is dead. All this foreign investment has encouraged more building but it is not really revitalizing the city. All the restaurants that open to follow all the expensive apartments quickly close because there is no traffic. They are building more complexes with retail and residential, the money may flow into them, but there are no people. How many of SF housing investors are really there?

ZeroHedge covered this a while back. I believe the driver here is NAR lobbied (successfully) to exclude real estate transactions from money laundering/drug money/etc rules. Basically if you are buying RE, the bank doesn’t care where the money comes from … thus US RE is now a great blunt instrument to clean your ill gotten gains … plus commissions and fees of course. If they only get 50 cents or 60 cents on the dollar in the end, who cares – it’s clean money at that point and part of something is better than all of nothing!

Regards,

Cooter

The situation in SF is very different from Miami. SF is a landlocked 49 sq. mi city exploding with population desperate for housing. As of now, more than enough people willing and able to pay the nosebleed rents. Miami, not so much.

Sounds like China. They have built a lot of ghost cities with nothing but buildings

This happened back in the 1970’s too. Then it was the FIRE economy driving out blue collar workers from their homes in the ‘avenues’ the People’s Temple suicides in Guyana driving what remained of the black ghetto in the Fillmore out and the influx of Chinese taking over the Richmond as the ‘gays’ took over the Castro.

Over in Marin, the same thing happened as bankers and brokers took over Southern Marin. Sausalito and Mill Valley went first then even San Rafael and Novato got too expensive for local people to remain. Even if the parents left the house to the kids the $35,000 Eichler tract home of 1965 was now a million dollar property with equivalent property tax and if two or more children inherited it they could not afford to buy the other/s out and pay the new property tax basis so it got put on the market.

As mentioned above, that $35K Eichler can’t be reassessed unless sold. Remember reading a few years ago about then in office politico paying $500+ property taxes annually on his Bernal Heights place he had bought in ’74 for $50K. That’s what Prop. 13 provides for those who got in early. The most delicious irony will be if they finally split commercial property off and reassess it, given that the big guy behind 13, Jarvis, was a lobbyist for the L.A. Apartment Owners Association and the operations were headquartered in their offices.

The Bay Area housing marketing isn’t going to come crashing down, a small dip here and there, sure, but I see it continuing to go up. As people who can’t afford to live around here move out, people who can will move in. Soon, we’ll have a bunch of people with money living in the Bay paying $5,000/month for a studio apartment, where 1200 sq ft single family homes will go for over $1 million in south San Jose. Every city around here will be like Palo Alto, where only the rich can afford.

Homes in neighboring cities will also jump in value as people scatter away from the core of the Bay. Eventually, you go out far enough where you’re no longer part of the Bay and at that point, people will just move out of California or down south to LA/San Diego. No reason to stay here unless you’re in the Bay.

I see people renting out small rooms for over $1k a month. China stock market crash, the drought, none of those things will crash this housing market, other areas of the country, sure, but not the Bay Area.

The ONLY thing I can see causing the housing market to plummet is a major earthquake but according to studies, that’s not going to happen for a while.

So for those who have a home in the Bay and want to make some extra money, rent out a room or two, people are so desperate right now, you’d be surprised what some are willing to pay. Those who don’t have home, either prepare to keep paying rent or move away from this place.

At some point, it just becomes a really bad financial decision to stick around here. For many, that point has long passed.

When, not if tech(now primarily social media) along with all the private equity & stock valuations funding it collapses, there will be a housing bust in the Bay Area. SF alone lost 50K jobs in the last one. This next one will be even bigger.

Hmmm…

In other words – it’s different this time? Or did you drink too much of NAR Kool-Aid? Rent and price certainly dipped in ah not so recession proof “tech” industries back in 2008 and ugly time in 2000 to 2002.

Heck at least the tech stalwarts of 2000 were internet and hardware companies but we have this moronic share boondoggle start-ups galore by 20 somethings who have no clue on P&L (other than souped up pie in the sky “valuation”). Next up just might be Web 2.0 crash akin to March 2000 where folks back than though profit is for pussies or something till it wasn’t.

It’s different this time. The Fed’s gonna print so much money in the end, bacon will probably be at 50 bucks :). Imagine housing prices then.

You are describing a city that is just a bedroom community for the affluent. Such a city loses its culture, its history, its very soul, Such a city loses all the qualities that once made it special. It will ultimately die because it has no reason anymore to live.

We still have the weather though and that alone is pretty huge.

When mobile homes in Sunnyvale are selling for $300k and up with $1k+ monthly space rent it’s getting really frothy. That’s if you can find one that hat hasn’t been snapped up. Saw a new 3BR 3BA listed for $429K at Casa De Amigos Mobile Park 94089.

Briny Breezes Trailer Park in Florida was going for millions back in 2007 until it wasn’t.

That’s Malibu mobile home prices!!

Hmmm…

Always wondered how much those mobile homes goes for off the PCH…

It’s hard to find anything in Sunnyvale under $800k and yet people are still fighting to buy those homes. It’s only going to get more expensive.

The Chinese economy is as meth’d out as the U.S. and EU – probably more so since some of their big books are closed / state secret stuff. I could care less about the synthetic “wealth” of the morons in silicone valley – as long as they keep their digital pollution out of states that have people with real jobs. Trouble is they don’t – they get bored and want to splash their cash around and buy houses and property in WA / ID / etc overpaying and creating synthetic PPSF increases while those of us who truly live and work here suffer the effects.

Reminds me of my daughter stacking little blocks higher and higher, one on top of the other with no foundation, hoping to reach the ceiling. She’s so engrossed in it that she can’t see it starting to list after the fourth or fifth block and is surprised when it crashes down. That’s what this fake housing BS reminds me of…..

How much longer can the momentum of the collective madness keep pushing up and up? Who knows but I do believe there is an end to it – and a nasty one at that – and deservedly so.

middle-class people who grew up in San Francisco can NO longer afford to live in a city -author please correct

Thanks. Corrected. That “no” must have fallen through the cracks in my keyboard.