Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

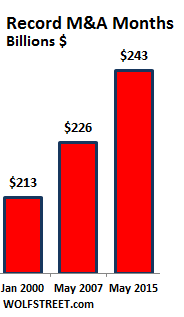

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results.

May included Charter’s $90-billion acquisition of Time Warner Cable and Bright House. Charter will issue around $30 billion in junk-rated debt to accomplish this, likely the second largest junk-debt deal ever, behind that of TXU in October 2007, which is now in bankruptcy [Junk-Debt Apocalypse Later].

May also includes Avago’s $37-billion acquisition of Broadcom, the largest tech deal since the dotcom bubble blew up.

This pressure to buy drives up prices and premiums. And the “synergies” needed to make these deals work even on paper will be harder and harder to come by. “Synergies” is corporate speak for cost-cutting, so mass layoffs, which will be announced with fanfare to push the shares higher. For these companies, it seems the only way to grow revenues is to acquire other companies, and the only way to grow profits is to cut costs. It’s not productive, hurts the economy, and mucks up the future of the company. But what the heck, it looks good on paper.

These deals are financed by a mix of shares, new debt, and cash raised with prior debt issuance – the “dry powder.” Much of this debt is in form of junk bonds and junk-rated leveraged loans, which banks then either sell to loan funds or craftily slice and dice and fabricate into highly-rated collateralized loan obligations (CLOs). Some of these CLOs are then put through the Wall Street sausage maker again to reemerge as tipple-A rated bonds denominated in yen for the Japanese market.

Loading up overleveraged junk-rated companies with more debt – even if it’s cheap – has consequences down the road: US default rates are creeping up, hitting 2% in May, the highest in 17 months, according to S&P Capital IQ’s LCD:

There were eight corporate defaults during the month, and all were public. Magnetation and Patriot Coal filed for bankruptcy; Colt Defense and Tunica-Biloxi Gaming Authority/Paragon Casino skipped bond coupons; Warren Resources and Midstates Petroleum inked sub-par bond exchanges; and SandRidge Energy and Halcon Resources completed bond-for-equity exchanges, also below par.

The report forecast a default rate of 2.5% by December 2015 and 2.8% by March 2016, assuming cheap debt continues to flow without limits. Once the money dries up, defaults will soar. Layoffs and defaults are the bitter aftertaste of M&A booms.

Downgrades are now hailing down on these companies. In May, Standard & Poor’s downgraded 41 issuers with total debt of $71 billion, but it only upgraded 18 issuers with total debt of about $43 billion – for a downgrade ratio by count of 2.28x, more than double the ratio of 1.0x in 2014 and 0.89 in 2013. It’s getting messier out there.

When our corporate heroes are not busy buying each other’s shares, they’re buying their own shares. In April, S&P 500 companies announced an all-time record of $133 billion in buybacks. It’s attracting the ire of the largest money managers in the world.

Blackrock Managing Director Rick Rieder wrote:

While some defend the buyback practice as a method of returning cash to shareholders, others, including my colleague Larry Fink, have argued that some companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future.

In my opinion, today’s boom is just one economic distortion created by the Federal Reserve’s excessively accommodative monetary policy.

The boom is, in essence, a response to today’s extraordinarily low interest rates….

Using debt to fund buybacks and dividends eventually crowds out long-term investment in the company’s core business and threatens its credit quality, which is, according to Rieder, “what we are seeing today.”

Oh, and we almost forgot, there are other consequences. Blackrock’s Rieder:

Indeed, the global economy is witnessing a massive redistribution of wealth and income with borrowers, equity shareholders, and short-term investors benefiting; and savers, bondholders and longer-term investors being placed at risk.

Monetary policy wins again.

Investment bank Natixis just pulled the rug out from under self-satisfied, complacent, monetary-policy-fattened markets. Read… Today’s ‘Liquidity Regime’ Is ‘Far More Dangerous for Investors’

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Always love your articles. This one is spot on as usual.

Mr Rieder has a major, major point that should be written in stone a put everywhere for everybody to see: “Companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future”.

Starting around 2000, patent filings started to grow an ever decreasing pace, even in countries traditionally associated with technical innovation such as Germany, Switzerland, Japan and Sweden. Most of these patents have largely concerned themselves with improving upon existing technology, not introducing breakthrough inventions.

At the time this decline was blamed on the lowest hanging fruits having already been picked, and in some sectors (like automotive) it may be true enough. But as the decrease in patent filings closely followed that in interest rates, it started to become clear financial engineering was becoming a more and more important activity even for traditional manufacturing juggernauts such as Caterpillar and Daimler-Benz.

Innovation is expensive business: Toyota’s engineers went through eighty different drivetrain solutions when designing the first Prius. GE has thousands of incredibly gifted people working on upgrading existing turbine technology and making sure it gets more and more fuel efficient and reliable. These skilled people, the software they use, the workshops were materials and engineering solutions are tested, the security to prevent industrial espionage… they cost major, major money. If money flows into financial engineering it means innovation has to slow down.

Just last week an European newspaper was decrying “Silicon Valley isn’t creating new jobs”, a bit of an exaggeration to say the present so called Social Media Revolution (which also includes fancy gimmicks such as self-driving cars) is adding very little if any value to worldwide economy, unless you happen to be a shareholder.

Facebook and Twitter may have changed many people’s lives, but they have hardly had the same effect on worldwide economy as CAD and CAM or even CAN-bus, just to stay in the same line of business. Yes, it’s nice to keep in touch with people, but do these new technologies make workers and processes more efficient? The answer is no. In short they are what in TPS language would be called muda, waste.

Apart from monetary policies and macro’s manipulation, what is keeping wages at 90’s levels in real terms is the fact worker efficiency is increasing at an anemic pace. The less efficient the worker, the lower his wage.

Some finished goods may be cheaper, even when adjusted for inflation, but that’s just thanks to China and her merchantilist policies.

How many more decades will we waste this way?

“Companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future”.

Sorry, but shareholder value is WHY people invest. They want money for their money.

The whole world is resorting to borrowing tapping into the debt liquidity firehose (soon to be traps). Corp especially in US under margin squeeze due to strong USD using cheap money for M&A (fire people afterwards) and stock buybacks, CBs and sovereign to local governments to finance its deficits unable control cost or raise taxes, individuals gorging on cheap mortgages/auto/student/credit card debts, etc.

That said debt is either paid off or defaulted and I suspect many of the governments and individuals may default. BTW each tax payer in US owes $154k if you divide astronomical 18 trillion in national debt by tax payers.

http://www.forbes.com/sites/mikepatton/2015/04/24/national-debt-tops-18-trillion-guess-how-much-you-owe/

Please be sure to thank the federal reserve.

Having spent 20 years in Greater China (some in Taiwan, which BTW is MUCH better) I don’t need Muddy Waters or Hugh Hendry to tell me never to trust at face value anything you are told, see, are sold or buy there. It’s the culture. Even my wife, who is ethnic Chinese herself, distrusts Chinese products and avoids them religiously in favour of Japanese, European or even American.

Never trust Chinese government statistics.

Never trust Chinese corporate statistics. (SinoForest, anyone?)

Never trust in the Chinese “rule of law”.

Trust, but verify beforehand your business dealings.

Assume that ‘family’ comes before ‘stranger’. Always.

Politeness is…well, POLITE. It is sincere AND for show.

Nah, all of this is progressing as expected. Eventually all companies will be merged into a single company called The Market (ticker: MFED). The FED can then simply buy the entire ticker acting as Private Equity with a 100% markup over closing price.

I seriously think there will be no crashes this time. There will be THE CRASH, just a single one that will wipe out everyone that’s not on the inside.

“some companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future.”

Should probably be “most companies today are focusing on maximizing short-term executive incomes, at the expense of shareholders.”

You all covered the points succinctly. Stay on ’em, Wolf! Thanks to Kreditenstalt for the inside snapshot of China.