Inflation has not been a problem recently, according to the Consumer Price Index. Energy prices have plunged, which helped, and the rising costs of housing, which account for over one-third of the index, are purposefully mitigated via some elegant statistical twists, and that helped a lot.

Everyone has been lulled to sleep by the sheer absence of consumer price inflation. And the Fed has used this low inflation as pretext to keep its foot all the way on the accelerator of total interest-rate repression, though it isn’t accelerating much of anything other than asset price inflation.

But that was then, and this is now.

The headline CPI still looks benign, inching up 0.1% in April on a seasonally adjusted basis, the Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index declined 0.2% before seasonal adjustment, thanks to the energy index, which plunged 19.4%.

But the core CPI (less food and energy) rose 0.3% in April, its largest increase since January 2013. Some of the standouts:

Shelter +0.3%; rent, owners’ equivalent rent, and lodging away from home +0.3%; medical care +0.7%, its largest increase since January 2007; medical care services +0.9%, hospital services +1.9%; household furnishings and operations +0.5%, its largest increase since September 2008; used cars and trucks +0.6%; new vehicles +0.1 percent.

Heat is building up beneath the overall index.

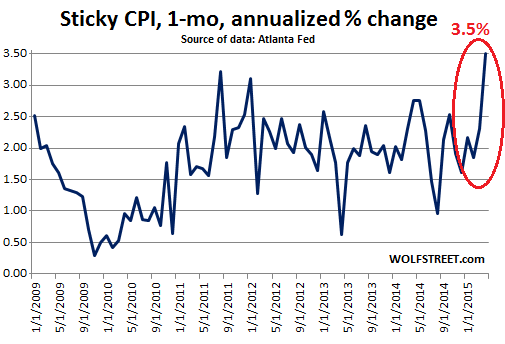

To shed more light on this phenomenon, the Atlanta Fed releases a “sticky-price consumer price index,” the “Sticky CPI,” which consists of a weighted basket of items that change price relatively slowly. And in April, annualized, it soared 3.50%, the sharpest increase since July 2008! “Core Sticky CPI ex-shelter” soared 3.83%, the highest since August 2008.

This puts the Sticky CPI at 2.1% above where it was a year ago, even though the overall headline CPI, thanks to the plunge in energy, actually declined over the same period. The Sticky CPI is not supposed to jump like this; it consists of items that change price “relatively slowly,” as the Atlanta Fed describes it. Now they’re in lift-off mode.

This chart, going back to January 2009 shows the sudden spike of inflation, as expressed by the Sticky CPI:

Fed Chair Janet Yellen said today that “it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy.” To support this sort of revolutionary activity, she would have to be “reasonably confident that inflation” – for her, that’s the PCE index – “will move back to 2% over the medium term.”

Energy is not going to decline much further from where it was in April. Other prices are rising and some are soaring. What gives?

This puts the Fed way behind the curve – as many experts have long predicted. So here is former Fed Governor Lawrence Lindsey, who was right before in a big way and got fired for it. He said that the Fed has “almost no credibility” with his clients about “staying on top of ticking monetary bomb.” Read… Former Fed Governor Predicts “Wrenching” Market Adjustment

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yellen just got her excuse for a June hike, and I wouldn’t be shocked if she began with a .5% hike. This will be the “oops, we accidentally crashed the markets” move. Not unlike the “oops, we should’ve bailed out Lehman” moment.

The FED ALWAYS crashes markets.

I am sure all the Fed’s asking is : “Has ZeroHedge folded yet?” If yes, raise rates, otherwise life goes on.

I think us lay folks often overlook this aspect which drives the power elite crazy. They own the media and traditionally their playbook relies on media narratives that help support their agenda. If we removed the internet from the picture, they would feel a lot more comfortable.

But today, everyone that is interested in knowing knows. So, the emperor is naked, folks figured it out, and now they aren’t sure what to do.

Who owns all the stocks? Do you *really* think its the joe six pack investor that lost his/her ass in 99/00 and 07/08? If they are still in after all that, they deserve what they get. The whole system is rigged and gamed. There was no productive use for all that cash the Fed shoved in the market, so those close to the teat just loaded up on stocks. And the retail bag holder isn’t around anymore. Market volume is a fraction of what it used to be – because retail left.

The sharks are about to run out of retail fish food and start throwing down on each other.

With all these annoying blogs folks can bypass the media all together and get straight up, professionally summarized information on how things really are. And then they can make more informed decisions. Because of this, I am deleveraging 100% and will stay that way for life. I suspect in 2 years I will be 100% debt free. Me and the wife drive old cars. We live a simple and enjoy life much, much more.

While this isn’t everyone, I am certain I am not alone.

Regards,

Cooter

Yes, that will be the interim strategy til they can mobilize the FCC to shut us all up.

All BLS BS. In 1966, I was a poor FSU student and would buy 3 dozen eggs for $1, boil them and put some in my pockets for lunch; today they are $3 per dozen: that is an average of 18%/yr. In 1971, gas was $.30/gal and now about $3.50 or about 25%/yr. I returned from an overseas tour of duty in 1976 and bought a new car for $3500 and a house for $10,000; a new car today is about $20,000 and a house about $100,000 or about 12%/yr for a car and 23%/yr for a house. When I left the USAF in 1983, I bought 35 acres of woods with a pond and creek for $800/acre. Today that same land is $3500/acre or up 14%/yr. Then there is the income “crash” that would make life expensive even if inflation was 2% per year. I paid off my college loan in a couple years; try that now.

Want some icing for your cake?

Everything you cite is true, but also hold in your mind the vast advances in technology, manufacturing, automation, and so forth that SHOULD have made everything cheaper (i.e. deflation) – not more expensive (i.e. inflation).

If it used to take 100 men to work a farm and the owner gets a tractor and does it with 10, the cost structure of production is CHEAPER and food is thus CHEAPER. The 90 displaced workers have to find new work, but food is more affordable. So now families have more discretionary income to spend on new products/services that will create opportunity for the recently displaced workers.

But that isn’t what is happening is it?

Not only has inflation eaten the working class alive, all the deflationary gains of technology advancements along the way have been pocketed by someone. Real wages of workers are in the shitter and getting flushed.

Regards,

Cooter

@CrazyCooter

“…the vast advances in technology, manufacturing, automation, and so forth that SHOULD have made everything cheaper”.

DING! Cooter wins the grand prize here with this one simply fact — a fact which is utterly overlooked by most folks — with robert h siddell getting an honorable mention for his right-to-the-point phrase, “All BLS data is B.S.

I’ll wager that not one person in fifty understands this basic understanding of economics. Over long periods of time, it is a natural trend for the overall inflation rate to constantly decline in a free country as a result of increases in knowledge & production efficiencies. Simple, yes? For a more detailed analysis see the following:

http://www.theburningplatform.com/2015/02/27/inflation-economics-in-one-easy-lession-or-how-i-learned-to-stop-worrying-and-loathe-the-fed/#more-93292

http://www.caseyresearch.com/cdd/that-couldnt-possibly-be-true-the-startling-truth-about-the-us-dollar

The details of this consumer inflation closely follow the bubbles in the stock and real estate markets. “Shelter +0.3%” and “household furnishings and operations +0.5%” are functions of the housing bubble. “Medical care +0.7% . . .; medical care services +0.9%, hospital services +1.9%;” are functions of the health care bubble including huge increases in the prices of drugs by big pharma.

“Used cars and trucks +0.6%” but “new vehicles +0.1 percent”, is more accurately a measure not of inflation but rather the impact that austerity has produced. When vehicles need to be replaced most people are selecting the cheapest option because the forced price increases in health care and housing make only the barest other essentials affordable.

I believe the Fed knows this to be a fact. The government needs to deflate the asset bubbles before they result in much further harm to the economy.

If the Fed raises interest rates some bubbles will deflate and the markets will quickly fall through October. However, this will be transitory. By November this Fed move should be over for fear of causing a new recession.

Nonetheless, this Fed action and market reaction will not have an impact on the health care bubble. That bubble is protected and its growth nurtured by Congress and the White House. This growth is invidious because it is cannibalizing the rest of us. By virtue of US laws we are precluded from taking any meaningful measures to avoid the inexorable increases in US health care costs. It doesn’t take much to realize that at a minimum 10% annual growth rate, health care’s share of the economy will increase well beyond its current 18% share.

I’m about 8 years behind you Robert but I remember those college salad days well haunting the Milo Bail Student Center and being so broke I made a tea bag last for 4 cups of tea. It never crossed my mind even then to mooch. Now I have to kick my way thru them at the truck stops. Reminds me of Robert Stack fighting his way through the Moonies in “Airplane”!