When the Reserve Bank of Australia cut its cash rate target to a record low of 2.0% this week, it specifically blamed the slowdown in China. It is the key market for Australia’s most important exports, such as iron ore, whose price has plunged due to slowing demand in China, dragged down by a number of factors, including weak exports of manufactured goods to slowing economies around the globe.

Trade moves in wobbly circles.

So today, China’s General Administration of Customs announced that imports had plunged 16.2% in April from a year ago, after they’d already plunged 12.7% in March (hence the fretting by the Reserve Bank of Australia). And exports dropped 6.4% from a year ago, after they’d plummeted 14.6% in March.

Analysts, who apparently never look at the collapsing shipping rates from China to certain parts of the world, had inexplicably expected exports to rise 2.4%. So the drop was “unexpected.”

The morose economic climate was unexpected apparently even at the very top in China: Reuters was told by “policy insiders” that China’s leaders were “caught off guard by the sharpness of the downturn.”

That hasn’t kept the Chinese stock market from soaring 75% over the past six months, despite the 5% swoon this week, the worst weekly loss in five years.

And so rumors of more stimulus of one kind or another have been circulating. Stimulating demand by creating more credit and building more high-speed rail lines and subway systems and allowing local governments to borrow more to build even more overcapacity is one thing. But stimulating demand in other countries is quite another. And that’s one of the sources of the China slowdown.

Exports to the US inched up 3.1% in April from a year ago, not exactly a dizzying pace. But exports to the EU plunged 10.4%.

The collapse of containerized freight rates from China to Europe have reflected that kind of drop in exports for two months, and I have been hammering on it [most recently a week ago]. And freight data released today are even worse.

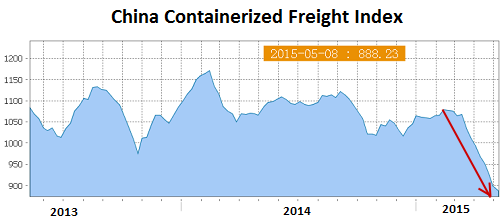

The China Containerized Freight Index (CCFI), operated by Shanghai Shipping Exchange and sponsored by the Chinese Ministry of Communications, tracks spot and contractual freight rates from Chinese container ports for 11 shipping routes across the globe, based on data from 16 global carriers. According to the SSE, it’s considered “the second world freight index” after the Baltic Dry Index.

And it skidded again. The index for the week just ended dropped another 11 points, or 1.2%, from the prior week to a new multi-year low of 888. It’s down 17% since mid-February. This is what the 2-month plunge looks like:

How ugly is this? The index was set at 1,000 on January 1, 1998. Today, the index is 11% below where it was 17 years ago, a journey it accomplished in two months!

Trade is a circular machine. Manufacturing and export economies, like China, import commodities and export manufactured goods. The plunge in imports is an all-around terrible reflection of demand in China, despite the still relatively glorious and most likely illusory 7% GDP growth bandied about by the government.

But the slowdown in exports is a sign of slowing demand in other parts of the world, particularly in Europe, where the purposeful devaluation of the euro is sinking in. Tough times ahead, not only for China.

As if a toggle switch had been flipped late last year, Americans suddenly gained confidence in the economy, to levels not seen since before the Financial Crisis. But now, it’s all unraveling. And the culprits are being lined up. Read… Confidence in the US Economy Plunges

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Something “wicked” this way comes, the question will be is it “transitory”

How can China prosper when its customers are flat broke? (A: it cannot. So much for leading the global economy, it’s all a big lie.)

Why are China’s customers broke? (A: they have borrowed too much to buy goods with zero- or negative utility. After the shortest time, the customers have nothing remaining of their purchases but the unpaid — and unpayable — debts.)

Why can’t the customers simply borrow more? (A: customers are at the end of the borrowing line. At the head of the line is finance which borrows/lends from/to itself, using the loans to goose asset prices. Customers are starved of funds. Lending to stiffs on the bottom of the food chain appears to do nothing for finance … even as the lowly customers are needed to retire finance’ bloated debts.)

What happens when the customers stop borrowing? (A: China’s banks have fewer dollars and euros => less collateral for their own lending. Hard currency within China makes a U-turn as the process of less lending, less insolvent customers feeds on itself.)

Can’t the central banks just make up the difference? (A: central banks are collateral-constrained and cannot ‘create’ new money. They can only lend against loans already made by commercial banks. If central banks make unsecured loans they are instantly insolvent, just like their commercial bank clients and for the same exact reason. No solvent central bank => no effective lender of last resort => bank runs. See, ‘Argentina’.)

What happens next? (A; more tumult and ‘volatility’ as the physical economy unravels due to shortages of affordable fuel and other capital while finance is stuck with the ultimate repudiation of its monstrous debts.)

One must ask why what is obvious to the majority of people, is an impenetrable mystery to the ‘experts’ and ‘leaders’?

Basically, it comes to this. Economists are experts at telling businessmen and politicians what they want to hear. The businessmen and politicians show their gratitude by giving the economists jobs, consulting fees, and speaking engagements with preposterous emoluments. It follows that it’s hard for experts to see things as problems when they are among the beneficiaries of those problems. To be candid, if you practiced economics in a Post Office, they would run you in for loitering.

Calling politicians leaders is in itself mildly funny. The politicians develop temporary blindness and a tin ear after being bombarded by campaign contributions from the same businessmen who employ the economists. Never forget, people do not go into politics to do good, they go into politics to do well. Simple really

China would be well-advised to end their trade surplus and concentrate on building up domestic demand. How much foreign currency reserve to they need? What’s the point of stacking up bills in a vault (or actually magnetic domains on a computer disk) if you aren’t ever going to spend them? I think $3 trillion or whatever it is these days, will be plenty for any conceivable ‘shock’.

China would be well-advised to end their trade surplus and concentrate on building up domestic demand. How much in the way of foreign currency reserves do they need? What’s the point of stacking up bills in a vault (or actually magnetic domains on a computer disk) if you aren’t ever going to spend them? I think $3 trillion or whatever it is these days, will be plenty for any conceivable ‘shock’. Time to go in reverse and raise the living standards of their people.

“Only Nixon can go to China.”

-Old Vulcan Proverb

No Nixon to go. Only fellow-travelers.

Bummer