By Mark Hansen, Australia, MarketCap:

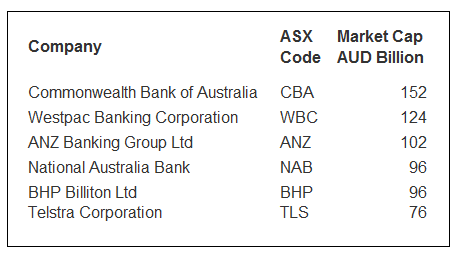

There are six large (with a market cap of over AUD50 billion) listed companies in Australia. The biggest four are banks, the fifth is BHP, one of the world’s largest mining companies. The sixth is the world’s most over-priced Telco, Telstra. The table below puts these companies into international perspective. They are small on a world scale, but behemoths in their domestic market.

The financial sector amounts to 44% of Australian stock market capitalization. The vast majority of the sector is comprised of banks and “diversified” banks. The remainder is insurance and real estate.

Before going further we need to understand just how small Australia is. In terms of population, Australia is the same size as Shanghai and slightly larger than Beijing; about the same as NY State; and three times larger than London. In terms of GDP Australia comes in at number twelve (IMF 2013). Australia’s GDP was USD1.5T, compared with the US at 16.7T and China at 9.5T.

Moving on.

The dominance of the financial sector is astounding. I doubt it is replicated in any other developed economy. The Australian stock market is capitalized at around AUD1.5 trillion (about twice AAPL). Almost half is represented by the financial sector. Worse, within the financial sector, the big four banks represent around 30% of total stock market capitalization.

These four banks dominate the market and yet their primary business is consumer loans and residential mortgages. Australia’s residential real estate market is already one of the top three most overvalued in the world, competing with Canada and Norway on several metrics.

Australian export income has collapsed, as has manufacturing. And imports are much more expensive, due to the decline of the Australian dollar. But our Reserve Bank takes comfort in the strength of our residential construction sector. So our economy is going to consist of building houses and apartments for which we will pay ever higher prices?

Since October 2014, the CBA share price has increased 28%, from AUD74 to AUD95. The other three big banks show the same steep price increase. These increases reflect the assumption that Australians will continue to borrow evermore for overpriced real estate. The recent, steep stock price increase was a result of buy recommendations from various financial organizations, based upon yield rather than future earnings potential.

And Australian business confidence is low. Very low. In fact, the CEO of the Commonwealth Bank warned last month that this is a “significant economic threat.”

With all this as a backdrop, the truly productive parts of the economy (Materials, Energy, Health Care, Industrials, IT and Utilities) are proportionately small, and shrinking. Not helped by Australia’s appallingly low productivity.

The Australian stock market is exposed to both internal and external shocks. Downside risk is considerable. I am reminded of Donald Horne’s 1964 book about Australia; “The Lucky Country”. He used the word “Lucky” satirically. Here’s a quote:

Australia is a lucky country run mainly by second rate people who share its luck. It lives on other people’s ideas, and, although its ordinary people are adaptable, most of its leaders (in all fields) so lack curiosity about the events that surround them that they are often taken by surprise.

The proof: The Australian government ran deficits through most of the resource boom. And now that the resource boom has collapsed, what’s next? We already know the answer: even higher deficits. By Mark Hansen, MarketCap

In the US, corporations are currently steeped in strong-dollar bashing. And it seems they need to. Read… Top Corporate Excuses for the Current Earnings Debacle, And What Gets Silenced to Death

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The government of Oz (last one and this one) does all it can to stoke the flames of the Real Estate maelstrom higher and higher. Highest immigration in the OECD (for which the infrastructure bill will come due), tax breaks for property investors (negative gearing to spur interest-only speculation), cash giveaways to first home buyers (which only pushed up sale prices by the same amount) and now allowing people to use their superannuation (like a 401k) to dump into property. Joe Hockey, the finance minister says he sees no bubble.. while owning quite a few investment properties himself.

But the level of willful ignorance of speculators on Oz property forums is astounding. The yield on properties from rent now is about 3%. That’s before rates, repairs, vacancies and agency fees. No matter how high the notional value of a property climbs, you can’t squeeze more rent from people who can’t pay. But they believe it climb higher, higher, higher. It’s only Chinese buyers left now goosing the weekly auctions. People who know the cost of everything but the value of nothing. Naturally Joe is turning a blind eye to flagrant breaches in the foreign investment regulation. Anything to push it another inch higher. Madness.

Very insightful article on Australia. Had heard about dislocations but now clearer.

I presume things will muddle along until they can’t down there. Probably another QE in the offing. When the banks near failing, the government steps in and rescues them with new electronic money to make their balance sheets look good again.

Switzerland’s financial sector relative to total economy may bigger than Oz’s

One wonders what the situation would be if Australia had heavily restricted industrial commodity exports and built domestic manufacturing capacity to use them, instead of strip-mining their resources to feed the Chinese manufacturing base.

I suppose that Commonwealth colony mindset dies hard.

Just moved to Auckland New Zealand from Denver CO and can say Auckland is in the midst of its own massive property bubble with the the same players as our friends across the ditch. I’m going to rent for the next year and see how things shake out this fall, (spring down under) no summer for me this year….

Chinese capital flight is oozing out across the globe. Not sure how this going to end, but I can tell you that I am not a fan of Chinese food.

The orgy of self-sacrifice has only just begun. Just read an article on FSN about a 22 year old killing himself on the Capitol grounds with a note reading “tax the 1%”. He obviously thought this necessary to get the message across. Little did he know he was pissing into a hurricane. Given the nature of what passes for education these days, one can forgive his naive assumption that this would make a whit of difference to the Powers That Be, in the same breath being saddened by the loss of life and unrealized potential. Diesel, who invented the engine that bears his name, commuted suicide by jumping into the English Channel after reading Schopenhauer. The philosophies that are destroying the world always result in mass death. Sometimes they can simply talk a person to death.