No one is backing off.

It was a breath-taking one-week rally for crude oil. West Texas Intermediate soared nearly 15%, from just above $47 a barrel on April 1 to over $54 a barrel yesterday at noon. It settled at $53.98 in the open-outcry session, the highest since December 30. End of the oil bust?

Part of the enthusiasm was based on the EIA’s Short-Term Energy Outlook yesterday, which shaved projections for US production fractionally from its outlook a month ago, to an average of 9.2 million barrels per day in 2015 and to 9.3 million bbl/d in 2016. Yet even the lowered outlook still adds up to production increasing by 5.7% and 6.9% respectively over average production in 2014. So, not exactly a decline in production, just slower growth. But it was enough to goose the markets.

It all unraveled unceremoniously when Saudi oil minister Ali al-Naimi, at a conference in Riyadh, carefully opened his mouth in front of reporters. And his words were underscored by two terrible crude-oil storage reports yesterday and today in the US. As I’m writing this, WTI has been beaten down 6.3% from its peak yesterday to $50.60 a barrel.

It was a purposeful maneuver. Saudi Arabia, he said, had produced a record 10.3 million bbl/d in March. It beat the prior record in the recent data series of 10.2 million bbl/d set in August 2013. He left it up to the imagination of the raptly listening world as to why Saudi Arabia was increasing production during these trying times, when everyone had hoped for the opposite.

Production wouldn’t drop any time soon, nor would OPEC cut production without cooperation from non-OPEC producers, al-Naimi said.

So Saudi Arabia is pumping at record levels. US production has been soaring. And Russia too has ramped up production and is now nearing the record set in 1972 during the Soviet Union. Those are the three largest oil producers in the world. And they’re not backing off. On the contrary.

The only thing missing is rising demand.

Al-Naimi laid out the strategy on how to “restore the supply-demand balance and reach price stability. This requires the cooperation of non-OPEC major producers, just as it did in the 1998-99 crisis,” he said.

A supply glut will eventually get the market to that point by repressing the price and forcing out weaker, over-indebted, cash-flow challenged producers, particularly the scrappy, junk-debt-funded players that have been the drivers in the US shale revolution. Fracking depends on prodigious quantities of new money, and when this new money dries up, production might go down. That’s the calculus. Then… “Prices will improve in the near future,” al-Naimi said.

The Saudi data came on top of fears that Iran, following the nuclear deal with the US & Co., would dump the oil it has in storage on the already oversupplied world markets, and that it would ramp up its own production though that might take a while in the current climate.

There have been speculations that production is already dropping in the US, and a number of estimates and data points have been cited to support this notion. But then came the US crude oil inventory reports.

Late Tuesday, the American Petroleum Institute added to the supply-glut fears by reporting that crude-oil stocks jumped by 12.2 million barrels last week, while analysts had expected a rise of only 3.4 million barrels.

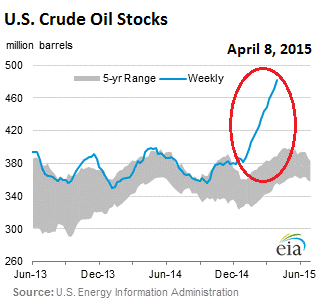

Today, the EIA confirmed the scenario when it reported that crude oil inventories during the latest week jumped by 10.9 million barrels to 482.4 million barrels. To put this into perspective: US production is about 9.3 million barrels per day; in just seven days, US crude oil stocks gained by over a day’s worth of production! Total stocks are now at the highest level in the data series going back 82 years. And they’re up over 25% from where they were a year ago. Driving season better start soon:

This horrendous growth in crude oil inventories is defying any theories that US production is already declining, and that these scrappy US frackers would somehow willingly and easily give in to pressures exerted on them by producers in Saudi Arabia and Russia. None of these three horsemen of the global oil glut are about to give in to the other two. They’ll keep producing until the money runs out.

Layoffs and the collapse of oil exact their pound of flesh in Canada. Read… Calgary Housing & Office Markets Crushed, Alberta Sinks, Vacancies Spread Across Canada, but Vancouver…

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Everybody assumes this will end peacefully with OPEC cutting or a gradual decline in shale production. Assumptions are dangerous when people’s livelihoods are at stake, especially when the assumption is that they will just roll over and die.

OPEC will let us know early(think they just did)that there will be no cut in June’s meeting.

Venezuela now has China supporting it, and Nigeria has quieted down of late as well. Seems that behind the scenes all non-north American oil producers have been given help, since they seem content to let this bust occur.

The US is being isolated, by the AIIB and it’s oil industry, which cannot export, though everyone else can. How convenient. There will be no storage problems, since you can build all the storage you need, but US shale will simply die a slow, agonizing death.

They wonder why demand isn’t soaring. The rich and powerful will never understand. I was at the grocery store today. Beef has doubled in price in just a few years. Rents are higher. Most consumers are living paycheck to paycheck. The money saved on gas goes toward food and paying down debt or actually saving if you can. Our household income is 150k. We get taxed hard. No Cayman Island accounts. Very little “investment” income to be taxed at much lower rates. Habits have changed as well. Gasoline could go to $1.50 a gallon and it won’t change consumption by those left behind in this economic “recovery”. I feel for the average oil field workers. They’ll never find jobs with comparable pay.

The Oil producers are cutting the prices to the bone,..according to reports!

While this is happening the price at the pump gets higher every time I fill up!

Seems like the oil producers are no longer f****ing us,….but the local wholesalers & distributors are taking their turn at bat with the public.

Us poor peasants can’t get a break!

Good comment, Mick.

I can hear the gears seizing up as I read your post. Pundits are still talking about ‘Saudi America’. Shale is flopping around like a beached dolphin. Finis.

I suspect the Saudi committed two crucial mistakes.

The first was assuming they are in control. They aren’t: oil prices are driven by a massive (and increasing) glut in supply and sagging consumption worldwide. Proof is all desperate attempts to prop up crude price in the last four months ended quickly and in tears. This isn’t a short term bust like we had in 2008-2009, when prices dropped from $148/barrel to $30/barrel for a brief time and then started soaring again. Oil at $50/barrel is the new normal. If Iran starts seriously opening the taps, the new normal could be $45 or even $40/barrel. Market dynamics are trumping even robot-traders armed with unlimited funds.

The second was underestimating the close ties between the US and Canadian shale/fracking industry and Wall Street. The Saudi expected a wave of bankruptcies which would have crippled the US oil industry in a relatively short time.

Yes, bankruptcies are increasing and layoffs have started but it isn’t the bloodbath the Saudi (and, I suspect, Big Oil) expected. Shale and fracking outfits are quietly dropping dead one by one by the side of the road, not falling like flies all over the place. The cost of servicing their debts has increased and their cash flow has been severely restricted. But servicing their debt is still cheap, considering the completely broken fundamentals: Wall Street and retail investors are so desperate for yield, any yield, they scoop up everything struggling oil companies put up for sale, thus bidding yields down. The Federal Reserve, which could initiate the bloodbath by increasing interest rates (which would make junk bonds far less palatable and hence force yields up in the realm of “impossible to service”), remains as cryptic as usual. We may have interest rates in May or June. No we’ll have them in the Fall. No, we’ll put them on hold indefinitely. Maybe we’ll have QE4 after all… Attempting to divine the Fed’s intentions is similar to trying reading the future in a sheep’s innards.

We shouldn’t underestimate to subversive elements against Saudi Arabia. Yemen is no happenstance. Russia, Iran, (probably even the US) would love to see an attack on a major Saudi oil facility that slows their output and spikes prices.

We are into an era that combines military (usually limited and mainly stealth) and economic forces.

For all we know, perhaps the US will let the Yemen conflict increase and actually threaten Saudi Arabia before stepping in. Maybe to make a point.

Last I read Canada’s production is slowing. It was announced last week that US production dropped. Saudi Arabia has shown no ability to produce much more than they’re producing. Russia is a question mark. Give it several months, and we may hear the term Peak Oil much more than glut.

Colin, wanna bet? Every market is manipulated, especially one as critical as oil. $50 oil is no accident, it’s being done purposefully and will not end until the objective is achieved.

Heck, the Saudis have outright told the world they’re doing this to clear out the marginal producers, so don’t hold your breath for higher oil, it ain’t coming. At least not until US shale, and Canadian tarsands are decimated.

The excess of supply over demand seems to be seriously underestimated.

Natural gas in storage was just reported to have increased by 15 billion cubic feet for the week ending April 3, 2015. This week included some of the coldest days the eastern US has experienced this winter. The 5 year average for the week ending April 3, 2015 is a draw of 10.5 billion cubic feet (-10.5 bcf).

If you wander over to the IEA, according to them the world was oversupplied by 1M BBL/Day (approximately) for most of 2014 with that closing somewhat in Q4. If no one is cutting back production, and demand continues to fall, inventories will continue to build.

There is a great deal of talk about OPEC, but most folks do not realize that as an organization they are modelled after the Texas Railroad Commission, which is the state agency that regulates oil. The RRC was set up to deal with a supply glut when the big East Texas oil fields hit almost 100 years ago.

Controlling the price is oil is a well traveled road. The real problems is that all the major producers need the cash flow. SA won’t cut because they know everyone else will NOT. So, it will be a game of max pain for a while until the heat gets so bad enough parties come to the table with a collective production portfolio big enough to push around global prices. Or, as the case may be, producers go offline as they sink in to BK. US frack oil is ~3M BBL/Day IIRC and that may have to come down 50% or more over the next couple of years (I don’t think it will collapse that quickly) to bring things back in balance – and that assumes demand doesn’t tank further.

And should a financial crisis hits which blows out actual businesses that use crude, well, demand may accelerate away from supply.

I think DEMAND is the real thing to watch because production isn’t going anywhere anytime soon (unless there is major a MENA war).

Regards,

Cooter