By Ted Ballantine, Pension360:

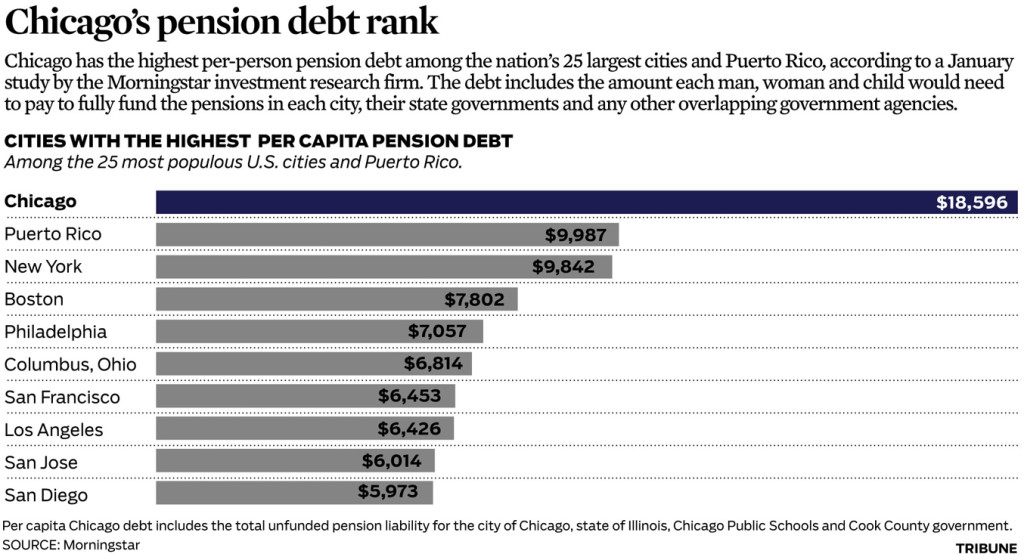

Among the country’s largest cities, Chicago’s per-capita pension debt is unmatched — in a bad way. Check out the chart below to see just how much pension debt each person in Chicago is shouldering compared to other large cities.

Here’s how Chicago’s unfunded liabilities broke down by system as of 2012, according to the city’s website:

– Municipal Employees’ Annuity & Benefit Fund of Chicago (MEABF): $8.2 billion

– Laborers’ & Retirement Board Employees’ Annuity & Benefit Fund (LABF): $0.9 billion

– Policemen’s Annuity & Benefit Fund (PABF): $7.0 billion

– Firemen’s Annuity & Benefit Fund (FABF): $3.1 billion

– Chicago Teachers Pension Fund (CTPF): $7.1 billion

– Park Employees Annuity and Benefit Fund (PEABF): $0.4 billion

By Ted Ballantine, Pension360

A few states consistently pop up as having the most pension debt. Hawaii isn’t always on that list. But it should be. Read… Hawaii: Fiscal “Sinkhole State”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

here is something else to add to this Wolf. A article I cam across on ood ole twitter today On IL policies regarding pensions. They added a whopping 111 Billion in unfunded liabilities at the State level alone and now stand at 37 cents on the dollar in unfunded liabilities. In order to solve this they would have to shut the entire State Government down for 3 years. No Medicaid. No Welfare. NO Police. No Libraries ,Highway funding . NOTHING!

In IL, everyone was complicit in this crime.

The unions had to be illiterate and innumerate to believe the promises were deliverable. The cities, state and school district administrators had to know they were promising what amounted to deferred compensation they’d never deliver, and the employees had to figure that as long as they retired early enough to cash in, who cared about those who came later.

My wife is an IL teacher. She pays 9.4% of her “income” to the Teacher Retirement System. Technically, it’s a 403(b) plan, AKA a tax-deferred annuity.

I count it much like my “contributions” to Social Security and Medicare; it’s a tax paid out and consumed by others today, and the promise of conning future employees out of THEIR money is hollow. I don’t want their money and what my wife and I paid out will never be seen again. We were robbed, but unlike most people, we know we were robbed. All government pension systems end up being just like the “entitlement” programs; money is paid in and squandered by the politicians in their zeal to buy their next election. Anyone with a brain knows not to count all these promises into their calculations of paying bills when they are too old to work. If people actually had a clue what’s coming, the savings rate would be north of 30%.

Eventually, like all criminal conspiracies this one will pit old thieves against new thieves and it will be one huge back-stabbing party. There is no honor among thieves.