Contrarian indicator: Gold sentiment at historic low

By Dan Popescu, Gold & Silver Analyst, Member of the Goldbroker.com Editorial Team. This article was originally published at Goldbroker.com

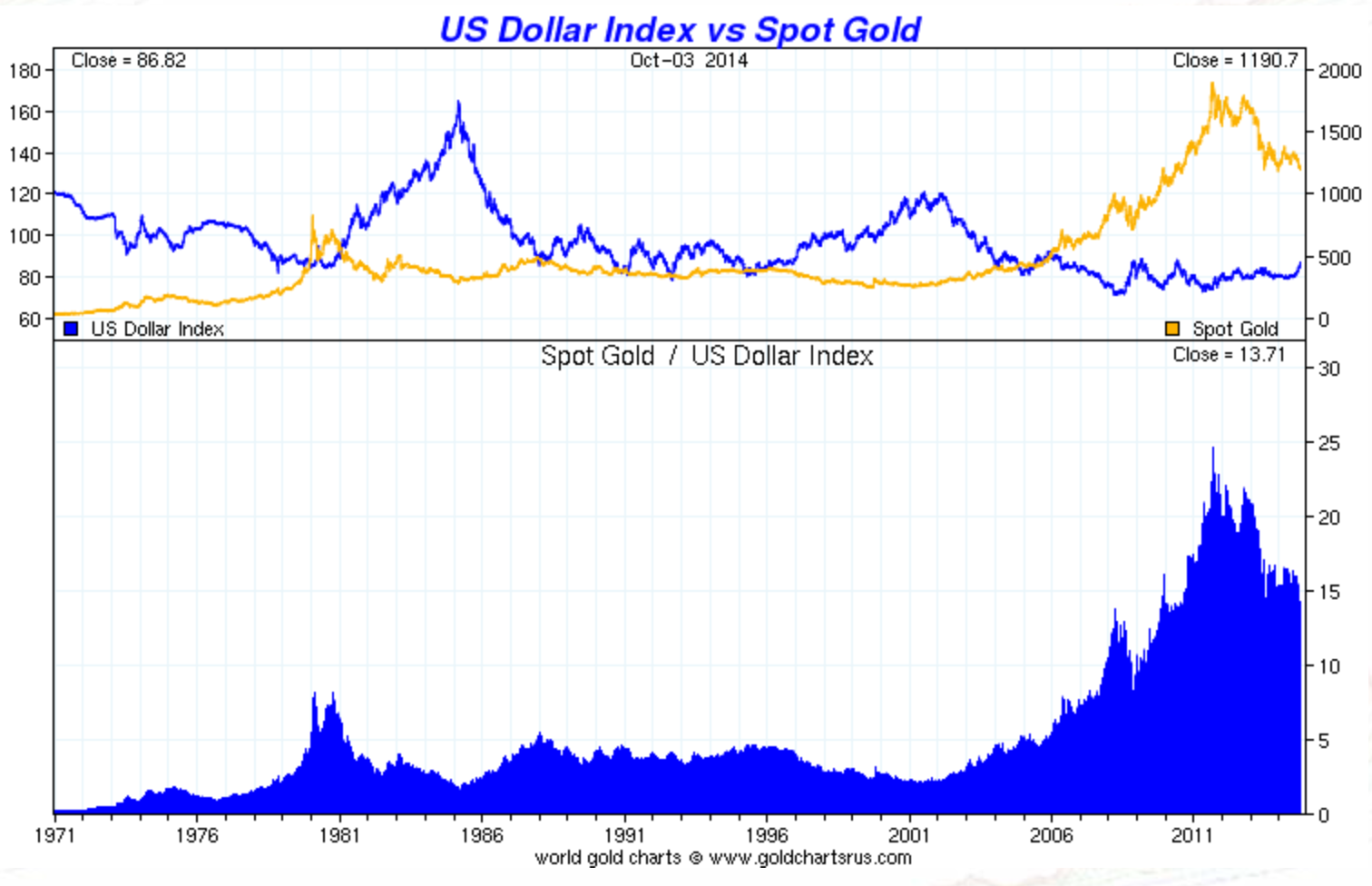

Again this week the gold price tested the $1,200 level dropping below it on higher US dollar against most fiat currencies. It is assumed that a stronger US dollar against the euro and other fiat currencies is also negative for the price of gold. However gold is not a hedge against the US dollar but rather against all fiat currencies.

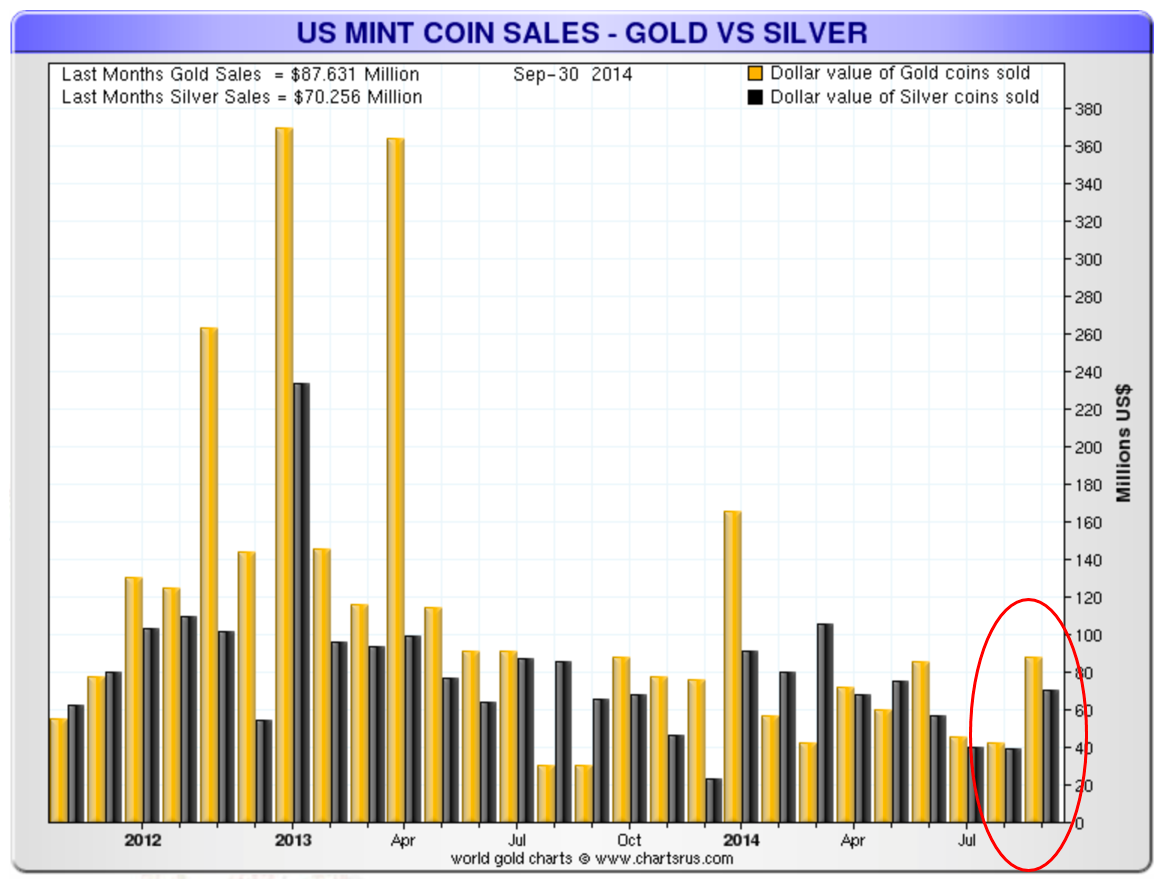

Even though gold’s price has been falling, in India and China gold premiums have increased signifying a rising demand. We have also seen a substantial increase in silver and gold coin sales in the US. Actually gold coin sales doubled in September compared to August.

With sentiment at historic low as I explained in my previous article [read… Gold Sentiment, How Bad is it?], $1,200 and more specifically $1,180 is more a correction within a secular bull market than a pause in a larger bear market. With more and more articles coming out with titles like “Gold Dies”, I am more convinced than ever that we are seeing a major bottom being created. Eastern central banks are still buying massively and Western central banks are holding on to their stock. This doesn’t look to me as a continuation of a downtrend.

On November 30, Swiss citizens will go to the polls to vote on three areas: whether or not the Swiss National Bank should increase its gold reserves to 20%, whether or not the central bank should stop selling its gold, and whether or not all its gold should be held within the country. If the Swiss people votes in favor, I expect major tremors in the gold market. Just the fact that Switzerland will have to buy a large amount of gold to reach the 20% will have a major psychological effect on the gold market not to mention also the snowball effect it will have on other countries [read… Swiss Gold Referendum: A Unique Opportunity to Lead the World Back to a Sound Money Policy].

Switzerland is a very small country but with a long history of gold ownership. A vote in favor in the Swiss Gold Initiative referendum would mean that Switzerland would have to buy 1,700 tonnes of gold. This represents 70% of annual world gold production. The Swiss National Bank has 5 years to acquire the 1,700 tonnes if the initiative passes.

Gold as a hard currency is also influenced by geopolitics. But for gold to go up you need not just a local crisis but a crisis that has global impact. Other ways it only increases in price locally in the conflict area with temporary impact on global price. With the Crimean annexation by Russia the world has switched from a détente and disarmament environment to a new cold war and rearmament. Local conflicts are appearing everywhere with potential of escalating into a global conflict.

The Middle East and in particular the Iraq/Syria region has become a stateless land where ISIS is trying to expand its influence and destabilize the entire region. Libya, an oil rich country is still in chaos and now social unrest in Hong Kong is threatening stability in China.

Let’s not forget the recent unrest in the US with the Ferguson riots, a suburb of St. Louis, Missouri. The US is not used to having social unrest on its own territory. Home grown terrorism spurred by economic hardship has not happened in the US since the 60s. There is a believe in the US that trouble can only come from the outside forgetting even the recent Oklahoma City bombing by a good American boy named Timothy McVeigh. In Europe high unemployment, the rise of the extreme right and secessionist movements (Scotland, Catalonia, etc.) threaten the European Union.

The currency wars are still alive and contrary to the G8 agreement not to manipulate their exchange rates, this is what is actually happening. The US dollar going up against the euro is a stated desire of the European Central Bank. But there is no reason why gold should move with the euro. Gold is the anti-fiat hard currency not just the anti US dollar. Gold has risen as much in all paper currencies in the last 15 years not just against the US dollar. In the most recent Fekete Research Gold Basis Service, Sandeep Jaitly states that “December silver remains in backwardation and December gold is soon to join it”.

In a recent article in the London Financial Times, John Dizard mentioned an increase in gold’s “popularity as a medium of exchange for international transactions has been soaring, particularly in the past few months as the impact of US government sanctions on non-compliant banks has become severe.” And that, despite gold being “the most expensive and least convenient of all of the monetary alternatives to the dollar.” I emphasize the words “medium of exchange” and “soaring” because if we believe the mainstream media nobody wants to use gold as money because it is expensive and least convenient. I mentioned it in a previous article on gold sentiment but I wanted to mention it again because I think it is a very important piece of information.

Physical gold is being accumulated and used in exchanges but very discretely as of now. In a recent report mentioned in the UK Telegraph it is revealed that a record number of super-rich elite are buying gold bullion bars weighting 12.5 Kg. The report says “The gold buying secrets of the UK come as it was recently revealed the number of 12.5kg gold bars being bought by wealthy customers has increased 243% so far this year, when compared to the same period last year.”

The geopolitical and economic environment in the last few months was in my view the calm before the storm. All the economic issues both in Europe and the US and all the geopolitical conflicts I mentioned above, or a combination of them have the potential to degenerate “unexpectedly”. Both the economic and political environments are uncertain and will surprise the complacent markets.

More and more the current environment reminds me of the Citigroup president’s statement to the Financial Times before the 2008 crisis. CEO Chuck Prince made clear that he was aware of the risks his company was taking but said “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing,”

An unexpected precipitating event like a black swan event in this uncertain environment will push gold and silver up with a quantum leap with gold leading. By Dan Popescu, Gold & Silver Analyst, at Goldbroker.com. Click here to read more, and to prepare yourself.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Over the longer term gold and silver, as a store of value, will remain relevant in the third world but not in the first world, the west. Bitcoin, which I consider a ponzi scheme, has brought digital currency to the forefront and I think it is an issue which cannot be ignored. In a modern society mobility has become a way of life and even fiat currency is starting to fade. The real future of money is digital, mobile, and virtual. So over all, the future of metals is tied to how they enhance digital systems.

LOL. I used to think like that, but I’ve come around. The real strength of gold in my opinion is that it can’t be created by anyone. All these digital BS is just one hack away or what have you from being compromised and I should know since I am a …. software engineer.

When the REAL crisis breaks later on, you would have to start from something real i.e. what you know for certain to exist as opposed to some entry in some digital ledger or some paper or what have you.

And you know what? America is now a third world country.

Good reply ‘NotSo..’ – Our tendency as short lived creatures (relatively) is to think things as they are now, is how they have been and will be. We don’t learn from history (which is the only lesson we learn from history), we learn from bitter personal experience.

For the life of me I can’t see how bitcoin can be anything other than fleeting. It is too vulnerable to manipulation and attack. I get the portability argument, but really, how many people flee their current circumstances? I think I read somewhere that most people in the US have not been out of the country.

TPTB are going to throw everything they have at holding on to what they have. This means less freedom, more manipulation, more ‘newspeak’ and propaganda.

What gold fans (I am one) mainly have wrong I think, is the belief that if gold goes to $10,000 or whatever they can cash in and live like kings.

IF fiat collapses, it will be chaos.

Anyone thinking that gold will help during the initial crisis deserves to have their head examined. You truly can’t eat gold. Gold is simply a vehicle through which you carry your current wealth to the other side. If you somehow have to use that gold during the crisis itself, you may be surprised that a tomato may be worth a lot more than gold.

Let me repeat that again: gold will only be useful once the initial crisis has passed and the realization of the need for a new financial system emerges. That does not mean however that you will be able to buy gold during the chaos though. The Big Players would have accumulated most of them already.

I would suggest reading fofoa.blogspot.com.

I couldn’t agree more. Cryptocurrencies can even be created far easier than “paper money” and the number of zero’s one can add in computer is de facto infinite. Gold is real, all the rest is an act of belief – and who believes authorities, governments or bankers nowadays?

There is a difference between digital/virtual currencies and crypto currencies like Bitcoin and others. You can consider ATM transactions and QE as the former- no physical fiat changes hands just computer adjustments made to accounts. Now consider this- the NSA spies on you- Apple has helped them. Apple now wants to offer a payment system with their phones that also track you with GPS. What could happen if you attend a campaign rally by a candidate who runs on the platform of disbanding this rogue agency? There is a real danger to putting all your eggs in one basket. It wouldn’t take much to erase all your wealth if the NSA decides you are dangerous to their existence. I may be crazy but I do not trust the federal reserve or the federal government. Also consider our outdated power grid. We are being threatened by terrorists today but what about an electromagnetic pulse-EMP overwhelming the system. That will be the threat if Bitcoin gains too much traction. It is sad when one feels threatened by their own government but that’s where I am at. Gold is the answer and a fiat backed by gold would be ok too.

I was referring to a digital, not crypto, currency there is a difference. Digital currencies can be backed by other assets and run by non govt entities. I hate to tell all you gold bugs this, but, the kids today would rather have virtual everything usable across the net. Don’t blame the messenger. BTW, I too am a software engineer/economist.

A story

When the Arab Spring broke out the young did not notice until Mubarak shut down the Internet in Egypt.

Suddenly several of them turned to me, a technically challenged 59 year old, one of them said, astonished,

Egypt shut down the Internet! They can’t do that, can they? I responded Its a machine, young man. OF COURSE it has an off switch. Caveat Emptor, children

Petunia: you bet your future on reliable electrical supply. Once the grid goes down, or even sporadic outages, all this technology is KAPUT!

You and NotsSoSure are both wrong but for different reasons:

The future just cannot be digital money. The reason’s why we have most of the financial problems today is largely due to its existence!

NotsSoSure believes that we cannot eat gold. However, I have not yet seen anyone eating any currencies either.

Crypto currencies are a ponzi scheme. After all, the buyer of the crypto coin has surrendered his hard earned cash for an encryption algorithum saved on a USB drive. Whereas the vendor has run off with the cash. No wonder there are over 300 crypto coins in existence.

Otherwise, why are crypto coins traded against currencies? So, if the dollar goes down, what does that imply for those holding a digital purse? Let alone, there has to be an electricity supply around otherwise your $100,000 dollars of “whatever-coin” is completely worthless.

Oh yes, of course, … gold will be useful and helpful during a crisis! That is exactly what gold has been used for, for thousands of years.

I have been accumulating American Eagle gold coins since March this year at $1,430, mid Aug at $1,330 and last Fri at $1,228 (Apmex eBay special). I never owned physical gold before and have invested in some GLD and lot of GDX shares.

Gold hit what I’d call triple bottom last Fri and appears cleared the last assault and kept above $1,200 – http://www.kitco.com/charts/techcharts_gold.html China and especially Russian CBs have been accumulating at recent prices and it puzzled me that gold price was impervious to regional drums of war (Ukraine, ISIL bozos, Israel), Argentinian default (again), and devaluing of many emerging market currencies and in last couple of week even Euro is under pressure. I suspect gold market is indeed manipulated by the CBs of the world in collusion with banksters or CBs in EU are busy selling off their gold reserves. All these factors resulted in what appears to be negative sentiment in general.

Swiss citizens may awaken and realize that only way to maintain their high standard of living (been there 3 times this year on business) and strong CHF (Swiss Frank) currency is to adopt gold standard. This may also usher in more money into the Swiss banks as safe haven not to mention currency with strong gold reserve to back it.

What is the Fed to do? The story since 2013 has been ‘tapering’ and higher interest as the US economy is expected to recover. On the back of this commodities crashed and the US stock marked skyrocketed. Now it looks like it changing the tune. This can get interesting with so many people short commodities and with the stock markets at all time highs. It might just get very volatile.

Fed is at whim of the stock and bond market with banksters calling the shots.

Case in point – Benny and Janet exhorts the improved economy and souped-up 6% unemployment rate for rationale for higher interest rate and throttling in 2-yr and continuing QE III and market gets spooked (evidence that Fed is indeed fueling the yet another stock/bond and housing market bubble). So the Fed today comes out with dovish talk fearing economic slowdown to re-inflate the “weakened” market. One would think the Fed would use the dovish tone when the market tanked a lot more but hey the banksters need more time to sell, right?

There were four trends in place before the Great Depression…

1.) the rich got richer

2.) accumulation shifted to speculation

3.) soaring market credit

4.) lagging business investment

The Federal Reserve’s actions are exacerbating the situation. The market is a joke. We no longer have capitalism. Look at stock charts prior to the Depression they look eerily like today.

You are absolutely right! When I looked at those charts, I had to shake my head and look at it again and again. Spooky or what?

It’s a one big giant long poker game and Fed is the dealer. Many countries have doubled down. Let’s see how blinks first.

I have folded mine long time ago.

I believe gold is being manipulated. But with Libya’s huge gold possibly being taken then the Ukraine gold supposedly taken, it looks like the reason for the price suppression is to discourage ownership. Supplying China with gold seems like the reason. Why China would want gold is plain. They want a part of the new world currency to be made up of yuan along with other currencies.

You no longer have to believe: Several banks have been prosecuted for doing so, including JP Morgan, Deutsche and Barclay’s Bank.

The bullion in Libya and Ukraine as not supposedly taken. They were taken and in the case of Libya, JP Morgan and Goldman Sachs publicly stated, that due to the rules of war, they could confiscate Libya’s assets!

at the tail end of the Industrial revolution of several 100 years we humans find we have maxed out the manipulation of our planet and its resources (we have squandered the gift of millions of years of fossil energy accumulation – mostly in the last 50 years) and we tell ourselves the next software app will deliver us. come on you engineers… hope ain’t goina do it!

Geopolitical risk has become so normalized that gold’s response has been ho-hum for quite some time.

IMHO, digital currency is a transaction mechanism (and a bloody good one), nothing else. Gold is money, nothing else.

I don’t know whether gold will go rocket or not. Judging by current geopolitical tensions, Ebola, hyper printing, etc, with how sentiment in precious metals, I just cannot help by getting some in my portfolio. I just hope one day, it can protect my purchasing power, nothing else. Remember, all the central banks have doubled down in Keynesian one way ticket. This have never been done before in the history. With that much of printing, every pricing discovery will be distorted. Perceptions of risks are distorted. My fear of mother of all bubbles (stock, housing and bonds) is also distorted.

Sorry to tell you guys, you seem to have the right information about gold. However I do want to correct you on Bitcoin and other cryptocurrencies like it. I too am a software engineer and how many of you have read the actual whitepaper, let alone seen the code or know how it actually works.

First I would like to point out Bitcoins” coin supply, in contrast to fiat currencies, can not just be created out of thin air. The total amount that will ever exist will be 21 million coins, it’s hardcoded and in order to change it you would need everyone running the software to use a different newer version with another amount in it.. which would be consensus and so the majority wants it.

Second adding zeroes to Bitcoin is like saying you can divide gold into smaller and smaller pieces, yes you can, until you reach individual atoms but really.. what’s the point. You add a zero.. we’ll now you have 1/10 a piece of a Bitcoin with 1/10 the worth.. it’s really the same and cutting gold into smaller pieces.

Third Bitcoin is not a ponzi scheme, a ponzi scheme pays initial investors with the money from new investors, this has got to continue or else the system collapses. What gives Bitcoin value is what gives anything, including gold, value.. if it is of use to people it will have some value and then supply and demand and necessity determine the price. It is true there is too little global liquidity right now, but that doesn’t need to be like this in the future. Of course new Bitcoins are being mined/created all the time and so with no new participants price could go down, inflation.. but that’s the same as with gold, new gold is being mined as well.

It is true you need electricity to handle Bitcoin, but even if one countries grid shuts down you really actually need 1 person in the enitre world running the Bitcoin software in order to keep it alive..

You don’t need a computer to store your Bitcoin as you can use paper wallets or even a brain wallet. In times of crises you might not find usable at all, same as gold.. but as stated before it might be a great tool to get across to the new system. For traveling I would say it’s even better as you can cross any borders and noone can take them from you or know you have them.

Sorry for any spelling mistakes but i’m typing this on a phone and English is not my native language.

Oh and in order to address the argument that you can just create a new cryptocurrency and so that will dilute the value of Bitcoin that’s the same as saying there’s gold and if I create a new material that will dilute the value of gold.. nonsense! Unless everyone using gold switches to using the new material..!