It elegantly depicted the same wobbly growth we’ve seen for years.

The news media had a field day on Friday morning – as if they were trying to force the Fed to change course with their headlines:

“Weak U.S. inflation, retail sales data dim rate hike prospects” – Reuters gleefully.

“Inflation Data Weakens the Fed’s Case for Another Hike” – Bloomberg.

“Retail sales fizzle out in June” – MarketWatch.

“U.S. Retail Sales Fell 0.2% in June” – Wall Street Journal.

“Wall Street Hits Highs as Data Supports Fewer Rate Hikes” – New York Times.

But wait….

The data Friday morning depicts elegantly an economy of the same type we’ve seen for years: wobbly growth. The data was better than late last year when the Fed started hiking rates in earnest and when some Fed governors started talking about unwinding QE.

“Retail sales fell 0.2% in June.”

OK, that’s from May to June, seasonally adjusted. Retail sales are very seasonal, requiring massive adjustments to shoehorn the month-to-month jags into a smooth line. Even a small quirk in the adjustments can throw the percentage off bigly. In the bigger picture…

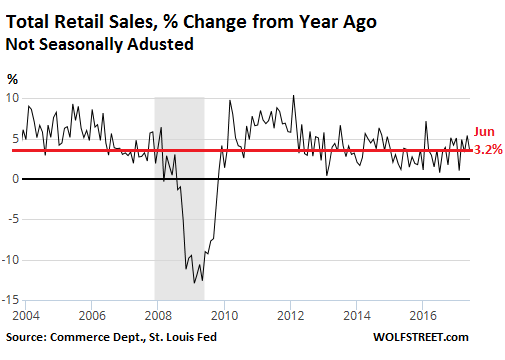

On a year-over-year basis not-seasonally adjusted – June 2017 compared to June 2016 – retail sales rose 3.2%!

This chart shows the year-over-year not-seasonally-adjusted percent changes in total retail sales, including food services; June’s 3.2% increase is in the middle of the range of the past few years:

This retail sales increase shows that consumers are giving their darndest to keep this economy above water, despite all the problems they face. They’re hypothecating their future to do it, but so be it, they’re trying. And the Fed sees this too.

In February, year-over-year retail sales growth was only 1.0%; and in March, the Fed hiked. The recent peak growth was in May at a healthy 5.4%. In June, the Fed hiked. This retail report lies right in between and does nothing to discourage the Fed.

Then there’s inflation.

Inflation is bad for some and good for others. It’s bad for workers whose wages lose purchasing power, and for bondholders, savers, and other creditors whose principal loses purchasing power. It’s terrible for people with credit-card debt, whose interest rates rise with inflation.

But it’s good for debtors that are borrowing at a fixed rate, such as bond issuers (governments and corporations) or homeowners with big mortgages. And it’s great for publicly traded companies that can claim revenue increases by just raising prices, without selling an extra thing.

The Fed couldn’t care less about workers. But its constituents are on both sides of the line: creditors (banks, bondholders) on one side, and the debtors (corporations, governments) on the other. So it wants some inflation to favor debtors, but not enough to wipe out creditors. Hence a compromise of 2%, based on PCE and core PCE, which are usually lower than the Consumer Price Index. More inflation would punish a big part of the Fed’s constituents – and that’s why the Fed can get antsy.

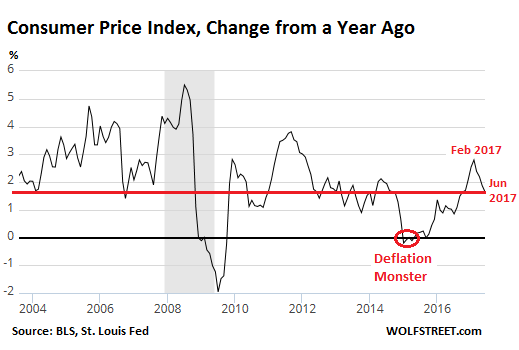

Inflation, despite the headlines, is alive and well, though not quite at 2% largely due to “transitory” reasons – some of which Yellen has already pointed out.

Year-over-year, CPI rose 1.6%. In the chart below, note the spike to 2.8% in February and the retreat since then. Also note the “Deflation Monster,” one of those rare occasions in the US when the purchasing power of wages rose just a tiny bit. It was caused by the energy bust. It too was “transitory.” Yet, economists and the media threatened that it would be the end of the world:

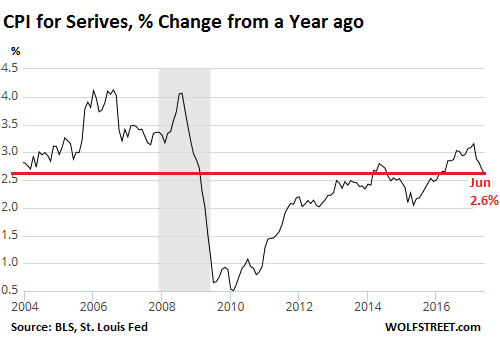

This is inflation in goods and services. But much of the economy is in services. And the consumer price index for services is not so benign.

There has been no instance of deflation in services going back to 1957. In February, the CPI for services had been a hot 3.2%, the highest since November 2008. In June, it rose 2.6% year-over-year, in the upper part of the range over the past eight years:

But there were some “transitory” factors. Two of them are related to the auto industry, whose travails I’ve vivisected for a while.

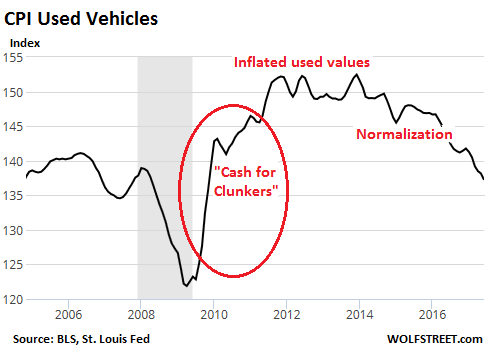

The auto industry is highly cyclical. After seven boom years, the cycle has turned and the slope is heading down. Used vehicle values have dropped due to large supply coming from rental car companies and lease turn-ins. This supply is a godsend for consumers, who’re buying these vehicles like hotcakes, at the expense of new vehicles. And dealers, who’re getting clobbered by declining new vehicle sales, are making money selling used vehicles.

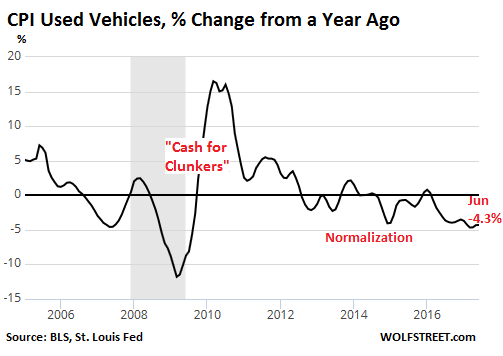

The CPI for used vehicles fell 4.3% year-over-year. This chart shows the index for used vehicle prices (we’ll get to the percentage chart in a moment):

The “cash for clunkers” program destroyed part of a generation of affordable cars. Buyers had to move up the scale. The buying pressure inflated prices through the entire range from 2009 onward. Prices began to deflate in 2014. More recently, the normalization process got a boost from a surge of rental cars and lease-turn-ins.

The chart below shows the year-over-year percentage changes in the CPI for used vehicles, which fell 4.3% in June. Note the declines from prices that had been artificially inflated by “cash for clunkers.”

Used vehicle prices aren’t going to zero. Lower prices stimulate demand. The supply will work itself out of the system, at the expense of new vehicle sales. Prices might briefly overshoot to the downside, but will then stabilize or even bounce, thus removing their downward impact from CPI. So this is truly “transitory.”

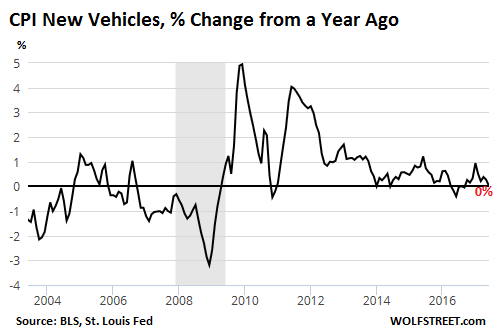

With new vehicle sales on the decline, automakers are hurling record incentives at the market to move the iron. Including those incentives, new vehicle prices have flat-lined in June:

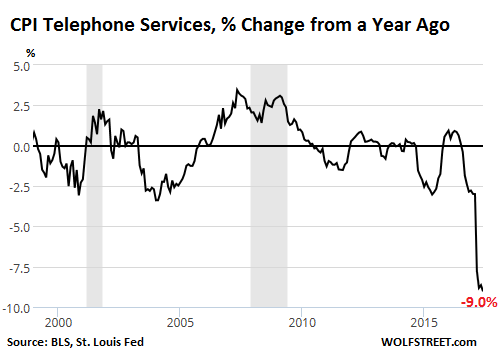

And here’s a special doozie – another godsend for consumers: A price war among wireless carriers has broken out last year. In June, the price index for telephone services fell 9.0% year-over-year. The wireless component plunged 13%. This is part of the reason why the services CPI (third chart above) edged off its spike in recent months. But that consumer bonanza is not going to last either:

These three components – new and used vehicles, and telephone services – account for about 8% of CPI and have a significant impact on the tiny percentage changes we’re tearing our hair out over. And they’re truly “transitory.” And Yellen has been pointing this out. So Friday’s data is unlikely to change her mind.

The Fed has been raising rates and has announced a plan to unwind QE. Financial conditions should be tightening in response. But the opposite has happened. Markets have blown off the Fed. Read… Stock and Bond Markets Blow Off Fed, Fed Gets Frustrated

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

If Yellen is toast, as many suggest, she’s going to try and protect her reputation. She’ll keep on keeping on.

At this late stage, I don’t think she has any choice in the matter, the ponzi scheme is no longer net beneficial to the countries who yields the most power at the moment. The plug has been pulled IMO

They can stall out any time they like and even reverse course. We have no control over them. Yellen goes home next year. The next Chair will set the tone for the next 4 years and possibly for the next several generations if the Establishment takes over again and we get negative rates combined with cash controls. Gary Cohn openly campaigning for the job of Fed Chair sends chills up my spine in a bad way. To me, it looks like the Establishment is getting desperate and needs to come out the shadows because the minions are getting uppity.

Bernanke’s exit made me think the same thing. Was he getting out before the deluge? What did he know that he wasn’t sharing?

Oh, he shared it. “We won’t see normalization of intrest rates during my lifetime”.

How is Yellen going to be “toast”?

She’s doing exactly the job her oligarch organ grinders are directing her to do: enabling the .1% to concentrate all wealth and power in their own hands at the expense of everyone else. Probably not one in fifty of the sheeple are aware of the financial warfare being waged against them by the Fed and its Wall Street accomplices.

I think he means her term is up soon and she will be replaced. I don’t think it matters. Reduction of the Fed’s balance sheet is career and political suicide for anyone involved. It will never happen.

Yellen and her flying monkeys will keep up their incessant jawboning about supposedly pending rate hikes and make noises about reducing the (insane) $4.5 trillion on the Fed’s balance sheet as they try to masquerade as responsible central bankers. At the end of the day, though, they can’t hide what they are: the oligarchy’s chief instrument of plunder against the 99%. Understand that, and the Fed’s actions become completely predictable.

Restore the Republic – End the Fed!

The FX market bought it all: hook, line, and sinker, Especially for the A$ which zoomed up 3% for the week…………

Looks like there are going to be some people that end up losing a whole bunch of bucks if the pundits are wrong………..

I bought it ALL as well I’ve been expected the demise of the US consumer since the 80s I’m only surprised at how long they and the dollar have held up to be honest I’m holding half a million US dollars and intend to sell quite a few very soon I’ll be holding my Gold Silver Euros Zlotys and Liras thanks Is that diversified enough Wolf?

“I’ve been expected the demise of the US consumer since the 80s I’m only surprised at how long they and the dollar have held up”

Never underestimate the bankers ability to cook up new credit schemes and float ever more consumer debt. All done in the name of propping up a consumer-driven eCONomy.

Wonder how much the Fed’s insider pals made on currency and precious metals manipulation by trading on this brief pretense at “hawkishness” by the Fed.

Most are still searching for yield due to the leverage in the markets

with a few eyeing the exits. If you need yield to survive short term

you have to stay in the markets.

Yellen’s statement that 2% inflation was not debatable was a line in the sand IMHO and provides the FED with enough wiggle room to opt not to raise or raise the FFR and begin to sell MBS, and Treasuries either later this year or next year.

And when the FED says it is data dependent, what they really mean is how is equity and bond markets doing? If stable or up, we raise the FFR and tighten our balance sheet; if down too much, we don’t do either one.

“The news media had a field day on Friday morning – as if they were trying to force the Fed to change course with their headlines:”

Yes. You see it, too. This is one way the establishment, globalists, insiders, etc. manipulate the world. Insiders who know people who perform influential jobs are the other. The media takes care of the masses. The insiders take care of the actual decisions that are implemented. This is how the globalists get their message out and take control.

The media overkill concerning their disfavor with the current Administration overplayed their hand and made their tactics too obvious to ignore, at least for all except the most pinheaded.

These headlines are an example of the establishment screaming bloody murder at the possibility of rate normalization. The plan is to make the masses think the end of the world is nigh if rates normalize and things go back towards a textbook Finance world.

Insiders are all working as hard as they can to control their minions in high places. The Fed may be up for grabs. Once the balance sheet is in firm sell off mode and short term rates exceed around 2.5%, the direction will be set and normalization will be around the corner. Whose side the Fed is on … ours for now or still backing the Establishment … remains to be seen.

Background: The Establishment wants the central bank to be the money printer of first and last resort. Low rates allow easy money to be made without the need to work for it. Negative rates allow government spending to exceed revenues with the negative rate serving as a form of taxation. The lowered standard of living caused by a lack of interest income for the masses makes them easier to control. People such as those on the FOMC are minions of the Establishment and replaceable with others who want to be minions. The actual Establishment stays in the shadows.

One tin foil hat for the gentleman in question as another round of conspiracy theory and speculation comes to the fore in an attempt to simplify what is an extremely complex issue .

Goodness .. Reynolds etc must be making a bloody goram fortune over the past ten years . Perhaps its time to add a few shares to my portfolio ?

What and who do you mean with, “One tin foil hat for the gentleman in question as another round of conspiracy theory and speculation comes to the fore in an attempt to simplify what is an extremely complex issue.”

“in an attempt to simplify what is an extremely complex issue”

No, fraud is an extremely easy issue to understand and explain. What is new is the pervasiveness and complexity of it’s breadth and width. It’s like a group of people noticed that if owning a bank is better than robbing one, then controlling the Fed is even more beneficial. The rest is social hacking and patience.

i think was a jest, reynolds and all that.

May be if you did wear your tin foil, then you would be so clueless.

Complex and unavoidable.

TJ Martin,

You got me. I am a nut and you have the clarity to see and know in your bones that those in power and at the highest levels of public service all want nothing but the best for the public they serve. Wars we participate in are all just causes in pursuit of good. Those who made billions from low rates and stock buybacks or HFT tricks are just damn lucky and their work serves the best interests of the public in the highest ways. Low rates support borrowers. Savers are simply at the unfortunate end of cost vs benefits analysis to overall society. The Fed is so good at what they do they can make up their own theory and always be right. Textbooks can’t keep up with them. The mainstream media holds truth to be sacred. How did you get so smart?

cdr, and everyone here and on every site that feels and thinks and screams, and posts analytics about this, politics, etc., is all for naught.

Who is afraid of postings on web sites? None of them, thus they do and take what they want because they know we will just post our contempt while at home and sipping our cocktails.

No one has any balls now…period. At least not since Vietnam, when we stopped a war by facing military guns here at home and in the streets, to make our anger felt. People died in the streets to make that point. Sorry to be offensive, but we are all sheep and wussises now.

Now if you don’t mind, I will have another short scotch for the road.

“At least not since Vietnam, when we stopped a war by facing military guns here at home and in the streets, to make our anger felt. People died in the streets to make that point.”

What, “Four dead in Ohio”? A real blood bath back here in the “World” compared to the salad days some experienced in Vietnam. Further testing next week to confirm prostate cancer. Ah yes, Agent Orange, the gift that keeps on giving.

“…we are all sheep and wussises now.” Speak for yourself Meme Imlost!

How many would have made you happy? Indeed Kent State, but there were many dozens with split heads from batons, many with lifetime injuries including blindness. I saw it, I was in it, right there in DC.

As for sheep and wussies, indeed I am now one too. How else could wall street and the FED get away with what they have done to America, while we type away and sip our coffee.

So who is in the streets now, my friend? WHO? All this web outrage means nothing to them, they laugh.

No idea where you’re getting the 1% growth in February from. You’re adding around 2.5 million people per year, so that is adding a little bit to YOY growth. If real inflation is a bit higher than the government claims(believed by many), the 3.2% retail sales growth sounds awful. The Trump economy is looking little different than the two previous Presidents. The many states having budget problems is a sign of our times. No way would I raise rates at this point.

“The Fed couldn’t care less about workers. But its constituents are on both sides of the line: creditors (banks, bondholders) on one side, and the debtors (corporations, governments) on the other. So it wants some inflation to favor debtors…”

You do realize, Wolf, that it is the big banks that own the Fed and all the other central banks- they are out for themselves, and not “the debtors”- you yourself pointed out that they do not give a damn about workers, who with students carry a ton of debt. Their M.O. is to obtain as much money, virtually interest-free from the Fed, meaning the people of the U.S. to the extent that public debt can be expanded, hopefully forever, meanwhile charging double digit interest rates to their cardholders (so much for loving debtors!)

The Fed is not solely a private institution. It’s a hybrid. As you said, the 12 regional Federal Reserve Banks are private, owned by the banks in their districts. But not the Board of Governors. Its seven members, including Yellen, are appointed by the President and confirmed by the Senate, and are then employees of the federal government, with a government salary.

So don’t underestimate the connection between the Fed and the Government. And the Fed’s number 1 job is to serve as a lender of last resort to the federal government in case of a debt crisis.

The fact that they earn a government salary (basically money from the “workers” pockets) just makes it more scandalous. But I get it: it’s a necessary layer to keep the illusion credible.

According to economist Richard Werner (author of Princes of the Yen), central banks “own” the government. They engineer crisis to reform the power structure of a nation if the government and its policies are not accomodating enough to the Bank’s ambitions. This is called the “shock doctrine” (I believe Naomi Klein was the first who coined this tactic): manufacture a crisis to trigger the desired change because the masses under distress will blame status quo and will accept virtually any proposed change. Werner detailed how that was done in Japan and the ASEAN region in his book (there’s a documentary based on the book on Youtube). The documentary claims the ECB is doing the same in Europe.

The Federal Reserve is neither a “reserve” (a reserve implies something that can become scarce, something of limited supply, something that can be depleted), nor “federal”.

Appointed by the President ? I wonder who whispers orders in the presidents ear from behind that curtain and as far as being confirmed by the Senate that’s highly suspect as well as we all know how bought and paid for those people are John McCain being a prime example of the lunacy money can buy

For all the attention heaped on Ben Bernanke (who expressed surprise, when as a professor of freshman economics, he was called on), or of late, Janet Yellen (could she have been the inspiration for Death Grips’ ” I Break Mirrors with my Face in the United States,” do you think?) neither the the Fed Chairman nor the other Board of Governors has any particular statutory clout when it comes to voting on policy decisions; it is the banks, and especially the New York Fed, which was conferred special powers from the very beginning, that call the shots.

The horrors caused by the explosion of debt from the massive deficit spending by LBJ on The War on Poverty plus The War in Vietnam fell on the hapless Jimmy Carter, and the the skyrocketing inflation(which, unlike today, was at least acknowledged) was blamed on his equally hapless choice of Fed Chief , William Miller, whose sin was to try to persuade the rest of the Fed to keep rates down(sound familiar?) and for his sins lasted just one year of his four year term until he was kicked upstairs… to run Treasury (!), which, it should be noted, unlike in the days of Albert Gallatin, when there was no central bank, is also a figurehead position: he gets his name on the Federal Reserve notes, but has no authority over the printing of the now utterly unbacked money.

With the full court press on against Donald Trump (who admittedly is no Gallatin nor a Jackson), it is beginning to appear that he, the first President of German extraction since Herbert Hoover, may be in the process of being ther patsy for the next Depression, record-breaking Dow aside (and which country has the best performing stock market this year- Venezuela).

Consumer spending and inflation are inversely linked. Retail includes both brick and mortar and online sales. It’s fair to say that inflation over the past several years combined with falling real wages is showing up in weak consumer spending. To say inflation – core or otherwise – is falling or even “tame” is disingenuous. Also the data for one month does not make a trend. Best to look at YoY data, or long-term charts. See link here:

https://www.advisorperspectives.com/dshort/updates/2017/07/14/what-inflation-means-to-you-inside-the-consumer-price-index

Real housing costs – both house prices and rental rates – while now turning lower, are up significantly over the past few years. Medical and higher ed. costs continue their trends of rising much faster than the bogus CPI number would indicate.

The bottom line:

– inflation is a direct result of money printing and currency debasement via the electronic printing press at the Fed. Got gold?

– The Fed is raising rates (barely) in this cycle, but is several years too late and is only exacerbating the economic slowdown of a very weak and now very long-on-the-tooth stimulus-induced expansion.

– Most consumers are tapped out due to weak expansion, decline in real wages, and high inflation in cost of living. Can you say stagflation?

– The economic/business cycle may be extended by Fed machinations, but cannot be prevented, although they try pretty hard.

What a system. Some believe that the Fed is good for the economy. Others believe the opposite is true. “First do no harm.” It’s been an unmitigated disaster since 1913 in my view.

“The enduring lesson of the 20th century is that socialism is a failure, and free markets are a success. But the politicians keep advocating just a little more socialism.” – Milton Friedman

“The rich rule over the poor,

and the borrower is slave to the lender.” – Proverbs 22:7

I was actually at the mall this past week and it wasn’t that depressing. It seems the a recently emptied big box store will be getting a new tenant and another empty store was replaced by a local merchant who sells upscale merchandise. Both good developments.

The only unusual thing going on was at the GAP, all full priced merchandise was selling at 50% off, the clearance merchandise was already discounted further. This was different because I have never seen all full priced merchandise discounted in a store before, unless they were liquidating.

Good to hear that the mall is getting new tenants.

Yes, based on anecdotal evidence from one of my infrequent shopping trips, our local outdoor mall was busy yesterday as well. However, that being said, there’s a huge overcapacity problem in retail, reflecting 1) brick and mortar overbuilding, 2) decline in real wages, 3) primarily low wage job creation in the current cycle. There’s an obvious shift to online retail, but I’ll stick to my view that low to mid income consumers (99%) are tapped out. High income (1%) don’t care (honey badger). Economics 101. Supply and demand.

http://247wallst.com/retail/2017/04/18/ceo-the-retail-bubble-has-now-burst-which-retailers-are-in-the-most-trouble/

Also, in my view, we’re on the cusp of the next contraction, if it hasn’t started already. See C&I credit. There’s a chart for this somewhere in the past couple of months on this most excellent website. A recession will only accelerate the trend.

Sidebar: It’s still not clear to me that Amazon’s core retail business is profitable (?). The stock looks like a short here to me, as do the equity indicies in general. Not a good portent going forward, IMHO. Just one of many bubbles currently percolating, courtesy of your local neighborhood Fed. Oh, and it’s different this time (again)…

Sounds great but I wonder how long they will last especially when the next recession hits which by the looks of the numbers could be very soon I’m not buying it

Setting the stage for stopping?

http://www.cnbc.com/2017/07/12/dovish-yellen-indicates-that-fed-may-not-need-to-hike-rates-much-more.html

No. They’re just sticking to the plan. They’ve already raised four times. No one expects them to go to 5%. They’ll get to 2% or a little higher, and it will be “gradual,” as they always say, and at a rate of inflation of 2% that might be where it ends. That has been the plan all along, unless something big happens.

So that might be four more or five more hikes of 25 bps. Minuscule by classic standards. But that’s the new era. And 4 or 5 qualifies as “not many.”

This is another headline the media got wrong. Yellen said specifically that they’re sticking to the plan.

“Does the ripe fruit never fall? Or do the boughs hang always heavy in that perfect sky?”

Wallace Stevens

“The ultimate result of shielding men from the effects of folly is to fill the world with fools.”

Herbert Spencer

When some major pension fund finally blows up due to under performance/under funding things will start to get interesting. For now the plates keep spinning.

Well, those funds can always invest in stocks, and/or start buying cryptocurrencies. ;-)

i shall have to read up on mr spencer.

meanwhile, it does seem that one should stick to one’s knitting.

Oh what an evil web we weave when first we do deceive….But over and over again is just too much for the human unit!

“Inflation is bad for some and good for others. It’s bad for … savers…

(but) good for debtors that are borrowing at a fixed rate …”

Zero is a good fixed rate, so it’s a good time to buy a vehicle.

A new car bought with a zero percent interest rate allows us small fry to pay off the loan from our savings account and get the benefit from inflation as equivalent to a higher interest rate on our savings.

As to the lower cost of used vs. new, the margin shrinks the longer the new vehicle is owned. Ergo, Buy a long-lived vehicle and enjoy its early, best years and its longevity afterwards.

Auto Dealers margins on new cars is much lower than used so this is a boon for their profitability. The OEM’s reward dealers based on CSI above 90, providing allocation bumps and higher payouts on new cars sold no matter the discounted MSRP. So dealers will maintain some semblance of profitable entities.

Auto dealers make much of their gross/net profit in Fixed operations and F&I. Amazon is eating into parts business as you see in the retail parts stores 40-50% drop in PPS…

If I am any indication there is no real wage growth. In the last month my rent, medical premium, and parking at work have all gone up. I have also just received a 2.5% pay raise. The net change in my discretionary income will be ZERO. I believe that most people who get wage increases are just covering their increased costs. Spending more shopping? No way.

I am not certain that it will difficult for the Fed to reduce their balance sheet. The ECB is required to keep purchasing peripheral Euro Zone bonds to maintain political commitment to the Euro project. Likewise the BOJ is required to keep Japanese Govt borrowing costs under control. These structural requirements mandate continual distortions in the these substantial bond markets resulting in a continuing thirst for yield. This threatens an inverted yield curve in the US bond market as the Fed funds rates and LIBOR rates increase. An anecdote would be a Fed unwind or more US long dated debt. From this perspective the Fed reducing its balance sheet may be a necessity.

The question of inflation raises the question of financial repression which is the time honoured method of dealing with excess debt usually in the past associated with wars. The Japanese Govt for example after WW2 was able to deal with its excess debt quite quickly in this manner with the US Govt taking a bit more time to do so. Is it possible much of the inflation in the US, Medical costs, higher rents for example is to narrow to achieve this effect with a strong dollar and a general deflationary environment precluding an inflationary blow out. Perhaps this possibility was attempted with these interest rates being held low for so long but the velocity of money declined significantly as well.

Raising interest rates poses significant risk to asset values especially bonds and equities. This will meet a great deal of resistance by vested interests in these asset classes who have many ways of expressing their displeasure and resistance. In the long run though it is necessary to encourage savings and not rely on debt expansion to artificially maintain growth.

Leading economic indicators are up and bank earnings are solid-so far. Minor second quarter slowdown in the cards but I think that markets will continue higher until year end.

The glass is 80% full, yet I detect a mild accentuation of the negative here. And if this is true, then we’re less likely to have anymore rate hikes and the markets will continue higher. Goldilocks, courtesy the FED.

https://www.conference-board.org/data/bcicountry.cfm?cid=1

https://www.barchart.com/stocks/quotes/JPM#/news/3256689/bank-earnings-are-good-but-fail-to-impress

Congress is playing around with health care as the 800 pound gorilla in the room stares them down…

Tax cuts, health care, infrastructure spending, military spending, build the wall. Raising the debt ceiling by 3+ Trillion must be done.

Reality is a month and a half away!